Filing a claim against inherited property

At the time of death, a citizen may be a debtor on loans, borrowings, mortgages and other obligations.

Debts can be divided into 2 categories:

- Personal debts.

They are not collected from heirs. From the moment of death of the debtor, they are considered automatically repaid. These are obligations for alimony and fines. Important! Personal debts include only the general alimony obligation. If a citizen has already accumulated debt, it must be repaid from the inherited property. - Property debts. These are loans, credits and other obligations. They pass to the heirs in proportion to their shares in the inherited property.

If a citizen dies without paying the loan or utility debts, the creditor can collect the debt from the heirs. Until they enter into legal rights, a claim may be made against the inherited property.

Since any property cannot be ownerless, the inheritance that was not formalized by the relatives of the deceased passes to the municipality or the state. This is called escheat inheritance (Article 1151 of the Civil Code of the Russian Federation).

Therefore, a claim against the inherited property can only be brought within 6 months from the date of death of the debtor.

Take the survey and a lawyer will share an inheritance action plan in your case for free

You might find it useful:

State duty calculator for inheritance

Samples of inheritance documents

Consultation with a lawyer on inheritance

Who is the defendant?

In accordance with Art. 1175 of the Civil Code of the Russian Federation, the heir is liable for the debts of the deceased to the extent of the property received. That is, he is not obliged to spend his own money on repaying the debt.

If the number of debts exceeds the amount of property, it is not profitable for the heir to accept the property of the testator. After all, during the registration process, he will have to pay the notary’s state fee, property valuation, and also incur other costs.

If the legal successors do not formalize the inheritance, then the property goes to the state.

Creditors can apply for debt collection during the entire limitation period (from the date of the last payment on the debt). Moreover, it is not subject to suspension or restoration.

The period of acceptance of the inheritance (6 months from the date of death) is also counted towards the limitation period. During this period, the creditor can only make claims against the inherited property. Since it does not yet have an official owner.

Important! The law does not establish a defendant in a claim against the estate.

Liability of the heir for the debts of the testator

Are debts and loans of parents inherited by children?

Choice of court

Before filing a claim for inherited property, the court should be determined, since a violation of jurisdiction will lead to a time delay. The application is submitted:

- at the place of registration of the defendant;

- according to the actual location of the heir’s property if his place of residence is unknown;

- at the place of opening of the inheritance case by a notary.

If an inheritance claim is filed in relation to a piece of real estate, then the rule of exclusive jurisdiction comes into force, and the trial is conducted at the location of the disputed real estate.

If the choice is incorrect, the court will leave the application without consideration. If it is clarified during the proceedings, the court transfers the case to the appropriate judicial authority for trial and a decision.

Procedure for filing a claim

Before initiating legal proceedings, the creditor must:

- Contact a notary to submit a claim. If the demand is not submitted in a timely manner and the heir has assumed rights, he may refuse to pay if he did not know about the debt in advance.

- Contact the executor of the will or a notary to ensure the safety of the inherited property. Within 6 months, the heirs can sell the property of the deceased, which does not require state registration. It is in the lender's interest to retain it.

Algorithm of actions:

- Collection of documents;

- abandonment of the claim;

- sample statement of claim;

- determination of jurisdiction;

- payment of state duty;

- trial;

- obtaining a court decision.

Important! If heirs appear, the creditor has the right to change the defendant at any time.

Collection of documents

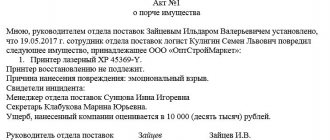

List of documentation to initiate the process:

- the applicant's civil passport;

- power of attorney on behalf of a legal entity (if the plaintiff is a legal entity);

- receipt of payment of state duty;

- loan agreement, receipt;

- a copy of the request to the notary and the response from him;

- information about the availability of property.

Note! Particular attention must be paid to preparing evidence. Often, courts refuse to satisfy claims if the plaintiff cannot prove that the deceased debtor has liquid property.

Filing a claim

The statement of claim must be made in writing. The document must comply with the rules of civil procedure.

Key points:

- name of the court;

- details of the applicant (full name of the plaintiff - an individual and place of registration, name of the legal entity and legal address);

- cost of claim;

- name of the statement of claim;

- data on the conclusion of a loan agreement or other document confirming the existence of an obligation;

- information about the death of the debtor;

- reference to law;

- a request to collect debt from inherited property;

- list of documents for the claim;

- date and signature.

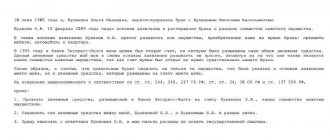

Sample statement of claim

Sample claim against inherited property: alt: Statement of claim by the testator's creditor, submitted before the heirs accept the inheritance

Consultation on document preparation

Determination of jurisdiction

A claim against inherited property is filed at the last place of residence of the deceased debtor. Therefore, the creditor must apply to the court at the place where the inheritance was opened.

The application is submitted to the district or city court.

Payment of state duty

A claim against inherited property is a property claim.

