Sample application to appeal a decision under Art. 14.19 Code of Administrative Offenses of the Russian Federation

To the Arbitration Court of the Sverdlovsk Region 620075, Sverdlovsk Region, Ekaterinburg, st. Shartashskaya, 4

APPLICANT: Limited Liability Company "A"

INTERESTED PERSON: Interregional Department of the Federal Service for Regulation of the Alcohol Market in the Ural Federal District INN: 6671294624, OGRN: 1096671010864 620144, Sverdlovsk region, Ekaterinburg city, Bolshakova street, 99 a

State duty is not paid

in accordance with Part 4 of Art. 208 Arbitration Procedure Code of the Russian Federation

STATEMENT on declaring illegal and canceling a decision in a case of an administrative offense

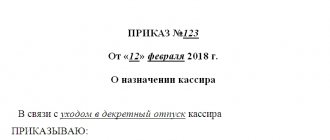

On August 28, the acting head of the MRU Rosalkogolregulirovanie for the Ural Federal District, state adviser of the Russian Federation 3rd class Anna Anatolyevna Ryabikova, in relation to LLC “A” (hereinafter referred to as the Applicant), issued a resolution imposing an administrative penalty in case No. 12-08/199-A, thereby imposed on LLC “A” the administrative penalty provided for in Article 14.19 of the Code of Administrative Offenses of the Russian Federation in the form of an administrative fine in the amount of 150,000 rubles.

As established by the Resolution on the imposition of administrative punishment, in the opinion of the authorized body, Declare, by his actions, committed an offense, expressed in the failure to record the supply of alcoholic beverages (beer, beer drinks) in the Unified State Automated Information System. In accordance with the consignment note No. AB-1269 presented by the Applicant, alcoholic products were shipped by the Applicant to TZK Metallurg LLC, while the specified consignment note is not recorded in the Unified State Automated Information System.

We do not agree with this resolution of the MRU Rosalkogolregulirovanie for the Ural Federal District (hereinafter referred to as the Respondent), we believe that this resolution was made illegally, since the Respondent did not take into account the factual circumstances of the case, and also violated the norms of substantive and procedural law, which is expressed in a violation of rights and legitimate interests The applicant due to the following:

According to the authorized body, the Applicant violated the requirements of paragraph 1 of Art. 14 of the Federal Law of November 22, 1995 N 171-FZ “On state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products”, according to which, organizations engaged in the production and (or) circulation of ethyl alcohol alcohol (except for the pharmaceutical substance of ethyl alcohol (ethanol), alcoholic and alcohol-containing food products, as well as alcohol-containing non-food products with an ethyl alcohol content of more than 25 percent of the volume of finished products, are required to record the volume of their production and (or) turnover.

Moreover, as established by the resolution, the Applicant violated paragraphs 7, 15 of the Rules for the functioning of the unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products, approved by Decree of the Government of the Russian Federation of December 29, 2015 No. 1459, in accordance with which organizations registered as a legal entity that use equipment to record the volume of purchase, storage and delivery of products submit to a unified information system using software and hardware that ensures the reception and transmission of information to a unified information system, the information specified in paragraphs. 1-3 18, 20, 25, 26 and 30 clause 6 of the Rules.

The applicant also violated clause 5 of the Rules for accounting for the volume of production, turnover and (or) use of ethyl alcohol, alcoholic and alcohol-containing products, as well as accounting for the use of production facilities, the volume of harvested grapes and grapes used for the production of wine products, approved by Decree of the Government of the Russian Federation dated 19 06.2006 No. 380, namely, accounting for the volume of product turnover using technical means with which the equipment is equipped to record the volume of product turnover, is carried out in organizations engaged in the circulation of products, from agricultural producers engaged in the circulation of wine, sparkling wine (champagne), individual entrepreneurs purchasing beer and beer drinks, cider, poire, mead for the purpose of subsequent retail sale of such products.

As established by the resolution, the Applicant violated clause 5.1.1. The procedure for filling out and deadlines for submitting an application for entering reference information on documents accompanying and permitting production and (or) circulation, including import of ethyl alcohol, alcoholic and alcohol-containing products: declarations of conformity, certificates of conformity, trademark, certificate of state registration goods approved by order of the Federal Service for Regulation of the Alcohol Market dated May 21, 2014 No. 149, according to which in the fields “5. Date of cargo release", "6. Document number and “7. Document series" indicates, respectively, the actual date of shipment, the number and series of the consignment note, information about which is recorded in the Unified State Automated Information System, and are filled in by the operator of the organization that supplies the products.

