What payments are due to civil servants upon retirement?

The amount of the benefit depends on the average monthly salary. Severance pay is paid on the day of dismissal, its amount is the average salary for one month. It is possible to receive severance payments upon retirement for the second and third months, provided that the citizen is not employed and is employed registration at the employment center.

First of all, their rights and privileges are related to the exercise of professional activities. It should be noted that a civil servant has a special legal status. Civil service positions are divided into categories and groups, civil servants have class ranks.

Retirement of a civil servant

- salary;

- long service bonus;

- additional payment for working conditions (harmful/dangerous working conditions, work in the Far North);

- additional payment for irregular working hours;

- award for conscientious performance of official duties.

This is interesting: Electricity benefits for Labor Veterans

Legislation

On the last day of work, a civil servant is issued a work book against signature. It records the reason (grounds) for his dismissal. As in the order, the personnel officer will refer to the relevant paragraphs of Article 33 of the Civil Service Law, and not to Article 77 of the Labor Code. The order itself - its number and date of publication - is entered in the last column of the work book, as a document on the basis of which the termination of service was recorded in it.

A fixed-term contract can be terminated at the initiative of the employee earlier than the specified period only for a good reason. For example, he can resign early if he has an illness that does not allow him to perform his duties. The law does not contain a complete list of valid reasons for early termination of a contract. Therefore, each situation is considered by the management of the government agency individually. If an employee is denied early dismissal, he can appeal to a higher authority and even to court.

In particular, the general grounds for termination of a contract and termination of official activities of civil servants are the cases established in Article 33. Articles 34, 36 and 37 of this law are devoted to the specifics of interrupting labor relations in accordance with the agreement of the parties, at the request of civil servants and at the initiative of the employer. It also describes contract termination situations:

Termination initiated by the hiring party

The specifics of dismissal depend on what contract is concluded with the civil servant. Depending on the duration of the employment relationship, the contract may be open-ended or valid for a specified period.

We emphasize that the provisions of Law No. 79-FZ define payments upon dismissal of a civil servant as compensation, but not as severance pay. In particular, clause 3.1 of Art. 37 of Law No. 79-FZ contains a requirement for payment of compensation in the amount of 4 months' salary upon dismissal of a civil servant due to the liquidation of a government agency or reduction of government positions. At the same time, according to clause 3.1 of Art. 37 of Law No. 79-FZ, severance pay upon dismissal for these reasons is not paid.

The procedure for assigning and paying pensions to civil servants based on length of service

If the length of service is 25 years and the employee worked in the civil service for 7 continuous years before dismissal, then he has the right to retire based on length of service at any time, even before reaching the age established by law.

The specific list of required documents must be clarified with the authority to which the application for a pension is submitted. It is worth considering that some categories of civil servants will receive payments not from the Pension Fund of the Russian Federation, but from the structure or department in which they served.

Payments upon dismissal upon reaching the age limit for civil servants

The answer to your question depends on the year in which the service contract, which was concluded in connection with the extension of the age limit for civil service, expires. If the contract expires in the current year, then the employee should be dismissed under clause.

Benefits for civil servants upon dismissal

4 hours 2 tbsp. 39 of the Law of July 27, 2004 No. 79-FZ. For a civil servant who has reached the age limit for being in the civil service, the period of civil service, with his consent, may be extended by decision of the employer's representative, but not more than until he reaches the age of 65 years (). In this case, a fixed-term contract is drawn up with the employee (Art.

This is interesting: Why there are no cameras in Magnit-Cosmetic

To extend the period of stay in the civil service, the head of the relevant body must agree with the head of the highest-level body (in the order of subordination) of the proposal, with which he then addresses the head of the Main Civil Service. The submission is sent no later than a month before the civil servant reaches the age limit or the end of the previous extension (clause 2 of Order No. 2020). The Main State Service must respond one month after receiving the submission. However, if necessary, the Main State Service may require the necessary documents and explanations. Then consideration of the submission may be postponed until such documents are received (clause 8 of Order No. 2020). Therefore, in order not to have to dismiss a civil servant on the day the age limit approaches, it is better to formalize such an application as early as possible.

