Entitled payments

Upon termination of an employment relationship with an employee, a full settlement must be made; he must be given a work book, a certificate of income and the required amount of money, which includes:

- severance pay;

- vacation compensation;

- wages.

Payments to the employee must be made on the last working day. The due amount can be received by a person personally at the company’s cash desk or transferred to a personal account. In the second case, the transfer of funds must be made the next day after the employee’s request.

It is important to know! If an employee resigns while on vacation or immediately after taking it, the date of termination of the employment relationship will be considered the last day of vacation.

In some cases, an employee may receive all payments due to him on payday. This request must be fully discussed with the supervisor in advance.

If for some reason a person refuses to collect money on his last day at work, then it must be provided to him on another day upon request.

If disputes arise regarding the amount of payments, the manager is obliged to pay the former subordinate the amount that is not subject to dispute. The remaining portion is transferred to the employee after a complete check and recalculation.

Sample of filling out a pay slip - front side Sample of filling out a pay slip - back side

Dismissal procedure at the end of the employment contract

If an enterprise cannot conclude an open-ended employment contract with an employee, due to certain valid reasons, then the law allows the conclusion of a fixed-term contract. It may be concluded, for example, for temporary or seasonal work, or for the performance of a specific specific task. In both cases, it is important to properly conduct dismissal at the end of the employment contract. As with the termination of labor relations on a general basis, the termination of temporary labor relations is also regulated by labor legislation and must be observed by the employer when dismissing an employee.

Vacation

Compensation for unused vacation can be received by anyone, regardless of the type of contract, who has worked for at least 1 month in the company. In Art. 291 of the Labor Code of the Russian Federation states that all employees have the right to receive two paid days of rest every month. Depending on the period, compensation calculations are required.

1 month

In case of an employment contract concluded for a period of 1 month or less, the calculation is carried out on a general basis, in accordance with Art. 291 and art. 139 Labor Code of the Russian Federation:

- If a citizen has worked for a company for a full month, then he is entitled to payment for 2 days of vacation that he did not use.

- If a person worked less than 15 days, no compensation is paid.

It is worth considering that if the contract is concluded for 14 days, then you will also need to pay various allowances, for example, according to the conditions in the RKS.

2 months

Payments under a contract concluded for a period of up to two months are calculated taking into account the time the person worked:

- If there is half a month left before the end of the contract, then in the calculation this period is taken into account as one month and payment is made for 2 days of vacation.

- If it is less than half a month, then no compensation is paid.

3 months

If the employee’s work activity lasted up to three months, then by common agreement he can be transferred to the status of an indefinite term. This requires the conclusion of a new employment contract or additional agreement. In such a situation, compensation for vacation is calculated according to the calculation algorithm for an open-ended contract:

- with a full month, the citizen receives cash payments for 2 days in accordance with the average monthly earnings;

- Payment for an incomplete month is carried out only in case of working more than 15 days.

From 2 to 6 months

When concluding a fixed-term contract for a long period, compensation for vacation is calculated taking into account only fully worked months. So, one month worked is equal to 2 days of paid vacation. The final amount is calculated by multiplying the average daily salary by the number of vacation days that the citizen did not use.

Read on topic: Procedure for terminating a fixed-term employment contract at the initiative of the employee

Rules in this matter

The legislation of the Russian Federation provides for the signing of employment contracts, which can have both an unlimited duration and an exact indication of the date of its completion, which is prescribed in Article 58 of the Labor Code of the Russian Federation. Article 59 addresses issues relating to when and under what conditions a fixed-term contract can be concluded with a particular employee.

This is important to know: How to draw up an employment contract with an employee: sample 2021

According to Article 127, if the agreement is concluded for a period exceeding 2 months, then compensation is calculated in the same way as for an open-ended contract. In fact, this means that payments will be made in proportion to the time worked with the required rest days. According to Article 291, 2 legal days of rest per month are assumed. After a year of work, a full-fledged vacation “flows” accordingly.

Payments upon termination of STD

Wage

Salary refers to mandatory payments that an employee must receive. Its size is determined taking into account the actual time worked before dismissal in accordance with Art. 139 Labor Code of the Russian Federation.