Therefore, the state duty is calculated based on the requirements of Art. 333.19 Tax Code of the Russian Federation:

- if the debt is less than 20,000 rubles, you must pay 400 rubles;

- with a debt amount of 20,000 rubles. up to 100,000 rubles, you will need to pay 800 rubles. and another 3% of the amount over 20,000 rubles;

- with a debt amount of 100,001 rubles. up to 200,000 rubles, you must pay 3200 rubles. and an additional 2% of the debt amount over 100,000 rubles;

- with a debt amount of 200,001 rubles. up to 1,000,000 rubles, you will need to deposit 3,200 rubles. and another 1% of the amount exceeding 200,000 rubles;

- if the debt is more than 1,000,000 rubles, the fee will be 13,200 rubles. and an additional 0.5% of the amount that exceeded RUB 1,000,000.

The maximum duty amount is 60,000 rubles.

Trial

Popular issues in litigation are:

- The judge's request to identify the defendant. Since the estate is considered a fictitious defendant. But the plaintiff must substantiate his claim, since inherited property, like the property of a legal entity, does not have a real owner. It is simply separate property. Therefore, the applicant must justify his claim.

- The next problem is the ability of the heirs to sell the inherited property in advance and before taking ownership. As a result, the lender cannot get their money back. To avoid this, the plaintiff must apply to the court to impose a ban on the sale of objects.

- Another difficulty is the lack of information from the creditor about the composition of the deceased’s property. The secrecy of the will does not allow the notary, the executor of the will and other citizens to notify the creditor about the composition of the property.

In addition, in 2021 there is no uniform approach to identifying the property of the deceased. The notary requests information from Rosreestr, the State Traffic Safety Inspectorate, and Sberbank. But the property may include accounts in other banks, special equipment and other things that the notary may not know about. Therefore, the creditor must himself find and prove the existence of property of the deceased.

Are you tired of reading? We’ll tell you over the phone and answer your questions.

Nuances of the procedure

All cases of claims from the inheritance, property, and monetary savings of the deceased in judicial practice are different, although the general essence of the plaintiffs’ claims is similar. The reason is the lack of legal knowledge, which leads to fatal mistakes. If the name of the representative is not indicated, but the statement of claim is filed in the wrong instance, there will be no movement in the case of collecting property from the inheritance in favor of paying off debts. With regard to the plaintiff himself, the sample statements of claim show that this may be a creditor personally, a company representative, or a lawyer who acts on the basis of a notarized power of attorney.

Application deadlines

If there are no heirs, or there is no information about applicants for the inheritance, this is not a reason to write off the debt. The remaining property is a guarantee of money back, but only if you file a claim for inheritance within three. The starting point is the date of opening of the inheritance case. And this is automatically the day of death of the debtor. The six months allotted for the adoption of inheritance rights are included in this period, and are not added to it, which is important not to forget.

It is necessary to understand that the remaining funds are what lies on the accounts, or property left by inheritance and available in kind:

- apartment;

- car;

- garage;

- country house;

- land plot;

- valuables, furniture;

- personal belongings;

- securities, etc.

To restore the statute of limitations for claims against property (inheritance), it is necessary to file a corresponding claim. The text indicates the objective reasons that caused the delay. If the judge decides that they are satisfactory, the case will be reopened and considered. This also applies to cases where there are persons who have accepted the inheritance.

What problems might arise?

Any mistake made when drawing up a claim can hinder the achievement of justice. If the procedure for repaying the debt is violated during your lifetime, it is important that the creditor tries to resolve the problem with debts, property and inheritance in a pre-trial manner.

For example, a collection claim case falls apart if there is no documentary evidence of the existence of a debt. It also happens that the repayment deadline has not arrived and the creditor is not able to submit a claim in a timely manner. Then a claim is filed to restore the statute of limitations.

Other reasons for refusal to implement claims include cases when a claim is filed with the wrong authority. Let us remind you that you need to contact the district court at the location of the property included in the inheritance. I mean most of it. Regarding the time count, this may not be the only reason. The state fee is paid before filing. If you do not attach a receipt, there will be no progress in the case. And decisions that have already been made are final if the essence of the dispute is the same.

Arbitrage practice

The court does not always satisfy the demands of creditors. Often, the plaintiff goes to court without sufficient grounds for this. The resolution of the Plenum of the Supreme Court in 2012 establishes that the death of the debtor is not a basis for early execution of the contract.

Thus, if the deceased borrower regularly made payments, and his heirs continue to fulfill their obligations, then the banking organization cannot oblige them to repay the debt immediately.

Only if there is a large delay and there are grounds for collecting the debt in full, the court will consider and satisfy the applicant’s demands.

The debt can be paid ahead of schedule at the initiative of the heir, upon notification of the creditor at least 30 days in advance and with the consent of the creditor.

When filing a claim against inherited property, it is necessary to take into account the fact that if there are several creditors, then the claims are satisfied in order of priority. The first person to file a claim receives the debt.

Important! If the amount of property is not enough to pay off all debts, it will not be possible to collect funds from the heirs.