A university graduate, having received the coveted diploma, as a rule, begins working life and at the moment of transition from carefree student life to harsh everyday life, a number of questions arise: Where to go to work? How and what to do next? It is extremely problematic for a bachelor, specialist, and sometimes even a master’s student to get a decent job with an attractive level of earnings without any experience. The head of the enterprise looks at the newly minted specialist with caution and is in no hurry to give him a responsible position.

Who is a young specialist and what benefits can he count on?

It is important to note that every citizen of the Russian Federation who has received a higher, secondary technical or secondary specialized education, when sent for employment, is considered a young specialist.

As a rule, men have no problems passing the first interview, but for women, HR department workers have special questions. First of all, this is due to the fact that every manager wants to have an employee on his staff who has come for more than one year and the work will not stop. Knowing all the problems, the HR specialist is forced to bombard the applicant for the position with questions:

- Are you married or not?

- Are you going to get married in the near future and if so, will you change your place of residence?

- Do you have a desire to have a small child and therefore go on maternity leave?

At the same time, in most professional fields, getting a coveted position is still much easier. And this is quite understandable, since the Russian government has introduced a support program on preferential terms specifically for young professionals.

Problem four. And it would be on everyone’s parcels...

When a young doctor joins an already established team, many people want to immediately put him in his place. Each employee sees this place in his own way - to the extent of his ambitions and intelligence.

Most, unfortunately, expect that a young specialist should be at everyone’s beck and call for another three years.

Is it possible to resist this? Yes. Firstly, we should not forget the old Russian tradition - a doctor is called by his first name and patronymic. So you should introduce yourself this way, without any diminutives.

Secondly, we open the Procedure for providing medical care to the population in the field of cosmetology and remind others that nursing staff provide services as prescribed by a doctor. And if he (the nursing staff, that is) decides that he can independently manage patients, he thereby exposes the owner to fines and inspections. And here we quote from the order of the Ministry of Health and Social Development of the Russian Federation dated July 23, 2010 N 541n , where it is written in black and white that the doctor MANAGES the work of nursing staff.

We also inform the manager that only the doctor has the right to make entries in the medical record of each patient, therefore, the initial appointment is the sacred right and responsibility of the doctor.

Moreover, when transmitting information to the manager, we do not flaunt our intellect and education, but refer to regulatory documents and examples from practice. You can find a lot of them on the pages of the portal 1nep.ru.

Assignment of status and necessary conditions

You can often hear about the status of a young specialist, which is assigned to young people when they are employed after graduating from an educational institution. Holders of this status have some kind of privilege, support provided by the employer and giving certain types and types of benefits depending on the area to which the young specialist was sent.

A necessary condition for obtaining this status is mandatory work in the specialty for 2 to 5 years (the period is specified in the employer’s contract), and the place of work is a budgetary organization, in which case payments to young specialists are mandatory on the basis of preschool education.

What do you need?

At the current time, it is impossible to obtain status without meeting several mandatory criteria:

First. This status can only be assigned to a person who has completed a full educational course on a full-time basis (unfortunately, correspondence courses are not considered).

Second. The applicant for the status had to undergo training on budget terms. The student did not study on a commercial basis through self-payment, but only at the expense of funds from the state budget or local one.

Third. A citizen of the Russian Federation must be certified and fall under the preschool educational institution classification. A mandatory condition is to have a diploma in a specialty that complies with state standards and a specific enterprise/production.

Procedure for applying for a housing subsidy

If a young professional wants to participate in a housing program, he must apply to the housing committee located in his place of permanent residence.

The important point is that the citizen must be recognized as needy. Only after receiving a special order can you apply for a subsidy. Documents required for application:

- passports of all family members who are over 14 years old;

- a diploma corresponding to the state standard confirming receipt of higher or secondary education;

- confirmation of official employment (work book or contract with the employer);

- extract on the citizen's marital status;

- conclusion of a special commission confirming the fact that the citizen needs housing;

- documentary evidence of the required amount to pay 30 percent of the cost of the purchased living space.

