In modern Russia, there are many different laws regulating the activities of employees and employers in the legal field. Often, the management of an organization takes advantage of the lack of knowledge of the nuances of the Labor Code by its wards, benefiting itself.

Travel expenses are a complex and integral aspect of the life of every employee aimed at long-term work. This article will help you avoid unforeseen situations and disagreements with administrative staff by clarifying the nuances of document preparation and the work of current bills.

An application for reimbursement of travel expenses, a sample of which can be found in the public domain, is drawn up in accordance with the regulatory guidelines that will be presented below.

The concept of travel allowances

What are travel expenses?

Travel expenses are expenses recorded by an employee that are necessary for the correct completion of a business trip. Legislative norms and acts regulate the procedure for their calculation.

According to Article 167 of the Labor Code of the Russian Federation, the employer undertakes to maintain the official position of the person under his charge and his average salary, and it is also necessary to reimburse the money spent by him during a business trip.

The above-described guarantees in an equal amount are imposed on employees who combine several positions and are officially employed in an organization, as demonstrated by part 2 of Article 287 of the Labor Code.

It is recommended that the chronological sequence of reimbursement of financial expenses and their volumes be established by a local regulatory document or a generally accepted agreement agreed upon with the workforce. However, you can resort to alternative options if they do not violate the norms of the Labor Code, legal acts and laws of the Russian Federation.

The employer has the right to change local regulations. It regulates the amount of reimbursement of travel expenses for various categories of employees. With the help of the innovation, the amount of payments will vary.

How to cancel a business trip?

Trip cancellation is possible for many reasons:

- employee illness;

- change of circumstances;

- no need to travel.

No special actions are required on the part of the employer.

The only point is to return the money if it has already been issued. If the money is not spent, the employee must return it within 3 days. But other situations are also possible. For example, this money was used to buy tickets, pay for housing, purchase materials or equipment, and so on. In this case, depending on the expense item, they can be classified as business expenses or a company loss.

Features of writing an application to reschedule a business trip

A trip can be postponed for a certain or indefinite period for a number of reasons (force majeure, changes in the market situation, illness, family circumstances). In this case, the money (if it has already been issued) is left with the employee.

Writing a justification for postponing the trip is not necessary, but is advisable. It should indicate the reasons that make the trip impossible at the present time, as well as the possible dates for which it can be postponed. It is with these deadlines in mind that the transfer order will be drawn up and the issue of returning the issued funds will be resolved.

Thus, the process of sending a person to work outside his place of permanent residence must be properly formalized by the personnel department. Competent writing of all required documents will allow you to avoid controversial issues and ensure the timely issuance of money for travel expenses.

Similar

The Constitutional Court of the Russian Federation introduced a resolution stating that a military serviceman, in the event of...

Every employee who has worked for a long time at an enterprise knows that every year the employer draws up an order to approve...

Unsafe working conditions in production are a fairly widespread phenomenon in our time. This entails unfavorable...

Time off for family reasons is a preference that is not provided for by today’s Labor Code of the Russian Federation. In the law of such a disposition in...

Despite high-quality and long-term work for the same person, no one is definitely insured...

The concept of a business trip and the main provisions related to business trips are defined by the Labor Code of the Russian Federation. The direction takes place on…

Procedure for paying travel allowances

When paying travel allowances, all nuances are taken into account.

According to current laws and regulations, the employer undertakes to pay the ward money for the following periods:

- disability caused by being on a business trip;

- every day you are on a business trip, including:

- Days of forced interruption of a vehicle;

- Weekends and non-working days;

- Days spent on the road.

If a person is sent to a state entity located fairly close to his place of permanent residence, travel expenses are not reimbursed. The conditions of transport communications and the nature of the work tasks performed should allow for daily return without damage to them.

A comment

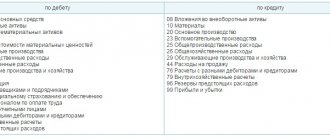

Travel expenses are expenses associated with a business trip of an employee of an organization: compensation for transportation costs, rental of living quarters, daily allowance, etc.

