According to official data, even before the onset of the coronavirus crisis, shadow employment in Russia accounted for over 20% of the working population, and according to Finance Minister Siluanov, the volume of the gray wage fund is at least 10 trillion rubles annually.

However, it should be noted here that labor activity without registration not only entails huge losses for the state, but also various negative consequences for both the employee and the unscrupulous employer, since it is illegal.

Why are employers in no hurry to register their employees?

The motives of an unscrupulous employer are absolutely banal:

1. Significant savings on “salary” taxes (no salary, no need to pay insurance premiums);

2. You can calmly deprive an employee of vacation or let him go for a few days at his own expense;

3. It is not necessary to pay sick leave;

4. If the employee is no longer needed, it is easy to get rid of him and, again, no severance pay, that is, the employer will not have to pay anything.

At the same time, during communication with a potential employee, an unscrupulous employer uses various manipulations. For example, an employer can argue its position by saying that the employee will not have to lose 13% of personal income tax from his salary every month. This is pure manipulation, for one simple reason: an officially employed employee has the right to paid leave and sick leave, which, based on the total amounts for the year, is almost equivalent to paying personal income tax.

In other words, if we consider the long-term period, the employee practically does not lose money on personal income tax.

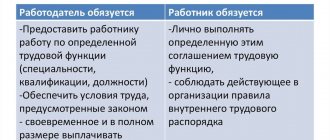

So, the main criteria by which a relationship can be recognized as an employment relationship:

- internal labor regulations have been established;

- there is a permanent salary;

- the same work is done systematically;

- there is a workplace and it is equipped;

- The terms of execution of the contract have not been established.

These criteria are important for the following categories:

- tax authorities and the Pension Fund. The tax authorities are interested in requalifying the employment contract into an employment contract, because this will allow additional taxes to be assessed. Most often, an enterprise enters into a rental agreement with an individual entrepreneur, and the employer saves on taxes. He often asks his employees to obtain registration as individual entrepreneurs in order to then formalize their work under a civil law contract;

- Labor Inspectorate and Social Insurance Fund. It is important for them to re-qualify the contract for collecting fines (for violation of employee rights) and for receiving insurance premiums;

- the workers themselves. They can demand judicial recognition of the employment relationship with the customer if the employment agreement actually characterizes this relationship as such. The motivation is easy to understand - the employee wants to receive the benefits and guarantees he is entitled to under the Labor Code. When it is the employee himself who files a claim, the court most often meets him halfway and reclassifies the GPA as a labor law. Therefore, the most dangerous situation for an employer is when an employee goes to court.

Summarize. It is important to choose the correct form of contract in advance. If the contract is classified incorrectly (a civil law one is chosen instead of a labor contract), then, if necessary, in court such a contract can be reclassified as a labor contract.

What will follow is that the employer will be forced to perform the following actions , which he may have wanted to avoid:

- he will have to pay the employee’s salary in full;

- the employee will have to be included in the staff of the enterprise;

- pay moral damages;

- add part of the taxes;

- pay contributions to the Social Insurance Fund;

- pay a fine;

- pay legal costs.

Negative consequences of informal employment for a worker

Unfortunately, there are many such consequences. By renouncing his right to official employment, the employee, first of all, becomes completely dependent on the employer, namely:

● Loss of a job without explanation (in this case, the employer’s decision may be completely unexpected for the employee, for example, today he works, but tomorrow he no longer needs to come);

● Refusal to pay (very often unscrupulous employers use unregistered workers for a week or a month, and then fire them without paying a penny);

● There is no opportunity to go on vacation, since there are no guarantees that it will be possible to keep the job, and the employer will not pay vacation pay;

● You can easily lose your job due to illness; not every employer will want to wait for the employee to return; as you understand, you shouldn’t count on paid sick leave in this situation either.

In the current situation with the Covid-19 pandemic, many people have fully felt the consequences of being exposed to the arbitrariness of employers.

Thus, if in relation to officially employed citizens the state, at the very least, controlled the observance of their rights, then unregistered workers were literally left without a means of subsistence and out of sight of the state.

