In the course of its activities, each enterprise or organization resorts to the help of hired employees, and therefore an employment agreement (contract) is concluded between them:

- of an indefinite nature (the duration of the employment relationship is not specified);

- urgent nature, i.e. for a clearly defined period or to perform a specific amount of work.

Each type of contract has its own characteristics, including vacation payments, which the article will focus on.

Duration for a contract period of up to two months and seasonal work

When signing a short employment agreement for a period of no more than two months or for the duration of any seasonal work lasting less than six months, vacation is calculated according to a certain rule. For each month worked, a worker can take two days for rest (Articles 291 and 295 of the Labor Code of the Russian Federation).

Article 291 of the Labor Code of the Russian Federation. Paid holidays

Employees who have entered into an employment contract for a period of up to two months are provided with paid leave or compensation upon dismissal at the rate of two working days per month of work.

Example: A worker entered into a contract for 3 months and worked the established period - September, October and November.

Thus, the vacation will be equal to six working days. If holidays that are recognized by law as weekends fall during the employee’s work period, then the vacation will be extended for this time.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

It is worth noting that holidays that fall during vacation are not included in the calculation and, accordingly, are not paid (we talked about how to calculate vacation and its payment on New Year's holidays in this article).

In a situation where a fixed-term contract is signed for a period of more than two months, but not for seasonal work, the duration is calculated differently. For each month worked, in fact, you are entitled not to two days of rest, but to 2.33.

The rules for making calculations are clearly explained by Rostrud letter No. 1133-6.

To make correct calculations, you must use the following formula:

When calculating the number of allotted days, rounding is carried out in favor of the employee.

That is, if a person worked for 4 months, the result will be: 2.33 * 4 = 9.32, rounded in favor of the employee - 10 days.

Vacation according to TC

The duration of leave when concluding a fixed-term employment contract is determined by Art. Art. 291.293, 295 of the Labor Code of the Russian Federation, as well as Letter of the Ministry of Labor dated January 1, 2002 No. 625-ВВ.

Vacation according to the Labor Code of the Russian Federation is calculated as follows:

- In the case of concluding a temporary employment contract for a period of up to six months to perform seasonal work, vacation pay is calculated according to the principle of 2 working days of vacation for 1 month of work. When calculating in this way, weekends and holidays are not taken or paid on vacation days.

- To perform work for a period of more than two months, not related to the time of year, the calculation is based on the principle of 2.33 days of rest for each month of work, i.e. According to the minimum rest time established by law for a year of work, it is 28 calendar days.

Every working citizen has the right to rest, however, in the case of a temporary contract, the employer can provide leave with subsequent dismissal upon expiration of the agreement. Most often, this method of dismissal is practiced after an employee has been hired for seasonal work. If the employee has been hired for more than several years, then he can apply for leave after six months of work.

Compensation for unused days upon dismissal

According to Article 127 of the Labor Code of the Russian Federation, an employee has the full right to vacation compensation even with a fixed-term employment contract.

Cash compensation for employees on a contract of up to 2 months or seasonal work is only provided if the person has worked for at least 15 days. If there are fewer days, no money is due; if there are more, it is counted as a month of work (that is, 2 days).

Step-by-step algorithm for calculations:

- We calculate the average daily earnings of a worker. Average daily earnings are calculated as follows: the amount of total income is divided by the number of days in the billing period.

- We multiply the amount received for one day by the number of vacation days due and get the amount of compensation.

Next, we multiply the number of vacation days by the amount of daily income: 4 * 1020.4 = 4081.6 kopecks - the amount of Sidorov’s compensation.

Vacation calculation rules

As for the amount of vacation payments, the calculation is based on the employee’s average earnings for a given billing period. The rules for calculating average wages themselves are prescribed in Art. 139 of the Labor Code of the Russian Federation, and the calculation procedure is set out in Regulation No. 922 of December 24, 2007.

Attention! Calculation of vacation under fixed-term contracts can be calculated both on working days and on calendar days.

Thus, when drawing up an employment agreement for a period of up to 2 months (or for seasonal work), the average wage per day is calculated based on the number of working days. In other cases, the calculation of vacation payments under fixed-term contracts is carried out in terms of calendar days.

Therefore, when calculating the average daily salary, two formulas can be used:

- The total earnings for a fully worked period are divided by the number of working days of the billing period (used for seasonal and fixed-term employment contracts issued for a period of up to 2 months).

- The total earnings for the last 12 months are divided by 12, and then by the average monthly number of calendar days, which is 29.3 (used for other fixed-term contracts).

