Home / Labor Law / Payment and Benefits / Bonuses

Back

Published: 04/08/2016

Reading time: 6 min

0

3122

Bonuses are one of the best ways to stimulate workers , which has a positive effect on the effective functioning of the entire enterprise as a whole.

The bonus system is developed for each enterprise separately, taking into account the goals and objectives set for its employees. Employers take into account several factors at once, such as efficiency and achievement of goals, labor indicators, and the conditions under which bonus funds are issued.

There are often cases when employees remain dissatisfied with the amount of accrued bonus funds and even write complaints to the labor inspectorate. To avoid such troubles, the employer needs to foresee possible conflict situations in advance and draw up bonus regulations adjusted for controversial issues.

The possibility of rewarding for effective and conscientious work is laid down in Article 22 of the Labor Code.

The procedure for paying cash bonuses must be clearly stated in the employment contract, taking into account the opinions and wishes of the entire team (in accordance with Article 144 of the Labor Code).

The following types of bonus incentives are distinguished.

- Systematic Based on the results of the work performed

- For length of service

Rules for payment of bonuses: types and existing regulatory framework

Bonuses are motivating payments made by employers to distinguished employees who conscientiously perform their duties or achieve good work results.

In accordance with Part 1 of Article 129 of the Labor Code of the Russian Federation, bonuses can be one of the components of wages. In this case, it is necessary that the bonuses are clearly stated, for example, in the bonus regulations or employment contract. It is in these papers that the rules for paying bonuses are formulated:

- Achievements leading to an award;

- Methodology for calculating the amount of the bonus;

- Conditions that prevent the accrual of incentive payments.

The bonus accrued in accordance with these documents becomes an integral part of the overall payment system.

Based on the frequency of payments, bonuses are divided into the following types:

- One-time – paid once, usually timed to coincide with an event;

- Periodic – paid at certain times (for example, every month or quarterly);

- Annual – paid at the end of the year.

Monthly, quarterly and annual incentive payments are divided into production (for example, monthly bonuses that are part of the salary) and non-production (for example, monthly bonuses for employees raising children). Moreover, bonuses are most often associated with the work achievements of employees. After all, very few employers can afford to issue bonuses that are not consistent with work results.

In accordance with Article 129 of the Labor Code of the Russian Federation, salary is the main type of reward for work. At the same time, non-production bonuses (the same monthly payments to employees with children) do not depend in any way on work success.

The same article of the Labor Code provides for the possibility of material incentives for employees through bonuses. The definition of the term “bonus” itself can be found in Article 191 of the Labor Code of the Russian Federation: it states that incentive payments to employees are not mandatory.

According to Article 193 of the Labor Code of the Russian Federation, an employer cannot leave an employee without a bonus, even if he has violated discipline.

The Labor Code does not regulate in detail the rules for paying bonuses - according to Article 135, the employer has the right to decide these issues himself.

Ambiguous or conflict situations arising around the volume and procedure for calculating bonuses are considered as labor disputes in accordance with Article 381 of the Labor Code of the Russian Federation. The form of payments is prescribed in Article 131.

Primary documentation of the company , which helps to take into account the costs of salaries and bonuses, as well as income tax, is:

- Gazette;

- Expense orders;

- Payment orders confirming the accrual of bonuses to the employee.

Features of the bonus are regulated by:

- Collective agreements;

- Regulations on bonuses;

- Internal labor regulations;

- Other documentation.

Regular bonuses

Regular bonuses are incentive payments upon achievement of predetermined results. They are permanent and are included in the wage system. If the bonus conditions are met, the employee receives a pre-agreed remuneration. If the conditions are not met, the premium is not paid.

Regular bonuses, in turn, are divided into:

- Monthly.

They are paid every month along with the salary and are included in the average salary of the employee.

- Quarterly.

Rules for payment of bonuses and methods of documenting them

According to legislative provisions, in practice, a number of methods can be distinguished that make it possible to spell out in detail the rules for paying bonuses.

