By the concept of “limitation period,” the Russian legislator means the time period during which a person can protect his own violated interests or rights in a judicial or other government body. What statutes of limitations exist in family law will be described in detail below.

By the concept of “limitation period,” the Russian legislator means the time period during which a person can protect his own violated interests or rights in a judicial or other government body. What statutes of limitations exist in family law will be described in detail below.

Limitation period in family law

As a general rule, statutes of limitations in Russian family law, including alimony obligations, are unlimited, except for cases expressly established by law .

Calculation of alimony by agreement

If the debtor does not timely pay the alimony allowance accrued under the agreement, then the recipient can recover it through the court at any time, provided that the basis for claiming alimony has not yet ceased to exist. These grounds include:

- Death of one of the parties to the agreement.

- Circumstances specified in the agreement, for example, the common child coming of age, the child receiving a diploma, the recipient reaching a certain age, the restoration of the child support recipient’s ability to work.

- End of the contract period.

It is necessary to take into account that the judge who took the case into his own proceedings is not obliged to consider the motives of the alimony worker, which guided him in the delay in payments, and to determine the degree of his guilt. The court will make a decision in which the amount of the debt will be calculated, multiplied by the indexation coefficient (the value of this coefficient is set depending on the level of inflation in Russia), and will oblige the payer to pay off the debt within the period established by the judicial act.

For example, the father and mother divorced when the child was three years old, concluded and notarized an alimony agreement, according to which the father was appointed as the payer and the mother as the recipient. However, the father did not pay child support for five years and ignored the written demands of the mother, who had no choice but to demand collection of the debt in court. If the judge decides in favor of the mother, then she will receive all the money due to her child from the moment the alimony agreement is certified, plus penalties and fines provided for in this document.

What should be done if the basis for collecting alimony under the agreement does not currently exist, for example, the child has reached the age of majority, i.e. eighteen years old? What are the statutes of limitations for child support after adulthood?

Here it is necessary to take into account that the alimony agreement in legal force is equivalent to a writ of execution, which means that the rules provided for in Article 21 of the Law on Enforcement Proceedings apply to it. According to their meaning, it turns out that after the expiration of the alimony agreement, the interested party has three years to collect the debt from the alimony provider. Thus, the limitation period is three years.

Consider the following examples. If the adult child is twenty years old at the time of filing the claim, then he can claim any child support debt that arose during the term of the agreement. However, if the child has reached the age of twenty-one at the time the claims are brought to court, then the defendant can defend himself in court, citing the passage of the statute of limitations. If the plaintiff does not have valid reasons for reinstating the statute of limitations, the right to overdue alimony will be lost.

Calculation of alimony by court

If the alimony recipient and the payer were unable to resolve the problem of alimony payment peacefully, then the interested person can claim it in court if there are circumstances allowing this to be done. Such circumstances include the minority of a child, the pregnancy of a former spouse, the incapacity of an adult child or a former spouse.

Alimony support is awarded in favor of the recipient from the moment of application to the judicial authorities. In other words, from the date of transfer to the office of the statement of claim with the documents attached to it.

However, the recipient must take into account that the collection of judicial alimony, in contrast to alimony by agreement, occurs only for the last three years and according to the following features:

- Prior to the filing of the claim, alimony maintenance was not transferred in favor of the recipient.

- The judge found that the recipient took measures to claim monetary support, for example, sent written claims by mail to the address of the alimony provider, corresponded with the payer on social networks, and reported to law enforcement agencies about non-payment of alimony.

- Alimony benefits were not received due to the fact that the payer culpably evaded payment.

To clarify the legal norms, we will give an example. Let's say the parents separated when their common child was five years old. During the divorce proceedings in court, the baby’s mother, for some reason, did not submit a request to calculate the amount of alimony and filed an alimony claim only five years after the divorce, when the child was ten years old.

The plaintiff will not be able to receive financial support in full for the past five years, but only for the last three years and only if she proves that she tried to claim alimony in other ways, and the alimony provider tried to evade paying it. The same rules apply to other categories of persons entitled to alimony, for example, disabled former spouses and needy disabled adult children.

What statute of limitations rules apply if the circumstances allowing for the claim of alimony cease to exist? The same rules as above apply, with a twist that can be illustrated with an example.

