Home » Buying and selling an apartment » Buying an apartment with a mortgage: step-by-step instructions

73

One of the most common ways to get your own home is to purchase an apartment on the secondary market using one of the many mortgage programs. Let's take a closer look at what and how to do to get a loan and become the owner of your apartment.

Do you need a notary when buying an apartment with a mortgage?

Mandatory – no, not necessary. Previously, a notary was needed to certify a purchase and sale agreement. This is not required now. However, it can be useful and even necessary in some cases.

Certification of the purchase and sale agreement

The process of buying an apartment involves drawing up a contract. It is not necessary to notarize it, but it is possible. This, of course, is an additional cost, but at the same time, a certified contract is more powerful than an uncertified one. This is especially true regarding the transaction of buying and selling an apartment on the secondary market. Of all the options available, this is the riskiest. As a result, anything that can at least slightly increase the reliability of the transaction is welcome.

Notary services can be paid by the seller or the buyer, depending on who exactly insists on it. In some cases, the parties agree to share the costs.

Certification of spouse's consent

When considering how the transaction proceeds if the seller or buyer is married, the first thing to note is the need to provide consent from the spouse for the purchase or sale of housing. Without such a document, the transaction may be declared invalid in court, which is not beneficial for both the buyer and the seller.

The notary in this case plays a decisive role. The fact is that such consent must be notarized. Otherwise, the document will not have legal force.

Registration of a transaction with the seller and transfer of money

The next step in the purchase procedure, after concluding a loan agreement, will be to receive funds and purchase the selected property. The transfer of money is the key point of the transaction. As soon as the money is in the hands of the buyer, you can begin to draw up an *apartment purchase agreement*. The relationship between the parties is reflected in the purchase and sale agreement, the important conditions of which are the value of the property and the payment procedure. The payment procedure can be carried out:

- Cash payment (in hand);

- By non-cash payment (transfer to the seller’s account);

- Through a safe deposit box.

Often banks issue a loan on the terms of the initial registration of a real estate purchase and sale transaction and mortgage, and only after that they issue borrowed funds. In such cases, the acquisition of real estate is carried out in the following stages:

- the buyer informs the seller about the concluded loan agreement and agrees to complete the transaction with the condition of deferred payment

- pays an advance to the seller from his own funds

- the transaction and mortgage are registered

- Certificates of the concluded transaction and registration of the mortgage are provided to the bank, on the basis of which money is issued

- final payment is made to the seller

As a rule, sellers agree to such conditions, since after registering a mortgage, the bank issues loan funds in the next working days. And the purchase and sale without payment guarantees the seller a deposit by force of law. So the seller has no risks.

The purchase transaction and registration of an apartment is carried out at the Federal Service for State Registration, Cadastre and Cartography (Rosreestr). When concluding a transaction, it is important to reach an agreement on all important conditions that will prevent this transaction from not taking place.

Do you need the help of a real estate agency or realtor when buying an apartment with a mortgage?

The procedure for buying and selling an apartment at the initial stage involves searching for an apartment seller. You can search for it yourself or contact specialists. The first option is much cheaper, but longer and more complicated. The second, as you might guess, is simpler and faster, but more expensive.

The difference between an agency and a realtor

There is no global difference. A real estate agency is a legal entity that provides certain services for finding buyers/sellers and supporting transactions. Typically, an agency employs several realtors and many other specialists, such as lawyers, managers, call center specialists, and so on. As a result, everyone does their job, which has a positive effect on the final result.

If a realtor works for himself (for example, by registering as an individual entrepreneur), usually his services cost much less than a full-fledged real estate agency. This is its only advantage. Otherwise, one person is simply not able to know everything and competently accompany the transaction acting as a lawyer.

Realtors, like real estate agencies, are very different. Very cool specialists who are capable of supporting the entire transaction at the highest level often go on their own. On the other hand, agencies can be so bad that it is better not to contact them at all. The level of services provided can only be determined in advance based on reviews from other clients.

Rights and obligations

Before signing an agreement with an agency or realtor, you need to check exactly what rights and responsibilities are specified in them. It is also a good idea to check the price for services. The document should not contain any ambiguous phrases or inaccurate data.

Example: If the contract contains a phrase similar to the following: “The client pays for the agency’s services based on the tariff rates posted on such and such a site,” there is a serious chance of very much overpaying. The company can change the rates at any time, both up and down. Of course, you can always try to prove the fact that the rates were implied on the date of signing the contract, but even in one day a lot can change and it is almost impossible to prove this.

If an agency or realtor only offers services to find a seller, it is better to refuse them. The fact is that a person can do the search himself, but only an experienced lawyer can handle transaction support. Ideally, it is worth hiring such a specialist separately, since those who work in agencies often do not have the proper qualifications or experience.

