general information

Severance pay in 2021 in Russia is the financial assistance specified in Article 178 of the Labor Code of the Russian Federation, provided to people who are fired not because of criminal acts, absenteeism or drunkenness at the place of work. All groups of dismissed workers specified in the law can count on receiving this benefit.

This fact does not depend on the position they held, work experience, job functions, social status, and so on. Assistance is also provided to working pensioners after retirement, who have equal rights with able-bodied citizens in terms of age.

Failure to pay pensioners money after layoffs is considered discrimination against employees based on age, and therefore may lead to sanctions against the administration of the institution.

Severance pay is paid to financially support people being laid off while they look for another job. This type of support is provided for the loss of a position not due to the “fault” of the employee (for example, a benefit upon dismissal due to staff reduction or due to the company changing its location, as a result of which the employee lost the ability to get to it).

» alt=”Calculation, terms and procedure for payment of severance pay when an employee is laid off”>

Average earnings

The average salary is retained by the employee for no more than two months after his dismissal. From this payment, severance pay must be deducted, which is paid separately. During this time, the employee must find a new place of work. As an exception, the average salary may be paid to the employee for one more month (the third). This happens if the employee manages to register with the labor exchange within two weeks after the layoff and they could not find a job (regulated by Article 178 of the Labor Code of the Russian Federation).

Naturally, these circumstances must have documentary confirmation (a certificate from the employment service). Thus, it is necessary to pay the employee an amount equal to the average earnings in the second and third months after dismissal only if the fact of absence of work is confirmed. The proof may be the work book of a laid-off employee, which does not contain a record of his new job. The average salary is due to an employee only until he is hired (taking into account that this date falls in the third month from the date of layoff), or for the entire month, if a job is not found.

How to calculate severance pay during layoffs

Payment to employees for whom the organization that is their employer is the main place of work is provided upon reduction in the amount of one average monthly salary. According to the law, those who registered as external part-time workers are not paid benefits at all.

The amount that an employee receives for thirty days in 2021 is calculated according to the provisions of the law. All questions about the calculation of severance pay during layoffs are also regulated by relevant regulations.

Taking into account how severance pay is calculated when staffing is reduced, it can be calculated correctly by taking the amounts of all accepted payments (bonuses are also considered) that were issued during the previous year. They are included in the organization’s labor remuneration scheme in proportion to the number of days actually worked by the person.

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

The amount taken into account when calculating payments does not include material payments that are not related to the main income (rent of living space, travel, training).

Sick leave and vacations, situations where the employee retained his average earnings in accordance with the Labor Code, but in fact he did not work, are not included in the calculation of benefits.

Important! If an employee is laid off before sixty days have passed from the date of notification, he is entitled to compensation according to the generally accepted calculation procedure.

Calculation example: Petrova A.P. is being laid off on October 16, 2021. His salary is fifteen thousand rubles, and his vacation days are fully used.

On the day of departure, the employee must receive:

- earnings for time worked this month;

- severance pay.

There were twenty-three working days in October. Of these, for example, eleven were worked, for which his salary is equal to: 15,000/23*11 = 7,173 rubles.

Severance pay is determined based on the average salary. It is assumed that during the year Petrov worked two hundred and seventy days without social benefits.

Average salary: 15000*12/270 = 666 rubles.

In November 2021, there are twenty days of work, which means the severance pay is: 666*20 = 13.333 rubles.

To calculate specific indicators, you can use an online calculator.

How to calculate payments when an employee is laid off (formula and calculation example)

To calculate the amount of severance pay, you need to multiply the number of working days by the average daily earnings. In turn, to find out the average daily earnings, you need to divide the total income for the year by 266 (the number of working days). Let's look at all the necessary charges using an example.

