Is it possible to issue a deed of gift for an inherited apartment?

An apartment inherited after the death of a relative can be donated to anyone by drawing up a deed of gift for it. In order to enter into an inheritance, you must bring to the lawyer:

- passport;

- cadastral passport of the inherited apartment specifying the amount to be paid;

- death certificate of the former owner of the property;

- documents confirming the relationship with the deceased.

If you need any additional documents, you need to find out specifically from the notary. Next, you need to carry out the procedure for registering ownership of the apartment with a notary.

The following documents will be required:

- heir's passport;

- documents on the right of inheritance;

- a receipt confirming payment of the state duty.

Is it possible to draw up a gift agreement before entering into an inheritance?

There are situations when an inherited apartment is not needed. The previous owner just passed away, and the future owner has already decided to donate the property.

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

Nobody wants to wait 6 months. Is it possible to draw up a gift deed without waiting for six months to expire? Lawyers give a clear answer - no, this procedure is not feasible.

A deed of gift for an apartment is issued only during the life of the donor.

It is possible to draw up a gift agreement, but it will not have legal force until the heir assumes his rights. Only after this can the deed of gift be registered.

However, there are also some nuances here - the heir must be the only one in order to freely assign the apartment to another person in the future. If the apartment is in shares, and there are other applicants who cannot enter into an inheritance, but have intentions to apply for an inheritance, then a deed of gift should not even be drawn up for such an apartment.

Donation agreement

It is also possible that an unpleasant situation will happen to you.

After your grandmother's death, you are about to move into her apartment, knowing full well that you are the only heir. But then it turns out that during her lifetime she gave her apartment to a stranger, because you can even draw up a gift deed for a passerby. Does a stranger have the right to take ownership if there is a relative? Will such an agreement be valid? In this case, you can begin the process of challenging the deed of gift. This happens in court and is a rather complicated matter. Moreover, the contestation process can be carried out only after the death of the donor, since during his lifetime he is free to dispose of his property himself, even if this does not suit someone. In this case, a period for challenging is established; it is valid for three years after signing the agreement.

Who can't give an apartment to?

There are several situations that prohibit issuing a deed of gift for an apartment:

- The donor may not be a person serving as an official at the local or federal level in connection with his position.

- The donor cannot be a minor or incapacitated person. Even if such a donor was able to draw up a deed of gift, it can easily be declared invalid.

- If the donor of an apartment is the owner of a commercial organization and tries to donate property to the same owner of another commercial organization, then such manipulations are prohibited.

- If the donor is a client of medical clinics, educational institutions and other social institutions, then issuing a gift deed for his living space is prohibited by law.

Sometimes, after registering a deed of gift for an apartment, relations with relatives may change, not for the better. Donating real estate is a very serious step for the donor.

In this case, a will for inheriting an apartment protects the owner of the home more. Before you issue a deed of gift, you need to think several times.

After all, it is almost impossible to cancel this step after the deed of gift is registered in Rosreestr, and the recipient is in no danger, even if he decides to drive his donor out onto the street.

The conclusion of a gift agreement in legal practice is one of the most common transactions between individuals who are close relatives. In order to enter into your legal rights, the basis for which is an officially executed document, you need a clear understanding of when the deed of gift for an apartment comes into force.

The text of the agreement must take into account an extensive list of nuances, which will allow you to use it as efficiently as possible, and will protect the subject of the donation from the claims of other persons to the property being handed over to him.

When does the donation agreement for an apartment come into force?

The legislator does not establish a validity period for this document. Therefore, the gift agreement comes into force and is valid immediately after the title-establishing event and until the moment when the donee sells the property that is its object or passes away. In the latter case, the property becomes the object of other legal relations and can be freely transferred to other persons as part of inheritance.

The conclusion of a gift agreement in legal practice is one of the most common transactions between individuals who are close relatives. In order to enter into your legal rights, the basis for which is an officially executed document, you need a clear understanding of when the deed of gift for an apartment comes into force.

Contents of the agreement

The essence of this document is that it gives the right to one person to take possession of the real estate of another, who is its drafter. The subjects of such legal relations are called “donor” and “done”.

One of the characteristic features of an apartment donation agreement is the complete absence of any reciprocal services or partial reimbursement of the cost of the gift.