As follows from the materials of case No. 12-08/199-A, according to information from the Unified State Automated Information System, there is no registration of TTN No. AB-1269 for the supply of alcoholic products, it also follows that TZK Metallurg LLC did not purchase alcoholic products from the Applicant under TTN No. AB- 1269.

However, the authorized body did not take into account the circumstances set out in the explanations of the director of LLC “A”, with which the principal explained that the sales made were formed on the basis of the application submitted by the client and recorded in the EGAIS system (TTN Identifier - 0279894613), but due to the presence circumstances, due to technical reasons the delivery was postponed, the Buyer refused this TTN in the EGAIS system. In this case, the shipment took place, but due to the actions of the Applicant’s employee, the date of the document was not changed by the employee whose job responsibilities included the preparation of the relevant documents on the date of actual shipment before the departure of the vehicle. Likewise, the date of actual shipment and receipt of the goods by the buyer is indicated in the transport section of the TTN No. AB-1259.

- The MRU of the Federal Service for Regulation of the Alcohol Market in the Urals Federal District has not unlawfully established that the offense committed cannot be classified as minor

According to Art. 2.9 of the Code of Administrative Offenses of the Russian Federation, if the administrative offense committed is insignificant, the judge, body, official authorized to resolve the case of an administrative offense may release the person who committed the administrative offense from administrative liability and limit himself to an oral remark.

Paragraph 18.1 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 02.06.2004 No. 10 “On some issues that have arisen in judicial practice when considering cases of administrative offenses” clarifies that when qualifying an administrative offense as a minor one, the courts should take into account that Article 2.9 of the Code of Administrative Offenses of the Russian Federation does not contain reservations about its non-application to any offenses provided for by the Code of Administrative Offenses of the Russian Federation.

The possibility or impossibility of qualifying an act as minor cannot be established in the abstract, based on the structure of the administrative offense formulated in the Code of Administrative Offenses of the Russian Federation, for which liability is established. Thus, the qualification of an administrative offense as minor cannot be refused only on the grounds that in the relevant article of the Special Part of the Code of Administrative Offenses of the Russian Federation, liability is defined for failure to fulfill any obligation and is not made dependent on the occurrence of any consequences.

According to the legal position formulated in paragraph 3 of the Resolution of the Constitutional Court of the Russian Federation dated November 12, 2003 No. 17-P, state regulation in the field of production and circulation of such specific products related to objects of limited circulation, such as ethyl alcohol, alcoholic and alcohol-containing products, is determined by the need to protect both the life and health of citizens and the economic interests of the Russian Federation, to meet the needs of consumers in relevant products, to improve their quality and to monitor compliance with legislation, norms and rules in the regulated area.

This position also corresponds to the goals of state regulation in the field of production and circulation of alcoholic products, which are enshrined in paragraph 1 of Article 1 of the Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products.”

At the same time, based on the nature of the offense committed, the authorized body did not take into account the circumstances of the insignificance of the offense, since taking into account the explanations of the director of LLC “A”, the Applicant did not pursue the goals of concealing, deceiving and providing false information when recording in the Unified State Automated Information System. Thus, the actions taken indicate the absence of a significant threat to protected social relations, did not infringe on the protection of consumer rights, or on ensuring the quality of alcoholic products, much less did they entail socially dangerous consequences.

- MRU Federal Service for Regulation of the Alcohol Market in the Urals Federal District, when bringing LLC “A” to administrative liability, circumstances mitigating administrative liability were not taken into account

In accordance with Part 3 of Art. 4.1 of the Code of Administrative Offenses of the Russian Federation, when imposing an administrative penalty on a legal entity, the nature of the administrative offense committed by it, the property and financial position of the legal entity, circumstances mitigating administrative responsibility, and circumstances aggravating administrative responsibility are taken into account.

As established by the Plenum of the Supreme Arbitration Court of the Russian Federation in paragraph 19 of Resolution No. 10 dated 02.06.2004 “On some issues that have arisen in judicial practice when considering cases of administrative offenses”, when considering an application to challenge the decision of an administrative body on bringing to administrative liability, the courts must proceed from the fact that the contested resolution cannot be recognized as legal if, when imposing a punishment, the circumstances specified in Part 3 of Article 4.1 of the Administrative Code of the Russian Federation were not taken into account.

