How to pay child support through an online service

Modern technologies are developing rapidly. So, just a few years ago, no one could even think that alimony, as well as other payments, could be made without leaving home. Almost every bank has various online services, but the most popular in this sector is Sberbank with its Sberbank Online application.

Paying alimony using this service is quite simple, you just need to follow the following step-by-step instructions:

- First of all, a person must have access to the service. You can do this either independently, using your bank card and terminal, or with the help of a bank employee. To gain access, it is enough to activate the Mobile Bank, which will allow you to receive codes about the failure of transactions. Using this you can get a login and password for Sberbank online.

- The next stage is logging into the service. To do this, a person needs to have a personal computer or mobile Internet with Internet access in order to access the main page of Sberbank. In the authorization field you must enter a password and login. If any of this information is lost, restoration can be done using a mobile phone and a linked bank card.

- If the user remembers the login and password, an SMS message with a confirmation code will be sent to the linked mobile phone number. It is worth remembering that you can enter this code only for a limited period of time, which is done to ensure security.

- The next step must be completed in your personal account, in the “Transfers and Payments” tab. Further selection is made depending on which bank the alimony recipient has an account with. For example, if the creditor is a user of the same banking institution, you can select the “Transfer to Sberbank client” item.

- Next, enter the recipient’s account number, select the account from which the funds will be paid, and enter the transfer amount. The best option is to transfer funds to a client of the same bank, since when entering data, the name, patronymic and first letter of the recipient’s last name will immediately be displayed, which will avoid mistakes and further misunderstandings with the bailiff service employees. It is worth remembering that in the appropriate field the purpose of the transfer must be indicated - alimony (the exact name of the child) for a certain month.

- The final step is to enter the confirmation code in a special field, which will be sent by SMS message confirming the transfer details.

The convenience of using such an online service is that now all information about the history of transactions is stored in your personal account. But, to be on the safe side, it is best to print out a receipt, which will serve as confirmation of the transfer in case any misunderstandings arise.

How to pay child support voluntarily?

According to the RF IC, family members who are able to work are obliged to support their child, elderly, and sick relatives.

This obligation can be fulfilled in various ways of transfer. The choice is made based on the interests of the obligee, as well as the ward himself.

How can I make a payment?

An agreement to pay maintenance to a close relative is voluntary or a court decision prescribes how to pay alimony correctly (amount, method, frequency).

Alimony can be voluntarily transferred in the following ways:

- using Russian Post services (cash on delivery);

- via bank transfer (to a bank account, for example, Sberbank);

- through electronic payment systems;

- in cash.

As a general rule, the addressee of the funds is the ward relative (child, parent, spouse, other close person).

For children, at the request of the alimony payer, the court has the right to allow only half of the assigned amount to be transferred to the child’s representative (the other parent), and the other half to be transferred to the child’s personal bank account.

Then alimony is divided in half, you can voluntarily transfer it in parts: to the account of the second parent (with whom the child lives permanently), to the child’s personal account.

By Russian Post

Using the services of the Russian Post is the most common way to transfer alimony funds voluntarily. The Internet, bank branches and terminals are not available in all localities, but post offices operate throughout the country; they are more accessible to many.

To make a transfer, you must fill out the appropriate form; you can get it from an employee. The filling procedure should not cause much difficulty, since a filling sample is usually posted on the stand.

It is necessary to fill out the form correctly:

- the amount of transferred alimony up to kopecks (in numbers, in words);

- Full name of the addressee;

- recipient's address (format: region-locality-street-house-apartment);

- address code (if unknown to the payer, you can find out from an employee of the institution);

- Sender's full name;

- sender's address (format: region-city-street-house-apartment);

- purpose of funds (column “Message”);

- indicate that a passport has been presented (fill in its details);

- citizenship of the sender;

- signature.

The final payment consists of the alimony amount and commission (postage). The size of the latter depends on the amount of the main payment.

Transfers via Russian Post come in several types:

- simple (about 8 days);

- “afterburner” (up to 100 thousand rubles - up to an hour, higher - up to 2 days);

- CyberMoney (for transfers abroad, the total period is 2-3 days, for branches without electronic exchange - 8 days);

- in which cash is accepted and the branch transfers it to a bank account;

- in which money is debited from a bank card and the ward is given cash;

- Western Union system (abroad, receipt in a few minutes).