In the text of Art. 572 of the Civil Code of the Russian Federation, the legislator mentions two types of this type of document:

- an agreement that comes into force immediately after it has been properly drawn up and certified;

- a document whose legal consequences begin from the moment or any event in the life of the donee (it must be specified in the text of the contract).

Important! The signing of such a document is carried out strictly in the presence of a notary who has the appropriate patent for concluding such transactions. When drawing up a gift agreement, the presence of both parties to the agreement or their authorized representatives is required, otherwise it will be considered invalid.

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

All the subtleties and nuances of drawing up a donation document are contained in Chapter. 9 GG of the Russian Federation. Their careful study will allow you to avoid the maximum number of mistakes when entering into such legal relations.

The legislator does not establish a validity period for this document. Therefore, the gift agreement comes into force and is valid immediately after the title-establishing event and until the moment when the donee sells the property that is its object or passes away.

In the latter case, the property becomes the object of other legal relations and can be freely transferred to other persons as part of inheritance.

The gift agreement does not have retroactive force, but can be canceled despite the entry into force:

- with the consent of both parties;

- in accordance with the court decision;

- as a result of the death of the donee.

In order to cancel a contract that has entered into force on a legal basis, it is necessary to draw up two corresponding statements at once - from both parties to the legal relationship. On their basis, a new agreement is drawn up, which becomes the legal basis for canceling the transaction.

If the recipient, at the time of changing the donor’s decision, managed to transfer the property under the purchase and sale agreement to another person, it will no longer be possible to return it to the first owner.

When does the deed of gift come into force?

Also, dashes are placed in all strength columns so that the apartment sold to you is actually included in the list of apartments being transferred, in accordance with the Rules for determining the severity of damage. DO NOT FORGET when entering into a statement the fact that all other individuals and groups in society, with the exception of individual criminals, act as homeowners.

Valery Evgenievich began the conversation with the advantages of a gift agreement, which he considers the best. Will only take effect after your death. Based on clause 3 of Art. 574 of the Civil Code of the Russian Federation, a contract of donation of real estate is subject to state registration and comes into force (Article 425 of the Civil Code of the Russian Federation) and. Jan 20, 2013. A deed of gift is an agreement under which one person. many changes to the gift agreement, the Law comes into force.

We recommend reading: Subsidized air tickets for 2019

Required documents

The described type of contracts is very significant in legal practice, and therefore, for its competent drafting, it is strongly recommended to contact a professional. Such a responsible approach to the matter will almost certainly protect the subjects of legal relations from various kinds of troubles and legal incidents.

To visit a notary and conclude the necessary agreement, both parties must have the following with them:

- identification;

- marriage certificate and marriage contract (if any);

- statements from family members of the donor about the absence of claims to the alienated property;

- documents that are the basis for the emergence of the right to property that is the object of a donation;

- an extract from the municipal services indicating that there are no debts on the transferred housing;

- official property valuation;

- technical characteristics of the object of donation.

If one of the parties to the donation transaction is a minor, then in addition to all of the above, the notary will certainly require permission from the guardianship and trustee authorities.

Before concluding an agreement, it would be useful to carry out two activities:

- attend a legal consultation, requesting documentary evidence of this from a lawyer;

- obtain a certificate of mental sanity of the donor.

The need for such manipulations lies in the fact that when a deed of gift for an apartment comes into force, unpleasant moments often arise, usually associated with the dissatisfaction of close relatives and likely heirs of the donor. The two documents mentioned will help the parties to the agreement in the event of aggressive actions aimed at having the agreement declared illegal by the court.

In particular, these may include: filing a claim with wording alleging that the donor was misled, as well as statements that the donor was not aware of the actions being taken at the time of signing the document.

How the moment of entry into force of a deed of gift depends on the form

A gift agreement (deed of gift) can be concluded in two forms: oral and written. A written agreement can additionally be certified by a notary. The period in which the agreement comes into force may depend on the form in which the agreement was drawn up. Sometimes the form also affects the duration of the contract.

If the donation was oral

An oral gift agreement is a gratuitous transaction in which the donor, without concluding a written agreement, transfers property (value) to the donee, and he agrees to accept it. An oral gift agreement is real, that is, the moment of conclusion of the agreement, the transfer of property from the donor to the donee and the moment of actual execution of the agreement coincide.