An employee whose salary is 40,000 rubles. received notice of my layoff in a timely manner on 08/08/2018. His annual salary is 40,000*12 = 480,000 rubles. Daily earnings are 480,000/266 = 1804.5 rubles. Then the severance pay is calculated using the formula 1804.5 (daily earnings) * 20 (working days) * 2 (months) = 72,180 rubles. For eleven unspent days of vacation, he will additionally receive 1804.5*8 = 19,489.5 rubles. And finally, for six working days in August you need to accrue 6 (working days) * 1804.5 = 10,827 rubles. The total amount will be 10,827+19,489.5+72,180 = 102,496.5 rubles.

How much salary is paid during layoffs?

The employee's rights include receiving one salary as severance pay. There are exceptions here: for example, seasonal workers are entitled to only half of their earnings, that is, money earned in fourteen days. All additional payments must be specified in the terms of the collective agreement.

If sixty days have already passed since the layoff and the person has not found another job, he can receive another salary.

People working in the Far North, that is, beneficiaries, have the right to compensation that is different from all others. They are entitled not only to the statutory benefit in the amount of one salary, but also to payments for ninety days of job search, that is, another 3 salaries, and in some situations – even 5.

Is severance pay subject to personal income tax upon layoff?

According to the Tax Code of Russia, this money is not subject to personal income tax (personal income tax) and insurance premiums, which means that the income code does not need to be indicated on the certificate. The same applies to the salary received by an employee during the sixty or ninety days allocated to look for another job.

But, it must be said that this does not apply to all the money allocated to the laid-off person. Article 178 of the Labor Code speaks of the possibility of increasing the amount, and in such a situation all financial assistance is subject to tax.

Alimony from severance pay upon layoff

Alimony from the cash benefit received can be collected exclusively for the maintenance of minor children.

The basis for this is taken:

- the court's decision;

- certification of the contract in a notary office.

These circumstances determine the inclusion of compensation payments in the list of sources of income from which deduction of alimony is permissible.

Alimony will not be collected from severance pay in the following cases:

- if you need to pay a spouse who is deprived of the ability to work;

- if you need to support parents who are unable to work;

- when the children for whom maintenance was previously paid are disabled and have reached the age of eighteen.

Procedure for payment upon dismissal due to staff reduction

In 2021, a retiring employee is entitled to the following types of payments in case of staff reduction:

- salary for the final time of work and money for vacation that was not used by him. All this is paid no later than the deadline;

- severance pay. How it is paid: within ninety days from the employee’s departure. Initially, the payment of severance pay takes place as an advance; further terms for the payment of severance pay in the event of a reduction are set later;

- privileges. Paid to a person who registered with the Employment Center and did not find a job within three months after leaving. The above-mentioned institution deals with how to calculate them and directly pay them.

Features of severance pay for certain categories of citizens

The above information is relevant in most cases, however, for some categories of employees the procedure for paying severance pay during layoffs may differ slightly:

| Categories of workers | Features of provision | Comments |

| Those being laid off who have decided to leave early. | In addition to the required payments, the employee is awarded additional compensation in the amount of average daily earnings for each working day before the expected date of dismissal. | The decision on early dismissal is mutual; documents are drawn up on the basis of a written application from the resigning employee. |

| Citizens carrying out their labor activities in the regions of the Far North and areas equivalent to it. | For this category of employees, additional benefits are provided, consisting of an extension of the period for providing benefits from three to six months. | This rule is met provided that the dismissed person is registered with the employment service no later than within a month after the dismissal. 4,5 and 6 payments are accrued provided that the laid-off worker was unable to find an official job within 4 months of active search. |

| Citizens performing seasonal work | For this category of employees, a slightly different procedure for paying severance pay is provided: the employer is obliged to notify the person being laid off no later than 7 days before the date of termination of the employment contract, and the severance pay in case of layoff is the average daily earnings for two weeks. | The procedure for calculating and timing of payment of severance pay when seasonal workers are reduced does not differ from those described above. |

| Citizens with disabilities | A category of workers that has some advantages. However, the law does not prohibit an employer from laying off such an employee. | When laying off a disabled person, the management of the organization is obliged to offer the dismissed person a list of vacancies. If such an employee moves to a position with a lower income, the employer retains the employee’s previous income for at least 1 month. |