What payments are due upon retirement? 173-FZ “On labor pensions in the Russian Federation”

These include children, including adopted children. Then the successors of the second stage, consisting of brothers, sisters, grandmothers and grandchildren, are considered. The size of the shares of the heirs is determined in equal parts. In the absence of first-degree relatives, second-degree relatives can count on receiving payments. Payments after the death of a citizen are made subject to certain conditions and in a certain order: if the death occurred before the moment they were appointed.

Citizens who have formed pension savings using additional contributions are entitled to immediate payment. Additional contributions refer to funds contributed in connection with the program for co-financing pensions and family capital, as well as investment income. This payment is made every month and consists of part of the savings made from the funds indicated above. You can choose the period yourself, but not less than ten years.

Payments upon retirement

Citizen Semelak P.G. reached retirement age and wrote a letter of resignation. According to labor laws, he was provided with payment for unused vacation and severance pay for 30 days . Having received financial benefits for old age, the citizen visited the regional employment center with a request for employment.

Question: Good afternoon. My name is Vitaliy. I have received information that the former employer must provide severance pay equal to the average salary for work for up to six months. Is this really true?

AutoJurist legal assistance

The head of the company can accommodate the specialist by dismissing him before the deadline established by law. It is important that the rights of a specific employee are not violated. And yet, it is worth notifying the company in advance about your departure so that there are no problems with a delay in payment. Possibility of resigning without service A pensioner may want to resign immediately. To do this, the application must indicate the reason - retirement. In accordance with Part 3 of Art. 80 of the Labor Code of the Russian Federation, it is important to provide an application due to the impossibility of further work. As a result, the manager must promptly cancel the current employment contract. If a specialist has a desire to leave his job, he should discuss this possibility in advance with his immediate supervisor.

We recommend reading: Received Income From Renting Out Your Apartment What Documents Are Needed?

Having reached retirement age, a citizen is free not to work and has the right to express this desire to the employer without informing him in advance. A situation in which an employee who has reached retirement age is forced to vacate his position is unacceptable and entails consequences for the employer in the form of prosecutorial checks and judicial sanctions. Let us repeat once again whether to quit or not in this situation is decided by the employee himself. This decision must be made entirely on a voluntary basis.

Instructions: dismissal from service of a municipal employee

Guarantees are provided if the termination of the employment contract occurs in connection with the liquidation or disbandment of a government agency. Then the employer is obliged to provide the employee with the opportunity to either transfer to another, lower-paid position, or provide information about the possibility of employment in another government agency. If the employee refuses the opportunities provided, termination is issued.

Deadlines for dismissal

A citizen is dismissed from local service on the general grounds established by the Labor Code of the Russian Federation, and special grounds for dismissal of a municipal employee are applied to him. The general grounds are collected in the table:

When a government agency reduces civil service positions, the employer's representative informs the civil servants in writing two months before the reduction. In this case, the employer's representative, with the written consent of the employee, has the right to terminate the service contract with him without warning about his release from the civil service position being filled two months in advance.

This is interesting: How to Save Money on a Card from Bailiffs

The monthly allowance will be 5873 rubles. 66 kopecks ((3795 + 1156 + 31.63 + 189.75 + 632.5 + 68.78), where 3795 rubles is the official salary, 1156 rubles is the salary for class rank, 31.63 rubles is 1/12 of the bonus for length of service, 189.75 rubles - 1/12 of the allowance for special conditions of civil service (60%), 632.5 rubles - 1/12 of the monthly cash incentive (200%), 68.78 rubles - 1/12 of the monthly bonuses for completing particularly important tasks (16.67%)).

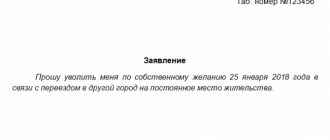

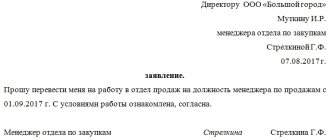

Dismissal at your own request

In case of dismissal from the civil service, the employer's representative is obliged to pay certain amounts to a state civil servant. At the same time, the calculation for terminating a service contract is somewhat different from the calculation for terminating an employment contract. What a civil servant is entitled to upon dismissal for one reason or another, how the monthly salary is calculated upon termination of a service contract and how to apply the provisions of labor legislation when making calculations, you will learn from this article.