Next, the resulting result of the average daily wage is multiplied by the number of vacation days based on the formulas:

- 2 working days = one month worked – for fixed-term contracts concluded for two months or less, as well as for seasonal work;

- 2.33 calendar days = one month worked – for fixed-term contracts exceeding a two-month employment period.

Important! According to Art. 120 of the Labor Code of the Russian Federation, the duration of vacation is not affected by non-working days and holidays.

We also remind you that, according to clause 5 of Regulation No. 922 of December 24, 2007, the following are not taken into account when calculating vacation pay:

- vacation pay;

- travel allowances;

- payment for temporary disability;

- the length of time the employee is on vacation;

- the length of time the employee is on a business trip;

- the length of time the employee was on sick leave;

- a period of time off that occurred through no fault of the employee.

That is, days on sick leave or a business trip are excluded from the calculation period, and the amount of disability benefits received and travel allowances are deducted from his total earnings for this period.

What is better for the employee - to rest or receive monetary compensation?

When requesting leave, each worker must carefully look at the contract under which he carries out his activities. If a civil law contract is concluded, the employee may not count on receiving compensation or vacation.

When talking about what is better - to take compensation or leave for a fixed-term employment agreement concluded for three months, you need to take into account the Labor Code of the Russian Federation. According to current legislation, compensation can only be received upon dismissal.

What is really worth considering is: why might you need a vacation if the fixed-term employment contract has come to an end and the work stops in any case? It is worth rationally assessing whether such a vacation is necessary or whether it is better to get money for it.

To summarize, we note that citizens employed under fixed-term employment contracts have the full right to leave and compensation if it is not used. It is worth considering that the required days differ depending on the type of work.

Video on the topic

Watch the video on how to calculate vacation pay for a fixed-term contract:

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Vacation compensation is not available to everyone and not in all cases. The most common is voluntary dismissal. In the event that an employee resigns, he is entitled to compensation for unused vacation; in another case, it can be received if he has additional vacation.

Additional vacation leave, which is entitled over the basic twenty-eight days to certain categories of citizens, namely:

- Who has irregular working hours?

- Difficult and harsh working conditions due to climatic factors

- Harmful production

- And also, if this is provided for by the regulatory act of the enterprise

The calculation of wages for dismissal at the initiative of the employee is the same as for payment for all other reasons.

The employee is entitled to wages for the time worked, as well as compensation for unused vacation, if any.

If the employee was on vacation in advance, the accountant needs to recalculate the payments and withhold the funds. Wages and compensation are subject to taxation and insurance contributions.

- Procedure for applying for vacation compensation for a fixed-term employment contract

- Procedure for paying compensation for unused vacation

- Calculation of vacation compensation upon dismissal

- Calculation of compensation without dismissal

- Answers to frequently asked questions

Leave for temporary workers according to the labor code

7.1. The parties are responsible for non-fulfillment or improper fulfillment of their duties and obligations established by law, Internal Labor Regulations, other local regulations of the Employer and this employment contract. At the same time, HR and accounting workers may have questions about how to properly register such workers, what is the procedure for concluding and terminating an employment contract with temporary workers, as well as what guarantees are provided to temporary workers. In this article we will try to understand these issues.

Please note => Payments upon concluding a contract for 5 years

Procedure for applying for vacation compensation for a fixed-term employment contract

Employment contracts are one of the most important documents between an employee and an employer. There are several types of contracts:

1. Fixed-term contracts - concluded for a certain period, but not more than five years; if neither party expresses a desire to terminate it and the employee continues to work, it automatically becomes unlimited

2. Perpetual – contracts that do not have a specific period of validity

The procedure for providing compensation is the same for both a fixed-term and an open-ended employment contract, namely:

- The employee must submit a free-form application for compensation addressed to the manager, indicating the reason why he is entitled to it

- If approved by the boss, his visa is issued

- The next stage is the publication of an order, which indicates to whom compensation is awarded and for what.

- A note is made on the personal card indicating that the vacation has been replaced by compensation and the basis.

- Then the accrual and payment occurs

Let's look at the entry as an example:

Procedure for paying compensation for unused vacation

IMPORTANT!! Compensation is provided for vacations exceeding twenty-eight days

The main leave is entitled to every employee who has worked for half a year at the enterprise; its duration is twenty-eight calendar days.