Step-by-step algorithm

To eliminate all questions and clearly show how the entire process of buying a home using mortgage schemes is implemented, the following algorithm was compiled:

- the future borrower selects a bank and a suitable program, submits an application and receives approval;

- then he looks for a suitable apartment;

- if the seller agrees to wait, a preliminary purchase and sale agreement is drawn up with the transfer of the deposit and the execution of a receipt;

- documents are submitted to the bank to verify the legal purity of the transaction;

- upon approval, the main purchase and sale agreement is drawn up;

- the agreement is registered with the MFC or Registration Chamber;

- then the new owner obtains a certificate from Rosreestr stating that he is the owner of the premises;

- the parties contact the bank, show the agreement and the certificate received;

- the seller receives the money, and the buyer enters into a mortgage agreement with the bank.

Social program or regular mortgage

All mortgage options can be divided into two main categories: regular and social. There is no point in dwelling on the first one – a classic loan secured by real estate. But the second option usually allows you to get housing much more profitable. Let's take a quick look at the three main types of social mortgages.

Military mortgage

As the name suggests, this product is relevant for Russian military personnel. There is a special program for them, under which a person opens a separate account into which a certain amount is received monthly. Basically, this money can be used to buy a home, although there are other options.

The main feature of such a mortgage is that the serviceman only chooses housing, and the state will pay for it. At least as long as he is in service. As you can easily guess, this is very profitable (the apartment will, in fact, be received for free), but such housing will not be sold until the entire loan is paid off and the service life is 20 years or more. Ideal for people who plan to spend their entire life (or most of it) with military service.

Help for young families

This is another special program under which you can receive a very significant amount for the purchase of an apartment. Of course, the state will not fully repay the debt for a citizen, but even 20-50% of the amount is very significant. Almost any person who really needs their own housing or does not have it in principle can participate in the program.

However, there are many disadvantages. To begin with, the program is only available to persons under the age of 35. Secondly, the state allocates funds from the budget for this program in very limited quantities. As a result, you have to stand in line for many years and it is not a fact that by the age of 35 this line will come. And even if a person turns 35 while on the waiting list, he automatically loses the right to participate in the program.

Maternal capital

This government program is relevant for families with two or more children. The bottom line is that after the birth of the second child, a certificate is issued for 466 thousand rubles (as of 2021). This money can be used both to pay off part of the mortgage loan and to pay the down payment, which is often extremely important.

Separately, it should be noted that many banks offer their clients special preferential lending programs, under which you can get a loan to buy a home on very favorable terms (much better than in a normal situation).

How do you purchase from relatives and parents?

- Banks are extremely reluctant to issue loans for the purchase of housing from relatives or parents. This is due to concerns on the part of the lender about misappropriation of funds and the fictitiousness of the transaction.

- One of the lender’s requirements in this case will be mandatory cashless payment between the seller and the buyer, incl. and cashless down payment.

- Purchasing housing from close relatives deprives the borrower of the right to participate in preferential social mortgage programs.

- According to clause 5 of Article 220 of the Tax Code of the Russian Federation, a citizen who bought real estate from a close relative cannot claim a tax deduction.

Where to start, terms and conditions

The first place to start buying an apartment is to search for a seller and choose a bank that will provide a loan. Everything else, if not secondary, is at least not so important.

Search for a seller

Since an apartment is being purchased, you need to look for the seller, not the buyer, which is somewhat simpler (more offers). To do this, you can use the following options:

- Acquaintances and friends . The easiest and most accessible way is to ask your acquaintances and friends if any of them (or someone they already know) is selling an apartment. Usually such transactions are quite reliable, since they are advised by trusted people and trusted people.

- Specialized sites . For example, Avito and its analogues. There are a lot of proposals here, most of which are quite relevant.

- Local newspaper advertisements . Even though newspapers seem to be becoming a thing of the past, they are still read by a huge number of people. And, as a result, advertisements are placed in them. Their relevance is a little lower, but it’s still worth a try. It should also be noted that many print publications have their own websites on which all the same information is posted, including advertisements for housing sales.

Among other things, you can not just search for advertisements, but also place one yourself: “I’ll buy a three-room apartment in the city center, I’ll consider all options” or something similar. They should also be posted both on websites and in newspapers.

Alternatively, if you don’t have time to search and have the opportunity to spend a certain amount, you can contact real estate agencies or private realtors. They will take care of this issue themselves and can provide additional services, for example, transaction support, which can be very useful.

Bank selection

The logical sequence of actions after finding a seller and conducting preliminary negotiations with him (in particular, you need to make it clear that the purchase is planned using borrowed funds) would be to choose a bank. You need to select it according to the requirements, conditions and loan programs.

Client requirements

To purchase an apartment on the secondary market using a mortgage loan, the client must meet the bank’s requirements. Much depends on the chosen financial institution, but on average, a sample list will look like this:

- Age of the potential borrower on the date of receipt of the loan: 18 years and older. Even if the client is recognized as emancipated (an adult) by a court decision, but is under 18 years of age, he will most likely be denied credit.