A fixed-term contract can be terminated at the initiative of the employee earlier than the specified period only for a good reason. For example, he can resign early if he has an illness that does not allow him to perform his duties. The law does not contain a complete list of valid reasons for early termination of a contract. Therefore, each situation is considered by the management of the government agency individually. If an employee is denied early dismissal, he can appeal to a higher authority and even to court.

In particular, the general grounds for termination of a contract and termination of official activities of civil servants are the cases established in Article 33. Articles 34, 36 and 37 of this law are devoted to the specifics of interrupting labor relations in accordance with the agreement of the parties, at the request of civil servants and at the initiative of the employer. It also describes contract termination situations:

Termination initiated by the hiring party

Unlike hired workers, a civil servant is hired not under an employment contract, but on the basis of a contract concluded with a government agency. In his activities he carries out the interests of this body. When hiring an employee for a position, the contract defines all the nuances of the relationship with the employer, including the dismissal of a civil servant from work with the cancellation of the concluded contract.

In contrast to the general procedure, insurance pensions for civil servants are paid without taking into account the fixed payment. Thus, the size of the old-age labor pension assigned to a civil servant is equal to its insurance part:

Payments of cash benefits upon retirement of civil servants

- citizens with the first and second disability groups are paid 75 percent of the previous monthly allowance;

- Citizens with the third disability group are entitled to a pension in the amount of 50 percent of their salary.

This law also increases the period of performance of duties for deputies of the State Duma and members of the Federation Council for calculating bonuses based on length of service; now it will be 5 years instead of the previously established year. The calculation of the amount of state pension payment for length of service for federal civil servants depends on the average monthly salary of length of service and the amount of accrued old-age (disability) pension, and is calculated using the formula:

Conditions for long service pension for state civil servants in 2021

Civil servants listed in Presidential Decree No. 1574 dated December 31, 2005 will receive a pension if two conditions meet:

- The amount of experience in the relevant work. In 2021 - 16 years, with its annual growth (until 2026) by six months, up to 20 years. If a person held a position in the federal state civil service, his minimum length of service must be a full 12 months, that is, at least a calendar year.

- Dismissal from service for the reasons specified in Part 1 of Art. 7 Federal Law No. 166 dated December 15, 2001. For example, due to termination of a contract at the will of the employee.

Long service benefits can be received before old age (disability) pension payments. To do this, the official must:

- resign of your own free will;

- have 25 years of service experience at the time of dismissal;

- immediately before leaving, hold a position in the federal public civil service for seven years.

Old age (disability) and long service pensions are paid simultaneously.

Longevity benefits are not paid in cases where the official:

- continues to serve;

- holds government positions in the Russian Federation, its constituent entity or municipality;

- permanently holds a municipal service position;

- works in interstate (intergovernmental) bodies (in positions) for which, under international treaties of the Russian Federation, the Russian Federation receives similar support.

Payment of such security can be resumed upon the employee’s application for its restoration from the next day after his dismissal from the specified work and positions. The application is submitted to the body (its apparatus) where the employee served before dismissal. Documents for granting a pension are also submitted there; their list can be seen in Appendix No. 1 to Order of the Ministry of Labor and Social Protection of the Russian Federation dated May 22, 2017 No. 436n.

Civil servants can choose a specific payment that will be assigned to them. This development of events is possible when they are entitled to several payments simultaneously. Options to choose from include:

- long service pension;

- monthly lifetime maintenance;

- monthly supplement to pension (maintenance);

- additional (lifelong) monthly financial support, which is assigned on the basis of the Federal Law, presidential decrees and government regulations and financed from the federal budget;

- security for length of service (monthly supplement to pension, other payments), which is assigned and paid on the basis of the legislation of the constituent entities of the Russian Federation or acts of municipalities for filling relevant positions or performing appropriate service.

