Accounting (financial) reporting

Homeowners' association, TSN (represented by the board) are obliged to keep accounting records and prepare financial statements. This is stated in paragraph 1 of Article 32 of the Law of January 12, 1996 No. 7-FZ and paragraph 7 of Article 148 of the Housing Code of the Russian Federation, letter of the Ministry of Construction of Russia dated April 10, 2015 No. 10407-ACh/04. This applies to both partnerships using the general taxation system and the simplified one (Law No. 402-FZ dated December 6, 2011, information from the Russian Ministry of Finance No. PZ-10/2012, letter from the Russian Ministry of Finance dated March 27, 2013 No. 03-11 -11/117). At the same time, when forming accounting (financial) reporting indicators, it is necessary to take into account the recommendations of the Ministry of Finance of Russia set out in Information No. PZ-1/2015.

The composition of the homeowners association (TSN) reporting depends on whether the partnership enjoys the right to conduct accounting in a simplified manner or not.

The partnership maintains accounting in a general manner

The annual accounting (financial) statements of the HOA (TSN), which maintains accounting in a general manner, consists of the Balance Sheet, the Report on the intended use of funds and appendices to them (clause 2 of Article 14 of the Law of December 6, 2011 No. 402-FZ) .

The appendices to the Balance Sheet are the Statement of Changes in Equity, the Statement of Cash Flows and Explanations, compiled in text and (or) tabular forms. This conclusion follows from paragraphs 2 and 4 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

Thus, the annual accounting (financial) statements of the HOA (TSN) include:

- Balance sheet;

- Explanations to the balance sheet;

- How to fill out a statement of changes in capital;

- Cash flow statement;

- Report on the intended use of funds.

The interim accounting (financial) statements of the HOA (TSN) consist of the Balance Sheet.

The partnership maintains accounting in a simplified manner

Homeowners' associations, TSN (as non-profit organizations) have the right to apply a simplified accounting procedure (clause 2, part 4, article 6 of the Law of December 6, 2011 No. 402-FZ). For those partnerships that exercise this right, the financial statements consist of the following:

- Balance sheet;

- Statement of financial results;

- Report on the intended use of funds.

Moreover, you need to use the simplified forms of these documents given in Appendix 5 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

For more information about preparing financial statements, see What documents to submit as part of financial statements.

Procedure for approving financial statements

In accordance with Art. 150 of the Housing Code of the Russian Federation at the end of the year, the execution of the estimate and report on financial activities is checked by the audit commission. After the audit, the audit commission submits to the general meeting of the partnership a conclusion on the estimate, reporting on financial activities and the amount of mandatory payments and contributions.

Approval of documents is necessary for reporting to members of the organization. The word “approval” in the Housing Code of the Russian Federation in relation to financial activities is used in the meaning of “familiarization”.

In the absence of legal obligations to submit a report for approval, it might not even be brought to the attention of the members of the partnership. The approval process is a formal procedure. The same cannot be said about the estimate, since it represents a plan for the next year. Each member of the partnership must know the amount of payments and the purposes for which they plan to spend them. The members of the partnership are required to agree with what the board proposes.

Approval of the estimate means that the organization's members agree with the board and are prepared for the costs included in the plan. Each item of expenditure is expected to be separately voted on upon approval.

Tax reporting

Homeowners' association (TSN) tax reports must be submitted. Regardless of the taxation system applied, the partnership is required to submit to the tax office information on the average number of employees (regardless of their presence), as well as submit certificates in Form 2-NDFL (for each employee who received income) and calculations in Form 6-NDFL.

For more information on this topic, see:

- What rights and responsibilities do taxpayers have;

- How to submit a certificate in form 2-NDFL;

- How to draw up and submit a calculation using Form 6-NDFL.

Otherwise, the composition of tax reporting depends on the taxation system that the partnership applies.

Tax reporting: OSNO

Homeowners' associations (TSN) are required to submit an income tax return, since this obligation does not depend on the availability of taxable income in the current reporting (tax) period. This conclusion follows from Article 246 and paragraph 1 of Article 289 of the Tax Code of the Russian Federation.

If you have income subject to income tax, prepare and submit a declaration according to the general rules.

If the HOA (TSN) does not have an obligation to pay income tax, submit the declaration once a year and in a simplified form. The simplified income tax return form consists of the following sheets:

- Title page (sheet 01);

- Calculation of corporate income tax (sheet 02);

- Report on the intended use of property (including funds), works, services received as part of charitable activities, targeted income, targeted financing (sheet 07);

- Appendix No. 1 to the tax return.

