The transfer of a dacha by inheritance is regulated by law, taking into account the specifics of this type of real estate. Along with the land plot, the ownership rights to what is located on this plot, including water resources, vegetation, and minerals, will also be transferred to the heir.

Regional standards determine the minimum size of the share of such land owned by one person. Therefore, if there are many heirs to the dacha plot, then shared ownership will be registered on it without dividing the plot into separate parts.

What does an heir need to know when inheriting a garden plot?

Entering into inheritance rights to a dacha occurs in the same way as when inheriting other property. If the testator left a will, his will will be carried out in accordance with this document. If there is no will or it is declared invalid, then inheritance will occur in accordance with the law. In this case, the circle of heirs will be divided into queues depending on the closeness of the relationship.

But still, land inheritance has some features:

- During his lifetime, the testator must register ownership of the land plot. Without this, he will not be able to pass it on by inheritance.

- All natural resources located on the territory of the site are inherited along with it.

- The heirs of such real estate can be both individuals and organizations.

- If the plot is very small, and there are many heirs, then the heir who already owns a share in it, or who ran the farm together with the testator, has the priority right to receive ownership of the plot. At the same time, he must pay compensation to the remaining heirs. The heirs can determine its size independently, or it will be determined by the court.

- If there is no holder of the priority right among the heirs, and the plot is too small for its division, then shared ownership will be registered for all heirs.

It is important that the testator leaves documents confirming his rights to lifelong ownership of this plot. Otherwise, the heirs will not be able to receive it.

Registration procedure

To register a dacha plot by inheritance, you will need to write an application to a notary for its acceptance. In situations where the testator did not include some items or real estate in the will, the successors must independently carry out this procedure.

Read also: Hereditary mass

After checking the documentation, the notary employee initiates the case and provides participants with recommendations on further actions. Following the procedure, legal successors receive a certificate.

Documentation

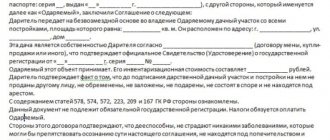

To inherit a dacha, you need the following documents:

- certificate of death of a relative;

- a certificate or extract from the house register about the last address of residence;

- personal passport of the legal successor;

- papers indicating family ties - if inheritance is carried out within the framework of the law, or a will.

Deadlines

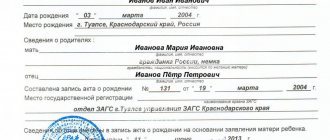

The period for accepting the property estate left by a deceased citizen is 6 months from the date of initiation of the case by a notary (Article 1154 of the Civil Code of Russia).

In addition, the date may be the day of death or the entry into force of a court decision. Note: reinstatement of deadlines is allowed if the absence was due to extenuating circumstances and there is documentary evidence. The procedure is carried out by filing a claim in court.

Article 1154 of the Civil Code of the Russian Federation “Term of acceptance of inheritance”

Real estate valuation

Carrying out assessment activities in relation to the site requires the involvement of an independent accredited organization. After the relevant activities have been carried out, a report is issued, which is subsequently transferred to the notary. The cost of country property depends on various factors, the main one of which is location.

It is almost impossible to independently assess the value of property. In addition, the information received cannot be attached to the case.

The procedure for distributing shares between heirs

When distributing shares among legal successors, the dacha plot is first provided to the heir of the first category.

If this group includes several persons, then a redistribution of property will occur, i.e., shared ownership will take place. It is noteworthy that adopted children of the deceased and persons dependent on him for at least 12 months can also apply and challenge the procedure. This is due to the fact that the current laws indicate the need to allocate a share in the property mass in relation to disabled citizens, as well as dependents.

The share is allocated even if there is a will executed in favor of relatives of one of the categories or third parties, i.e., in any case, a number of citizens must receive part of the inheritance. As a rule, it is 50% and if the residual property is not enough to cover it, then the missing property is allocated from the shares of the main successors.

Procedure for state registration of property rights

In the question of how to inherit a dacha for a person, the main factor is obtaining a certificate of ownership of the plot. Such a certificate is issued by a notary and subsequently it must be registered with the cartographic authorities, cadastral institution and Rosreestr.

