At the end of each quarter, before the end of the next month, employers who are tax agents submit a Calculation in Form 6-NDFL. This calculation contains generalized indicators for accrued income, amounts of calculated and withheld income tax, as well as indicators for the reporting quarter broken down by date.

Any income paid to an individual and subject to income tax is reflected in 6-NDFL, sick leave is no exception. How to reflect paid temporary disability benefits in the 6-NDFL Calculation, what types of benefits do not need to be included in the Calculation, and how to fill out the 6-NDFL form - all this in our article.

Reflection of sick leave in 6-NDFL

Do all payments for sick leave need to be reflected in Calculation 6-NDFL? Obviously, only those that are subject to income tax need to be included in the report. Otherwise, the control ratios on line 040 will not be met, and the personal income tax amount will not be calculated correctly.

Only one type of payment for temporary disability is exempt from income tax, which is not reflected in 6-NDFL - maternity benefits (clause 1 of Article 217 of the Tax Code of the Russian Federation). Other types of benefits, including sick leave for child care, must be shown in Calculation 6-NDFL.

Sickness benefits are not wages - they are a social guarantee provided to employees by law, not related to the performance of work duties. The benefit is calculated on the basis of a certificate of incapacity for work, which the employee must provide. After receiving the certificate, the employer is given 10 calendar days to accrue sick leave, then he must pay the benefit on the next payday.

The day the employee pays sick leave or transfers benefits to his bank account will be considered the date of receipt of income in accordance with paragraph 1 of paragraph 1 of Art. 223 Tax Code of the Russian Federation. On the same day, income tax from sick leave must be withheld by the tax agent (clause 4 of Article 226 of the Tax Code of the Russian Federation).

For personal income tax withheld from sick leave, there is a special period during which the employer must transfer the tax to the budget: no later than the last day of the month when sick leave benefits are paid to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation). If the last day of the month coincides with a weekend or holiday, the payment deadline moves to the next working day.

Let's look at how to reflect sick leave in 6-NDFL:

- In the first Section, income in the form of hospital benefits is included along with other income. Accrued and withheld personal income tax is reflected in the same way.

- In the second Section, payment for sick leave and personal income tax on them is shown separately from income with other deadlines for transferring tax (clause 4.2 of the Procedure for filling out form 6-NDFL, approved by Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/450).

Filling rules

Maternity pay belongs to the category of income from which there is no deduction to the state.

In form 6-NDFL, benefits related to childbirth are not indicated either in the first or second part of the declaration.

Filling Features

If a young mother, after filing a sick leave, continues to work, even part-time, she is not entitled to maternity benefits, because she receives a stable income.

Current legislation does not provide for the simultaneous transfer of wages and benefits. A woman needs to decide what type of income she is most interested in.

When compiling 6-NDFL in relation to maternity benefits, the following is determined:

- if the expectant mother works officially until the moment of birth, the declaration is drawn up according to the generally established template;

- If a young mother decides to go on vacation after the birth of a child, information about the accrual of social benefits to her is not reflected in the reporting.

If the head of the enterprise decides to make additional payments, in addition to maternity funds, tax will be withheld from them.

Data on additional remuneration must be indicated in the second part of the declaration.

When drawing up a declaration, it is necessary to take into account that birth assistance in an amount not exceeding 50,000 rubles is not taxed.

The sick leave certificate, which is the main document for calculating financial assistance, is not included in the Form 6-NDFL declaration, because This type of benefit is not taxed. The form includes only those amounts that are voluntary additional payments by the employer. The tax office will withhold tax from this amount and transfer it to the state treasury. The total amount of remuneration is indicated in the first part of 6-NDFL. The second part needs to transfer data when the rewards have been completed.

Sick leave in 6-NDFL. Filling example

When paying for sick leave, different situations are possible, so we will give several examples of filling out the Calculation. Let's take the following conditional data as a basis:

Ostrov LLC paid 1,000,000 rubles in wages to employees for 9 months of 2021, and personal income tax was calculated and withheld from it in the amount of 130,000 rubles. In the 3rd quarter, employees were paid salaries for June, July and August, 100,000 rubles in each month of the quarter. In addition, one employee was awarded temporary disability benefits. Let's look at some options for how to reflect sick leave in 6-NDFL.

