Do you know how to correctly indicate the purpose of a business trip? An example can, of course, be easily found on all sorts of professional forums for accountants or HR specialists. But copying someone else's experience is not always justified.

The regulations do not contain a list of purposes for business trips. However, it is worth formulating the reason why an employee travels in such a way that travel and daily expenses can be reflected in accounting to reduce taxable income.

To do this, it is important to consider a number of points.

Which ones?

Practicing accountants easily give various examples of business trip purposes and point out the following:

- An employee's business trip must clearly be in the best interests of the company. The purpose of the business trip is formulated so that it is clear: the “travel” is beneficial for the company, directly or indirectly contributes to the enterprise earning profit, increasing the volume of activities, and improving the quality of goods and services. An employee of an organization cannot be sent on a business trip with the task of “resting,” “recuperating,” or “recovering.” For this purpose, vacations are provided - annual or for health reasons.

- The purpose of the business trip should not contradict the employee’s job description. Thus, an accountant cannot be sent on a business trip to negotiate with clients. And the commercial director of a company cannot be sent to another city for the purpose of “transporting employees.”

- The reason for a business trip must correspond to the duration of the “travel” and its route. If the purpose of a business trip is, for example, participation in an exhibition, an employee of the organization is obliged to “move” in the opposite direction within 24 hours after the end of the event.

- You should be extremely careful when justifying business trips on weekends. If a company employee goes to another city, for example, for negotiations on Monday, and the travel time is one day, then he can leave no earlier than Saturday evening. Otherwise, the cost of tickets or fuel and lubricants cannot be classified as expenses.

- It is better to avoid general language. It is important to indicate why exactly an employee of the organization is sent to work outside his place of permanent duty. Otherwise, controllers may have doubts about the legality of attributing travel expenses to tax accounting.

- The purpose of the trip should be formulated in such a way that one can make an unambiguous conclusion about whether the assigned task was completed or not. After the trip, the employee will have to submit a report on the results and attach documents confirming the completion of the task. By the way, it is possible that the purpose of a business trip is not achieved. In this case, the employer requires an “explanatory statement” from the employee indicating the reasons why the official task could not be completed. If you have this document, travel expenses can be taken into account for tax purposes.

- If the purpose of the business trip is extensive and consists of several tasks, it is important to also write down the individual tasks of the trip, the completion of each of which will also need to be confirmed.

- If a specialist’s work is of a traveling nature and moving to another locality is associated with the performance of everyday affairs, then such a “travel,” according to the Labor Code, is not recognized as a business trip at all.

Documentation of a business trip by car

The table provides a list of required documents depending on how the employee goes on a business trip: in the employer’s car or in his own car, receives rent or compensation for the use of his vehicle.

Required documents | Travel by car | ||

| employee | employer | ||

| rent | compensation for use | ||

| Lease agreement for a vehicle without a crew (Articles 642 and 643 of the Civil Code of the Russian Federation) | • | — | — |

| Certificate of acceptance and transfer of property for rent (letter of the Ministry of Finance of Russia dated June 15, 2015 No. 03-07-11/34410) | • | — | — |

| A document confirming the employee’s ownership of a car, for example, a copy of the title (Article 608 of the Civil Code of the Russian Federation; letter of the Ministry of Finance of Russia dated June 27, 2013 No. 03-04-05/24421) | •* | — | — |

| An additional agreement to an employment contract or a separate agreement on the use of an employee’s car in the interests of the employer, establishing the amount of compensation for the use of such property (Article 188 of the Labor Code of the Russian Federation) | — | • | — |

| Order on sending an employee on a business trip using a leased, personal or employer-owned vehicle (clause 3 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 - hereinafter referred to as the Regulations) | • | • | • |

| An official note and/or other document that confirms the actual length of stay on a business trip, for example a travel certificate with notes from the receiving party (organization or official) about the date of arrival (departure) of the employee to the place (from the place) of the business trip (clause 7 of the Regulations) | • | • | • |

| An advance report with attached primary documents confirming travel expenses during a business trip: receipts for fuel and lubricants, etc. (clause 26 of the Regulations) | • | • | • |

| A waybill containing information about the route during the business trip and the amount of fuel and lubricants consumed (letter of the Ministry of Finance of Russia dated September 23, 2013 No. 03-03-06/1/39406; Resolution of the Moscow District Arbitration Court dated April 8, 2015 No. F05-3450/2015 in case No. A40-108772/14) | • | • | • |

Note. *The written permission of the car owner to provide his property for rent by an employee can be used as a supporting document.