Pensions for state civil servants of the constituent entities of the Russian Federation and municipalities are established on the basis of regional regulations and are paid from local budgets. Such persons have the right to receive additional payments for length of service simultaneously with both the insurance pension assigned in accordance with the Federal Law dated December 28, 2013 No. 400, and with the one established ahead of schedule under the Law of the Russian Federation dated April 19, 1991 No. 1032-1. The required length of service for this case in the current 12 months is 16 years.

What payments are due upon retirement?

In fact, a lump sum payment to pensioners upon retirement replaces further regular support. However, if a person continues to work after retirement age, he cannot apply for it.

From 2021, Russian citizens will become pensioners much later. But the change in the retirement age did not affect the list of payments due to a citizen who has served his time. Let us turn to Federal Law No. 360-FZ of November 30, 2011.

Conditions for receiving additional payment for length of service

Simultaneously with the increase in the retirement age, a bill was passed that increases the required length of service in the civil service from 15 to 20 years. These changes will also be introduced gradually, raising the temporary level of experience by 6 months annually. For 2021 it is 16 years and will reach its final result in 2026.

If you continue to work beyond the required length of service, you can qualify for additional pay based on length of service. To apply for an allowance, you must meet the following conditions:

- have worked in the public service for 16 years or more (as of 2018);

- before the dismissal of a citizen, his position in the federal civil service must be at least 12 months;

- dismissal must occur for one of the reasons specified in the section on the assignment of pensions;

- a civil servant is a recipient of an old-age or disability insurance pension.

With the minimum possible length of service, a civil servant can receive 45% of the salary. Each subsequent year of work above the norm will increase the pension by another 3%. The upper threshold for increasing payments is 75%.

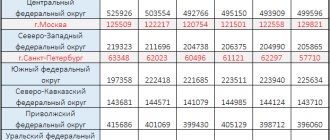

Retirement age data for government employees

Payments to civil servants

11. I have 8 years of experience as a federal civil servant. From 2021 on old age pension. Do I have the right to a preferential pension and will it not be deducted from the assigned old-age pension? In the pension fund for m.f. They explained to me that there is now a new procedure for paying preferential pensions. The amount of the preferential pension will be deducted from the amount of the assigned old-age pension.

8. I am a civil servant and during the reorganization, my position is reduced, I fall under layoffs. I will be paid 4 allowances. Can the money paid back be withheld from me if I get a job back in the same body at the rate of a person who is on maternity leave?

Payments upon dismissal upon reaching the age limit for civil servants

A civil servant has the right to monetary compensation for all days of unused annual basic and additional leave upon dismissal. The number of days to provide compensation for main leave is calculated in proportion to the time worked for which the civil servant did not take leave, up to the date of dismissal, and for additional leave - based on the full duration, depending on the relevant length of service in the civil service (For civil service experience over 10 years, 5 calendar days are provided additional leave, and starting from the 11th year, this leave increases by 2 calendar days for each subsequent year, but not more than 15 calendar days (clause 1 of resolution No. 250).) (see joint letter of the Ministry of Labor, the Main State Service dated January 27, 1999 No. 13-294, dated January 26, 1999, No. 10/364).

Dismissal from civil service upon reaching the age limit

If necessary, the head of the relevant government agency, having received the consent of the head of the Main Civil Service under the Cabinet of Ministers of Ukraine, can extend the period of stay in the civil service to five years. At the end of this period, the civil servant can only count on serving in the civil service as an adviser or consultant.

The increase in the retirement age from the new year will affect officials at all levels: state (municipal) employees, individuals holding federal and regional government positions, as well as municipal positions on a permanent basis. Already in 2021, for example, employees of tax authorities, the federal treasury department, the judicial department, the bailiff service, the forestry department, etc. will retire six months later than usual.

Pension portal of the Russian Federation

In order to retire, a corresponding application must be submitted. The assignment of pensions to civil servants occurs after it is submitted to the MFC, Pension Fund. It can also be sent by mail. In the latter version, the date of circulation will be considered to be the one on the postal stamp. If you act through the MFC, the date will indicate the date of reception at the center. Applications for benefits are sent to work, to the personnel service. It is received by the Chairman of the Board.