In addition to being dependent on an employer, there are other negative consequences. Work without registration does not form a length of service, and an unscrupulous employer does not make contributions to the pension fund and health insurance fund.

It means that:

● The employee may in the future lose his pension or a significant part of it;

● The employee will have to be content with the amount of social health insurance;

● If you lose your job when applying to the employment exchange, you can only count on a minimum unemployment benefit of 1,500 rubles, as a person who has never worked.

Working without an employment contract

Most often, the consequences of such cooperation are disastrous for the subordinate, who conscientiously fulfilled his duties for a certain time, and as a result, was left with nothing.

He does not have the right to prove his activities and demand compliance with laws, in particular the Labor Code, because there is no document confirming the validity of the labor relationship. The director may say that he is seeing this person for the first time and it will be quite difficult to refute his words.

The employer who hires the subject may also have negative consequences from such cooperation.

If an employee performs his duties poorly and thereby brings losses to the company, the director will not be able to recover compensation from him or file a lawsuit asking him to hold the person accountable. Unofficial work has both positive and negative sides, and no one can predict the possible outcome. Important! A frequent method of fraud on the part of managers occurs when accepting a person for a so-called “probationary period”, at the end of which the person learns that he is not suitable (the reason in such situations is usually vague and unfounded) and will not receive any payment.

What threatens an employer who does not register an employee?

In fact, as practice shows, the benefits and savings of the employer in this situation are not justified by high legal and other risks. The shadow economy is becoming a thing of the past. In recent years, state control over business has increased significantly. The gray turnover of remuneration is becoming more and more transparent, and the employer’s responsibility is only growing.

At the same time, for example, inspections by labor inspectorates since 2018 can be carried out without prior notification of an upcoming inspection by the State Labor Inspectorate.

For violation of labor laws, there are currently many penalties, and in some cases, employers may be held criminally liable.

So, let's look at what exactly threatens the employer if regulatory authorities reveal facts of unofficial employment.

Pros and cons of an employment contract for an employer

Advantages for the employer:

- the employee independently provides the necessary working conditions, since according to the contract, it is the results of labor that are important. The employee himself chooses the place of work and calculates the required time to complete it. He uses his own material for the work, unless, of course, the contract provides otherwise;

- There is no unified social tax in terms of tax in the Social Insurance Fund (4%).

- there is no need to provide the employee with the guarantees provided for by the Labor Code;

- there is no need to spend money on social insurance contributions, except in cases where the employer, when concluding the employment contract, himself determined his own obligation as an insured to pay social insurance contributions;

- Remuneration for work under a rental agreement is based on the result of the work. Remuneration is usually made upon completion of the work in accordance with the price indicated in the contract, and not twice a month.

Disadvantages for the employer:

- there is no regulation of the work itself, since the result is important. The contractor does not comply with the internal regulations of the enterprise. An employee cannot be punished for violating the rules;

- The court may recognize such an agreement as an employment agreement if it determines that the agreement de facto defines the relationship between the employee and the employer;

- If a rental agreement is signed with a person who is not registered as an entrepreneur, he may be punished for illegally engaging in business.

Personal income tax

Tax officials have promised to collect the full amount of unpaid personal income tax from “salaries in envelopes” from 2021, not from the employee’s salary, but at the expense of the employer.

Thus, offended workers, who were previously afraid to complain about an unscrupulous employer for fear that they would have to pay the entire personal income tax, will now be active, turning to the court, prosecutors and labor inspectors.

They may do this not only out of a desire for revenge, but also in the hope that they will be able to restore their seniority, replenish their pension points, and at the same time recover vacation and sick pay from the employer.

Position on parole

The plaintiff tried to prove in court that there was a real employment relationship between her and her employer. And it was difficult to prove this without a trial. Because no employment order was written, there was no entry in the work book. And the employment contract itself was signed only after some time.

The citizen was unlucky in the local courts - two instances rejected all the employee’s arguments and rejected the claim. But the Supreme Court explained to its colleagues that the absence of papers in such a situation does not at all mean the absence of labor relations.

