Starting from 04/13/2019, by Decree of the Government of the Russian Federation dated 04/01/2019 No. 388, compensation for employee expenses for using a personal car for business purposes is excluded from the list of income from which the employer withholds alimony.

This news gave rise to a conversation about what payments alimony is withheld from, what is the basis for its withholding, and how to correctly fill out a payment order for its payment. Examples from judicial practice are given about payments to which the collection of alimony does not apply. Moreover, fines for violating legislation in this area reach 100 thousand rubles.

Voluntary payment of alimony

The responsibility of parents to support minor children is spelled out in paragraph 1 of Art.

80 IC RF. Child support can be paid voluntarily, both on the basis of an agreement concluded between the parents, and without it. The agreement must be in writing and certified by a notary. In this case, it has the force of a writ of execution. If the established form is not observed, the agreement is considered void.

The agreement can be changed or terminated at any time by mutual agreement of the parties, which must also be notarized. This follows from Art. 100–101 RF IC. If the agreement is presented at the place of work, the employer is obliged to withhold alimony from the salary or other income of the employee paying the alimony and transfer it to the recipient.

Payment of child support can occur voluntarily and in the absence of a notarized agreement on the payment of alimony, but only on the basis of an application from the employee with a request to withhold alimony from him.

Editor's note: at the request of the employee, it is allowed to withhold any amounts without restrictions, but only after withholding personal income tax and amounts under executive documents (letter of Rostrud dated September 26, 2012 No. PG/7156-6-1).

Personal income tax when withholding alimony if the debtor uses a property deduction

When constructing or purchasing housing, the taxpayer has the right to a property tax deduction (clause 2, clause 1, article 220 of the Tax Code of the Russian Federation). To obtain such a deduction, he can contact the employer by presenting him with the necessary documents (clause 3 of Article 220 of the Tax Code of the Russian Federation).

As a rule, the amounts of the named deduction are significant. This means that for several months or even an entire tax period, personal income tax will not be withheld from such an employee. But alimony must be withheld from the entire amount of wages (other income) received by the employee. After all, when providing property tax deductions, the tax base actually decreases and, accordingly, income increases (Letter of Rostrud dated December 28, 2006 N 2261-6-1).

If the employee has declared to the employer his right to provide a property tax deduction not from the first month of the tax period (by submitting a written application and notification issued by the tax authority, in the form approved by Order of the Federal Tax Service of Russia dated December 25, 2009 N MM-7-3/ [email protected ] ), this deduction is provided starting from the month in which the employee applied for its provision, in relation to the entire amount of income accrued to the employee on an accrual basis from the beginning of the tax period with offset of the previously withheld tax amount. At the same time, the tax previously withheld from the employee’s income must be offset against future payments, since the personal income tax is calculated on an accrual basis (clause 2, clause 1, article 220, clause 3, article 226 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated 22.01. 2013 N 03-04-06/4-18, dated 12/29/2012 N 03-04-06/4-374, dated 09/14/2012 N 03-04-08/4-301, Federal Tax Service of Russia dated 10/02/2012 N ED -4-3/ [email protected] ). But it is impossible to return to an employee the personal income tax withheld before receiving a notice of deduction. After all, only over-withheld tax can be returned, and when providing a deduction, such tax is only personal income tax withheld after receiving a notification from the employee. And the amount of tax withheld from the beginning of the year until the month of receipt of the notification is legally withheld (Letters of the Ministry of Finance of Russia dated October 26, 2011 N 03-04-06/7-286, Federal Tax Service of Russia for Moscow dated March 22, 2011 N 20-14/ 4/026441).

The algorithm of the organization’s actions in relation to the calculation of alimony when the employer provides a property tax deduction depends on the size of the deduction and the employee’s income and will be as follows.

Option 1. If the amount of the deduction is less than or equal to the employee’s income received for the period from the month of notification to the end of the year, then:

- months before the notification is provided to the Federal Tax Service, it is not necessary to restore the income of an employee from whom alimony was not previously withheld, and there is no need to recalculate the amount of alimony, since personal income tax was legally withheld, is not subject to recalculation and must be reflected in the personal income tax register until the end of the year (Letter of the Ministry of Finance of Russia dated 22.01. 2013 N 03-04-06/4-18). To obtain a refund of this tax amount, the employee will have to contact the Federal Tax Service at the place of residence at the end of the year (clause 2 of Article 220 of the Tax Code of the Russian Federation), submitting a personal income tax declaration (form 3-personal income tax, approved by Order of the Federal Tax Service of Russia dated November 10, 2011 N MMV-7 -3/ [email protected] ) and documents confirming the right to a property deduction (paragraph 24, paragraph 2, paragraph 1, article 220 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated November 26, 2012 N 03-04-08/7-413, Federal Tax Service of Russia dated December 17, 2012 N ED-4-3/ [email protected] ). The tax inspectorate will recalculate and return to the employee the overpaid personal income tax, but it is not granted the right to recalculate and collect child support from persons obligated to pay it. Therefore, the Federal Tax Service will not recalculate alimony;

- starting from the month of notification and up to December inclusive (provided that the amount of the deduction is less than or equal to the employee’s income received for the period from the month of notification to the end of the year), alimony is calculated from the full amount of wages (other income) of the employee (without deduction Personal income tax), since the employee does not need to withhold personal income tax in connection with the provision of a deduction.

Option 2. If the amount of the deduction is greater than the employee’s income received for the period from the month of notification to the end of the year, then:

- (or) alimony throughout the year is calculated in the generally established manner: (accrued amount of salary (other income) minus personal income tax) x 1/4, 1/3 or 1/2, and at the end of the year the employee will apply for a return of personal income tax to his Federal Tax Service with declaration (form 3-NDFL) and documents confirming the right to deduction. The tax office will not recalculate alimony payments, which is beneficial to the employee;

- (or) actions under option 1, and then the employee will have to submit an application to the Federal Tax Service for issuing a notice of deduction for the next year in order to continue receiving a property deduction from the employer.

Note! An employing organization that has returned to an employee personal income tax withheld prior to the notification of the Federal Tax Service for deduction may be subject to liability in the form of a fine in the amount of 20% of the amount of tax and penalties not transferred to the budget (Articles 75, 123 of the Tax Code RF, Letter of the Ministry of Finance of Russia dated September 14, 2012 N 03-04-08/4-301).

Example 4. Based on a writ of execution, alimony for the maintenance of one minor child in the amount of 1/4 of income is withheld from the employee’s salary.

The employee's salary is 100,000 rubles. per month. The annual income that will be accrued to the employee for 2013 will be 1,200,000 rubles. To simplify the calculation, we will assume that a standard tax deduction for child support expenses is not provided.

Monthly - in January, February 2013 - the following was withheld from the employee’s salary:

Personal income tax in the amount of 13,000 rubles:

13,000 rub. = 100,000 rub. x 13%;

alimony in the amount of 21,750 rubles:

RUB 21,750 = (RUB 100,000 - RUB 13,000) x 1/4.

In March 2013, the employee submitted to the organization’s accounting department (clause 2, clause 1, clause 3, article 220 of the Tax Code of the Russian Federation):

- an application for a property tax deduction for personal income tax for 2013 in the amount spent by him on the purchase of an apartment;

- notification from the Federal Tax Service confirming his right to a property tax deduction in the amount of 1,200,000 rubles. in connection with the purchase of an apartment.

An employer can provide a property tax deduction only in an amount equal to the employee’s income from March to December inclusive, i.e. in the amount of 1,000,000 rubles. (RUB 100,000 x 10 months). Personal income tax in the amount of 26,000 rubles. from income for January - February is already legally withheld and is not recalculated (Letter of the Ministry of Finance of Russia dated January 22, 2013 N 03-04-06/4-18), the tax base for January - February remains unchanged, alimony is not recalculated, since the employee’s income is not restored . To request a refund of this tax amount, the employee must contact his tax office, which will return the tax, but will not recalculate alimony.

For the period from March to December 2013, personal income tax does not need to be withheld from the employee due to the provision of a property tax deduction. The tax base for personal income tax (cumulatively) for each month (March - December) will remain unchanged and will be equal to 200,000 rubles. (in January - 100,000 rubles, in February - 200,000 rubles), and the amount of personal income tax withheld and transferred to the budget (on an accrual basis) will remain equal to 26,000 rubles during March - December. (January - 13,000 rubles, February - 26,000 rubles). Alimony must be calculated from the full amount of wages. Their monthly amount for March - December will be 25,000 rubles: 25,000 rubles. = 100,000 rub. x 1/4.

How much alimony is collected?

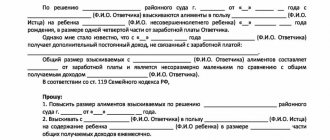

If agreement on the payment of alimony is not reached between the parents, alimony is collected by the court.

