What happens to the mortgage during a divorce?

The fate of the mortgaged apartment depends on when it was purchased:

- Before marriage.

- During marriage.

When dividing property, spouses should take into account the provisions of Chapter. 7 RF IC, ch. 16 of the Civil Code of the Russian Federation and Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 5, 1998 N 15 “On the application by courts...”.

Let's look at everything in detail.

Mortgage issued before marriage

Everything is very simple here. According to Art. 36 of the RF IC, property acquired by one of the spouses before marriage is considered his property. The second spouse cannot apply for housing: it will remain with the one who repaid the loan.

If the mortgage was taken out before marriage but paid off after marriage, the situation is different. In Art. 34 of the RF IC states that all income is included in common property, even if the husband or wife did not work. The mortgage is repaid at the expense of the family’s funds, therefore, upon division, it is possible to recover half of the amount paid after the marriage was registered, even if the second spouse was not a co-borrower.

Example. Before marriage, the man took out a mortgage on an apartment for RUR 5,000,000. together with interest, paid 2,000,000 rubles. A few years after marriage, the loan was repaid (RUB 3,000,000). Upon division, the wife will be able to recover half - 1,500,000 rubles. or demand that an equal share be allocated to her.

Mortgage taken out during marriage

If a mortgaged apartment was purchased after marriage, then it will be divided equally (Article 39 of the RF IC).

There are several options here:

- The mortgage was repaid at the time of division. Spouses can sell the apartment and divide the money in half, or allocate equal shares and not sell. Another option is to register housing as the property of one spouse with payment of compensation for the share of the second.

- The mortgage has not been paid off. When dividing, a bank is involved as a third party. Until the debt is closed, his housing is pledged, and transactions are prohibited without the consent of the creditor (Article 37 of the Federal Law of July 16, 1998 No. 102-FZ “On Mortgage”). The court may divide the remaining debt in half and allocate equal shares to each. Either leave the debt and housing to one of the spouses, and the second will receive monetary compensation for his share, or he will not have to repay the loan.

It is best to sell an apartment, even with a mortgage. The price for it will be lower than for housing without encumbrances, but you won’t have to go to court. In order for the bank to remove the encumbrance, a purchase and sale agreement is concluded with the buyer, under which he makes a deposit equal to the balance of the debt. This money must be transferred to repay the loan. The restrictions are lifted within 7-10 days, after which the transaction can be registered with Rosreestr.

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

Example. A man and a woman got married in 2014, a year later they took out a mortgage on an apartment for RUB 4,000,000. Then they decided to get a divorce, the balance of the debt together with interest was equal to 1,000,000 rubles. By mutual agreement, the parties put the property up for sale for RUB 3,000,000. When a buyer was found, 1,000,000 rubles were deposited into the mortgage account. for full repayment and removal of encumbrances. Another 2,000,000 rub. The sellers took it in their hands and divided it equally among themselves.

Note: with a high degree of probability, the court will refuse to divide the outstanding mortgage, since the interests of the bank are affected here. The plaintiff can close it himself, and then recover part of the payments from the defendant.

If a marriage contract has been drawn up

People who have a marriage contract need to be guided by its provisions:

- If the document says that debts and property remain with one of the spouses, and the second receives compensation, this is what needs to be done.

- If the agreement contains conditions according to which the mortgage and real estate are divided equally, you should contact the lender and re-register all documents and ownership.

If there is a prenuptial agreement, there is no need to enter into a separate separation agreement. If the parties want to divide housing and debt, everything can be resolved peacefully through the bank. If the lender agrees to this, the mortgage agreement is reissued for each person, and then the parties fulfill their obligations separately.

Complete the survey and a lawyer will share a plan of action for alimony in your case for free.

You might find it useful:

Child support calculator

Penalty calculator

Samples of documents on alimony

Legal advice on alimony

Does alimony affect the mortgage?

Alimony and mortgage are completely different things. The former are intended solely for the maintenance of children, while the mortgage is taken out by their parents mainly for their own interests. Even if one of the spouses remains fully obligated to pay the housing loan, payments for the child will still have to be transferred, and their amount will not be reduced.

