A fixed-term employment contract differs from an open-ended one in that it is concluded for a specific period. Let's look at the peculiarities of the conclusion of this document. With whom can you negotiate how sick leave and vacation pay are paid? Also in the article, by clicking on the link at the end of the article, you can find a sample of a fixed-term employment contract.

A fixed-term type of contract should be concluded in cases where the employment relationship cannot be established for a long time.

In practice, concluding an employment contract for a limited period is used in the following cases:

- The need to perform work for a short period of time – up to two months;

- When performing seasonal work;

- If it is necessary to replace an employee who works on a permanent basis, but is temporarily absent for any reason, for example, due to maternity or child care leave.

- When hiring pensioners;

- If this job is part-time for a person.

All these cases, in which it is appropriate to conclude a fixed-term employment contract, are prescribed in Articles 58, 59 of the Labor Code of the Russian Federation.

The disadvantage of this type of employment contract for the employee is that once the contract period has passed, the employee can be legally dismissed by the employer. All that is required from the employer is to warn the employee at least 3 days before dismissal. You can read more about dismissal upon expiration here.

A sample of an open-ended employment contract can be downloaded from the link.

Payment of sick leave for a fixed-term employment contract

People often take temporary jobs, and during such employment they encounter various life situations that make them unable to work.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

We describe the issues of calculating and paying sick leave under a fixed-term employment contract.

This is important to know: Does the employer have the right not to pay sick leave?

Design nuances

The provisions of Article 59 of the Labor Code establish the rules in accordance with which an employment contract must be filled out, as well as the specific form of this document.

In accordance with these instructions, when drawing up a fixed-term employment contract, the following information must be indicated:

- full and abbreviated name of the employing organization indicating its exact registration address;

- date of document execution;

- personal data of both parties who executed this agreement;

- the subject of the agreement with a mandatory indication of the workplace, position held, accountability, as well as clarification of the probationary period;

- the period of time for which this agreement is drawn up;

- the rights and obligations of each of the parties participating in the execution of the contract;

- conditions of production activity;

- the system according to which the hired worker is paid;

- working hours and the period allocated for employee rest;

- adopted provisions regarding social security and insurance;

- information about any amendments or adjustments to the provisions;

- data on the provision of compensation in the event of termination of employment;

- special conditions provided for in this agreement;

- rules for terminating this agreement;

- final provisions.

After drawing up the document, it must be secured with the signature of each of the parties involved in its execution, as well as the obligatory indication of the date of its conclusion and the seal of the enterprise. After this, one copy of the document is sent to the HR department, while the other is provided to the employee.

In what cases does it consist?

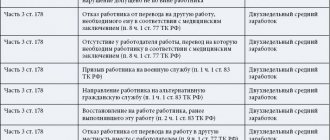

The law provides for the following circumstances for concluding fixed-term employment contracts:

- replacing the duties of an absent employee;

- carrying out temporary work for up to two months or seasonal work;

- when sending people to work abroad;

- during temporary expansion of production or various works not related to the employer’s normal activities;

- with persons applying for work in organizations created temporarily to perform functions for a certain period;

- with people doing casual work;

- to perform work that is provided for by additional internship, advanced training, etc.;

- when elected to an elected position;

- with people assigned to temporary work by the employment center;

- when performing alternative civil service;

- by agreement of the parties.

Is sick leave paid if they work under a contract?

Often employees come to our organization who, up to a certain point, believe that they are protected from the arbitrariness of the employer, since they have an agreement with the employer.

When an employer refuses to fulfill his obligations under the Labor Code of the Russian Federation, it is time to figure out what kind of agreement this is. Anyone can temporarily lose their ability to work. According to the legislative and labor standards of the Russian Federation, all employees have the right to be absent from work on days of treatment, regardless of whether the contract contains a clause on passing a testing period or not. during the probationary period, it is drawn up and paid in the same way as when working on a general basis.

The most common misconception is that due to illness a person does not automatically complete the probationary period.