This follows from Article 285 and paragraph 2 of Article 289 of the Tax Code of the Russian Federation, paragraph 1.2 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Homeowners' association (TSN) in the general taxation system is recognized as a VAT payer (clause 1 of Article 143 of the Tax Code of the Russian Federation). Consequently, the partnership is obliged to submit a VAT return (clause 1 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558).

As for other tax returns, the obligation to submit them depends on whether the partnership has an object subject to the corresponding tax.

Is it necessary to hold an annual reporting meeting of the HOA?

Mandatory - in accordance with the Housing Code (2017 edition), namely Art. 45. The event is held in the second quarter of the year that immediately follows the reporting year (Federal Law No. 176-FZ of June 29, 2015).

In addition to mandatory reporting on the initiative of groups of owners or individual enthusiasts, unscheduled meetings can also be held - but on an extraordinary basis.

The validity of a meeting is determined by the presence of a quorum. This takes place if at least 50% of the total number of votes are present - the owners of the apartments or their legal representatives. If a quorum is not reached, then the general meeting will still have to be held, albeit out of turn.

The association must notify each of the apartment owners about the upcoming event at least ten days before the day of the meeting - in writing.

The Partnership is obliged to maintain and timely submit:

- Accounting and tax reports (this also applies to those organizations that have chosen a simplified system for themselves - Article 23 of the Tax Code of the Russian Federation, Federal Law No. 402-FZ);

- Special reporting.

Tax reporting: simplified tax system

Homeowners' associations (TSN) in a simplified manner are recognized as single tax payers (clause 1 of Article 346.12 of the Tax Code of the Russian Federation).

Consequently, the partnership is obliged to annually submit to the tax office a declaration on the tax paid in connection with the application of the simplified taxation system. Moreover, the obligation to submit a declaration does not depend on the presence in the current year of income and expenses recognized under simplification. This conclusion follows from the provisions of paragraph 1 of Article 346.19 and paragraph 1 of Article 346.23 of the Tax Code of the Russian Federation.

In addition, a simplified partnership needs to keep a book of income and expenses. This is stated in Article 346.24 of the Tax Code of the Russian Federation and paragraph 1.1 of the Procedure approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

For more information on this topic, see:

- How to draw up and submit a single tax return under simplification;

- How to keep a simplified book of income and expenses.

Homeowners' associations (TSN) on a simplified basis are not recognized as payers of income tax, property tax and VAT (clause 2 of Article 346.11 of the Tax Code of the Russian Federation). Consequently, the Homeowners Association (TSN) is not required to submit declarations for the listed taxes. An exception is provided for partnerships that have property for which the tax base is determined as the cadastral value (clause 2 of Article 346.11 of the Tax Code of the Russian Federation). On such property you will need to pay tax and submit a declaration in the general manner. As for other tax returns, the obligation to submit them depends on whether the partnership has an object subject to the corresponding tax.

Structure and content of reports

A report of any nature must contain basic information regarding the life of the house:

- Condition of public property - this includes a description of all elements of the building and equipment used to service more than one apartment. Naturally, only what is available is described, the indicators are formed in the form of a table.

- Data on income and expenses - data is provided regarding the work done and expenses made in connection with this, data on income is also entered here - government benefits, contributions, etc. An estimate for the indicators is generated in the form of a table.

- Information about the personnel and the effectiveness of their work - this item is not required, but if it is available, it is necessary to indicate all violations of management, protocols of administrative responsibility. This item can include an assessment of the work of the entire staff and the effectiveness of its maintenance.

In addition, any report must begin with the following data:

- General information about the partnership - details, composition of the board;

- Technical indicators of the house - address, area, number of floors, type of building, and other characteristics according to cadastral and technical documentation;

- Information about the availability of utility networks and their condition;

- List of activities carried out to maintain the house;

- Information about the plot of land under the building;

- Information about fees for major repairs.

Features and nuances

Reports must be based on truthful data.

All indicators in the documentation must coincide with the indicators provided to the company during the year, since it is by comparing facts that the members of the partnership will draw conclusions about the positive or negative work of management.

The report should be drawn up in as much detail as possible, describing the numerical data of their inflows and outflows.