Example. The woman filed for divorce, alimony and division of property - a mortgaged apartment. At the time of filing the claim, the debt to the bank was 2,000,000 rubles, 3,000,000 rubles had already been paid. In her claims, she stated:

- Collect money from the daughter in the amount of ¼ of the defendant’s total income.

- Allocate ½ share in the apartment and divide the loan in half.

- Divorce the marriage.

Having considered the case, the court satisfied the requirements.

Important! Children have no relation to the parents' real estate acquired during marriage. There is no need to allocate shares to them. An exception is the use of maternity capital when purchasing housing: here, by law, shares are allocated to all family members (Article 10 of the Federal Law of December 29, 2006 No. 256-FZ “On additional types of support...”).

Amount of child support for one child in 2021

Amount of child support for two children in 2021

Challenge process

If a person does not understand how to argue and state their claims, it is worth contacting a specialist who will help with this. You need to contact the district court. You have one month to appeal.

To refute the results of the meeting, the party must indicate in the complaint those facts that were not considered at the last meeting. And also provide evidence that the reasons for which the payer refuses to pay alimony were false or not supported by law.

IMPORTANT !!! After a careful consideration of the case, the judge makes a decision on whether to leave everything as before or to refuse the payer’s claim. If a party filed a claim not in the city court, but in the Supreme Court, then the decision of the previous judges may be annulled.

Considering the presented situation from different angles, it evokes mixed feelings. After all, a reduction in child support payments is considered to be a deprivation of the child’s due money. The ex-husband and breadwinner of the family has the right by law to file a claim for a reduction in payments. And the likelihood of getting what you need is high. To receive competent advice regarding appealing a claim, you should entrust the matter to a specialist who knows all the intricacies of such situations.

Housing child support for a mortgage

In February 2021 in Art. 86 of the RF IC have been amended. From this moment on, the parent with whom the child remains can recover additional rental costs from the other party. Previously, it was possible to reimburse only part of the payment for the services of a nurse, treatment, and medications for a minor.

An important condition is the lack of housing suitable for permanent residence. If the mother has a mortgage on the property, but for some reason she and the child do not live there, but rent an apartment, it will not be possible to recover half the rent from the father.

It is also possible to recover part of the mortgage payments if the claimant and the child live in the mortgaged apartment. For example, the court has the right to oblige the defendant to compensate half the cost of mandatory monthly payments.

Are you tired of reading? We’ll tell you over the phone and answer your questions.

Child support for a mortgage

When going to court, the defendant may be required to both repay the mortgage and pay alimony:

- As a share of salary.

- In a fixed amount of money (hereinafter referred to as TDS).

- In a mixed form.

Note! If a woman is on maternity leave with her child for up to three years, she has the right to demand alimony for herself (Articles 89, 90 of the RF IC). Payments are assigned in a fixed amount, taking into account the cost of living per adult in the region.

As a share of earnings

If the defendant has official income, the plaintiff has the right to recover payments from the child in shares of earnings (Article 81 of the RF IC):

- For one minor – ¼ of income.

- On two – 1/

- For three or more – ½.

The maximum amount of deductions cannot exceed 70% of salary. This is relevant if the defendant has to pay alimony for other children, spouse or parents (Article 99 of the Federal Law of October 2, 2007 Federal Law No. 229-FZ “On Enforcement Proceedings”).

Payments from wages are calculated after personal income tax is withheld. If the debtor also has to pay the mortgage, payments are not taken into account. Alimony is calculated only from the full amount of earnings.

In a fixed amount of money

Payments in TDS are assigned if the payer does not have a regular income, he receives a salary in foreign currency, in kind, or does not work at all (Article 83 of the RF IC). They can also be collected in cases where the alimony shares are not enough to adequately provide for the child.

The amount of alimony in the TDS is determined in proportion to the regional subsistence minimum per child. Usually the courts require 0.5 or 1 PM, but you can ask for more. It is not a fact that the court will approve - the financial situation of the parties is taken into account - but it is worth a try.