At the time of application, the applicant will need to submit the following documents:

- successor's passport;

- certificate of ownership of a dacha;

- inheritance certificate;

- an application drawn up according to the sample;

- a receipt confirming payment of the state fee for the registration of rights.

Amount of state duty and tax obligations

In accordance with the Decree of the Government of Russia dated January 1, 2006, the tax burden on the inheritance procedure was abolished. There is no tax in 2021 , but the successor will need to prepare for financial costs.

Read also: Inheritance disputes

This is due to the fact that the procedure is additionally burdened with a state duty for notary services. The tariff is set at the state level, and you will not be able to get a discount or benefit on it. The price of a notary's work depends on the value of the dacha indicated in the appraisal report. At the same time, an independent examination also costs money and is paid for by the relatives of the deceased.

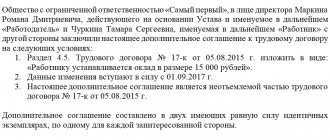

Further, the amount of state duty is calculated depending on the family ties of the successor to the testator. For example:

- The first stage, whose representatives are a child, husband or wife, as well as father and/or mother, are required to pay 0.3% of the cost of the dacha plot. The collection limit is 100,000 rubles;

- If the receiver belongs to the third and subsequent categories, then the amount of encumbrance will be 0.6%. The limit on the obligation is RUB 1,000,000.

In a situation where there are several legal successors, payment of the state fee is distributed among the participants in accordance with the share received from the property mass.

Circle of heirs

The list of heirs can be determined by the testator himself. To do this, he must draw up a will. In this case, he can transfer his property not only to relatives, but also to outsiders, as well as organizations. Also in the will you can divide property between recipients and indicate a list of those relatives who are not worthy to receive this property.

If a will has not been drawn up, then inheritance occurs according to law. In this case, only relatives can claim it. They are divided into 8 queues:

- Parents, wives, husbands and children.

- Sisters, brothers, grandparents.

- Uncles and aunts.

- Great-grandparents.

- Cousins, grandparents.

- Great-aunts, uncles, nephews, great-grandparents.

- Adopted children and parents.

- Disabled dependents who have lived with the testator for at least a year.

Typically, the inheritance is received by representatives of the first priority. But if they are not there or they refuse, the right to inheritance passes to the applicants of the next level.

Judicial order

The court is approached if there is a conflict of interest or it is necessary to revoke the will. Another reason is to challenge the actions or inaction of a notary, for example, if the application is not accepted. In any case, to successfully resolve the problem, it is necessary to file a claim, collect evidence, and pay a fee. You can participate in the process personally, but it is better to hire a lawyer who, on the basis of a power of attorney, will defend the interests of the principal.

Each argument presented in the statement of claim is supported by documents. Only documents that are current and have legal force are accepted. In some situations, witness testimony, audio and video recordings are used. This is necessary when the essence of the matter is the recognition of paternity, the unworthiness of the heir, or the illegality of the actions of an employee of a notary office. The outcome of the proceedings is the issuance of a court order, which comes into force after announcement.

How does inheritance of a land plot occur in SNT?

There are two ways of inheriting a dacha - formal and actual. It is important to understand their differences.

Formal

This method allows you to formalize full ownership rights to a summer cottage. To do this, within six months after the death of the testator, you need to contact a notary with an application and a set of documents. After this period, he will issue a certificate of inheritance.

With this document it will be possible to re-register the dacha as personal property in Rosreestr.

Actual

This procedure for inheriting a dacha does not require contacting a notary. It is enough for the heir:

- Pay land fees.

- Pay off the debts of the testator.

- Get his money from debtors.

- Use his property, protect and improve it.

It is important that all these actions are documented. For example, payment receipts. Then these documents can be presented to a notary or court to obtain an official certificate of inheritance. And sooner or later this document will be needed, since without it the dacha cannot be sold, donated or inherited.

With any method of inheritance, along with the property, the debts of the testator also pass to the heir.

Conditions for inheriting a dacha

To register a dacha, you need to enter into an inheritance after the death of the testator or testator. This is done in one of two ways:

- According to the law, the property mass is distributed among successors according to priority;

- According to a testamentary document, property is alienated to the citizens specified in the act of last will.