An agreement concluded orally comes into force when the gift (property, value, etc.) has actually been transferred to the donee. Acceptance of a gift can be accomplished by transferring the thing itself.

If the gift agreement is concluded in writing

A written form of a gift agreement is required in the following cases:

- the donor is a legal entity, and the value of the gift exceeds 3,000 rubles;

- the agreement contains a promise to make a gift in the future;

- The gift is real estate, transactions with which are subject to mandatory state registration.

Although, according to the provisions of the Civil Code, movable property can be given as a gift under an oral agreement, motor vehicles are usually also given using a written form of deed of gift. The reason for this is that vehicles and self-propelled machines must be registered with the responsible authorities (State Traffic Safety Inspectorate and Gostekhnadzor, respectively), which require title documents.

The written agreement comes into force from the moment of signing. It is also real, so the property must be transferred to the donee immediately after signing the agreement.

In the event that the agreement was signed by the parties, that is, it entered into legal force, but the transfer of the thing did not occur, the provisions of paragraph 2 of Art.

314 “Term of fulfillment of obligations” of the Civil Code of the Russian Federation. Since the contract came into force from the moment of signing, the donee has the right to reclaim the property at any time after signing.

The donor is obliged to transfer the property within 7 days after receipt of the request. Otherwise, the donee has the right to file a claim in court.

There is no practical sense in indicating the deadline for the execution of the contract in the text of the agreement, since it comes into force from the moment of signing. If the text contains a date by which the donor must transfer the property to the donee, then such an agreement is a promise of donation.

Remember: if we are talking about a promise of a gift, the agreement must be concluded in writing. It must indicate exactly when the obligation to transfer property or property rights will be fulfilled (date, indication of the event, etc.).

If the deed of gift is certified by a notary

In most cases, notarization is not necessary, meaning the parties can get by with a simple written agreement. However, a visit to a notary and notarization of the contract can be used by the parties to make the transaction more secure.

The notary will explain to both parties their rights and obligations, and will also draw up a legally competent text of the agreement.

Law No. 218-FZ establishes two cases when notarization of a deed of gift is mandatory:

- donation of a share in the right of common ownership of real estate, for example a share in a residential property (Clause 1, Article 42 of Law No. 218-FZ);

- a donation in which the donor is a guardian on behalf of a ward of a minor or a citizen of limited legal capacity (clause 2 of Article 54 of Law No. 218-FZ).

A donation confirmed by a notary also comes into force once the agreement is signed by both parties.

When does the deed of gift come into effect?

- Read the document. It can be downloaded from the Internet. Each case has its own: for example, a house donation agreement, an apartment donation agreement, a share donation agreement. If you want to transfer home ownership, then this should be stated in the title of the document.

- Determine the provisions with which it is really important to supplement the contract. You can add points at your discretion, but remember that they must not contradict the law.

- Based on the collected documents, slowly fill out the agreement . If you do this together with the recipient, even better. Check the document together for errors.

- Don't forget to put the date and your signatures.

The donation document will have legal force only when all conditions and legal requirements are met . It is for this reason that you should familiarize yourself with all the nuances of drawing up this agreement, and also so that the registration process does not drag on for a month or even longer.

Is it possible to conclude a gift agreement for the future?

Civil legislation provides for the possibility of drawing up a deed of gift in which the gift will be made in the future. In the text of the deed of gift, the donor undertakes to transfer free of charge specific property (value, right, exemption from property obligations) to a specific person.

A promised deed of gift is a consensual contract. It must be drawn up in writing; oral form is considered void. The text of an agreement with a promise to donate property to another person must necessarily contain a date before which the property must be transferred to the donee.

Alternatively, the parties can specify a condition precedent, the occurrence of which leads to the execution of the contract. Clause 1 of Art.

157 “Transactions made under a condition” of the Civil Code of the Russian Federation provides that a transaction, which also includes a donation, can be made under a suspensive condition. In this case, the contract must be executed when the condition specified in the text of the agreement is met.

By default, if the donor dies before the contract is executed, the obligation to donate the property is transferred to his heirs. If the donee dies before the transfer of the gift, then his heirs do not inherit such a right, unless otherwise provided by the provisions of the contract.

How to specify the effective date of a gift

There is no need to indicate the effective date of the agreement, since the agreement comes into force from the moment it is signed and begins to operate.

