Home » Inheritance » The procedure for registering an inheritance with a notary after death according to the law: step-by-step instructions

50

Registration of an inherited apartment is carried out in two stages: acceptance of rights to real estate and registration of ownership. The implementation of each of them is strictly regulated by the legislation of the Russian Federation: the Civil Code and the Federal Law “On State Registration of Real Estate” dated July 13, 2015. All that remains is to figure out how all this happens in practice and what exactly is required of the heir when registering the inherited living space.

Where to start registering an inheritance

The first thing you need to do after opening an inheritance case is to find out the reasons for receiving it:

- If the testator managed to draw up a will, then this document will be decisive in determining the heirs and the share of property due to them.

- In the absence of orders of the deceased person certified by a notary, his relatives become his legal successors in the order established by Chapter 63 of the Civil Code of the Russian Federation.

In the first case, the main task of the heir is to find the act of posthumous dispositions of the deceased. And it becomes noticeably more complicated if the testator did not inform his successors about the location of the document. In such a situation, they will have to go looking for him on their own.

It is recommended to start by examining the personal belongings of the deceased. Perhaps you will be able to find a will among them. But, if this does not happen, you should not despair, because the testator has only one copy of the act in storage. The other remains with the notary who certified it.

All active notaries in the country have the authority to certify wills, regardless of the degree of their distance from the place of residence of the testator.

Even if the successor does not know which notary the deed was drawn up, he can come to any of them and request the information of interest. This opportunity became available thanks to the introduction of the Unified Notary Information System, which stores data on all executed wills and inheritance cases. The heir will be able to receive them after presenting the death certificate of the testator, an identity card and, if available, a certificate of kinship or marriage.

In response to a request, an authorized person can provide information about the availability and storage location of the document. Its contents will be disclosed by the notary who participated in its preparation only at the request of an interested person - a relative of the deceased or a citizen who is directly affected by the last orders of the testator.

If the act of the last expression of will was not executed or gross violations of the law were committed during its execution, the inheritance will occur in the mode of legal priority. It is easy to find out about the right to inheritance here - just determine the current line of succession and find out the category of persons included in it. They are the legal heirs.

To confirm the status, heirs by law require documentary evidence. Without them, the right to receive the property of the deceased is very difficult to establish, and in most cases it is completely impossible.

This point should be paid attention to “common-law” spouses, officially unrecognized children and parents deprived of parental rights. From the point of view of inheritance legislation, they are not included in the circle of successors. While adopted children and adoptive parents are called upon to inherit on an equal basis with natural and officially recognized children and parents.

Which notary should I contact regarding inheritance?

Before registering property, you must accept the rights to it. To do this, the heir must contact a notary operating in the territory where the last place of residence of the testator was registered and write an application to take ownership of the property.

There are cases when the registered place of residence of the now deceased cannot be determined or it is located outside the Russian Federation. Then the opening of an inheritance case is carried out near the real estate assets of the testator. If they are dispersed over a large area, then the location of objects with the greatest material value is selected. And in the absence of real estate, the localization of movable property is taken into account.

After receiving a certificate of inheritance issued by a notary, the heir must appear at the registration chamber to register the received object as his property. The territorial location of the state registration authority does not matter.

You can also submit documents for real estate registration through a multifunctional office, located in a place convenient for the applicant.

Is it possible to register an inheritance without a notary?

When registering an inheritance, you cannot do without the services of a notary. But in populated areas and inter-settlement areas where they are absent, officials of local administrations are authorized to carry out the necessary actions.

Therefore, if the testator lived and was registered in a given territory before his death, his heirs should find out who exactly in the local government or administration is responsible for the procedure (the official or head of education must have the appropriate license and access to the Unified Notary Information System).

Is it possible to register an inheritance with any notary?

The criterion for choosing a notary when entering into an inheritance is strict. By law, this can only be a specialist working at the place of residence of the testator.

If it is difficult to travel to him, the applicant has the right to accept the inheritance remotely:

- Have your signature on the application for inheritance rights certified by the nearest notary.

- Send the application and attached documents by mail to the place where the inheritance was opened.

- Pay the state fee.

- Submit a request to forward the certificate of inheritance.

All documents should be sent by certified mail to minimize the risk of them being lost or not received by the addressee.

