Raising children and providing them financially until adulthood is the main responsibility of parents. Any issues related to family relationships in our country are resolved on the basis of the Family Code. It determines the persons in whose favor alimony is withheld and their amount is calculated.

Article 81 of the Family Code explains how to calculate child support depending on the income of the second parent (or other person from whom it is withheld) and the number of children.

What determines the amount of child support for one child?

The government does not set a fixed amount that the child support provider must pay to his children every month. The amount of payments is influenced by a number of reasons and factors. However, a person who is planning to file a lawsuit or has received a writ of execution can figure out how child support is calculated and the approximate amount to expect.

The amount that children remaining after divorce will receive monthly depends on the following factors:

- Is the decision to pay voluntary? If the divorce is more or less amicable and both parents understand their responsibility in raising children, they can independently agree on how much the other parent should pay. In this case, the amount may not depend on the income of the former spouse. However, it should not be less than the minimum wage adopted in the region of residence of the child.

- If alimony is assigned after filing an application with the court, then a variety of factors will be taken into account: the level of income of the parent, the immediate needs of the child. If he has health problems, the amount of payments will be larger. If the parent himself is a non-working disabled person, you can only count on minimal deductions from his benefit.

The calculation of alimony and its calculation will be made on the basis of the Federal Law “On Enforcement Proceedings” and under Article 113 of the Family Code. In order to start making payments from the salary, you need a statement from the parent himself, if this is his voluntary decision, an agreement sealed by a notary. If alimony is paid by court, then a court decision and a writ of execution issued on its basis, and a court order will be required.

Challenging paternity of a child born out of wedlock

According to the Investigative Committee of Russia, in relation to children born in a civil marriage, there are three scenarios for the development of events:

- voluntary acceptance of paternity and entering the man’s name on the birth certificate;

- forced establishment of kinship as part of legal proceedings;

- a woman’s refusal to register her real father in order to receive additional preferences from the state.

Important! If a man knows in advance that the child is not his own and still gives his consent to include him as a father, then he is subsequently deprived of the opportunity to challenge paternity. This rule is regulated by Article 52 of the RF IC.

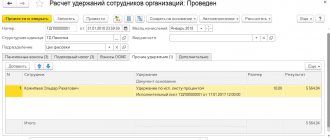

Calculation example

Ivanov P.I., by court decision, pays an amount equal to 2 subsistence minimums established for the city of Moscow.

In 2021, when the court made this decision, its figure was 13,300 rubles. Consequently, Ivanov P.I. paid 26,600 rubles.

In 2021, the indicators have increased, and the minimum is now 13938. To calculate the indexation level, you need 26,600: 13,300 * 13,938 = 27,664.

There is another way to calculate indexation. We determine the ratio of the new minimum indicator to the old one and multiply by the amount of established payments:

- 13 938 : 13300 = 1,04

- 1.04 * 26600 = 27664 rub.

Either way, the amount will be the same.

Let's take a closer look at examples of how alimony is calculated in different situations.

Example of calculation for one child

Let's look at an example of how child support is calculated for one child. The general procedure looks like this:

- The employee is paid his salary for the period worked (month) in accordance with his position and employment contract.

- A tax of 13% is withheld from the salary.

- The calculation of alimony under a writ of execution or a notarial agreement is made from the remaining amount.

- The funds received are transferred to the specified account.

An employee of one of the enterprises has a salary of 45,000 rubles per month under an employment contract. It is necessary to calculate the deductions for his child who has not reached the age of majority. According to the writ of execution, their amount should be 25% of income. In addition, the employee is entitled to a tax deduction of 1,400 rubles.

- To calculate the amount on which tax will be withheld, you need to subtract the amount of tax deduction from your salary: 45,000 – 1,400 = 43,600 rubles.

- We calculate the tax: 43,600 * 13% = 5,668 rubles.

- We determine the amount of net income: 43,600 – 5668 = 39,332 rubles.

- Alimony will be calculated from this amount. Their size is equal to a quarter of income. This means 39,332 * 25% = 9883 rubles. - the amount that must be transferred to support the child.

- The employee’s salary will ultimately be: 39,332 – 9883 = 29,449 rubles.

For two children

Deductions in favor of two children are calculated in the same way. However, in this case, a tax deduction is provided for everyone, that is, 1,400 * 2 = 2,800 rubles are subtracted from the salary before calculating personal income tax. And the percentage of alimony is 33% of income.

- 45,000 – 2800 = 42,200 rub.

- 42,200 * 13% = 5,486 rubles. – Personal income tax

- 45,000 – 5486 = 39,514 rubles.

