We prepare an advance report

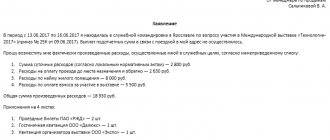

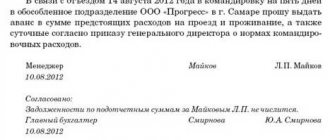

Upon returning from a business trip, the employee must, within 3 working days, under your strict guidance, fill out an advance report (Form N AO-1) about the money spent on the business trip . Before submitting the expense report to the manager (other authorized person) for approval, you need to:

— check the report for correct completion, as well as arithmetic errors;

— make sure that the supporting documents indicated in the report are actually attached to it and that they are all drawn up properly.

What should be attached to the expense report

Here are the documents that must be attached to the advance report (Clause 26 of the Regulations):

- travel certificate in form N T-10 (for business trips to CIS countries with which there are agreements that border marks are not made in the international passport) (Clause 15 of the Regulations) or copies of pages of the employee’s international passport with marks on border crossing;

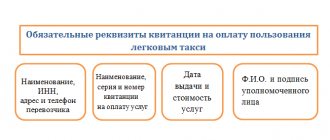

— documents confirming travel expenses . Moreover, if an electronic air or railway ticket was purchased, then the supporting documents may be a printout of the itinerary receipt (ticket) and boarding pass, as well as documents confirming payment for the ticket (cash register receipt or payment terminal receipts, bank statement);

— documents confirming living expenses (invoices, payment receipts);

- documents confirming other expenses (if any): for visas and medical insurance, for paying for bed linen on the train, excess baggage, entertainment services, postage, communication services, etc.

For convenience, you can take several sheets of blank paper, title each by type of expense (for example, “Transportation expenses,” “Hotel expenses,” “Other expenses”) and stick the corresponding expense documents on them.

But it doesn’t matter what the employee spent his daily allowance on. There is no need to confirm this with any checks, receipts or other similar documents.

Attach to the advance report an official assignment form for sending on a business trip (Form N T-10a) with completed section. 12 “A brief report on the completion of the task” (Clause 26 of the Regulations) is not necessary, since the tax authorities believe that the official task together with the report on its completion are not the documents necessary to confirm expenses.

Issuing an advance for a business trip in foreign currency

Before being sent on a business trip, the employee must be given an advance payment for upcoming expenses. It is paid in rubles or foreign currency.

With a ruble advance everything is clear. But let’s take a closer look at issuing a foreign currency advance for travel expenses.

On the date of payment to the employee of the travel allowance in foreign currency, it must be recalculated at the Central Bank exchange rate in order to be reflected in accounting simultaneously with the foreign currency amount of the advance. Before the approval of the advance report, the debt of the reporting entity (the amount of the advance issued) in foreign currency does not need to be recalculated. This is stated in paragraphs , , , , , PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.”

What to do if the “primary” is in a foreign language

It is logical to assume that some of the documents confirming expenses on a business trip abroad will be drawn up in a foreign language. The regulatory authorities believe that it is necessary to make a line-by-line translation of such documents into Russian on a separate sheet - either on their own or by contacting a translation agency.

For air tickets and other transportation documents issued in a foreign language, the Ministry of Finance requires translation only of the details necessary to recognize profitable expenses (passenger's full name, direction, flight number, date of departure or arrival, ticket price). Translation of information that is not essential for confirming expenses (for example, fare conditions, air transportation rules, baggage transportation rules) is not necessary.

But according to the Federal Tax Service, there is no need at all to translate an electronic air ticket into Russian. After all, such an air ticket is a unified international form of document. Therefore, most of the ticket details are filled in in accordance with the Unified International Codifier.

However, the tax authorities will probably find fault with the lack of translation of other supporting documents (except for air tickets), for example, bills from a hotel or for renting a car or taxi service, emphasizing the fact that it is impossible to establish the target nature of the expenses incurred.

And most likely, they will not miss the opportunity to charge your company additional income tax, as well as penalties and fines.

But there are chances to fight off tax claims in court. Some courts, when considering similar cases, rightly noted that:

— the Tax Code of the Russian Federation does not establish the taxpayer’s obligation to translate documents drawn up in a foreign language;

— nothing prevents the tax authority from exercising its right to suspend a tax audit to translate documents into Russian.

Advice

In order not to awaken the beast in the tax authorities, it is better to translate documents in a foreign language into Russian. Moreover, your employee who speaks the required foreign language can also do the translation, if this is part of his job responsibilities. If you apply for translation to a specialized organization, the translation costs can be included in other expenses.

Paying the employee

So, the advance report is approved by the manager. And you see that the posted employee did not fully spend the advance payment given to him or did not confirm some expenses with primary documents. In this case, he must return the unspent amount to the cashier according to the cash receipt order.

If the employee does not return the unused balance within the time allotted for the final payment of the advance payment issued to him (3 working days (Clause 11 of the Procedure)), you can withhold this amount from his salary (Article 137 of the Labor Code of the Russian Federation). To do this, it is necessary that (Article 248 of the Labor Code of the Russian Federation):

- within a month from the end of the 3-day period, the manager issued a written order to recover the unspent amount from the employee;

- the employee has given written consent to deduct this amount from his salary if it exceeds his average monthly earnings.