It's no secret that managers, teachers, and directors of enterprises sometimes get sick. Often - “on my feet” in order to have time to complete urgent work that requires personal presence. However, sometimes you still have to go on sick leave. Who will pay for the sick leave certificate and how? What to do if you are sick and don’t have an employment contract? This is what our article is about today.

Let's start with the fact that sick leave opens strictly on the day of visiting a doctor.

Our editorial office receives many questions every day from accountants regarding the calculation of temporary disability benefits. In this article we decided to answer the five most common of them.

You can see a sample of filling out a sick leave certificate by an employer here.

Payment of sick leave for a part-time employee If an employment contract has been concluded with a part-time employee, then contributions to the social insurance fund for the period of incapacity for work are paid for it. Therefore, a part-time worker has the right to part-time sick pay.

Part-time work can be external and internal. External part-time work is when an employee works under an employment contract with another employer, and internal part-time work is when an employment contract is concluded within the framework of one employer.

When calculating sick leave payments for a part-time worker, the FSS allowed the use of the earnings that the employee receives as a part-time worker. This is stated in the FSS Letter dated January 23, 2006 No. 02-18/07-541.

People often take temporary jobs, and during such employment they encounter various life situations that make them unable to work.

Cases of its use are regulated by Article 59 of the Labor Code of the Russian Federation. The law provides for the following circumstances for concluding fixed-term employment contracts: Duration of validity In such cases, Art.

The Labor Code gives the employer the right to enter into fixed-term employment contracts with employees to perform certain work or replace absent employees.

During the work of such employees, there may be situations when the question arises: do they have the same rights as employees with whom a permanent employment contract has been concluded? One of these issues is the payment of sick leave to an employee under a contract concluded for a certain period and his dismissal. An employment contract is fixed-term when it specifies an expiration date.

How sick leave is paid Every officially employed person has the right to paid sick leave.

Who has the right to paid sick leave Officially, according to the Labor Code of the Russian Federation, a period of illness when a worker is not present at work is called a period of temporary disability, and payment for this period is called a benefit.

The term “sick leave”, as popularly used, comes from the legal basis for the payment of such benefits - sick leave.

In order to significantly facilitate this process, we suggest considering the question: will sick leave be paid after dismissal by agreement of the parties, in more detail.

We invite you to read: Is it necessary to notarize a contract of donation of shares of agricultural land?

Is sick leave paid after dismissal by agreement of the parties? When the employment relationship between an employee and the individual providing him with work is terminated, at the mutual request of the parties, in some cases the employee is entitled to certain payments for the period of his absence due to illness. Since this is one of the types of documents indicating the temporary inability to work for a certain individual, and also giving him the right to receive financial benefits.

Hello! My husband works under an employment contract, should he pay for sick leave and vacation?

Upon dismissal, am I entitled to compensation for unused vacation? July 15, 2014, 06:36 Svetlana, Moscow

if the husband works under an employment contract, then all the norms and rules established by the Labor Code of the Russian Federation and by-laws on labor apply to him.

On the day of dismissal of an employee, the employer is obliged to issue a work book and make final payments, including payment of compensation for unused vacation days.

It's easier to ask a lawyer! to our lawyers - it’s much faster than looking for a solution.

Payment of sick leave to a part-time worker in 2021 is carried out in a manner that depends on the status of a particular organization in legal relations with the employee who issued the sick leave.

Let us consider under what scenarios these legal relations can be carried out.

The way in which sick leave for a part-time worker is paid for in 2021 depends on the place where the part-time worker was employed in the 2 years preceding the year of incapacity for work. It may turn out that he worked: 1. For the same employers as in the year when he went on sick leave.

2. From employers who are legally independent from those for whom he works when he goes on sick leave (i.e.

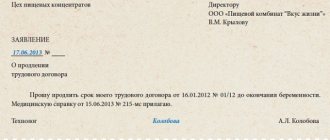

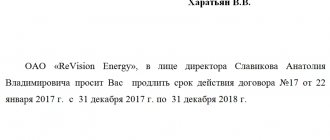

A fixed-term employment contract is concluded on certain grounds that do not relate to the employer’s initiative. But the question arises: how to warn an employee three days in advance about the upcoming dismissal? Here you need to remember that notice of dismissal is provided only in cases where the employment contract specifies a specific date, and not another basis for the end of a fixed-term employment contract.