First way

This is perhaps the most affordable of all. It consists of issuing separate bonus orders for each case . The papers indicate the type of bonus, the grounds for issuing it, the list of people who need to be encouraged, the volume of bonuses and the timing of their issuance.

This method has the following advantages :

- There is no need to regulate in detail the rules for paying bonuses;

- There is no need to agree on the amount of payments with each employee - you just need to bring to their attention the relevant orders, which employees must sign;

- You can issue separate orders for issuing bonuses for holidays, anniversaries and other significant events. In addition, workers who solve particularly important and difficult tasks can be rewarded for conscientious work (Article 191 of the Labor Code of the Russian Federation). The employer has the right not to pay such bonuses whenever appropriate circumstances arise.

At the same time, there are a number of negative aspects associated with issuing separate orders for issuing bonuses:

- This method can only be used in those companies that do not intend to pay bonuses systematically. Thus, the method is not suitable for time-bonus and piece-rate wage systems - in these cases, bonuses must be paid periodically, since they are a variable component of the salary;

- The desire of employers to issue a periodic bonus for a one-time bonus, in order to be able to pay a smaller bonus at any time or deprive the employee of it altogether, causes some dissatisfaction with labor inspectors. Also in this case, the employee may sue to protect his right to receive a fixed bonus, and the magistrate is unlikely to side with the employer. The court will consider such bonuses from the point of view of their essence - this will help determine their legal nature, regardless of the name of the payment;

- If differences between bonuses for different employees are not supported by documents, this may be considered a failure to comply with labor laws and discrimination in the issuance of salaries and bonuses. After all, remuneration, including incentive payments, must be calculated based on the employee’s qualifications, the difficulty of the tasks he solves, and the quantity and quality of his work (Article 132 of the Labor Code of the Russian Federation).

Draft orders for the calculation of bonuses are drawn up according to unified forms No. T-11 and T-11a, which were adopted by the State Statistics Committee on January 5, 2004 (Resolution No. 1). The agency provides specific instructions on how to complete these forms. According to the law, such orders:

- Used to reward successful work activities;

- Issued by order of the head of the department or department of the company in which the employee works;

- Signed by the director of the company or his authorized representative, as well as by the employee receiving the bonus. After signing the order, entries are also made in the personal card (form No. T-2 or No. T-2GS (MS) and the employee’s work book.

Second way

It involves the inclusion of bonus payment rules in the employment contract signed by the employee.

Among the advantages of this method is the strict implementation of Part 2 of Article 57 of the Labor Code of the Russian Federation. The document states that bonus payments are one of the components of the remuneration system and are necessarily included in the contract between the employee and the employer. Thus, the possibility of violations of labor legislation, which are usually recorded by inspectors and the court, is excluded.

However, this method of fixing the rules for paying bonuses has several serious disadvantages , since it often does not reflect the needs of the employer:

- By including rules for the payment of bonuses in an agreement with an employee, the employer is deprived of the opportunity to adjust these provisions unilaterally (in particular, he cannot change either the size or timing of bonus payments). He must coordinate any changes with the employee, who may refuse to sign the contract if it worsens his position;

- Companies often use approved forms of employment contracts; it is difficult to introduce new bonus provisions into them. After all, the sample contract should set out different approaches to bonuses, which depend on the qualifications of employees and their working conditions for each position (if the company uses a differentiated approach to bonuses). The inclusion of all possible volumes, terms and rules for the payment of bonuses in each employment contract makes these documents too cumbersome and voluminous. And the absence of this information will inevitably raise questions from inspectors checking compliance with labor laws, and courts advocating the validity of a differentiated approach to the payment of bonuses to each employee;

- If specific amounts of bonuses, terms and frequency of their payments are specified in the employment contract, this will inevitably entail the obligation of the employer to strictly comply with the terms of this contract. Any reductions or delays that worsen the employee's position will subject the employer to material and administrative consequences. If the employment contract does not include a clear list of violations that do not allow the employee to count on a bonus or allow it to be reduced, any such actions will be considered illegal. At the same time, prescribing all these conditions in the employment contract, as already noted, will make the document too cumbersome and voluminous.