Note: when determining the amount of alimony, the court is primarily guided by the interests of the children.

Example. After the divorce, the couple divided the mortgaged apartment, the debt remained with the man. The woman also exacted from him alimony for their common son - 1 monthly wage (RUB 10,000). At that time, the payer earned 50,000 rubles. He transferred 20,000 rubles towards the mortgage, 10,000 rubles for alimony, leaving him with 20,000 rubles in total.

Mixed

Such payments are assigned if the debtor has a basic income from which shares can be calculated in accordance with Art. 81 of the RF IC, and additional earnings - a fixed amount is collected from him.

Example. A man earns 70,000 rubles. Of this, he transfers 25,000 rubles monthly to pay off the mortgage. He also has an unstable income from daily rental of an apartment (about RUB 100,000 per month). The common daughter remained with his ex-wife after the divorce.

The woman collected mixed alimony: 25% of earnings under an employment contract (RUB 17,500), and TDS from additional income - RUB 12,000. or 1 rep for minors.

100,000 + 70,000 = 170,000 rub. – the payer’s total income for the month.

170,000 – 25,000 = 145,000 rub. – remains in hand after paying off the mortgage.

170,000 – 25,000 – 12,000 – 17,500 = 115,500 rub. – remains for the needs of the debtor after all payments.

Elena Plokhuta

Legal expert. 6 years of experience. I specialize in civil disputes in the field of family law.

Features of calculating the amount of alimony in the presence of a mortgage

Before moving on to the calculation rules, an important nuance should be noted: a mortgage is not an excuse for the alimony holder to accumulate alimony debts, and also cannot be a reason to refuse to fulfill alimony obligations. Child support refers to the unconditional obligation of parents who, according to the law, must support their own children. It doesn’t matter whether parents have loans or not.

Accordingly, the maximum that an alimony payer can do is, in some cases, to raise the issue of reducing alimony payments with the court.

Mortgage taken out before marriage

According to the general rule enshrined in the Family Code, premarital property after the dissolution of marital relations is considered to belong to the former spouse who was its owner before marriage. The same rule governs premarital loan obligations. This legislative norm is not an axiom, since spouses or future spouses have the right to regulate the fate of premarital property in a marriage contract at their own discretion.

Thus, we can highlight some legal nuances in the situation when the alimony holder pays for the mortgage after a divorce and when the alimony recipient pays for the mortgage.

| Mortgage on alimony | Mortgage on alimony recipient |

| It must be taken into account that the court first of all takes into account the interests of minors regarding the payment of alimony for their support, and secondly - debt obligations. It follows that if the alimony payer has a sufficient level of income, then he will not be able to achieve a reduction in alimony payments, citing a large mortgage debt. In other words, large amounts of debt without other valid reasons will not convince the judge to reduce the amount of monthly alimony. Let us explain what sufficient income is with an example. Let’s say a man living in Moscow officially earns 65,000 rubles. in 1 month. He has 1 child, for whose maintenance he pays a quarter of his salary in the form of alimony, i.e. RUB 16,250 In addition, he pays a monthly annuity mortgage payment of RUB 30,000. The cost of living for an adult in Moscow is 17,487 rubles. The concept of “sufficient income” means that after paying loans and alimony, a man should have an amount left to live on that is higher than the minimum subsistence level established for Moscow. So, 65,000 rubles. – 16,250 rub. – 30,000 rub. = 18,750 rub. Thus, we can see that the remaining income is RUB 18,750. more than the subsistence minimum of 17,487 rubles, and, therefore, the man in our example has sufficient income and cannot count on a reduction in alimony. | In this case, the obligated person is free from the mortgage and will thus pay alimony in full if there is sufficient income. |

Mortgage taken out during marriage

According to the general rule established in the Family Code, during a divorce, all property of the spouses will be divided in half, including the mortgage loan. The rule of sufficient income also applies in this situation. If the alimony holder has enough funds to pay both half of the mortgage and alimony, and at the same time he has more money left than the minimum subsistence level, he has no right to demand in court a reduction in the monthly alimony payment.