| Pensioners | The main feature of the reduction of this category of citizens is the possibility of early retirement for people of pre-retirement age. | Payment of severance pay to a pensioner is made in a general manner that does not differ from the standard rules. |

back to menu ↑

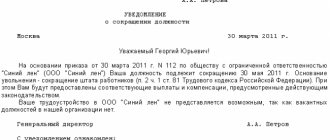

Order on payments upon layoff

In order for compensation to be paid during staff reduction, the employer issues an order. There is no specific form for its preparation, so it can be developed by each organization in its own way.

An order of dismissal with payments is the basis for the accounting department to calculate the required compensation. No additional documents are required from the employee.

When completing the paperwork, the main thing is to correctly write the reason for dismissal with reference to the required article, and also write down the following wording: “with the provision of severance pay.”

The rules for drawing up a document on the payment of compensation are similar to those used when drawing up other orders. It is drawn up on the organization’s letterhead with its name, details, as well as the paper number and date of compilation. You can download a sample order on this website.

The order is signed by the head of the enterprise, and then handed over to the employee for review. He must confirm the fact of reading with his signature.

If the employee refuses to read and sign, in front of two witnesses the order is read out loud to him and a special report is drawn up. In a controversial situation, the document is considered confirmation that the dismissed employee has familiarized himself with the order, in accordance with the requirements of the legislation of the Russian Federation.

The benefit described is one of the mandatory compensations that all laid-off employees can receive. It is calculated on the basis of a person’s average salary, but internal company documentation allows a different amount to be determined.

The employer is obliged to pay the money at the time of dismissal of the person, otherwise each day of delay is fraught with the accrual of penalties for him.

The severance pay in case of layoff depends on the average earnings for the year preceding the termination of the relationship. The amount is different for each person. The article will tell you how to calculate severance pay during a layoff and in what order it is paid.

Payment for the second and third months

The provisions of Article 81 of the labor legislation indicate that the transfer of the benefit in question for the initial monthly period is made to all citizens. No exceptions are set here. To receive funds for the next period, you must meet certain conditions:

- the reason for the termination of the relationship is that the staff is being reduced;

- The citizen was unable to find a new place of work within a couple of months.

Payment for the next period is also established, equal to a month. This situation also assumes that the following conditions are met:

- formalization of termination of the contract as a result of layoffs;

- a couple of weeks after the situation in question, the person contacted the Labor Center and was registered as needing work;

- no job was found within a three-month period;

- there is a decision formalized by the employees of the employment center that payment should be provided for the period in question.

A citizen should independently contact the company management to receive payments. It has been established that for the first monthly period, payment is made on the day of termination of the relationship, the remaining periods provide for compliance with the provisions of the documentation.

In particular, for the second month, the presence of an application and a copy of the work book, which states that the person is not re-employed, is taken into account. You will also need to bring an act of identification.

In the third month, you will need to add a solution developed by employment service employees to the above list.

Terms and procedure for payment

At the end of the last working day, settlement transactions and funds are issued. In addition, at the same time, other payments due to the person in accordance with labor legislation are also transferred.

In this situation, there is no need to take certain actions, including no need to write statements. This indicates that the management of the enterprise independently carries out the accrual process and issues funds to the citizen.

For the payment of benefits for the second and third time periods, the date determined by agreement of the parties is taken into account. Often this day is the transfer of funds as wages or advance payments. Another date may also be specified.

Speaking about the procedure for making payments, it is worth pointing out that for the first month, accruals are realized together with the calculation of earnings and other payments. The second and third periods require the provision of a work book, which indicates that the person has not found a new place of work.

It is important to note that if a citizen has a job, only the period during which he did not work will be subject to payment.

Payment for the third period is provided on the condition that the person is registered with the relevant authority as unemployed and lacking work. To receive money, you need to obtain a certificate issued by employees of the employment center. For the rest of the time, exceeding three months, funds are issued provided that the person worked in the northern territory.

