Innovations for 2021

Now the certificate is received for the first baby born, or adopted from January 1, 2021. The amount of the certificate has increased and amounts to 466,600 rubles. At the birth of a second child in the family, 150 thousand rubles are added. In general, for two children it turns out to be 616,600 rubles.

There are several options for improving housing:

- Purchasing an apartment, room, house

- Using subsidy funds for a down payment when applying for a mortgage loan, repaying debt on an existing mortgage

- Construction of a house subject to the following conditions:

- if the housing in Russia is in a residential condition.

- if the certificate is completely spent

Interesting fact: you should buy real estate in the region where you live. No need to consider other regions. Because it is difficult to understand whether living conditions have really improved and by how much.

In 2021, opportunities to spend maternal capital will become wider. The funds can be used as a down payment on a rural mortgage. Banks often refused loans to borrowers, citing the fact that the use of maternal capital was not provided for by the rules of the rural mortgage program. Now it will be easier for people to get a loan for the purchase or construction of housing.

Starting from 2021, maternity capital funds can also be used to pay off military mortgages. Russian President Vladimir Putin signed the corresponding document at the end of 2021.

What changes in the use of maternity capital occurred in 2021?

In addition to the fact that the above-mentioned legislative document extended the validity of the state maternity capital program, two new options for disposing of the certificate were added.

The innovations were:

- The opportunity to receive payments from maternity capital monthly in cash for children born after January 1, 2021, for low-income families . Money will be issued in the amount of the subsistence level established in the region of residence. Payments will be provided until the child reaches one and a half years old;

- The ability to use a certificate, without waiting for the child’s third birthday, to pay for kindergarten services . It is allowed to take funds for this need from the very birth of the child.

Opportunity to receive payments from maternity capital on a monthly basis in cash for children born after the first of January [y]year, for low-income families

What payments can be cashed out?

Until two thousand and eighteen, it was possible to obtain money for use using maternity capital only through non-cash payments.

One-time payments from the amount of maternity capital were gradually introduced, which certain categories of families can receive.

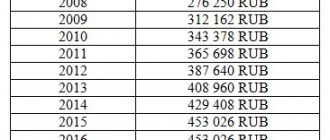

These benefits were provided for a limited time and are listed in the table below.

| Year | Amount of one-time payment from MSC funds |

| 2009 and 2010 | 12,000 rubles |

| 2015 | 20,000 rubles |

| 2016 | 25,000 rubles |

At the end of two thousand and seventeen, another legislative document was approved:

Federal Law No. 418-FZ “On monthly payments to families with children.”

According to this bill, only needy families who can document their status can receive monthly payments from maternity capital.

These manuals have the following features:

- The family income must be less than one and a half subsistence minimums for able-bodied citizens established in the region of residence;

- The amount of the benefit is the minimum subsistence level per child established in the region of residence;

- Benefits are provided only for the second child, who was born from January 1, two thousand and eighteen , until they reach one and a half years of age.

In addition to this payment for up to 1.5 years, parents can simultaneously receive child care benefits for up to one and a half years, as well as other types of financial support.

It is not clear why payments are provided in a minimum amount and only up to one and a half years, if maternity capital is provided in the amount of 453,026 rubles, which would be enough for payments until the child reaches three years of age or even more.

How can I use it to pay for kindergarten?

In addition to regular payments for families in need, current legislation now provides the opportunity to use certificate funds to pay for preschool education services immediately after the baby is born.

This helps to fully provide a program to support motherhood and childhood, which includes eliminating queues at nurseries for children from two months to three years.

According to official statistics, throughout Russia there is a shortage of more than three hundred twenty-six thousand places in nurseries.

For the next two years, the State Government plans to create a sufficient number of places.

According to assumptions, this target need will be in great demand and will help speed up the mother’s exit from maternity leave, with a return to full-time performance of official duties or education.

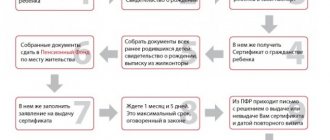

How to obtain a certificate?

In 2021, the deadlines for issuing a certificate have changed - you can now manage funds faster. The certificate is issued within five working days (previously - 15 days). Applications for disposal of maternal capital funds will be considered within ten days (previously - 30 days).