Lawyer's answers to frequently asked questions

What value of real estate is used to calculate state duty: market or cadastral?

The cost can be cadastral or market. The heir has the right to independently determine from what value the state duty will be calculated, but it must be confirmed with a certificate (Letter of the Department of Tax and Customs Policy of the Ministry of Finance of Russia dated April 4, 2021 N 03-05-06-03/19714). As a rule, the cadastral value is lower than the market value, and it is more profitable to use it for calculation.

Who gets benefits when applying to a notary to enter into an inheritance?

Benefits are provided on the basis of Art. 333.38 of the Tax Code of the Russian Federation when applying to notaries for certificates for the following categories of citizens:

- For disabled people of groups I and II – 50% of the fee.

- Individuals who live together with the testator in the inherited real estate at the time of his death, and continue to live there after, are completely exempt.

- Minors or incapacitated heirs. Parents or guardians act on their behalf; no fee is paid.

- Heirs of those insured against accidents at work, if a certificate of inheritance of insurance amounts is issued.

To take advantage of the benefits, you will need documents confirming your right to them.

I live in one region, the inherited apartment is in another. Can I submit documents for inheritance through the MFC?

No. The application can be sent by Russian Post or submitted to a notary at the place where the inheritance case is opened through a legal representative.

How to find out if a person left a will?

Contact a notary. If the will was executed before July 1, 2014, he will receive information from the notary chamber. Information about wills drawn up after the specified date is stored in the Unified Information System and is issued to the notary upon request quite quickly.

Is it possible to obtain a certificate of inheritance at the MFC?

No. The certificate is issued only by a notary.

Documents for registration of inheritance after death

One of the most important points when registering inherited property is collecting the necessary documentation.

Accepting an inheritance from a notary requires collecting the following package of documents:

- the applicant's identity card;

- death certificate of the testator;

- extract from the House Register;

- certificate of registration of the testator’s last place of residence;

- a power of attorney when accepting an inheritance through a voluntary representative or a decision of the guardianship and trusteeship authority through one appointed by law;

- refusal of inheritance by priority heirs or evidence of their death (if such a fact occurred).

Before submitting documents, you should carefully examine each of them and make sure that there are certifying seals and signatures, dates, full names of the indicated individuals, names of legal entities without abbreviations, and addresses.

Arbitrage practice

When it is necessary to defend an inheritance in court, they turn to the court at the location of the property. In this case, a statement of claim is filed and the state fee is paid. The receipt is attached to the complaint along with copies of the evidentiary documentation. In practice, witnesses who claim that the heir took care of the things included in the inheritance and provided proper care for them help prove the case.

A notary is not needed in court. The property is re-registered based on the decision made, which is final. But if a lawyer is involved, then a power of attorney is drawn up. This document requires notarization. But the applicant does not personally participate in court hearings, debates, or collection of documentation. This method of solving problems in court is optimal, despite the fact that the services are paid. It’s much worse to lose everything just because you didn’t go to the notary on time.

How to properly register an inheritance under a will

When inheriting under a will, there are several important points to consider:

- Only a document that complies with the established rules and regulations has legal force (Article 1124 of the Civil Code).

- The testator may appoint any individuals and legal entities as legal successors, even if this deprives the rights of the heirs by law.

- When the transferred property is represented by one object or real right, regardless of the orders of the testator, part of it will belong to minor children, disabled relatives and a spouse (in case of acquiring property during marriage).

- A citizen has the right to make as many wills as he sees fit, with each subsequent one canceling the previous one. Therefore, having a document in hand, you need to make sure that it reflects the last will of the testator.

- When transferring property, the testator may oblige the heir to execute a testamentary refusal in favor of the specified person (legatee). This may be expressed in the right of the legatee to live in an apartment or use other specified property for a certain period of time or for life, while a change in the owner of the object does not cancel this order.

- Another condition for entering into an inheritance may be the execution of a testamentary assignment - a service to perform a generally beneficial matter. The testator has the right to assign this obligation, like a testamentary refusal, to his successors at the expense of the inherited property (i.e., all material expenses incurred by the executor of the testamentary assignment must be fully compensated by the property received).

- The testator has the right to appoint a person responsible for the execution of his posthumous orders. His powers include transferring to the heirs the property due to them and monitoring compliance with the testamentary refusal or assignment.