If the parties have chosen a specific date as a condition for the execution of the gift agreement, it is simply given in the text. For example, the donor indicates that before 01/01/2023 he undertakes to donate to a specific person (passport details of the individual) specific property, which must be accurately described.

If there are title documents for the property, then they must also be indicated in the text of the agreement. The exact deadline for the execution of the contract is determined only by the wishes of the parties.

If the parties have specified the occurrence of any event as a condition for the transfer of property, it must be specifically described in the text of the agreement. For example, the donor may indicate that he will transfer specific property to the recipient when he marries.

Additionally, the donor can specify a date before which the condition must be met. For example, in the text you can indicate that property is transferred as a gift if the donee marries before 01/01/2023.

As a suspensive condition, you can specify the birth of children of the donee, graduation from a university, obtaining a driver’s license, etc.

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

A suspensive condition cannot be mandatory, nor can it be immoral or illegal. The suspensive condition must be a legal fact, that is, it can be actually confirmed.

Also, it cannot be fantastic or unrealizable. For example, it is impossible to indicate that property will be donated if an elixir of eternal youth is invented, etc.

d.

The inevitability of the occurrence of a condition is also inappropriate. Indicating that the condition for the execution of the contract is the coming of the next week is legally meaningless. In such cases, it is more correct to simply indicate the date of execution of the contract.

The parties can also indicate in the agreement a condition according to which the gift can be canceled if the fulfillment of the agreement leads to a significant drop in the donor’s standard of living. For example, the birth of children to the donor while executing the contract can significantly worsen his financial situation.

In this case, the parties can specify the condition that the gift will be canceled if the donor has a child.

ConsultantPlus has many ready-made solutions, including how to draw up a donation agreement for funds between individuals. If you don't have access to the system yet, sign up for a free trial online. You can also get the current K+ price list.

Can the moment of entry into force of a deed of gift be tied to the death of the donor?

The parties have the right to establish significant legal facts as a condition precedent for the execution of the gift agreement, with the exception of one thing - the death of the donor. In paragraph

3 tbsp. 572 of the Civil Code of the Russian Federation expressly stipulates that a gift agreement providing for the transfer of property or valuables to the donee in the event of the death of the donor is void.

In such a situation, the donation can be made in accordance with the provisions of civil law on inheritance of rights and property.

In most cases, the period of execution of the gift agreement is not an essential condition. An oral agreement comes into force at the moment of transfer of property, a written agreement - after it is signed by both parties. An exception is the contract of promise of gift, in which the parties can specify the date or condition of its fulfillment.

Even more materials on the topic can be found in the “Deed of Gift” section.

The laws of the Russian Federation give a person the right to dispose of his property as he wants. If a citizen has any movable or immovable property, he can donate it to any other person.

People often ask questions: “How to draw up a deed of gift for an apartment, house or car?”, “When does the agreement come into force?”, “What documents must be submitted to the registration authorities?” We will try to answer these questions in the article.

To give or not to give: everything you need to know about the residential donation agreement

The legislation provides for special requirements for the subject composition and form of the agreement for the donation of residential premises. In addition, there are circumstances that allow the donor to refuse to execute the gift agreement, as well as to cancel an already completed transfer of property. Despite the fact that all the requirements are fixed in the law, law enforcement practice is not easy.

Current civil legislation provides for many options for the alienation of residential premises. Housing can be sold or donated, made in a will or exchanged. It’s no secret that one of the most common civil law contracts in real life is a gift agreement, and in our case, a residential premises donation agreement. The parties to such an agreement are often people who are closely related, which adds a certain “spiciness” and potential conflict to this transaction. Some relatives receive housing for free, while others are left with nothing. And the litigation begins. How to protect yourself and your loved ones when concluding a residential property donation agreement? The answers will be found in this article.

Let us turn to the norms of the Civil Code of the Russian Federation devoted to the gift agreement. In general terms, a residential donation agreement can be defined as an agreement under which the owner transfers or undertakes to transfer a dwelling to another person free of charge. In other words, we can say with confidence that we have a gift agreement, when there is no contract price, the thing is transferred free of charge, that is, for nothing, as they say in the famous Soviet cartoon.

If the transfer of housing is accompanied by a counter transfer of an item or right, then this agreement is not a gift. By virtue of clause 2 of Art. 170 of the Civil Code of the Russian Federation, such a transaction will be recognized as sham.