- Papers confirming completion of service;

- Passport and its photocopy;

- Certificate of position;

- A photocopy of the dismissal order;

- A paper on average income for the last 365 working days;

- Photocopy of military ID;

- A certificate stating that funds were previously allocated based on age or disability (if any);

- A photocopy of the work book.

What payments are due to civil servants upon retirement?

The legislation provides for cases when, when a pensioner is dismissed, the payment of benefits lasts longer. These are the following categories of employees:

In accordance with the wording of Part 1 of Article 7 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (hereinafter referred to as Federal Law No. 212-FZ) , which was in force in 2010, the object of taxation of insurance premiums for payers of insurance premiums making payments and other remuneration to individuals was recognized as payments and other remuneration accrued by them in favor of individuals, in particular, under employment contracts.

Insurance pension for civil government employees in 2021

A civil servant, like any other citizen of the Russian Federation, will be assigned an old-age insurance pension when he reaches three criteria:

- Age.

- Insurance experience.

- Individual pension coefficient.

However, this is where the similarities end and the nuances begin.

The retirement age for civil servants in the civil service is regulated by Federal Law No. 400 dated December 28, 2013, namely Appendix No. 5 to it. The retirement age of civil servants in Russia from 2021 is 56 years for women and 61 for men, with an annual (until 2032) increase of six months. That is, up to 65 (for men) and 63 years (for women).

The insurance period (in this case) is the total time of work in federal, regional or municipal positions with insurance contributions to the Pension Fund of the Russian Federation. In 2021, the required minimum of such experience is nine years with an annual (until 2024) increase by a year, up to 15 years. The periods of work that are included in the relevant length of service are stated in Art. 11 and 12 Federal Law No. 400 dated December 28, 2013. Its duration can be calculated according to the rules from Art. 13 and 14 of the same Federal Law.

The individual pension coefficient is measured in points, its value is determined according to Appendix No. 4 to the same Federal Law 400. In 2021, its required minimum is 13.8 points, every 12 months (until 2025) it increases by 2.4 points, up to 30.

The conditions for assigning insurance pensions are set out in more detail in Art. 8, 35 Federal Law dated December 28, 2013 No. 400. The formula from Art. 15 of this Federal Law.

Formation of pensions for municipal employees

Municipal employees (hereinafter referred to as MS) are citizens of the country who perform duties in the public service for monetary compensation.

MS's pension in 2021 will be paid according to a new scheme. Therefore, study the detailed information in this material to keep abreast of the latest developments in the calculation of pension payments to municipal employees. In the next two years, municipal service employees who decide to continue working once the required parameters are achieved will not be able to see the annual recalculation until they leave the workplace. At the same time, you are allowed to work until you reach 70 years of age, no more.

Federal Government Employees Pension

The award of state benefits for length of service, the recalculation of its value and the transition from one form of pension to another occur at the request of a citizen and are carried out regardless of the time after the opportunity arises for it without a time limit, with the exception of social benefits for disability.

- Government experience service for at least 15 years (was in 2021).

- Dismissal on one of the grounds: reduction of state staff. employees or liquidation of federal agencies;

- dismissal from positions due to termination of their powers by persons;

- reaching maximum age;

- due to poor health, which prevents continued service;

- dismissal at will due to retirement.

Retirement age for civil servants - main provisions of the reform

The provisions of the new reform will affect categories of civil servants who will retire this year, as well as those employees whose retirement age was at the end of 2015. The latter were given the opportunity to remain in their jobs.

The reform came into full effect in 2021. 2021 is designated as a transition period. Thus, a gradual increase in the retirement age is provided for officials. According to the latest news, the retirement age of civil servants in Russia will finally increase to 65 years. It will be possible to continue serving until the age of 70, but no pension will be paid. So, if an employee retired at 65 and returned to service at 67, then the payment of the pension will be suspended. But the official will be able to be reinstated only in the first three years after his official retirement.