Procedure

To register inherited property inherited under a will, the heir must follow the following procedure:

- Find the will.

- Prepare the necessary documents.

- Choose a notary.

- Write an application for inheritance.

- Submit the collected package of papers to the notary, and upon his request, deliver the missing ones.

- Pay the state fee (if you receive a certificate of inheritance).

- Obtain a certificate of right to inherited property (optional).

Registration procedure

Key points in the preparatory stages of registering the property of the deceased (searching for a will, choosing a notary and collecting documentation) were highlighted above. The procedure for accepting an inheritance is as follows:

The heir, with a package of up-to-date certificates, acts and certificates, contacts the notary * to submit an application for acceptance of the property due. The application can be written either at an appointment with a notary, or independently (with the help of a lawyer). Its purpose should be to accept the inheritance and/or issue a certificate of title to it.

The applicant has the right to submit an application with documents not only during a personal visit to a notary, but also through an intermediary (by proxy) or by mail with a signature certified by another notary.

The authorized person checks the received acts, ensures the validity of the will and, if necessary, compiles a list of missing ones.

The applicant receives details for paying the state fee (if it is planned to issue a certificate of inheritance) and provides a receipt to the notary.

This is where, as a rule, the responsibilities of the heir end. The property of the deceased is considered acquired after the notary accepts the relevant application and documents. If the successor wishes to receive a certificate of title and declared this simultaneously with entering into inheritance, he will receive the document within six months from the date of death of the testator.

In some cases, the process of accepting inherited property may be delayed due to the absence of heirs for valid reasons. In this case, the objective impossibility of the successor (personally or with the help of a representative) to declare his rights on time may become valid. Examples of such situations:

- the heir does not have access to any method of submitting an application - there is not a single notary in his access area to certify the application or power of attorney, and/or a post office to send the document;

- the successor is temporarily unable to take action to accept property due to illness or injury;

- the heir indicated in the will has not yet been born (relevant for those conceived during the life of the testator);

- To register an inheritance, one of the applicants appointed by the testator requires a lengthy preparation of the necessary documentation.

A deferment in any of the above situations is assigned only if the notary is notified of the obstacles to succession and that, despite them, the heir still intends to assume his rights. Otherwise, his interests may be ignored, which can later lead to the cancellation of issued certificates of the right to inheritance, the return of the received property and the restoration of the right of succession of a previously unrecorded heir.

Additional documents

The basic package of documents must necessarily be accompanied by a will, as well as other legal acts that the notary may require. Among them:

- technical passport of the object (living space, building, vehicle);

- boundary plan of the land plot;

- an act recording the transfer of inherited property to its previous owner (testator) - a privatization agreement, sale and purchase agreement, gift agreement, etc.;

- an extract from the Unified State Register of Real Estate and/or the Unified State Register of Legal Entities (depending on the type of inherited property right);

- certificate of no encumbrance on the property;

- a report from an independent expert organization or a certificate of the cadastral value of the property.

Actual acceptance of inheritance

Already mentioned more than once, basic in relation to the issue under consideration, Art. 1153 of the Civil Code of the Russian Federation, names 4 grounds so that one can talk about the actual acceptance of an inheritance.

If we consider each of them separately, then we can ask the question, what, in fact, actions are hidden under each of these foundations?

The Civil Code of the Russian Federation does not disclose specific actions that the heir must perform in order to be considered as having actually accepted the inheritance, however, they have been developed by judicial practice.

Let's look at each of them in more detail:

- Entry into management and ownership.

This basis refers to a wide range of actions of the heir, including:

- living in a house/apartment that is an inheritance;

- use of items that make up the interior decoration of the house;

- use of utility rooms of the property (garages, basements, cellars);

- cultivation of land.

- Taking measures to protect property.

These are actions that are, in one way or another, related to restricting access to property by third parties:

- installation of locking devices;

- installation of an alarm system;

- physical fencing of the facility from access by outsiders.

- Payments to creditors.

Considering that not only property, but also the debts of the deceased are inherited, future heirs will still have to pay for them. And if one of the heirs has already begun to make mutual settlements with creditors, then this indicates that this heir actually accepts the inheritance.

Specific actions include:

- repayment of loans (including interest on them);

- payment of debts and penalties for mandatory payments (taxes);

- payment of debts to third parties (who confirmed the existence of debt by agreement or other documentation).