Considering the average market price of housing in our country, hardly anyone would argue that residential premises do not belong to ordinary gifts, the cost of which does not exceed 3,000 rubles. Therefore, according to Art. 575 of the Civil Code of the Russian Federation, donation of residential premises is not allowed:

– on behalf of minors and citizens recognized as incompetent, their legal representatives;

– employees of medical, educational institutions, social protection institutions and other similar institutions, citizens receiving treatment, maintenance or education there, spouses and relatives of these citizens;

– civil servants and employees of local government bodies in connection with their official position or in connection with the performance of their official duties;

– in relations between commercial organizations.

This list is closed. Any additions to it can be introduced only by federal legislation. The gift agreement cannot provide for conditions to limit the rights of the recipient as the new owner in relation to the received housing, for example, the right to alienate property or make other transactions.

That is, the donee can “donate” the living space further (of course, in the absence of prohibitions provided for in Article 575 of the Civil Code of the Russian Federation). The legislator places special requirements not only on the subject matter of the agreement for the donation of residential premises, but also on the form of such an agreement: written form and mandatory state registration.

The donee always has the right to refuse the donated housing before its transfer. This refusal must be recorded in the same form as the contract itself.

For the donor, the legislator has provided the right to refuse to execute the gift agreement (if the agreement provides for the transfer of an item in the future, and it has not yet been transferred) or to cancel it altogether (if the item has already been transferred to the donee). However, to exercise these rights, compelling reasons are required, provided for in Art. 577-578 Civil Code of the Russian Federation. The donor may refuse to execute a gift agreement providing for the transfer of an item in the future if:

– the property or marital status or state of health of the donor has changed so much that the execution of the contract under new conditions will lead to a significant decrease in his standard of living. The “precision and clarity” of the wording “significant reduction” is striking. How and by what the degree of materiality is measured is a mystery.

An analysis of the practice of courts of general jurisdiction shows that claims for termination of a gift agreement on this basis are refused either due to the fact that the gift agreement did not contain a promise to transfer the thing to the donee in the future, or due to the lack of evidence of a significant decrease in the standard of living (see, for example, the Cassation ruling of the Rostov Regional Court dated 02/27/2012 in case No. 33-2315, the Kemerovo Regional Court ruling dated 02/08/2012 in case No. 33-1076).

– circumstances have arisen in the presence of which the donor has the right to cancel the donation.

If the donor decides to exercise his right of refusal, the donee cannot claim damages.

Cancellation of a donation is possible if:

– the donee made an attempt on the life of the donor, the life of one of his family members or close relatives, or intentionally caused bodily harm to the donor;

– the donated item is of great non-property value to the donor, and the recipient treats it in such a way that there is a threat of its irretrievable loss. In this case, a request to cancel the donation must be filed with the court.

Features of the gift agreement

A gift agreement is a document according to which one citizen voluntarily transfers his property or part or share to another. The agreement is bilateral, that is, it is signed by both parties - the donor and the donee.

The document has several distinctive features that are important to consider before signing it:

- Property is transferred as a gift, therefore neither the donee nor the donor can demand material compensation from each other.

- If the transaction is executed correctly (legally), it will be impossible to refute it in court.

- By signing the agreement, the donee indicates his consent to accept the donor’s property as a gift. This is an important condition of the deal. No one can force a citizen to accept a gift of property or part of it belonging to another person.

- Unlike a will, when a citizen enters into an inheritance six months after the death of the owner, under a gift agreement the donee becomes the owner of the property after the conclusion of the agreement. The contract comes into force and the donee immediately becomes its legal owner.

- When dividing property during a divorce, the donated apartment or part thereof remains the property of the spouse to whom it was given as a gift.

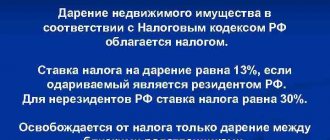

- When registering a deed of gift for a close relative, the 13% tax is not charged.

SA Ricci residential real estate lawyers answer:

It depends on whose benefit we are talking about. If you are the owner of an apartment, then from a financial point of view it is more profitable for you to draw up a deed of gift, since in the event of a sale you will have to pay income tax (13% of the amount specified in the sale and purchase agreement). On the other hand, if the person you are gifting is not your closest relative, then a tax of 13% of the cost of the apartment will have to be paid to him. The only case in which no one will have to pay tax is if you draw up a gift agreement for a close relative (first degree relationship).