Example 1

The employee provided sick leave on September 2, and the benefit was paid to him along with his salary for August - September 5. The benefit amount is 10,000 rubles, personal income tax is 1,300 rubles.

We fill out 6-NDFL for 9 months:

In Section 1 of Form 6-NDFL, we will include sick leave together with wages for 9 months.

Line 020 – total income 1,010,000 rubles (1,000,000 + 10,000),

line 040 - accrued tax 131,300 rubles (130,000 + 1300),

line 070 - withheld tax 131,300 (130,000 + 1300).

In Section 2, sick leave must be reflected in a separate block, since the deadline for paying personal income tax on wages is the next day after the payment of income, and on sick leave – the last day of the month when the benefit was paid. In 6-NDFL, we will reflect the sick leave as follows:

Line 100 – sick leave payment date 09/05/2016,

Line 110 – personal income tax withheld 09/05/16,

Line 120 – the deadline for paying personal income tax on sick leave is 09.30.16,

Line 130 - benefit amount is 10,000 rubles,

Line 140 – tax amount is 1300 rubles.

Answers to basic questions about filling out form 6-NDFL

If an organization is in a special tax regime, the so-called “simplified” tax regime, it is impossible to reduce the tax when taxing child and maternity benefits by this amount. Everything is very simple: this type of benefit is paid from the Social Insurance Fund by the state, and such expenses cannot be counted as expenses of the organization.

However, the legislation on taxes and fees provides for many benefits and exemptions both in relation to certain categories of taxpayers and types of income. Let’s find out what is taxed and whether sick leave for pregnancy and childbirth is exempt.

What payments are due at the birth of a third child With the birth of a third child in Russia, a family receives the status of a large family. Mother and father have the right to count on government support. The state offers monetary compensation and...

When receiving money, it is difficult for an employee to understand whether personal income tax has been calculated, since the benefit is calculated based on earnings over a fairly long period. Over the course of 2 years, the salary could change several times. However, there is no need to doubt the correctness of the calculation of PBiR.

sick leave in 6 personal income tax example

Example 2

Let's look at filling out 6-NDFL with an example of sick leave and vacation. Let's leave the previous data unchanged, but let's assume that in addition to sick leave, the employee was also paid vacation pay in September. The date of payment of vacation pay is September 15, the amount is 15,000 rubles, personal income tax is withheld - 1,950 rubles.

In Section 1, we include the total amount of salary, sick leave and vacation pay:

Line 020 – total income 1,025,000 rubles (1,000,000 + 10,000 + 15,000),

line 040 - accrued tax 133,250 rubles (130,000 + 1300 + 1950),

line 070 - withheld tax 133,250 (130,000 + 1300 +1950).

We fill out Section 2. The deadline for transferring personal income tax from vacation pay and sick leave is the same - this is the last day of the month of payment, but the dates for receiving income are different. Therefore, we reflect salary and sick leave in exactly the same way as in example 1, and enter vacation pay into 6-NDFL as a separate block:

Line 100 – vacation pay was paid on September 15, 2016,

Line 110 – personal income tax withheld 09.15.16,

Line 120 – personal income tax payment deadline is 09.30.16,

Line 130 - the amount of vacation pay is 15,000 rubles,

Line 140 – tax amount is 1950 rubles.

Part-time job

A fairly common situation is when a woman continues to work, but with less workload. It should be noted that in this case she cannot claim to receive two payments (salary and maternity benefits) at the same time. She should choose one of them. If a pregnant employee prefers to receive wages, she is equal to other employees and is subject to the general rules for issuing a 2-NDFL certificate.