A business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Business trips of employees whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips.

Travel expenses are defined in the Tax Code of the Russian Federation (TC RF). Yes, pp. 12 clause 1 art. 264 of the Tax Code of the Russian Federation (regulates corporate income tax) indicates that other expenses associated with production and sales include:

“business travel expenses, in particular for:

— travel of the employee to the place of business trip and back to the place of permanent work;

- rental of residential premises. This item of expenses also covers the employee's expenses for additional services provided in hotels (with the exception of expenses for service in bars and restaurants, expenses for room service, expenses for the use of recreational and health facilities);

- daily allowance or field allowance;

— registration and issuance of visas, passports, vouchers, invitations and other similar documents;

— consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees;”

Date of recognition of travel expenses

Business travel expenses are recognized on the date of approval of the advance report (clause 5, clause 7, article 272 of the Tax Code of the Russian Federation).

Example

The employee was on a business trip in March. The employee submitted the advance report in April and in the same month the advance report was approved by the manager. In the advance report, the employee reflected the hotel bill for March.

Travel expenses, including hotel expenses for March, are reflected in April - on the date of approval of the advance report.

Daily allowance

Daily allowances are additional expenses compensated by the employer related to living outside the place of permanent residence during a business trip.

Employers in the private sector themselves determine the amount of daily allowance and approve it by collective agreement or local regulation.

For income tax, the amount of daily allowance is recognized as an expense without limitation, based on the amount established by the employer (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation).

For personal income tax, the amount of daily allowance is limited by the standard established by clause 3 of Art. 217 of the Tax Code of the Russian Federation - 700 rubles per day for business trips within Russia and 2,500 rubles for business trips abroad. That is, payment of daily allowances in excess of the established standard is subject to personal income tax, and other travel expenses are not taxed.

Daily allowances are subject to insurance contributions (as for personal income tax) only if the daily allowance exceeds the established standard - 700 rubles per day for business trips in Russia and 2,500 rubles for foreign business trips (clause 2 of Article 422 of the Tax Code of the Russian Federation). This rule has been introduced since 2017. Before this, daily allowances were not fully subject to insurance premiums (Clause 2, Article 9 of Federal Law No. 212-FZ of July 24, 2009).

Other travel expenses reimbursed (and documented) to the employee (for example, transportation costs, taxi costs, etc.) are not subject to insurance contributions (clause 2 of Article 422 of the Tax Code of the Russian Federation).

Example

The employee was on a business trip in the city of Samara in connection with the company’s acquisition of a machine. The organization established a daily allowance of 1,000 rubles for each day of a business trip. The employee was on a business trip for 5 days.

For income tax, the organization recognizes daily allowance in the amount of 5,000 rubles.

1500 rubles of employee income is subject to personal income tax (1000 - 700) * 5.

1,500 rubles of an employee’s income is subject to insurance contributions.

Date of receipt of income by the employee according to personal income tax

If an employee receives a daily allowance in excess of the established standard (700 rubles per day for business trips in Russia and 2,500 rubles for business trips abroad), then the amount of daily allowance exceeding the standard is subject to personal income tax. Taxable income for an employee may arise in other cases. For example, if an employee does not return part of the funds received to the account, without supporting documents.

In what cases is an application required?

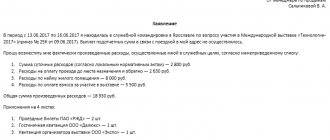

An application for reimbursement of travel expenses must be submitted personally by the returning employee. The HR specialist must be sure that the document was drawn up by him.

Despite the proliferation of fax signatures and electronic media, the presence of handwritten confirmation still plays a significant role. Therefore, a statement must be drawn up and signed in all cases where the established budget is exceeded.

What should the application contain?

The application is written according to the general rules.

There is no generally accepted application form for travel reimbursement in the government system. In most cases, it is compiled in electronic form or in handwritten form.

