Features of salary documentation

Any economic organization or individual entrepreneur has the right to independently determine for itself a document that will become fundamental in the issue of economic relations with workers. Before issuing monetary remuneration to an employee for performing work duties at the workplace, it is important to complete the accruals on paper.

Some enterprise managers prefer to draw up individual statements for each worker, which allows them to keep salary information confidential. This helps to avoid conflicts in the team and maintain a calm working atmosphere.

The salary form is filled out every month at the stages of issuance at the salary institution. At the same time, the norms and rules of the current legislation on the preparation of documentation are strictly observed.

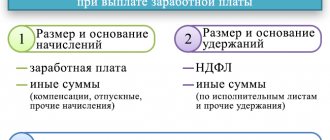

Payment and settlement accounting documentation reflects the following information:

- tariff rate (fixed amount of remuneration) for each employee

- number of working days actually worked in the billing period

- accruals made and amounts withheld from the salary

Types of salary statements

Drawing up a payment and settlement document for each employee separately is a painstaking and financially expensive process. In order to submit a salary report to the inspection authorities in accordance with all standards, the company’s accounting department must attach a paper document. Electronic versions are not suitable. And if you also draw up individual statements for additional payments (advance payment, sick leave, vacation pay), this will take a lot of time and financial costs.

For this reason, the majority of employers prefer to use general salary accounting documents, choosing only a certain form for themselves:

accruals for the entire staff of employees- issuance of monetary remuneration for work for all workers of the organization

- established uniform form of documentation, which covers information on the calculation and payment of cash

A salary accounting document is a register, which is based on relevant records reflecting the calculation and payment of wages to employed persons in an organization. The preparation of a documented medium of information is carried out according to forms approved by the system of legislative acts:

- T-49, T-51 (payment/settlement) - reflects the calculation and payments for each employed person, T-49 - cash payment, T-51 - non-cash payments.

- T-53 (calculation) – covers the calculation of monthly wages for each subject of labor law.

Use funds in your current account with Sberbank

You can give permission to the bank to write off amounts from the current account according to the registers. Then you won’t have to generate payment orders yourself—the bank will promptly do it for you.

Indicate the type of payment in the register

When creating a register in Sberbank Business Online, you need to select the Type of enrollment (salary, child benefit, or other). Then the type of payment will be indicated in the statement of the organization’s current account, the recipient will receive a corresponding SMS notification, and in the statement of his account he will see the amount with the appropriate explanation.

Salary payments have a positive effect on the recipient's credit potential. The cost of the enrollment operation also depends on the type of payment.

! If a certain amount must be recovered from the recipient of the payment under enforcement proceedings, then the amount of recovery directly depends on what funds were received into the recipient’s account. Therefore, it is important to indicate that alimony or other immune funds are being paid in accordance with the requirements of the Federal Law on Enforcement Proceedings.

! If the payment is made to a nominal account (see Article 37 of the Civil Code), then according to the terms of such an account, some types of payments cannot be credited to it.

! For some types of payments when conducting a currency transaction on the register, additional supporting documents may be required, so their use in currency transactions on the registers is not provided.

Pay attention to the recipient's details

The recipient of funds for distribution according to the register is the bank. In the payment order to the register, in the Recipient's account , the bank's correspondent account must be indicated, which can be found on the bank's website or in the agreement. The name of the recipient indicates the name of the bank division with which the salary or social contract was concluded.

Pay attention to the amounts of documents

The amounts of the payment order to the register and the register itself must match.

Pay attention to the register and contract numbers

It is important to correctly indicate the type of payment; the register number must be indicated along with the keyword. The bank will quickly figure out which register corresponds to this payment order. The number of the current agreement must be indicated without spaces and in a form understandable to any person or computer program.

Let's consider the correct example for register No. 123 on wages, where the text that you need to pay special attention to is highlighted in green.