An adult child, who is twenty years old, filed a claim against his father, who is the payer of the alimony obligation in favor of the minor. No child support claims had previously been made against the father. According to the law, the father is obliged to pay child support for the last three years. However, for two years (from 18 to 20 years) the alimony obligation in relation to a minor does not apply, because it is considered terminated when the child reaches adulthood.

Thus, the payer is obliged to transfer alimony to his child for only one year, namely for the period of time when he (she) was seventeen years old.

From this we can draw the following conclusions:

- It is more profitable for the recipient to enter into an alimony agreement, since in this case he can collect the entire amount of the debt both during the period of existence of the alimony obligation and three years after its completion.

- If the payer refuses to sign the agreement, then you need to seek legal protection as quickly as possible.

How to initiate collection of alimony penalties?

What penalty is due for alimony depends on its basic size and type of payments - voluntarily or through bailiffs. The first option involves a clause in the agreement regarding a penalty in percentage or a fixed amount. In the second, the recovery is completely subordinated to the RF IC. This is done in court. In case of delay in voluntary alimony and the penalty specified in the agreement, the recipient also goes to court.

The size is mentioned above. The procedure for judicial collection involves filing a statement of claim justifying the following facts.

- Payer's fault. If no documents confirming the regular receipt of income by the alimony holder can be found, it is enough to indicate in the application his place of work. The court will make its own inquiries.

- Calculation of penalties for alimony. It is done in accordance with an agreement or law and is drawn up on paper - separately or in the text of the application.

- Actually debt. Its amount and period of non-payment are the basic elements of calculating the penalty. The claim must indicate both the amount of the debt and the period of non-payment.

Bailiffs who collect alimony do not deal with penalties. Their task is to execute decisions already made by the court. As long as there is no such decision regarding the penalty, they have no right to deal with it.

Penalties and penalties for non-payment of alimony

In addition to debt collection, the alimony provider may be subject to additional obligations. Their varieties are indicated in the table.

| Grounds for requesting alimony | A comment |

| Agreement | Any penalties that the parties agree upon. It can be:

An obligation to perform an action specified in an agreement. |

| Court | A penalty equal to 0.5 percent per day of the total amount of unpaid alimony support. The penalty is charged every day until the debt is fully repaid. |

How to restore a missed deadline?

If the plaintiff submits an application to the court to restore the statute of limitations and attaches documents confirming that the deadline was missed for good reasons, then the judge may rule in his favor and allow him to file a claim. Legislation includes the following valid reasons:

- Force majeure, i.e. the claim could not be filed due to natural or man-made disasters in the plaintiff’s place of residence.

- Legal illiteracy. It is confirmed by the lack of legal education and testimony.

- Long-term business trip or stay in the Armed Forces. The application is accompanied by a business trip order signed and stamped by the employer or a military commissar's order on conscription for military service.

- Serious illness. To prove the validity of this reason, the plaintiff will need to provide extracts from the medical record and documents from the medical institution.

The judge can recognize these circumstances as valid only if they occurred within the last six months of the statute of limitations. Otherwise, the limitation period will not be terminated.

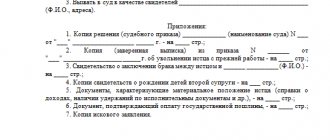

The application is sent to the magistrate serving the court district where the plaintiff lives. A sample application can be found at this link.

Limitation period for alimony penalties

A penalty for alimony that has already expired can be filed for three years prior to going to court. In cases of alimony collection, the statute of limitations does not apply, that is, an application can be filed at any time.

But, the maximum period for which the court will award a penalty for alimony is three years. The limitation period for alimony penalties does not apply.

The amount of debt, along with penalties, can be claimed through the court by an adult child. Three years is the maximum for which in 2018 you can receive a penalty for alimony, provided that the defendant has filed an appropriate application for a reduction in penalties. If such an application is not received by the court, then the three-year period does not apply.

Arbitrage practice

The case was heard in the Zavodsky District Court of the city of Grozny, Chechen Republic.

The plaintiff submitted the following list of demands to the judge of the Zavodsky District Court:

- To collect the defendant's overdue alimony debt, equal to 312,000 rubles, which arose from the birth of their daughter.