Compensation is due to an employee who has earned additional leave in excess of these days. The following cannot claim compensation:

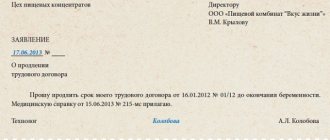

1. Before going on maternity leave, a pregnant woman does not have the right to receive it, only upon dismissal

2.Not adults

3.For employees of authorities and customs

The employer is responsible for taking employees on vacation; he does not have the right not to allow employees to go on vacation for more than two years in a row, and failure to pay compensation leads to a fine and administrative liability.

Calculation of vacation compensation upon dismissal

In order to calculate compensation, you need to know:

- period of work under a fixed-term employment contract:

- Number of unused days

- Average earnings per day

- If an employee has worked for less than a full month, namely less than 15 days, this month is not taken into account.

- The coefficient by which the salary must be multiplied if it changed during the billing period

The compensation will be 384.61 *6 days = 2307.66 rubles.

The accountant will transfer personal income tax and insurance premiums from it.

Personal income tax will be 2307.61*13%=300 rubles.

Insurance premiums will be:

1. Contributions to Pension insurance 22% 507.67

- Medicine 5.1% 117.68

- Social insurance 2.9% 66.92

- Accidents 0.2% 4.61

When an employee is dismissed, the HR department issues him a certificate of income for the past two years in Form 2 of the Personal Income Tax, in which you can see all payroll accruals, including compensation, each payment is encrypted under its own code. From 2021

the compensation code for unused vacation is 2013, thus knowing what code is under which you can understand your accruals.

The procedure for calculating the amount of compensation paid upon dismissal

The procedure for calculating the amount of compensation payments is similar to the procedure for determining the amount of vacation pay paid to an employee when taking annual leave.

To calculate the exact amount of compensation, you must:

- Determine the number of vacation days.

- Calculate the number of days worked and the amount of earnings received during this time.

- Determine the average daily earnings, for which you need:

- divide the amount of salary received by the total number of days worked if vacation is provided in working days;

- divide the amount of earnings by the number of months worked, the result by 29.3 (average monthly number of calendar days), if vacation is calculated in calendar days.

- Multiply the resulting value by the number of vacation days earned.

Answers to frequently asked questions

Is a personal income tax deduction available for a child in the case of compensation and wages?

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Answer: Yes, a deduction for a child is provided without fail, for the first one in the amount of 1,400 rubles once a month, that is, if in one month you receive both compensation and wages, then there is only one benefit

What is the difference between calculating compensation upon dismissal under a fixed-term employment contract and an open-ended one?

A regular employment contract differs from a fixed-term one in that it is concluded on a permanent basis and without a deadline, there is no difference in accrual, there are some peculiarities, such as vacation is not accrued for less than a month of work, and if you have worked more than 15 days, then as expected

What penalties are imposed on an employer for non-payment of compensation?

According to the Labor Code, in any case, the employer will have to pay the amount due, as well as interest in the amount of one hundred and five tenths of the Key Rate of the Central Bank for each day of delay in payment, starting from the next day.

In some cases, legislation allows you to hire an employee for a certain period of time. This situation is not typical for any accountant, and in connection with this, certain difficulties often arise. In this article we will examine in detail the topic of providing and paying leave to such an employee.

General and special rules

In general, an employee who is hired on a fixed-term contract has the same holiday rights as anyone else. But there are two exceptions:

- If the term of the employment contract does not exceed 2 months (Article 291 of the Labor Code of the Russian Federation).

- If the employee is involved in seasonal work (Article 295 of the Labor Code of the Russian Federation).

In these cases, leave is granted at the rate of 2 working days for each month of work .

If both situations are not applicable to a “fixed-term” employee, then he is granted leave on a general basis.

Leave for temporary workers according to the labor code

Here is one option: the employee was hired for seasonal work. In this case, the fixed-term employment contract indicates that the vacation is two working days per month. And if a specialist replaces a temporarily absent main employee, then his rest lasts 28 calendar days. The difference between seasonal workers and temporary workers is that seasonal workers must be included in the vacation schedule if their seasonal work lasts at least six months, because According to the general rule of Article 122 of the Labor Code, the right to use vacation for the first year of work arises after six months of work.

21 Dec 2021 marketur 170

Share this post

- Related Posts

- How to calculate vacation pay in 2021 upon dismissal

- How is sick leave paid if the total length of service is interrupted in 2019?

- Penalty for transport tax statute of limitations

- Medal 25 years of the Ministry of Emergency Situations of Russia benefits for a labor veteran

Fixed-term contract and vacation schedule

When drawing up a vacation schedule for the next year, a specialist may doubt whether to include “urgent” employees in it. Especially if the contract is for a period of less than a year.