If the expiration date of the employment contract is indicated by a specific date, then it is better to draw up a notice and send it to the employee by registered mail. Some organizations practice the following mechanism: along with the employment contract, the employee is immediately given notice of termination.

Current legislation provides for mandatory payment of sick leave to all Russian citizens by employers, and in particular, this applies even to those cases when they work on the basis of fixed-term employment contracts. At the same time, many employers do not know what conditions are prescribed in the current legislation and how they need to be met so that during the next audit, tax and other authorities do not impose any administrative or any other types of penalties on the organization.

That is why it is better to understand in advance how to correctly draw up a fixed-term employment contract and sick leave, which is drawn up during its validity. Definition Employment of citizens must be formalized by signing an appropriate employment contract, by which both parties establish the rights and obligations of each party.

There may be two options here:

- the employee brings information about income from previous places of work in the form of a certificate in the established form, and then the amount of sick leave is calculated based on the amounts indicated there;

- the employee did not provide information about earnings for the previous two years. In this case, the calculation is made based on the established minimum wage.

We invite you to familiarize yourself with: Rules for drawing up a loan agreement between individuals

If an employee works under a part-time contract, and he does not have earnings from this employer for the two previous years, then he is not paid sick leave, but the time spent on it is considered a valid reason for absence from work. The letter “t” is indicated on the time sheet for unpaid disability.

And the very first one is sick leave payments. After all, according to current legislation, sick leave is calculated based on earnings received for the two previous calendar years. In order to accurately answer this question, you must first decide on the type of employment contract. It can be:

- contract for the main place of work;

- contract on a part-time basis.

If the main contract, that is, the employee’s work book is with this employer, then sick leave is paid according to general principles.

since data for 24 months will be taken to calculate sick leave payments. Unfortunately, only general provisions are contained in the labor code and payment of sick leave. its registration is established by federal laws. may contradict each other. This legal situation creates confusion, which is very difficult for an ordinary citizen to understand. One of the most common violations is related to the incorrect calculation of the amount of payment for a temporary disability certificate by FSS specialists. Based on this document, temporary disability benefits will be assigned and paid.

For example, in connection with a domestic or work injury, due to the illness of the employee himself, while caring for a sick child or in connection with the birth of a baby. A sick leave confirms the employee’s incapacity for work and is the basis for temporary release from work; A sick leave certificate as a financial document is the basis for assigning monetary benefits for temporary disability.