According to Art. 4.2 of the Code of Administrative Offenses of the Russian Federation, the number of circumstances mitigating the guilt of the offender may include the commission of an administrative offense for the first time; admission of guilt and repentance of the person who committed the administrative offense, prevention by the person who committed the administrative offense of the harmful consequences of the administrative offense, voluntary compensation for the damage caused or elimination of the harm caused, as well as other circumstances.

Based on the materials of the administrative proceedings, it follows that the authorized body in relation to LLC “A”, as a person who committed an administrative offense, did not take into account the fact of admission of guilt, which is a mitigating circumstance. Since, in written explanations, the Applicant’s representative specified the admission of guilt for the offense committed. Moreover, the Interested Person did not dispute the fact of guilt.

Also, the authorized body did not take into account the circumstances that the Applicant’s actions did not entail socially dangerous consequences.

Taking into account these circumstances, the official of the MRU Federal Service for Regulation of the Alcohol Market in the Urals Federal District, when bringing the Applicant to administrative responsibility, did not establish and take into account mitigating circumstances of administrative responsibility, which violated the norms of the legislation of the Russian Federation on administrative offenses, as well as the rights and legitimate interests LLC "A"

- The MRU Federal Service for Regulation of the Alcohol Market in the Urals Federal District, when bringing LLC “A” to administrative liability, did not take into account circumstances indicating the difficult property and financial situation of the Applicant

As established in Part 3 of Art. 4.1. Code of Administrative Offenses of the Russian Federation, when imposing an administrative penalty on a legal entity, the nature of the administrative offense committed by it, the property and financial position of the legal entity , circumstances mitigating administrative liability, and circumstances aggravating administrative liability are taken into account.

According to Agreement No. 8597785113G4N4R2Q0QQUZ3F on the opening of a non-renewable credit line (with a free drawdown mode), LLC A entered into a loan agreement with PJSC Sberbank of Russia for a loan amount of 3,000,000 rubles. The amount from the provided limit for settlements with product suppliers was 1,770,421 rubles. The amount repaid was 1,196,713 rubles. The balance of outstanding debt is 573,708 rubles. The due date for payment of debt under the loan obligation according to the payment schedule is RUB 180,281.

Moreover, in accordance with Agreement No. 85425977РККК83R2Q0QQ0UZ9A on an overdraft loan concluded between LLC A and PJSC Sberbank, the lender undertakes to provide an overdraft loan in the amount of 1,500,000 rubles. As of now, the limit of 1,050,199 rubles has been used for settlements with suppliers, payment of taxes and payment of wages. Funds received into the current account daily without acceptance are written off to repay the overdraft loan.

According to data from the Unified Register of Small and Medium-Sized Enterprises, LLC “A” belongs to the “microenterprise” category. This fact was confirmed by a government agency and was not disputed by anyone.

USEFUL : watch the video and find out why it is better to draw up any sample claim or complaint with our lawyer, write a question in the comments of the video, subscribe to the YouTube channel

Thus, including a non-revolving credit line, 1,700,000 rubles were used, 1,200,000 rubles were repaid, and the balance of outstanding obligations was 500,000 rubles. In turn, an overdraft loan: a credit limit of 1,500,000 rubles has been opened. Of these, approximately 1,300,000 rubles have recently been constantly used to replenish our own working capital. Amounts received into the company's current account are written off daily to repay the overdraft loan. The daily balance on the current account is 0 rubles. Consequently, these circumstances confirm the difficult financial condition of the enterprise, since there is not enough of its own working capital, in connection with which the Applicant is forced to take out loans in order to continue to function, create jobs, receive income, and also pay tax obligations.

All other things being equal, taking into account the presence of credit obligations, when analyzing the size of the profit of LLC “A”, it follows that bringing the Applicant to justice and, as a consequence, applying the sanction of the article in the form of a fine in the amount of 150,000 rubles may lead to a difficult financial situation for the organization, inability to pay tax obligations. Consequently, the stated circumstances may give rise to the risk of chronic insolvency of the organization, but the authorized body did not take into account these circumstances.