To summarize, it should be said that benefits for pregnancy and childbirth are fully paid by the Social Insurance Fund and are not subject to income tax. Therefore, the accountant should not include these payments in forms 2-NDFL and 6-NDFL. If the employee continues to work in the organization, she is subject to the general procedure for filling out reporting forms.

sick leave in 6 personal income tax example 2

Example 3

Let's consider another situation: an employee handed in sick leave on September 29, 2021. The allowance was accrued and paid to him on October 5 along with his salary for September. How to show sick leave in form 6-NDFL in this case?

This sick leave will no longer be included in the calculation for 9 months; it will need to be included in 6-personal income tax for 2021. In this case, on line 100 we will indicate the date of payment of sick leave - 10/05/16, on line 110 - the day when the tax was withheld - 10/05/16, and on line 120 - the deadline for transferring personal income tax - 10/31/16.

Rolling sick leave

In case of illness or injury of various nature, an officially employed employee is sent to the clinic. At a medical institution, the local doctor makes a diagnosis and refers you to another specialist for sick leave. This document is very important not only for the sick employee, but also for his employer.

The form is an official confirmation of the onset of the disease. This means that the employee has the right to spend some time at home. During the days of forced “vacation”, the company’s accountant is obliged to calculate the patient’s benefits for the period of incapacity for work.

If an employee wishes to stay at home during illness and has not filed an official sick leave in accordance with the law, days spent off duty will be considered absenteeism and will not be paid.

If an employee fell ill in one month and began his job duties during that month, then this is a regular sick leave. And if the sick leave ends in the next month or even in the new year, it will be considered rolling (that is, the sick leave goes to another year).

Example. The employee issued a certificate of incapacity for work on March 22, and left on April 9 - this is a rolling sick leave. If the illness lasted from December 25 to January 18, then the recovery period ends in the new year.

Is income tax withheld from such a certificate of incapacity for work?

You can find out how many days sick leave for pregnancy and childbirth is provided for and whether it can be extended here.

After this, mutual settlement occurs between the enterprise and the Social Insurance Fund, that is, the Fund counts the benefit paid by the employer against future insurance contributions.

Thus, on the one hand, sick leave for pregnancy and childbirth is an increase in the employee’s funds, and on the other hand, it is a payment made by the enterprise. In view of this, as a result of such an operation, an object of taxation may arise only for 2 types of mandatory payments:

- Personal income tax, since the object of taxation is the income of an individual (Article 209 of the Tax Code of the Russian Federation).

- Insurance premiums, since the basis for their calculation is payments in favor of employees (subclause 1 of clause 1 of Article 420 of the Tax Code of the Russian Federation).

However, the legislation on taxes and fees provides for many benefits and exemptions both in relation to certain categories of taxpayers and types of income. Let’s find out what is taxed and whether sick leave for pregnancy and childbirth is exempt (read more about issuing sick leave for pregnancy and childbirth here).

Are taxes taken from benefits or not?

Maternity benefits, being a citizen’s income, are included in the subject of personal income tax taxation. At the same time, the basis for calculating the amount of withdrawal to the budget is reduced by non-taxable payments.

According to paragraph 1 of Article 217 of the Tax Code of the Russian Federation, no tax is levied on the amounts of state benefits. These benefits include sick leave for pregnancy and childbirth. This means that this benefit should not be subject to personal income tax. And the employer is obliged to pay the entire accrued amount of sick leave without withholding tax.

Levying another type of tax (other than income tax) on the sick leave amount would entail double taxation. And taxation of the same object is not allowed.

This follows from the provisions of part two of paragraph 1 of Article 38 of the Tax Code of the Russian Federation, which stipulates that any tax must have an independent object.

Are insurance premiums paid?

Insurance premiums are not taxes, but they are also considered mandatory payments. For the purposes of their calculation, the Tax Code of the Russian Federation also establishes a list of non-taxable payments.

Thus, the norms of subparagraph 1 of article 422 of the Tax Code of the Russian Federation relieve the employer of the obligation to charge insurance contributions for any types of security within the framework of compulsory social insurance. At the same time, one of the types of such support is sick leave for pregnancy and childbirth.