The answer is simple - an employee on a fixed-term contract is included in the vacation schedule according to the general rules . Let us remind you that this schedule must be drawn up at least 2 weeks before the end of the year.

And if at the time of planning vacations an employee is listed in the company, then it is impossible not to include him in the schedule. In addition, there is always a chance that the term of his contract could be extended.

Or that the employee will move from the category of “urgent” to permanent. To avoid a controversial situation regarding your vacation later, it is better to foresee this in advance.

Should conscripts be included in the vacation schedule?

HR officers and accountants often doubt whether it is necessary to include in the vacation schedule people who work under fixed-term employment contracts concluded for a period of less than a year. Doubts are caused by the fact that, according to Article 123 of the Labor Code of the Russian Federation, the vacation schedule for the next year is drawn up no later than two weeks before the start of this year. And it may happen that the scheduled vacation time for a conscript will fall during the period when the contract expires and the employee is fired.

However, when drawing up a vacation schedule, the “conscript” cannot be ignored. Indeed, in December of the previous year, that is, at the time the schedule was drawn up, he was still on the staff and, as a result, had the right to leave. In addition, despite the limited term of the contract, there is no complete certainty that the employee will certainly leave the organization next year. After all, it is possible that the employer will sign another fixed-term employment contract with him. It is also impossible to exclude the possibility of reclassification of a fixed-term contract into an open-ended one. This can happen if neither party requests termination of the contract at the end of its validity period, or it turns out that the term of the contract was established without sufficient grounds (Article 58 of the Labor Code of the Russian Federation; for more details, see “Fixed-term employment contract: how to extend it, renew it or terminate"). In such circumstances, the person will remain at work and retain the right to annual leave, which, as is known, is granted in accordance with the schedule.

Duration of vacation

to 28 calendar days of vacation annually . But we are talking about employees who work on a permanent basis.

In this regard, the question may arise: is it necessary to recalculate the length of leave for a “fixed-term” employee? For example, if a contract is concluded with him for 6 months, does this mean that he should be given a vacation of not 28, but 14 calendar days?

We answer: no, there is no need to recalculate anything . The Labor Code does not contain any guidance in this regard. Reservations are made only for seasonal workers and those hired for less than 2 months - we mentioned them above. All other employees on a fixed-term contract are entitled to a full 28-day vacation.

In accordance with Article 127 of the Labor Code of the Russian Federation, it is allowed to provide leave outside the term of the employment contract (vacation with subsequent dismissal). In this case, the day of dismissal will be considered the end date of the vacation.

If the leave was provided in advance, then upon dismissal, the share corresponding to the unworked part is deducted from the salary.

Is a temporary worker entitled to leave?

1, Article 59 of the Labor Code, employees who have entered into an employment contract lasting up to 2 months are considered temporary) and can exercise their right to leave in kind only upon dismissal. In this case, the employer can not only satisfy the employee’s request for leave with subsequent dismissal, as prescribed in Part. If an employee is hired temporarily, during the vacation of the main employee, and he works for only one month, upon dismissal he is entitled to accrue compensation for leave 2 ,33 days, or in this case no compensation is accrued. Thank you If an employee is hired temporarily, during the vacation of the main employee, and he works for only one month, upon dismissal he is entitled to accrue compensation for 2.33 days, or in this case no compensation is accrued.

Vacation pay calculation

Next, we will consider two examples of calculating the amount of vacation pay: for special conditions of temporary work (seasonal or lasting less than 2 months) and for a regular “conscript”.

Seasonal work

Let's calculate vacation pay:

- the duration of the vacation will be: 3 months * 2 working days = 6 days (Article 295 of the Labor Code of the Russian Federation);

- the employee is entitled to vacation pay in the amount of: 1,346.15 * 6 = 8,076.9 rubles.

Fixed-term contract for 12 months

Even seasonal workers have the right to vacation days

All employees are, of course, entitled to vacation under a fixed-term employment contract. But the amount of paid time off depends on the period of time the parties agreed on employment. In particular, the Ministry of Labor of Russia, in Letter No. 625-BB dated 01.02.2002, recommended employers to calculate the duration of paid rest for an employee who is employed:

- short-term for a period of 2 months;

- for seasonal work up to 6 months,

as a general rule - 2 days for each month of work (Articles 291 of the Labor Code of the Russian Federation, 293 of the Labor Code of the Russian Federation, 295 of the Labor Code of the Russian Federation). Most often, such employees are provided with vacation days followed by dismissal.