How to divide a mortgaged apartment and collect alimony: step-by-step instructions

There are two ways to divide property and debts, as well as collect alimony - by notarial agreement or through the court. Most often, people have to go to the courts, and the procedure is as follows:

- Claims are determined. It is necessary to clarify what property will be divided; who will pay off the mortgage, who will be allocated what shares.

- A statement of claim is being drawn up. One copy is needed for the defendant, the second for the court.

- One copy of the application and all documents that the defendant does not have are sent by the plaintiff to his address by registered mail with notification.

- Documents are submitted to the court. The plaintiff can do this at his own address or the defendant’s place of residence if a claim for alimony is simultaneously filed (Article 29 of the Code of Civil Procedure of the Russian Federation). The judge accepts them for proceedings within 5 days.

- A preliminary meeting is scheduled in 10-15 days. It is carried out in the form of a conversation, where the judge clarifies the claims and requests additional information.

- The case is assigned to trial by ruling.

- During the proceedings, the presented evidence and documents are thoroughly studied.

- The judge alone makes the decision. He may fully or partially satisfy the requirements, or refuse to satisfy them.

The case will be considered in two months. Before a decision is made, both parties can file motions, present their arguments and evidence.

If you want to get a divorce faster and there are no disputes about children, it is better to submit an application to the magistrate’s court. There, a decision will be issued within a month, and then other issues can be resolved in court: dividing property, collecting alimony. The more claims, the more complicated and longer the case drags on.

Contents and sample of the statement of claim

The statement of claim must contain the following information:

- name, address of the court;

- Full name, address, telephone number of the plaintiff;

- Full name, address of the defendant;

- date of marriage;

- date of birth, full name child;

- inventory of jointly acquired property;

- the value of divisible values;

- who should get what, according to the plaintiff;

- claim;

- date of compilation and signature.

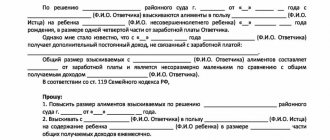

Sample claim

Consultation on document preparation

Documentation

When going to court, the plaintiff will need:

- passport;

- statement of claim;

- marriage certificate;

- child's birth certificate;

- documents for divisible property;

- income certificates (yours and the defendant’s);

- notification of receipt of the claim by the defendant;

- receipt of payment of state duty.

Depending on the situation, additional documents may be required.

Expenses

For consideration of a claim for alimony, the plaintiff does not need to pay a state fee - he is exempt from paying Art. 333.36 Tax Code of the Russian Federation. Divorce through court will cost 600 rubles. (Clause 5, Clause 1, Article 333.19 of the Tax Code of the Russian Federation). The fee for the division of common property depends on the value of the claims. It is determined from the value of the share that the plaintiff asks for himself (clause 1, clause 1, article 333.19 of the Tax Code of the Russian Federation):

| Cost of claim (RUB) | State duty (rub.) |

| Up to 20,000 | 4%, minimum 400 |

| 20 000-100 000 | 800 + 3% of the amount over 20,000 |

| 100 001-200 000 | 3,200 + 2% of the amount over 100,000 |

| 200,001-1 million | 5,200 +1% of the amount over 200,000 |

| From 1 million | 13,200 + 0.5% of the amount over 1 million. |

The maximum duty amount is 60,000 rubles.

What to do after

A copy of the decision is issued within five days after adoption (Article 214 of the Code of Civil Procedure of the Russian Federation), a writ of execution for alimony - immediately. Payments for the child are awarded from the moment the plaintiff goes to court (Article 107 of the RF IC).

The decision comes into force in a month, but the writ of execution can be presented to the bailiffs immediately. Then the bailiff will handle the matter. He must send documents to the employer, if necessary, find the debtor and his property, and work with him.

When the decision comes into force, you can apply to the registry office for a divorce certificate. It will be issued immediately.