- Set the amount of alimony allowance at 8,000 rubles and collect it from the defendant until the daughter reaches eighteen years of age.

- Determine that the child will continue to live with the plaintiff.

- Oblige the defendant to reimburse the expenses that the plaintiff spent on a lawyer, namely 10,000 rubles.

At the court hearing, the plaintiff confirmed her claims and explained that she was with the other party to the lawsuit in a religious marital relationship for several months in 2012. After the separation, she gave birth to a daughter. According to the court decision, the defendant is recognized as her father.

The ex-husband does not care for his daughter, is not interested in her life and does not help her financially. In addition, the defendant does not have a permanent job and his earnings are unstable. Because of this, according to the plaintiff, her daughter should stay with her.

The parties had not previously entered into an alimony agreement, so the plaintiff demanded maintenance in a fixed amount equal to 8,000 rubles, as well as collection of alimony debt, namely 312,000 rubles. As for the 10,000 rubles paid for the lawyers’ services, the plaintiff explained that she paid them without drawing up contracts and other documents.

The former spouse has not previously made any demands for payment of alimony in any form. She calculated the amount of alimony debt herself. The plaintiff’s earnings are 6,000 rubles. The daughter has been supported by her mother for the entire time since her birth.

In turn, the defendant did not object to the demands of his ex-wife and did not appear at the hearing. A representative from the Department of Education of the Chechen Republic provided an inspection report of the plaintiff’s home and confirmed that it was suitable for children. In addition, he supported the claims of his ex-wife regarding the collection of alimony.

A representative from the Department of Education of the Grozny City Hall tried to contact her ex-husband, went to his place of registration, but did not find him at home. Based on the information she has, she agrees to hand over the girl to be raised by her mother, and leaves the issue of child support to the discretion of the judge hearing the case.

After analyzing the evidence presented, the judge considered that the ex-wife’s claims could be partially satisfied. This is due to the following reasons:

- The living conditions in the mother's house fully comply with sanitary standards. In addition, the girl is attached to her mother, so it is undesirable to separate them.

- Since the ex-husband does not have a stable income, alimony for the girl will be awarded in a fixed, constant amount. This amount is calculated on the basis of the children's subsistence level established in the Republic of Chechnya. It is 7549 rubles. The court considered it sufficient to establish the amount of alimony equal to 1/2 of the subsistence minimum, i.e. 3775 rubles.

- The court cannot satisfy the ex-wife's demand for the recovery of 312,000 rubles. This is due to the fact that the plaintiff did not try to obtain money from her ex-husband out of court and was unable to prove otherwise.

The 10,000 rubles that the ex-wife spent on lawyers cannot be recovered from the other side of the process, because the court was not provided with contracts, receipts for payment of services or other documents confirming the transfer of money, and their recipient was not named.

Judicial practice on alimony penalties

Filing a claim does not guarantee its satisfaction. To impose a penalty, the court must establish the guilt of the debtor. Deliberate evasion of alimony payments is recognized on the basis of the following facts.

- Lack of contact with the payer. He deliberately does not communicate with the recipient and bailiffs, does not answer calls and notifications.

- Hiding the move. The cessation of alimony payments may be due to the relocation of the payer. He is obliged to inform the bailiff or alimony recipient about this fact.

- Deliberate concealment of income. Alimony workers often work without registration or under a gray scheme. The latter pay alimony only from their official salary. The rest of it remains entirely at their disposal. When filing a claim based on this fact, it is necessary to indicate the actual place of work, position and the amount of the payer's expected income.

- Debt for more than 1 month. It is not advisable to file a claim within a shorter period due to small fines.

- Voluntary dismissal and long-term unemployment. Many alimony providers practice this scheme as an escape from obligations. Working without registration in a new place gives them the opportunity to earn income without deductions.

- Deliberate avoidance of official employment. The reasons here are similar to the previous point. Collecting alimony penalties is difficult, as well as the principal debt.

When considering a claim for the recovery of alimony penalties, the judge takes into account all of the above circumstances. In addition, the payer has the right to initiate a claim for review of alimony and penalties for it. It can act as counter or parallel. If non-payments are related to its consideration, then the court for alimony penalties will take into account this circumstance as mitigating and refuting the defendant’s guilt.