The period for consideration of an application in different regions is determined individually. The total number of people wishing to receive a subsidy also has a great influence on the speed of consideration.

The subsidy is provided to a citizen at 5% per annum for a period of 10 years. The payment amount is divided into equal parts. Funds are transferred by bank transfer:

- to the account of the direct seller;

- a contractor who is engaged in the construction of future housing;

- to the developer, if living space is purchased in a house under construction.

Termination of an agreement

If the contract is terminated early for reasons not specified in the labor code of a given state, the status of the young specialist is lost, entailing the need to return lifting equipment and vacate departmental housing, subject to its provision.

When concluding a GPC agreement with an employee, the status of a young specialist is not assigned and payments to young specialists, regardless of position, are not made.

At the present stage, it is extremely important for managers of all spheres of production and business activity to maintain an optimal list of positions that fall under the preschool education classification.

Payments to teachers

Lifting equipment intended for specialists in the field of pedagogy ranges from twenty to one hundred thousand rubles. These funds will be paid if the teacher works in a state secondary school. The amounts paid are also regulated at the regional level. As one would expect, the most expensive entity is the city of Moscow, where citizens are paid funds in the amount of 100,000 rubles. In St. Petersburg, this amount is equal to fifty thousand rubles.

Is there an age limit for the status of a young specialist?

It is important to note that the state program “young specialist” applies only to a graduate of a secondary specialized, secondary technical or higher educational institution, who at the time of consideration is at a strictly defined age, which is unchanged.

In accordance with current labor legislation, the maximum age limit for a citizen who takes part in the program and counts on payments to young professionals is set at thirty-five years. However, if we take into account the preschool education classifier, then depending on the professional field in which the status applicant works, the age threshold may be lowered (coal mines, metallurgical production and others included in the all-Russian classifier of positions with dangerous and harmful working conditions).

Who belongs to the young

When creating the program, the Government counted on attracting doctors, teachers, and other highly specialized specialists to rural areas. Young people who wish to participate in the program must meet established requirements.

Read also: Benefits for participants of military operations in Chechnya

| Availability of higher specialized education or completion of training | This is due to the fact that many students begin to look for a future job or internship in their last year. |

| Age category no more than 35 years | It is not necessary to have only one higher education |

| Lack of own housing | This fact must be documented. The extract is provided by the local administration. Only in this case will a citizen be able to apply for assistance declared from the state. |

The legislation does not establish a clear list of professions that can participate in the state program. Doctors and teachers remain the most in demand.

In addition to the above conditions, additional requirements must be met:

- the diploma issued must correspond to the state standard;

- employment in the village must be registered no later than within a year after graduation in the specialty;

- Work experience or practice is not required. Having it is a small advantage.

Under what conditions are young specialists ready to stay in rural areas?

Receipt procedure

For specialists who are employed in the educational field and without work experience, payments are made on the basis of legislative acts of the Russian government. Responsibility for timely payments lies directly with the managers who provided the graduate with a place of work. The all-Russian job classification provides for a state benefit, which is aimed at financial and material support for young personnel who do not have work experience.

It is important to note that no tax is taken from the lift amount. However, in order to fully participate in the support program, the applicant guarantees that he will not leave his job in one of the positions for five years from the date of receipt of financial or material benefits. Managers are responsible for maintaining the scope of activity in accordance with the specialty acquired by the employee.

❗ Responsibility measures for the employee for failure to comply with the conditions

If the employee and the employer are happy with each other and have entered into an employment contract, they become full participants in the program to increase labor mobility. And from the moment such an agreement is signed, they are subject to certain penalties for violating the terms of this program.

An employment contract between an employee and an employer under this program is signed either for an indefinite period (that is, in accordance with the concepts used in the Labor Code, it is unlimited) or for a period of at least two years (that is, it is fixed-term).