Payment of wages for February 2021 according to register 123 under agreement 12345678 dated 12/12/12 to employees’ bank accounts

Use (parentheses)

If you need that when returning a partially uncredited amount according to the register (if there are discrepancies in the full names of recipients, closed accounts, etc.), part of the text of the original document is retained in the payment document, then indicate the necessary information in parentheses at the beginning of the payment purpose text: (l/c 12345678910) Payment of wages for February 2021 according to register 123 under agreement 12345678

The return in this case will look like this: (l/c 12345678910) Return according to register 123 under agreement 12345678

Complete currency transactions correctly

If your organization makes payments to the accounts of non-resident individuals or is a non-resident, then when drawing up payment orders in the purpose of payment, the code of the type of operation must be indicated before the text in the format {VO_____}, where the code of the type of operation is indicated in place of the space (for more details, see. Appendix 1 to Bank of Russia Instruction No. 181-I dated August 16, 2017).

For example, the purpose of payment when paying wages may look like this: {VO70060} Salary according to register 12 according to contract 12345678

Before processing the register, the bank checks the transaction type code. If it corresponds to the type of payment (credit) specified in the register, then credit to the recipients’ accounts will be carried out successfully. Otherwise, corrections will be required in the purpose of the payment or an indication of a different type of payment in the register and re-sending them to the bank. If, according to the agreement, a bank generates payment orders for you to the registers, then in the statement of the organization’s account the debiting of funds from the register will be reflected in the purpose of payment indicating the type of transaction code that corresponds to the type of credit you have chosen in the register. In this case, not all types of payments can be selected in the registers. If your organization is not a budget or credit organization, resident and non-resident recipients must be listed in different registers.

What is a payroll slip?

A payroll slip is a payment record used within an enterprise and confirms the procedure associated with the issuance of cash directly from the cash register.

Remarkable! It is not necessary to use exclusively a unified payment document (form T-53). The law also provides for other options for processing wages for employed persons.

You can pay the salary to one employee using an expense cash order in the established form, and the collective disbursement of funds can be illustrated in the settlement and payment accounting document (T-49).

Why do you need the T-53 form if you have the T-49 statement?

Indeed, with the help of another commonly used unified document - the payroll sheet in the T-49 form - you can solve absolutely all problems related to accounting for cash payment of wages. In accordance with clause 6 of Bank of Russia Directive No. 3210-U dated March 11, 2014, any form of the employer’s choice can be used: T-49 or T-53 (or only RKO - in the required quantity - instead of any of them).

At the same time, the T-53 document has a noticeably simpler structure in comparison with the T-49 form. If we consider the tabular part of the form, then in the T-53 document it is supposed to fill out 6 columns (in this case, the numerical data on salary are reflected in only one), and on the T-49 form - 23 columns (of which more than half are numerical on salary ).

The form was approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

Payroll form T-53

It is assumed that a preliminary calculation of those figures that are to be included in the T-53 form will first be made using other tools. In the general case, using the registers of an accounting program: then the T-53 form will be used only as a summary (reflecting the results of calculations) primary document. Which, one way or another, should be - since the payment of wages from the cash register must necessarily be reflected in one statement or another in accordance with the requirements of the Central Bank of the Russian Federation.

Thus, the T-53 document is, first of all, applicable in cases where the salary calculation registers used by the employer are difficult to reproduce in the unified T-49 form. Only the finished amount is taken from these registers and is reflected against the signature of the employee receiving the salary in a document in the T-53 form.

At the request of the employer, the corresponding register may be the form of a “clean” payroll T-51 (which is usually used for non-cash payments as a primary document). In this case, it and document T-53 form a logical link between the “payroll” and “payroll” statements.

What is it used for?

PV is necessary for the institution to correctly issue salaries, temporary disability benefits, bonuses and other payments to staff.

The document contains the following information:

- unique company employee number

- his full name

- amount of cash reward to be paid in person

- recipient's signature

Important! The payroll is prepared by the organization's accounting department in one copy. At the same time, the document does not include information about payments under contracts for paid services and civil law agreements.