You can receive alimony at the branch at a specific address (in the service area of the recipient’s place of residence) or at any branch. The chosen method is discussed in advance with the recipient of the alimony and is indicated in the transfer form.

Other translation methods

Payment of alimony is possible using other methods: a bank card or an electronic wallet.

Via bank card

It is convenient for bank card holders to pay voluntarily alimony debts through a bank, terminal, or personal account (for example, Online Sberbank). To do this, the recipient opens a bank account.

Typically, transfers between accounts of the same bank are carried out without charging a commission.

To voluntarily make a transfer through a bank terminal, personal account (Online Sberbank), you need to know:

- Recipient's full name;

- His account number.

Many banks (for example, Sberbank) provide, which you can set up yourself through your personal account online or with the help of a bank branch employee.

The service assumes that funds will be transferred from the account to the specified account on the specified day. To confirm the fact, you must save or print the generated receipts for the transaction performed.

The procedure for paying alimony through the bank cash desk is as follows:

- Many banks already require you to take an electronic queue (get a coupon, as, for example, Sberbank provides for this). If this is not the case, then take the “live” queue.

- Approach the employee, order a transfer service, handing him your passport, bank card, and account details.

- Inform the amount of the transfer and its purpose (with the child’s full name).

- The employee will make the transfer, return the documents, and issue a receipt for the transaction.

Through a savings book

If the payer does not have a card, but is the holder of, for example, a savings book (Sberbank of Russia), then alimony is transferred from it:

- The amount to be withdrawn from the book is ordered (up to 10 thousand rubles is issued immediately).

- The Sberbank cash desk issues money (a receipt is handed over, the account balance is noted in the book).

- Alimony is transferred (a check is issued indicating the amount, recipient, purpose of the transfer).

Alimony money from a salary card can be written off through the employer.

To do this, an application is submitted to the accounting department (to the manager himself) to write off a certain amount on a specific day of the month to a specified bank account (the sample is not established, it is written in free form).

An alimony payment agreement/writ of execution is attached to it. The recipient (his representative) can write such a statement.

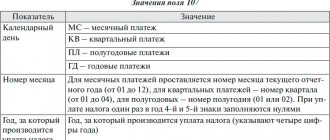

The employer and his accountant draw up a payment order, stating:

- Full name of the payer;

- purpose of transfer (with the child’s full name);

- details of the document providing the basis for the accrual (agreement, writ of execution, court order);

- paid period (per month, per quarter);

- write-off size;

- recipient's account.

Having received the payment order, the bank in which the employer has an account for salary payments makes the transfer. Payment occurs on the day of payment of salaries to employees or three days after such payment (for example, Sberbank).

Through the company's accounting department

If the employee is not the holder of a bank card and receives his salary in cash from the employer, then the recipient of the alimony has the right to voluntarily contact the head of the organization with a request to withhold alimony from the salary. Then the issuance takes place in person on the day the salary is paid at the enterprise.

Along with the payment, a receipt is issued, and the employee himself is given a payslip, which reflects the size of the salary and payments from it, for example, for a child.

If the payer voluntarily transfers alimony funds, then to confirm the fact of payment it is necessary to document the moment of transfer with a receipt (specify the amount, for which child, purpose). The sample receipt is not specified; it is filled out randomly.

Via electronic wallet

Electronic payment systems are becoming increasingly popular: QIWI, WebMoney, etc. You can voluntarily transfer money from an electronic wallet either to a bank account or to its electronic wallet.

Operations within one system are not subject to commission, as a rule (it is better to find out in the call center of the system). The QIWI system offers a service in which the recipient can pick up the money in cash at the post office.

Some systems have their own terminals with which you can voluntarily pay alimony.

To transfer through an electronic account from a wallet, you must open the “Payments” tab, fill out the form, be sure to indicate the purpose of the payment (for which child, for what period).

When concluding an agreement on alimony or when resolving this issue in court, when the method of making alimony funds is established, the choice of a specific method should take into account the interests of both parties: the payer and the recipient.