To initiate an inheritance case you need:

- personal visit to a notary at the residence address of the deceased;

- filing an application;

- collection and provision of documents.

An application to a notary organization must be made no later than six months from the date of death of the testator.

Required documents

Inheritance of a dacha can only occur if there is a list of documents established by law:

- Statement of desire to inherit.

- Will (if one has been drawn up).

- Death certificate of the testator.

- Certificate of the last place of registration and deregistration.

- Documents confirming the relationship of the heir and testator.

- Documents for the land plot.

- Agreement on the division of shares, if the heirs agree on this. Otherwise, the shares will be divided by the notary in accordance with the law.

- Receipt for payment of state duty.

After six months, the notary will issue a certificate of inheritance. The heir must contact Rosreestr with this document. You also need to submit:

- Passport.

- Documents for land.

- Receipt for payment of state duty.

Based on these documents, changes will be made to the land ownership register, and the heir will become the full owner of the dacha.

Successors

To enter into a dacha inheritance, you must adhere to the legal regulations established in Federal Law No. 146 of November 26, 2001. According to the current provisions, a legal successor is a citizen or group of persons who has the right to register real estate, provided that the former owner has died.

In this case, relatives are divided into several queues:

- The first includes close family members - mother, father, son and/or daughter, spouse of the deceased;

- In the second place they include a brother, sister, grandmother, grandson, etc.;

- The third and subsequent lines include distant relatives.

Order of succession by law

However, in addition to these citizens, persons who are dependent on the deceased person can claim the inheritance mass. Their inclusion in the registration process is mandatory - no matter the procedure under a will or law.

Civil Code of the Russian Federation (Part Three) dated November 26, 2001 No. 146-FZ

What to do if the summer cottage plot has not been privatized?

If the testator did not take care to register ownership of the dacha during his lifetime, his heirs may have problems obtaining it.

But despite all the difficulties, inheriting an unregistered dacha is possible.

When there is a house on the site

If a house is built on a non-privatized dacha plot, and this house is registered as the property of the testator, then the heir can file a claim with a request to include the plot itself in the inheritance estate.

However, you need to take into account that unauthorized buildings will not be included. But you can try to arrange them too. To do this, the claim must ask to recognize the deceased’s right of ownership of these buildings, and then the right of the heir.

If you didn’t manage to privatize

There are cases when the privatization process was already underway when the testator died. In this case, the law determines the right of the heir to complete such a process.

When a realtor was involved in privatization, he may not even know about the death of the client and complete the privatization. In this case, it is also recognized as legal.

According to the dacha amnesty through the court

The dacha amnesty is valid until 2021. These are amendments to the legislation that allow inheritance of an unregistered dacha. More precisely, it can be registered in the name of the heir.

Such cases are often heard in court. In this case, you should present:

- An archival extract for the land, which will be proof of the absence of owners of this land.

- Documents on the indefinite or lifelong right to use this land by the testator.

- Extracts from the business book about expenses for maintaining the site.

That is, in any case, when receiving a non-privatized plot, you need to go to court and often have to resort to the help of lawyers.

Independent examination and assessment when registering an inheritance for a dacha

You can order an independent assessment - assessment of the dacha and legal support for registering an inheritance for the house (dacha). We perform:

- independent assessment of value for calculating state duty upon inheritance;

- valuation of dachas for division of property between heirs;

- extrajudicial and judicial assessment of dacha plots when considering court cases;

- assessment for registration of ownership of non-privatized plots;

- handwriting examination of the will.

Possible problems

The lack of a site boundary plan creates many problems. People believe that it is enough to put up a fence, and the boundaries of the land are already defined. But if the neighbors disagree with the location of this fence, the conflict will have to be resolved in court. Judicial practice on dacha inheritance is full of similar examples.

When inheriting a plot that has not been surveyed, the heirs may also encounter difficulties. For example, they will not be able to make a single transaction with him, since the law prohibits the sale or gift of land plots without clearly established boundaries. In this case, the heirs themselves must carry out the land surveying.

