What is a court order to collect a loan debt?

A court order is a writ of execution that comes into force if the bank files a claim with the court to forcefully collect the debt from the borrower. The basis for going to court is the formation of overdue debt as a fact of violation of the rights of the creditor.

To go to court, the bank must have grounds - at least 3 overdue monthly payments, the amount of debt is not less than 50 thousand rubles, as well as confirmation of the fact that the borrower is avoiding cooperation with the credit institution (ignoring calls from employees, not getting in touch ).

The magistrate, having in hand confirmation of these conditions, prepares and issues a court order to the bank within 5 days from the date of consideration of the case.

Important! This method of debt repayment applies to small consumer loans. It is called simplified, but has one drawback for banks - the borrower’s right to challenge it.

How to correctly write an objection to a court order under a loan agreement

A court order is a rather dangerous thing for a debtor. After all, he may not be aware that it will be issued, especially when the registration address (where documents from the court usually arrive) does not coincide with the actual place of residence.

Expert opinion

Zakharov Viktor Yurievich

Practicing lawyer with 8 years of experience. Specialization: family law. Recognized legal expert.

Therefore, a person who has problems with loans begins to realize the seriousness of the situation when bailiffs come to him to take away cash, describe and seize property.

In order to prevent the bank from collecting debts, you need to act wisely from the very beginning.

The following recommendations will be helpful:

- The bank or other creditor must be informed not only of your permanent residence address, but also your current coordinates. Then they will become known to the court and the order form will most likely reach its destination.

- Before filing an objection to the execution of a court order, it is recommended to carry out your own calculation of the accumulated debt. An adjustment is also made for the duration of the limitation period.

- The grounds for a judicial act to lose force are shortcomings in its form. It is advisable to make sure that the magistrate has complied with the requirements of Art. 127 Code of Civil Procedure of the Russian Federation.

- Loss of force of a court order entails the filing of a claim by the creditor. You need to be prepared for the new upcoming process.

This is important to know: Statement of claim to declare a person incompetent: sample 2021

There is no need to pay a state fee to cancel a court order, which is a separate advantage, especially if the debt is large.

Further, it is recommended to periodically find out in the district court at your place of residence whether a claim has been received from the creditor’s bank, and when the hearing of the case will be scheduled. Afterwards, actions are taken depending on the circumstances and the position of the lawyer.

Author: Vladimir Roslyakov, source sud-isk.ru.

Be sure to share with your friends!

The legislative framework

Notification of the debtor about the issuance of a court order is regulated by Article 1 28 of the Civil Procedure Code of the Russian Federation.

The judge is obliged to send a copy of the order to the borrower, and after receiving it, he has the right to submit to the court his objections regarding the execution of the document within 10 days.

The procedure for canceling a court order is fixed in Article 129 of the Code of Civil Procedure of the Russian Federation. If the debtor submits his objections within the period specified by law, the judge is obliged to cancel the order. In this case, the bank has the right to make a claim for collection in accordance with the current claim proceedings.

A copy of the decision to cancel must be presented to both parties no later than 3 days from the date of its preparation. An application to cancel the order is drawn up by the debtor on the basis of Art. 124 Code of Civil Procedure of the Russian Federation.

Cancellation of enforcement proceedings by court order

Is it possible to cancel enforcement proceedings by court order if the debtor does not agree with the opinion of the court?

To ensure that courts make decisions quickly, there are writ proceedings in many cases. This phenomenon is far from perfect, especially in matters related to proper notification of debtors about the existence of court orders against them.

The main difference between a court order and other court decisions is that they are issued by the court as a result of a simplified procedure for considering cases. A simplified procedure is provided not only for its adoption, but also for its cancellation.

Is it possible to cancel it

Since the cancellation of a court order is provided for by law, the debtor has every right to insist on it. To do this, he must meet certain conditions.

In what cases is this possible?

The most important condition is for the borrower to submit an application for cancellation to the court. It is drawn up according to a specific model in accordance with legal requirements. In addition to correct completion, the content of the document is also important.

We strongly recommend that you indicate in it the reasons why the debtor demands to cancel the order; this increases the chances of the court making a decision in his favor.

Grounds for termination of a court order:

- Conducting the meeting in absentia.

- The amount of debt in the order is higher than the actual amount.