- Other expenses for the maintenance of inherited property.

This refers to any current costs that arise from the fact of owning property:

- property repairs or improvements;

- payment of housing and utility expenses.

This list is not exhaustive. In each specific situation, depending on the type of inherited property, it will be possible to identify other actions of the heir, which can be regarded as actual acceptance of the inheritance.

What it is?

In fact, you can only enter into an inheritance in full, and then we’ll look at why. We list the signs under which a person actually accepts property:

- the recipient not only lives in private property on a permanent basis, but also pays bills and carries out repairs;

- the successor has fully repaid all debt obligations of the testator;

- the recipient accepted funds to pay off the debts of the deceased;

- the citizen protected the property of the testator.

With this method of inheritance, if a citizen accepts a share of the property, he automatically enters into inheritance. And also by entering into inheritance in full, because partial acceptance of property is not provided for in this option.

How to apply?

The main feature of actual inheritance is the limitation of certain rights. Property cannot:

- sell;

- give;

- dispose of possession.

Because of this, the right to property will have to be established through legal proceedings, that is, through the court. The issue must be resolved, even if there is the presence/absence of other legal successors. This is due to the fact that in the absence of other claimants to the inheritance, the state will be vested with such ownership rights.

The applicant will need to prove the fact of acceptance of the inheritance. The recipient of the property will have to provide irrefutable evidence that confirms the facts of the protection and use of the property.

If the successor lives in the deceased's property, pays bills, carries out repairs and carried out these same actions previously, he will be recognized as the actual owner, even if his registration in the living space is missing.

There is no need to visit a notary. You just need to file a statement of claim demanding recognition of ownership through legal proceedings. Then registration of property rights to the object will require only a corresponding court decision.

Deadlines

Is it possible and how to enter into an inheritance without a notary was described above. Now it remains to figure out what the deadlines are for the actual acceptance of property.

Actual inheritance has one positive feature - it is not subject to the usual statute of limitations. The deadlines will begin to be calculated only from the moment the assignee learns of the violation of his rights.

If another person has issued state registration for real estate, this will also not be the moment when the applicant for actual inheritance learns of a violation of his right. The exception is that the registration coincided with the requirements for eviction.

Therefore, it is possible to establish the property right to property through the court, upon actual acceptance of the inheritance, at any time. However, the recipient must declare his claims no later than 3 years after he learned about the registration of the deceased’s property by another heir.

Deadlines for registration of inheritance

According to Art. 1114 of the Civil Code, the opening of an inheritance case cannot occur during the life of the testator. But you shouldn’t hesitate to contact a notary, since the law has limited the time frame for registering property to 6 months. In this case, for the first-priority heirs, the report is kept from the date of death of the testator, and for subsequent heirs - from the day the rights to the inheritance are acquired (refusal of previous applicants).

If, after six months, the main successors do not apply for entry into the inheritance or do not actually transfer ownership of the property, then the heirs following them can declare their rights within three months.

How to prove the fact of acceptance of an inheritance

If the six-month deadline for contacting a notary was missed, but the property was actually accepted by the heir, in order to be able to dispose of this property, you need to obtain a court decision confirming the actual acceptance. A sample claim to court for actual inheritance can be found here.

The trial is conducted according to the general rules of procedural legislation and begins with the heir filing a claim in court to recognize the right to the accepted inheritance.

In order to confirm this circumstance, the court must verify the legality of such treatment - the heir will have to prove that he actually accepted the inheritance. If he cannot prove this, then the court will not issue a positive decision and the issue of disposing of the inherited property will hang in the air.

As evidence, the heir may submit the following documents:

- receipts for payment of housing or utility services paid on your own behalf;

- documents confirming the heir’s registration in the residential premises;

- contracts, receipts or checks that confirm that the property has undergone repair or restoration work at the expense of the heir;

- receipts of the testator's creditors with whom the heir has paid off;

- any other documents that directly or indirectly confirm the grounds referred to in Art. 1153 of the Civil Code of the Russian Federation.

The heir in court may also resort to the testimony of persons who will confirm the legality of his rights to property. The actual ownership of real estate, especially if it is related to repairs, is difficult to hide - the testimony of neighbors can be a serious argument.