Their size is determined in paragraph 1 of Art. 81 of the RF IC: for one child - 1/4, for two children - 1/3, for three or more children - 1/2 of the earnings or other income of the parents. The size of these shares may be reduced or increased by the court, taking into account the financial or family situation of the parties and other noteworthy circumstances (clause 2). Collection of alimony for the maintenance of minor children in court can be carried out not only in shares of the earnings of the parent from whom alimony is collected, but also in a fixed sum of money.

According to paragraph 1 of Art. 83 of the RF IC, the court has the right to determine the amount of alimony collected monthly in a fixed sum of money (or simultaneously in shares and a fixed sum of money), if the parent obligated to pay alimony:

- has irregular, fluctuating earnings or other income;

- receives earnings or other income wholly or partially in kind or in foreign currency;

- has no earnings or other income;

- in other cases, when the collection of alimony in proportion to the earnings or other income of the parent is impossible, difficult or significantly violates the interests of one of the parties.

Is an employee paying alimony entitled to a standard personal income tax deduction for a child?

In general, an employee who is supporting a child is provided with a standard tax deduction for a child for each month (until the cumulative income from the beginning of the year does not exceed 280,000 rubles) in the amount of (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation) :

- 1400 rub. - for the first child;

- 1400 rub. - for the second child;

- 3000 rub. - for the third and each subsequent child;

- 3000 rub. - for each child if a child under the age of 18 is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

One of the conditions under which the right to take advantage of such a tax deduction is granted is the fact that the child is supported by the parents or the parent’s spouse. In this situation, this must be confirmed by the fact of payment of alimony to ensure the maintenance of children. To do this, the divorced parent must submit to the tax agent (Articles 99, 100, 106, 109 of the RF IC, Letter of the Ministry of Finance of Russia dated May 30, 2011 N 03-04-06/1-125):

- child's birth certificate;

- certificate of divorce;

- an agreement to pay alimony certified by a notary, a writ of execution or a court order to collect alimony;

- documents confirming the payment of alimony (a receipt from the recipient confirming that he has received alimony, a copy of the payment order transferring alimony to the recipient’s account, or a certificate from the employer withholding alimony from the employee’s salary).

Failure to pay child support in accordance with a parental support agreement or a court order means that the parent does not participate in the financial support of the child and cannot claim a child support deduction.

If it is documented that one of the parents pays alimony in accordance with the procedure and amounts established by the RF IC, he has the right to a standard tax deduction for children (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated 10.11.2012 N 03-04-05/8-1179, dated 03/23/2012 N 03-04-05/8-367, dated 04/21/2011 N 03-04-05/5-275, dated 07/27/2009 N 03-04-06 -01/194, Federal Tax Service of Russia for Moscow dated 03/05/2010 N 20-15/3/022941, Resolution of the Federal Antimonopoly Service of the Central District dated 06/24/2011 in case N A35-8471/2009). Since the payment of alimony in itself means participation in the maintenance of the child, the employee’s right to receive a standard tax deduction for the child does not depend (Letters of the Ministry of Finance of Russia dated October 11, 2012 N 03-04-05/8-1179, dated April 3, 2012 N 03-04 -06/8-96, dated 03/23/2012 N 03-04-05/8-367, Federal Tax Service of Russia for Moscow dated 04/19/2010 N 20-15/3/ [email protected] ):

- from the place of residence of such an employee (together with the child or not);

- depending on the marital status of such an employee - unmarried (divorced or unmarried).

Example 5. An employee has three minor children: two children from his first marriage, for whom he pays alimony according to a writ of execution; the organization deducts them from their salary, and one child from his second marriage. The employee's total income does not exceed 280,000 rubles.

An employee has the right to a standard tax deduction for all three children, since he pays alimony for two children from his first marriage and also supports a child from his second marriage (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation).

The employing organization must provide the employee with deductions in the total amount of 5,800 rubles: for the first and second child - 1,400 rubles each, and for the third child - 3,000 rubles. (Clause 4, Clause 1, Article 218 of the Tax Code of the Russian Federation). The order of birth of children is determined by the dates indicated in the birth certificates.

To receive standard tax deductions for children, the employee must submit to the organization’s accounting department (clause 3 of Article 218 of the Tax Code of the Russian Federation):

- a free-form application requesting a standard child tax credit;

- copies of birth certificates of all children;

- writ of execution for payment of alimony.