Accounting, payroll and reporting in a friendly service.

Try it for free

Can any employees be sent on business trips?

This is as important as the question of how to determine the purpose of a business trip. Examples of cases where an employer was fined for sending an employee to another city who should not have been sent on a trip are not isolated.

Before sending an employee to another city or country, it is important to consider the following:

- It is strictly forbidden to “equip for travel” pregnant women and minor workers (except for personnel employed in the creative field).

- An employee sent on a business trip must have an employment relationship with the employer. At the time of departure, a rental agreement must already be concluded, drawn up in accordance with applicable laws.

- There are categories of citizens who have the right to refuse business trips. It is permissible to send them to another city or country for official reasons only with their written consent.

Such persons include:

- Mothers of children under 3 years old.

- Parents or guardians of disabled people under 18 years of age.

- Citizens caring for sick family members, in accordance with a medical report.

- Mothers and fathers raising children under 5 years of age without spouses.

Employees who do not belong to these categories are subject to disciplinary liability for failure to comply with orders to go on a business trip. In some cases, you can even fire an employee who refuses to travel to another city on company business.

Procedure for registration of a business trip

First of all, the head of the company writes an order to send the employee on a trip in a personal car. It can be drawn up in free form or on T-9 form. After review, the employee expresses consent by signing the document. Additionally, you can issue a work assignment and a travel certificate.

The second stage is drawing up a waybill. This is a distinctive feature of business trips in a personal or company car. After this, the amount of the advance payment for gasoline and the citizen’s accommodation is agreed upon.

An employee returning from a trip must submit a waybill or expense report to the accounting department within three days. These documents contain information about the money spent. Checks and receipts must be attached to account for costs. If the advance amount is exceeded, the organization undertakes to pay the difference within three days. If there is a balance on the advance payment, the employee will have to return it.

List of documents

Using a personal car involves preparing the documents necessary to complete a business trip. These include:

- order to dispatch an employee;

- waybill;

- a copy of the vehicle registration certificate (confirmation of vehicle ownership);

- receipts and checks confirming expenses.

Additionally, a memo and an advance report can be drawn up.

What documents contain the purpose of the trip?

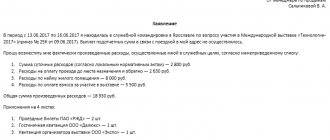

Until 2015, an employee’s trip was arranged:

- By order.

- Service assignment.

- Travel certificate.

- A report.

Currently, all characteristics of the “travel” are indicated in the order. The unified forms of “official assignment”, “travel certificate” and “report” have been cancelled.

To confirm the fact of the trip and the execution of the order, the following are used: tickets, waybills, checks for payment of fuel and lubricants, reports, explanatory notes, minutes of negotiations, certificates of training, concluded contracts, inventories.

From the composition and content of these documents it should be clear whether the designated purpose of the trip was achieved.

Let's look at how business travel tasks are determined for different categories of employees.