For example, in March, sales manager Ekaterina received 15,000 rubles as a salary, having worked for 20 days. To calculate payment for 1 day, 15,000 / 20 = 750 rubles are required. Before being fired, Ekaterina managed to work 10 days. To calculate the final amount that will need to be paid to Ekaterina upon dismissal as wages, 750 * 10 = 7,500 rubles are required.

Severance pay

Severance pay implies payment provided for by the Labor Code or a fixed-term employment contract. This amount of money is given to the employee for the period of searching for a new job. The amount of the benefit largely depends on the reasons for which the employment contract was terminated. Payment of benefits in an amount equivalent to the employee’s earnings for 2 weeks is provided if a person quits due to:

- failure to pass certification and inadequacy of the position held;

- medical indications that do not allow you to continue working;

- the return to work of another employee, in whose place a person was temporarily hired;

- mandatory service in the Russian Armed Forces;

- relocation of the organization and refusal of the employee to move.

Read on the topic: Peculiarities of dismissal of employees during liquidation of an enterprise

In the event of termination of a fixed-term contract for reasons beyond the employee’s control, for example, due to the liquidation of an enterprise or staff reduction, the compensation is equal to the amount of the average salary. Its payment is made within two months after dismissal. Payment of benefits can be extended after a two-month period, provided that the citizen is registered with the Labor Exchange and, during the allotted period of time, was unable to find a job.

It is important to know! Payment of benefits is carried out only if the employment contract was terminated prematurely for a valid reason. If the dismissal is made at one’s own request or by agreement of the parties, then the benefit is not paid (unless otherwise stated in the text of the contract).

General information

Before determining the amount of payments for leave upon termination of employment, it is necessary to study in detail the options for concluding a contract and the reasons for its cancellation. All this information will help the dismissed employee receive all the compensation due by law, and the employer will avoid possible litigation.

Terms of the agreement

Vacation compensation upon dismissal under an employment contract (fixed-term) can be received by a former employee of the enterprise only if the document was concluded legally. The Russian Labor Code provides for the possibility of drawing up an agreement that is not only limited by a time frame, but also indefinite. In most cases, the first option is used, which allows the employer to fire an unprofessional employee immediately after the document expires.

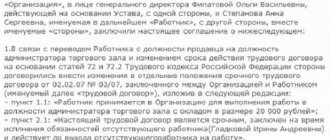

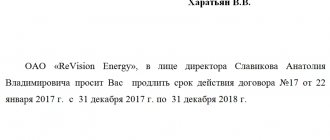

When concluding a fixed-term employment agreement, not only the expiration dates of its validity must be specified, but also the reasons that prevent the execution of an open-ended contract. Russian legislation provides for a maximum duration of such an agreement, which is 5 years. However, if the employee justifies the trust of the company owner and conscientiously fulfills his job duties, then the possibility of extending cooperation is provided.

Conditions under which a fixed-term employment contract can be concluded:

- The work performed is seasonal (heating season, harvest, tourist season).

- A short period of time required to complete a specific order (from 50 to 60 days).

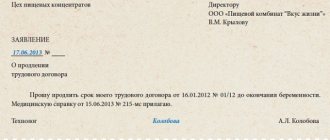

- A permanent employee is absent for a long period (due to maternity leave or official illness).

- A company or firm is created to perform a specific task that requires a limited amount of time.

- If a permanent employee has been elected to an elective position and will hold office only for a certain period.

- An employee is undergoing training or internship at the enterprise.

- The employee is sent from the employment center to perform public duties.

- When conscripted into civil service, which is an alternative to military service.

Reasons for registration

The Russian Labor Code clearly states the grounds on which a fixed-term employment agreement can be concluded. Any other reasons for its registration will be considered illegal. Due to such erroneous actions, both interested parties may suffer.

The basis may be:

- An entrepreneur who owns a company with no more than 30 employees expresses a desire to hire one more person.

- The worker has the opportunity to perform the functions assigned to him only for a certain time. This situation includes the inability to work indefinitely for medical reasons or due to reaching retirement age.

- The work must be performed in conditions with difficult climatic conditions (the Far North or similar regions). This rule applies only if the employee needs to move from his permanent place of residence.

- Organization of activities aimed at eliminating the consequences of disasters, accidents, natural disasters and other emergency situations.

- Hiring people who work part-time in any other public or private institution.