- 39,514 * 33% = 13,039 rubles. – child support for two children

As a result, the employee will receive “clean”, without deductions and taxes - 38,211 rubles.

For three children

If an employee has three or more children, then he is obliged to transfer half of his income to their maintenance. The tax deduction is 1,400 rubles for two children and 300 rubles for a third child. That is, 5,800 rubles are deducted from the salary before taxation:

- 45,000 – 5800 = 39,200 rub. – taxable part.

- Personal income tax from it will be 5096 rubles.

- 45,000 – 5096 = 39,904 rubles. is the employee's income. Child support will be calculated from this amount:

- 39,904 : 2 = 19,952 – these are the funds that will be transferred to the children.

And the same amount is due to the employee.

Calculation for less than a month

If the writ of execution contains the date from which alimony is calculated, and it does not coincide with the calendar beginning of the month, then payments will be calculated from the day indicated in the document. Let's say it's April 20th.

There are 21 working days in April. Funds are credited within 9 working days.

- We calculate the employee’s income for this period, if his monthly salary is 40 thousand rubles: 40000: 21 * 9 = 17142.85

- Next, we calculate personal income tax: 17142.85 * 13% = 2228.57

- The salary for the billing period will be: 17,142.85 – 2228.57 = 14,914.28

- Payments for the child will be calculated from this:

14,914.28 * 25% = 3728.57 rub.

Accordingly, at the end of the month, the employee’s salary, after transferring the tax, will be reduced by this amount.

Article 81 of the RF IC. The amount of alimony collected from minor children in court

A generalization of judicial practice showed that the courts generally correctly determined the amount of alimony in proportion to the earnings and (or) other income of the parents, subject to recovery from parents for minor children.

When resolving such claims, the courts proceeded from the provisions of paragraph 1 of Article 81 of the RF IC, according to which, in the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents monthly in the amount of: for one child - one quarter, for two children - one third, for three or more children - half the earnings and (or) other income of the parents.

In cases where the applicants asked to recover alimony for a minor child in an amount exceeding that established by paragraph 1 of Article 81 of the RF IC, the courts took into account the provisions of paragraph 2 of Article 81 of the RF IC that the amount of shares provided for in paragraph 1 of this norm may be reduced or increased by the court taking into account the financial or marital status of the parties and other noteworthy circumstances. In the absence of evidence of the existence of such circumstances, the courts made decisions to collect alimony in the amount of the corresponding share of earnings established by law (clause 1 of Article 81 of the RF IC).

Thus, the magistrate of the Central District of Kaliningrad, when considering the case on the claim of S. for the collection of alimony for his minor daughter, made the correct decision to collect alimony in accordance with paragraph 1 of Article 81 of the RF IC - in the amount of one-fourth of earnings and (or) other income defendant monthly, refusing to satisfy the claim for the recovery of alimony in the amount of 1/3 of all types of earnings of the defendant, since when considering the case, the plaintiff did not refer either to her financial or marital status, or to any other noteworthy circumstances giving grounds for collection of alimony for one child in an amount exceeding that established by law (clause 1 of Article 81 of the RF IC), and did not provide relevant evidence to the court.

At the same time, in a number of cases, the courts, without sufficient grounds, deviated from the size of shares established by paragraph 1 of Article 81 of the RF IC.

For example, by decision of the magistrate of the city of Nalchik, Kabardino-Balkarian Republic, alimony for two children was collected from the defendant in the amount of 1/5 of all types of earnings. The court motivated its decision by the high (more than 45,000 rubles) earnings of the defendant, his obligation to repay the loan received, as well as the plaintiff’s obligation to support children.

The appeal ruling of the Nalchik City Court of the Kabardino-Balkarian Republic changed the decision of the magistrate, and alimony in the amount of 1/3 of all types of earnings was collected from the defendant. When making a decision, the appellate court correctly came to the conclusion that the defendant’s earnings exceeded 45,000 rubles. per month, and credit obligations, as well as the equal responsibility of parents to support children cannot serve as sufficient grounds for changing the amount of alimony provided for in paragraph 1 of Article 81 of the RF IC. The financial and marital status of the defendant allows him to pay alimony in the amount of 1/3 of all types of his earnings, and the collection of alimony in the specified amount will ensure that the children maintain their previous level of financial security.

In another case, a magistrate of the Volgograd region issued a court order to collect from K. in favor of N. alimony for a minor daughter in the amount of 1/2 of all types of income. Meanwhile, as the Volgograd Regional Court indicated in a certificate based on materials summarizing judicial practice in cases of collection of alimony for children, it follows from N.’s statement that N. and the debtor have the only common minor child, any other alimony obligations in relation to minors The debtor has no children. The validity of issuing a court order by a magistrate to collect from K. alimony for one child in the amount of 1/2 of his earnings, and not in the amount of 1/4 of his earnings, as defined in paragraph 1 of Article 81 of the RF IC, is not confirmed by evidence.