Lawyer Roman Kharlanov answers:

If the borrower has no alimony arrears (he pays them without delay) and there are no violations, then the need to pay alimony does not at all interfere with mortgage transactions. Restrictions are imposed only if there is a delay or non-payment of alimony. Moreover, the State Duma is currently considering (and has even adopted in the second reading) a law providing bailiffs with the opportunity to detain debtors who do not pay alimony.

So, if alimony is paid, it is not considered a burden. The same as tax debt or fine debt, if there are no delays or they are insignificant. “Insignificant” means the absence of enforcement proceedings regarding the debt, that is, going to court.

Is it possible to reduce the amount of alimony for a mortgage?

Debts do not affect the amount of alimony in any way. Even if the payer is involved in bankruptcy, payments for children still remain a priority.

But there are other reasons on which payments can be reduced (Article 119 of the RF IC):

- receiving disability;

- a serious illness that requires high costs and long-term treatment;

- the appearance of another dependent.

For example, payments already collected for the first child from a previous marriage can be reduced if another one is born in the new family and the spouse also applies for alimony. If before this the first received 25% of the debtor’s income, then after consideration of the case, 16.5% or 33% in total will be assigned to each. In fact, 16.5% will remain in the new family's budget.

A deliberate reduction in child support for an older child is usually resorted to by mortgage borrowers who cannot cope with all payments. They reach an agreement with their spouses, and they also go to court. This is permitted by law. But if payments are collected in TDS for the first child, they are unlikely to be reduced when collected for the second.

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

Step-by-step instruction

To reduce the amount of alimony on a mortgage, you need to:

- Collect evidence. A mortgage is not a reason for a reduction; other reasons are necessary.

- Draw up a statement of claim and send one copy to the defendant (the recipient of alimony acting in the interests of the child).

- Submit the application and other documents to the district court at the defendant’s address.

- Participate in legal proceedings.

The decision will be made in 1.5-2 months. When it comes into force, you need to send a new writ of execution to the FSSP, if the old one was submitted there.

Contents and sample of the statement of claim

This statement contains the same information as in the claim for divorce and division of property, only the requirements are different. For example, “reduce the amount of child support from ¼ to 1/6 of the debtor’s total income.” The grounds on which the court must satisfy the claim are also indicated.

Sample claim

Consultation on document preparation

Documentation

Along with the application to the court, the plaintiff submits:

- passport;

- a copy of the decision or order under which payments were collected earlier;

- evidence confirming that there really are grounds for a reduction: for example, medical certificates, a certificate of disability, a decision or order for alimony for another dependent;

- receipt for payment of state duty.

Expenses

The fee for reducing alimony is calculated from the price of the claim. It is determined based on the amount for the year by which payments should be reduced.

For example, if a person previously paid 10,000 rubles, but asks to reduce it to 7,000 rubles, the difference will be 3,000 rubles. It needs to be multiplied by 12 months - the price of the claim will be: 36,000 rubles.

Then the duty is calculated as for a property claim in accordance with paragraph 1, paragraph 1 of Art. 333.19 Tax Code of the Russian Federation. As a result, the plaintiff will have to pay 1,280 rubles when submitting an application.

The lawyer told how to legally reduce the amount of alimony

https://static.news.ru/photo/417b87a6-6bb2-11eb-9d31-96000091f725_660.jpg Photo: Sergey Lantyukhov/NEWS.ru

The court may decide to reduce alimony if the father has another child (natural or adopted) or is dependent on elderly disabled parents. Lawyer and forensic expert Yuri Kapshtyk stated this in a conversation with NEWS.ru.

The payer can also make a corresponding request to the court if he receives a disability of the first or second group, which entails the need for additional expenses for treatment, care or maintenance. The court can also decide to reduce the amount of alimony if the child has income that significantly exceeds the father’s salary: for example, as a result of employment (after 16 years) or renting out his own real estate (after 14 years).

Nevertheless, you need to understand that if placing a child at work was a necessary measure due to a lack of money, then this will not become a basis for reducing child support ,” Kapshtyk explained.