We can conclude that a detailed statement of the rules for paying bonuses in an employment contract makes sense only in those companies where incentive payments are part of the salary, are not differentiated and always have the same amount, and one-time bonuses are issued only in specific situations and volumes.

Third way

It implies the conclusion by the company or its branch of a collective agreement, which outlines all the rules for paying bonuses .

This method has the same benefits that are provided by including bonus rules in the employee's employment contract. If we compare this and the previous method in detail, we can highlight a number of others:

- If you set out in detail the rules for paying bonuses in the collective agreement, they will not need to be specified in the employment contract with employees - accordingly, there is no need to change the terms of the contract and re-sign it with the employee when adjusting the bonus rules;

- A collective agreement allows you to clearly and accurately specify in it all the rules for the payment of bonuses (volume of remuneration, terms of payments, differentiation of bonuses, conditions for bonuses related to the achievement of certain labor indicators), as well as indicate violations that deprive employees of the right to a bonus or reduce its amount . Bonus standards are enshrined in the collective agreement both in the section on wage conditions (Article 41 of the Labor Code of the Russian Federation) and in a separate annex to the agreement, which should be named according to the content (“Regulations on bonuses, incentives, motivation, etc.”). Such a document must be an integral part of the contract.

However, this method also has some disadvantages , for example:

- Not all companies practice signing collective agreements;

- The provisions of the collective agreement must be agreed upon with the employees. An elected representative (eg a primary trade union) usually acts on behalf of the staff. When agreeing on a contract, it is necessary to follow the procedure set out in Articles 36-38 of the Labor Code. It is worth noting that the provisions on salaries and bonuses are the most controversial, and it is often difficult for the parties to the contract to come to an agreement;

- If the employer wants to adjust the clauses of the contract or supplement it before the expiration of the document, he is also obliged to coordinate the changes with the employees or their representative. The approval rules are established by the Labor Code or the contract itself in accordance with Article 44 of the Labor Code of the Russian Federation.

The last point was changed for the better only in October 2006. Previously, it was possible to change the collective agreement only on the basis of the Labor Code. Nowadays, the contract itself can provide for a simplified system for changing it - however, this provision also needs to be agreed upon with employees. At the same time, the employer should not forget that the simplified system for adjusting the contract can be used not only by him, but also by his staff or his legal representative, who demands an improvement in the remuneration system.

Read the material on the topic: Financial responsibility of the chief accountant: types and involvement

Fourth method

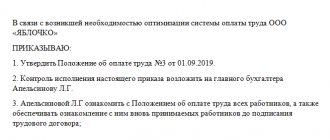

This method consists of regulating the types, volumes and other provisions on bonuses in a special local regulatory act - the Regulations on Bonuses. The document must be adopted in accordance with the law. Its name can be different: “Regulations on remuneration”, which includes a separate clause on bonuses, “Regulations on employee incentives”, etc.

The advantages of a legally drafted local regulatory act regarding bonus issues include the following:

- In labor and collective agreements, you can only indicate references to the local regulatory act on bonuses (with clarification of its name and date of adoption). This will make it possible not to set out the rules for paying bonuses in detail in labor and collective contracts and not to make adjustments to them when changing the order of bonuses;

- A local act allows you to specify all the nuances of the bonus system specific to the company and build a real reward scheme for quality work - it will be an effective mechanism for increasing the productivity of the enterprise;

- With this method, there is no need to agree on the rules for paying bonuses with the employees themselves, you just need to follow the process of taking into account their opinion expressed by a legal representative (for example, a trade union).

disadvantages with this method :

- The employer must strictly comply with all the conditions and obligations specified in the document. And since the payment of bonuses depends not only on compliance with the terms of the bonus, but also on the prevention of violations in work, these negative factors are reduced to a minimum;

- If a local regulatory act regulating the bonus procedure is adopted by the company for the first time, it is necessary to make changes with references to it in previously signed contracts and other documents.