However, not every divorced parent paying child support can take the standard child deduction. For example:

- if alimony is insignificant and does not allow the child to provide a means of subsistence, this may mean that the parent is not involved in providing for it (Letter of the Ministry of Finance of Russia dated May 21, 2009 N 03-04-06-01/117). However, comparison of the amount of alimony in terms of its sufficiency to provide for the child is an evaluative category, not regulated by the Tax Code of the Russian Federation;

- a divorced parent paying child support is, in principle, not entitled to a standard tax deduction for children (Letter of the Federal Tax Service of Russia for Moscow dated 03/05/2009 N 20-15/3/ [ email protected] );

- if a taxpayer provides for a child, but is not his parent, he is not entitled to receive a standard deduction for children (Letter of the Federal Tax Service of Russia for Moscow dated 03/05/2010 N 20-15/3/022941).

From what income can alimony be deducted?

The full list of income from which alimony is withheld is approved by Decree of the Government of the Russian Federation of July 18, 1996 No. 841. It indicates the following types of income:

- wage;

- vacation pay;

- amounts of financial assistance;

- severance pay;

- all types of pensions (except for survivor's pension);

- scholarships paid to categories of students specified in the list;

- benefits for temporary disability, unemployment - only by court decision and court order for the collection of alimony or a notarized agreement on the payment of alimony;

- income from entrepreneurial activities, determined minus the amounts of expenses incurred related to its implementation;

- income from the rental of property;

- income from equity participation in the organization (dividends);

- from other payments made by the employer in accordance with labor legislation.

According to paragraph 4 of the list, the collection of alimony from wages and other income is carried out after taxes are withheld from these amounts.

Decree of the Government of the Russian Federation of July 18, 1996 No. 841 “On the List of types of wages and other income from which alimony for minor children is withheld”

Editor's note : a parent who pays alimony for the maintenance of his minor children is entitled to a standard child deduction for personal income tax. This is possible due to compliance with the conditions of paragraphs. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation: the fact that the child is supported by the parents or the spouse of the parent. Payment of alimony confirms this fact (letters from the Ministry of Finance of the Russian Federation dated November 7, 2018 No. 03-04-05/80099, dated August 10, 2016 No. 03-04-05/46762).

How should alimony be calculated: before personal income tax is deducted or after?

Alimony is calculated and withheld from the salary (other income) of the debtor employee only after personal income tax has been withheld. This is indicated in Part 1 of Art. 99 of the Federal Law of 02.10.2007 N 229-FZ “On Enforcement Proceedings”, clause 4 of the List of types of wages and other income from which alimony for minor children is withheld, approved by Decree of the Government of the Russian Federation of 18.07.1996 N 841, Letter of Rostrud dated December 28, 2006 N 2261-6-1. Therefore, before determining the monthly amount of deductions, you need to calculate the personal income tax on the employee’s income. Having calculated the tax amount, you will receive a base value on the basis of which the maximum amount of withheld alimony is calculated - this is the employee’s total income remaining after withholding personal income tax.

Example 1. An organization collects alimony from an employee’s income in the amount of 1/4 of income. The employee's salary is 50,000 rubles. The month has been completely worked out. The standard personal income tax deduction for a child is not provided (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation). Before calculating alimony, the amount of earnings must be reduced by personal income tax. In this situation, the tax will be 6,500 rubles. (RUB 50,000 x 13%). The employee's basic income, on the basis of which the maximum amount of deductions is calculated, is 43,500 (50,000 rubles - 6,500 rubles). The amount of alimony to be collected is 10,875 rubles. (RUB 43,500 x 1/4).

If an organization returns excessively withheld personal income tax to an employee (Clause 1 of Article 231 of the Tax Code of the Russian Federation), from whose income alimony is withheld, the amount of alimony is recalculated. That is, alimony should be calculated from the refund amount (Letter of Rostrud dated December 28, 2006 N 2261-6-1). So, from the income remaining after withholding personal income tax, you need to withhold the amounts specified in the writs of execution. This provision is especially relevant when calculating alimony if one employee receives several writs of execution. In such cases, the accountant must comply with the following order of repayment of the employee’s debts (Part 1, Article 111 of the Federal Law of October 2, 2007 N 229-FZ, Section IV of the Methodological Recommendations on the procedure for fulfilling the requirements of executive documents on the collection of alimony, approved by the FSSP of Russia on June 19. 2012 N 01-16). First, you need to withhold amounts to pay off first-priority debts. This also includes alimony. But, besides them, the requirements of the first priority include the following (clause 1, part 1, article 111 of Law No. 229-FZ):

- for compensation for harm caused to health;

- for compensation for damage in connection with the death of the breadwinner;

- for compensation for damage caused by a crime;

- on compensation for moral damage.