Salary accrual and payment sheet No._________

Organization (division):__________________________________________________________

| № | Full name | Position, degree (title) | Discharge | Bonus (fine) | Amount to be issued | Signature |

Total:_______(__________________________________________) rubles ___ kopecks

Date: "___"_________________ 20___

Download the document “Statement of calculation and payment of wages”

Documents based on it

The accountant transfers all the data from the payment form to the payment accounting document, according to which earnings are calculated. During this process, information from the last strip of the T-51 form is taken into account. In order to form it correctly, the accountant will need information from the list of employees by name with notes on the use of working time in the accounting period. The listed documentation is completed individually for each employee of the enterprise.

Procedure for working with the document:

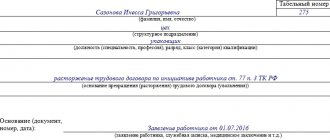

Form T51 and T49

The salary sheet is prepared by the company's accountant using one of the unified forms - T-49 and T-51. T-49 is distinguished by the fact that it is a settlement and payment device at the same time, and is used to issue money to recipients through a cash register. T-51 is used when the employee receives payments to a bank card. Considering that most organizations have switched to non-cash payments with employees, the T-51 form is more in demand. It cannot be used for calculations. Both forms are available for download below.

T-51

Let's look at a sample of filling out T51 - the most popular form now. The work will begin by indicating the name of the company and structural division at the top of the page. Below indicate the document number, calculation period and execution date. The preliminary preparation is completed, you can proceed to the main one.

The main part of the document information will be presented in the form of a table, where the accountant will write sequentially:

- serial and personnel number;

- recipient's last name;

- his position;

- tariff rate or salary;

- the amount of days worked per month (working days and weekends separately);

- accrued amounts;

- income tax;

- debt (if any).

Form T-51: download Statement T51

For issuing salaries in cash, form T-49 is used, for non-cash transfers - T-51

T-49

Now let's look at the principles of preparing salary statements using the T49 form. As you remember, it is settlement and payment at the same time, which means it will contain a column for the employee’s signature on the issuance of money. In the header of the sheet, the accountant indicates the name of the company and structural unit (optional) and indicates the date on which the cash desk will issue money. The next line will contain the total value of payments in words, below - the signatures of the chief accountant and director of the company.

Next we move on to the table itself. Here they indicate:

- serial and personnel number;

- recipient;

- his position;

- tariff rate or salary;

- days worked per month, working and non-working;

- accrued amount (salaries separately, sick leave separately, bonuses separately);

- prepaid expense;

- income tax;

- total to be issued minus tax;

- signature for receipt.

After the table, it is indicated who made the payments, what amount was paid, and what amount was deposited - that is, not received by someone from the team. The payroll statement ends with the date and signature of the accountant. Absolutely all employers who pay money for work in cash from the cash register are required to use T49.

Filling procedure

The monthly generation of statements begins from the beginning of the year or reporting period. Like any other documentation on labor accounting and payment, the presented document is drawn up by hand or by filling out a standard form. It is also appropriate to use a computer and then print the finished document on a printer.

For reference! Most statements exceed the format of a standard sheet, so more often accountants fill them out manually.

The statement includes:

- title card

- main table

- part with information about deposited amounts (payments that the worker did not receive on time for any reason)

Basic filling rules:

- availability of all necessary details

- filling in all columns and lines

- Marks, corrections and the use of a proofreader are not acceptable

- mandatory indication of information about the compiler

- the presence of the date of creation of the document, its final closure

- presence of the signature of the person who approved the statement

First page design

The preparation of the first sheet is carried out according to the following algorithm of actions:

- indicate on the title plate the full name of the institution and the officially allocated part of the enterprise (if any)

- enter OKPO code

- in the column “Corresponding account” write the number 70

- determine and indicate the period of legal significance of this documentation (no more than 5 working days from the date of signing)

- in a special line of the first sheet, write down the total amount accrued to workers for the billing period (introductions are illustrated in words and figures)

- enter the date of creation of the form and its serial number

- indicate the period for which payments are provided

Payroll (form T-51)

Home / Cash discipline

| Table of contents: 1. Unified form or your own form? 2. Is it necessary to maintain Form T-51 in the company? 3. Frequency of registration of the statement 4. Instructions for filling out form T-51 5. Duration and place of storage of the document | Download form T-51 View sample filling T-51 |

A payslip is a document with the help of which the employee’s wages and other amounts (vacation pay, sick leave) are calculated, as well as the amount of tax and cash that the employee will receive in hand.