- Age of the potential borrower at the date of full repayment of the debt: 60-75 years. Here, too, everything depends on the bank. Usually the limitation is based on retirement age, but not always. It is recommended to clarify this in each individual case. Moreover, some banks offer special, preferential conditions for pensioners with reduced interest rates and so on.

- Total work experience: from 6 months to 3 years. Most often: 1 year.

- Work experience at last place of work: from 1 to 6 months.

There are no special salary requirements, but the bank will definitely take into account the income received to determine the potential loan amount.

Documents for the bank

Requirements for client documents also vary from bank to bank. Approximate list of required papers:

- Applicant's passport.

- Certificate of income (ideally, in the form of a standard 2-NDFL, but many banks are ready to accept other types of such document).

- A copy of the work record, certified by the manager.

- Documents for the apartment you plan to purchase (they must be requested from the potential seller).

The bank may request other documents, depending on the specific situation of the client.

Mortgage programs

Most banks have at least 2-3 mortgage programs aimed at purchasing an apartment on the secondary market. Before applying for a loan, you need to look through all the available options and choose the most suitable one.

What loan parameters to analyze

As a rule, it is better to send several applications to different banks (it is more effective to do this online than to personally visit each office), obtain approvals and analyze proposals according to the following parameters:

- interest rate - the lower the better, as a rule, it will be in the range from 10 to 15%;

- duration of lending – it is not worth taking out a mortgage for more than 20 years, since a long term has little effect on the size of the monthly payment, but the amount of overpayment increases;

- total approved mortgage amount - it is calculated for each client individually;

- amount of overpayment;

- currency of the loan (it is better to take out a loan in the currency in which you receive your salary; you should not rely on low interest rates on foreign currency mortgages; 2014 showed this well);

- whether security and surety are required;

- conditions for transferring housing as collateral;

- the amount of home insurance (this is mandatory, but life and health may not be insured);

- parameters for issuing a loan - in hand, by transfer to an account or to a card;

- conditions for early repayment.

You should not blindly trust the loan parameters that are stated in bank advertising or on official websites: for each applicant, banks usually establish individual conditions determined during the process of scoring and document verification.

Also, when choosing a bank, be sure to pay attention to how you will repay the loan. If the bank is located on the other side of the city, and you have to come to the office to repay the mortgage, then this option is unattractive. The best and most convenient way to pay off debt is online. This way you can view other loan parameters without leaving your home. It would be ideal if you could even repay ahead of schedule via Internet banking. For example, Sberbank recently implemented such a function.

What is the difference between buying an apartment on the secondary and primary markets?

The procedure for purchasing an apartment on the secondary market differs from the primary market in many ways, from the sequence of actions to prices. Both options are convenient and interesting in their own way, but much depends on what exactly is a priority for the potential borrower.

Price

Apartments in a new building are usually more expensive than those on the secondary market. This is not a mandatory rule, but this is exactly what happens most often. Apartments in a new building without renovation (roughly finished) and well-furnished apartments on the secondary market are more or less comparable in price.

If the buyer still plans to do major renovations, purchase the furniture he likes, remodel, and so on, then it is better to choose new buildings. In all other cases, especially when you need a “move in and live” apartment, the best choice is the secondary market.

Home improvement

The second important point is the arrangement of the apartment. Housing in new buildings is usually provided with a rough finish. In some cases, with “repairs from the developer”. The latter is the simplest, cheapest and most primitive option, in which the apartment takes on a more or less residential appearance, but still requires major repairs.

Some developers offer their clients to make high-quality repairs and even furnish the apartment with furniture/appliances of the customer’s choice, but the cost of such housing will be significantly higher than exactly the same on the secondary market.

Reliability of the transaction

But in terms of reliability, the option of buying a home from a developer is significantly better. Simply due to the fact that the apartment has not yet had owners, most of the potential problems with the seller’s relatives, his heirs, minors registered in the apartment, and so on are automatically resolved. There are still certain risks, but they will be significantly less.

Features of calculations

In almost all cases, housing in a new building (on the primary market) is purchased using a non-cash transfer. But when purchasing on the secondary market, the seller may require payments to be made exclusively in cash. This is very inconvenient, especially considering the fact that housing will be purchased on credit and the bank will agree to issue a loan only taking into account the non-cash transfer of funds.

Selecting a creditor bank for secondary financing

The service of lending for the purchase of residential real estate on the secondary market is offered by many domestic banks - both large (for example, Rosbank, Alfa-Bank, Gazprombank) and medium-sized (for example, SNGB, BZhF, Zenit).

Note that targeting the lowest interest rate may cost the borrower more in the long run than offers with seemingly higher interest rates. In each bank, secondary mortgages and their conditions are assessed according to a number of criteria.

An initial fee

. Analyze how much the borrower’s own savings are required for a mortgage in this bank, what is their ratio to borrowed funds. Mortgage lenders often tie the interest rate to the size of the down payment.