If you decide to pay bonuses to employees based on the local regulatory act “Regulations on Incentives,” your next step should be to determine the types of bonuses to which this document applies.

The following methodology is often used: the rules for the payment of bonuses, which are part of the general remuneration system, are indicated in the document, and the possibility of paying one-time bonuses is indicated as a reference to special orders of the director or his proxies, as well as calendar events, performance of special tasks, outstanding achievements etc.

Is it possible for the bonus to be greater than the salary and its maximum size?

The current law does not limit the amount of incentive bonuses in any way. Therefore, the amount of additional payments can be absolutely any, even amounting to an amount exceeding the employee’s salary.

Restrictions on the amount of additional payments apply to management companies, their deputies and the chief accountant of government institutions at the regional, federal and municipal levels. Such restrictions are established in accordance with the rules in Article 145 of the Labor Code of Russia, which requires compliance with the maximum permissible limits for the ratio of the average salary of management personnel and ordinary employees, which are established:

- At the federal point - documents of the Government of Russia;

- At the regional point - documents of the constituent entities of Russia;

- At the municipal point - documents of local management services.

For the federal point, in terms of such consent, one should rely on the Decree of the President of Russia of August 5, 2008, number 583, which applies to employees of budgetary, autonomous and government institutions (Resolution of the President of Russia of December 10, 2021, number 1339).

Municipal and regional authorities, when establishing maximum salary ratios for manager and employee, are required to rely on the federal level to a maximum of eight. That is, the salary of the manager, any of his deputies or the chief accountant cannot be more than the average salary of employees multiplied by eight. An exception is made for the chairmen of state extra-budgetary services: their average salary can exceed the average salary of their subordinates by a maximum of ten times (Resolution of the President of Russia of November 29, 2021, number 1259).

Rules for payment of bonuses in the structure of the Regulations on bonuses

Bonus regulations usually have a standard structure. It should contain a number of sections that include certain information.

General provisions

This section sets out the goals for issuing bonuses - for example, improving labor productivity through material incentives for employees to increase target indicators. Here it is also worth clarifying the circle of persons covered by the Regulations.

Types of bonuses and sources of payment

All types of bonuses provided for in accordance with the document are indicated here, as well as indications for them and the rules for issuing bonuses for different categories of employees. Several incentive options are possible, for example:

- Bonuses for good production parameters (with a description of what is meant by these payments);

- Bonuses based on work performance (for example, for a certain period of service, for performing above the norm, for introducing new technologies, etc.);

- Bonuses for continuous work experience in the office (they can be timed to coincide with anniversaries), as well as for long work on the occasion of retirement.

The provisions need to be formulated as clearly and clearly as possible - this will help to avoid disputes around the grounds for issuing bonuses.

In the same section, you should clarify which categories of employees are entitled to incentive payments, when the payment is made (once a month, quarter, year), and also indicate the frequency of bonuses (regular or one-time).

Here it is worth mentioning a clause about the taxes that are levied on bonuses. Funds for this item may be part of sales expenses and the average earnings of employees, or they may be excluded from these items and allocated from the office profits remaining after paying other taxes.

Premium amounts

They can be recorded in a document or calculated using a percentage formula. In order to document the amount of the bonus, you need to clearly state the indicators on which its volume depends.

Such indicators can be quantitative or qualitative. The first ones have a percentage expression and are directly dependent on the timing of the work, production standards, etc. Qualitative parameters, accordingly, are determined by improving the quality of work, saving costs in relation to the given standards.