With the help of this statement, the salary is only calculated; it is issued according to another document (form T-53).

A unified form or your own developed form?

Despite the fact that the mandatory use of unified forms has been abolished since 2013, it is still necessary to use the T-51 form for the payroll, since it will relate to the primary accounting documents.

This instruction can be found in the Ministry of Finance Information number PZ-10/2012, which states that the abolition of the obligation to use unified forms will not apply to primary accounting documents. And if we proceed from the definition of the concept of primary documents, then the payroll will be one of them.

Is it necessary to maintain Form T-51 in the company?

Despite the fact that the payroll should be kept only in a unified form, the company may not have one at all. This happens if the organization’s accounting department uses in its work a unified form of payroll statement T-49, which can also replace form T-53.

But at the same time, the use of the T-51 form does not mean that the T-53 payroll will be present in the document flow. If all payments to employees at the employer are made only by bank transfer, then the need to prepare a payroll does not arise.

Frequency of issuance of payroll statements

The salary payroll is prepared once when payroll is calculated for the month. At the discretion of the employer, it can also be drawn up for an advance, but in this case it will not reflect the amount of personal income tax.

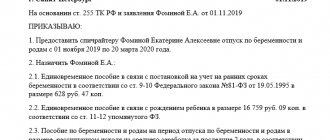

In addition, a payslip can be issued within a month for employees in certain cases - such as dismissal or calculation of vacation pay.

Instructions for filling out form T-51

The payroll accountant is responsible for filling out the payroll.

Then, on its basis, a payroll is drawn up, but only those employees who will receive wages through the organization’s cash desk are included in it.

The payslip can be filled out manually or printed on a computer. This form is also provided in all specialized programs.

Title page

Name of company

It should be included here in full, without abbreviations. This procedure is established by Decree of the State Standard of the Russian Federation dated March 3, 2003 No. 65-Art. It also clarifies that if the constituent documents contain an abbreviated name of the company, it may be indicated below the full name (or next to it in parentheses).

The above document is valid only until 07/01/2018, and then GOST R 7.0.97-2016 will come into force, but it also contains the same requirement regarding the name as a document requisite.

All the above rules fully apply to individual entrepreneurs.

OKPO code

Next to the name there is a small field reserved for OKPO; the data for filling it out is taken from the list of codes issued by statistical authorities when registering a company. But leaving this field empty will not be a serious mistake.

Structural subdivision

Indicated if available in the organization, otherwise the line is not filled in.

Reporting period

The period for which the salary calculation was made in the statement is indicated.

Second page

The second sheet of the payroll contains information about accrued wages and all other payments due to each employee, as well as amounts withheld. It is filled out in columns numbered from 1 to 18:

- Number in order (1,2,3,4,6, etc.);

- Personnel number, that is, the individual code of the employee. If the organization does not keep such records, then this column is not filled in.

- Last name and initials of the employee to whom the salary will be paid;

- Employee position;

- Tariff rate or salary - here the amount of salary, hourly rate or percentage established for the employee is indicated. In the case when an employee’s salary consists of several amounts (salary + % of a certain amount + increased % for exceeding the plan, etc.), then it is advisable to make the calculation on a separate sheet, which is then attached to the statement.

- Number of days or hours worked - hours or days included in the standard working hours are entered.

- Number of weekends and holidays/hours worked. Filled out only if the employee went to work on these days. The data for these two columns is taken from the time sheet.