As an example, consider a situation where an employee was temporarily hired to harvest crops for the period from 08/01/2018 to 11/01/2018. That is, on November 1, the employer will have to:

- or provide time for rest for 6 working days (2 days for each month worked) followed by dismissal;

- or pay compensation for 6 unused vacation days.

In this case, 6 working days will be paid based on a six-day working week (that is, all days except Sunday). In addition, non-working holidays, as defined by the norms of Article 120 of the Labor Code of the Russian Federation, are not included and not paid when calculating the duration of the vacation period in working days. This norm is similar to that provided for paid leave, calculated in calendar days.

If vacation was not used

An employee becomes entitled to leave after 6 months of continuous work with a particular employer. Leave can be granted earlier, but this requires the consent of the employer. If an employee is hired for a short period of time, he usually does not have time to receive vacation.

In this case, upon dismissal, he must be paid compensation for unused vacation days. The calculation goes like this: the average daily earnings and multiplied by the number of vacation days that the person did not use .

Here it is worth paying attention to the following point. As stated above, vacation pay for seasonal work and when hired for less than 2 months is considered in a special manner. In this case, compensation is calculated in working days . If we are talking about other “fixed-term” workers, then compensation is calculated in calendar days.

Important! The period of time actually worked does not play a role in this case. For example, if an employee was hired for 4 months, but only worked 1 of them, compensation still needs to be calculated in calendar days .

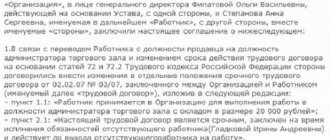

The legislation of the Russian Federation provides for the conclusion of employment agreements for an unlimited period of time, as well as indicating the exact date of its completion (58 Art. Labor Code).

Article 59 of the Labor Code of the Russian Federation considers when and under what conditions it is possible to conclude a fixed-term contract.

When concluding a fixed-term employment agreement, the expiration date and the reasons why an open-ended contract cannot be concluded must be indicated.

In any case, a fixed-term contract is concluded for a period of no more than five years, although it can be extended after a specified period of time.

Such employment agreements are usually concluded:

- when the very nature of the work performed determines its seasonal necessity (for example, harvesting, or the heating season);

- if a permanent employee is absent for a long time (due to illness or maternity leave);

- for the duration of work that requires a short period of time (50 – 60 days);

- if the enterprise is initially created to complete a given task for a certain time period;

- for internships and training in professional skills;

- in place of an employee working on a permanent basis if he was elected to an elective position for a certain period of time;

- when they are sent from employment centers to find temporary work of a public nature;

- when sending persons who, due to their convictions, do not have the opportunity to serve in the ranks of the country's armed forces, to alternative civilian service.

It happens that some employers prefer to enter into fixed-term contracts, believing that in this case the employee is not entitled to any benefits upon dismissal.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

This opinion is erroneous, since when terminating such a contract, the employee has the same rights and guarantees as when dismissing an employee hired for a permanent job.

A concluded fixed-term contract without specifying specific terms and circumstances that served as the basis for its conclusion is considered to have an indefinite period, that is, unlimited.

A fixed-term contract can be drawn up by agreement between the employer and the party being hired in the following cases provided for by the Labor Code:

- if an individual goes to work for an entrepreneur where the number of employees is no more than thirty-five people;

- when a person has reached retirement age or, according to the conclusions of medical commissions, has the right to work only temporarily;

- work in an organization located in the Far North or areas that are equivalent in their climatic conditions, if it is necessary to move from a permanent place of residence;

- work is organized to prevent the consequences of emergency situations, such as disasters, accidents, accidents;

- with full-time students;

- persons employed part-time,

and other cases provided for in the second part of Art. Art. 58, 59 Labor Code of the Russian Federation.

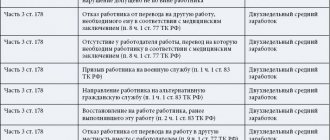

Upon termination of an employment contract concluded for a certain period, compensation payments are offered under labor legislation and determined by the norms of Chapter 27 of the Labor Code of the Russian Federation.

In the event of an upcoming staff reduction or liquidation of the enterprise, the owner must pay the dismissed employee, if there is no vacancy for transfer to another place of work, severance pay in the amount of average monthly earnings.

Similarly, a dismissed employee working under an open-ended contract must be provided with up to three months of guaranteed benefits in the amount of earnings if the dismissed person registered with the territorial employment center within two weeks, but was not provided with a suitable job.

When concluding an employment contract, the employment contract may stipulate other cases of payment of compensation under various conditions of termination of the agreement.

