Last modified: January 2021

A system of rewards and punishments helps regulate the work process, improving the quality of work and the results achieved. Almost every enterprise has developed a remuneration system that provides for the possibility of bonuses. Different types of bonuses can be applied, depending on the characteristics of the organization’s activities and the nature of the work. Since there are no identical organizations, each employer has its own objectives, based on which the types of bonuses and remunerations are selected.

When determining the possibility of paying a bonus, it is necessary to establish the parameters under which bonuses are allowed to be paid to employees. For some, the most important thing is the quality of the work performed, others are aimed at achieving certain quantitative indicators. There is no perfect reward system, and this often leads to people who are dissatisfied with the assessment of their work by managers. Therefore, it is so important to correctly select the assessed indicators that can objectively determine the degree of employee productivity.

Incentive payments (bonuses) as a form of payment for work

The current labor legislation (Article 129 of the Labor Code of the Russian Federation) allows the employer to establish a wage system consisting of several parts:

- payments for work performed in accordance with job duties;

- compensatory payments taking into account the conditions in which work is carried out;

- additional incentive payments designed to increase employee interest in work.

By adopting such a remuneration system, the employer has the opportunity to:

- influence the employee’s interest in the results of his activities;

- regulate the amount of labor costs taken into account when calculating the income tax base.

The types of bonuses and remunerations used as additional incentive payments are reflected in the internal regulations developed by the employer (Article 135 of the Labor Code of the Russian Federation). This act establishes:

- list of types of incentives used;

- conditions and frequency of their accrual;

- the circle of persons to whom each type of incentive applies;

- a list of indicators that allow an employee to qualify for appropriate remuneration and deprive him of such an opportunity;

- a system for assessing indicators giving the right to remuneration, the result of processing of which will be the monetary value of the remuneration;

- procedure for reviewing assessment results and challenging its results.

However, incentive additional payments, when included in the remuneration system, become mandatory for the employer if all conditions for applying the incentive are met.

For information on how an internal regulatory act on bonuses , read the article “Regulations on the remuneration of employees - sample 2019-2020”.

Rules and payment procedure

After submitting a report to the head of the structural unit, the head considers this request. The decision to award an employee a bonus is made by the manager after an analysis of the work performed.

Then the manager’s order is processed in the accounting department, where the bonus calculation itself is carried out (you can find out more about why an order to reward an employee is needed, and also see a sample document here).

Rewarding an employee of an enterprise with a monetary payment and a sample order for bonuses for an employee.

If the bonus amount is determined as a percentage, then the accountant multiplies the salary by the corresponding percentage specified in the bonus order. And then, according to paragraph 6 of Art. 164 of the Tax Code, already deducts income tax from the amount received, which is 13%.

In the case where the bonus is a fixed amount, then 13% is immediately calculated from it, that is, income tax (we talked about the peculiarities of taxation of funds allocated for bonuses to employees here). The remaining amount will be paid to the employee.

- Example: The employee worked for a full month, and his monthly salary is 10,000 rubles. The employee receives a bonus of 30% of his salary.

The employee's salary is 10,000 rubles.The bonus is 30% of the salary.

Calculation:

- 10,000×30%= 3,000 rubles – premium in rubles;

10,000+3,000=13,000 rubles – total accrued to the employee (salary + bonus);

- 13,000×13%= 1,690 rubles – income tax;

- 13,000-1690=11,310 rubles.

- Example: The monthly salary of an employee who has worked for a whole month is 20,000 rubles. He receives a bonus of 5,000 rubles.

Calculation:- 20,000+5,000= 25,000 rubles;

25,000×13%= 3250 – income tax;

- 25,000-3250= 21,750 – total.

From the amount received you will need to subtract contributions to the funds. These calculations are carried out in the same way as when calculating regular wages.

In the case where the bonus is a fixed amount, it is summed up with accrued wages for the time actually worked, and 13% is calculated from the resulting amount.

From the amount received, it will be necessary to make an accrual to the funds, which is carried out as for regular wages.

Important! According to the latest changes to the Labor Code dated October 3, 2016, the period for payment of wages and bonuses has been reduced. Now payments to the employee for the last month must be made before the 15th of the next month

.

Read more about how to register and record the payment of one-time bonuses here.

Are there any differences in the concepts of “monetary remuneration” and “wages”

The term "cash reward" can be applied to any payment made in money, regardless of its purpose. That is, it can be either remuneration for work or any other payment. Additional incentive payments made for the employee’s labor achievements are part of the salary and, when issued in cash, are regarded as monetary rewards issued as payment for labor.

But in addition to payments related to labor achievements, the employer can use other additional payments that are not determined by the employee’s labor functions. Usually they are one-time in nature and do not have a regular accrual period. An example of such additional payments are bonuses paid for anniversaries or holidays. They fully correspond to the term “monetary remuneration not related to wages.”