The changes that were made to the program in 2021 will continue to apply in 2021. Now the certificate is issued without an application: the necessary information is supplied to the Pension Fund automatically from the civil registry office. Notification of the issuance of a certificate will be sent to your personal account on the public services portal

The Ministry of Labor is also currently working to simplify the use of capital in the construction of a house. If previously it was necessary to provide a certificate of work done to the Pension Fund, then soon an extract from Rosreestr on the ownership of the house will be sufficient.

The legislative framework

At the initial stage of approval of the state program, in 2007, the validity period was determined until December 31, 2016. However, in the last month of December, a new final deadline was set - 12/31/2018.

And already on January 1, two thousand and eighteen, a bill came into force approving the extension of maternity capital until December 31, 2021.

The changes were defined in the following legal document:

Federal Law No. 256-FZ of December 29, 2006 “On additional measures of state support for families with children”

Photo of Law No. 256-FZ of December 29, 2006

In addition, this bill will determine two additional targeted needs for which maternity capital can be spent. The state program will operate in its standard mode until the established date; its further fate will be determined later.

However, even if the program ends in 2021, the state will fully pay all funds for those families who receive certificates before that date.

Can the certificate be cashed?

Beware of scammers! Maternity capital cannot be exchanged for money. But you can arrange a payment from the certificate funds. You receive it monthly, but only if you meet certain income conditions.

If you are offered any way to exchange a certificate for cash, do not agree! These are scammers. Many families have already trusted such “people” and are left with nothing. It’s difficult to immediately understand that there is a dishonest person in front of you. It is almost impossible to return a certificate that has fallen into the hands of fraudsters.

Although there used to be some kind of deception scheme, when people themselves wanted to receive money instead of capital. The family deliberately chose dilapidated housing and negotiated a deal with the seller. The money came to his account and part of it went to the deal, and part of it went back into the hands of the family. As a result, people lose support and are left homeless and without a certificate. They are also found guilty. Therefore, now the acquired real estate is first tested for suitability and only then is it allowed to complete the transaction.

Family capital, if the eldest child is an adult

As the main condition for obtaining MK Art. 3 of Federal Law No. 256 determined the appearance of a second child in the family after the start of the program, that is, after 01/01/2007. There are no age restrictions, qualifications for parents or other criteria limiting a family’s right to receive state support.

The right to maternal capital can be exercised even if the eldest child has not only reached the age of majority, but has also become a parent himself.

The age difference between the children does not matter, nor does the fact that one child is natural and the second is adopted.

Moreover, the mother can declare her right to maternity capital even if the child, whose birth gave rise to the right to maternity capital, is 18 years old (for example, in the case of the adoption of an adult child or coming of age in the future). The main thing is that at this moment the MK program is in effect, and the certificate has not been redeemed earlier.

Similarly, the 18th birthday of the first-born child does not create obstacles to managing money under the certificate. Maternal capital is issued not for a specific child, but for the family as a whole, so the interests of the first-born must also be taken into account.

For example, according to paragraph 3 of Art. 11 Federal Law No. 256, until the child is 25 years old, this money can be used to pay for his education expenses.

If the parents decide to spend MK on buying a home, he, as a family member, must receive his share in it, no matter how old he is - this is the requirement of clause 4 of Art. 10 of the law.

How to use certificate facilities?

You can use the subsidy to resolve the real estate issue when the child turns three years old. But there are exceptions when a family needs to repay the principal debt or make a down payment on a loan. Then you are allowed to spend the funds immediately after the birth of the child.

Funds from the certificate are transferred to a bank account in the case of a mortgage or to the seller’s account. You can use financial support only after you sign a loan agreement or a purchase and sale agreement.

If the purchase of an apartment did not involve maternity capital, then at the legislative level each family member is required to be allocated shares in the existing housing. Subsequently, the housing can be sold. The consent of the guardianship authorities will be an important point.

An integral condition when raising funds from maternity capital in a real estate transaction is the allocation of shares to minors. If an apartment is purchased with a mortgage, then the shares are registered after full payment of the debt or receipt of ownership of the apartment.