- Payment for days worked - the amount of the basic salary is entered here. Ideally, this is the salary divided by the norm of days in the current month and multiplied by the actual number of days worked. In practice, this should include the amounts that the employee will receive for work performed, excluding bonuses.

- Prize amount;

- Amount for sick leave (sick leave);

- Other income - material assistance, one-time bonuses paid not for the performance of job duties, compensation.

- Total – the total accrued amount is calculated, including personal income tax.

- Personal income tax withheld - 13% of the entire amount that is subject to taxation.

- Withheld and offset (other) – in this column you can enter the amount of the previously paid advance.

- Total withheld, columns 13 and 14 are added.

- The amount of debt owed by the organization is the amounts that the organization owes to the employee (for example, recalculation of last month’s salary in favor of the employee).

- The amount of debt owed by the employee is the amount that the employee owes to the organization (for example, recalculation of last month’s salary in favor of the organization).

- Amount to be paid is the amount that the employee will have to receive in hand, minus the advance and income tax.

At the bottom of the statement is the signature of the employee who compiled it.

Duration and place of storage of the payslip

The payslip is kept in the accounting department. Usually it is filed in the “Salary” folder, which also includes time sheets, orders, etc. Such documents are stitched monthly.

The shelf life of the payslip may vary:

- 75 years – if the organization does not have personal accounts for employees;

- 5 years – in all other cases.

Did you like the article? Share on social media networks:

- Related Posts

- Receipt cash order (form KO-1)

- Cash discipline in 2021

- Cash limit for LLCs and individual entrepreneurs in 2021

- Cash payment limit in 2021

- Cash accounting book (form KO-5)

- Application for the release of money for reporting

- Order establishing a cash limit in 2021

- Sample of filling out form T-51

Leave a comment Cancel reply

Filling out the second sheet

The more employees there are at the enterprise, the longer the salary form will be. It is important to indicate the number of sheets of the finished document in the specially designated column.

Table 1. Information from the columns of the second page in order.

| Column number | Data |

| First | Serial numbering of employees |

| Second | Unique employee number |

| Third | Full transcript of the employee's full name |

| Fourth | Amount of accruals to be paid in figures |

| Fifth | Employee's signature confirming receipt of funds |

| Sixth | Links to documentation for settlement transactions at the cash desk (written authorities, documented requests from employees, etc.) |

Important! Under the table, you must indicate the total amount of accruals to be paid.

Document in 1C, look at the video:

Are corrections acceptable?

The risk of making mistakes when filling out documents always remains. Especially if we are talking about a large number of forms. Therefore, if the cashier finds errors in the document before disbursing funds, it must be returned to the accounting department to make amendments.

If it is impossible to re-issue a document, errors are crossed out and the correct data is entered.

Attention! All corrections must be certified by the signature of the manager and the chief accounting specialist. It is also important to indicate the date the amendments were made.

Features for a budget institution

For budgetary institutions, the legislation provides for special forms of salary accounting documents when calculating remuneration for labor:

- payment form – 0504403

- form of settlements and payments – 0504401

The formation of payroll in a budgetary organization is carried out on the basis of a time sheet.

Take into account! The salary sheet of a budgetary enterprise must be signed by the compiler, as well as the inspector and the cashier. At the same time, they must indicate their official place at the enterprise and the date of signature.

Download the payroll (form T-53) and journal (T-53A). Sample and form

Download samples of the organization's personnel documents : Form T-1 and T-1a. Employment orderForm T-2. Employee personal card Form T-3. Staffing table of the organizationForm T-6 and T6a. Vacation orderForm T-7. We draw up a vacation scheduleForm T-8. Order of dismissalForm T-9 and T-9a. Business trip orderForm T-10. Travel certificateForm T-10a. Business trip assignmentForm T-13. Working time sheetForm T-49. Payroll Form T-51. Payroll for calculating and calculating wages Form T-53a. Payroll register Form T-54. Employee's personal account Form T-60. Note-calculation on granting leaveForm T-61. Calculation note upon dismissal

What are the differences between payroll and payroll?