In one of the cases, the magistrate satisfied the claims for the collection of alimony for two minor children and recovered from the defendant alimony for one child in the amount of 1/3 of all types of earnings, as well as in the amount of 1/3 of all types of earnings for another child, with subsequent indexation in proportion to the increase in the established subsistence level until children reach adulthood. Meanwhile, when making such a decision, the judge did not take into account that, in accordance with paragraph 1 of Article 81 of the RF IC, alimony in the amount of one third of the parent’s earnings and (or) other income is subject to recovery not for each child, but for two minor children. In addition, family law (Article 117 of the RF IC) indexes the amount of alimony in proportion to the increase in the cost of living only for cases where alimony is collected in a fixed sum of money, and not as a share of earnings.

The courts revealed violations of paragraph 3 of Article 83 of the RF IC, according to which, if each of the parents has children left with them, the amount of alimony from one of the parents in favor of the other, less wealthy one, is determined in a fixed sum of money, collected monthly and determined by the court in accordance with paragraph 2 of this article.

For example, by the decision of the Obluchensky District Court of the Jewish Autonomous Region, the decision of the magistrate regarding the recovery of alimony from the defendant in proportion to earnings was changed, the amount of alimony was set in a fixed sum of money. The appellate court indicated that the court of first instance correctly determined the legally significant circumstances in the case and came to a reasonable conclusion that alimony should be collected from the defendant in favor of the plaintiff G. for one minor child living together with G., and not for two children , as requested by the plaintiff. Meanwhile, having established that the other child remained to live with the defendant, the court of first instance did not apply the provisions of paragraph 3 of Article 83 of the RF IC. By virtue of the direct indication of this norm, in this case, alimony in favor of G. was subject to recovery in a fixed sum of money, and not as a share of earnings.

In one of the cases, the court, without sufficient grounds, applied the provisions of paragraph two of paragraph 2 of Article 60 of the RF IC on the right of the court, at the request of a parent obligated to pay alimony, to decide to transfer no more than fifty percent of the amounts of alimony payable to accounts opened on name of minor children in banks.

Thus, according to a certificate from the Primorsky Regional Court based on materials from a summary of judicial practice, by decision of the magistrate, B. was awarded alimony for two sons in the amount of 1/3 of his earnings and (or) other income monthly. The defendant, citing the fact that his salary is about 140,000 rubles. and the amount of alimony for each child will exceed 10,000 rubles, he submitted a petition to transfer 50% of the alimony amounts to the children’s personal accounts opened in a branch of the Savings Bank of the Russian Federation. The magistrate, despite the plaintiff’s objections, granted this petition, but did not motivate the decision in this part.

Meanwhile, the receipt of high earnings by the person obligated to pay alimony cannot serve as an unconditional basis for satisfying his request to transfer 50% of the alimony amount to an account opened in the child’s name in a bank. According to the legal position of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation, set out in the Review of Judicial Practice of the Supreme Court of the Russian Federation for the first quarter of 2012 (approved by the Presidium of the Supreme Court of the Russian Federation on June 20, 2012), the court’s decision to transfer no more than 50% amounts of alimony to be paid to accounts opened in the name of minors in banks, it is possible, in particular, in the event of improper fulfillment by the parent receiving alimony of the obligation to spend the appropriate payments on the maintenance, upbringing and education of the child and maintaining the court decision in this way the level of material support for the child sufficient for his full development (nutrition, education, upbringing, etc.). This legal position was not taken into account by the magistrate.

A summary of judicial practice has shown that if, when considering a case on the collection of alimony for a minor child, it was established that the defendant pays alimony on the basis of a court order or court decision for other minor children and in favor of another claimant, the amount of alimony to be collected for this child in most cases was determined by the court based on the statutory amount of alimony for all the defendant’s children (that is, taking into account the children for whom he pays alimony on the basis of a court order or court decision, and the child for whom alimony is being collected).

For example, when considering T.’s claim to B. for the recovery of alimony for a minor child in the amount of 1/4 of earnings and (or) other income, the magistrate of the Leninsky district of Vladivostok, having established that the defendant has alimony obligations to another claimant in terms of maintenance a minor child, collected from the defendant alimony in the amount of 1/6 of all types of monthly earnings.