How to calculate vacation pay

Contract duration: 2 months or more (non-seasonal work)

For a “fixed-term” employee whose contract is concluded for two months or more (and the work is not seasonal), vacation pay should be calculated in the same way as for an employee with whom an open-ended employment contract has been signed. Namely: first you need to calculate the average daily earnings, and then multiply it by the number of calendar days of vacation (for more details, see “Crib sheet for calculating salaries, vacation pay and sick leave”).

Read more: How to place a person in a psychiatric hospital

The employment contract with the employee Kuptsov was concluded for a period of 12 months (from August 1, 2021 to July 31, 2021). During this period, Kuptsov received a monthly salary of 40,000 rubles. Kuptsov had no vacations, sick leave or absenteeism.

From August 1, 2021, Kuptsov was granted leave of 28 calendar days followed by dismissal. The accountant determined that the calculation period for calculating vacation pay is the period of time from August 1, 2021 to July 31, 2018. During this time, Kuptsov earned 480,000 rubles (40,000 rubles x 12 months). Average daily earnings are 1,365.19 rubles (480,000 rubles: 12 months: 29.3). Kuptsov's vacation pay amounted to 38,225.3 rubles (1,365.19 rubles x 28 days).

Contract duration is up to 2 months (or seasonal work)

As mentioned above, if an employment contract is concluded for a period of seasonal work, or for a period of up to two months, leave is granted at the rate of two working days for each month of work. In this case, the average daily earnings is the accrued salary divided by the number of working days according to the calendar of a six-day working week (Article 139 of the Labor Code of the Russian Federation). This value must be multiplied by the number of working days of vacation.

The employment contract with employee Barinov was concluded for a period of seasonal work, which lasted three months (from July 1 to September 30, 2018). During this period, Barinov received a monthly salary of 32,000 rubles. Barinov had no vacations, sick leave or absenteeism.

From October 1, 2021, Barinov was granted leave of 6 working days (3 months x 2 working days) followed by dismissal. The accountant determined that the calculation period for calculating vacation pay is the period of time from July 1 to September 30, 2021. During this time, Barinov earned 96,000 rubles (32,000 rubles x 3 months). The number of working days according to the six-day working week calendar was: in July - 26, in August - 27 and in September - 25. Total: 78 workers. days (26 working days + 27 working days + 25 working days).

The accountant determined that Barinov’s average daily earnings are 1,230.77 rubles (96,000 rubles: 78 working days). Vacation pay amounted to 7,384.62 rubles (1,230.77 rubles x 6 working days).

Possible reasons for dismissal

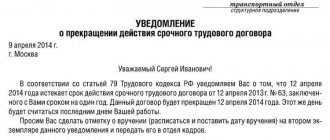

Article 79 of the Labor Code considers the conditions for termination of a fixed-term employment contract between an enterprise and an employee.

- Upon expiration of the period, with a warning to the employee from the management of the enterprise about the upcoming dismissal three days in advance, except in cases where the contract was concluded during the absence of a permanent employee.

- After completing the scope of work specified in the contract, when it is impossible to predict in advance the completion date.

- Upon the departure of the employee during whose absence this employment agreement was concluded.

- In case of seasonal nature of work, respectively, at the end of the designated period.

Like any working person, an employee under a contract concluded for a certain period can quit before the established date at his own request (Article 80 of the Labor Code of the Russian Federation).

Termination of a fixed-term contract is also possible by agreement between the manager and the employee hired under a limited-term contract (by agreement of the parties, Article 78 of the Labor Code of the Russian Federation).

Also, in cases of violation of labor discipline or the organization’s charter, the manager has the right to terminate the employment relationship: dismiss the employee, regardless of whether he works on his own initiative on a permanent or temporary basis (Article 81 of the Labor Code of the Russian Federation).

In addition, like all employees, a person who has entered into a fixed-term contract is not insured against dismissal in the event of a need for staff reduction or liquidation (closing) of the enterprise in the absence of suitable vacancies for transfer to another workplace (position) or refusal of possible job replacement options .

Features of dismissal under a fixed-term employment contract

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

The reasons for termination of a fixed-term contract, other than those established at the legislative level, may be specified additionally when concluding the agreement itself.

One of the features of employment contracts concluded for a certain period of time is that it cannot be concluded for a period of more than five years, but this does not exclude the possibility of extending it if necessary or concluding a new employment agreement for the same period.

There is one more nuance. If, after the expiration of the agreement, the employee continues to perform his job duties, and the employer does not take the initiative to terminate the employment relationship, such continuation of the employment relationship can be interpreted as a reason for the transition of a fixed-term employment contract into a regular indefinite employment.

