Courts of general jurisdiction also consider various administrative cases.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

But the decisions adopted by the first and appellate instances may not suit one or more of the participants in the case.

In this case, they have the right to take advantage of the opportunity to file a cassation appeal.

However, it is necessary to comply with a number of legal requirements for this procedure and take into account the nuances associated, in particular, with the payment of state fees.

Sample of a cassation appeal to the Judicial Collegium of the Supreme Court of the Russian Federation

By the decision of __.__.____, left unchanged by the decision of the Seventh Arbitration Court of Appeal dated __.__.____, the initial claim was rejected, the counterclaim was satisfied.

LLC "__________" is entrusted with the obligation, within thirty calendar days, to eliminate the deficiencies in the result of work on ____________________, performed on the basis of the contract dated __.__.____ No. __, by dismantling the installed __________ again in accordance with the terms of the contract dated __.__.____ No. __ and current building codes and regulations. In addition, a penalty in the amount of __________ rubles was collected from LLC “__________” in favor of MBU “__________”. __ kopecks, state duty costs in the amount of __________ rubles. __ kopecks, expenses for forensic examination in the amount of __________ rubles. decision of the Arbitration Court of the Novosibirsk Region dated __.__.____ in case No. A__-___/____, resolution of the Seventh Arbitration Court of Appeal dated __.__.____ in case No. __AP-____/____, resolution of the Arbitration Court of the West Siberian District dated __. __.____ in case No. F__-____/____ cancel, send the case for a new trial to the Arbitration Court of the Novosibirsk Region.

State duty cassation court

Tax Code of the Russian Federation Article 333.19. The amount of state duty for cases heard in courts of general jurisdiction by magistrates 3) when filing a claim of a property nature that is not subject to assessment, as well as a claim of a non-property nature: for individuals - 100 rubles; for organizations - 2,000 rubles; 9) when filing an appeal and (or) a cassation complaint - 50 percent of the amount of the state duty payable when filing a claim of a non-property nature;

When concluding a settlement agreement before the arbitration court makes a decision, 50 percent of the amount of the state duty paid by him must be returned to the plaintiff. This provision does not apply if the settlement agreement is concluded in the process of executing a judicial act of the arbitration court. Submit to the tax authority at your place of residence: 1. Application for refund of state duty. 2. Court decision. 3. Certificate from the court regarding the return of state duty. 4. Genuine payment documents (paid state duty).

State duty cassation appeal to the Presidium of the Supreme Court of the Russian Federation about

For the same reason, it is permissible to attach additional materials in support of the stated arguments: court records, examined evidence (i.e., not new evidence), etc. New evidence can be presented by persons who were not involved in the case. The text of the complaint must meet the same requirements that apply to a cassation appeal sent to the presidium of a regional court (Article 378 of the Code of Civil Procedure of the Russian Federation, Article 401.4 of the Code of Criminal Procedure of the Russian Federation).

- Individual

- Organization

- Filing an application to recognize a non-normative legal act as invalid and to recognize decisions and actions (inaction) of state bodies, local governments, other bodies, officials as illegal Status:

- Individual

- Organization

- Filing an appeal and (or) cassation complaint Status:

- Individual

- Entity

- Filing an application for an award of compensation for violation of the right to a trial within a reasonable time or the right to execution of a judicial act within a reasonable time.

What it is

A cassation appeal is an appeal in which the applicant asks a higher court to overturn a decision made by a court of appeal or first instance.

The application must necessarily contain arguments confirming the validity of the requirements, i.e. indication of specific violations, incorrect application of legal norms and other errors of lower authorities.

The applicant must confirm all the facts and circumstances cited in the cassation appeal, indicating references to legislative acts, evidence, etc.

The content of the cassation appeal should be given special attention, since the decision ultimately made by the court largely depends on it.

That is why it is recommended to involve professional lawyers to draw up a cassation appeal, since it can be very difficult to independently convince the court of the correctness of your position, especially with the help of just one appeal.

The cassation instance does not examine evidence if this was done by the courts of previous instances without errors.