Thus, the benefit, which is accrued to pregnant women for a period of 140 days, is not subject to either insurance contributions or personal income tax.

https://www.youtube.com/watch?v=2EOLdMNg7UI

What it is

Every year the Russian government tries to modernize the procedure for supporting families with newborn children. The most effective support is of a material nature. The corresponding benefit is a one-time payment that can be assigned if a person decides to go on maternity leave.

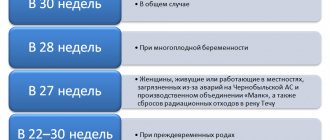

In this case, the time frame for the rest itself may be as follows:

The above deadlines are fully disclosed in the provisions of the current federal legislation. In the vast majority of cases, the benefit amount reaches 100% of the person’s average salary over the last 2 years.

It is worth noting that such funds can be obtained:

- at the place of permanent work activity;

- in the territorial branch of the state body responsible for social protection of the population;

- in any regional branch of the FSP.

If, depending on a variety of reasons, the average salary is less than the minimum wage established in the Russian Federation, then the amount of the benefit is rounded up to the minimum established in the region.

Basic formalities

Notes on the law

Transfer of financial support in favor of citizens who have children is carried out at the expense of state, regional or municipal budgets. Each territorial branch of the FSS of the Russian Federation is responsible for monitoring the payment of funds. The overwhelming majority of child benefits are paid from the Fund.

Not long ago, the Federal Tax Service of the Russian Federation took the position that benefits should be subject to personal income tax. However, thanks to recent amendments, the tax legislation has included an exclusive list of categories of persons who may not pay taxes. Now parents may not pay tax on benefits for children under 1.5 or 3 years of age.

Possible situations

Those amounts of income that entail the direct emergence of benefits of a material nature must be subject to personal income tax, except for the cases specified in Article 217 of the current Tax Code. Maternity benefits are included in this exclusive list of non-taxable income of a person.

The legislator leaves in favor of employers the opportunity to support their employees without paying personal income tax. In accordance with the provisions of Article 217 of the Tax Code, financial assistance cannot be taxed, the amount of which is less than 50,000 rubles within a year from the actual moment of the birth of the child.

Under these circumstances, the employer must make a one-time transfer of funds in favor of the employee within the regulated limits

It is important to ensure that the child's father has not previously received the same support. Individuals can use the allocated amount of funds in any way they wish.

In each specific case, the benefit is transferred to the account of one person who directly cares for the newborn child.

These may be the following categories of persons:

- parents;

- Grandmothers and grandfathers;

- official guardians.

The corresponding benefit is assigned at the time of the birth of the child and ceases to be accrued on the day the parent leaves for permanent employment. Accrual of funds can also be stopped when the child reaches the age of 1.5 years.

Current legislation contains provisions that organizations must submit certificates in established forms to the territorial tax service every year for all employees engaged in official labor activities.

The reporting documentation reflects all relevant information about the transferred amount of income, deductions, transferred tax fees, and so on.

When completing reports, authorized representatives of organizations must follow certain requirements. In accordance with them, in 6-NDFL, maternity benefits are not indicated in any format. This is due to the fact that regulatory authorities do not need such information.

How to reflect

As part of the calculation using Form 6-NDFL, the vast majority of companies reflect the amounts of income that are subject to direct taxation. Based on the provisions of Article 217 of the Tax Code, all child benefits are completely exempt from personal income tax. As a result, the corresponding financial support should not be reported.

It is worth noting that in other cases, within the documentation, the following lines are filled in:

What to count on

State social support programs provide for the payment of certain financial resources in favor of women expecting the imminent birth of a child.

Among them it is worth highlighting the following:

- payments upon birth;

- benefits in favor of expectant mothers registered with a doctor in the early stages of pregnancy;

- maternity benefit.

The first payments are made immediately after the birth of the child. The actual amount of the amount directly depends on the number of newborns. Payments are made both at the place of actual residence and place of employment. It is worth noting that the state can change the actual amount of payments in accordance with the current economic situation in the country.

At the same time, if an employee of the organization does not take out maternity leave and continues to carry out her professional activities, then the benefit cannot be paid in her favor. The employer simply does not have legal grounds for this.