The adjustment coefficient K2 affects the amount of the single tax on imputed income, taking into account various factors affecting the basic profitability of the business. The limit values of the parameter can be within the range of 0.005 to 1.

The final tax amount is calculated using two indicators - the deflator coefficient K1 and the basic profitability coefficient K2. Let's take a closer look at how to find K2 in 2021.

Indicator K2 is reflected in the tax return for UTII, section 2 line 060 - instructions for filling.

What is the K2 coefficient for UTII?

The definition of K2 is given in Art. 346.27 of the Internal Revenue Code. This coefficient adjusts the basic profitability, taking into account the totality of business activities. It is influenced by:

- variety (range) of goods, works and services that allow a businessman to extract profitability from his business;

- operating mode;

- the amount of income received;

- seasonality of work;

- any features of the place where the business is conducted;

- field area of information boards, outdoor advertising;

- the scale of use of any type of transport for advertising;

- other factors.

The value of K2 is set annually by local authorities, which operate in a specific territory. You can find the value for your region on the official website of the tax authority or in the table below.

Entities are allowed to use the regional deflator in such a way as to regulate the conduct of business in a specific area or territory. For example, the K2 value for rural areas is lower than for urban areas, and for household services it is lower than for passenger transportation. This makes it possible to influence the decisions of entrepreneurs planning to open their own business.

Using the example of St. Petersburg, we will consider the change in K2 values by type of activity and territory of business. All of them are valid in 2021 in accordance with the St. Petersburg Law of June 17, 2003 No. 299-35.

| Type of business activity | Coefficient K2 for St. Petersburg | K2 coefficient for the Leningrad region |

| Shoe repair | 0,4 | 0,2 |

| Repair of equipment | 0,8 | 0,6 |

| Hairdressing and beauty salon | 0,6 | 0,4 |

| Pet care | 0,6 | 0,4 |

| Veterinary services in specialized hospitals | 0,6 | 0,6 |

| Transport passenger transportation | 1,0 | 1,0 |

If a new coefficient is not established for 2021, then during this period the value that was adopted last year will be valid. As a general rule, the K2 value cannot be changed during the calendar period.

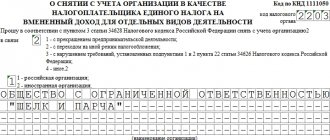

The document represents a decision that lists all types of activities subject to UTII. It also sets out the procedure for calculating K2.

The UTII rate is established by clause 1 of Art. 346.31 of the Tax Code and amounts to 15% of the amount of imputed income.

K2 coefficient table for UTII for 2021

By law, the coefficient can be set annually, but in practice its value is rarely changed. The table lists K2 for UTII for 2021.

Get the table for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Download the table and find the value of the K2 correction factor for your region.

When preparing your UTII tax return, reflect it on line 060 of section 2 of the form. If local authorities have not established the size of the K2 deflator coefficient for UTII for 2021, take it as one.

How to use the K2 deflator coefficient to calculate UTII for 2020

The value of K2 is set taking into account the type of activity, seasonality, range of goods, operating mode, expected amount of income, etc.

When calculating UTII, the following must be taken into account:

- if you have several types of business (within one business activity code), take the maximum K2;

- if the coefficient is not set for this year, last year’s value must be used;

- if the K2 value is not established for your type of activity, take the maximum value from those established for your goods or services;

- to calculate UTII, you will also need the K1 coefficient. In 2019 it is 1.915. And in 2021 it will be equal to 2.009.

More than 1,500,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

How to find the K2 correction factor for UTII

Using the Chelyabinsk region as an example, we will find the coefficient K2:

- In the search bar above, enter the code or region of interest and follow the link.

- A page with the section “Features of regional legislation” will open; select the desired one from the list of municipal districts. In our case, click on the city of Chelyabinsk.

- The “Solution” page will open below, download the document by clicking on the “Download” button.

How will the values of deflator coefficients change?

The values of the current deflator coefficients and the coefficients approved for 2021 are given in the comparative table.

Deflator coefficient values for 2021 and 2018

| Tax regime | 2017 | 2018 |

| simplified tax system | 1,425 | 1,481 |

| UTII | 1,798 | 1,868 |

| PSN | 1,425 | 1,481 |

| Trade fee | 1,237 | 1,285 |

| Personal income tax | 1,623 | 1,686 |

| Property tax for individuals | 1,425 | 1,481 |

Also see “Deflator coefficients for 2021 have been approved.”

Deflator coefficient for 2021 for the simplified tax system

For the simplified tax system, a new deflator coefficient is established for 2021 in the amount of 1.481, which does not affect anything, due to the fact that indexation will not be carried out in the Russian Federation in the period 2017-2020 (the provisions of the Tax Code of the Russian Federation are suspended until 01.01.2020 - articles 346.12 (paragraph 2, paragraph 2), as well as Article 346.13 (paragraph 4, paragraph 4)).

As already noted, in 2021 the amount of the marginal income, which limits the right of an enterprise to switch to the Simplified Taxation System, will not be indexed to the deflator coefficient.