Secondly, requirements related to payments to the budget are satisfied (for example, personal income tax amounts additionally accrued to the employee by the tax office). The remaining deductions are made in third place.

The demands of each subsequent queue must be satisfied only after the claims of the previous queue have been fully satisfied (Part 2 of Article 111 of Law No. 229-FZ). In this case, it is necessary to comply with the established restrictions on the amount of deductions (Parts 2, 3, Article 99 of Law No. 229-FZ).

Note! When collecting alimony for minor children and other first-priority claims, the total amount of withholding cannot exceed 70% of the debtor’s salary and other income. In other cases, no more than 50% can be withheld (Parts 2, 3, Article 99 of the Federal Law of October 2, 2007 N 229-FZ, Article 138 of the Labor Code of the Russian Federation, Section IV of the Methodological Recommendations, approved by the FSSP of Russia on June 19, 2012 N 01 -16). In the event that the total amount that can be withheld from an employee’s salary is not enough to pay off all the debts of one priority, the accountant must himself distribute the amount withheld from the employee’s income among all his debts of the corresponding priority (in proportion to the amount of debts for each executive document) (Part 3 Article 111 of the Federal Law of October 2, 2007 N 229-FZ, Section IV of the Methodological Recommendations, approved by the FSSP of Russia on June 19, 2012 N 01-16).

Example 2. The organization’s accounting department received two writs of execution for an employee:

- to collect child support;

- for compensation for material damage caused as a result of an accident.

The employee’s salary for July 2013 is 30,000 rubles, of which must be withheld according to two writs of execution:

- — alimony for 2 children in the amount of 1/3 of income;

- — compensation for material damage due to an accident in the amount of 20,000 rubles.

The employee is provided with a standard deduction for children in the amount of 2,800 rubles.

The procedure for withholding alimony should be as follows: first of all, it is necessary to withhold alimony (up to 70% of the salary), and then - compensation for material damage, provided that the total amount of withholding (together with alimony) does not exceed 50% of earnings (Article 138 of the Labor Code). Code of the Russian Federation, Part 3, Article 99 of Law No. 229-FZ).

Calculation of withheld amounts according to two writs of execution:

1. Personal income tax: 3536 rub. = (RUB 30,000 - RUB 2,800) x 13%.

2. Alimony: 8821 rub. 33 kopecks = (RUB 30,000 - RUB 3,536) x 1/3.

3. Limit amount of deductions: RUB 13,232. = (RUB 30,000 - RUB 3,536) x 50%.

4. Compensation for material damage due to an accident (taking into account the 50% limit on deductions and the amount of alimony already withheld):

4410 rub. 67 kopecks = 13,232 rub. — 8821 rub. 33 kopecks

5. Debt for compensation for material damage, subject to collection in the following months: RUB 15,589. 33 kopecks = (20,000 rubles - 4410 rubles 67 kopecks).

Alimony is withheld from severance pay

The Ministry of Labor of the Russian Federation answered the question about the withholding of alimony from severance pay and average earnings for the period of employment, paid upon dismissal of an employee.

True, the letter is about alimony for the maintenance of parents, not children. The agency indicated that alimony should be withheld from these amounts; this is expressly provided for by law. Specifically, in paragraphs “k” and “e” of the list of types of wages and other income from which alimony for minor children is withheld. Moreover, from these payments, alimony is withheld both for the maintenance of minor children and for the maintenance of parents.

Letter of the Ministry of Labor of the Russian Federation dated September 12, 2017 No. 11-1/OOG-1816

From what income can alimony be withheld?

All types of income for which alimony cannot be collected are listed in Art. 101 of the law on enforcement proceedings. Let's name some of them. These are, for example, compensation payments provided for by the Russian labor legislation:

- in connection with a business trip, transfer, employment or assignment to work in another area;

- due to wear and tear of a tool belonging to the employee;

- in connection with the birth of a child, the death of relatives, and the registration of marriage.

In addition, these payments also include benefits from the Federal Social Insurance Fund of the Russian Federation, in addition to sick leave benefits, and various compensation payments from the budget.