In the payroll, unlike the payroll, each employee signs for receipt of the salary amount. It is important to note that their use is only justified if funds are given to workers in cash.

If the salary transfer is carried out to a plastic card linked to a bank current account, then there is no need to draw up a PO. With this form of payment, you only need a settlement form in form T-51, containing data on the calculation of remuneration for labor, but not on its payment.

How is the payment of wages according to the statement?

The payroll is something like a form indicating the names of several employees. The procedure for issuing funds usually occurs as follows:

- The original statement is brought to the manager. He familiarizes himself with it and, if there are no comments, signs.

- An employee enters the settlement department and signs to receive funds in the amount indicated on the form.

- After this, the cashier can give him his wages.

If for some reason an employee cannot come to collect his wages, the cashier sets aside the amount indicated in the statement until he appears. This form of payment of wages is inconvenient for several reasons:

- Human factor. We need constant monitoring and personal presence of each employee. The situation becomes more complicated if there are many such employees in the organization.

- Awareness of accruals for all employees. In the case of non-cash payments, only the person responsible for the payments knows about the amount of the salary, but in the case of handing out money in person, each employee will see the amounts of other employees and compare them with their own. In some cases, this has a negative effect, not only psychologically, but also physically demoralizing the employee himself.

Payroll - form T-51

The payroll is intended for calculating wages and reflecting the accrual of wages to employees. Unlike other forms, a payslip cannot be used to pay wages. In this connection, this form does not have a column for affixing employee signatures.

This is also important to know:

How overtime is paid: calculation

Payslips are convenient for organizations and entrepreneurs who pay wages non-cash by transferring them to employees' salary cards. In this case, since cash is not paid to employees, there is no need to record the payment of wages.

You can find the T-51 form above, and you can see a sample of how to fill it out in a special article at the link provided.

How to close a statement

As soon as 5 working days have expired, the payroll must be closed. The procedure is formalized by the cashier. It is important that this action must be carried out without fail, even if not all employees have received a salary.

The cashier's procedure when closing the statement:

mark uncollected amounts as “deposited”- calculate the amounts of money issued and not issued to recipients

- sign the statement

- draw up a cash settlement register (order) indicating the amount of cash issued

- enter the order number in the documentation

After closing, the notice is transferred to the accounting department of the enterprise.

Frequency of filling

Almost always, employees are paid at the beginning and end of the month. Such rules are regulated by the Labor Code of the Russian Federation. For violation of these conditions, the enterprise bears administrative responsibility.

An advance is the first payment (a small percentage of the basic salary rate), drawn up using a simplified format payroll.

The main part of the salary (the remaining amount) requires the preparation of Form T-51 with full documentation. In this case, in the column “Retained and offset”, the compiler must take into account the amount of the advance, highlighted in the first document.

Found documents on the topic “salary statement”

- Statement of accrual and issuance of wages Enterprise records management documents → Statement of accrual and issuance of wages

Sheet of accrual and issuance of wages No. organization (division): No. ... - Record sheet for the issuance of workwear, safety footwear and safety devices (Standard interindustry form N MB-7)

Enterprise records → Record sheet for the issuance of workwear, safety footwear and safety devices (Standard interindustry form N MB-7) - Sample. Statement accounting issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7

Accounting statements, accounting → Sample. Record sheet for the issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7form no. MB-7 was approved by the Decree of the State Statistics Committee of the USSR dated December 28, 1989 no. 241 +-+ okud code +-+ record sheet for the issue (return) of work clothes, safety shoes and safety equipment +-+ month number, type workshop code, department...

- Sample court order for collection salaries

Court orders, decisions → Sample court order to collect wagesCOURT ORDER "" 20, district (city) people's court of the region (region, republic) Judge (full name)

- Sample. Power of attorney to receive salaries

Powers of attorney: sample completion → Sample. Power of attorney to receive salaryPOWER OFFER city of Moscow the first of May two thousand and thirteen I, gr. Ivanova Maria Ivano

- Sample. Order on granting leave without saving salaries for passing university entrance exams

Employment agreement, contract → Sample. Order on granting leave without pay to take entrance exams to a universityorder to grant leave without pay . Tula July 11, 1997 order no. 1. Morozovaya Nadezhda Alekseevna to be granted leave without pay...