- If the employee is a full-time student.

Reasons for breaking the labor relationship

In order to understand whether it is necessary to pay compensation upon dismissal under a fixed-term contract, you should consider the possible reasons for the early termination of the employment relationship. All of them are listed in Article 79 of the Labor Code of Russia and are legal grounds for cancellation of a document.

The main reasons for the termination of cooperation between an employee and the owner of the enterprise:

- There is no way to pre-calculate the completion date of the work. In this case, after fulfilling the scope stipulated by the contract, the employer has the right to cancel the document.

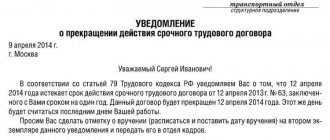

- Expiration date. In this case, the employee must be notified by the company management three days before the end of the contract. This option does not apply to cases where the contract was drawn up for the period of absence of a permanent employee.

- End of a pre-agreed period. This only applies to work that is seasonal in nature.

- The departure of a permanent employee, for the period of whose absence a contract was signed.

An employee performing his labor duties under a fixed-term contract has the right to sever relations with the employer at any time (at his own request) before the agreed date. In addition, you can resign by agreement of the parties.

In some cases, the reason for the cancellation of an employment contract is a violation of the company’s charter or a serious offense that entails negative consequences for the employer. However, the most common reason for dismissal is company liquidation or staff reduction.

Additional payments

Additional payments are considered to be any payments that are due to a person in addition to the mandatory ones. They can be specified both in the Labor Code and in a fixed-term employment contract and other agreements between the employee and the employer. A citizen may lose additional funds if he violates the company’s rules during the period of employment. However, Art. 84 of the Labor Code of the Russian Federation retains the right to additional payments if violations did not occur through the direct fault of a person.

Sample of filling out 2nd personal income tax

Guarantees for employees

When resolving disputes arising during the calculation of compensation and payments in the event of termination of a fixed-term employment contract, it is necessary to follow the following articles:

- 84.1,

- 140.5,

- 291,

- 139 Labor Code of the Russian Federation.

Vacation compensation upon dismissal - topic of the video below:

Expert opinion

Semenov Alexander Vladimirovich

Legal consultant with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

As you know, everything in the world is finite. Including work, even permanent work.

Moreover, if the contract was concluded for a certain period. The employee, aware of the approaching end of the contract, is gradually looking for a new place.

You also need to know what payments are due upon termination of employment contracts and why. In what cases can an employee count on compensation? We will try to deal with this issue in the article.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Refusal of the organization to pay

If the employer refuses to pay compensation to employees, you must contact the labor inspectorate with a complaint. After the inspection, the inspectorate obliges the employer to make a payment of funds.

If the manager does not comply with the inspection order, the citizen can go to court. If the employer’s guilt is proven, he may be held administratively liable and a fine imposed. In court, a citizen can demand from the employer payment of compensation for moral damage if it is proven that the delay in payments had a negative impact on him.

If the employment relationship with an employee is terminated, both before the expiration of the contract and after, the employer is obliged to pay the funds provided for by law. In case of failure to fulfill obligations on the part of the manager, the employee may go to court to recover the entire amount of money.

Video on the topic

Watch the video on how to calculate vacation pay for a fixed-term contract:

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Vacation compensation is not available to everyone and not in all cases. The most common is voluntary dismissal. In the event that an employee resigns, he is entitled to compensation for unused vacation; in another case, it can be received if he has additional vacation.

Additional vacation leave, which is entitled over the basic twenty-eight days to certain categories of citizens, namely:

- Who has irregular working hours?

- Difficult and harsh working conditions due to climatic factors

- Harmful production

- And also, if this is provided for by the regulatory act of the enterprise

The calculation of wages for dismissal at the initiative of the employee is the same as for payment for all other reasons.

The employee is entitled to wages for the time worked, as well as compensation for unused vacation, if any.

If the employee was on vacation in advance, the accountant needs to recalculate the payments and withhold the funds. Wages and compensation are subject to taxation and insurance contributions.

- Procedure for applying for vacation compensation for a fixed-term employment contract

- Procedure for paying compensation for unused vacation

- Calculation of vacation compensation upon dismissal

- Calculation of compensation without dismissal

- Answers to frequently asked questions