What is the telephone number of the Rosgosstrakh insurance company hotline?

There is a unified help desk that accepts calls by phone. Requests are processed around the clock.

The hotline number is available throughout the country for free - 8. You can call from any location using mobile or landline phones.

Due to the heavy workload of the call center in Moscow, an auxiliary number was opened - +7 (495) 926 55 55. Tariffing depends on the conditions of your operator.

Obtaining an MTPL policy

Every motorist has the right to choose independently where to insure their vehicle under MTPL. In any locality there are several insurance companies ready to provide their services in the area of motor third party liability insurance. It is advisable to choose an insurer based on the cost of the policy, since in the event of an accident it will not be the owner of the MTPL insurance who will turn to him, but the innocent driver whose car was damaged.

In one of our articles, we will look at the offers of insurance companies and determine which of them is worthy of getting new clients.

If you are receiving compulsory motor liability insurance for the first time, it would be correct to make calculations in several companies, choosing the most profitable option at the end. The fact is that there is no single fixed price for this policy. The Central Bank sets MTPL tariffs, but each motorist pays an individual amount for insurance, calculated from several parameters.

The price of compulsory motor insurance depends on the total driving experience and accident-free period (the longer both, the cheaper the policy), the age of the vehicle, its power, and the location of the steering wheel (insurance for right-hand drive cars is traditionally more expensive). The named parameters are calculated; increasing and decreasing coefficients are also applied to them. Also, the cost of insurance depends on its type - closed or open.

How to independently calculate the cost of an MTPL policy? Read more here.

OSAGO closed and open

If the driver cannot choose the design parameters, they are given by default, then the OSAGO type is fine. When we talk about open or closed insurance, we mean the number of people included in the policy:

- closed MTPL: specific people are included in the policy, whose data is included in the calculation parameters and affects the final price of insurance (usually spouses, close relatives or friends are included);

- open compulsory motor liability insurance: anyone with a driver’s license has the right to drive a vehicle (usually done for taxis or other cars driven by different people).

Open insurance costs more than closed insurance

With open insurance there are more risks, because it is impossible to predict in advance which driver will be behind the wheel. Accordingly, open MTPL always costs significantly more and is calculated according to maximum parameters and with increasing coefficients.

Insurer companies often provide discounts to regular customers who register closed MTPL policies from year to year. Such motorists are encouraged for careful, accident-free driving and are insured at preferential rates (the discount can reach up to fifty percent of the base rate of 3,000-4,000 thousand rubles). This is called the “break-even bonus.”

It is also worth considering the validity period of the policy - the cost significantly depends on the time period for which the vehicle is insured. The classic period for issuing an MTPL policy is one year; at the same time, this period is the maximum, that is, it will not be possible to insure a car for more than 365 days. The minimum insurance period is three months.

Contact support via the app

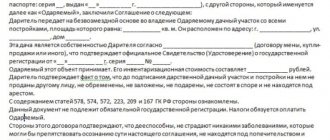

Application "Rosgosstrakh", screenshots

The mobile application "Rosgosstrakh" greatly facilitates the use of company services, such as appeals, submission of documents, etc. You can install software for smartphones on gadgets with an Android or iOS platform.

By logging into your personal account, the client will be able, in addition to using basic capabilities, to send a message to the contact center. To do this, you will need to fill out the form in the “Technical Support” section.

Is it possible to file a lawsuit without going through the stage of filing a claim?

Articles 12, 16.1 and 19 of the Federal Law No. 40, as well as the Resolution of the Plenum of the Armed Forces of the Russian Federation dated January 29. 2021 established the mandatory use by the plaintiff of a pre-trial procedure for resolving a dispute with the insurer. If a claim is brought without following this procedure, the judge leaves it without motion.

This rule applies in the following cases:

- filing claims against the insurer;

- simultaneous involvement of the culprit of the accident and the insurer as co-defendants;

- replacing the defendant on the side that caused the damage to the insurer.

In 2014, Rosgosstrakh massively paid additional claims to claimants. When the sample claim is justified and well-drafted, it is obvious that the claim will be the same. If you lose, the insurer will have to additionally compensate the plaintiff's legal costs and attorney's fees.

Contact support through your personal account

Sending messages in chat or through the feedback form is available only to authorized users. The “Support” section, like others, is activated after logging into your personal account.

To register and log into your personal account, use the link - https://my.rgs.ru.

You can use account options from a PC or mobile device.

How to write a claim?