In another case, the magistrate of the Berezovsky district of the Krasnoyarsk Territory, when considering P.’s claim against B. for the recovery of child support, also proceeded from the fact that P.’s demands for the recovery of alimony in the amount of 1/4 of the defendant’s earnings and (or) other income are not subject to satisfaction, since B., on the basis of a court decision, pays alimony in favor of another claimant for the maintenance of three children in the amount of 1/2 of all types of earnings. Taking into account this circumstance, the principle of equal provision for children and the equal amount of alimony for the maintenance of each child, the magistrate ordered alimony in the amount of 1/8 of all types of earnings of the defendant.

When considering K.’s application for the collection of alimony for a minor child, the magistrate of the Leninsky district of Vladivostok took into account that the defendant, on the basis of court decisions, pays alimony in favor of the same claimant for his son in the amount of 1/6 of his earnings and for his daughter in the amount of 1/6 part of the earnings, and also pays alimony in favor of another claimant for his daughter in the amount of 1/6 of the earnings, and collected alimony for the fourth child in the amount of 1/8 of all types of earnings and (or) other income of the defendant.

At the same time, in the course of summarizing judicial practice, cases were identified where the courts unreasonably determined the amount of alimony for the maintenance of a minor child without taking into account the fact that the parent from whom alimony is to be collected has other obligations to pay alimony on the basis of a court order or court decision.

For example, by the decision of the Krasnokamensky City Court of the Trans-Baikal Territory on the claim of the education management committee of the administration of the municipal district "City of Krasnokamensk and Krasnokamensky District" against L. for the deprivation of his parental rights and the collection of alimony from L., alimony was collected for his minor daughter in the amount of 1/4 of his earnings and (or) other income. The court of appeal changed the decision regarding the amount of alimony collected, the amount of alimony was reduced to 1/6 of the earnings and (or) other income of the defendant, since the court of first instance did not take into account the fact of collecting alimony from the defendant on the basis of a court order in favor of M. for his second daughter.

When considering the case of collecting alimony from P. for his minor daughter, the magistrate of the city of Kislovodsk, Stavropol Territory, concluded that the defendant did not provide evidence of his payment of alimony for the child from his first marriage. By decision of the magistrate, alimony in the amount of 1/4 of all types of earnings was collected from the defendant. At the same time, as the court of appeal found, the case contains a copy of the writ of execution and a certificate of the defendant’s salary, issued by the military unit, according to which he pays alimony for the child from his first marriage, but the court did not evaluate this evidence. Taking this into account, the appellate court concluded that the magistrate's decision was unfounded. The defendant's appeal was upheld, the court's decision was changed: the amount of alimony was reduced to 1/6 of all types of earnings and other income of the defendant.

We believe that the practice of those courts that established the amount of alimony taking into account alimony collected from the debtor on the basis of a court decision (court order) for other minor children is correct.

1. Collection of alimony in proportion to the earnings and (or) other income of the parents (Article 81 of the RF IC). “Review of judicial practice in cases related to the collection of alimony for minor children, as well as for disabled adult children” approved. By the Presidium of the Supreme Court of the Russian Federation on May 13, 2015.

Responsibility for non-payment of alimony

Sometimes, after a divorce, one of the parents, not wanting to pay money for the maintenance of the children, begins to evade this responsibility in any way: does not report his whereabouts, works unofficially, or receives a salary equal to the minimum wage.

In this case, according to the law, there are two types of liability: civil and criminal. He bears civil liability for failure to comply with a notarial agreement or writ of execution.

For each day of non-payment, penalties are charged. The defendant must repay the resulting debt along with the amount due withholdings. The amount of the fine for non-payment of alimony is established on the basis of the Family Code.

In some cases, it is possible to contact bailiffs. They can block the alimony provider’s accounts or withdraw the required amount from them.

For malicious evasion of one's duties, the payment of fines or forced correctional labor, and even imprisonment are provided. The term of arrest and the amount of fines are determined by the court on the basis of the Criminal Code. Being punished does not exempt you from paying alimony, that is, a negligent parent, once released, is obliged to continue paying money to his children.

Grounds for collecting alimony

The adoptive parent takes responsibility for the upbringing, development and maintenance of the child. If he subsequently evades fulfilling his duties, then this is a reason to go to court to collect alimony.

Cases where a court decision may order payments in favor of an adopted child include:

- Cancellation of adoption without returning children to their original family.

- Divorce of adoptive parents and evasion of voluntary assistance for the former family.

Procedure for withholding alimony

Deductions are made by the employer's accounting department if the parent paying child support has an official salary. They are calculated from all types of earnings and from almost all benefits. The only exception may be the benefit that an employee receives in connection with the birth of a child.