These parameters may also depend on profit margins, compliance with the contract, and increased production indicators. All these criteria must be very detailed and competently set out in the regulations; they must differ for each category of employee and for different departments of the office.

The procedure for issuing awards

This section reflects the following parameters:

- What documents regulate bonuses for employees?

- What are the conditions and rules for paying the bonus;

- What is the amount of bonuses for each category of employees (for example, for employees who did not work the full number of working days of the month due to military training, enrollment in a university, retirement, dismissal due to staff reduction or other valid reasons, as well as due to recent taking office).

The same paragraph indicates the grounds for deprivation of the bonus, as well as a list of papers that need to be drawn up for this.

The final part specifies the timing of payments (on the day the salary is paid, upon a certain achievement, etc.)

Final provisions

It sets out in detail the procedure by which the document comes into force, its validity period, as well as responsibility for its non-fulfillment.

Such local acts are signed by the director of the company and approved by his personal order. Each employee must be familiarized with the document by signature (it is placed on a special familiarization sheet attached to the document, or in the familiarization log).

Systematic bonuses or one-time bonuses

Systematic bonuses are bonuses that are valid for a long time and are awarded several times during this time.

As a rule, systematic bonuses are:

- monthly

- quarterly (4 times a year)

- semi-annual (2 times a year)

- annual (once a year). Annual bonuses are often called "bonuses."

One-time bonuses are bonuses that are calculated and awarded once. For example, a bonus for 10 years of work in a company or a bonus for completing a project.

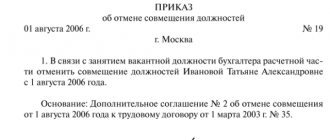

Order for payment of bonus

Bonuses are paid to employees based on the order of the manager. It should describe in detail who receives the bonus, for what merits and in what volume. Based on clause 24 of the Rules for maintaining a work book, after issuing an order, the following information is indicated in the work book :

- On the presentation of certificates and letters of gratitude, the conferment of special titles and the awarding of other insignia that are produced in the company;

- About other types of remuneration that are provided for in Russian legislation, as well as in collective agreements and other internal documents of the company.

A manager’s order can affect only one employee or an entire group. One way or another, the order must state which clause of the bonus regulations it refers to, what volume and procedure for issuing the bonus is implied. Employees read the order and sign it.

The order can be issued using forms No. T-11 or No. T-11a

Regular bonuses or payments that are part of wages are not entered in the work book. Such incentives can be reflected in the employee’s personal card.

To classify an incentive payment as an expense that reduces the income tax base, you need to pay attention to the unified form of primary accounting of wage papers adopted by the State Statistics Committee of the Russian Federation.

Forms No. T-11 and T-11a are used when registering and accounting for remuneration to employees for special achievements; they are signed after the relevant order is issued by the head of the structural unit of the company in which the employee works. They are also signed by the director or his authorized representative, then they are announced to the employee, who must sign. After this, a corresponding note is made in his personal card.

With regard to the rules for the payment of bonuses that are part of remuneration or provided for in the regulations on bonuses and the employment contract, it is not necessary to issue an order from the manager.

Read material on the topic: Accounting for gifts to employees, their children, clients and business partners

Bonuses based on work results for a month, quarter, year, as the main types of bonuses for employees

In each organization, bonuses can be differentiated according to the frequency of their payments. Bonuses for a month, quarter and year are characterized by the fact that they, as a rule, are of a regular nature, although the possibility of a one-time, one-time accrual is not excluded.

All types of bonuses under consideration can be established by internal regulations of the organization, or paid at the will of the employer. It is possible that such bonuses may be paid based on the provisions of the employment contract with a specific employee. Payment is made based on the employer's order.

Premiums can be paid either with or without grounds.

Rules for payment of bonuses: taxation procedure and accounting

When talking about rewarding employees, we must not forget about taxes. Bonuses belong to the employee’s income, accordingly, they are taxed in the same way as other types of income of an employee - personal income tax must be paid on bonuses according to clause 1 of Art. 210 Tax Code of the Russian Federation.