In many ways, the reason for such reforms is that, even after retiring, many officials continue to work, simultaneously receiving both a pension and a salary. In connection with this, the retirement age was increased.

On the other hand, the need for reforms is due to the imbalance between the working-age population and the population that, according to age indicators, should complete their working career. This situation could lead to the collapse of the pension system in the country.

Thus, the retirement ages established back in 1932: 55 for women and 60 for men are today undergoing forced changes. Thus, women are given the right to work until they are 60 years old, and men until they are 65 years old. In addition, you can continue working until you are 70 years old, but without accruing a pension. It is likely that the retirement age of civil servants will be changed in 2021.

Pension of civil servants: procedure for appointment, size and calculation

However, the size of the pension depends on the region in which the person lives and works. If we consider the capital of the country, then the pension of a civil servant there will be 55% of wages. In almost all other regions the limit is 45%.

If we talk about an insurance pension, we mean the part that can be received when applying for a long-service pension. In 2015, the legislation changed slightly, and with it the calculation procedure. For independent study, it is recommended to read two Federal Laws: “On Insurance Pensions” and “On Labor Pensions.”

Payments to municipal employees upon retirement

Municipal employees are coordinators between the state system and the population in order to respect both the rule of law and the rights of ordinary citizens, which predetermines certain specifics of work and leads to increased psychological stress.

A long-service pension is not available to everyone, but only to people in certain professions. They can count on it: We will talk about such a category of citizens as municipal employees. Workers in this sector have the right to receive long-service pensions.

Federal Law No. 143 - the main bill

The amendments to the Federal Law on raising the retirement age for civil servants dated November 15, 1997 N 143-FZ, signed by the president, which sets out the new procedure for pension provision for civil servants, have several main provisions:

- The generally established retirement age is increasing for persons holding government positions in the Russian Federation, constituent entities of the Russian Federation, as well as those in municipal service. The increase will occur by 5 years for men and 8 years for women;

- the retirement age will be raised gradually, increasing by 6 months every year;

- the required work experience for civil servants is also increasing from 15 to 20 years, in connection with which amendments have been made to the law “State pension provision in the Russian Federation”;

- constituent entities of the Russian Federation can independently make changes that increase wages at the expense of local budget funds, as well as adjusting the age limits for civil service employees;

- persons who acquired the right to receive an old-age insurance pension before the approval of the amendments do not fall under the law;

- deputies of the State Duma or members of the Federation Council will begin to receive monthly supplements to their old-age or disability pensions after five years of civil service.

The main bill is Federal Law No. 143 of November 15, 1997

What payments are due to civil servants upon retirement?

- agreement between the parties to the service contract;

- expiration of a fixed-term service contract;

- termination of a service contract at the initiative of a civil servant;

- refusal of a civil servant from a civil service position proposed to be filled in connection with a change in the essential terms of the service contract;

- refusal of a civil servant to be transferred to another position in the civil service for health reasons in accordance with a medical report or the absence of such a position in the same public service;

- refusal of a civil servant to be transferred to another locality together with a government agency;

- reductions in civil service positions in government agencies;

- abolition of a government agency;

- inconsistency of a civil servant with the civil service position being filled: for health reasons in accordance with a medical report;

- due to insufficient qualifications confirmed by certification results;

Important. In addition to the above periods, other periods in accordance with the regulatory legal acts of the constituent entities of the Russian Federation and municipal legal acts are included (counted) in the length of service of municipal service for the purpose of assigning a pension for length of service to municipal employees.

Indexing

The increase in the volume of pension provision is carried out in order to bring the amounts received by citizens into line with the increase in prices for goods and services. In 2021, there was an increased indexation of insurance and social payments. The growth index was 7% and 2% respectively. As for retired officials, they should also expect improvements.

On March 13, 2020, Order No. 415-r of the Government of the Russian Federation was approved. The percentage by which monthly payments are planned to increase is 4.3%. This indicator is set based on the inflation rate. The planned increase will affect federal civilian government employees. It will be possible to feel the consequences of the adopted acts as early as October 1, 2020.