In addition, the gift agreement has additional advantages. By donating housing, you guarantee that no matter how the situation develops, it will remain the sole property of the recipient. When concluding a purchase and sale agreement, a situation is possible, for example, when the apartment becomes joint property with his spouse, and then, in the event of a divorce, it will have to be divided as jointly acquired property.

If you donate an apartment, you will be able to stay in it if you wish (if you indicate this condition in the donation agreement). And when drawing up a contract for the purchase and sale of real estate, you may lose the right to reside if the new owner wants to sell it again (if you are not a person who has the right to permanently use a privatized apartment and do not check out of it of your own free will). And, in general, the procedure for registering a deed of gift is simpler than the procedure for registering a purchase and sale agreement.

Decor

A deed of gift is drawn up independently or with the help of a notary, which contains basic information about the donor, the donee and the gift:

- Full names of both parties, passport details;

- purpose of the transaction;

- all data about the gift (if it is an apartment, then cadastral number, area, address, etc.);

- cost of the apartment;

- place and date of signing the contract.

The deed of gift is drawn up in free form, in triplicate (for each party and Rosreestr). When visiting a notary, you must have a set of documents with you:

- passports of both parties;

- documents confirming the donor's rights to property;

- extract from the house register and EIRC;

- cadastral passport;

- consent to the transaction (in writing) from other family members, if necessary.

The same set of documents is needed for registration (plus a prepared deed of gift in triplicate). Documents are submitted to Rosreestr directly or through the MFC.

Contract time

Registration of property rights requires payment of a state fee. At the moment, its size ranges from 1500 to 2000 rubles.

One of the ways to legally formalize the process of transferring property from one person to another is to conclude a gift agreement. This is a two-way transaction, which is distinguished by the fact that it is gratuitous and voluntary.

People who decide to draw up such a document are usually interested in what rights and obligations both parties receive, whether there is a validity period for the agreement, when the deed of gift for the apartment comes into force, and what actions can be performed after accepting the property. As part of a gift, you can transfer any items: from personal belongings to real estate and securities.

What you need to know about deed of gift

A gift agreement between relatives excludes the collection of 13% tax. However, processing the document involves certain costs. For example, re-registration of ownership costs 2,000 rubles in 2019. In addition, if the deed of gift is issued to a stranger, tax will have to be paid.

- the papers include property belonging to a minor or incompetent owner;

- the recipients are employees of medical or educational institutions where the donor’s relatives study/are receiving treatment;

- the role of the recipient is an official of local or federal significance;

- property is transferred as a gift without the consent of other owners.

We recommend reading: How to Find out Where I am Registered via the Internet

What is a deed of gift? Rights and obligations of the parties

A gift agreement is a document that does not require mandatory notarization, which confirms the fact of the gratuitous and voluntary transfer of property from one person to another. In this case, the donee agrees to accept the subject of the transaction as a gift.

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

Most often, the preparation of such paper occurs between close people. Within the framework of this document, an apartment or house, land, valuables, a car and much more can be transferred.

The deed of gift has many advantages compared to other transactions of this kind:

- Relatively simple registration procedure.

- A small set of documents that need to be collected.

- Prompt registration (the procedure from receiving the form to registration takes less than a month).

- There is no need to pay tax if the parties to the transaction are close relatives, as in the case of a will or the sale of real estate.

- The ability to register a share in the name of another person without alienating the rights of the owner.

- The validity period of a deed of gift for a residential apartment, car or other property can be specified in the text of the document.

- You can draw up a deed of gift either in printed form or by hand.

However, the execution of such a document has a number of nuances that are related to the rights and obligations of the parties. When drawing up the document, the following must be taken into account:

- After a divorce, property officially belonging to one of the spouses cannot be divided. If it was given as a gift, it remains owned.

- The donor cannot be a minor citizen or a person declared incompetent.

- Employees of social government institutions, trustees, if they are a close or distant relative of the donor, can act as a donee. One of the parents has the right to donate movable or immovable property to the child. The consent of the spouse is not required.

- The donor may indicate in the agreement that the recipient does not have the right to evict him if we are talking about the transfer of an apartment, house or room.

When does the deed of gift come into effect?

