Any company has the right to decide for itself what valuable information in its opinion should be declared a trade secret of the organization.

The list of general information subject to non-disclosure is specified in Art. 5 of the Law “On Trade Secrets”.

What liability does an employee face for disclosing a trade secret in 2021? More on this later.

What is a trade secret?

Federal Law No. 98 of July 29, 2004 contains a definition according to which a trade secret is some valuable information unknown to third parties.

This concept should not be confused with the concept of “confidential information”. In fact, a trade secret is a subspecies of it.

Confidential information includes:

- personal data;

- professional confidentiality (for example, medical confidentiality);

- secrecy of investigation, legal proceedings;

- official secret;

- data on discoveries or inventions;

- trade secret.

All information related to a trade secret is confidential, but at the same time, not all confidential information can constitute a trade secret.

What can constitute a trade secret?

According to the above-mentioned law, only information that meets the following criteria can constitute a trade secret:

- the information actually has commercial value and is unknown to third parties;

- third parties do not have free access to this information;

- the owner of valuable information has introduced a trade secret regime in relation to it.

Here is an approximate list of information that could potentially be classified as a trade secret:

- data from management reporting;

- budget information;

- list of clients and planned transactions;

- terms of concluded contracts;

- strategic plans;

- methodology and principle of pricing;

- investment projects;

- business correspondence;

- information about employee salaries.

The following information cannot constitute a commercial secret:

- contained in the constituent documents of a legal entity entered in state registers;

- giving the right to engage in entrepreneurial activity;

- of an environmental nature (for example, about environmental pollution), as well as information regarding the state of fire safety, radiation and sanitary-epidemiological conditions, food safety, etc.;

- on the composition and number of employees, on the payment system, conditions, labor protection, on the availability of vacancies, on industrial injury rates;

- employers' debts to pay wages;

- on the size and structure of income, as well as on the expenses of organizations;

- on the conditions of competitions for the privatization of property;

- on the composition of the property of state enterprises and on their use of budget funds (Article 5 of the Federal Law - No. 98).

A trade secret regime cannot be established in relation to accounting (financial) statements by virtue of Part 11 of Art. 13 Federal Law - No. 402 dated December 6, 2011 “On accounting.”

Protection of trade secrets

A key condition for ensuring the protection of trade secrets is the introduction of a trade secret regime into the organization. For this purpose, a package of necessary documentation is created and a number of measures are taken to protect classified information.

Only if this condition is met and the requirements specified in Federal Law No. 98 are met, the organization will be able to protect its rights in accordance with current legislation.

The content of the components of the trade secret regime is developed by the company independently and recorded in internal regulatory documents (orders, regulations, instructions). Most companies develop a Trade Secret Regulation and then have it approved by the manager.

This regulatory act requires:

- Clearly define the list of information that constitutes a trade secret of the organization.

- Indicate the procedure for working with this information.

- Establish the circle of persons who have access to classified information.

- Indicate who will be assigned the control function.

- Determine the extent of liability for disclosure of trade secrets.

After approval of the Regulations, you should:

- Make appropriate changes to other administrative documents of the company (job descriptions of employees, employment contracts, etc.).

- Familiarize all employees with the approved documents for signature.

- Obtain a written commitment to maintain confidentiality from employees who have access to trade secrets.

- Create all the necessary conditions for compliance with the trade secret regime (store documents in locked cabinets, safes, provide personal access to a computer, etc.).

Agreements with counterparties should include a provision that all information is confidential and is not subject to transfer or disclosure to third parties without mutual agreement of the parties.

Civil liability

Penalties applied to those who disclose secret data are not reflected in civil law. We are talking about individual provisions in the Civil Code. At the same time, the owner of information constituting a trade secret, in the event of its disclosure, may demand certain actions from the culprit. This applies to a situation where the disclosure occurred without the company's consent.

They can demand compensation for losses incurred in full. It is worth paying attention to the fact that laws or agreements may establish a smaller amount of compensation. If, as a result of the disclosure of data, a person received funds, the owner of the information can demand, among other things, compensation for lost profits. Its amount is no less than the amount received by the offender.

Disclosure of trade secrets: features of the crime

The corpus delicti of this crime is formal with the presence of direct intent.

The qualifying features of such a crime are indicated in Art. 183 of the Criminal Code of the Russian Federation. Let's consider them further:

- Trade secrets are disclosed to third parties without the consent of the owners.

- The culprit pursued selfish goals.

- Causing major damage from disclosure.

- Serious consequences (for example, people were injured).

If the actions of the accused contain none of the above, then liability will only be administrative (Article 13.4 of the Administrative Code).

Features of initiating a criminal case

The key factors in opening such a case will be:

- The company has a document regulating work with trade secrets.

- The suspect has an obligation to comply with the requirements of this document.

If the employee did not sign any non-disclosure obligations, then it will not be possible to bring him to criminal liability.

For example, a person hired under a contract to process documents used the data obtained for personal gain. But at the same time, he did not sign an agreement to maintain the confidentiality of this data. As a result, the injured company will be denied the opportunity to open a criminal case and will only be able to recover compensation for damages through a civil lawsuit.

How to prove the disclosure of a trade secret?

To prove the crime, it is necessary to collect evidence of the fact that information was disclosed by one or another employee.

To do this, it is necessary to collect documents that indicate the suspect’s access to confidential information, such as:

- Order on the protection of classified information.

- Approved procedure for access to trade secrets.

- Non-disclosure signatures, etc.