Its task is to check compliance with the rules of law when making decisions of the first and/or appellate instance.

For this reason, it makes no sense to add new evidence to the cassation appeal.

They simply won't be accepted. The application must be drawn up based only on the material already available in the case.

When preparing and filing a complaint, you must pay attention to the following points:

| Deadline for cassation appeal | It lasts 6 months and begins from the moment the judicial act comes into force. A deadline for appeal missed for valid reasons can be restored with the help of an appropriate petition attached to the cassation appeal. But you will need to provide evidence that there were valid reasons for missing |

| A cassation appeal is filed immediately with the cassation court | This distinguishes this type of appeal from appeals, which must be filed through the court that made the contested decision |

| Payment of state duty | According to the Code of Administrative Procedure, for consideration of a cassation appeal the applicant must pay a state fee in the prescribed amount |

Failure to comply with mandatory requirements may result in the return of the cassation appeal to the applicant.

Sometimes this leads to missing the deadline for appeal and loss of the opportunity to protect one’s rights and interests in this way.

By law

The filing of appeals and cassation complaints, the rules for their preparation and consideration in administrative cases are regulated by the CAS of the Russian Federation.

The same document indicates the need for the applicant to pay a state fee.

However, the amount of the fee, as well as various benefits for certain categories of persons, are already regulated by the Tax Code of the Russian Federation.

In any case, you need to study both documents before preparing a cassation appeal.

Comment. The content of the complaint itself is based on the decision being appealed, the materials of the case, and when drawing it up, one must be guided by various regulatory legal acts, not limited only to the norms of the Code of Administrative Procedure and the Tax Code.

Who is obliged to pay

The state fee when filing a cassation appeal is paid by the applicant.

His role can be played by any participant in the case who is not satisfied with the conclusions of the appellate instance and the first court, as well as persons not participating in the case, provided that their rights or interests were violated by a court decision.

If a cassation appeal is filed by a person not participating in the case, then he will be required to explain how exactly the decision affected his rights and interests.

This point can be described directly in the text of the complaint itself, or by submitting a separate application.

In what cases is it not necessary?

When appealing decisions on an administrative offense, you are not required to pay a state fee. They are appealed according to slightly different rules, in accordance with the norms of the Code of Administrative Offenses of the Russian Federation.

Certain categories of applicants are also exempt from paying state fees:

- public organizations of disabled people;

- disabled people of groups I and II;

- Heroes of Russia and the Soviet Union, participants and disabled people of the Second World War.

If there are benefits (exemptions) for paying state duties, you must note this point in the text of the complaint and attach documents confirming their availability.

Video: how to pay state duty online

State duty for a cassation appeal to the Supreme Court of the Russian Federation in a civil case

Civil procedural rules have determined a single deadline for filing a cassation appeal in a civil case - 6 months from the date of the decision of the appellate instance. The state fee must be paid before filing the cassation and confirmed by a bank or cash receipt.

We recommend reading: State services social card of a Muscovite

The cassation appeal system in arbitration is two-level. It includes arbitration courts of districts and a panel for economic disputes of a single Supreme Court. The cassation appeal is submitted to the arbitration court through the court of the instance that made the appealed decision. The cassation appeal is drawn up in written or printed form. It is possible to use a special form that can be downloaded on the website of the arbitration court.

When you don't have to pay

Cassation and appeal is the right of citizens to express disagreement and appeal against a court decision. Such a complaint can only be filed when the initial court decision comes into force.

All participants in the process whose interests are affected have the right to appeal. A cassation appeal is always filed with a higher authority than the court that made the initial decision.

Art. 333.36 of the Tax Code of the Russian Federation reports that both parties to divorce proceedings are exempt from paying the state fee for a cassation appeal in a civil case considered in the Supreme Court.

In addition, if the plaintiff has serious financial difficulties, he has the right to apply to the court to ask for a deferment or installment plan to pay the state fee.

If the plaintiff wins the case, he can apply to recover all legal costs incurred from the defendant. State duty is certainly included in the list of such costs. The application for reimbursement of legal costs must be accompanied by a copy of the receipt confirming the fact of payment of the state fee.