The court may ask why the heir did not apply to the notary to obtain a certificate of inheritance. If it turns out that the heir was unable to carry out these actions for good reasons, then this will be taken into account by the court as confirmation of the respectable behavior of such an heir.

The following reasons may be considered valid:

- disease;

- the need to care for sick relatives;

- being on a business trip;

- other reasons that the court may accept as valid.

In turn, such circumstances as ignorance of the laws, reluctance to see one of the heirs due to personal hostility, lack of time due to the fact that “there was a lot of work” will not be regarded by the court as respectful.

Sometimes items previously owned by the deceased may be provided as evidence.

However, this is not such significant evidence as to be decisive - these things could have been received in another way, for example, as a gift from the testator during his lifetime.

In addition, the very fact that these things belong to the testator also requires independent confirmation.

If, as a result of the trial, the court issues a negative decision, the heir can appeal it to a higher court.

In order to avoid another mistake, the best option would be to contact a lawyer for advice, who will not only help with the appeal, but will also assist in preparing a high-quality evidence base.

And an even more correct option is not to bring the matter to court, but to try to resolve the inheritance issue within the regulatory period for accepting an inheritance, having worked out all the issues with a notary.

What to do if the deadline for entering into inheritance is missed?

The law also provides for exceptions to the rules. They relate to the possibility of reinstating the missed period for accepting property in the presence of truly insurmountable obstacles or with the permission of all relatives who entered into the inheritance.

The latter method is considered preferable, since in order to restore inheritance rights in this case, only the written consent of the successors and the corresponding actions of the notary are required. But, if at least one heir is against it, the interested party will have to go to court.

In the district court, a late application for inheritance rights may be considered justified due to the presence of good reasons. This will need to be proven to the plaintiff during the trial. The following evidence may help him:

- sending on a business trip to a territory or facility remote from communication channels and/or existing notaries;

- certificate from a medical institution;

- witness statements;

- tickets, receipts, photos, videos, etc.

To restore the term, it is important to prove not only the validity of the reasons, but also their inevitability throughout the entire period allotted for inheritance.

If successful, the notary, based on a court decision, will cancel the issued certificates of right to inheritance property and include the plaintiff in the list of legal successors.

Inheritance by law

Under what conditions does legal inheritance occur?

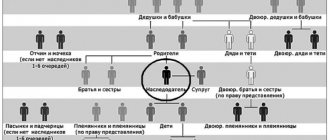

Inheritance by law occurs in the absence of a will, the impossibility of its execution, or the presence of part of the property not included in the will. How does legal inheritance occur? The legislation of the Russian Federation determines the order of succession. The heirs of each subsequent line inherit if there are no heirs of the previous lines or they cannot inherit for some reason.

- First priority heirs: children, spouse and parents of the testator.

- Heirs of the second stage: brothers and sisters, grandparents;

- Third line of heirs: uncles and aunts of the testator;

- Fourth priority: great-grandparents of the testator;

- Fifth line: cousins and granddaughters, great-aunts and grandfathers;

- Sixth line: cousins, great-grandchildren, cousins, nieces and nephews, cousins, uncles and aunts;

- The seventh stage includes: stepsons, stepdaughters, stepfather and stepmother of the testator;

- In the absence of other heirs by law, the disabled dependents of the testator inherit independently as heirs of the eighth order.

Who are the unworthy heirs? Unworthy heirs are citizens who, by their deliberate illegal actions directed against the testator, any of his heirs or against the implementation of the last will of the testator, expressed in the will, contributed or tried to promote the calling of themselves or other persons to inherit, or contributed or attempted to promote an increase in the share of the inheritance due to them or other persons, if these circumstances are confirmed in court. Unworthy heirs do not inherit either by law or by will. Parents do not inherit by law after children in respect of whom the parents were deprived of parental rights in court and were not restored to these rights by the day the inheritance was opened.

However, citizens to whom the testator bequeathed property after they lost the right to inherit have the right to inherit this property.

At the request of an interested person, the court excludes from inheritance according to the law citizens who have maliciously evaded the fulfillment of their obligations under the law to support the testator.

Moreover, a person who does not have the right to inherit or is excluded from inheritance on the basis of Article 1117 of the Civil Code of the Russian Federation (unworthy heir) is obliged to return, in accordance with the rules of Chapter 60 of the Civil Code of the Russian Federation, all property that he unjustifiably received from the inheritance.