Alimony established in a fixed amount must be indexed

If alimony is established in a monetary amount, then its size must be periodically indexed.

This helps to protect, on the one hand, alimony payments from inflation, and on the other hand, to avoid repeated appeals to the court to change the amount of alimony. The Ministry of Finance of the Russian Federation reminded of this obligation. Namely, when the cost of living increases, the organization indexes alimony, established in a fixed monetary amount. Indexation is carried out in proportion to the increase in the cost of living for children in the region where the recipient of alimony lives. If there is no regional minimum, alimony is indexed in proportion to the increase in the national subsistence minimum.

Letter of the Ministry of Finance of the Russian Federation dated September 3, 2018 No. 03-05-06-02/62540

Editor's note : indexation of alimony collected in a fixed sum of money is provided only in proportion to the increase in the cost of living, therefore, if the cost of living decreases, indexation is not carried out.

It is the employer who is obliged to index alimony payments established in a fixed amount.

Previously, the obligation to independently index alimony collected from the debtor by court decision in a fixed sum of money was provided only if the writ of execution was brought to the accounting department of the enterprise by the claimant. In all other cases, indexing was the concern of the bailiffs. They had to calculate the amount of indexation, make an appropriate decision and send it to the debtor’s place of work. The accounting department could only accept this resolution for execution. But from November 25, 2017, with the entry into force of amendments to the RF IC introduced by Law No. 321-FZ of November 14, 2017, it became unimportant from whom the employer received the writ of execution with a fixed amount of alimony - from the claimant or from the bailiff service.

Failure to fulfill the obligation to index alimony risks a considerable fine from bailiffs under Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation:

- for an organization - from 50 to 100 thousand rubles;

- for its manager (or individual entrepreneur) - from 15 to 20 thousand rubles.

The amount of deductions from income is limited by law

When withholding alimony, it is necessary to take into account the requirements established by Art.

138 Labor Code of the Russian Federation. Namely, the amount of deductions from wages when collecting alimony for minor children cannot exceed 70 percent. Moreover, this refers to the total amount of all deductions, since in addition to alimony, the employee may have other grounds for collection. Editor's note : Exceeding the maximum amount of deductions from wages is subject to criminal, administrative and disciplinary liability. Criminal liability, according to Art. 145.1, is expressed in the imposition of fines, deprivation of the right to hold certain positions or engage in certain activities, forced labor and imprisonment. Administrative liability for legal entities and individual entrepreneurs provides for fines under Parts 6 and 7 of Art. 5.27, which can reach a maximum amount of up to 100 thousand rubles for legal entities. In addition, a prosecutorial audit and a labor inspectorate audit may be initiated against the employer.

If compensation is established by law, alimony cannot be withheld from it

An employee of the Murmansk sea trade port filed a claim against the employer for the recovery of funds and compensation for moral damage.

In terms of recovery of funds, the court satisfied his demands. The reason for the claim was the illegal deduction of alimony from the amount of compensation for travel expenses to the vacation spot and back. According to the plaintiff, these actions of the employer violate his rights, since the said compensation payment does not relate to the employee’s income and compensation from which alimony can be withheld by force of law.

The port, in turn, decided to file an appeal to overturn the court decision. The appeal upheld the decision. The court justified the illegality of deduction from compensation amounts with the following arguments:

- in accordance with Part 4 of Art. 138 of the Labor Code of the Russian Federation, deductions are not allowed from payments that are not subject to foreclosure in accordance with federal law;

- the list of income from which alimony is withheld for minor children is determined by the Government of the Russian Federation;

- despite the fact that this compensation is not named in the specified list, it is indicated in another legislative document - Law of February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas” . Therefore, compensation is a measure of state support for citizens living in extreme climatic conditions of the north, and not income at all.

Moreover, according to Art. 325 of the Labor Code of the Russian Federation, persons who work in organizations located in the regions of the Far North and equivalent areas have the right to pay once every two years at the expense of the employer the cost of travel and luggage transportation within the territory of Russia to the place of vacation use and back. This right arises for the employee simultaneously with the right to receive annual paid leave for the first year of work in this organization.

Thus, the deduction of child support from the specified payment is illegal and violates the plaintiff’s rights to receive compensation for travel expenses incurred to the place of use of the vacation and back in full.

Appeal ruling of the Murmansk Regional Court dated May 20, 2015 No. 33-1457/2015

Alimony is not deducted from compensation for rental housing expenses.