How much is paid in case of staff reduction?

The amount of payment is specified in Article 178 of the Labor Code of the Russian Federation. In the event of a layoff, the employee receives one average monthly salary on the day of dismissal. That is, he is compensated for the first month’s pay after dismissal. It is assumed that during this time the person will find a new job.

If certain conditions are met and the person is not employed in the subsequent months after dismissal, he can receive two more monthly earnings (for the second and third months). They are calculated according to the same rules as for the first month after leaving.

The amount of severance pay may be increased compared to that prescribed in the Labor Code of the Russian Federation, but cannot be reduced. The employer, on his own initiative, can assign a payment in a larger amount, having previously fixed this norm and the increased amounts in local internal documentation.

If no company acts provide for an increased amount of benefits, then the employee receives the amount prescribed by Article 178 of the Labor Code of the Russian Federation.

The calculation of earnings for severance pay is carried out in accordance with the Regulations to Resolution No. 922 of December 24, 2007.

We recommend reading about the payment of severance pay upon liquidation of an enterprise.

How are payments calculated for the second and third months?

For the first month upon dismissal due to staff reduction, every dismissed employee receives benefits under clause 2 of Article 81 of the Labor Code of the Russian Federation, without exception.

Payment for the second month is received only by citizens for whom the following conditions are met:

- A person was fired due to staff reduction.

- In the first two months after leaving, the person did not find a job in another organization.

Citizens receive payment for the third month

- The dismissal is framed as a layoff.

- Within two weeks after the termination of the employment contract, the person registered with the employment center.

- In the first three months after leaving, the person did not get a job, even with the help of the central employment center.

- There is an official decision from the employment service on the need to issue severance pay for the third month.

To receive funds, a citizen must contact the employer independently.

If for the first month management pays money on the day of dismissal, then for the second and third - only after the redundant has presented the relevant documentation:

- for 2 months - an application, a copy of the work record book, which shows the absence of new employment, a passport;

- 3 months in advance - application, copy of work record book and decision of the employment service, passport.

Terms and procedure for payment according to the Labor Code of the Russian Federation

On the last working day, a person receives all payments provided for by the Labor Code of the Russian Federation - salary, vacation pay compensation, severance pay for the first month. The employee does not need to perform any actions to receive funds. The employer himself issues the required amount on the basis of the Labor Code of the Russian Federation.

The deadline for payment of benefits for the second and third months is on the nearest day of payment of wages for the enterprise after the presentation of the necessary documents by the laid-off employee.

Calculation procedure

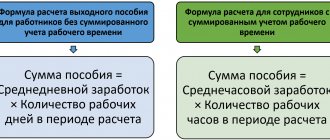

To pay the money, you will initially need to make benefit calculations. In this case, the formula applies:

P – amount of severance pay;

H – quantitative expression of days that occurs in the month following the day of termination of the employment relationship;

SZ is the average value of the earnings of a dismissed person.

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

When a citizen has worked the standard time in full during the settlement period, it is established that the average payment cannot be less than 1 minimum wage. This minimum is intended to determine wages.

In a situation where a citizen’s working time is subject to recording in daily terms, the average earnings are determined using a different formula. It is presented like this:

SZ – average value of earnings;

Z – the amount of a citizen’s salary for the time worked in the billing period;

BH is a quantitative expression of days actually worked.

It is worth pointing out that the calculation includes bonuses and remuneration.

Personal income tax

Such benefits are taxed if their amount is more than 3 times the average salary. Such payments may be accrued if the internal regulations of the organization determine an increased salary in the event of leaving.

When such benefits are calculated only in accordance with the law, the payment amount is not subject to personal income tax deduction. In addition, when paying “3 salaries”, insurance premiums are not calculated from this amount.

If an amount higher than three times the salary was credited, then compulsory insurance-type contributions should be deducted from the specified amount and transferred to the fund. If this is not done, serious problems may arise.