- The defendant (debtor) does not agree with the court decision.

Pros of cancellation

The advantages of filing a counterclaim are obvious. You get the opportunity to defend your interests, that is, not to pay an inflated amount of debt (banks often overestimate the amount of debt, counting on the fact that the debtor will not delve into the intricacies of forming the amount of debt). Also, in a number of cases, credit institutions violate the rights of the borrower by increasing the interest rate on the loan without the consent of the other party.

If your application is accepted by the court and the order is cancelled, the bank will have the right to demand satisfaction from you as part of the lawsuit, but even in this case you will have the opportunity to defend your interests, for example, to achieve refinancing or debt restructuring.

Important! Cancellation of a court order to collect a debt does not mean the termination of the existence of the debt itself.

When an order to collect a credit debt can be canceled

Practice shows that there are several grounds on which it is possible to obtain the cancellation of a court order to collect a loan debt. In the first place is the discrepancy between the collected amount of debt and the real state of affairs.

For example, the bank could incorrectly calculate the principal, interest and penalties specified in the agreement. Then, as we have already said, you will need to present your own debt calculation as an argument. It can be prepared with the assistance of a lawyer or financial specialist.

For some components of the credit debt, the statute of limitations for collection may expire. After all, not all borrowers know that for each payment under a loan agreement, the limitation periods are counted separately (clause 25 of the PPVS dated September 29, 2015 No. 43).

You can also emphasize that some clauses of the loan agreement are invalid. All of the above can turn into powerful arguments for a magistrate to review a previously made decision.

How to cancel a court order

In order to suspend enforcement proceedings, an order issued by the court can be canceled in the manner prescribed by law. To do this, you need to prepare documents and fill out an application.

Required documents

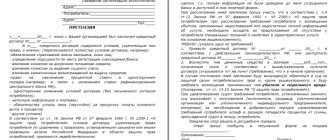

To file a counterclaim in court you will need:

- Copies of identity documents.

- A copy of the loan agreement.

- Reasons for suspending loan payments (loss of job, illness, force majeure).

- The application itself and its copy.

- A copy of the received court order.

Procedure

If you receive a letter from the court, the first step is to contact the magistrate at your registered address. The deadline for submitting an application is limited. It is 10 days.

You can cancel a document in 3 ways:

- independently in person;

- using the services of a lawyer;

- by sending an application by mail.

Prepare a statement indicating the reasons for your disagreement. Be sure to provide references to Articles 128 and 129 of the Civil Procedure Code of the Russian Federation.

You submit one copy of the application to the court, and on the second copy the secretary must put a mark indicating that your application has been received and accepted for consideration.

How to write an application correctly

Its acceptance for consideration depends on the correctness of the document. You can prepare the text and format it yourself, without the help of a lawyer.

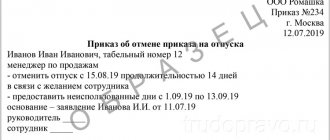

Sample

The text of the application must be correctly composed. It is important to format the header correctly, indicating your details and the details of the person you are contacting (the justice of the peace for your area).

The text consists of an introductory part, your objections with references to the legislation and a petition in which you appeal to the judge with a request to cancel the order and recall it from the bailiffs of the executive service.

The final part of the text contains the date and signature of the compiler.

Submission deadlines

You have 10 days to prepare and submit your application. This period starts from the moment you receive a copy of the document.

Important! The debtor learns about the existence of a court order from the bailiffs who come to him with this document, or receives a notification by mail. If the borrower has not received the letter and it is returned to the addressee (court), 10 days are counted from the day the letter was returned.

If you owe a debt to the bank and the debt is overdue for more than 3 months, carefully check your correspondence so as not to miss receiving this document.

What to do if you miss it

If you did not receive a letter with the order and missed the time to file your application, file a petition to reinstate the period to appeal the court order.

To exercise your right to file a motion, provide evidence that you were unable to receive notice of the court, which is why you were late in filing your motion.

Good reasons for delay:

- business trip;

- stay outside the Russian Federation;

- stay in hospital treatment;

- living in another place (district, city).

These reasons must have documentary evidence (a certificate from the hospital, from the place of work, certificates from neighbors about a change of place of residence).

If the court finds your arguments convincing, it will accept your petition and you can apply to have the debt collection order set aside.