Current classification of bonus payments

Despite the absence of special explanations in the law, there has been a practice of dividing bonuses into different types of bonuses according to the nature of payments and the circumstances of their appointment.

There are three classification options, depending on:

- employee merit;

- regularity;

- transfer financing.

When considering the merits of an employee, it is difficult to reduce the assessment to numerical indicators, and the types of bonuses for merit are presented:

- Payments for achievements in work in production or provision of services.

- Material incentives for other achievements not related to the performance of direct duties, or not related to work results at all.

The second type of awards is dedicated to holidays and memorable dates.

Depending on how often the bonus is paid and whether there is a sign of regularity, it is divided into:

- One-time use.

- Periodic (once a month, quarter), with regularity over a certain time interval.

- Annual, based on the results and merits of the past year.

Varieties depending on the source of funding include:

- payment through the enterprise’s normal expenses for core activities;

- transfers financed from the fund of other expenses;

- payments from the organization's income.

Depending on the type of payment, there are specific application features.

What kind of bonuses are there and how else can employee incentives be expressed?

Incentives that serve the purpose of stimulating employees are divided into 2 main types:

- material (monetary or in kind), representing various types of additional payments;

- intangible, which can be expressed in a declaration of gratitude, placement on the honor board, assignment of an honorary title, awarding a diploma, medal or memorial sign.

Among material incentives, the leading role is given to bonuses. But there may also be other types of cash payments, expressed, for example:

- in bonuses to the salary or tariff rate established for a certain period;

- additional payments for length of service.

Among bonuses in relation to the regularity of their payment, there are 2 main groups:

- Regular (systematic), accrued and paid at a certain frequency (month, quarter, year). All issues related to such bonuses are regulated by the employer’s internal regulations on incentive payments. Special instructions (decisions) for calculating such bonuses are not needed. If the conditions stipulated by the internal regulations on bonuses are met, they must be accrued without fail.

- Irregular (one-time), which can be named in the internal regulatory act on bonuses as included in the remuneration system, but their accrual requires additional information on indicators essential for bonuses. Therefore, for such bonuses it is necessary to draw up a separate document justifying the employee’s right to receive a bonus, and to make a separate decision on this document by the head of the organization.

According to the sources through which bonuses are calculated, they can be divided:

- included in expenses that reduce the income tax base - this will include bonuses related to the employee’s labor achievements, both included in the remuneration system and not included in this system;

- attributable to net profit - such attribution applies to bonuses for non-production purposes, paid not for labor achievements (letter of the Ministry of Finance of Russia dated April 24, 2013 No. 03-03-06/1/14283).

For information about what bonuses are included in the calculation of average earnings, read the material “Are bonuses taken into account when calculating vacation pay?”

What do they get a bonus for?

Bonuses must be paid after the employer has signed the order. Therefore, we will now find out what the bonus is for:

- when an employee exceeds the work plan;

- when an employee produces high-quality products without a single defect;

- resource efficiency - using less material than planned;

- when an employee goes to work on his legal day off or holiday;

- if the work was very complex and time-consuming;

- holidays - anniversary, corporate party, public holiday and much more.

The order should display the following:

- the director of the company approved the receipt of bonuses for the specialist;

- when the internal act states that the employee should receive a bonus;

- the director personally signed a memo or application from the employee, and came to the conclusion that he needed to issue bonuses.

The Labor Code of the Russian Federation does not imply the mandatory implementation of this action without the signature of the head of a particular organization. Therefore, it is necessary to turn to SEO promotion technologies by specialists who know how to get premium ones. There are many reasons, but we will list the most significant:

- the employer himself comes up with bonuses;

- if there are acts within the state that stipulate the issuance of bonuses;

- everything is described in documents that fall directly into the hands of the company manager.

What are the differences between a bonus and a bonus, a regular bonus and a guaranteed one?

With regard to the words “premium” and “bonus”, dictionaries of financial terms give very similar interpretations, implying the same concept - “remuneration”. Therefore they can be considered identical. Although some nuances of the explanations given in the dictionaries allow us to consider the bonus as an unexpected payment (a gift), which makes it closer in meaning to irregular (one-time) bonuses.

Regular types of bonuses to employees include bonuses included in the remuneration system (i.e., which have become mandatory for the employer), accrued and paid at specified intervals. In certain circumstances, they may not be accrued (for example, in the event of unsatisfactory financial and economic performance of the organization for the period or in relation to an employee deprived of a bonus in accordance with the bonus rules), but this turns out to be the exception rather than the rule.

Guaranteed bonuses should be considered those regular bonuses that are set in a fixed amount and do not depend either on the results of the employee’s work or on the time actually worked by him.