The maximum amount of earnings for calculating sick leave is limited by Federal Law No. 255-FZ dated December 29, 2006. The formula for average daily earnings is as follows: Sick leave payments = amount of income for the last 2 years / 730, where 730 is the number of days for 2 years. If the year was a leap year, then for the calculation you need to take the number 731. Therefore, the maximum amount of daily earnings on sick leave in 2015 will be equal to (568,624) / 730 = 1,632.88 rubles. There is also a minimum average salary for an employee per day. Temporary disability benefits (sick leave) for working participants, disabled people of the Great Patriotic War and persons equivalent to them are paid from the first day of loss of ability to work in the amount of 100% of the average salary. Temporary disability benefits (sick leave) related to a work injury or occupational disease of an employee are paid by the employer in the amount of 100% of the average salary from the first day of the onset of incapacity until returning to work or being diagnosed with disability. During inpatient treatment of children, a mother (father) or other person directly caring for children under three years of age who, according to doctors, requires additional care, is given an allowance in connection with the care of sick children under three years of age. However, contracts of a civil law nature that provide for a different subject (for example, the provision by a citizen of property for use or the transfer of property rights belonging to him) are not covered by state social insurance and, as a consequence, in this case, these employees are not subject to state social insurance. Thus, persons performing work under civil contracts, upon the occurrence of an insured event, have the right to the following payments under state social insurance, received at the place of performance of work under a civil contract: • for temporary disability in cases of: - loss ability to work in case of employee illness or due to injury at home; — caring for a sick family member, including a sick child under 14 years of age (disabled child under 18 years of age); — an employee caring for a child under 3 years of age due to illness of the mother or another person who actually cares for this child; - care for a disabled child under the age of 18 in the case of his sanatorium-resort treatment, medical rehabilitation - in connection with the process of prosthetics and his stay in the hospital of a prosthetic and orthopedic enterprise; — quarantine; • for pregnancy and childbirth in cases of pregnancy and childbirth, adoption of a child under the age of 3 months or establishment of guardianship over him. In terms of assigning benefits for temporary disability and the procedure for calculating it, we are guided by the Regulations on the procedure for providing benefits for temporary disability and pregnancy and childbirth, approved by Resolution of the Council of Ministers of the Republic of Belarus dated June 28, 2013 No. 569 (hereinafter referred to as Regulation No. 569). The procedure for providing maternity benefits to women whose right to benefits arose starting from January 1, 2013 is regulated by the Law of the Republic of Belarus dated December 29, 2012 No. 7-Z (hereinafter referred to as Law No. 7-Z) and the norms of Regulation No. 569 in that parts in which they do not contradict Law No. 7-Z. The norm of Regulation No. 569 should be taken into account.

We suggest you read: How to restore a lost apartment rental agreement

Validity periods

It is concluded for no more than 5 years, unless the Labor Code or federal laws provide otherwise. Also, this type of contract is used if it is impossible to establish a permanent employment relationship, when the period of employment depends on the nature or conditions of the work.

In such cases, Art. 59. of the said Code.

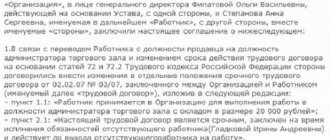

By agreement of the parties, such an agreement is concluded without taking into account the specifics and conditions of work.

What do accountants and HR managers need to know?

The urgency of the contract is considered a key principle from which to proceed when registering an employee and calculating wages.

Above all, these employees need to know the following.

Firstly, the conclusion of this agreement must be justified according to the following criteria:

- nature of work, for example, seasonality;

- its conditions - for example, maintaining a job for another employee; most often this concerns replacing women who have gone on maternity leave;

- characteristics of the employee’s life - he must indicate the reason why he is entering into an urgent agreement;

- in other situations specified in the laws.

If there are no grounds, the conclusion will be considered unfounded, and the employee will not be dismissed according to the law.

A fixed-term contract can be renewed.

If the employment relationship actually continues, it is considered extended for an indefinite period. Dismissing a person will be considered illegal, and the court will order the person to pay the average salary for the period of absence from work.

How to reflect sick leave on a time sheet? Details are here.

Examples of sick leave calculations

No. 1. Popova E.L. A five-month employment contract was concluded with the Progress company. Due to illness, the employee was given sick leave for 12 days. Will benefits be paid according to the employee’s VN and how is this calculated?

Answer: The organization is required by law to pay for temporary disability. Calculation formula:

payment = Z x D, where Z is the average daily payment according to accounting data (900 rubles), and D is the number of days of disability. The amount of the accrued benefit will be 900x12=10,800 rubles, from which personal income tax will be withheld - 1,404 rubles, the amount of payment to Popova - 9,396 rubles.

No. 2. An ill employee with a Group III disability will be dismissed on December 28, 2021 at the end of the fixed-term contract. Payment according to the VN sheet was not carried out. In mid-January 2021, the employee is provided with sick leave for 45 days. How to deal with payments under the document?

Answer: The dismissal was made correctly. A certificate of temporary incapacity for work is submitted to the organization within the established time frame, payment is made in full, taking into account the period after calculation. Pay attention to the urgency of concluding an employment contract - there are restrictions on payment - and the correctness of filling out the VN sheet itself.

