When children travel to various sports and exhibition performances, parents are faced with the need to take out life and health insurance to cover damage from accidents and provide high-quality and immediate assistance for varying degrees of injuries.

Despite the fact that personal insurance for children is voluntary, many sports organizations, associations and coaches insist on purchasing a policy. This condition guarantees the removal of financial obligations in the event of an insured event, since the organizers and mentors are directly responsible for the life and health of children during training and competitions.

Choosing an insurance company

To choose sports insurance, you need to decide on a company. It must be a reliable company with extensive experience in the insurance market. Before purchasing, review the terms and conditions of this company's insurance, pay attention to coverage, exclusions and limitations.

Minimum insurance coverage is 50,000 rubles. If the company offers less, then the policy will never “work.” The insurance amount from 300,000 rubles is optimal. In case of a fracture, you can receive from 10,000 rubles, and for a more serious injury - several tens of thousands of rubles.

Popular programs

Any insurance company offers various insurance solutions. Some of them separate sports insurance for competitions (when playing sports) into separate programs. Let's list them:

- “Children and Sports” (Alfa Insurance);

- “Junior” (VTB-Insurance);

- “For Children” (Sberbank-Insurance);

- “Personal protection” (Reso-Garantiya);

- “My child is sport” (ASKO-Insurance);

- “Ready” (Max);

- “Insurance for athletes” (Liberty-Insurance);

- “Insurance protection against accidents while playing sports” (My Helmet);

- “Insurance for athletes against accidents” (Ingosstrakh);

- "Fortune. Children” (Rosgosstrakh);

What additional options should you choose when insuring your child?

Once you have chosen an insurance company, you need to decide on additional options. There are policies with and without hospitalization. If you require medical intervention in a hospital, the company will compensate you for these costs.

You can also choose an insurance policy that works around the clock, and not just during training and competitions. After all, you can get injured just walking down the street. If you do not have such an additional option, the insurance company may refuse compensation.

Video: how to insure a young athlete and how much it will cost

Insurance for a child who is passionate about sports is not just a necessity. Medicine has become too expensive and in case of complex injuries it is difficult to regain health financially. Insurance covers the main expenses associated with treatment. Also, in case of disability, financial support will not be superfluous. After all, treatment can only be the beginning, and then a long period of recovery and rehabilitation will be required. We also recommend that you read our article which will tell you the cost of a voluntary health insurance policy.

Duration of insurance

You yourself determine how long the insurance coverage should be valid during sports activities: one day, a period or a whole year. We recommend one-day insurance coverage for children who take part in competitions. If you have seasonal sports, your child is going to camp or sports training, then choose a policy with a validity period. Parents whose children regularly exercise often buy annual sports insurance. It is very convenient and much cheaper per day.

Insurance can be purchased in advance. The earliest the policy can begin is tomorrow. At the latest - in 6 months. This is convenient when you plan your competitions in advance.

What does sports insurance cover?

There are three main risks that a sports insurance policy covers for a child:

- Death by accident

- 1st or 2nd degree disability

- Getting injured

When an insured event occurs, the payment depends on the severity of the injury and the insured amount. To calculate the amount of compensation from the insurance company, check the payment table. It will indicate the percentage of the insured amount for each injury. If you multiply this percentage by the sum insured, you will get the amount of your compensation from the insurance company.

For example, for a broken arm, depending on the company, you can receive up to 5% of the insured amount. If the coverage is 1,000,000 rubles, the payment will be 50,000 rubles.

Peculiarities

Insurance in sports differs significantly from that which applies to ordinary citizens. This is due to the specific nature of the activities of professional athletes and the increased risk to which they are exposed every day.

Standard insurance usually does not cover injuries related to training and sports.

With athletes, everything is different: it is the events and risks that arise during competitions, daily activities and travel that underlie the insurance applicable to them. When insuring ordinary citizens, their type of activity rarely affects insurance rates.

When protecting the life, health and other interests of athletes, the type of sport they practice is not the least important. Based on this, different insurance rates are applied.

They can be increased if the injury rate is at a serious level or differentiated if the sport does not imply an increased daily danger to the life and health of the athlete.

For example, badminton, table tennis players, shooters and curlers are insured at a differentiated rate.

Increased insurance rates apply to gymnasts, athletes, swimmers, football players, hockey players, volleyball players, figure skaters, etc.

The highest rates apply when insuring wrestlers.

Insurance for athletes is characterized by non-standard terms. If regular contracts are usually drawn up for a period of a year, then athletes can insure themselves for several weeks, days or even hours.

It is considered absolutely normal to insure the life and health of a team or national team for the period of a match, which can last several hours, and sometimes even less.