Options for collateral real estate

And. Find out what kind of real estate this bank is ready to lend to – “primary” (new building), “secondary”, individual house, plot of individual housing construction, room, share in the right to residential property.

This is important to know because your needs may change once your loan is approved and as you search for a home. And if the mortgage rates in the selected bank for “secondary” and “primary” in comparison with the offers of other banks are optimal, you will be able to choose real estate in several market categories.

Special conditions for collateral housing

. The bank is interested in the liquidity of the mortgage collateral. He may put forward requirements for your future apartment - for example, its number of floors, the total number of floors in a high-rise building, its year of construction, type of floors and location area. Knowing this, you will not waste time inspecting and negotiating with sellers of housing that is obviously unpromising as bank collateral.

Additional costs for obtaining a mortgage

. For example, the House of the Russian Federation does not have its own cash desks, so you have to purchase housing through the cash desks of other banks and pay them a percentage for transferring funds.

Mandatory risk insurance

. Find out which insurance companies are accredited by this bank, find out their conditions for mortgage insurance. Insurance companies have different rates and the difference can be double.

How does the procedure for buying an apartment with a mortgage work?

Let's take a closer look at the algorithm for buying an apartment with a mortgage based on the step-by-step actions described above. So, the search for a buyer and a bank was mentioned at the beginning of the article. Negotiations are recommended to be carried out immediately in a tripartite format: buyer, seller and bank representative.

Loan processing includes:

- Compiling an application for a loan.

- Awaiting pre-approval.

- Filling out the client questionnaire.

- Providing all necessary documents.

- Waiting for loan approval, taking into account the documents and application form.

- Signing the purchase and sale agreement, loan and collateral (usually simultaneously).

- Payment by the buyer of the down payment.

- Registration of property rights to housing.

- Signing the transfer and acceptance certificate.

A down payment is a mandatory requirement of the bank. You won’t be able to buy an apartment without paying anything for it. On the other hand, the bank does not restrict the buyer in any way and, in fact, he can simply give the money in cash to the seller, asking him for a corresponding receipt. They will be considered confirmation of the fact of payment for the bank.

Registration of ownership usually occurs even before full final payment and signing of the transfer and acceptance certificate. Only when the buyer is convinced that he really is the new owner of the apartment, the bank transfers money to the seller, and the parties sign the transfer and acceptance certificate.

It is often supplemented by a receipt for the full amount of payment for the apartment, but given the fact that the bank sends money by bank transfer and this can be easily tracked, there is no particular need for such a receipt.

What to check when choosing housing

Once you have decided on the choice of bank and a suitable mortgage program, you can begin looking for housing. Typically, approval is valid for 2-3 months; it is better to clarify this point so as not to miss the last day of application activity.

When choosing suitable housing, you need to pay attention to the following points:

- whether the apartment or house meets the bank’s requirements - for example, under the state support program you can only buy new buildings;

- who is the owner and how long has he owned the property - for example, if he entered into inheritance quite recently, then his ownership rights can be challenged within six months, so it’s better to play it safe;

- whether there are children among the owners - then ask them to demonstrate permission for the transaction from the guardianship authorities;

- whether the apartment has rent debts - ask for a certificate from the management company;

- to make sure that the apartment is not encumbered or mortgaged, request the appropriate certificate from Rosreestr;

- check on the local court website via “Search” to see if the apartment is the subject of a legal dispute;

- be sure to check the actual layout with that indicated in the technical passport - otherwise you will have to legalize all alterations or return them to their original form at your own expense;

- check who exactly is the owner and whether they all agree to sell the apartment, otherwise you may end up in an unpleasant situation when one of the owners does not consent to the transaction;

- if an apartment is being sold by an intermediary, check his power of attorney - whether the deadline has expired, what powers he has, etc. - and still contact the owner and make sure that he agrees to sell.

Naturally, you need to pay attention to such parameters of the apartment as its area, number of floors, layout, surrounding infrastructure, etc. - but we are talking here about the legal purity of the transaction.

Required documents

To purchase an apartment with a mortgage, you must request the following list of documents from the seller:

- Passport of the current owner . This document is needed in order to compare the data of the person who is selling the apartment and its real owner. Some scammers take advantage of the fact that many people do not verify such information and, not being the owners, fictitiously sell housing. In the case of a purchase through a bank, it is almost impossible to do this, since the bank will also check all the papers, but there is still the possibility of an error or inattention.

- Extract from the Unified State Register of Real Estate . This document now replaces the certificate of ownership. But in addition to the fact that with the help of an extract you can find out who is the owner of this apartment, it also displays information about whether there are any encumbrances on the apartment or not. If so, the bank most likely will not approve the loan. It is advisable to obtain the extract as “recent” as possible.

- Technical passport . Using this document, the bank and the new owner can determine whether the apartment has illegal redevelopment or not. If so, the bank will not approve the loan. This comes with possible risks. So, for example, if it is necessary to sell housing at auction (if the client cannot repay the debt), an apartment with unauthorized redevelopment cannot be sold.