What payments are taken into account for calculation purposes?

To establish the amount of average earnings, you will need to determine the period used for the calculation, as well as the total designation of income during this time. The calculation period takes into account a period of 12 months. The year preceding the termination of relations with the employee is taken into account.

For example, when dismissal on the basis in question is made in mid-January 2021, the calculation period should be considered the beginning of January 2021 and the end of December of the same year. Please note that the month in which the relationship is terminated will not be taken into account.

The exception is the situation when the reduction is made on the last day of the month.

When calculating the average level of earnings, you will need to establish what time is considered calculated and add up the citizen’s income for the specified period. Everything related to wages is subject to accounting:

- earnings in monetary terms;

- bonuses, reflected as a percentage or a fixed amount, related to work activities;

- various types of incentive payments, which are awarded depending on the results of work.

The charges take into account the regional coefficient, which increases the amounts. However, this value does not apply to all regions of the country. This depends on the region of residence of the citizen and the location of the company where he works.

When calculating the average salary, the following amounts are not taken into account:

- payment of compensatory value, for example, to pay for housing, study;

- social benefits, for example, maternity benefits;

- financial assistance paid on various grounds;

- vacation payments;

- payment for business trip time;

- other accruals that depend on the average wage.

A period of one year is used for calculation. The time preceding the calculations is taken into account. Which benefits will be taken into account is reflected above. There is no need to take into account the time while the person was on or was on a business trip.

Example of calculating severance pay

To understand the situation, you will need to consider a specific example. The citizen was fired due to staff reduction on December 12, 2018.

The said day is the last day he worked for the company. The man worked according to a five-day work week.

The billing period is allotted 205 days, while the amount of all payments for this time is 150.7 thousand rubles.

It is necessary to take into account the amount of average earnings for the period from the beginning of December 2021 to the end of November 2021. Provided that the collective agreement does not provide for other calculation rules.

Downsizing procedure

Before considering the payments that an employee will receive, it is necessary to understand the procedure for dismissal to reduce the number and staff in stages.

- The company's management decides to reduce the number of employees.

- In case of mass layoffs, the trade union and employment agency must be notified 3 months in advance.

- 2 months before the date of dismissal, the employee must be familiarized with the layoff order against signature.

- According to Part 1 of Article 180 of the Labor Code of the Russian Federation, before dismissal, the employer offers the laid-off persons to take other positions in the organization. The employee will be notified of any suitable vacancies up to and including the last day of work. If an alternative for the person is not found, then an order is issued with a mandatory indication of the date of dismissal.

- On the last day of work, which is considered the day of dismissal, a work book and other documents are issued in accordance with Article 84.1 of the Labor Code of the Russian Federation.

- In accordance with Article 178 of the Labor Code, on the day of layoff, the employee must receive a full cash payment, incl. payment in the amount of one average salary per month (AMS).

Main conditions

If a person is fired due to layoffs, the manager makes compensation provided by law. This procedure is established by Article 140 of the Labor Code of Russia.

In such a situation, the following must be paid:

- unpaid official salary;

- compensation for vacation days that were not wasted;

- severance allowance;

- wages for two months, during which the worker must find a new job, but if problems arise, this period is increased to 3 months;

- other payments determined by the signed employment agreement.

The employee must receive all of the above payments, with the exception of wages for the next three months, on the last working day.

Funds are credited based on the average income for 1 day of work .

The average monthly salary is calculated by the accounting department using a special form. As noted in Art. 180 of the Labor Code of Russia, the boss must inform the worker about the imminent severance of business relationships due to staff reduction or closure of the company three months before the end of the employee’s duties.

The employer notifies the worker of upcoming changes by letter at least two months in advance, this is established by law. The company may also offer another position or other solutions to the problem, it all depends on the management.

For example, an employee may not wait for dismissal or closure of the company and leave earlier, which is not prohibited by law. You can always reach an agreement with your boss if you have a good relationship.

