Home / Labor Law / Employment / Hiring

Back

Published: 07/25/2016

Reading time: 7 min

0

1050

A dismissed employee can return to his previous employer for the purpose of employment.

A new employment contract will be drawn up with him, and his personal file will undergo changes .

- Legislation

- Cases of re-employment

- Registration of documents Personnel number

- Card T-2

- Private bussiness

- Vacation

How to apply correctly?

If an employee quits and is rehired, the parties must enter into a new employment contract. The exception is situations if:

- the employee did not have time to officially resign and after the decision to return, the dismissal procedure was terminated - but in this case there is no need to talk about real dismissal;

- the employee moved from one position in the company to another, but even here it is not entirely correct to talk about dismissal; there is a transfer to a new position.

In all other cases, the employer does not know whether it is necessary to collect all the documents again and create a new personal employee card.

Collection of documents

When an old employee is hired, a HR specialist may decide that there is no need to request documents, since all the information is already available. But such a step would be wrong. Archived information may be out of date, but the employer must have current data. Therefore, when hiring an employee, you need to ask:

- passport;

- SNILS;

- military ID;

- TIN.

Documents are copied or scanned so that they can later be attached to the employee’s personal file.

Receiving subsidies

Many Russians today prefer to use tax deductions provided by the state. Most often we are talking about deductions for an apartment or children. Even if the employer has a complete package of documents from the previous time, he should not use them, since information about the employee may be out of date. If these changes did not occur at the time of work, responsibility for the use of false information will lie with the employer.

The situation is completely different if the employee does not provide up-to-date information during the period of work. Then he bears responsibility for incorrect calculations of contributions and other amounts.

Therefore, when applying for a job, the employer must require that all information be documented by the employee.

Internal documents of the organization

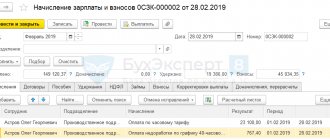

Hiring is always accompanied by assigning a personnel number to the employee. It is used in payroll and accounting documents as an identifier for a person. Therefore, getting a job necessarily involves establishing a personnel number.

It’s another matter if the employee already worked at the enterprise and had his own personnel number. In this case, the employer does the following:

- if an employee leaves less than 2 years ago, he may be assigned an old number;

- if an employee has been fired for more than 2 years, he is usually assigned a new number.

What explains this decision? Because the law does not recommend assigning the personnel number of a dismissed employee to another employee for 2 years.

Some employers do not consider it necessary to create a new personal T-2 card for an employee, explaining this by the fact that all data about him has already been collected in the old document. This option is unacceptable for several reasons:

- hiring a person is necessarily accompanied by filling out the T-2 form, and upon his dismissal, the document is handed over to the archives;

- the card has a column with information about the concluded employment contract, and since the person is hired again, a new employment contract is drawn up with him with a different date (the latter affects the features of calculating seniority);

- one of the last sections contains information about dismissal; when concluding a new contract, this column must be empty.

Unfortunately, the HR employee will have to draw up a new personal file. Such recommendations were given by the Board of Rosarkhiv. Therefore, simply using the old file will not work - you will have to enter the information again.

We choose, we are chosen

Life is a changeable thing.

It happens that even the most loyal employee decides to leave the company. The reasons can be very different: some are not satisfied with the remuneration system, others want to try their hand at a new market, others leave for higher positions, having failed to advance in their home company. Some cannot keep up with the pace of work, others are simply outbid by competitors. There are also personal stories: moving to another city, family circumstances, conflicts with superiors or colleagues. After working for a long time in one company, an employee accepts its values and gets used to the rhythm and internal code. It seems to him that other companies exist under similar laws and the working atmosphere will be the same.

Having tried himself in other places, he understands that everywhere has its own culture and its own laws, which do not always meet expectations. Then the employee decides to return. And the decision to hire him and the work of adaptation falls on the shoulders of the HR department.

Features of calculating insurance deductions

Receiving a child deduction is the most common subsidy measure used by employers. That is why a personnel specialist, when hiring an old employee, may have a question about whether it is necessary to re-issue the deduction and how exactly to do it correctly. There are three possible situations here:

- Let's say a person almost immediately returned to his previous place of work. Then he will receive a tax deduction from the month in which he resumed his duties. Moreover, for the period when he did not have a job, he will not be able to get a deduction. However, when accepting an application for a deduction, the employer must ask to indicate the lack of income for the required period. There should be no records of employment in the work book.

- If, after dismissal, a person managed to work in another place, then in order to provide a deduction for the entire period, it is necessary to provide the old and new employer with a certificate of income 2-NDFL to calculate the base. If you refuse, the employee loses the right to provide a deduction for the child.

- If an employee has not worked anywhere for a long time, then he should receive deductions for previous tax periods directly from the regional Federal Tax Service. In this case, the employer does not have to make payments and transfers. He can only accept an application for a deduction from the moment he is hired.