If such a contract is terminated at the initiative of the employee within a period of less than 12 months from the date of employment, he will be subject to special liability measures provided for in Part 10 of Article 22.2 of the Law of the Russian Federation “On Employment in the Russian Federation”. The employee will be required to reimburse the employer for all expenses that the latter incurred in order to ensure the relocation of its employee to the region participating in the program. All funds that the employer actually spent on the resigned employee as support measures, compensation payments, as well as various additional benefits as part of the implementation of the terms of the program are subject to payment.

However, if in the text of the employment contract, as well as in the text of the agreement between the employer and state employment authorities in a particular region, cases were indicated according to which the employment contract between the employee and the employer can be terminated without reimbursement of costs incurred, then the employee will not have to pay anything .

The procedure in accordance with which such payments must be made from the employee to the employer as compensation for costs incurred must be specified in the text of the employment contract.

Support for young professionals in the field of education

Support for young teachers may include the following items:

- The payment for housing does not depend on positions. • Preferential mortgage. • One-time payment on the date of employment (depends on local managers). • Additional payments to the established and subject to the preschool education classification monthly salary, regardless of position, until its level reaches the regional average. • Preferential payment for independent professional development that does not fall under the preschool education classification.

Important! At the moment, there are no Federal programs that regulate the support of teachers, so all preferential payments, as a rule, vary depending on a particular region. You can find out about current programs only by studying the articles of regional and local legislation.

Important points

The situation in the healthcare sector is somewhat different. For medical workers who want to receive preferential payments, a mandatory condition is set - living in a rural area (residence and work).

So, in order to receive housing, distributed regardless of position and work experience, under the preferential program, the applicant must attach to the mandatory package of documents a certificate confirming the absence of other residential property or a government act that indicates the need to improve housing conditions. However, this program also has a huge disadvantage - a high down payment, amounting to 30% of the total assessed value of a residential building, room or apartment. This contribution can be made by an enterprise if the managers have a certain interest in the employee. Subsequently, the amount of the down payment is deducted from the beneficiary’s salary.

Payments due to young professionals

In the Russian Federation, young professionals can count on a number of benefits. For example, when employed in the first year after admission, a probationary period is not established for them. Of course, if they found a job in their specialty.

But this is an intangible benefit.

Graduates can also count on various cash payments. For example, salaries in some industries, in the same education, include an additional payment for higher education. For holders of “red” diplomas, it has an increased size.

The collective agreement of an organization or enterprise may establish other allowances, benefits or other types of financial assistance for young specialists.

Regional youth support programs provide one-time payments to young professionals upon employment - the so-called “lifting benefits”. Their employer pays them in the first month after concluding an employment contract. For him, such benefits are quite profitable, since they are not subject to taxes.

In addition, the payment of allowances may be associated with the simultaneous obligation of young personnel to work in their specialty for a certain period of time, usually 3-5 years.

If a young specialist gets a job in a different area than where he lives, then in addition to the allowance, he has the right to receive:

- compensation for relocation (especially to rural areas);

- payment of expenses for transportation of furniture and other furnishings;

- compensation for travel expenses for yourself and your entire family;

- daily allowance for each day on the road (as on a business trip);

- average salary for the same period.

Lifting benefits can be paid only once, or can be assigned as annual payments for three years. But every year the amount will decrease. You can check specific conditions with your employer or local administration.

How and where to get lifting tickets

To obtain the necessary funds, a graduate must take several actions.

- Lifts will become available only after the conclusion of the first employment contract. Before signing it, the graduate is required to present his diploma of education to the employer. More than a year must pass from the moment it was received; only in this case can you apply for state assistance.

- The second condition is employment in the specialty indicated in the diploma. If, for example, a teacher gets a job as a salesperson, this does not give him the right to receive allowances.

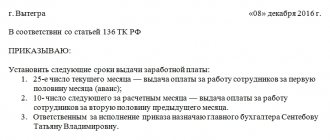

- Employment is accompanied not only by the signing of an employment contract, but also by the issuance of a hiring order. This document must be presented to the new employee for review and signature. Only after this can employment be considered successful.