Practice

Statistics show that the cancellation of court orders occurs in the range of 50 to 50 applications.

The applicant will also be able to send the document by registered mail with a list of the attachments and a return receipt.

If it is difficult for a debtor to independently draw up an application to cancel a court order, he should turn to specialists for advice, since each specific case has its own nuances and features.

The decision will be made within 3 days; there is no charge for filing the application.

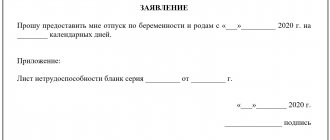

applications to cancel a court order

" Application for cancellation of a court order - sample 2019 " Download, print and fill out " Application (option 2) for cancellation of a court order - sample 2019 " Download, print and fill out

Why it may not be possible to cancel a court order

It is not always possible to cancel a court order. This will not work in the following cases:

- The borrower did not meet the 10-day deadline for writing the application.

- If the debtor was unable to correctly draw up an application for cancellation on his own.

- The debtor did not receive notice of the order on time.

This is important to know: Which court to send the statement of claim to?

The authorized body reviews the papers and makes an appropriate decision.

- The citizen is notified of the final verdict.

Application for restoration of a missed procedural deadline

Expert opinion

Zakharov Viktor Yurievich

Practicing lawyer with 8 years of experience. Specialization: family law. Recognized legal expert.

You can receive an order while on a business trip. In this case, documentation issued by the employer is presented. If there is an injury or illness, it is important to supplement the package of papers with a sick leave certificate.

If another citizen received the order, this fact is confirmed by putting someone else’s signature on the form with a decryption of the data.

How to cancel an order that has entered into legal force

If you find yourself in this situation, the procedure is as follows:

- Submitting a request to extend the application period. Be sure to indicate the reasons why you did not do this within the time period established by law, and provide evidence.

- Consideration of the petition in court. If all documents are completed and contain reliable, convincing information, your application will most likely be granted.

- If the court rules in your favor, apply to have the order set aside.

- The court makes a decision and notifies the parties within the period established by law.

If the court has ruled in your favor and you have a document confirming this fact, visit the district bailiff service office and inform them about it. Based on the document you have, the legal proceedings will be suspended.

If you wait until the bailiffs are notified by the court, there is a chance that during this time they will visit you themselves.

When the court refuses to extend the deadline for filing an application, the debtor has the right to file a cassation appeal. This is given 6 months from the moment the decision was announced in the courtroom of first instance.

How to cancel a court decision?

According to current legislation, the losing party has the right to express its disagreement with a judicial act on a loan, regardless of who it is - a credit institution or a debtor. In addition, it is possible to cancel or appeal a court decision on a loan, regardless of the order in which it was made. Thus, you can cancel:

- act of the court of first instance (standard claim proceedings);

- a default judgment on a loan made by a court of first instance;

- court order.

The procedure for canceling a court decision on a loan depends on which act needs to be cancelled. To appeal the loan act of the court of first instance, it is necessary to file an appeal. The borrower (or the loan guarantors) can submit such a complaint no later than one month from the date of adoption of the judicial act (before it enters into legal force). The court will have two months to consider the complaint.

Important! Even if, following the consideration of the appeal, the court leaves the judicial act in force, you retain the right to appeal it further, i.e. you can file a cassation appeal. But this is, in fact, no longer annulment of the act: the case will be considered anew.

You can cancel a loan decision that was made in absentia by sending an application to the court that issued it. In this case, the court must provide evidence that you did not have the opportunity not only to attend the meeting, but also to notify the judicial authority of your absence for a good reason. After filing the application, the court will notify the defendant (i.e., the loan debtor) of the date and time of a new trial. It is imperative to attend this meeting: the outcome of the consideration of the loan case depends on how competently your position is presented.

This is important to know: Statement of claim to establish the fact of recognition of paternity

In what cases is refusal possible?

The main reason for refusal is the absence of compelling reasons why you did not request to cancel the order on time. Also, refusal and further enforcement proceedings (visit of bailiffs) are possible if the borrower continues to avoid contact with the bank and ignores court notices.

The consequences of refusal are payment of the amount of debt specified in the order, or collection of the debtor’s property for subsequent sale at auction. The bank will add its costs for legal proceedings to the amount of debt.