These rules also apply to heirs who have the right to an obligatory share in the inheritance.

What is inheritance by right of representation? Who can inherit by right of representation? The right of representation in an inheritance applies only to inheritance by law. According to the right of representation, in the event of the death of an heir by law, this right passes to his heirs (for example, in the event of the death of the testator's brother, this right passes to his children, i.e., the testator's nephews). It should be noted that in this case we are talking about the death of the heir, which occurred before the death of the testator.

If the heir died after the death of the testator and after the opening of the inheritance, the right of inheritance transmission arises. Unlike the right of representation, the right of inheritance transmission applies to both inheritance by law and inheritance by will.

Heirs by right of representation also have queues of representation in the inheritance:

- the children of the testator are represented by the grandchildren of the testator and their direct descendants in a descending line (great-grandchildren, etc.);

- the testator's full brothers and sisters (also half-brothers) are represented by the testator's nephews and nieces;

- siblings of the testator's parents are represented as cousins of the testator.

What to do if there are no heirs? What is escheat property? If there are no heirs, both by law and by will, or cannot enter into inheritance for any reason, the property of the deceased is considered escheat and passes to the state.

What to do after receiving an inheritance certificate

The main purpose of a certificate of inheritance is to confirm the powers of the heir regarding the received property. And first of all, this is necessary for its state registration.

This procedure is necessary to formally secure the ownership rights of the new owner of the inheritance object. Information about it is entered into the unified state register of real estate, legal entities or a specialized department of the State Road Safety Inspectorate. After this, the fact of transfer of property can be certified by a corresponding extract at the request of the successor.

Each competent state registration authority requests from the applicant a certain list of documents, but what remains unchanged when registering ownership of an inherited object is the certificate of title obtained for it.

Rosreestr (Federal Service for State Registration, Cadastre and Cartography) or the State Center when registering ownership of real estate requests the following documents:

- certificate of inheritance;

- acts reflecting all transactions carried out with property;

- certificate of privatization;

- title documents;

- technical plan.

Registration of living space, building, land plot, property complex of an enterprise as a property takes 7 working days from the date of submission of documents and verification by authorized specialists. This applies to Companies House. Processing a case accepted into “My Documents” takes a little longer – 9 business days.

Registration of a share in a limited liability company is carried out at the Tax Service. Data about the co-owner of the authorized capital of the organization is entered into the Unified State Register of Legal Entities after presenting the necessary documents:

- applicant's passport;

- extracts from the charter of the limited liability company;

- written and certified consent to register the remaining members of the LLC.

Registration of changes made is carried out within five working days, and the application itself and documents are submitted no later than three days after receiving the consent of the Limited Liability Company.

Ownership of a vehicle is recorded in the Interdistrict Registration and Examination Department of the State Road Traffic Safety Inspectorate. The application and documents must be submitted within ten days (calculated from the date of receipt of the certificate of inheritance). After its expiration, the car must already undergo re-registration.

MREO will require the following documents from the applicant:

- vehicle diagnostic card;

- compulsory motor third party liability insurance policy issued in the name of the new owner;

- technical certificate.

Insufficient knowledge of the procedure for registering an inheritance, or an inaccurate interpretation of the law or will can lead to gross errors that threaten the heir’s share due. A well-written application and a suitable list of documents to be submitted are also important - if the rules and regulations established for this are not followed, misunderstandings may arise and the time frame for receiving an inheritance, which is critical for most cases, may be significantly delayed.

The lawyers of our website ros-nasledstvo.ru will help you avoid this by providing a free consultation and assistance throughout the entire process of registering an inheritance.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

2 ratings, average: 4.50 out of 5)

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

24

Entering into an inheritance through the court or how to file a claim for recognition of the right to inheritance

The standard order of inheritance is a simple, strictly regulated procedure where...

2

How to restore a death certificate

A death certificate is one of the first documents required by a notary...

8

Tax on inheritance from close relatives in 2021

In Art. 217 of the Tax Code, material benefits received as a result...

10

Mandatory spousal share in inheritance

The spouse is the primary legal successor and, under certain conditions, the legal owner...

30

Opening an inheritance case

Opening an inheritance case is the first and mandatory stage of accepting property...

3

Is inheritance considered joint property?

In modern realities, an inheritance received is the main opportunity for a valuable acquisition...