In civil law, an application for reimbursement of legal costs must be submitted within three years after the end of the litigation. Later, the statute of limitations is considered expired.

State fee for an appeal in St. Petersburg

If the decision in your case was made by a court of general jurisdiction in St. Petersburg, you can find a lot of useful information on this site. There is also a state duty calculator here.

However, it will be needed more in other situations. As already mentioned at the beginning of the article, the state cassation fee always costs 150 and 3,000 rubles for individuals and legal entities, respectively.

This page contains a list of all courts in St. Petersburg with addresses and contacts. Here you will find all the necessary information about accepting statements of claim, the procedure for familiarizing yourself with case materials, issuing rulings and filing private cassation and appeal complaints in civil cases.

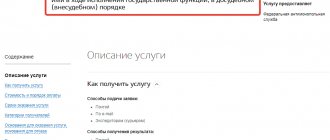

Using this form, you can submit an application to the court and track its progress online. To get this opportunity, you need to agree to the terms of the user agreement and be registered on the State Services portal.

If you have a personal account, you will be taken to the “Complaints” section, where you need to fill out the form provided and select the “Complaint” type of appeal in the lower right corner.

Next, click “Find”, and the program searches for your request.

Details for paying the state fee in St. Petersburg for filing a cassation appeal in St. Petersburg for individuals are as follows:

- UFK for the city of St. Petersburg (Interdistrict Inspectorate of the Federal Tax Service of Russia No. 28 for St. Petersburg);

- account 40101810200000010001;

- in the North-Western State Administration of the Bank of Russia, St. Petersburg;

- BIC 044030001;

- INN/KPP 7810056685/781001001;

- KBK 18210803010011000110;

- OKTMO 40375000.

Details for paying the state fee in St. Petersburg for filing a cassation appeal in St. Petersburg for legal entities are as follows:

- UFK for St. Petersburg (Interdistrict Inspectorate of the Federal Tax Service of Russia No. 23 for St. Petersburg);

- account 40101810200000010001;

- in the North-Western State Administration of the Bank of Russia, St. Petersburg;

- BIC 044030001;

- INN/KPP 7810000001/781001001;

- KBK 18210803010011000110;

- OKTMO 40375000.

You can always take a ready-made receipt with details and amount from the court where the complaint is being filed, and pay it through a terminal (cash or bank card), at the cash desk of any bank, or through your personal account from a smartphone, tablet or personal computer linked to your debit or credit bank card.

State fee for filing a cassation appeal

Valery is right, I’ll add. State duty is a tax. And taxes are paid ONLY by the TAXPAYER HIMSELF, so it is necessary to eliminate the violations established by the court. Apparently you did not eliminate them within the time period prescribed by the court ruling, and the complaint was returned without execution. It is useless to appeal - the court is right. Now the PLAINTIFF must pay the state fee and file the “complaint” again, if there are no other obstacles. About. » Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation “On some issues of application by arbitration courts of the legislation of the Russian Federation on state duty” dated March 20, 1997 N 6, in part 5 clause 3 of which it was stated that if “”payment of state duty in the established manner and amount is made for plaintiff (applicant), for the person filing the appeal or cassation complaint, by another person. “Now, if this Resolution is in force, it is only to the extent that it does not contradict the Tax Code. Before the introduction of the Tax Code, state duty was not a tax, and could be paid to other persons. Now the state duty is a tax.

Tax Code of the Russian Federation Art. 33.19: 9) when filing an appeal and (or) cassation complaint - 50 percent of the amount of the state fee payable when filing a claim of a non-property nature; For claims of a non-property nature, the state duty is 200 rubles.