Funds from the certificate can be used to pay off a mortgage or for a down payment. But banks like the down payment to be paid from the borrower’s personal funds. Banks are also concerned about some issues. If a certificate is required to obtain a mortgage, but people cannot make payments on the loan, the bank will have difficulty selling the apartment that is pledged to repay the principal debt. Any actions with such a property, even auctions, are considered as an inappropriate use of capital. Each of the children must have housing (or a share), or an amount of money equal to the share in the collateral property. Therefore, it is easier for banks to resolve such difficult situations without selling mortgaged property and going to court with borrowers.

Money from government support is not always enough for a down payment. Yes, this happens too. It seems that 600,000 rubles is quite enough for a down payment. But good housing for a large family now costs about several million, and most banks ask for an initial deposit of 10-15% of the cost of housing. In such a situation, the subsidy is simply not enough. What should the family do in this case? There are a couple of options left: raise money yourself and add it to the certificate funds, or find a bank where it is permissible to use a certificate for a down payment. If it turns out that the family has saved up money and added it to buy a home, then one of the parents also has the right to a tax deduction. It is registered at the tax office or at your job.

In general, most banks do not want to deal with a down payment from capital because they do not want to wait for the money to arrive in their account. In addition, using a subsidy for a down payment reduces confidence in the client as a borrower. Some banks, on the contrary, reduce the interest rate, attracting people's attention.

Until what year will maternity capital be valid?

As of today, the validity period of the state maternity capital program is set until December thirty-first, 2021.

For 2021, the amount of the benefit provided was indexed and increased from 250,000 to 453,026 rubles.

However, the next recalculation of financial assistance will be carried out only in 2021.

The program period is not extended annually, but indexation is made every year, which increases the size of the payment or leaves it at the same level. It all depends on the economic situation in the country and the size of the country’s planned budget.

When determining until what year maternity capital will be valid, it is necessary to consider three different possible options for the duration of validity:

- For the period of accrual of payments under the maternity capital certificate . This means that the certificate will be valid until the money is fully spent. In fact, the certificate does not expire. As an example, maternity capital can be invested in the formation of a pension when the mother retires at the age of fifty-five, or later;

- For the period of application for a certificate, not limited to specific dates by law . This means that you can apply for financial assistance from the state at any convenient time, after the corresponding right arises;

- The right to receive a family certificate arising at the birth of the second or each subsequent child . The duration of the state program may vary, depending on the Federal laws approved by the Government of the state.

President of the Russian Federation V.V. Putin, who initiated the maternity capital program ten years ago, has repeatedly noted the following reasons why such a state program is being extended:

- The state budget must cope with payments for all families who become eligible to receive a certificate. Also, the difficult economic situation in the country is taken into account, which makes budget planning a little more complicated;

- The state maternity capital program should be extended into future years, in one form or another. The government can make its own changes, tightening the targeted purpose of payments, as well as introducing the principle of targeted assistance.

The state government is constantly reviewing options for extending the program for future years, and is also expanding the range of needs on which money from the state budget can be spent.

How to sell an apartment purchased with capital?

Selling an apartment purchased with funds using a maternity capital certificate is considered difficult on the market. And that's why. Our state protects childhood, including the child’s right to “his own corner” when allocating a share. This was discussed above. When a child who has not reached the age of majority has his own part of the living space, he becomes a full member of the transaction under the purchase and sale agreement. If the owner does not fulfill promises to receive maternal funds and does not allocate a share to the child, this is a serious violation of the criteria and leads to a judicial review of all further actions with the property.

Children who will be able to claim a share in the living space when they reach adulthood, as well as the prosecutor’s office and guardianship authorities have every chance to file a claim with the tribunal. As a result, the client of the living space (new owner) has the opportunity to lose belongings based on a court decision, and the living space will be returned to the previous owner and distributed in the form of shared ownership. The sale of such an apartment is first approved by the guardianship authorities. Then an application is written in the presence of special persons, who subsequently certify the documents. Minor children are not left without a share equal to that which was allocated in the apartment. Or are not deprived of an amount equal to this share. Living conditions should not be worse. A good prospect would be if you sell your first apartment and immediately buy another. Selling an apartment that is still in debt is more difficult than selling the entire debt for the apartment.