A simplified way to design a dacha

The basis for this is the “Dacha Amnesty”, effective in 2020. According to current legislative acts, land plots and buildings on the site can be registered under an accelerated scheme if:

- Ownership arose before 2001.

- The land is intended for gardens and vegetable gardens.

- Cadastral passport available.

Then just contact Rosreestr. Fill out an application, prepare documentation, wait for re-registration (up to 30 days), receive an extract from the register.

Selling a dacha after taking ownership

At the legislative level, there are no restrictions on the sale of property received as a result of entering into inheritance law. However, there is a nuance - if a citizen has owned real estate for less than 5 years, then for the sale of such property it is necessary to pay a tax of 13%, i.e. a tax on the income of individuals.

The inheritance of a summer cottage is subject to strict registration regulations, which are prescribed in Russian legislation. Violating the procedure or ignoring the provisions of the Civil Code of the Russian Federation when drawing up a testamentary document can bring many problems to legal successors.

Therefore, you cannot do without the help of a lawyer in the question of how to register ownership of a house according to law or will. This is due to the fact that it is necessary to prepare documents, correctly distribute shares, and also carry out land surveying.

Do I need to pay taxes for accepting a dacha as an inheritance?

Federal Law No. 78-Z dated January 1, 2006 simplified the taxation procedure. In Art. 217 of the Tax Code states that there is no need to pay real estate tax upon inheritance. This rule applies to all citizens regardless of conditions. When the successor, after the death of the owner, decides to sell the dacha to another citizen within three years, he must pay 13% of the total value of the property. A state fee is paid for the legal services and certificate provided.

The specific size depends on the circumstances. The calculation is carried out as follows: for family members (spouse, children, father, mother, sisters, brothers) - 0.3% of the total amount (up to 100 thousand rubles); for other heirs – 0.6% (up to 1 million rubles). Persons actually living on a dacha plot, some categories of participants in military operations and heroes of Russia and the Soviet Union may not pay the federal duty.

Until 2006, in the Russian Federation, heirs must pay taxes on property received through inheritance. This practice has now been abolished in accordance with Art. 217 Tax Code of the Russian Federation.

Article 217 of the Tax Code of the Russian Federation

“Income not subject to taxation (exempt from taxation)” (

more details

)

Personal income tax of 13% is paid only when the heir decides to sell a dacha that has been owned for less than 3 years. The period is counted from the moment the certificate is received.

We invite you to familiarize yourself with: Inheritance, civil marriage, judicial practice

The legislative framework

According to the Civil Code of the Russian Federation, there are two ways to transfer inheritance - by law and by will:

- In the first case, the property is transferred to relatives after the death of the owner, if he did not express his will in writing during his lifetime.

- In the second, a will is drawn up by a notary, according to which the property is inherited by one or more persons with the distribution of shares for each.

Making a will is possible in several ways, according to Art. 1127 Civil Code of the Russian Federation:

- at a notary;

- from the head of a hospital, hospital or other medical institution, if the testator is undergoing long-term treatment;

- from the captain of the ship, if the testator is on a long voyage;

- from the commander, when a citizen serves in a military unit located in an area where there are no notaries;

- from the head of the correctional institution, if the prisoner is in a place of deprivation of liberty.

Article 1127 of the Civil Code of the Russian Federation

“Wills equivalent to notarized wills” (

more details

)

| Will form | Peculiarities | Civil Code of the Russian Federation |

| Open | Done in the presence of a notary or other authorized person. Information about heirs is available to them. If witnesses are required, they cannot be illiterate people who do not speak Russian, the heirs themselves | Art. 1124 |

| Closed | The contents of the document are known only to the testator. It is handed over to the notary in an envelope in the presence of two witnesses, and is opened after the death of the testator | Art. 1126 |

In addition to the simple form of a will, there is a will with a condition, but in practice it is used extremely rarely. The essence of such a document is to receive an inheritance only if a number of requirements established by the testator are met. If the heir during the life of the testator did not help him and did not take care of him, although according to the law he had to do this, other relatives can go to court to challenge the will and declare it invalid and the heir unworthy.