Article of the Tax Code of the Russian Federation

2.1) when filing an application to challenge regulatory legal acts of federal executive authorities affecting the rights and legitimate interests of the applicant in the field of legal protection of the results of intellectual activity and means of individualization, including in the field of patent rights and rights to selection achievements, rights to topologies of integrated circuits , rights to production secrets (know-how), rights to means of individualization of legal entities, goods, works, services and enterprises, rights to use the results of intellectual activity as part of a unified technology:

2.2) when filing an application to challenge acts of federal executive authorities in the field of patent rights and rights to selection achievements, rights to topologies of integrated circuits, rights to production secrets (know-how), rights to means of individualization of legal entities, goods, works, services and enterprises, the right to use the results of intellectual activity as part of a unified technology, containing clarifications of legislation and having regulatory properties:

State duty on an administrative claim

If an administrative claim is filed to challenge (in whole or in part) regulatory legal acts (regulatory acts) of government agencies, the Central Bank of the Russian Federation, state extra-budgetary funds or to challenge non-regulatory legal acts of the President of the Russian Federation, the Federation Council, the State Duma, the Government, the state duty is (clause 6 p. 1 Article 333.19 of the Tax Code of the Russian Federation):

Administrative cases are cases considered within the framework of administrative proceedings on the protection of violated or contested rights, freedoms and legitimate interests of citizens, rights and legitimate interests of organizations arising from administrative and other public legal relations (Article 1 of the CAS RF ). Administrative cases are considered by the Supreme Court of the Russian Federation, courts of general jurisdiction, and justices of the peace in accordance with the norms of the CAS of the Russian Federation.

Cassation appeal to the Supreme Court

The question of the possibility of further transfer of the complaint to the board for consideration is resolved solely by the judge to whom it is submitted for examination. The complaint may be examined with or without a claim. The period for its consideration in the first case is extended by 1 month. The judge makes one of 2 rulings (rulings in criminal proceedings):

- express disagreement with the opinion of a lower judge of the same court, cancel the judicial act and transfer the cassation appeal along with the case to the appropriate board for consideration;

- extend the period for consideration of a complaint in a civil case to a total of 5 months (clause 3 of Article 382 of the Code of Civil Procedure of the Russian Federation).

Arbitration Court of the Far Eastern District

According to Article 291.2 of the Arbitration Procedural Code of the Russian Federation, cassation appeals and presentations are filed within a period not exceeding two months from the date of entry into force of the last appealed judicial act adopted in this case, unless otherwise provided by this Code.

Decisions and rulings of arbitration courts of republics, territories, regions, federal cities, autonomous regions, autonomous districts that have entered into legal force; decisions and rulings of arbitration courts of appeal; decisions and rulings of district arbitration courts adopted by them in the first instance; decisions and rulings of the Intellectual Property Rights Court adopted by it in the first instance; rulings of arbitration courts of districts and the Court for Intellectual Rights, issued by them in the process of cassation proceedings, if these judicial acts were appealed in the arbitration court of cassation, formed in accordance with the Federal Constitutional Law of April 28, 1995 No. 1-FKZ “On Arbitration Courts in the Russian Federation” Federation"; decisions and rulings of arbitration courts of districts and the Court for Intellectual Rights, adopted based on the results of consideration of a cassation appeal (complaint), can be appealed to the Judicial Collegium of the Supreme Court of the Russian Federation in cassation proceedings in whole or in part by persons participating in the case, as well as by other persons in cases provided for by the Arbitration Procedural Code of the Russian Federation, if they believe that the contested judicial acts contain significant violations of substantive law and (or) procedural law that influenced the outcome of the trial and led to a violation of their rights and legitimate interests in the field of business and other economic activities.

We recommend reading: OKVED sublease of premises

Complaint against a decision in a case of an administrative offense

Administrative cases regarding offenses provided for by the Code of Administrative Offenses of the Russian Federation, depending on the type of case, can be considered by magistrates, judges of district courts, garrison military courts, or by arbitration courts or other government bodies (Article 23.1 of the Code of Administrative Offenses of the Russian Federation). The decision made can be appealed according to the rules established by Art. 30.1 Code of Administrative Offenses of the Russian Federation:

- if made by a judge - to a higher court (of general jurisdiction or arbitration);

- if accepted by a collegial body - to the district court at its location;

- accepted by an official - to a higher body or official, to a specially authorized body or to the district court at the place of consideration of the case;

- if accepted by authorities created in accordance with the law of a constituent entity of the Russian Federation - to the district court at the place of consideration of the case.