- Sample. Payment statement. Form No. 253

Accounting statements, accounting → Sample. Payment statement. Form No. 253standard form no. 253 organization page shop - to calculation. statement no. department payroll no . for issuance for 20 years - time sheet - last name, first name, patronymic amount of receipt...

- Sample. Statement № 13

Accounting statements, accounting → Sample. Statement No. 13statement no. 13 analytical accounting for service industries and farms for 20, section 1. calculation and justification of the amount...

- Sample. Statement № 11

Accounting statements, accounting → Sample. Statement No. 11statement no. 11 movement of material assets (at accounting prices) for 20 to workshops, farms (in production) (unnecessary...

- Sample. Statement № 1

Accounting statements, accounting → Sample. Statement No. 1statement no. 1 on the debit of account no. 50 “cash” from the credit of accounts +-+ balance at the beginning of the month rub. +- cash register date line 46...

- Calculated statement. Form N T-51

Enterprise records management documents → Payroll. Form N T-51... from to payslip ...

- Sample. Statement № 2

Accounting statements, accounting → Sample. Statement No. 2statement no. 2 on the debit of account no. 51 “current account” from credit accounts +-+ balance at the beginning of the month rub. +- string date of issue...

- Sample. Statement № 2.1

Accounting statements, accounting → Sample. Statement No. 2.1statement no. 2/1 on the debit of account no. 52 “currency account” on account credit +-+ balance at the beginning of the month rub. +- string date you...

- Statement inventory results

Accounting statements, accounting → Statement of inventory resultsstatement of inventory results appendix to the letter of the USSR Ministry of Finance dated December 30, 1982 no. 179 led...

- Settlement and payment statement. Form N T-49

Documents of the enterprise's office work → Payroll. Form N T-49document “payroll statement . form n t-49″ in excel format you can get from the link “download file”

Responsibility for violations

If during an inspection an authorized labor inspector discovers a lack of personnel documentation, the company faces administrative liability in the form of a fine:

- 1-5 thousand rubles. for officials

- 30-50 thousand rubles. for legal entities

According to the norms of the code of laws on labor and labor protection, the official carrying out the inspection has the right to suspend the activities of the institution for 3 months.

In case of repeated administrative punishment, the official faces deprivation of the right to hold a leadership position for a period of 12 to 36 months.

For incorrect maintenance of personnel records and abuse of official position, inspection services may apply more severe penalties. Compliance with the rules of labor legislation and labor law norms is monitored by the State Archives and the Labor Inspectorate.

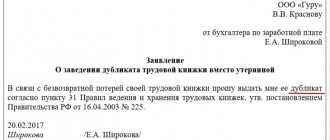

If it was lost

The employer is responsible for the safety of the statement at the enterprise. If a document is lost, he must draw up an order demanding the creation of a commission to review the incident and identify the causes of what happened.

The formed composition necessarily includes an accountant and employees of the personnel department. The primary task of the commission is to obtain explanatory notes from all persons who were partially or fully responsible for the safety of the document.

Based on the results of the investigation, a report is drawn up indicating the causes of the incident and recommendations aimed at restoring the record.

The best solution if a statement is lost is to restore it. To do this, just print it out again and put down all the necessary signatures.

If by the time the duplicate was created some of the employees had been fired, the compiler leaves the entry “could not be restored” in the lines with their full names.

Accounting entries

Taking into account the information from the payroll, the specialist makes the appropriate entries in accounting. Account assignments for basic remuneration, bonuses, vacation and sick leave payments look like this:

A payroll is an important primary accounting document used to legally issue monetary rewards to workers for performing their duties. The calculation of remuneration for labor must be accompanied by strict compliance with legal norms, and therefore, the execution of a salary form.

Top

Write your question in the form below