Driver's business trip

Sending an employee on a business trip is regulated by labor legislation. In the commented Letter, the Ministry of Finance on issues of application of the Labor Code of the Russian Federation will redirect the author of the request to the Ministry of Health and Social Development of Russia. And we will present our own thoughts on the problem under consideration. The opportunity to use the recommendations of the Ministry of Finance from the commented Letter and send the driver not on a business trip, but on a business trip, in order to painlessly write off the daily allowance paid to him as an expense under the simplified tax system on the basis of paragraphs. 13 clause 1 art. 346.16 of the Tax Code of the Russian Federation (business travel expenses), depends on the terms of employment contracts with these employees, collective agreements and local regulations (administrative documents) of the organization. A business trip is a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work (Article 166 of the Labor Code of the Russian Federation). The place of permanent work, as well as the nature of the work (mobile, traveling, on the road, etc.) are mandatory conditions that must be enshrined in the employment contract (Article 57 of the Labor Code of the Russian Federation). The specifics of sending employees on business trips are established by the Regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749 (hereinafter referred to as the Regulations). Clause 3 of the Regulations defines the concept of “place of permanent work”. This is the location of the organization (a separate structural unit of the organization), the work in which is stipulated by an employment contract. An employee’s trip to a separate unit of the organization located outside the place of permanent work is also considered a business trip. In the commented Letter, the Ministry of Finance sets a condition: in order for expenses in the form of travel allowances to be recognized as “simplified”, the corresponding trips of drivers must be documented as business trips . The Regulations list a number of mandatory documents that are drawn up when sending an employee on a business trip. The purpose of the employee’s business trip is determined by the head of the sending organization and is indicated in the job assignment, which is approved by the employer (clause 6 of the Regulations). Also, based on the decision (order) of the employer, a travel certificate is issued, which confirms the length of the employee’s stay on a business trip (date of arrival at the destination point(s) and date of departure from it (from them)) (clause 7 of the Regulations). Business trips abroad are not required without issuing a travel certificate, with the exception of sending an employee to CIS countries, at the border with which marks are not placed in the passport about crossing the state border (clause 15 of the Regulations). Unified forms of job assignment (N T-10a) and travel certificate (N T-10) were approved by Decree of the State Statistics Committee of Russia dated 01/05/2004 N 1. The procedure and forms for recording posted workers in sending and receiving organizations were approved by Order of the Ministry of Health and Social Development of Russia dated 09/11/2009 N 739n. Upon returning from a business trip, the employee is obliged to submit to the employer within 3 working days a written report on the work performed on the business trip, as well as an advance report on the amounts spent on the business trip and make a final payment for the advance payment for travel expenses (clause 26 of the Regulations). Regarding sending drivers on business trips, we give the following example of official explanations. The Letter of the Ministry of Finance of Russia dated 01.06.2005 N 03-05-01-04/168 (It should be taken into account that the Letter was issued before the appearance of Article 168.1 of the Labor Code of the Russian Federation) states that if truck drivers constantly work on regular intercity transportation, then such trips business trips are not recognized . In such cases, truck drivers are paid an increase to the monthly official salary (tariff rate) for a day of work on the road.

If the trips of truck drivers are not of a permanent nature and in each case are carried out by separate order of the employer, then these trips should be considered as business trips . A situation similar to that discussed in Letter N 03-05-01-04/168 may occur if the employment contract with the driver stipulates that his service area is, for example, the city where the company’s head office is located and the adjacent region (district, region, edge, etc.). Then, in the case of one-time assignments to destinations located outside the boundaries of the serviced region (for example, abroad), such trips can be processed as business trips. However, “simplified” workers who will try to overcome the absence in the closed list of their expenses for paying “non-travelling” per diems to employees with a traveling nature of work by arranging business trips for them should take into account the problems that arise when business trips are too frequent. For example, a posted worker retains his average earnings (Article 167 of the Labor Code of the Russian Federation). When calculating it, time is excluded from the billing period, as well as amounts accrued during this time, if the employee retained the average earnings (clause “a”, paragraph 5 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922). That is, with frequent business trips, at a minimum, wage calculations become more complicated. An important negative factor is the rationing of daily allowances for business trips for personal income tax purposes: the limit is no more than 700 rubles. for each day of a business trip in the Russian Federation and no more than 2,500 rubles. for each day of being on a business trip abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation). While daily allowances for traveling work are not standardized for personal income tax purposes.

Director

The work of the top officials of enterprises is often associated with “travel”.

A business trip for the director of a company, as a rule, is formalized not by an order, but by an order containing the phrase: “I’m leaving on a business trip for the purpose of...”.

The head of the company can go on a business trip, in particular to conquer new markets, search for clients, and conclude contracts for the supply of products. What would the purpose of the director’s business trip sound like in this case? Examples:

- conducting negotiations and concluding a contract with Firma LLC;

- holding negotiations with participants of the conference “Products of the Future” in Nsk “___”________ 20__;

- demonstration of samples of the product “Item-1”;

- presentation of goods for .