Compensation payments in the event of termination of a fixed-term employment contract in accordance with labor legislation are similar to the required payments when a permanent employment relationship is terminated.

When dismissing an employee, the company must pay him on the last working day:

- underpaid wages for actual hours worked;

- upon termination of employment due to liquidation or closure of an enterprise, as well as in case of staff reduction, a benefit in the amount of average monthly earnings is due.

If it is not possible to transfer the employee to another job or in the event of his refusal from the offered vacancies, the amount of average earnings for two months is also paid, provided that the dismissed employee is registered with the territorial employment center on time (within two weeks after termination of the employment relationship ), but was not employed;

- The amount of compensation for unused vacation days is also required to be paid.

Payment of compensation for unused vacation upon dismissal in the event of termination of an employment contract concluded for a certain period depends on its duration, stipulated in the terms of the contract itself.

According to Article 127 of the labor legislation, if an agreement is concluded for a period of more than 2 months, compensation is calculated in the same way as for an open-ended contract, that is, in proportion to the time actually worked (2.33 days of rest are provided for the entire month worked).

Compensation for dismissal of a temporary employee

In accordance with current legislation, a worker who has worked at an enterprise for less than 6 months has the right, on an equal basis with other employees, to receive all due payments upon dismissal. This also applies to compensation for unused vacation days. To determine the amount of payments due, the HR department needs to prepare information: In the process of terminating the employment relationship, special attention is paid to the correctness of the final calculation. The procedure for implementing this procedure is enshrined in labor legislation and is used in all cases, regardless of the specifics of the situation. The total payment amount includes:

Compensation upon dismissal under a fixed-term employment contract for up to 2 months

According to Article 291 of the labor legislation, it is considered that for each month worked there are two days of rest.

It turns out that for two months worked, the dismissed employee will receive compensation of four days of vacation if he did not use them for their intended purpose during his work.

It turns out that compensation for dismissal under a fixed-term contract for 1 month should be paid based on the average earnings for two days. Another feature when calculating compensation for unused vacation is that if a person worked more than fifteen days, that is, more than half a month (in February it will be fourteen days), compensation is paid for two days, but if he worked less than half a month, at least for one day, no compensation is paid at all.

Compensation for unused vacation under a fixed-term employment contract

When concluding a fixed-term employment contract, a person sometimes does not think about whether he is entitled to annual leave. But after a while, this question may arise as needed.

The legislator, in Article 114 of the Labor Code of the Russian Federation, provided that when concluding any employment relationship, employees are guaranteed additional rest (vacation) in addition to weekends.

Consequently, to the question of whether compensation for vacation is due under a fixed-term employment contract, one can give an unambiguous answer - it is due, if during the work or upon dismissal the employee did not take advantage of his right to rest.

Vacation compensation upon dismissal under a fixed-term employment contract has some features depending on the term of the contract.

For workers who have entered into employment agreements for a period of up to two months, as well as for seasonal workers, the number of days allotted for rest is calculated at the rate of two days per month worked (in fact, more than half the month must be worked).

For longer employment agreements, the duration of leave is calculated according to the general procedure for granting leave, that is, similar to the calculation for permanent work.

Accordingly, compensation for unused vacation days is calculated for the number of days allotted for rest.

Let's consider an example of calculating compensation for dismissal under a fixed-term employment contract.

1. A seasonal employment contract was concluded with citizen Privalny A.I. for the heating season from October 15, 2013 to April 15, 2021. He was accepted by the boiler room operator. On March 1, 2016, at his own request, Privalny A.I. terminated his employment relationship with the company earlier than the employment contract was supposed to end.

The average daily earnings during work amounted to six hundred rubles (with all the required bonuses and other monetary rewards for the period worked).

In fact it worked:

17 days in October (more than half a month);

November, December, January, February – completely;

March – one day (since the day of dismissal is considered the last working day).

This makes a total of four full months and one month more than half.

This means that for the purposes of calculation we assume that five months have been worked.

Since only one day was worked in March 2021, vacation is not allowed for this month.

5 (months) x 2 (days due for one month of vacation worked) = 10 days

We calculated how many vacation days the boiler room operator A.I. Privalny earned. during his work.

By multiplying the number of days by the amount of average daily earnings, we find out how much money he should receive when calculating for unused vacation. 650 rubles x 10 days = 6500 rubles.

2. Ivanchenko P.R. entered into an employment agreement for the maintenance of office equipment from 01/05/2016 to 01/05/2017 (for a year).