It is then necessary to gather evidence against the alleged whistleblower, namely:

- conditions and circumstances of disclosure (accidentally, intentionally, under threat);

- method of transmitting information (orally, via electronic media, by mail);

- reasons and motives for committing a crime (revenge, reward, etc.);

- any other information supporting the accusation.

If the whistleblower accidentally learned about a trade secret and shared it unintentionally, then he cannot be charged with the crime we are considering.

What is the penalty for disclosing a trade secret?

Current legislation provides for several punishment options for disclosing trade secrets.

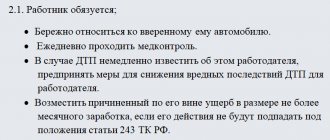

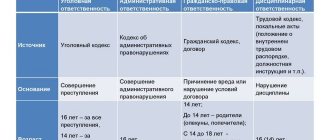

According to Part 1 of Art. 14 Federal Law - No. 98, the guilty person is subject to disciplinary, administrative, civil or criminal liability.

If the disclosure of a trade secret violates the internal regulations of the enterprise, then disciplinary punishment is applied. The offending employee will be punished with a reprimand, reprimand or dismissal (according to clause 6 “c” of Article 81 of the Labor Code of the Russian Federation).

In this case, lost profits cannot be recovered from the culprit, and actual property damage will still need to be proven.

Administrative liability is established in accordance with the Administrative Code and involves a fine of 500 to 1000 rubles for an individual and from 4 to 5 thousand rubles for an organization.

Criminal liability for disclosing trade secrets is much more severe. Fines in this case can reach 1-1.5 million rubles or in the amount of 2 years’ income of the perpetrator.

A ban on engaging in certain types of work or any positions may be added to the fine.

Article 183 of the Criminal Code of the Russian Federation also provides for correctional/forced labor (up to 2/5 years, respectively) or up to 7 years in prison.

Dismissal for disclosing trade secrets

Disclosure of a trade secret is one of the good reasons for dismissing an employee at the initiative of management. This opportunity is provided for in clause 6 “c” of part 1 of Art. 81 Labor Code of the Russian Federation.

But in order for an employer to dismiss an employee legally, he must ensure that a number of conditions are met.

Here are the main ones:

- the presence of a clearly defined list of information included in a trade secret;

- written notification to employees of the special status of certain information;

- collected evidence of the fact of disclosure;

- the presence of previously developed measures to protect information and limit access to it by third parties;

- approval of the list of persons with access to classified information;

- the presence of a material medium marked “trade secret”.

Categories of employees not subject to dismissal:

- pregnant women;

- minor citizens;

- employees on sick leave or vacation.

The dismissal procedure consists of the following stages:

- Recording the fact of disclosure.

- Collection of evidence.

- Delivery of a written request to the employee for an explanation (against signature or registered mail).

- Receiving explanations from the employee (within 2 working days after delivery of the request).

- Drawing up a report (if the employee did not give an explanation).

- Evaluation of the explanations received from the employee by a specially created commission and drawing up a protocol with conclusions and recommendations regarding the future fate of the employee.

- Issuance of an order for dismissal by the employer indicating the grounds and reference to the relevant article of the Labor Code of the Russian Federation.

- Familiarization of the employee with the order.

- The employee’s consent to dismissal against signature; in case of refusal, drawing up an act.

- Making a record of dismissal in the work book indicating the grounds (disclosure of trade secrets) and a link to the article.

- Payment to the employee and issuance of a work book.

Punishment in the form of dismissal can be applied within 6 months from the date of commission of the offense and 1 month from the date of discovery of the misconduct.

In addition to dismissal, the employer has the right to hold the guilty employee financially liable. In this case, he may be required to compensate for the damage caused to the company as a result of his actions.

However, the employer has the right to demand compensation only for those funds that were actually lost by the organization. In this case, it is impossible to recover the amount of lost profits from the culprit.

Disciplinary punishment

In a situation where a company employee discloses secret data, various measures may be applied to him. Information must be secret. They become known to the employee due to the performance of job duties.

The employer may apply disciplinary liability to him. It is expressed in a reprimand or remark. In addition, they may decide to terminate the employment relationship with the person. This basis for dismissal is reflected in Article 81 of the Labor Code.

The listed measures can be applied to a person in the event that it is established that secret information has been disclosed to him. In this case, it must be the employee’s fault. The action can be performed once.

Responsibility for disclosure of trade secrets after dismissal

If the disclosure of a trade secret took place after the dismissal of the employee, then the application of certain liability measures to the former subordinate is also possible.

For example, if, after dismissal, a former employee went to work for competitors and revealed to them the secret information of his former employer, then he can be required to pay a penalty or compensation for damages to the employer (including lost profits). The amounts will be determined in court.

Judicial practice in relation to this crime shows that the most important condition for imposing punishment for disclosure of trade secrets is the availability of evidence.

It can be quite difficult to record a violation, even if the employer is aware of the fact and knows exactly who the culprit is.

Therefore, when dismissing an employee, it is worth realistically assessing the chances. If the evidence is insufficient, then it is worth finding another way to solve the problem, otherwise the employee may challenge it in court.

So, an employee can be punished for disclosing a trade secret only if all the conditions and procedures presented above in the article are met.

Video: Disclosure of trade secrets

Procedure for punishment and proof of guilt

To prove intentional disclosure of a trade secret, a person must:

- Know that this information belongs to this category of information.

- Understand that his actions contradict the requirements of the law and internal company documents for working with this information.

Among the specific evidence of the culprit’s actions, information from the company’s computer system is often used, which reflects the employee’s work time, his actions and what documents he used.

The presence of intent is the most important factor in qualifying a crime. Therefore, it is considered important to prove that the offender was aware of the illegality of his own actions.