Thus, in order to switch to the “simplified” system from January 1, 2018, the organization’s income should not exceed:

1. For 2021 – 150 million rubles. 2. for 9 months of 2021 – 112.5 million rubles.

On establishing deflator coefficients for 2021

ORDER

dated October 30, 2021 N 579

ON ESTABLISHING DEFLATOR COEFFICIENTS FOR 2021

In accordance with Article 11 of the Tax Code of the Russian Federation (Collection of Legislation of the Russian Federation, 1998, N 31, Art. 3824; 1999, N 28, Art. 3487; 2003, N 52, Art. 5037; 2004, N 31, Art. 3231 ; 2006, N 31, Art. 3436; 2007, N 22, Art. 2563; 2010, N 31, Art. 4198; N 48, Art. 6247; 2012, N 26, Art. 3447; 2013, N 26, Art. 3207; 2014, N 48, Art. 6657; 2021, N 1, Art. 6; N 27, Art. 4176) set for 2021:

deflator coefficient required for the purpose of applying Chapter 23 “Income Tax for Individuals” of the Tax Code of the Russian Federation, equal to 1.686;

deflator coefficient required for the purpose of applying Chapter 26.2 “Simplified Taxation System” of the Tax Code of the Russian Federation, equal to 1.481 <*>;

———————————

<*> In accordance with Part 4 of Article 5 of the Federal Law of July 3, 2021 N 243-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the transfer to tax authorities of powers to administer insurance contributions for compulsory pension, social and medical insurance" the provisions of paragraph two of paragraph 2 of Article 346.12 and paragraph four of paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation are suspended until January 1, 2021, and therefore the value of the maximum amount of income of the organization, limiting the right of the organization to switch to a simplified taxation system , is not subject to indexation by the deflator coefficient established for 2018, necessary for the purposes of applying Chapter 26.2 of the Tax Code of the Russian Federation.

deflator coefficient required for the purpose of applying Chapter 26.3 “Taxation system in the form of a single tax on imputed income for certain types of activities” of the Tax Code of the Russian Federation, equal to 1.868;

deflator coefficient required for the purpose of applying Chapter 26.5 “Patent taxation system” of the Tax Code of the Russian Federation, equal to 1.481;

deflator coefficient required for the purpose of applying Chapter 32 “Property Tax for Individuals” of the Tax Code of the Russian Federation, equal to 1.481;

deflator coefficient required for the purpose of applying Chapter 33 “Trade Fee” of the Tax Code of the Russian Federation, equal to 1.285.

Minister M.S.ORESHKIN

Deflator coefficient for 2021 for trade tax

The 2021 deflator factor for the trade tax increases the maximum rate for this tax. Let us remind you that the rate is set in accordance with paragraph 4 of Article 415 of the Tax Code, for various markets in the amount of 550 rubles per 1 m2. In 2021, the size of the deflator coefficient will also increase.

| Deflator coefficient for trade tax for 2017 | 1,237 |

| Deflator coefficient for trade tax for 2018 | 1,285 |

In 2021, the marginal rate for the trading fee, taking into account the deflator coefficient, will be:

(550 rubles x 1.285) = 706.75 rubles.

Today, the trade tax applies exclusively to Moscow. At the same time, the rate used is lower than the maximum value (in accordance with Moscow City Law No. 62 of December 17, 2014) and it is 50 rubles per 1 m2.

Deflator coefficient for 2021 for PSN

From 2021, potential income under PSN must be multiplied by a deflator coefficient of 1.481. It is important to remember that authorities in the regions of the Russian Federation can set their own income levels, which must be within the maximum established at the federal level.

In 2021, the deflator coefficient for PSN has been increased:

| Deflator coefficient for PSN for 2017 | 1,425 |

| Deflator coefficient for PSN for 2018 | 1,481 |

Thus, patents will become more expensive.

Deflator coefficient for personal property tax for 2021

The deflator coefficient established by the Ministry of Economic Development for 2018 for personal property tax also increased. The new indicator will be used by individuals to calculate tax payable for the period 2021.

| Deflator coefficient for personal property tax 2017 | 1,425 |

| Deflator coefficient for personal property tax 2018 | 1,481 |

Based on Article 404 of the Russian Tax Code, property tax for individuals is calculated using a deflator coefficient from 01/01/2014. This indicator is important for adjusting the inventory price of a real estate property.

All real estate objects located within the same municipal district are taken into account. The number of months during which the property was registered to the taxpayer is taken into account.

Please note that if a taxpayer increases the number of properties he owns, then not only the final tax amount will change, but also the property tax rate.

That is, in order to calculate the property tax of individuals for the period 2021, it is necessary to use a coefficient of 1.481. When calculating tax for 2021, a different coefficient is used - 1.425.

Deflator coefficient for 2021 for UTII

In 2021, the K1 coefficient for the Unified Tax on Imputed Income will increase. Calculation of UTII tax involves adjusting the base yield by this coefficient.

| K1 for UTII for 2017 | 1,798 |

| K1 for UTII for 2018 | 1,868 |

In accordance with paragraph 4 of Article 346.29 of the Tax Code, to calculate the UTII tax, the basic yield must be multiplied by the new deflator coefficient K1.

Deflator coefficient for 2021 for personal income tax

For an employee who is a foreigner and pays an advance on income tax for a patent, the deflator coefficient increases the amount of this advance.

| Minimum payment 2017 | (1200 x 1.623) = 1947.6 rubles |

| Minimum payment 2018 | (1200 x 1.686) = 2023.20 rubles |

Thus, the deflator coefficient in 2021 will be higher compared to the previous year. If the authorities in the constituent entities of the Russian Federation decide to introduce a regional coefficient, the payment amount will increase.