In the event that an employee spends more money on a business trip than was given to him, the amount of overexpenditure must be reimbursed to him. It is advisable to do this no later than the next payment of his salary.

At what rate to calculate expenses for foreign business trips in 2018

For foreign business trips, the rate of daily travel expenses in 2021 cannot exceed 2.5 thousand rubles per day. For trips within Russia - 700 rubles. This norm applies to employees of state enterprises.

The new decree has changed the procedure and points for calculating the minimum amount of cash coverage for a business trip, but the amounts in the Labor Code are conditional and vary greatly depending on the territory of the employee’s work and the region of his trip.

The Labor Code of the Russian Federation does not include payment for meals for a business trip employee in the list of expenses required to be reimbursed.

The legislation stipulates only one requirement for the company regarding daily allowances, including for business trips abroad - their amount must be indicated in the local regulations. Usually, the Regulations on Business Travel are used for this, but it can also be done with a separate order approving the amount of daily allowance.

We take into account travel expenses

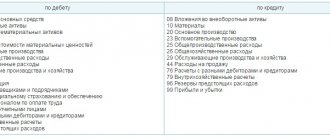

how the main business trip expenses are recognized for tax purposes .

| Type of expenses | Income tax | Personal income tax | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Compulsory Medical Insurance and Compulsory Compulsory Compulsory Medical Insurance | |

| Daily allowance in the amounts provided for by local regulations or collective agreement | Fully included in expenses | Not withheld from amounts not exceeding: (or) 700 rubles. per day - for business trips around Russia; (or) 2500 rub. per day - for business trips abroad. If the daily allowance was paid in a larger amount, then the excess amounts are subject to personal income tax | Not credited | |

| Daily allowances for the day of arrival from a business trip abroad must be paid according to the norm established for business trips in Russia (in rubles). And even if the regulations on business trips adopted by your company state that daily allowances for the last day of a business trip are paid in the same amount as for all days of a business trip abroad (for example, 2,500 rubles), only 700 rubles will not be subject to personal income tax. If daily allowances were paid in foreign currency, then in order to compare the amount of daily allowances with the established ruble standard for the purpose of calculating personal income tax, you need to convert them into rubles at the official exchange rate in effect on the date of payment of daily allowances (and not on the date of approval of the advance report) | ||||

| Travel expenses: — to the place of business trip and back (including business class or in SV carriages); — to the airport, train station, pier (including by taxi) and back | Counted into expenses without restrictions | Doesn't hold | Not credited | |

| Expenses for renting residential premises - subject to availability of supporting documents | Counted into expenses without restrictions | The entire hotel payment amount is not deducted. If there are no supporting documents, then personal income tax is imposed on amounts in excess of: (or) 700 rubles. per day - for business trips around Russia; (or) 2500 rub. per day - for foreign business trips | Not credited. If there are no supporting documents, then the amount reimbursed to the employee is not subject to contributions within the limits established in the local regulations. If you have not established such standards, then urgently supplement your business travel regulations with a procedure for reimbursing employees for unconfirmed expenses in order to avoid paying contributions | |

| Expenses for service in bars, restaurants, in the room, as well as fees for the use of recreational and health facilities (for example, a fitness room, sauna, etc.) are not taken into account for profit tax purposes. | ||||

| Costs for processing and issuing visas, international passports, vouchers, invitations, etc. | Counted into expenses without restrictions | Doesn't hold | Not credited | |

| Payment for communication services | ||||

| Payment for services of VIP lounges (superior lounges) at airports | ||||

| You can justify the cost of paying for VIP rooms, for example, like this: service in the VIP room provides access to telephone and other types of communications, as well as access to the Internet, which allows a business trip employee to quickly solve production problems that require his participation | ||||

Daily allowance for business trips in 2021: amounts of payments, changes

Correspondence of invoices: An employee of a budgetary institution is sent on a business trip to the territory of the Russian Federation for a period of five days. Travel expenses are financed through subsidies for government assignments. However, due to insufficient subsidy funds, the daily allowance was paid from the institution’s own income.

Correspondence of accounts: By order of the head of a budgetary institution, the employee was sent on a business trip from August 1 to August 5, 2011. The budgetary institution purchased train tickets for the employee (in both directions) for a total amount of 3,000 rubles. (including VAT), payment for which is made in advance from the institution’s personal account.

Along with the standard set of expenses for business trips in Russia, including compensation for travel there and back, costs of renting accommodation, daily allowance and other expenses agreed upon with the employer, when traveling abroad the following expenses of the business traveler are subject to additional compensation:

- production of a foreign passport;

- costs for obtaining a visa (consular, visa fees, visa center services, etc.);

- airport and port taxes.

Correspondence of accounts: How to reflect in the accounting of a federal budgetary institution the return by an employee of an advance received for travel expenses in foreign currency as part of an income-generating activity?

However, for budgetary organizations, the amount of daily allowance for business trips abroad is established by the Government of the Russian Federation. And commercial organizations, if desired, can be guided by these daily allowance amounts.