An employee of a machine-building plant filed a lawsuit against the bailiff to declare his actions illegal, which resulted in the plant’s accounting department being obliged to calculate and withhold alimony from the amounts of compensation payments for renting housing and to determine the amount of arrears he had accumulated in the payment of alimony in the amount of 71 thousand. rubles

The man indicated that housing rental compensation is not his income, so it cannot be taken into account when calculating and withholding alimony.

The citizen was hired from another area, and he did not have living space. According to the regulation on rental compensation approved by the general director, the plant compensated the costs of renting residential premises to employees who do not have permanent housing or permanent registration.

The court of first instance satisfied the citizen's demands. However, the appeal overturned the decision. The cassation returned the case for consideration to the previous instance for the following reasons:

- compensation was established by the labor legislation of the Russian Federation and, in accordance with clause 1 of the list of types of wages and other income from which alimony for minor children is withheld, alimony is not collected from them;

- compensation for the cost of housing is not stimulating in nature and, therefore, does not relate to the income of the debtor from whom alimony is subject to deduction. A non-resident specialist with special experience and qualifications was invited to work, that is, his invitation was made in the interests of the organization, and not in order to increase the motivation and efficiency of the employee’s work function;

- Taking into account the direction of the employer's expenses, the mere circumstance that, as a result of compensation to the employee for his expenses for renting residential premises, his personal needs are satisfied to a certain extent, is not sufficient to conclude that he has income from which alimony is subject to deduction.

Resolution of the Presidium of the Moscow Regional Court of October 18, 2017 No. 546 No. 44GA-279/2017

Personal income tax under a settlement agreement

When an alimony claimant applies to a bailiff, the debtor may enter into a settlement agreement with the claimant at the stage of enforcement proceedings, apply to the court for approval of this document and submit it to the bailiff to cancel the measures of forced execution of alimony obligations. The fact is that a settlement agreement approved in court is the basis for termination of enforcement proceedings. This follows from the norms of clause 3, part 2, art. 43, part 1 art. 44, part 1 art. 50 of the Federal Law of October 2, 2007 N 229-FZ “On Enforcement Proceedings”, clause 2, part 1, part 2 of Art. 439 Code of Civil Procedure of the Russian Federation.

True, in this case, the amounts to be paid to the alimony claimant under the settlement agreement are subject to personal income tax in the general manner, since they are not among the payments on which personal income tax is not charged (Article 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated January 24. 2013 N 03-04-06/9-23). While alimony received by the claimant under writs of execution is not subject to personal income tax (clause 5 of Article 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated October 4, 2012 N 03-04-05/6-1141). Moreover, in order to calculate personal income tax at the stage of approval of a settlement agreement by the court, it is necessary to indicate to the court the need to divide the amounts into funds due to the alimony collector and the tax subject to withholding (Letter of the Ministry of Finance of Russia dated October 4, 2012 N 03-04-05/6 -1141).

The Ministry of Labor of the Russian Federation explained how to fill out a payment form for the transfer of alimony

The Ministry has issued detailed instructions for filling out a payment order for alimony payments. The document must reflect:

- number and date;

- amount (in numbers and words);

- details of the organization sending the payment (name, tax identification number, checkpoint, address, bank details);

- details of the payment recipient (full name, address of residence and bank details);

- the purpose of the payment, which indicates the data of the writ of execution or agreement on the payment of alimony (information about the organization that issued the writ of execution, the date of issue, the number of the case or materials on the basis of which the writ of execution was issued, the period for which the money is withheld, and the amount of payment);

- priority and type of payment (according to clause 2 of Article 855 of the Civil Code of the Russian Federation, alimony is a payment of the first priority, therefore in the corresponding field “21” of the order you must enter the number 1).

The agency explained why these details are required to be filled out:

- according to Art. 109 of the RF IC, the organization at the place of work of the alimony payer is obliged to withhold and transfer alimony monthly from his salary or other income. The basis for payment is either a notarized agreement on the payment of alimony, or a writ of execution;

- To pay alimony, three days are given from the date of payment of wages. This requirement is established by Part 3 of Art. 98 of the Law of October 2, 2007 No. 229-FZ and Art. 109 RF IC.

If the address of the recipient of alimony is unknown, it should be transferred to the bank account of a structural unit of the territorial body of the FSSP of the Russian Federation (clause 9 of clause II of Appendix No. 1 to the methodological recommendations on the procedure for fulfilling the requirements of executive documents on the collection of alimony (approved by the FSSP of the Russian Federation on June 19, 2012 No. 01 -16).If

alimony is transferred to an individual’s bank card, then the recipient must clarify the bank details and personal account number.