Part 3.2. Art. 4.1. The Code of Administrative Offenses of the Russian Federation stipulates that in the presence of exceptional circumstances related to the nature of the administrative offense committed and its consequences, the property and financial status of the legal entity brought to administrative responsibility, the judge, body, official considering cases of administrative offenses or complaints , protests against decisions and (or) decisions in cases of administrative offenses, may impose a punishment in the form of an administrative fine in the amount of less than the minimum amount of the administrative fine provided for by the relevant article or part of the article of Section II of the Code of Administrative Offenses of the Russian Federation, if the minimum amount of the administrative fine for legal entities is at least one hundred thousand rubles.

A similar position was stated in its decision by the Arbitration Court of the Central District dated 06.06.2018 N F10-1718/2018 in case N A48-6245/2017, namely, the court of first instance made the correct conclusion that, subject to the existence of an administrative offense provided for in Article 14.19 of the Code of Administrative Offenses RF, taking into account the factual circumstances of the case, assessing mitigating and aggravating circumstances, the property and financial condition of the Applicant, decided to apply the provisions of Part 3.2 of Art. 4.1 of the Code of Administrative Offenses of the Russian Federation in the form of an administrative fine in the amount of 75,000 rubles. At the same time, the appellate court agreed with the conclusions of the trial court; the district court did not see any grounds for canceling the appealed judicial acts.

Thus, taking into account the above circumstances, when bringing LLC “A” to administrative responsibility and imposing an administrative fine on it in accordance with Art. 14.19 of the Code of Administrative Offenses of the Russian Federation, the MRU of the Federal Service for Regulation of the Alcohol Market in the Ural Federal District were not taken into account and took into account the circumstances of the insignificance of the administrative offense, the circumstances indicating the difficult property and financial situation of the organization, and the circumstances mitigating the administrative responsibility of the Applicant were not taken into account. The authorized body also did not take into account that no circumstances or other facts entailing the presence of aggravating circumstances were established; therefore, the official of the MRU Federal Service for Regulation of the Alcohol Market in the Urals Federal District did not take into account these circumstances and made a decision to bring to administrative liability without taking into account these circumstances, which is a violation of the rights and legitimate interests of LLC “A”, as well as a violation of substantive and procedural rules of law.

Based on the above and guided by current legislation,

ASK:

- Declare illegal and cancel the Resolution of the Acting Head of the State Counselor of the Russian Federation, 3rd class, Anna Anatolyevna Ryabikova of the Interregional Directorate of the Federal Service for Regulation of the Alcohol Market in the Ural Federal District on case No. 12-08/199-A on the imposition of an administrative penalty under Art. 14.19 of the Code of the Russian Federation on Administrative Offenses in relation to Limited Liability Company “A”

Application:

- Postal receipt for sending the application and attached documents to challenge the decision to the Interested Person

- A copy of the Unified State Register of Legal Entities for the Applicant

- A copy of the Unified State Register of Legal Entities for the Interested Person

- A copy of the Certificate of state registration of the Applicant as a legal entity

- Copy of Protocol No. 12-08/199-A

- Copy of the Resolution on the imposition of an administrative penalty

- Copy of agreement No. 859751137вG4N4R2Q0QQUZ3F on opening a non-revolving credit line (with a free withdrawal mode)

- Copy of Agreement No. 85977РККК83R2Q0QQ0UZ9A on overdraft loan

- Print screen of TTN fixation in EGAIS

- A copy of a bank statement confirming the absence of funds in the Applicant’s account

Director

Limited Liability Company "A"

Date, signature

Procedure for appealing administrative arrest

The assignment of administrative arrest to a citizen may be unlawful from his position. To prove that you are right and not be punished for an administrative offense that you did not commit, you should appeal the decision of the judiciary. Very often, participants in peaceful protest demonstrations are held accountable for such actions and may even be sentenced to imprisonment for a certain period of time.

If you do not agree with such a decision and are ready to prove its illegality, you should appeal the administrative arrest, that is, submit a petition (complaint) in writing:

- the document will need to indicate the name of the court that made the decision;

- the date of the guilty decision;

- in this case, the complaint is not subject to tax, there is no need to pay a state fee for it;

- a petition in an administrative case, if there is one, it is also advisable to include it in the text of the complaint, so as not to waste time on its application in the future;

- their personal data and demand to cancel the punishment, change the resolution in the case of administrative liability.

The standard procedure for appealing an administrative arrest is very simple. A citizen’s complaint is considered within 24 hours from the date of filing.