You may also like

Source: https://oalimentah.ru/razmer-alimentov/poryadok-uplaty-alimentov.html

The nuances of paying alimony through Sberbank online

The most popular question that worries almost all alimony payers is how much is alimony with this option of transferring it?

As a rule, if the accounts of both parties to the agreement or executive document are opened in the same banking institution, the funds arrive in the recipient’s account in a matter of seconds. Of course, there are small delays, but, as a rule, their duration does not exceed a day.

Another distinctive feature of this service is that citizens have the opportunity to make transfers by connecting a special one, as well as using a template.

Despite the fact that errors sometimes occur in the operation of Sberbank Online, it is still the most convenient option for transferring funds to support a minor child.

Expert opinion

Marina Bespalaya

In 2011 she graduated from the University of Internal Affairs with a degree in jurisprudence. In 2013, master's degree course, specialty "law". In 2010-2011, a course at Portland State University (USA) at the Faculty of Criminal Law and Criminology. Since 2011 - practicing lawyer.

The advantage of this method is that in online banking you can create a template that makes it convenient to transfer money without constantly entering and checking details. It will also be possible to create an automatic payment, in which money will be transferred to the children’s account automatically on the day specified in the function.

How to pay child support using a mobile phone

Another way to transfer funds, which is available to Sberbank users, is using a mobile phone; for this you just need to connect a mobile bank. In this case, funds can be transferred by entering a special SMS command.

To make a payment, a citizen must send a certain set of words and numbers to a special number 900. However, in order to avoid mistakes, it is best to first clarify the exact command in SMS with bank employees on the official website of the organization.

Most often, to carry out such an operation, it is enough to write in the message the word “transfer”, the phone number of the recipient of the funds, and the amount of the transfer. As confirmation, you will receive an SMS with further instructions.

There is also a negative point in using this method - the alimony payer does not have the opportunity to accurately indicate the purpose of the payment. But it is possible to get out of this situation: it is enough to simply send the claimant a message in advance that the funds paid as alimony will be transferred to him in the near future.

In this case, money is also transferred in a matter of minutes.

Payment of alimony through a mobile application

You can also transfer money via phone using a mobile application. For example, Sberbank clients can install Sberbank Online on their phone and make payments through it, which eliminates the need to confirm all their transactions via SMS messages.

Payment of alimony using the application is made in almost the same way as through a full-fledged personal account in the browser. As statistics show, this option is not very popular, largely due to the widespread dissemination of information that such applications are very easy to hack, although this fact has not been reliably established.

Other traditional methods of paying alimony

Of course, not all alimony payers have the opportunity and desire to transfer alimony payments remotely. In this case, you should choose one of the traditional options for transferring funds to the recipient’s account.

When choosing any of the methods, it is important to adhere to a few simple rules:

- When transferring funds, it is important to indicate the purpose of the payment. It is advisable that the document record the payer’s full name, the purpose of the payment, the child’s full name and date of birth. If this information is not included in the payment document, the citizen may have problems with bailiffs in the future. For example, in the absence of such information, the claimant may claim that he did not receive alimony, and the transferred funds were directed to the card for other purposes.

- It is important to always keep receipts as proof of the transfer. Of course, when paying alimony through Sberbank online or a mobile application, the transaction history is saved, but it’s still better to have a paper version of this document with you, it’s much more reliable. Unfortunately, there are cases of program malfunctions, so in the absence of a paper version it will be difficult to prove the fact of translation in court.

- After the transfer, it is best to call the recipient back and make sure that the funds have reached him. If there are delays in payments, you need to contact the bank and consult on this issue.

- You should not split your alimony payment into several separate parts; it is advisable to send the money in a single payment in the amount stated in the enforcement documentation.

Rules for processing alimony payments

Paying child support is the responsibility of the parent who does not live with the child. Failure to comply with a court decision regarding the transfer of alimony is punishable by law, including criminal liability. Therefore, you cannot be negligent here, even if you regularly pay child support payments to your child. Failure to comply with at least one of the rules may result in you having to transfer money again. So, here are the mandatory conditions that you must adhere to when paying alimony through a bank.