Payment of sick leave for a fixed-term employment contract in 2021

With such employment agreements, many questions arise, including regarding sick pay.

Is it allowed?

Employers pay insurance premiums for all their employees, so they must pay sick leave to everyone.

According to the law, the amount is calculated from income earned over the past 2 years.

It depends on the type of contract. If it is concluded at the main place of work, then sick leave is paid on a general basis.

To do this, you need to bring certificates of the established form from previous places of work with salary amounts.

If there is no information about past work, then sick leave is calculated based on the minimum salary.

This is important to know: Is it possible to select years for calculating sick leave?

If the contract is for a period of less than a month

In such a situation, you need to rely on your insurance experience. It refers to the periods during which temporary disability insurance was in effect.

Experience is calculated based on full months, and every 30 days is recalculated into a full month. This rule applies only to partial months and years.

If the term of the employment contract does not exceed six months, then the benefit is provided for a maximum of 75 days, and code 46 is entered on the certificate of incapacity for work.

In this case, the amount of sick leave will be no more than one minimum wage.

Is it possible to fire an employee during this period?

Yes, an employee can be fired while he is on sick leave, since the end of the employment contract is considered an independent basis for dismissal.

It is enough to promptly and correctly notify the sick person by mail.

Example notification:

Then an order in a standard form is issued.

If the employee is not present, then a note is made indicating that it is impossible to familiarize him with the text of the order due to absence.

If an employee fails to appear on the day of expiration, he is sent another notification by registered mail with a request to pick up the work book or give written consent to send it by mail.

An example of such a notification:

Then they make an entry in the work book. All records of his work are certified by the signature of the employee keeping the books and the seal of the organization.

If the dismissed employee brought a certificate of incapacity for work

Sick leave must be paid in accordance with Article 5, Clause 2 of the Federal Law of December 29, 2006 N 255-FZ.

It is paid to insured persons in the event of illness or other insured events during their work activities during the period of validity of the contract or within 30 days from the date of its cancellation.

You will find information about excluded periods when calculating sick leave here.

Is it profitable to take sick leave while on vacation? Find out in this article.

How to pay and calculate? Peculiarities

The payout amount is calculated quite simply.

Use the formula:

Amount payable under BL = Average daily earnings x Number of days of incapacity for work

In general, the following must be taken into account when calculating disability benefits:

- you need the original sheet;

- the employee has the right to apply for sick leave within 6 months;

- the employer is obliged to pay benefits if the employee applies within 30 days from the date of dismissal;

- calendar days are considered;

- whether it was the employee's illness, or whether he was caring for a sick person;

- if an employee violated medical instructions without good reason or did not show up for an examination, or received sick leave due to intoxication, then they are counted not from the daily earnings, but from the minimum wage (the minimum wage for paying sick leave).

Is it possible to terminate a contract with an employee while on sick leave?

Termination of an employment contract with a person on sick leave due to the expiration of the contract is a completely legal procedure. In this case, dismissal is carried out not at the request of the employer, but on the basis of clause 2 of Art. 77 Labor Code of the Russian Federation. That is, due to the fact that the contract loses its legal force due to expiration or for the reasons given in Art. 79 Labor Code of the Russian Federation:

- completion of specific work, if its implementation was the basis for concluding an employment agreement;

- the employee who was replaced by an employee under a fixed-term contract returns to work;

- completion of the period of seasonal work, if their implementation was the basis for concluding the contract.

IMPORTANT! If the employer does not use the legal mechanisms for terminating an employment contract with an employee, provided for by the Labor Code of the Russian Federation, then it will acquire the status of an indefinite term (Article 58 of the Labor Code of the Russian Federation). After this, dismiss the person on sick leave based on the provisions of Art. 77 of the Labor Code of the Russian Federation, the employer will not have the right, nor will he have the right to terminate the agreement with him on his own initiative (Article 81 of the Labor Code of the Russian Federation).

You can learn more about the specifics of an employer terminating an employment agreement with an employee on sick leave from the article “Is it possible to be fired during sick leave?”