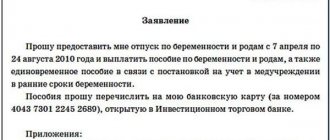

- The new employee must write and submit to the manager an application for payment of allowances. It is written in any form. There is no need to attach supporting documents; the employer has copies of them.

- Having considered the application, the manager draws up an order to assign allowances to the new employee. This order, like any other concerning the employee, must be presented to him for signature.

- Funds are transferred to the new employee in the usual way for the organization. Or they are paid in cash through the cash register.

A number of regions provide additional measures to support young professionals. To receive them, the application and documents are transferred to the local administration. You will need a diploma and an employment contract confirming the required status.

What is the size of the lifting payments?

The amount of payments to young professionals is determined by regional social support programs. And it can range from one salary to very substantial amounts. The size of lifts in rural areas is especially large.

Let's give a few examples.

Since 2010, the Zemsky Doctor program has been in effect.

According to it, medical specialists can receive up to 1 million rubles:

- with completed higher education;

- not older than 50 years;

- those who moved to the countryside;

- who have entered into an employment contract for at least 5 years.

Nurses and paramedics are not eligible for this program.

The doctor must complete his internship and be ready for completely autonomous and independent work. The benefit received can be spent on building or purchasing your own home. Beginning teachers have the right to receive from 20 to 100 thousand allowances when applying for a job in public secondary schools.

Moscow teachers traditionally receive the maximum payments - about 100,000 rubles. for St. Petersburg this amount will be approximately half as much. In addition, teachers receive a 40% bonus for having a higher education. For those who received a diploma with honors, it will be 50%.

Refusal to provide benefits

What to do in a situation where, during employment, one of the managers refuses to exercise the young specialist’s right to receive raise funds or material compensation? Refusal to pay compensation is a violation of the law, and if the employer nevertheless takes such a step, the applicant can appeal this decision.

To do this, he needs to submit a complaint drawn up in any form to the institution that was involved in the distribution, to organizations superior to the violating managers, as well as to the representative office of local executive authorities. It is important to note that a complaint about refusal to pay compensation is sent to the above authorities by mail, preferably by registered mail and with mandatory notification of receipt.

How to get lifting tickets?

The procedure for getting allowances for a young specialist is quite standard and does not require a lot of effort from the applicant - you just need to collect a package of documents, transfer it to the responsible organization and wait for the money. Teachers need to contact the regional office of the Ministry of Education, doctors - the local Compulsory Medical Insurance Fund. Required documents to obtain a lift include:

- Original diploma plus a copy.

- A copy of the work book.

- Employment contract.

- Application for payment.

The application form will be provided to the young specialist at the organization where he applied.

When the allowance is given, it is better for the young specialist to check directly with the organization that deals with the registration - they can share information about the deadlines based on practice. The law sets a deadline of 1 month, but the money can arrive in 3-4 days. There are no two opinions about how allowances are paid to young professionals - the money is credited to the applicant’s personal bank account. The designer should not count on receiving cash.

Deadlines for payment of allowances

In accordance with Resolution of the Council of Ministers of the Russian Federation No. 821 in Chapter 4, paragraph 25, which establishes the relationship between managers and specialists in matters relating to assignment, distribution, and redistribution, reimbursement of state costs for their training is carried out.

The preferential program states that the payment of allowances is carried out, regardless of position and work experience, within a month from the date of conclusion of an employment agreement/contract on the basis of the TKK between a company/manufacturing enterprise/commercial organization and a young specialist, exclusively in full (cash equivalent ). The number of rest days used over the entire period is not taken into account. The accrual amount depends on the preschool educational institution and falls under the classifier and cannot change depending on the positions held and work experience.

Employers versus mortgage holders

Literally on the eve of 2021, the people's representatives decided to once again show concern for the people, but is it really caring? But first things first.