The top person of the company can also travel to another city or country to meet with existing clients of the company. For this case, HR specialists have already figured out how to write the purpose of the trip on the travel certificate. Examples:

- discussion of the terms of the contract for the supply of production equipment to Nash Friend LLC;

- agreement with Concern JSC on the procurement plan for the 2nd half of the year ____.

Company directors are sent from time to time to other cities or countries to “open a new branch of the company.” This formulation of the desired result is also acceptable in documents. However, in this case it is worth identifying both the goals and objectives of the business trip. Example:

“I’m leaving for Nsk to organize the work of a new structural unit.

Tasks:

- Studying the target market.

- Testing and hiring an employee for the position of branch manager.

- Coordination with the head of the branch of work plans for ___ year.”

Also, the head of a small company, like a specialist in the purchasing department, can go to another city or country in order to purchase new equipment, conclude contracts for the supply of raw materials, materials, components, and negotiate terms of cooperation with suppliers. In this case, the documents should also correctly indicate the purpose of the director’s business trip. Examples:

- conducting negotiations with Partner LLC on the purchase of a batch of goods “Thing”;

- concluding an agreement for the purchase of products from Pomoschnik LLC;

- purchase of “Machine” equipment;

- study of samples of the “Stuka” product from Manufacturer LLC.

How else can the purpose of a business trip of the company's chief executive be formulated? Examples:

- training;

- participation in an exhibition, seminar, conference” (attending events related to the financial and economic activities of the enterprise);

- professional development;

- development of new technologies;

- checking the quality of the department's work.

Sales Manager

In departments involved in the sale of goods and services, the purposes of business trips are usually specified in great detail. Employees receive detailed instructions in writing, indicating which tasks must be completed and which quantitative targets have been achieved.

First, the main purpose of the sales manager’s business trip is set. Examples:

- increasing sales volumes in the region;

- market research;

- negotiations with potential clients.

A “large” job assignment is divided into stages, and based on the results of each stage, the employee draws up a written report. A sales manager is often given the following “subgoals”:

- make visits to existing clients according to the visit schedule;

- visit potential customers in accordance with the meeting plan;

- collect information on the new market for the marketing department;

- visit competitors' outlets and conduct a comparative analysis.

Legislative regulation

Since 2015, the requirements for registration of business trips and business trips have changed, some points of the Regulations on the specifics of sending employees on business trips, approved by Resolution No. 749, have been canceled.

Until this moment, the following documents were used to register a business trip:

- order of the director of the company;

- a travel certificate, which was filled out according to certain rules: for example, the time of arrival and departure of the employee was necessarily noted;

- an official assignment, which also formulated the purpose of the trip and in which the employee compiled a report on the work done.

Since 2015, the last two forms have been abolished, although their use is not prohibited. No new forms were introduced. Many managers are of the opinion that their use is quite rational on the basis of local acts and inclusion in accounting policies. This is necessary for the correct accounting of money spent, obtaining information about the execution of orders during a business trip in accordance with the assigned task. Now, if the travel certificate is not filled out, the purposes and duration of the business trip are indicated in the order.

Also, if this is specified in local acts, a trip plan is drawn up, which indicates the details of the organization and the employee, as well as the timing of the trip, its goals, destination, specific tasks and stages of their implementation, which the employee gets acquainted with and signs, indicating that that he read the document. For some budgetary organizations and government bodies, the preparation of this document is mandatory in accordance with internal regulations.

Engineers, production staff

Business trips for these categories of employees are long-term, as they are usually associated with ensuring the efficient operation of machines, automatic lines, and robots.

It is also very important for engineers and workers to correctly formulate the purpose of the business trip in the travel certificate. Examples:

- installation, adjustment of equipment;

- training responsible employees to work with the production line;

- checking, testing the operation of machines;

- warranty repairs, service maintenance of devices supplied under Contract No.___ dated "___"__________;

- routine maintenance, equipment maintenance.

Many engineers go on business trips to communicate with colleagues and gain new practical knowledge. This is a very common purpose for business travel. Example:

- exchange of experience with developers of “Powerful” devices.