- The main thing when making any bank payment is to correctly indicate the recipient’s details, the sender’s full name, the amount and purpose of the payment. The purpose of the payment is indicated in a separate field at the bottom, after all other data. There it is fundamentally important to indicate the purpose of the payment. In our case, this is, for example, “child support for January 2021, full name of the child and date of birth.”

- If the money is sent not to the Sberbank card number, but to the current account of another bank, then you will need complete internal details, indicating the name of the bank, account number, INN of the organization, etc. In order not to make mistakes, in such a situation, let the recipient take a template from his bank with his account details for payment to third parties and give it to you or attach it to the writ of execution.

- All receipts and payment confirmations must be retained. The shelf life is 3 years. The law provides for appeals against alimony payments for a period of no more than 36 months. Therefore, in order to prove your correctness in paying alimony, keep all supporting documents - if the payment was made through the cash register, then you will have a receipt in your hands, if through the terminal, then you will receive a check, if through the online system, then you can issue a release with a breakdown of payments for a specific period.

- It is better to pay the amount indicated in the writ of execution at one time, rather than splitting it up.

- According to Article 109 of the Family Code, payment of alimony must occur no later than the third day after payment of wages. If the deadlines are violated, the payer is charged a penalty. Therefore, adhere to this rule and do not delay the deadlines, especially if you are sending money to the account of another bank, as it can take up to 5 days.

In the purpose of payment, the word “alimony” must be indicated, and not “financial assistance” or “payment for a specific period.” Since only alimony refers to the type of obligatory payments of the parent, the payment of which is controlled by bailiffs.

Another point that needs to be emphasized is when the payer is another person, for example, you are on a business trip and left the amount for alimony to your parents so that they make a transfer on the appointed date. So, if a payment is made through a bank cash desk or from another person’s card, then the payer’s name must be indicated as yours. Since the law does not allow alienation to third parties for alimony payments. And then it will be very difficult to prove your involvement in this money.

How to pay alimony through Sberbank

In accordance with the requirements of Russian legislation, alimony payments must be transferred within 3 days from the moment the payer receives earnings. The basis for the transfer of funds may be a writ of execution or a voluntary agreement (necessarily certified by a notary office).

How to pay child support

At the legislative level, there are no ways to make such payments intended for the maintenance of a minor child. Therefore, the payer has the opportunity to independently choose exactly how the transfer will be made:

- Mailing.

- Transfer in cash against receipt of receipt.

- Bank transfer.

According to statistics, it is the latter option that is the most popular, as it is the fastest and safest. It is when choosing this method that the alimony payer is left with a document or an extract with which you can prove the fact of the transfer of funds.

In most cases, funds are transferred through Sberbank, since this institution has established itself as a trusted bank where payments are not lost (or this happens quite rarely) with a developed transfer protection system.

It is for this reason that it is important to understand how to correctly pay alimony through Sberbank.

Alimony: what is it spent on and payment methods

Child support can be paid according to one of three executive documents, which indicate the amount and period of payment:

- Agreement on payment of alimony, mandatory certified by a notary office;

- A court decision to collect alimony;

- Performance list.

The received amount of money can be used to provide a child or other needy relative (pregnant wife, mother of a child under 3 years old, elderly parents, etc.) with everything necessary:

- Food;

- Medicines and medical services;

- Cloth;

- Trips to medical sanatoriums, etc.

You can pay child support in several ways:

- Pay personally in the hands of the recipient, taking from him a receipt for receipt of funds;

- Pay alimony through the cash register: At a bank branch;

- Cash desk of the accounting department of the payer's employer.

- Pay child support via postal order;

- Electronic payment systems;

Today we will talk in more detail about the last point and how to pay alimony online.

Advantages of transferring funds through Sberbank

There are several positive aspects due to which citizens most often transfer funds for the maintenance of their minor children through this banking organization.

- A significant number of bank branches and terminals are located within walking distance.

- The child's mother already has an open account with Sberbank (it is to this account that funds paid as child benefits are transferred).

- There is a convenient system with which you can make payments online.

- The money arrives on the recipient’s card within 24 hours.

- The user has the opportunity to set up an automatic payment, in which funds will be transferred to the creditor’s card automatically (if there is money on the payer’s card).