So, the essence of the bill submitted to the lower house of the Russian Parliament is to protect employees who have debts on loans and mortgages from illegal actions of the employer. Thus, young families will have equal rights with people caring for seriously ill people, as well as with those injured at work.

One of the largest job search sites conducted a survey among employers and job seekers on their attitude to the proposed initiative. The majority of respondents were in favor of adopting amendments to the labor code. A minority of respondents were against it, since employers will not be able to fire an employee who does not fulfill his job duties due to the mere presence of a mortgage.

On the other hand, an employee with a mortgage receives a negative attitude towards him from the employer, who views an employee with a mortgage, first of all, as a potential violator of labor discipline and the employer is afraid to deal with such an employee.

Choosing an employer

Thus, the employee becomes powerless, since the employer knows about the employee something that, in fact, should not concern him. On the contrary, if an employee has financial obligations, then he is motivated to work conscientiously and the employer must hold on to conscientious employees. But in practice, it turns out the other way around: the employer will be more willing to give preference to an inexperienced employee, whom he can fire whenever he wants, but he will no longer be able to fire an employee with a mortgage, since this will be prohibited by law.

From this we conclude that those employers who are afraid to hire workers who have legal immunity are themselves not averse to breaking the law in some part of it. For example, not paying wages for a month or two, not documenting overtime. Or not formalize the employment relationship with an employment contract at all. In a word, they are looking for a certain benefit at the expense of the employee, or, roughly speaking, they are deceiving the employees, the state, and conscience...

Of course, job advertisements will never indicate preferences by gender, age, or the same credit obligations to banks. But, in fact, having found out this information from the employee during the interview, he will simply throw the resume in the trash, whether he is an academician or his relative.

Of course, there will be employees who will strive in various ways to get to such an employer, but if the employer breaks the law for his own benefit, is it worth sacrificing his time, effort, and, sometimes, reputation, in order to then still become a victim of such deceivers? The question is rhetorical.

Do I need to pay financial compensation?

Many people ask the question, and this is especially true for managers, whether it is necessary to pay financial compensation in connection with a change of place of residence of a young specialist, provided that he is sent to his place of work in a locality of permanent residence? The answer is clear - no. In this situation, financial compensation is not awarded and is not even considered.

At the same time, in case of assignment, the place of permanent residence is recognized as the locality (city, village) where the future applicant lived before entering the educational institution. Today, every large company, as well as small organizations, wants to hire competent specialists as employees. Initially, it is worth deciding what these companies mean by “competent specialists.”

What is an experienced worker?

So, a competent worker is a specialist who has deep knowledge in a certain field, professional experience that allows him to analyze all current events and quickly make decisions in difficult situations. This person often takes innovative actions that benefit the company.

A competent employee is always in demand by several companies at the same time. Often large companies invest huge amounts of money in personnel search agencies in order to find just such an employee.

So, a competent team member is a luxury that small and medium-sized companies often cannot afford. But what should a graduate of a higher educational institution do who wants to become a first-class specialist, but cannot even find a simple job? Should a manager hire such a young employee and make him a first-class specialist?

Disadvantages of a young employee

Company managers are forced to spend their time and the time of their subordinates on training a young specialist. Ideally, a young employee turns out to be smart, quickly adapts to everything and grows before the eyes of the manager. In the opposite case, a young employee takes up valuable time from the company, money is spent on his training, but there are no tangible results from his work.

It will take a long time for a young employee to learn to apply his theoretical knowledge in practice, and this will again cause damage to the company. In addition, the work of a young employee must be checked, which means again wasting time and money, paying extra to senior employees for guardianship. In order to select a competent employee from the crowd of people willing to learn, it is necessary, at a minimum, to create a number of test programs, which again cost money.

Benefits of a young employee

Among the advantages, it is worth listing such qualities of a young employee as enthusiasm, desire to work, desire to learn and gain experience and knowledge. A young worker is also economical. Most often, young specialists do not occupy high positions in the team, which means that the employer pays them small amounts of money.