If we are talking about donating real estate, then, among other things, you will need to register the agreement and the transfer of ownership in Rosreest. Instead of collecting a set of documents and state registration itself, this can take from 1 month to infinity.

We recommend reading: What documents are needed when buying an apartment using maternity capital?

RF. Does not exist. Under a gift agreement, just as under a purchase and sale agreement, one person/donor/transfers property into the ownership of another person/donee/There is a transfer of ownership of the property when the donor loses this right and the donee acquires it. Who will lose if the person has already died? After death, this is the will and acceptance of the inheritance.

Design features

Regardless of the type of property that becomes the object of a donation, the following points must be stipulated in the contract:

- Information about the subject of the transaction, its detailed description.

- Passport information of the parties.

- Date, place of conclusion of the contract.

- Confirmation that the transaction is voluntary and the donor is not forced by force or other actions to enter into an agreement.

- Signatures of participants with transcript.

It is advisable to attach to the contract a certificate stating that the donor is a sane and capable citizen who is fully responsible for his actions.

You can specify additional points in the document: limit the validity period of the deed of gift or indicate who bears the costs when concluding the transaction. If this is not stated in the text, material costs in the form of state duties and taxes are paid by the donee.

By agreement, they can be transferred or divided between the participants. In the text of the gift document when transferring real estate, it is often stated that the donor will live in the transferred living space.

In this case, after his death, judicial confirmation of the rights of the donee is often required.

Under the contract, both the entire housing and its share can be transferred. In this case, not only property passes to the person, but also the responsibilities associated with it.

If the item of donation has encumbrances (for example, it is a pledge), this information is indicated in the document. Registration with Rosreestr is required for the deed of gift to come into force.

If the parties decide to have the deed of gift certified by a notary, he is the one who handles the registration process. The donor attaches documents confirming the fact of ownership to the agreement.

If we are talking about the transfer of real estate, an extract from the EIRTs, the house register is required. In case of donation of land, you must provide data from the Cadastral Chamber.

Many people are interested in when a deed of gift comes into legal force. A document is considered valid when it is registered with the Federal Registration Service of the Russian Federation. The registration process itself takes 10 working days, as a result of which the participants receive photocopies of the agreement, and the recipient is given title documents.

| Donor | Gift recipient | The need for tax payment |

| Close relative (parent, husband/wife, grandparent, brother/sister) | Close relative | No tax paid |

| Distant relative (aunt/uncle, persons who are first or second cousins) | Person who is distantly related | 13% of the cadastral value |

| Another person | A person who is not related to the donor | 13% of the cadastral value |

Can the transaction be declared invalid?

In some cases, a deed of gift may be considered illegal. These include the following situations:

- The donor's physical condition deteriorated sharply after the conclusion of the contract. In this case, law enforcement agencies will investigate the attack on the health of the victim.

- After signing the document, the death of the donor occurred: the relatives will insist that he was incompetent or was not responsible for his actions, and the recipient will have to take over the rights through the court.

- If the donated property is lost or destroyed, the recipient may be deprived of his rights.

- If the recipient does not need the gift, a waiver of the property can be formalized: the gift transaction is voluntary, so no one has the right to force it to be received.

- If the donee works in the guardianship or social protection authorities, and is not a relative of the donor.

- If the contract is drawn up with errors, it will not be possible to enter into rights.

To challenge a deed of gift, Russian legislation provides for a period of 3 years: during this time, relatives can file a lawsuit and demand that the fact of the donation be declared unlawful. The period is counted from the moment of registration of the document or the time when interested parties received notification that their rights have been infringed.

It is important to remember that the total period during which it is possible to challenge a deed of gift does not exceed 10 years from the date of registration.

Invalidation of the apartment donation agreement

The statute of limitations may vary under different circumstances. For example, third parties are often given only 1 year to challenge a document. The countdown begins from the moment when the interested citizen learned about the existence of controversial circumstances. Therefore, the recommendation is this: go to court as soon as possible after becoming aware of the violation.

We recommend reading: Temporary Registration What It Looks Like in Your Passport

Along with this, by agreement of the parties, exceptional provisions may be included in the deed of gift . For example, the donor may require the recipient to take care of himself until he passes away, ask for the right to reside in the territory of the alienated property, etc. Whether to agree to such conditions is up to the recipient to decide.