To determine the calculation period for the purpose of issuing compensation, the final 12 months before the reduction are used.

ATTENTION! It should be emphasized that if a person leaves at the end of the month, this month is considered the last month in the billing period.

If an employee stops working on the thirty-first of August 2018, then the period from the first of September 2021 to the thirty-first of August 2021 is taken for calculations. If an employee held a certain position for less than a year, then the calculation is based on the period during which the worker actually performed his duties.

For citizens who work seasonally, average earnings are calculated for two working weeks. By multiplying the average monthly salary per day by the number of days, we obtain the amount of compensation indicated above.

The manager and the employee are obliged to take into account the powers and interests of each other when finalizing the end of the business relationship. If management violates your rights, immediately contact the court with a statement.

What funds are due to an employee upon dismissal?

Payment after layoff of an employee is carried out as follows: as a general rule, all dismissed workers are paid wages for the last month worked.

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

Upon dismissal, it is calculated as usual, including all allowances, coefficients, and bonuses. Failure to accrue one of the standard points is grounds for contacting the labor inspectorate;

A “redundant” worker has the right to count on additional payment from the employer - severance pay in the amount of the salary, financial assistance until official employment.

Compensation for the first month

On the day of full payment, the laid-off employee also receives severance pay for the first month of unemployment.

Benefits for the period of employment due to staff reduction are issued as if in advance (in advance), but if you are officially employed within a month after dismissal, they do not need to be returned.

This is an indisputable guarantee - compensation for the layoff and for the inconvenience caused by this fact.

Procedure for paying severance pay in case of layoff for the second month

Paying a second benefit upon redundancy is a very common occurrence. A laid-off employee who has not found a job 2 months after dismissal has the right to receive from the employer’s funds another payment for the second month in case of staff reduction in the amount of his SPM at this place.

The Labor Code of the Russian Federation does not explain the procedure for paying benefits for the second month, which is why misunderstandings and disputes often arise. In particular, citizens are interested in the question of how to get money for the second month of layoff. Let's look at everything in order.

Redundancy benefits for the second month have a intended purpose - financial support for an unemployed person dismissed from the company. Accordingly, the person must have the right to payment of severance pay for the second month upon reduction and have it documented.

The simplest evidence in this case will be an “empty” work book. Those. one in which, after leaving a given company, there is no record of employment in another organization.

The former employer cannot mobile check the employment of a laid-off employee, so situations where a working person receives a second payment upon layoff are not uncommon. There is no liability for such deception for those dismissed.

Every expense transaction of the company must be justified.

For a tax audit, a copy of the work record is not a justification for issuing large sums from the cash register.

Payment of redundancy benefits for the second month is carried out based on the written request of the former employee.

There is no unified form, so any option containing:

- Details of the parties in the header in the format “to whom - from whom”.

- Demand for payment of money.

- Indication of the reason for payment.

- Date, personal signature and transcript of the recipient.

Director of Tort LLC I.I. Petrov

From the former baker P.P. Ivanov, living ... (address), telephone,

I was laid off from the company on 02/01/16. Until now I have not found a job. I provide my work record as confirmation. I ask you to pay me compensation in the amount of average monthly earnings for the period from 03/01/16 to 03/31/16, provided for in Art. 178 Labor Code of the Russian Federation.

Ivanov P.P., personal painting, date

The application is sent to the HR department. The direct decision to issue money is made by the financially responsible person authorized in this company: director, chief accountant, head of the personnel department, etc.

The application is marked with an authorization visa in the format “to issue, prepare an order.” But how is severance pay paid in the case of a layoff for the second month? The answer is quite simple.

Funds are issued by order of the employer, also drawn up in free form. Funds are transferred by cash order or by payment order if the transfer is made through a bank .

We hope that in this paragraph you have found the necessary information about when severance pay is paid when reducing staff for the second month, as well as to whom it is due.

Payment for the third month

Not everyone can extend the forced “leave” due to layoffs and receive benefits for the third month from the employer.