So, young professionals are definitely worth training. But in order not to make a mistake in choosing such an employee, it is necessary to at least make the interview more strict.

It is noteworthy that the provision of additional living space is not included in the mandatory support program due to the lack of government support.

At the same time, provided that the specialist in the direction moves to the locality in which he was trained, compensation is paid.

Benefits for young teachers

About 100 thousand rubles are provided as allowances to young teachers from the capital. Also, Moscow teachers receive a monthly bonus of 40-50%. The exact amount of the bonus depends on the color of the diploma.

In St. Petersburg, the size of the lump sum payment depends on the color of the diploma. Excellent students will immediately receive more than 67 thousand rubles, and specialists who have completed their studies with blue diplomas will receive 50 thousand rubles. Teachers from the Northern capital are not entitled to a monthly bonus, but they have the right to claim compensation for half of the cost of travel on public transport.

The issuance of allowances is also practiced in provincial cities, but there we are talking about much less significant amounts - from 10 to 20 thousand rubles. The most favorable conditions are offered in Irkutsk. In this city, young teachers are paid a lump sum of 50 thousand rubles plus a bonus of 60% of their salary during the first year. In the second and third years of work, the teacher is also paid extra, but less - 36% and 24%, respectively.

About compensation

The Labor Code of the Russian Federation (including regional legislative acts) contains Article 96, which regulates the issue of calculating compensation for young professionals, as well as members of their families, who are sent to work in accordance with the distribution plan at the location of the educational institution where they completed their training. In this case, due to a change of place of residence, compensation is paid in full, but on the condition that before training their permanent place of residence was another area.

Provided that by the time of assignment to a place of work, the applicant for benefits has received permanent registration at the address in the locality where the educational institution is located and where he has been assigned to work, then receiving benefits is impossible.

Unfortunately, many employers do not always correctly understand the term young specialist. A teenager is applying for a job; the legal aspects of registering cooperation with a minor are completely different concepts.

So, a boy or girl, having arrived or called their parents after the next interview, joyfully announces the approval of their candidacy for the coveted position. In this case, what should attentive and caring parents and inspired teenagers pay attention to? Below are some fairly important facts:

For the provided list of documents

A teenager will not be accepted for a vacant position if he (she) does not have:

- legally certified written permission from parents, guardianship services or guardians (this document is relevant for minors aged fourteen to sixteen years);

- passports or birth certificates;

- a certificate or certificate from the institution where the teenager is studying (college, external and home study, evening school);

- inn and snilsa;

- certificates of medical examination and medical record (an extremely important document, without which they are not issued and are not allowed to work either).

A work book, on the contrary, is not required; as a rule, the employer prepares it himself according to all the rules.

To the workplace and working conditions

It must comply with all Sanpin standards. established for a teenage worker. So, for example, in a catering establishment there should be no small pests (rats, cockroaches), there should be a minimum frequency and there should be no possibility of lifting loads above the physical norm established for the child.

Conditions and duration of a teenager’s work shift

According to the rules, children between the ages of fourteen and sixteen cannot work more than three hours a day (which includes twelve prescribed hours during school hours, and twenty hours during the summer months and holidays). From sixteen to eighteen years of age, no more than four hours (which includes seventeen hours a week during school and thirty-five during the summer and holidays).

Among other things, children and their parents should also take note that a probationary period for a teenager after being hired is not legally established. Among other things, cases regarding collective or individual payment of material damage (except for cases of intentional damage to the employer’s property by minors) cannot be brought against a teenager under sixteen years of age.

It is worth understanding that honest companies and individual entrepreneurs greatly value their “white” reputation in their field. They, the employers, have absolutely no need for proceedings with the labor and tax inspectorates, or claims from reasonably angry parents whose children have suffered undeservedly.

Such employers of minor workers register immediately either under an employment contract or according to a work book, without waiting for the end of three legal working days.