A complaint against a resolution or decision in a case of an administrative offense is not subject to state duty (Article 30.2 of the Code of Administrative Offenses of the Russian Federation, paragraph 4 of Article 208 of the Arbitration Procedure Code of the Russian Federation, Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 24, 2005 No. 5 “On some issues arising in the courts when applying the Code of the Russian Federation on Administrative Offenses”).

Decisions of officials made as a result of an appeal can be appealed to a court, and if the case has already been considered by a court, to a higher court according to the rules of Article 30.9 of the Code of Administrative Offenses of the Russian Federation. When filing subsequent complaints (including cassation), the state duty is also not paid (clause 3 of Article 30.9 of the Code of Administrative Offenses of the Russian Federation).

CASSATION APPEAL IN THE SUPREME COURT OF RUSSIA: DEADLINES! DEADLINES

Without knowing these subtleties, a person misses the 6-month period, calculated from the moment the acts of the courts of first and appellate instances enter into legal force, and the consequence of this is the return of the cassation appeal by the Supreme Court of the Russian Federation on the grounds of missing the deadline and the absence of a judicial act on its restoration. By the way, the issue of restoring the term is considered by the court of first instance, and the term, according to the law, can be restored only in exceptional cases, and even then under special conditions - exceptional circumstances must occur no later than one year from the date of entry into force of the appealed judicial act legal force (Part 4 of Article 112 of the Civil Procedure Code of the Russian Federation).

It is necessary to note this point. If, nevertheless, a person “met” the 6-month deadline and, in relation to filing a cassation appeal with the Supreme Court of the Russian Federation, calculated it correctly, the option cannot be ruled out that a judge of the Supreme Court of the Russian Federation can issue a ruling refusing to transfer the complaint to the Judicial Collegium for consideration . According to the rules of Part 3 of Article 381 of the Civil Procedure Code of the Russian Federation, the Chairman of the Supreme Court of the Russian Federation and his deputy have the right to disagree with such a determination of the judge, cancel it and transfer the complaint along with the case to the Judicial Collegium for consideration. But in order for the Chairman of the Supreme Court of the Russian Federation or his deputy to do this, a person must apply to the Supreme Court of the Russian Federation with a corresponding application addressed to its Chairman. The procedure for filing such an application is subject to the same legal provisions as for filing a cassation appeal, including the requirements for a 6-month period. In other words, such an application must be filed within 6 months from the date of entry into force of the judicial acts of the first and appellate instances, and not from the moment the judge of the Supreme Court of the Russian Federation issued a ruling on refusal to transfer for consideration.

Fee for filing a cassation appeal

Considering that Federal Law No. 353-FZ did not make changes to Chapter 25.3 “State Duty” of the Code regarding the amount of state duty paid when filing an appeal, cassation or supervisory complaint in cases considered by courts of general jurisdiction or magistrates, when filing a cassation complaints by an individual to a court of general jurisdiction,

in the opinion of the department,

a state duty must be paid

in accordance with subparagraph 9 of paragraph 1 of Article 333.19 of the Code

in the amount of 100 rubles.

Let us remind you that state duty payers are legal entities and individuals who have applied to perform legally significant actions. Also, if they act as defendants in courts of general jurisdiction, arbitration courts, or in cases that are considered by magistrates and the decision is not made in their favor, and the plaintiff is exempt from paying state fees.

State duty on administrative matters

If administrative disputes arise between the parties, during which documents are notarized, the fee is transferred after completion of the documentation. If several citizens apply for the same judicial actions at the same time, the fee is divided equally between all applicants. You can transfer the duty amount through bank payment devices, terminals or through an electronic payment system implemented on the Internet. A receipt or certificate of payment made must be sent to the court.

- before submitting the statement of claim to the courts at various levels;

- before the issuance of documentation, in a situation where it is necessary to obtain a duplicate or original document;

- before affixing an apostille, if necessary, confirming the legality of the document in accordance with international legal norms

- before the date of submission of the application to perform legally significant actions.

We recommend reading: How to get a technical plan for an apartment through government services