A similar algorithm applies to other deductions, for example, for an apartment and mortgage.

Possible reasons for termination of the contract

Dismissal on the first day often occurs on the initiative of the employee himself, if the person has come to the conclusion that he will not be able to work in the position given to him. If the parties managed to reach a mutual agreement, then there is no need to work out the required two weeks. But the employer has the right to terminate the employment contract on his own initiative, for example, in the following cases:

- when drawing up the contract, the employee provided forged documents and/or false information;

- the subordinate appeared on the territory of the enterprise in a state of alcohol or drug intoxication;

- the new employee did not begin direct duties on the first working day or was absent from work for more than four hours in a row without a valid reason;

- the employee has committed theft of the enterprise's property, its intentional damage or destruction;

- an employee engaged in educational activities committed an act contrary to moral standards.

If the new employee does not begin his immediate duties on the designated day, then the employer can simply cancel the contract. In such a situation, the document will be considered unconcluded.

When the employment relationship with a subordinate was terminated before a record of employment was made in his book , there is also no need to mark the cancellation. If the information was entered, then the entry is declared invalid in accordance with the established procedure with reference to the order to terminate the contract. For this reason, it is more advisable for an employer to record the employment of an employee after he has worked for the organization for 5 days.

How to calculate vacation pay correctly?

Art. 121 of the Labor Code of the Russian Federation states that an employer must provide its employees with leave if they have sufficient experience for this. And in part 1 of Art. 122 of the Labor Code of the Russian Federation states that all employees of the enterprise have the right to annual paid leave. To correctly decide the issue of granting leave, the employer must proceed from whether the employee was dismissed within the organization or not. There are 2 common situations possible.

In case of repeated admission

Sometimes employees, having quit, realize that they cannot find a more worthy position. In this regard, they decide to return to their old job. Such actions may be associated with other reasons. And then the employer has a question: how to correctly calculate vacation for such an employee?

It must be remembered that the beginning of the working year for an employee does not coincide with the calendar year. The countdown starts from the moment of employment. That is, after 1 year of work, full leave is granted. If an employee wants, he can go on vacation, but not immediately, but after six months.

Let’s say Voropaev has been working since July 1, 2014. He retired in 2021 (February 4). However, he returned to work almost immediately – on May 4th. However, he did not work in other organizations. When can he go on vacation? The countdown must be made from the moment of the last hire, that is, from May 4. Therefore, the employee will be able to go on vacation no earlier than November 4, 2021.

If in fact there was no dismissal

Sometimes an employee moves to work from one structural unit of the organization to another. In this case, a new employment contract is concluded. Therefore, the countdown of the working year begins anew. That is, if in fact there was no dismissal, then the employee will have to work in the new department for six months, and only then go on vacation.

Moreover, vacation at the previous place is not lost - upon termination of the employment contract, the employer must compensate for all vacation days not taken, so as not to violate labor laws.

Payment of compensation

The employee reinstated must receive financial compensation. Therefore, the management of the enterprise needs to prepare documents for making such payments as:

- salary for all missed working days;

- vacation compensation;

- payment of sick leave;

- dismissal benefits.

The employer should also be prepared to pay all legal costs, since they are paid by the losing party. In addition, do not forget that an employee may demand payment of moral compensation for illegal dismissal.

Even in the event of voluntary dismissal, an employee can count on reinstatement. How long it will take, as well as how simple the return process will be, depends on the reasons that prompted the employee to write an application to terminate the employment contract.

Benefits and insurance premiums

Any employer is responsible for the correct calculation and transfer of insurance premiums. Each employee has their own accrual base. It is determined by the cumulative total from the beginning of the calendar year, regardless of the moment of hiring. Insurance contributions are made monthly by the employer. Moreover, there are restrictions on their calculation:

- up to the limit established for the year - in the usual amount;

- if it is exceeded - at a reduced rate.

The level of limits increases every year, which is understandable, because other indicators are also increasing.

In such a situation, it is important for the employer to know how to calculate the base of insurance premiums for an employee who quit and got a job again. Breaking these amounts is not allowed, since we are talking about their calculation on an accrual basis. Moreover, the employee may have time to work in another place. And then these amounts must be added to the calculation base.

When hiring an old employee, an employer may need to calculate various benefits, namely:

- for temporary disability;

- on pregnancy and childbirth.

In the first case, everything is simple. When calculating the required amount, the employer must take into account the employee’s earnings for the previous 2 years. Moreover, it does not matter at all whether at that time he worked only at his enterprise, or worked somewhere else. All these amounts must be taken into account when calculating sick leave. The situation is exactly the same with maternity benefits - they are taken from the last 2 years.

Difficulties for the employer can arise only if the employee himself cannot provide a certificate from his previous place of work, but there is information about employment in the work book. Then the employer needs to ask to draw up the paper, and if the employee cannot do this, then a request is sent to the Pension Fund.