- complicated procedure for confirming unemployment;

- lack of a unified legislative basis for payment; the decision is unique each time.

Payment for the third month in case of staff reduction differs from the second one mainly in that the decision to give a person money from the employer’s funds is made by the employment authorities. Objective criteria remain in the background, because The SZN inspector independently assesses whether a person deserves benefits or not.

To begin with, in order to simply qualify for such payments after laying off an employee, you need to:

- When resigning, be sure to pick up your work book with the last entry “dismissed on the basis of clause 2, part 1, article 81 of the Labor Code of the Russian Federation,” copies of the notice and order of layoff certified by the employer.

- Within 14 days from the date of dismissal, register with the employment service by providing the above documents.

- Do not miss SZN events and meetings, respond to all offers, be able to justify your refusal of vacancies (if suitable ones are found).

By the way, registering with the employment authorities does not change anything when receiving payments for the second month. Refusal to provide the employer with a certificate of employment from the SZN will not be recognized as grounds for refusal to pay maintenance.

However, the legislator does not stipulate the timing of payment of severance pay in case of reduction for the third month.

The certificate is mandatory; the employer is subject to administrative liability for evading payment of severance pay for the third month upon layoff.

What payments are due when an employee is laid off in 2018?

The employer must comply with the strict norms of the Labor Code of the Russian Federation; it is important not only to legally terminate the employment relationship with hired employees, but also to fully accrue all required payments upon dismissal due to staff reduction. Basic and mandatory accruals for 2021: severance pay, compensation for unspent vacation, salary - are made based on the expiration date of the cooperation agreement. These payments for the period of subsequent employment help a person during the period of active search for a new job.

Severance pay

Type of monetary payment - severance pay upon dismissal, assigned to a hired employee in connection with a reduction, as compensation for subsequent lost income. The accrual is equal to the average value of the employee’s monthly earnings. Severance pay upon dismissal due to staff reduction is retained for the period of further job search, for a period of no more than two months from the date of reduction.

Compensation upon layoff for unused vacation days

The second guaranteed payment upon layoff is monetary compensation for unused days of paid leave. If in the same year in which the dismissal occurs, an employee has “unfilled” days of paid vacation, he must be reimbursed this amount in cash equivalent. The accrual occurs regardless of the reason for termination of the employer’s contractual obligations with the employee. Compensation is subject to income tax and is added to the calculation of severance pay.

Earnings for full time of work before dismissal

When dismissed due to redundancy, the employee is generally paid wages for the days actually worked in the month. This income remains the main one and constitutes the bulk of compensation. The remaining additional payments are calculated from the amount of this payment. The Labor Code of the Russian Federation, under any conditions of termination of the employment contract, guarantees compensation for this accrual. Payments are made in full on the day of dismissal.

Who is entitled to severance pay?

Such benefits after reduction are due:

And it’s illogical to hire a “conscript” employee if layoffs are coming in the company.

Payments beyond the statutory deadlines are made as follows:

- in case of early dismissal, the employee is paid additional compensation for the period from the date of dismissal to 2 months of notice;

if a person gets a job, then the payment for the second month after the layoff is calculated proportionally for the days of this month when he did not work. The basis for calculation is the date of admission to another organization.

What to do if the employer does not pay severance pay

If an employee is not paid benefits after being dismissed due to staff reduction, he can send a complaint:

- To the labor inspectorate;

- To the prosecutor's office;

- To the court.

Initially, the employee can submit an application to the labor inspectorate or the prosecutor's office. They will order an inspection of the employer, and when a violation is confirmed, they will impose an administrative fine and an order to pay the debt. If this does not help, and the payment is never made, then you can collect documents for the court.

A claim against an organization must be filed at its location. The exact address can be found in the extract from the Unified State Register of Legal Entities. The court will not consider the application if it is completed incorrectly and does not contain all the necessary documents.

Attention! The employee is not charged for legal expenses in disputes in the field of labor law.