- Funds are transferred promptly (it is possible to make instant and regular payments).

Commission for transferring funds to the recipient's account

The distinctive convenience of using the services of this banking organization lies in the fact that the transfer fee is not deducted from the alimony payment itself, but is accrued in addition to the amount already paid by the payer. In general, the size of the commission directly depends on which payment method is chosen, the services of which bank the recipient uses, and the recipient’s place of permanent residence.

- If funds are transferred between clients of the same bank living in the same city, then no commission is charged.

- If both parties to the transaction are Sberbank cardholders living in different localities, then the commission amount is 1.5 percent when transferring through a bank branch. When using the Sberbank online service, the commission is slightly lower - 1 percent. The minimum commission fee is 30 rubles, the maximum is 1,000 rubles.

- If transfers are made in cash, then the banking organization has the right to take a percentage of the transaction only from the recipient of the funds. The commission fee in this case is 1.75. This percentage can be increased depending on the bank chosen by both parties and the localities where the parents live.

- For an instant transfer you will have to pay an additional commission of 1.5 percent, but a minimum of 150 rubles.

- If the alimony payer credits cash to the card within one locality, such an operation is performed free of charge. If the parties to the transaction live in different cities, you will have to pay a commission fee of 1.25 percent.

Alimony transfer commission

The amount of the fee charged or the lack thereof depends on the type of alimony transfer:

- cash payment – no more than 1.75%, which is influenced by the territorial factor;

- enrollment to a Maestro social card or between SB clients within the same city is free;

- in cash, on non-resident SB cards - 1.5%, through the Online service - 1% (within 30-1000 rubles);

- to a third-party bank card – 2% (both sides).

Bank fees are borne by the party paying the alimony.

Other payment methods through Sberbank

There are several more ways to credit funds to the alimony recipient’s account through Sberbank.

- Go to the cash desk of the nearest bank branch. This is the method most often used by people who do not want to deal with modern applications and personal accounts. In this case, this option is the most convenient, but only when both the alimony payer and the recipient are clients of Sberbank. To make a transfer, you must inform the bank employee about the card number, full name of the recipient of the funds, and the purpose of the payment. It is worth remembering that transfers, regardless of the destination, are made only if the sender has a passport. A distinctive feature of this bank is the ability to issue a kind of “autopayment”, even if the client does not use any Internet services. When registering for a regular transfer service, the cashier carries out the operation on behalf of the client, debiting funds from his account and sending them to the addressee. This option is popular among citizens who often go on business trips outside the Russian Federation.

- Using an ATM or terminal. When choosing this method, you need to insert a plastic bank card into the ATM, enter your PIN code, select the line “Payments and transfers”, then “Transfer of funds”. Next, you only need to enter the card number of the recipient of the funds, the purpose of the transfer, and the payment amount. After the operation, you must wait for the receipt to appear, which you should take with you as confirmation of the transfer.

Please note that Russian legislation is constantly changing and the information we write may become outdated. In order to resolve a question you have regarding Family Law, you can contact the site’s lawyers for a free consultation.

Auto payments and auto transfers

Autopayments are not available for all service providers. You can configure their automatic implementation mainly for the housing and communal services sector or cellular operators. In the menu in the automatic payments tab:

- select "Connect";

- enter the name of the service provider organization;

- fill in the fields and details;

- confirm via SMS.

When there is no longer a need for automatic payment, for example, a change of place of residence when paying for utilities, it can be completely removed or suspended for a certain time.

For some payments, you can select specific payment dates or periods. If there are funds in the account from which the payment is to be made, it will proceed automatically. A notification will be sent to your smartphone indicating that the payment has been successfully completed or that there are not enough funds in your account to process it.

Using the same scheme, you can set up automatic transfers in favor of other individuals. For example, regularly topping up a relative’s account or a child’s card. Both the sender and the recipient of the funds will receive notifications about the successful execution of the transaction. Auto translation settings are also confirmed by SMS.

Remote services allow users of Mobile Banking and Sberbank Online to free up time. If the templates are set up and they are automatically processed, it only takes a couple of minutes. Sberbank connects online services to its cardholders for free, and a number of services are provided with a minimum commission, so clients save not only time, but also money.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email