Calculation of personal income tax when withholding alimony from material benefits

The income from which alimony is withheld does not take into account material benefits, incl. received in the form of savings on interest for the use of borrowed funds (clause 1, clause 1, article 212 of the Tax Code of the Russian Federation). This follows from Art. 82 of the RF IC, List of types of wages and other income from which alimony for minor children is withheld, approved. Decree of the Government of the Russian Federation of July 18, 1996 N 841, section. VI Methodological recommendations on the procedure for fulfilling the requirements of executive documents on the collection of alimony, approved. FSSP of Russia 06/19/2012 N 01-16.

In such cases, it turns out that the amount of income from which alimony is withheld is less than the amount of income from which personal income tax is withheld.

Material benefits are taken into account as income only for personal income tax purposes (Letter of the Ministry of Finance of Russia dated 05/07/1997 N 04-04-06). It is impossible to withhold alimony from this type of income, since it is virtual and exists only on paper.

In such situations, when determining the base for calculating alimony, the income from which alimony is withheld is reduced only by the amount of personal income tax that is withheld specifically from this income.

Example 3. Based on a writ of execution, alimony for the maintenance of one minor child in the amount of 1/4 of income is withheld from the employee’s salary. The employee's salary is 30,000 rubles. per month. When subject to personal income tax, an employee is provided with a standard tax deduction for child support expenses in the amount of 1,400 rubles.

On January 14, 2013, the employee entered into a loan agreement with the organization in the amount of RUB 288,000. for 3 years. Payment of interest for the use of borrowed funds is not provided for in the loan agreement. The organization provided the employee with a loan on January 14. The debt is repaid in equal installments, starting in February 2013, for 8,000 rubles. per month.

For the first time, the employee repaid part of the loan (8,000 rubles) on February 28, 2013. On this day, he received income in the form of material benefits from saving on interest (clause 1, clause 2, article 212 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated September 23 .2011 N 03-04-06/6-236, dated July 25, 2011 N 03-04-05/6-531, dated May 16, 2011 N 03-04-05/6-350, Federal Tax Service of Russia for Moscow dated 05/04/2009 N 20-15/3/ [email protected] , dated 06/20/2008 N 28-11/058540).

In February, the interest rate, which is 2/3 of the current Bank of Russia refinancing rate, is 5.5% (8.25% x 2/3).

In February 2013, the organization’s accounting department made the following calculations:

1. Personal income tax on wages for February (clause 3 of Article 210 of the Tax Code of the Russian Federation) is equal to 3,718 rubles:

3718 rub. = (RUB 30,000 - RUB 1,400) x 13%.

2. The material benefit from savings on interest for using a loan for the period from January 14 to February 28 (46 calendar days) amounted to 1996 rubles. 27 kop.:

1996 rub. 27 kopecks = 288,000 rub. x 5.5% : 365 days. x 46 days

3. Personal income tax on income received in the form of material benefits in February at a rate of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation) is equal to 698 rubles. 69 kop.:

698 rub. 69 kopecks = 1996 rub. 27 kopecks x 35% (rounded to RUB 699).

The child tax deduction does not apply (clause 4 of Article 210 of the Tax Code of the Russian Federation).

As the loan is repaid, the organization will, in a similar manner, calculate the amount of material benefit from savings on interest and personal income tax from it for each date of partial repayment of the loan until it is fully repaid by the employee.

4. The total amount of personal income tax withheld from the employee’s income for February and transferred to the budget is 4,417 rubles.

4417 rub. = 3718 rub. + 699 rub.

5. Alimony for February (calculated only from the amount of salary after deducting only that amount of personal income tax that relates to salary):

6570 rub. 50 kopecks = (RUB 30,000 - RUB 3,718) x 1/4.

For comparison:

Alimony for February, calculated after deduction of taxes from wages (other income) in accordance with tax legislation (Part 1, Article 99 of Law No. 229-FZ, clause 4 of List No. 841):

6395 rub. 75 kop. = (30,000 rub. - 3,718 rub. - 699 rub.) x 1/4.

From a moral and ethical point of view, when calculating alimony in this way, the rights of the child will be infringed (reduction in the amount of alimony) if one of his parents paying alimony is provided with loans on free or preferential terms, which is unacceptable.