Salary

First of all, you need to understand what wages are. This term is usually used to refer to the form and mechanism of rewarding a person for work performed. The average citizen knows that his work can be paid according to time or according to the amount of work actually done, and this is stipulated in the individual employment contract that a person concludes when hired.

However, any working citizen also knows that almost all employers form wages from two indicators - salary and bonus, and sometimes mysterious “incentive payments” and “bonuses” are added to these lines in the payroll. And if everything is simple with the salary, then various bonuses and bonuses are perplexing. What it is? What is the difference between a bonus and a premium? What determines the payment of these sums of money?

How is a bonus for a professional holiday or anniversary taxed in 2021?

Bonuses paid for labor achievements are regarded as payment for labor and, like regular salaries, are subject to personal income tax and insurance contributions.

But incentive payments not related to work achievements, such as an employee’s anniversary bonus or a holiday bonus, are also employee income. And they, just like wages, must be subject to personal income tax and insurance contributions (Article 420 of the Tax Code of the Russian Federation, paragraph 1 of Article 20.1 of the Law “On Compulsory Social Insurance against Accidents...” dated July 24, 1998 No. 125-FZ). Moreover, contributions, in contrast to the amount of such a premium itself, can be taken into account in expenses when determining the income tax base (subclause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 06/09/2014 No. 03-03-06/1 /27634).

ConsultantPlus experts explained in detail how to reflect bonuses in form 6-NDFL. Get trial access to the K+ system and switch to the Ready-made solution for free

The concept of "premium"

In Russian legislation, all premium wages are called bonuses. Although there is no such legal term, and the concept of a bonus as part of remuneration for work is also absent.

The term "premium" exists. This is the name for the payment in any expression that an employee receives in addition to the basic salary. This means that such encouragement is a reward - for increased quality indicators, for results, for achievements, etc.

In this case, the bonus can be considered part of the salary - in this case, it increases the amount of his average earnings, and the employer reflects this money as an expense that reduces profit, which reduces the amount of tax. In order to give the bonus a legally significant form, the procedure and amount of its payment must be specified in the regulations on bonuses and bonuses at the enterprise. Most often, this document is of a collective nature, but sometimes such information is reflected only in an individual employment contract. Among other things, it is necessary to specify the indicators on which the payment or amount of remuneration will depend, the system for evaluating these indicators, formulas for calculating amounts, the procedure for considering all of the above, and also determine the circle of employees who will be affected by this bonus system.

If this is not done, the bonus will be considered an incentive payment. In any case, it will be the employee’s income and will be reflected in the amount of income tax, but will be more irregular and unsystematic.

How to fill out an order if a company’s employees have been given a bonus (sample)

To issue an order for bonuses, there are unified forms approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1:

- T-11, issued when awarding bonuses to one employee;

- T-11a, compiled with the encouragement of a group of workers.

However, these forms are not mandatory for use and nothing prevents the employer from issuing such orders using a form developed independently.

The basis for issuing an order will be:

- the results of the distribution of regular (systematic) bonuses approved by the head of the organization;

- a memorandum with a positive resolution from the head of the organization regarding the nomination of an employee for an irregular (one-time) bonus.

A sample of filling out an order for bonuses, drawn up on form T-11, can be seen on our website.

Types of bonuses and employee benefits

What are they? Classification

There are three classifications of types of awards:

- by type of merit;

- by frequency;

- by source of payment.

The classification according to merit is presented in the table.

| Awards for labor achievements | Closely related to production or service provision. They are paid for good results |

| Non-labor bonus payments , or incentive payments without a direct connection with labor achievements. | Usually they do not have a significant connection to the employment relationship. They are paid on holidays and various important dates |

The following awards are distinguished according to frequency:

- One-time. They are paid once;

- Monthly and quarterly. They are received at specified time intervals;

- Annual. Appointed at the end of the year.

According to sources, the following types are distinguished:

- Funded from normal costs. They are included in the standard costs of the organization's traditional activities.

- Recorded against other expenses.

- Accrued from profits.

Please note that there are several types of one-time bonuses.

They are awarded either for high results of work activity, or upon the occurrence of certain events, holidays, etc.

One-time bonuses are often considered synonymous with one-time bonuses. Therefore, different types of one-time bonuses are considered payments tied to certain events, high performance or circumstances.

How to fill out an application for payment of a bonus to the chief accountant? What types of employment contracts are there? Find out here.