- Title documents . This “section” includes housing purchase and sale agreements, donation agreements, wills, and so on. Any documents on the basis of which the seller received ownership of the property. Possible risks largely depend on them.

- Extract from the house register . An important document showing who is registered in the apartment. The bank will insist (and it is better for the buyer to join it) that all persons registered in the apartment be discharged before the sale takes place.

- Certificate from the management company . Using this paper, you can understand whether the apartment has debts for utilities or not. Formally, you can sell your home with debts. Moreover, the management company will not be able to demand them from the new owner, and if they try to do this, they can immediately go to court. However, this will still cause some inconvenience, because housing with debts is usually sold at a good discount.

- Permission to sell housing from the guardianship authorities . This document will be needed if a minor is registered in the apartment or is its co-owner. Without permission from the guardianship authorities, it will be impossible to sell such housing. This certificate has an expiration date of approximately 1 month. As a result, it is recommended to receive this document at the very last moment.

- Consent of the seller's spouse to the transaction . This paper is relevant only if the seller is married and the housing is in common joint ownership. Considering the fact that almost any apartment, even a private one, can, under certain conditions, be recognized as the common property of the spouses, the bank usually requires consent, regardless of who, how and for what money it was acquired.

Example: A husband can buy an apartment with money given to him. It will be considered personal property. However, subsequently, if the spouses made repairs to the home, purchased furniture, equipment, and so on, the wife can legally recognize the apartment as common property and not personal property. It's difficult, but possible.

Step-by-step instructions on how to buy or sell a home correctly

Registration of the purchase and sale of an apartment occurs in several stages. Each stage of the procedure will require certain actions from the seller and buyer. Next, we will talk about the stages of the transaction when buying a mortgage home, consider the sequence of actions for the buyer and the nuances for the seller. Here is a general algorithm for selling and buying that will help both participants navigate.

- Selecting a creditor bank and submitting an application. You can get a home loan from almost any bank. To do this, the buyer must submit a corresponding application to the bank branch.

Documents from the future borrower will also be required:- passport;

employment history;

- SNILS/TIN;

- certificate 2-NDFL.

- Selecting a property. Approval of an application for a mortgage loan has a statute of limitations, so it is better not to delay choosing an apartment.

The borrower should ask specialists for a list of requirements for residential real estate that may affect bank approval. Important! The buyer is obliged to warn the seller that the purchase will be carried out using credit funds. - Conclusion of a preliminary agreement. A preliminary agreement is concluded between the owner and the buyer in order to protect both parties from troubles. The document stipulates the rights and obligations of the parties, the amount of the deposit, the timing of its return, and liability for failure to fulfill the agreement.

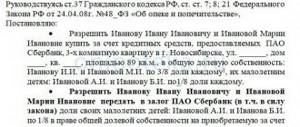

- Collection of documents. At this stage, before selling the home to the buyer, the apartment owner must collect a package of necessary documents for the bank:

- Evidence of ownership, the basis for its origin.

Owner's passports.

- Marriage certificate.

- Consent of the spouse to sell the apartment.

- Extract from the Unified State Register of Real Estate.

- Extract from the house register.

- Cadastral and technical passport.

- Certificate of absence of debt for housing and communal services, etc.

After reviewing the application and checking the client’s solvency, the bank will make a decision on approving the application. Read about the features of buying and selling an apartment with a mortgage in Sberbank here.

The borrower also collects the necessary documentation:

- Conclusion of an expert appraiser on conducting an appraisal examination of the apartment. Banks require examination from accredited partner companies.

- Consent of the spouse to purchase housing with a mortgage.

- Marriage/divorce certificate.

- An account statement indicating the availability of funds for the down payment.

- Other documents confirming the client’s employment and solvency.

After collecting all the papers, the seller and buyer submit them to the bank for review. Review may take several days, and sometimes additional documents may be required from participants. This is followed by the bank’s approval of the chosen mortgage option or refusal.

The draft document is drawn up by a notary in the presence of the client, and then transferred to the bank. The agreement must contain the basic terms of the loan:

- loan amount;

maturity;

The following is a form for downloading a standard mortgage agreement:

The document is drawn up in triplicate, signed by all participants, and certified by a notary. After this, the money is transferred, which occurs through the opening of letters of credit.

Separate accounts are opened for the transfer of the borrower's personal funds and funds provided by the bank. All costs associated with opening accounts and transferring money are borne by the buyer.

- notarized copies of participants’ passports;

What are the purchase costs associated with paying mandatory fees? The amount of state duty when purchasing real estate will be:

- The fee for paying for government services for registering property rights is paid by the buyer and amounts to 2,000 rubles.

- The fee for registering a mortgage is paid by the buyer and amounts to 1,000 rubles for individuals and 4,000 for legal entities.

What documents are needed to buy an apartment with a mortgage?

In addition to the above list of documents for the apartment, the buyer will also need additional documents to apply for a loan. This was briefly discussed above. Now let's take a closer look.