Report for all damage incurred during the year, specifying in detail the reasons for the incident.

Form accounting indicators and estimates in a form accessible to the average person, while remembering that it is the chairman who will be asked for expenses and the quality of work performed by the staff, since he is the only person in control of everything and manages finances on the basis of a power of attorney.

Reporting on insurance premiums

Since the HOA (TSN) attracts hired employees to carry out its statutory activities, whose wages are included in the annual estimate of income and expenses of the HOA (TSN), the partnership in relation to its personnel acts as an insurer for compulsory pension (social, medical) insurance (Article 6 of the Law dated December 15, 2001 No. 167-FZ, Article 2.1 of the Law of November 29, 2006 No. 255-FZ, Article 11 of the Law of November 29, 2010 No. 326-FZ).

It should be noted that simplified partnerships can apply reduced rates of insurance premiums if real estate management is their main activity (subclause 8, part 1 and part 3.4, article 58 of the Law of July 24, 2009 No. 212-FZ, subclause 8 Part 4 and Part 12 Article 33 of the Law of December 15, 2001 No. 167-FZ). At the same time, mandatory payments by premises owners for the maintenance and repair of common property and for utilities are included in the income from the activities of the HOA (TSN) in managing real estate. Similar clarifications are contained in the letter of the Ministry of Health and Social Development of Russia dated March 22, 2012 No. 800-19 (sent for use in work by the letter of the Federal Social Insurance Fund of Russia dated April 3, 2012 No. 15-03-18/08-3638).

Homeowners' associations (TSN), like other insurers, are required to submit appropriate reports on insurance premiums (clause 2 of Article 14 of the Law of December 15, 2001 No. 167-FZ, Article 4.8 of the Law of November 29, 2006 No. 255-FZ , clause 11 of article 24 of the Law of November 29, 2010 No. 326-FZ).

Statistical reporting

Non-profit organizations are responsible for compiling statistical reporting. This is stated in paragraph 1 of Article 32 of the Law of January 12, 1996 No. 7-FZ. Consequently, homeowners' associations (TSN), along with other organizations, must report to the statistical authorities.

For more information on this topic, see:

- Who is required to submit statistical reports to Rosstat;

- What documents are included in statistical reporting;

- How can you submit statistical reports?

Information disclosure

Homeowners' associations (TSN) are obliged to disclose information about the main indicators of their financial and economic activities. This is stated in paragraph 10 of Article 161 of the Housing Code of the Russian Federation. This must be done in accordance with the Standard approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731.

Disclosure of information implies ensuring access to it by an unlimited number of persons (clause 2 of the Standard approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731). For the composition of the disclosed information, see the table.

The homeowners association (TSN) is obliged to disclose information by posting it:

- on the website www.reformagkh.ru;

- on one of the following websites: an authorized regional department or local government body;

- on information stands located in an apartment building.

The forms on which information must be posted are approved by the Ministry of Construction of Russia (clause 8 of the Standard, approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731). The current forms are given in the order of the Ministry of Construction of Russia dated December 22, 2014 No. 882/pr.

The procedure for disclosing information about their activities on the website www.reformagkh.ru is set out in the Regulations approved by order of the Ministry of Regional Development of Russia dated April 2, 2013 No. 124. At the same time, newly created TSN must disclose information no later than 30 calendar days from the date of state registration (p 9 of the Standard approved by Decree of the Government of the Russian Federation dated September 23, 2010 No. 731).

Information on the activities of organizations managing apartment buildings must be available for 5 years. If changes are made to the disclosed information, publish them in the same sources (on the Internet - within 7 working days, on stands - within 10 working days).

This is stated in paragraphs 5.1, 6, 15 and 16 of the Standard, approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731.

In addition, the HOA (TSN) is obliged to provide information in written (electronic) form upon requests from interested parties. The procedure for disclosing information through requests is set out in paragraphs 17–23 of the Standard, approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731.

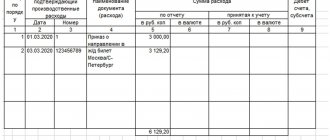

Basic accounting entries for HOAs

According to Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting the financial and economic activities of organizations and instructions for its application” (with amendments and additions), the HOA maintains accounting records using the accounts of the financial and economic activities of the organization .

It is necessary to remember: accounting for contributions from homeowners is kept on account 86, and accounting for cash receipts from income-generating activities is kept on account 90.