Similarities and differences (comparative table)

Common and unique features of awards issued on the basis of different criteria are indicated in the Table.

| Classification feature | Common features | Differences |

| According to merit | Principles of calculation and organization of payments | Reward and incentive goals |

| By frequency | Purposes and basis of accrual and issuance | Destination time interval |

| By sources | The expected result of this stimulus | Rules for calculation, accrual and taxation determined by the source of financing |

General procedure for calculation and registration

The general principle of accrual is indicated in Article 135 of the Labor Code of the Russian Federation. It provides for the right of the employer to create a bonus system, which is fixed in collective agreements, agreements, and local regulations in accordance with the law.

Bonus payments to employees of federal budgetary institutions are determined by special guidelines. Other organizations are developing collective agreements that establish general provisions. And the procedure itself, indicators, circumstances, as well as the amounts and other aspects of bonuses are described in the regulation on it or part of the general regulation on remuneration.

The mentioned documents are considered local acts. They may also be specified in employment contracts.

The specific payment of bonuses is regulated by an order for the organization, issued on the basis of the adopted bonus system, which consists of the following:

- quantitative or qualitative indicators of bonuses;

- necessary requirements;

- amounts;

- designations of individual people or groups of recipients;

- appointment time intervals;

- grounds.

Bonus indicators are determined by the characteristics of the organization and the employee.

Features are understood as carrying out actions or behavior, without which a bonus will not be awarded.

For example, compliance with safety regulations.

The amounts can be any. They are determined as a fixed amount or as a percentage of the basic monetary remuneration.

Time depends on the organization of work. The basis is an order or other order for the payment of bonuses.

In what documents should organizations be reflected?

All these documents have already been mentioned above.

Let us recall them in the list:

- methodological instructions for budgetary organizations;

- collective agreements;

- employment contracts;

- orders;

- bonus provisions;

- agreements;

- other papers.

What is depreciation? Read our article. A sample application for payment of the bonus can be found here.

How to draw up an order for granting leave? Find out here.

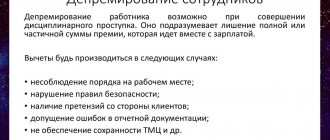

How to reflect it in the bonus regulations?

The regulations on bonuses can be general for all organizations or individual for a division, workshop, or department.

It should contain the following points:

- destination indicators;

- conditions;

- amounts;

- periodicity;

- calculation method;

- disorders that reduce their size;

- various payments that are not subject to bonuses.

It is recommended to break the document into the following sections:

- general principles;

- types and indicators of bonuses;

- calculation procedure;

- conclusion.

Attached to the article is a sample bonus regulation adopted by one of the Russian organizations. It describes the relevant standards in great detail.

In this context, a bonus can be considered as one of the types of long-term staff remuneration.

And the employee will know that today and in the foreseeable future the enterprise encourages such and such results of labor or other activities.

sample bonus clause

Taxation

According to tax law, the payment of bonuses is considered as part of the cost of profit.

In Art. 25 of the Tax Code of the Russian Federation provides a list of purposes for using bonus funds. And Article 225 of this code regulates the reduction of the tax base by the amount of bonuses.

Bonus costs are included in labor costs in the following cases:

- exclusive accrual of bonuses for the results of professional activities;

- a clear indication of the conditions for receiving this remuneration in a collective or employment agreement.

A reference to the bonus regulations is acceptable. Be sure to indicate the calculation procedure and amounts.

Otherwise, the document relates to Article 270 and is considered as remuneration for activities not provided for by work duties.

Funds for such bonuses are taken from special funds or from net profit.

Results

One of the components of the remuneration system can be incentive payments.

The main role among these payments is given to bonuses. Bonuses can be regular or one-time, expensed and paid out of net profit. But they are taxed according to the same rules with the calculation of personal income tax and insurance contributions. Payment of the premium must be formalized by order. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Regarding allowances and surcharges

The Labor Code practically does not describe these types of bonuses and does not differentiate them in any way. Such finances are paid in addition to the basic salary. They help make calculations more individual.

The following parameters must be taken into account:

- How does a citizen feel about the work process?

- The mastery of the subordinate.

- Intensity of activity.

The difference between such payments and others is that they have a permanent basis. The employee is rewarded for the individual results he was able to achieve during his work.

Article 135 of the Labor Code regulates only the policy that an enterprise must adhere to in this direction. Balancing and intensifying the activities of employees is the main goal for introducing such payments.

Bonuses can be received if the following conditions are met:

- Working in difficult or dangerous conditions, at night.

- Supervising a group of other workers.

- Replacement of absentees.

- Combination of several positions.

In addition, allowances are given to those citizens who:

- Completed a particularly important task.

- Achieve high results.

- New academic degrees are being earned.

- Receive the next grade in their position.

- Demonstrate a high level of mastery of the profession.

You can develop a system of allowances yourself, or you can rely on Government Decree No. 491/26-175 of 1986. The document was approved back in the days of the USSR, but remains valid to this day.