- Applicant's passport . Before submitting the application, you need to make sure that everything is in order with your passport - it was replaced with a “fresh” one in a timely manner (for example, upon reaching 25 years old), there are no third-party marks in it, and so on. Any violation and this document is considered invalid. As a result, the loan will not be issued.

- Temporary registration . This document is relevant only if the client does not have permanent residence. Despite the fact that loans are usually not issued under temporary registration, in the case of a mortgage an exception is usually made, but only on the condition that immediately after registration of ownership the client registers in his new home.

- Certificate of income . A mandatory document that is always required by the bank. Shows income level. The bank will prefer the official 2-NDFL certificate, but will consider other options. The main thing is that the document bears the signature of the head of the company where the borrower works, a seal and salary information.

- A copy of the work book . This document is not always required, but is desirable. It indicates that the person currently works absolutely officially, worked before, where he worked, how long he worked, and so on. You can ask for a copy from the accounting department. They cannot refuse.

Nuances of a military mortgage

Military mortgages have existed since 2005; there used to be a complex program for providing housing to military personnel, but starting in 2014 it was simplified. They began to simply issue government subsidies in addition to preferential mortgage lending.

The amount of payments for each participant is individual and depends on the duration of service, rank, and the number of family members. For example, for someone just starting their service, this could be an amount equal to 1 million rubles, the maximum – about 5,000,000 rubles. This takes into account the average cost per square meter of housing throughout the country.

The mortgage itself for the military consists in the fact that the participant is issued a loan at an interest rate lower than that of ordinary borrowers. Part of the money to repay the loan is sent by the state to a special account opened in the name of the military man. This program is called the “savings-mortgage system.”

The advantage of such a mortgage is that it becomes possible to purchase housing in any region of Russia. Many banks that are entrusted to issue such loans do not require a down payment, do not charge commissions, do not need to provide proof of income and do not need to insure their life and health.

The disadvantages are that the loan is provided only after three years of participation in the savings-mortgage system; immediately after dismissal, the payment of monthly amounts stops.

Expenses

What else you need to pay attention to is the possible costs. In an ideal situation, the buyer pays only for the apartment and insurance. However, the seller may offer to share the costs if such costs are too significant for him. So, for example, a tentative list of expenses would look like this:

- Payment to a real estate agency for finding a seller (or, if the seller asks, for finding a buyer and supporting the transaction): about 2-5% of the cost of the apartment.

Example: If we assume that housing costs 5 million rubles, then the agency’s services will cost 100–250 thousand rubles.

- Payment to the notary for certification of the purchase and sale agreement: about 5-10 thousand rubles.

- Payment to a notary for certifying the consent of the spouse: from 2 thousand rubles.

- Payment to an appraisal company for assessing a home: about 10-15 thousand rubles.

- New extract from the Unified State Register of Real Estate: 350 rubles.

- New registration certificate: from 10 thousand rubles.

- State duty for registering property rights: 2000 rubles for each new owner.

Decor

All transactions involving the signing of mortgage agreements, after all permissions have been received, take place at the bank in the presence of the buyer, loan manager, seller and, possibly, a realtor. If the bank stipulates that guarantors are required, then their presence at the time of signing is also mandatory.

First, they sign a loan agreement and open an account for the borrower to transfer the entire amount. The down payment is transferred to the seller's account.

Next, a purchase and sale agreement is signed, and the property is immediately registered as collateral for the bank.

If a notary was not present at the transaction, then be prepared for the fact that when registering ownership, all copies of documents submitted to the registration chamber will still have to be certified by him.

After registration of the property with the relevant authorities is completed, the buyer is given a document establishing ownership with an encumbrance, and the balance of funds is transferred to the seller.

Applying for a mortgage is the last stage, after which it will be impossible to refuse the deal. To declare an agreement invalid, you will have to go to court and you must have good reasons to challenge it.

About the deposit for an apartment

A mortgage loan is a loan secured by real estate. Most often, the exact housing that is purchased is accepted as collateral, although this is not a mandatory condition.

Apartment valuation

To understand the market value of an apartment, you first need to evaluate it. Banks often require an official report from licensed appraisers. Moreover, they often insist on those that are accredited by this bank. Housing appraisal is a fairly expensive procedure, but it allows you to rightfully demand a specific amount for an apartment.

Most often, the assessment is carried out on the basis of already existing analogues. Simply put, you can roughly estimate the cost yourself, based on other offers of similar apartments in the city or its region.

Example: To simplify it very much, you can imagine 3 apartments similar to the target housing. One of them costs 2 million, the second 2.5, and the third, 1.7 million rubles. The average figure will be the approximate cost of the target apartment: (2.5+1.7+2)/3=2.07 million rubles.

Collateral verification

Before registering collateral, bank specialists must check it. They study the compliance of everything that is said in the documents with the real state of affairs, evaluate access to the apartment and many other parameters. You should prepare for the fact that such checks will be carried out regularly. On average – once a year, but it can be more or less often.