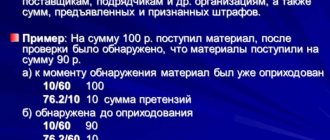

Accountant

Chief accountants travel to other cities to check the quality of work of accounting specialists, train employees, collect information, and summarize the financial and economic activities of the company.

An ordinary accountant can go on a journey to improve his skills, exchange experiences with colleagues, and take part in a meeting.

How can the purpose of an accountant’s business trip be formulated? Example:

- conducting an internal audit, checking the correctness of the financial and economic operations of the branch being reflected in the accounting records.

Any other purpose of the trip that corresponds to the accountant’s job description is also acceptable. Example:

- visit to accept cases.

Why is the purpose of a business trip important?

A business trip involves an employee traveling for a limited period of time outside the territory where his permanent place of work is located to complete a task issued by the employer (Article 166 of the Labor Code of the Russian Federation).

Two important conclusions follow from this formulation:

- the employee sent on the trip must be a full-time employee, signed under an employment contract, and work primarily in the same place;

- the concept of a business trip is not applicable to systematically carried out trips of persons whose work is carried out on the road or in the process of traveling (this clarification is even enshrined in a separate phrase in the text of Article 166 of the Labor Code of the Russian Federation).

The list of purposes for which a business trip may be required is not recorded anywhere, and, accordingly, the range of issues that can be resolved through a business trip is not limited by law.

But it is obvious that trips, called business trips, must be carried out to solve problems that are significant for the financial and economic activities of the employer. If this condition is met, the costs of such a trip can be easily taken into account in expenses that reduce the income tax base.

That is why the official purpose of the trip should be characterized in the formulation of its purpose. And the more precise and complete this formulation is, the better.

Agricultural workers

Farmers, agronomists, machine operators, livestock breeders, and poultry farmers are faced with the need to travel on business trips, perhaps much more often than “urban” specialists. Working in rural areas, they must constantly be in touch with “civilization”: purchase seeds, animal feed, attend exhibitions of national economic achievements, get acquainted with new technologies and, finally, sell products to city enterprises and individuals, market visitors.

In accordance with the objectives of a specific trip, the purpose of the trip of agricultural workers is formulated. Examples:

- purchase of fertilizers;

- obtaining permits;

- presentation of an investment project at a specialized exhibition;

- participation in a farmers' conference, exchange of experience;

- purchase of special equipment;

- sales of products at the city fair;

- delivery of a consignment of goods.

Driver

Another category of workers whose occupation involves frequent travel is drivers. Their responsibilities include transporting company employees, goods, valuables, and documents.

How to write the purpose of the trip in the order depends on the specific task. Examples for the driver:

- delivery of goods to (address);

- transportation of a commercial director;

- delivery of goods and materials, receipt of invoices.

What else might the purpose of a driver’s business trip “look like”? Examples:

- purchasing spare parts for car repairs;

- routine vehicle diagnostics;

- delivery of original transaction documentation.

Reimbursement of expenses

According to Art. 168 of the Labor Code of the Russian Federation, an employee can count on daily payments and compensation:

- travel to and from your destination;

- renting housing for temporary residence;

- other expenses upon agreement with the employer.

The amount of daily payments for business trips is determined by the boss. In addition to them, the citizen is paid wages for all working time spent on the driver’s business trip.

How to confirm expenses

To confirm expenses during a business trip, the employee must submit an advance report in form No. AO-1 to the organization’s accounting department. Attached to it:

- receipts from the hotel or receipt from the landlord;

- receipts for fuel and lubricants;

- route sheet;

- memo.

All these documents confirm the duration of the trip and the employee’s expenses.

If you need repairs while traveling

If a car breaks down, the employee retains documents confirming expenses for car repairs en route (receipt). However, the employer cannot be sure that the damage actually occurred during a business trip. Therefore, such cases are sometimes considered controversial.

Researcher

Scientists, researchers, experts, theorists from various fields, teachers of secondary and higher educational institutions go on business trips to participate in conferences and competitions, exchange experiences, study unique sources, visit specialized exhibitions and museums, and participate in archaeological excavations.

How can the purpose of a business trip be formulated? Example:

- Collecting information for scientific work on the topic (title).

Or:

- Studying original documentation.