So, if maternity capital is used, then living space is purchased both on the secondary market and in a new building. When making such transactions, there are certain nuances that affect the successful outcome of the case.

When selling an apartment or house, the seller makes sure that the buyer is solvent. To do this, in addition to a certificate for the disposal of money, a person purchasing a home also needs a certificate from the Pension Fund. This certificate proves that the potential buyer has the right to specific capital. To avoid cases of fraud, the owner of the property requires from the future owner a certificate for the use of maternity capital and additionally confirming paper about the current status.

Will maternity capital of one and a half million be accepted for the third child in 2021?

A new bill No. 571638-6 was submitted to the State Duma, which envisaged the extension of the state maternity capital program for another ten years, with changes to the procedure for obtaining and disposing of the certificate.

The rules established in that legislative document specified the following:

- The social group of citizens who could receive maternity capital was changing - it was assumed that only families with three or more children born (adopted) between January 1, 2021 and December 31, 2026 would be able to receive financial support from the state;

- The amount of the accrued benefit was supposed to be increased three times - from 450,026 rubles to 1,500,000 rubles;

- Changing target needs - maternity capital could be spent exclusively on improving housing conditions (purchase of an apartment, house, construction of an individual residential building, reconstruction of an existing residential building) for families in need.

After consideration of this bill by the State Duma in April two thousand and fifteen, it was rejected due to the high cost of implementing this program.

According to preliminary calculations, almost twice as much money should have been allocated from the state budget.

The reasons for the refusal were the following arguments put forward:

- Too unequal rights for families who gave birth to a third child after the first of January two thousand seventeen, and before that date;

- The inability to index the payment every year, which will lead to inequality among families who have already received funds. The closer we get to 2026, the more money will depreciate, creating an unequal playing field.

Since the bill implied significant changes in regulatory documents, it was decided not to amend it as an amendment, but to put forward it as a separate law.

However, a large amount of outrage over the repeal of the law was caused after the rejection of the legislative draft. This is due to the fact that many families with two or more children are in dire need of significant government support to enable them to acquire their own housing.

But due to the possibility of abuse of maternity capital and a number of other nuances that are difficult to understand with the current legislation, the regulatory document remained unapproved.

When can you use MK?

In general cases, it is not allowed to use maternal capital immediately after the birth of the second child. According to paragraph 6 of Art. 7 of the law, this can be done no earlier than 3 years after the second child is born. But since a family may urgently need money, the legislator has provided a number of exceptions, allowing funds to be spent immediately after childbirth/adoption on:

- down payment on a mortgage, payment of a loan and other forms of housing lending;

- socialization of children with disabilities;

- payment for kindergarten, including private, and other educational expenses for preschoolers;

- receiving benefits, the amount of which depends on the size of the monthly minimum in the region of residence.

The certificate itself can be obtained immediately, but you can use it, unless this is an exceptional case, only after 3 years. The deadline is not limited by law, the certificate is valid until demanded.

Amount of payment for the second child

Due to significant changes in the family capital program, the amount of payments upon the birth of a second child in 2021 will be increased by 150 thousand rubles in addition to the base one.

Let us remind you: since 2007, the increase in payments under the certificate has been annual, which has made it possible to significantly increase the basic amount of maternity capital from 250 thousand to 453,026 rubles. It was paid in the same amount regardless of the order of birth of the child who gave the right to MK.

According to Art. 12 of 12/19/2016, the indexation of the amount of payment for maternity capital is frozen until 01/01/20, and this year it will be resumed again and the base amount will be 466,617 rubles. And taking into account the increase by 150 thousand rubles for the second child, the total amount will be 616,617 rubles.

The appearance of a second child may open up other forms of assistance, for example, regional maternity capital, if such rules for issuing it work in the region.

A striking example is the Moscow region, where, according to Art. 20.2 dated January 12, 2006, a regional certificate is issued after the birth of the second child.

Of course, its size cannot be compared with what they give at the state level, and is only 100 thousand rubles. But received simultaneously with the state MK, it will significantly expand the family’s opportunities for managing funds. Moreover, if you use both certificates for one purpose, for example, to purchase a home.