The circumstances that developed for our heroine are no exception.

Working without registration, of course, carries many risks for citizens. But, as the explanations of the Supreme Court show, even in such situations, citizens can actually prove, and therefore defend, their rights.

This story began with the fact that our heroine worked for more than six months as a salesperson in a certain store with an artsy name. And only then they signed an employment contract with her and gave her a job description. At the same time, the general director of the limited liability company, which was the official name of the store, was aware that the saleswoman was working for him without registration. The saleswoman herself worked all this time as expected. The woman obeyed the internal labor regulations, went on leave according to the schedule drawn up by the organization and, as required by the position, bore full financial responsibility. She also received a pre-agreed salary - 30,000 rubles per month. This went on for four years.

And then the woman was simply shown the door, that is, the saleswoman was verbally fired, without even bothering to explain to her the reason for such an action. Since the employer did not consider it necessary to calculate wages and did not pay the saleswoman the vacation pay due in such cases, she submitted a statement of claim to the court and demanded that she be paid.

The citizen also indicated in the lawsuit that she was asking the court to establish the fact of labor relations, and the plaintiff also demanded that the store, which was listed in the documents as a limited liability company, be required to make an entry in the work book.

But this was not a complete list of requirements. The citizen asked the court to declare her dismissal illegal, reinstate her at work, and pay her the lost money. Plus, in her statement of claim, she asked to be compensated for her forced absence and be sure to pay her for moral damages.

If a person was allowed to work, but did not draw up a contract with him, then this is an abuse of right

At first instance, the case was heard in the city court. The Vorkuta City Court called and heard numerous witnesses. They practically said in unison on the record and confirmed that the saleswoman really fully fulfilled her official duties. She regularly ordered, received and released goods.

The court also examined a bunch of official documents signed by the plaintiff. It is important to emphasize that in some of them she is referred to as a senior salesperson, as was printed in the agreement on full individual financial responsibility, the employment contract, salary reports, vacation schedules, the job description of the senior salesperson, invoices and product reports. The same thing was indicated in numerous lists of write-offs of goods, inspection reports of the object, and even in certificates for the consignment note.

But it turned out that the testimony of the absolute majority of witnesses and a huge number of papers did not convince the court. And in the end, he came to the conclusion that the evidence presented “does not confirm the emergence of labor relations between the plaintiff and the LLC: the performance of a certain labor function, the permanent and paid nature of the work.”

The court in its decision referred to the absence of a senior salesperson position in the staffing table of this limited liability company.

In addition, the city court did not accept a copy of the agreement on full financial responsibility and pointed out the discrepancy between the position in the employment contract. As a result, the citizen’s claim to establish labor relations was denied.

The next instance, the Supreme Court of Komi, only confirmed the correctness of the decision of the lower court and said that it completely agreed with its colleagues.

But the citizen did not accept the refusal and went all the way to the Supreme Court of the Russian Federation, defending her labor rights. Her case was requested by the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation. And there they checked her arguments and stated that the saleswoman’s arguments were trustworthy.

This is the main thing that the Supreme Court said after studying this case. The court clarified that the mere absence of a written employment contract does not exclude the possibility of recognizing it as concluded, and the relationship that has developed between the parties as labor if the appropriate signs are present.

If the employer, the court emphasized, actually allowed the employee to work, but did not draw up a written contract with him, then this can be regarded as an abuse of right, which is the subject of Article 67 of the Labor Code of the Russian Federation.

The Supreme Court emphasized that if an employee with whom an employment contract has not been drawn up begins work with the knowledge or on behalf of the employer, then the employment contract is considered concluded. In this case, the Supreme Court referred to Articles 15-16, 56 and 67 of the Labor Code of the Russian Federation.

The Judicial Collegium for Civil Cases of the Supreme Court stated the following - the local court must in such a situation establish whether an agreement was reached on the personal performance of work, whether the plaintiff was allowed to perform this work, whether she obeyed the internal labor regulations in force at the employer, whether she performed the work in accordance with interests, under the control and management of the employer, whether wages were paid to her.