In the latter case, the applicant is recommended to leave his signature and the date of submission of the document. The form must include the following elements:

- Content. The essence of the application is described;

- Title. Contains the initials and position of the recipient;

- Bottom line. The date and time the document was written is indicated. By signing it, the applicant agrees with the stated requirements.

How to correct mistakes made

If an error is found in the document, you must do the following:

- Rewrite/retype the document. You can use this method if an error is noticed:

- before the manager’s signature was affixed;

- at the time of signing.

- Issue a new order. But before you start issuing a new one, you need to create an order canceling the order, which contains various types of errors. It should contain the following:

- registration number;

- the date it was compiled;

- document's name;

- the beginning of the text, starting with the words: “Declare invalid” or “Consider invalid”;

- grounds for cancellation;

- who is responsible for corrections;

- signature.

Order on accrual of travel allowances

Often, employees exceed the standard amount of financial expenses while on a business trip. To receive a refund, you will need to issue an appropriate order. It contains the following information:

- Sender's full name;

- place of business trip;

- position held;

- dates of business trip;

- authorized person executing the order;

- reasons for cash payments.

The information described above is indicated in a separate document, which allows you to reimburse funds spent in excess of the norm.

Sample application for reimbursement of travel expenses.

State employees have different rules

For organizations financed from the budget, the procedure for reimbursement of expenses, in particular, expenses for accommodation on a business trip, is established by special regulations.

For federal government bodies, extra-budgetary funds and federal institutions, the procedure for reimbursement of travel expenses is established by the Government of the Russian Federation. For regional government bodies and institutions, the procedure is established by the executive authorities of the constituent entities of the Russian Federation. For local government bodies and municipal institutions - local executive authorities (Parts 2, 3 of Article 168 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation dated October 2, 2002 No. 729).

Let us note that budgetary institutions can increase these amounts by saving budget funds, as well as money received from entrepreneurial activities (clause 1, clause 3 of the Decree of the Government of the Russian Federation dated October 2, 2002 No. 729, letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14 -2-291).

Before a business trip takes place, HR employees must document it. For example, an order is issued in advance on behalf of the employer (as well as a memo for a business trip: a sample for 2021 can be found).

Since the initiative comes from the head of the enterprise, the business trip must be paid for from the company’s budget (in the case of the military, the situation is slightly different, as well as regarding the preparation of the corresponding report).

Article 168 of the Labor Code of the Russian Federation establishes the right of employees to receive funds

, if they are going on a business trip. The exact amount of money is calculated based on the destination and other estimated costs. In any case, the employee will have to write a statement in which he asks for reimbursement of potential travel expenses. This is usually issued on the basis of a completed trip report.

Tags: accountant, personnel, tax, order, expense

Memo for refund of funds: sample

The reason for this may be the person moving to work in a new area (Art.

169 of the Labor Code of the Russian Federation). The main condition for the enterprise to reimburse the funds spent is the employee’s pre-agreed intention to use his income and property to achieve work goals.

Each organization individually develops a unified procedure for reimbursement of expenses and it is formalized, as a rule, by order or regulation. Therefore, all kinds of expenses of employees in the interests of production should be regulated by such documents in advance.

Features of cost compensation: main types and grounds As is known, the specifics of the activities of organizations are widely differentiated, and issues related to covering certain expenses can arise for a variety of reasons.

Accountant's Directory

07/10/2018 Contents It is necessary to attach the appropriate receipts, travel tickets, housing receipts and other documents indicating that the employee paid for these services.

- Then indicate the minute-by-minute time of arrival and indicate the list of documents that you will attach as a basis for receiving money.

- In addition to the main points accepted for all notes, in the text of the document indicate the exact time, minutely, and the city from which the employee departed, as well as the city of arrival.

- Then list in detail all the services for which compensation is required, describing them as informatively as possible, but at the same time concisely.

- Clearly record the date of departure of the employee on a business trip and the date of his arrival.

For financial assistance, Russian legislation provides for the possibility of employees receiving one-time payments.