The law also limits the amount of deductions. According to Article 138 of the Labor Code, they cannot account for more than half of the employee’s income. However, in some cases their size may be higher.

Example

An employee of the enterprise received 2 writs of execution. According to one, he must pay funds in favor of 3 children from his first marriage. The amount of deductions should be 50%.

According to the second, he must transfer 8 thousand rubles for the maintenance of his second wife.

The citizen’s income after paying 13% was 30,000 rubles.

The children should be deducted 15,000 rubles from him. And 8 thousand - for the second wife. The total amount of deductions should be 23 thousand, which significantly exceeds the 50% required by law. In cases where money is withheld in favor of minors, it is allowed to deduct up to 70% of income, which equals 21 thousand rubles. This amount will be divided proportionally between the two spouses:

- 21,000 * 15,000: 23,000 = 13,695.65 rubles. - will be received by the first wife of a citizen.

- 21,000 * 8000: 23,000 = 6,720 rubles. – alimony for the second wife.

- The remaining funds are 23,000 - 21,000 = 2,000 rubles - a debt that will be gradually paid.

If an employee also has deductions from wages based on writs of execution or fines, then first of all, alimony is always calculated and withheld.

Attention! If a citizen pays funds for the maintenance of children from different marriages, then all transfers are made simultaneously.

What to do if the legal spouse is not sure about the relationship with the child

If there is an official marriage, the so-called presumption of paternity applies, according to which the mother’s current spouse is automatically entered as the father on the birth certificate. However, if the latter is not completely sure of his relationship with the child, he has the right to challenge his own paternity.

Important! According to paragraph 3 of Article 47 of the Civil Code of the Russian Federation, the cancellation of entries in the civil registration books is carried out exclusively on the basis of a corresponding court decision.

A man who doubts his wife’s fidelity must file a statement of claim with the following requirements to the authority to challenge paternity:

- Cancel paternity and remove the applicant's name from the father column in the baby's document. The legal act confirming the legality of this requirement is Article 51 of the RF IC.

- Indicate in the child's birth documents information about the delegation of paternity to the new husband of the former spouse or another citizen who has expressed a desire to adopt a minor.

How to calculate child support from a non-working parent

If, after a divorce, a wife files a lawsuit for alimony, then a writ of execution is sent to her husband’s place of work. Then the deduction of alimony from his wages is carried out by the accounting department of the enterprise where he works.

But if the father does not work, this does not relieve him of responsibility to the children. In case of official recognition as unemployed, funds will be deducted from unemployment benefits.

If the parent is an entrepreneur, then in this case, in order to calculate the amount, you need to know the specifics of taxation in the region of residence. If he submits an income tax return at the end of the year, payments are made based on this information.

If a simplified taxation system is in effect, then a scheme is used that determines the average salary in the region and from this the amount of payments per child is calculated.

Internet portals dedicated to legal topics contain online calculators that easily allow you to calculate the approximate amount of money owed for one child or several children.

Alimony for an adopted child

Adoption is the process of recognizing a child as a son or daughter and its legal registration.

There are several different cases of adoption into a family. Intended parents (parent) can adopt:

- child of the spouse from another marriage;

- orphan;

- a minor left without care.

At the moment of recognizing oneself as a parent, a person is endowed with the full range of parental rights and responsibilities and consents to their implementation, including material support.

Is it possible to return child support if the child is not mine?

A quite obvious solution for a man who learns that he is not related to a child is to return the funds transferred as alimony. When paternity is annulled, a man has the opportunity to demand in court:

- complete cancellation of alimony obligations;

- refund of funds for the past three years of alimony payments.

In order to obtain the right to a refund, a man, according to Article 116 of the RF IC, must collect evidence showing that the mother deliberately hid information about paternity in order to obtain financial gain.

Important! Even after receiving a genetic examination conclusion that there is no relationship with the child, the man does not have the right to stop alimony payments. The need to transfer obligations to a minor can be canceled solely by decision of a judicial authority.

I paid child support, but the child turned out to be not mine: how to challenge paternity

If a man is sure that the child is not his own, then he has the right to challenge paternity in court. However, before making a statement, the victim must provide convincing evidence. As the latter, according to Article 86 of the Code of Civil Procedure of the Russian Federation, the following have the right to act:

- the conclusion of a genetic examination indicating the absence of relationship between the plaintiff and the child;

- letters, recordings of telephone conversations, messages from social networks, photographs and other materials containing evidence from the mother that the child is not the plaintiff’s relative;

- documents proving that the parties have not lived together for a long time, which means the plaintiff is physically unable to be a father;

- testimony telling about the presence of another man in a woman’s life.