A single template for contacting an insurer is not approved by law. Sometimes the form of the claim is determined by the transaction of the parties (the sample appears as an annex to the contract). Regarding compulsory motor liability insurance, this is impossible: the victim did not participate in the agreement between Rosgosstrakh and the policy holder, therefore their transaction cannot create obligations for him regarding the form of the claim.

If it is possible to reach an agreement with the insurer out of court, the applicant should be less concerned about the sample claim than about its persuasiveness. Your arguments must be substantiated by reference to the provisions of the law and the contract. The latter are public. A sample can be found on the insurance company's website. If litigation is a priori inevitable, the main thing is to comply with the formalities:

- correctly compose the “header”, indicating:

- details of the insurer (taken from the policy/contract);

- your full name, tax code, permanent residence;

- if the claim is filed by a representative - his full name and details of the power of attorney.

- consistently describe the course of events;

- attach supporting documents that were not attached to the initial application, indicate their inclusion in the text of the claim:

- re-evaluation report;

- agreement with experts, work acceptance certificate;

- receipt for payment of services;

- indicate the requirements.

Rules and procedure for filing a claim with Rosgosstrakh

The document can be drawn up in free form, since the law does not provide for any specific actions in this regard. The claim must contain information such as:

- information about the applicant : full name, address, telephone;

- information about the insurance company : name, address;

- main part : description of the problem situation. This is not necessary, but it would be better to refer to the legislation and provide evidence. Be sure to mention bank details for transferring funds>;

- a request to Rosgosstrakh , for example, to pay insurance or recalculate.

- signature and date.

What documents need to be attached

Copies of the following documents must be attached to the claim:

- passport or other document identifying the owner or victim (passport of an official trustee or heirs>);

- technical expertise or expert opinion;

- medical certificates>;

- insurance policy and payment documents for it;

- registration certificates or passports>;

- papers confirming ownership>;

- certificates of road accidents, protocols, resolutions or refusals to initiate proceedings regarding an administrative offense;

- any other documents that can prove the position of the applicant.

Procedure and method of filing a claim

The document is drawn up in two copies, one of which is personally marked when submitted. When sending papers by mail, you should choose a service such as registered mail with notification. You can also submit a claim on the official website of Rosgosstrakh.

Deadlines for filing a claim and subsequent actions

This process is subject to the standard deadlines specified in Article No. 966 of the Civil Code of the Russian Federation; accordingly, you can submit a claim to Rosgosstrakh:

- within two years for property insurance>;

- for three years to insure the risk of liability for damage caused to the health, life or property of other persons.

The paper must be reviewed within ten days from the date of submission. If there is no reaction, the citizen has the right to file a claim in court.

Claims up to fifty thousand rubles are considered by magistrate courts, and above this amount - by district courts.

How to properly file a claim

The document is drawn up in free form, but it is recommended to use a sample claim to the insurance company for compulsory motor liability insurance, containing all the information required by law.

If any data is missing, the claim may be returned without consideration.

The application must indicate:

- full name of the defendant's company;

- legal address of the office;

- Full name, place of registration and actual address of the victim;

- list of claims to the insurance company;

- a description of the reasons why the applicant considers the insurer’s actions to be unfair;

- references to legislative acts confirming the grounds for the claim;

- a note stating that the claimant does not agree with the compensation awarded;

- requirement to provide a fair amount of compensation (indicate the amount);

- details of the bank to which funds must be transferred if the requirements are met.

For claims sent on behalf of a legal entity, it is necessary to indicate the name and position of the originator.

How to formulate requirements?

Claims and claims are logically interrelated. The plaintiff must demonstrate to the court that he approached the defendant with the demands stated in the claim, but the insurer refused him or did not bother to respond within the allotted time.

If during the litigation it turns out that the claim was not the subject of a pre-trial settlement, the court may refuse to consider it. This rule does not apply to side issues, for example:

- compensation for the cost of the examination carried out at the plaintiff’s initiative;

- fine - 50% of the difference between the amount of the insurance premium established by the court and that which was paid voluntarily by the insurer (Part 3 of Article 16.1 of Federal Law No. 40);

- recovery of moral damages;

- compensation for the plaintiff's expenses for state fees and legal services.

When formulating requirements, you should not rewrite someone else’s sample. In addition, do not be afraid to write too much: the insurer has the right to admit the claim in whole or in part. The final sample of an insurance company’s claim for compulsory motor liability insurance may contain the following sentence:

- compensate for the involvement of third-party experts;

- accept the results of the independent assessment;

- reimburse the difference based on the results of two examinations;

- review the results of the examination made at the initiative of the insurer;

- bring a Rosgosstrakh employee to disciplinary liability.