It is possible to carry out seasonal insurance, which is also typical and practiced by team sports federations.

For example, the relevance of beach volleyball takes place in Russia only during the summer. There is no need to insure against risks at competitions at other times of the year.

The insured amount depends on the professional level of the athlete (team) and sports category.

For example, insurance for children's teams is carried out within the framework of 30-50 thousand rubles (maximum for elite sports).

Professional athletes are insured for hundreds and millions of thousands of dollars. In the Russian Federation, this insurance area is at the stage of development.

How is the cost of insurance determined?

The cost of an insurance policy is affected by:

- Age of the insured child-athlete

- Danger of the sport

- Insurance period

- Sum insured

The younger the child, the more expensive the policy is for him. Martial arts are considered more dangerous than playing chess, checkers or Go. The longer your insurance policy lasts, the more expensive it is. However, there may be cases when a six-month policy may cost more than an annual policy.

Each of the parameters affecting the cost has its own coefficient, which is unique for each company. This is why some insurers offer cheaper policies, while others cost more.

"Ingosstrakh" - Accident Insurance Cost Calculator

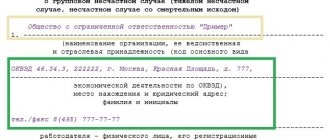

You can apply for an insurance policy by visiting the Ingosstrakh-Life office in person. For the busy population, it is possible to purchase the product on the official website. This is done as follows:

1. You must go to the official website of the company by following the link: lifeingos.ru . In the upper left part of the page, click on the phrase “Types of insurance” and go to the appropriate product.

2. In the window that opens, after the text describing the program, there will be an oval field with the phrase “Buy online”, which you need to click on with the mouse.

3. Next, indicate the number of people who need to be insured, their age, period of validity of the contract, region of residence, and the process continues by pressing the “Buy Policy” button.

4. At this stage, the full name of the policy buyer, date of birth, gender, passport data, registration address, contact information and full name, date of birth and gender of the insured are entered in the specially designated fields.

5. After clicking on the “Apply” button, the buyer pays for the cost of the policy with a bank card and receives its electronic version to the specified email.

Online purchasing is not available for all insurance products. Under the Edges of Health program, you can only submit an application through the website, indicating your name, email, phone number and a convenient time to call.

What documents are needed to receive insurance payments?

To receive payment you will need:

- Policyholder's passport

- Documents of the insured. In the case of a child, this is a birth certificate or passport

- Documents confirming receipt of medical care

- Application for compensation from an insurance company

- Other documents if required by the insurance company

Please note that the amount of payment is determined by the insurance company according to the insurance rules and payment schedule and may not match your actual treatment costs.

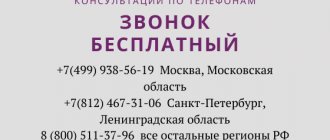

Apply for insurance online

Is it required by law?

In accordance with Chapter 48 of the Civil Code of the Russian Federation “Insurance”, in particular, Article 935, life and health insurance of a citizen (child under 18 years of age) cannot be carried out forcibly. In this case, the child is protected only by the compulsory medical insurance policy (VHI), according to which he is provided with the necessary medical care in case of illness or injury (not at sports competitions).

As of 2021, there are no separate laws regulating the compulsory nature of children's insurance during sporting events, competitions or performances in Russia.

Article 927 of the Civil Code of the Russian Federation indicates the possibility of state compulsory life and health insurance, including for children, at the expense of budgetary funds. In the practice of organizing sports games, budget funds are spent only on travel, accommodation, food and awards (Order of the Ministry of Sports of the Russian Federation dated March 30, 2015 N 283).

In general, if children are sent to sporting events from kindergartens, schools and colleges, insurance is issued at the request of the parents.

Considering the high traumatic nature of sports, it is advisable to have a policy in any case, at least covering minimal risks.

The situation is different if a child (under 18 years of age) plays sports professionally, concluding an employment contract with an employer. Article 348.2 of the Labor Code of the Russian Federation establishes the requirement for compulsory insurance of athletes (in addition to compulsory medical insurance or voluntary medical insurance).

On the territory of the Russian Federation, athletes receive a compulsory social insurance policy, the insurer of which is the FSS of the Russian Federation. The insurance also covers damage from accidents (Law “On compulsory social insurance against accidents at work and occupational diseases” N 125 -FZ).

When organizing competitions in another country, children are also provided with travel insurance that covers the costs of first aid and treatment in medical institutions.

Legal aspects of medical care for children involved in physical education and sports are also set out in the Law “On Physical Culture and Sports in the Russian Federation” N 329-FZ