Due to family circumstances, in connection with moving to another city for permanent residence, I was forced to resign on September 1, 2016.

His average daily earnings were 738 rubles.

In fact, we believe he worked for a full eight months. Multiplying by the number of days 2, 33, assumed when calculating vacation in the event of concluding a contractual relationship for a period of more than two months, if the work is not seasonal, we obtain:

8 (months) x 2.33 (days of allotted vacation) = 18.64 days is rounded in favor of the employee to 19 days.

A fixed-term employment contract is a document concluded between an employee and an employer for a certain period of time. It is regulated by the Labor Code of the Russian Federation, where it has several articles.

Sometimes a hired employee does not perform his duties well, and the owner has the right to terminate cooperation. In this case, he needs to know whether compensation for vacation is due upon dismissal under a fixed-term employment contract.

- General information

- Terms of the agreement

- Reasons for registration

- Reasons for breaking the labor relationship

- Dismissal under a fixed-term agreement

- Main features

- Compensation under the contract up to two months

- Calculation of provided payments

Rules for granting regular vacations under the Labor Code

Each employee officially employed at enterprises in various fields of activity is obliged to rest annually and replenish spent energy, while he retains his job and the average salary according to his position. During this period, the employee is temporarily released from work. Each type of activity requires different physical and mental effort, and depending on working conditions, a citizen can exercise his right to rest no less than the established minimum regulated by law. The Labor Code considers regular leave as a mandatory procedure with the basic rules that are prescribed in Part 5 of Article 37 of the Constitution of the Russian Federation and in Chapter 19 of Art. 114 Labor Code of the Russian Federation.

- In case of irregular working hours in accordance with Art. 119 of the Labor Code of the Russian Federation for a period of at least three days, and possibly for a longer period specified in the Collective Agreement of the enterprise.

- In case of harmful working conditions, 7 days may be added to the vacation according to Art. 117 Labor Code, if the employee worked for a full year.

- For specific activities, for example, for military or civil servants, who, in accordance with Federal Law No. 79 and Federal Law No. 76, are provided with additional days of rest in proportion to the period worked in the interests of the country, namely 5 days for every 10 years of service, but not more than 10 days.

Please note => What years are apartments currently receiving?

General information

Before determining the amount of payments for leave upon termination of employment, it is necessary to study in detail the options for concluding a contract and the reasons for its cancellation. All this information will help the dismissed employee receive all the compensation due by law, and the employer will avoid possible litigation.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Terms of the agreement

Vacation compensation upon dismissal under an employment contract (fixed-term) can be received by a former employee of the enterprise only if the document was concluded legally. The Russian Labor Code provides for the possibility of drawing up an agreement that is not only limited by a time frame, but also indefinite.

In most cases, the first option is used, which allows the employer to fire an unprofessional employee immediately after the document expires.

When concluding a fixed-term employment agreement, not only the expiration dates of its validity must be specified, but also the reasons that prevent the execution of an open-ended contract. Russian legislation provides for a maximum duration of such an agreement, which is 5 years.

However, if the employee justifies the trust of the company owner and conscientiously fulfills his job duties, then the possibility of extending cooperation is provided.

Conditions under which a fixed-term employment contract can be concluded:

- The work performed is seasonal (heating season, harvest, tourist season).

- A short period of time required to complete a specific order (from 50 to 60 days).

- A permanent employee is absent for a long period (due to maternity leave or official illness).

- A company or firm is created to perform a specific task that requires a limited amount of time.

- If a permanent employee has been elected to an elective position and will hold office only for a certain period.

- An employee is undergoing training or internship at the enterprise.

- The employee is sent from the employment center to perform public duties.

- When conscripted into civil service, which is an alternative to military service.

Reasons for registration

The Russian Labor Code clearly states the grounds on which a fixed-term employment agreement can be concluded. Any other reasons for its registration will be considered illegal. Due to such erroneous actions, both interested parties may suffer.

The basis may be:

- An entrepreneur who owns a company with no more than 30 employees expresses a desire to hire one more person.

- The worker has the opportunity to perform the functions assigned to him only for a certain time. This situation includes the inability to work indefinitely for medical reasons or due to reaching retirement age.

- The work must be performed in conditions with difficult climatic conditions (the Far North or similar regions). This rule applies only if the employee needs to move from his permanent place of residence.

- Organization of activities aimed at eliminating the consequences of disasters, accidents, natural disasters and other emergency situations.

- Hiring people who work part-time in any other public or private institution.

- If the employee is a full-time student.