Collateral insurance

A property that is already fully ready for registration as collateral is required to be insured. Moreover, you cannot refuse this insurance - this is a legal requirement. The cost directly depends on the price of the apartment, the insurance period and many different parameters, including even the material of the walls/floors.

Typically, insurance is issued for 1 year and is renewed annually until the loan agreement is closed. However, in some cases, the apartment is immediately insured for the entire term of the loan. Usually in this situation the insurance company gives a good discount.

Encumbrance of collateral

After signing the contracts, an encumbrance is placed on the apartment. In this case, the client does not have to do anything. The bank itself will impose the encumbrance and, moreover, will remove it itself after the debt is repaid.

It must be remembered that the encumbrance will not allow you to sell this home. Also, usually, according to the terms of the agreement, the bank client is limited in certain actions with his home: he cannot register other persons, do redevelopment, and so on without the approval of the bank.

Of course, the financial institution will not constantly monitor all this, but if this fact comes up during the inspection, the bank may demand early repayment of the loan or impose penalties.

Insurance and mortgage transfer

To conclude a mortgage agreement, it is necessary to undergo the procedure of compulsory insurance of the collateral real estate against the risks of damage and loss. This procedure is provided for by the mortgage law.

Banks often require insurance on the borrower's life or other risks. The decision to sign an agreement with additional types of insurance is the decision of the borrower, because it leads to an increase in loan payments (hidden interest).

Next comes the process of drawing up a mortgage and mortgage agreement. The mortgage agreement is registered in Rosreestr, which will not allow the borrower to perform any actions with the property without the consent of the bank, the holder of the mortgage. The mortgage remains with the banking institution and allows it to resell the right of claim under the pledge agreement.

How long does it take to buy and sell an apartment with a mortgage?

A home purchase and sale transaction, in ideal conditions, without going to the bank, takes at most 1 day. But this is actually very rare. Most often, discussing the conditions, completing all the necessary papers and other actions take about 3-4 weeks, or even a couple of months. If we also take into account the application to the bank (review of the application, verification of collateral, internal procedures for approving a loan, and so on), then the period can be safely increased by about 1 month.

Thus, the entire procedure for purchasing an apartment with a mortgage will take from 1 to 3 months.

Registration of a transaction and registration of a mortgage

After the agreement has been drawn up, it is necessary to prepare copies of all documents mentioned in it and contact one of the following organizations to register it:

- directly to the Registration Chamber;

- to a multifunctional center (the so-called single window);

- through the website for the provision of public services (if all owners have an electronic signature).

As a rule, the second option is most often chosen - as the fastest, most convenient and understandable. The signing of the contract occurs upon direct submission of documents. The procedure is quite simple. The main thing is not to forget to pick up a receipt from the registrar for receiving the documents.

As of 2021, the issuance of certificates has been abolished. Therefore, when you take the documents back, there will no longer be such paper. To confirm that the transaction has taken place, you must contact Rosreestr to issue the appropriate certificate.

Together with it and the signed agreement, the parties must go to the bank. The further course of action is as follows:

- the borrower applies for a mortgage by signing the necessary papers and obtaining insurance;

- funds are transferred directly to the seller’s account or card;

- the parties are issued payment orders confirming the completion of the transaction;

- the seller issues a receipt that he has received all the money from the buyer (it will later be useful for tax deductions).

This completes the procedure for purchasing an apartment using a mortgage loan.

Tips on what you need to know when buying an apartment with a mortgage

As you know, buying an apartment, even through a bank loan, is a rather risky procedure. Let's look at the main features and advise on how best to avoid the most popular problems.

Underwater rocks

Pitfalls that are relevant when buying a home with a mortgage:

- Minors are registered . As mentioned above, the bank will insist that all persons registered in the apartment be registered before the loan is issued. An absolutely reasonable request. However, if it is not heard, then a serious problem may arise. It is simply impossible to evict a minor. More precisely, it is possible, but for this he first needs to be provided with housing of similar quality. The new owner, to put it mildly, is not very interested in this. This problem should not be solved, but anticipated: you should independently check the extract from the house register and, if minors are listed there, demand that they be written out.

Discharging adults is also not easy, but it is possible. It is enough to go to court and declare that the residents are living here without the consent of the new owner and are undesirable. However, usually all such persons agree to be discharged voluntarily.

- The apartment was received as a gift . The gift may be taken away. For example, if the donor considers that the apartment is not being used the way he wanted. Let's say the home is valuable to the donor (for example, several generations have grown up in it). Of course, this person will be against the fact that the housing goes to a complete stranger. In such a situation, he can invalidate the gift agreement in court, and the new owner automatically loses the right to the apartment. There is no optimal solution to the problem. Unless you make sure that the donor will not challenge the contract or wait until the statute of limitations expires (1 year from the date of donation).