Personal income tax on bonuses is not paid only in two cases (clause 7, article 217 of the Tax Code of the Russian Federation):

- From awards given to international, foreign and Russian companies for special achievements in the fields of science, education, culture, arts, media and other areas from the list approved by the government;

- From prizes issued by the highest authorities of Russia for special successes in areas approved by these authorities.

The employer issuing bonuses is obliged to calculate taxes from them and pay them to the budget (clauses 4 and 6 of Article 226 of the Tax Code of the Russian Federation). In addition, insurance contributions to extra-budgetary funds are also charged for any types of material incentives. Also, all premiums are subject to insurance contributions to the compulsory social insurance fund against industrial emergencies and occupational diseases.

Awards are taken into account based on their sources.

Thus, incentives that are issued in accordance with labor contracts or local regulations and are associated with improving the quality of production are prescribed as follows: D 20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General business expenses " - K 70 "Settlements with personnel for wages."

Incentives that are issued in accordance with employment contracts, local regulations and are not directly related to improving the quality of production (for example, for organizing corporate events) are carried out in the debit of account 91 “Other income and expenses”, subaccount 2 “Other expenses” in correspondence with a score of 70.

Incentives that are issued in accordance with employment contracts, internal local acts of the office and are related to capital work (for example, construction of facilities, installation of equipment, etc.) are calculated by the debit of account 08 “Investments in non-current assets” in correspondence with account 70.

Incentives can also be issued from targeted funding funds. In such situations, they are taken into account by posting D 86 “Targeted financing” - K 70.

What do employees' salaries consist of?

Salary may consist of the following parts:

- a fixed salary that covers basic needs;

- monthly bonuses based on key performance indicators;

- bonuses, the level of which depends on additional incentive systems. For example, an employee may receive bonuses for not giving negative feedback.

Financial incentives are often awarded to employees who effectively allocate resources, have extensive experience working in an online store, bring clients, and take part in promoting affiliate and other programs. The main recipients of bonuses are sales managers , because bonuses make up about 50-60% of their monthly income.

Employer's liability for violation of bonus payment rules

Employers who violate the rules for paying bonuses may face various types of liability.

Failure to comply with labor laws is punishable by:

- Administrative liability, in accordance with Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation (CAO RF). Failure to comply with labor laws by an official may result in an administrative fine of up to 50 times the minimum wage. If the violation is committed repeatedly, the person faces disqualification - deprivation of the right to hold high positions in any companies (Part 1 of Article 3.11 of the Code of Administrative Offenses of the Russian Federation) for a period of one to three years (Part 2 of Article 5.27 of the Code of Administrative Offenses);

- Deprivation of bonuses can be considered in court (by a magistrate) if there are delays in the basic salary and other offenses in the field of labor legislation (Article 142 of the Labor Code of the Russian Federation). And Article 236 of the Labor Code states that if an employer delays an employee’s salary, then he will subsequently have to pay it including interest - the so-called monetary compensation - in an amount of no less than 1/300 of the current refinancing rate of the Central Bank of the Russian Federation. The percentage is calculated on the entire amount of the delayed salary for each day of delay, including the day on which the salary should have been paid and the current date;

- Judicial practice shows that employers often have to pay also the amount of moral damage (Article 237 of the Labor Code of the Russian Federation) that was caused to employees (if the employee can prove that he was caused physical and mental suffering).

Award for conscientious performance of official duties

This type of bonus is paid to military personnel and is enshrined in the Rules approved by the Decree of the Government of the Russian Federation “On the payment of bonuses to military personnel...” dated December 5, 2011 No. 993.

The maximum amount is 3 salaries per year. It is permissible to pay bonuses both monthly and quarterly, along with cash allowance. The size of the bonus is determined depending on the military salary. The size of bonuses and the procedure for calculating depend on the troops in which the serviceman serves.