It is also possible to reduce the amount of alimony if the father leaves the child an apartment, a share in it or, for example, a car. In this case, an appropriate agreement is concluded between the parties, the lawyer notes.

In addition, according to the law, the court has the right to reduce the amount of alimony paid if its amount significantly exceeds the real needs of the child. However, in reality this point does not work, explains Kapshtyk.

Meanwhile, it should be understood that for a man who has achieved a reduction in the monthly payment for a child, his relationship with him may worsen. The problem in this case lies not so much in the child’s personal thoughts on this matter, but in his mother’s reaction to the current situation. Clinical psychologist and psychoanalytic psychotherapist Marina Nachkebia stated this in a conversation with NEWS.ru.

If a mother includes a child in a marital relationship, then alimony is often seen by the woman as the equivalent of the father’s love. This is of great importance for the child, since in the event of a family split, he is usually forced to take the side of one of the parents, explains the psychologist.

It is also worth noting that the formation of the image of the father and relationships with him occurs through the mother. It's no secret that first a child discovers the image of his mother, forms a dyadic relationship, and only then is able to perceive his father. For this reason, it is important whether a woman allows an emotional connection between her child and his father and how she treats men ,” Nachkebia explained.

As NEWS.ru previously wrote, bailiffs in 2021 collected 1.2 billion rubles more in alimony than in 2019. The deputy head of the department for organizing enforcement proceedings of the FSSP Dmitry Zheludkov spoke about this. Bailiffs managed to achieve payment of alimony in 78.9% of cases out of the total volume of relevant enforcement proceedings, but it must be taken into account that several proceedings may be initiated against one debtor.

Add our news to your favorite sources

Add

Arbitrage practice

Let's consider several examples of the division of common property, including mortgage real estate:

- During marriage, the couple purchased an apartment with a mortgage, and preferential lending programs were also used. As a result, the court allocated 1/3 of the share to the spouses and collected compensation from the defendant in the amount of half the cost of the car (Decision No. 2-274/2017 2-40/2018 2-40/2018 (2-274/2017; 2-7609/2016 ;) ~ M-6493/2016 2-7609/2016 M-6493/2016 dated February 27, 2021 in case No. 2-274/2017).

- The plaintiff wanted to recover from his ex-wife the cost of making monthly mortgage payments, part of the cost of mortgage insurance, court costs and utility bills. But by Decision No. 2-3612/2011 2-3612/2011~M-3850/2011 M-3850/2011 dated September 22, 2011 in case No. 2-3612/2011, the court satisfied only the claim for compensation for utility bills and legal expenses , and ordered the defendant to pay a total of 17,653.67 rubles.

- The woman asked the court to collect child support and divide the common property with the defendant, including mortgaged real estate. By decision No. 2-935/2015 2-935/2015~M-657/2015 M-657/2015 dated July 29, 2015 in case No. 2-935/2015, the housing was divided in half while maintaining the mortgage encumbrance. A car and a plot of land are also recognized as joint property.

Lawyer's answers to private questions

I’m paying a mortgage, can the court release me from alimony if I don’t have enough money?

No. The presence of debts is not a basis for exemption from alimony obligations.

Is it possible to collect housing support for the mortgage paid by the mother who is left with the child?

Yes, if the minor has his own room in the mortgaged apartment and lives there.

Is alimony taken into account when applying for a mortgage?

Yes. When considering an application, the bank takes into account all the expenses of the potential borrower: other debt obligations, housing rent, alimony. If more than 50% of your earnings are spent on this, there is a high probability of being denied a housing loan.

Is it possible to demand alimony if my husband pays the mortgage, but I live in an apartment with a common child?

Yes. Alimony and mortgage obligations are not related to each other. Especially if a man voluntarily makes obligatory payments to the bank.

How is a military mortgage divided and alimony collected?

Housing purchased with a military mortgage most often remains with the military personnel and is not included in the general property. It can be recognized as common if it can be proven that during the marriage its value increased significantly due to joint efforts (Article 37 of the RF IC).