Since the local courts for some reason did not analyze this, the Supreme Court canceled all decisions taken in this case and ordered to reconsider this dispute from the very beginning, taking into account its explanations.

Administrative responsibility

Parts 4 and 5 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation provide for a system of imposing penalties on employers for evading the execution of an employment contract.

So, if the offense was committed for the first time, then

● The guilty official will pay from ten to twenty thousand rubles;

● The individual entrepreneur will pay from five to ten thousand rubles;

● The legal entity will pay from fifty thousand to one hundred thousand rubles.

The amount within the specified penalties will be determined by the inspector, taking into account all the circumstances of the offense.

If the offense is repeated, the fines will increase:

● For individual entrepreneurs – from thirty to forty thousand rubles;

● For legal entities – from one hundred to two hundred thousand rubles. In addition, officials may be subject to disqualification for a period of one to three years.

How to draw up and register a contract without errors

Conventionally, several types of miscalculations and inaccuracies can be distinguished:

- failure to include the necessary information about the employee and (or) employer in the contract;

- technical errors that distort data;

- absence of certain mandatory conditions.

For failure to correct some errors, administrative liability is provided (up to 50 thousand rubles in accordance with Article 5, paragraph 27 of the Code of Administrative Offenses of Russia):

- the employer forgot to specify a number of mandatory conditions (Article 57 of the Labor Code of the Russian Federation);

- the employee did not put his signature on the document (Articles 61 and 67 of the Labor Code of the Russian Federation);

- the employee did not put his signature on the employer’s copy indicating that he received a copy of the contract (Article 67 of the Labor Code of the Russian Federation).

Can errors in the contract be corrected? Yes, you can. To do this, it is necessary to draw up an additional agreement to it, where all necessary adjustments should be indicated.

An employment contract is a special document that reflects the legal relationship between an entrepreneur and an employee. It applies in all cases without exception. For violation of the requirements for drawing up, processing and storing contracts, administrative liability in the form of fines is provided.

Criminal liability

In cases where the volume of evasion from paying “salary taxes” (personal income tax and insurance contributions to extra-budgetary funds) over the past three years reaches a large or especially large amount, the employer may be brought to criminal liability simultaneously under several articles of the Criminal Code:

● 199 CC – evasion of taxes and insurance premiums;

● 199.1 of the Criminal Code – failure to fulfill the duties of a tax agent (we are talking about non-payment of personal income tax from an employee’s salary);

● 199.2 of the Criminal Code – concealment of funds or property of an organization from which taxes and insurance contributions should be collected;

● 199.4 of the Criminal Code – evasion of the employer from paying “accident contributions” (we are talking about insurance of accidents, industrial injuries and the prevention of occupational diseases).

● 159 of the Criminal Code - Fraud, which, as a rule, always goes in conjunction with the “tax articles” of the code itself.

Please note that large and especially large amounts, depending on the specific criminal offense, may be different amounts, directly indicated in the notes to the relevant articles of the Criminal Code.

How to fill out a temporary employment contract without errors

When drawing up fixed-term contracts, an entrepreneur should be especially careful. After all, mention in its text of provisions indicating the existence of an employment relationship between a businessman and an individual is fraught with claims from inspection authorities. If the contract contains clauses on compliance with internal labor regulations or on payment for work twice a month, tax inspectors may suspect that the individual entrepreneur is trying to evade paying insurance premiums. This is fraught with the accrual of penalties and fines.

Other employer risks

One should not discount the fact that an employee without registration can also greatly “annoy” an unscrupulous employer. Since he is not officially employed, he may also not show up for work any day, sell the company’s trade secrets, leak the customer base, etc. and so on.

At the same time, it will no longer be possible to hold such an employee accountable. Thus, it is obvious that the legal consequences of refusing official employment can be very painful for both the employer and the employee. Every decision of the employer and employee related to employment must be balanced and take into account all the advantages and disadvantages.