- The apartment was inherited . In such a situation, other relatives of the deceased may demand their share in the housing. If there is a will, this is not bad, since it immediately indicates all the features of the transfer of ownership. And if not, then the inheritance will be carried out on a general basis and there is a possibility that one of the heirs will not receive everything that is due to him. As a result, the agreement will be challenged in court. Here you can also wait for the statute of limitations to expire or check whether other heirs really have no claims.

- The apartment was received as part of privatization . Such a system may result in a person having the right of lifelong residence being registered in the apartment. It cannot be written out under any circumstances. This point should be clarified using an extract from the house register.

Not all aspects can be checked and anticipated by the client on his own. In many cases, only an experienced lawyer can do this. It is recommended to contact specialists to minimize possible risks.

Who is better to register an apartment for?

What should you do if a family man buys an apartment with a mortgage and wants to make it his personal property? In such a situation, it is necessary to register housing only for yourself, but this will not be enough. According to the law, even if the apartment is registered in the name of one of the spouses, but is acquired during marriage, the other half may demand that such real estate be recognized as joint property.

Moreover, if housing is purchased on credit, then the very fact of payments can be considered as expenses from the family budget. As a result, the apartment will still become joint property. The only option would be to use exclusively donated funds, but this point will also need to be proven.

If we talk about who is better to apply for a loan for an apartment, then the answer is obvious: the one who earns the most and has official employment. If, for example, only the wife is officially employed, but the husband earns more, then you need to apply for a loan for her, and he should be involved as a co-borrower.

In practice, banks almost always require spouses to become co-borrowers with each other.

What documents are issued when purchasing an apartment with a mortgage?

When purchasing an apartment with a mortgage, the buyer is left with:

- Contract of sale.

- A recent extract from the Unified State Register of Real Estate (issued upon registration of ownership).

- The act of acceptance and transfer.

- Loan agreement.

- Pledge agreement.

- Insurance policy for the apartment.

You usually have to obtain a registration certificate yourself. Other documents or copies thereof may also remain. For example, a gift agreement, on the basis of which the previous owner became the owner of the apartment, or, for example, the consent of the seller’s wife. All of them can be used only as a safety net in case of possible problems.

Even when buying an apartment with a mortgage, despite all the bank’s checks, the buyer may have problems with the seller, the housing, the persons registered in it, and so on. At a free consultation, experienced lawyers will tell you what exactly you should pay attention to first. They can also accompany the transaction, minimizing problems.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

2 ratings, average: 4.00 out of 5)

Author of the article

Natalya Fomicheva

Website expert lawyer. 10 years of experience. Inheritance matters. Family disputes. Housing and land law.

Ask a question Author's rating

Articles written

513

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

3

Apartment purchase and sale agreement using a safe deposit box

The procedure for purchasing an apartment is closely related to numerous fraudulent schemes. Get rid of...

33

Contract of sale of an apartment

In the majority of transactions for the alienation of property, a standard agreement is concluded...

6

How to bargain when buying an apartment on the secondary market

You can reduce the price when buying an apartment if you know some of the preparation details...

8

What documents are needed to buy an apartment?

Filling out documents for purchasing an apartment is one of the most responsible...

5

Buying an apartment by assignment of rights

When planning to buy an apartment on the primary market, you may come across advertisements...

29

Agreement on deposit when purchasing an apartment

In case of expropriation of real estate for compensation, the Seller and the Buyer may agree not...

Risks

When buying an apartment with a mortgage, you need to consider all the risks that may arise during the entire duration of the loan. There are not many of them, but you shouldn’t ignore them either:

- You need to be confident in your permanent income, which would allow you not only to pay off the loan, but also not to reduce your quality of life. Therefore, life, health and solvency insurance will help you in case of unforeseen circumstances.

- It is very important not to make late payments, even small ones. The Law “On Mortgages” clearly states: if payments are delayed three times within a year, then the bank has every right to foreclose on the apartment. To get the money back, he will sell the property, the price will be significantly reduced. Therefore, be careful about payment dates; it is better to make a payment in advance.

- If you suddenly decide to take out a mortgage in foreign currency, then by receiving income in rubles, you are at great risk, since your payment can be greatly increased due to the growth of the exchange rate. Of course, if your salary is calculated in dollars or euros, then it is more profitable to take out a foreign currency mortgage, since the interest rates on it are reduced and the amount of overpayment will be much lower.

If you have difficulties paying a loan, you should not hide or ignore calls and demands from the bank. If you find yourself in a difficult situation, it is best for you to contact the credit institution yourself with an application in which you must indicate the reasons that make payment difficult. Based on this, the bank can offer several solution options: deferment of payments, reduction of the contribution amount by increasing the term of the loan agreement, or another option.

We hope that you are a law-abiding citizen. If you want, you can pay taxes through Sberbank. To do this you must have an account. Here you can see how to open an account with Sberbank online.

Are you trying to open a bookmaker's office as a franchise, but it's not working yet? Go here!