When is it required?

Making a decision on the need to request the signing of a reconciliation report with a counterparty is justified if:

- there is a need to confirm the debt of one of the parties (to the Social Insurance Fund or another organization);

- there is a long-term partnership between the two organizations;

- there is a wide range of products sold;

- transactions for large sums are made;

- an inventory of the state of mutual settlements is required;

- it is necessary to clarify the debt to regulatory authorities;

- The buyer requests a deferred payment.

In any of these cases, reconciliation can be made for any period . It is advisable to draw up and sign a document confirming the status of settlements monthly, quarterly and at the end of the year in order to:

- correct reflection of data on receivables and payables in accounting reports;

- preventing the formation of debts and the accrual of fines.

In matters of interaction with the Federal Tax Service, there are reconciliation rules that are established by Order of the Federal Tax Service dated September 09, 2005 N SAE-3-01/ [email protected] (as amended on February 3, 2017, clause 3 of the regulations):

- The document is required if the organization, due to a change in location, is forced to register with another Federal Tax Service.

- Subject to liquidation or reorganization of a legal entity.

- If an organization wishes to clarify the information available in its own records.

- For commercial organizations that have the status of large taxpayers with significant turnover of payments, a quarterly reconciliation report on taxes and fees is mandatory (by the 15th day of the month following the reporting quarter.

- At the request of the Federal Tax Service with a request for reconciliation (clause 3 of Article 78 of the Tax Code of the Russian Federation), the taxpayer is not obliged to participate (clause 5.1, clause 1 of Article 21 of the Tax Code of the Russian Federation).

- The taxpayer has the right to initiate a reconciliation with the tax authority (clause 5, 1, clause 1, article 21, clause 7, article 45 of the Tax Code of the Russian Federation) in order to identify overpayments or debts on mandatory payments. In response to the application, the tax authority will provide detailed information on the status of tax payments (clause 11, clause 1 of Article 32 of the Tax Code of the Russian Federation).

Important. The legislation provides for the possibility of returning taxpayer funds if there is an overpayment of taxes and fees. The basis for the return is an application with reference to the signed reconciliation report.

There are other requests: to the bank for information, to check sick leave, about prices, about the tax system, a request to the tax office for information or documents.

Reconciliation of insurance premiums in 2021

If the payer is reconciling payments accrued for the period from January 1, 2017, then to obtain a reconciliation report, the organization should contact the Federal Tax Service at the place of registration.

The procedure for reconciliation with the fiscal service corresponds to the mechanism for reconciling settlements with the Social Insurance Fund:

- Before reconciliation begins, the payer submits an application to the Federal Tax Service.

- Based on the application, the Federal Tax Service generates a reconciliation report in 2 copies and sends it to the payer (the form for a reconciliation report with the Federal Tax Service can be downloaded here ⇒ Reconciliation report with the Federal Tax Service (form) ).

- After receiving the act, the payer enters his data into it and transfers one copy to the fiscal service.

- If there are discrepancies, the parties continue reconciliation based on supporting documents.

- After eliminating the discrepancies, the parties sign an updated act, after which the reconciliation is considered completed and the calculations are approved.

Purpose of the statement

The purpose of forming a request is to agree on a reconciliation act for mutual settlements between the parties.

For reconciliation acts between counterparties, decryption is requested:

- In order to confirm business transactions, any of the interacting parties can request to sign a reconciliation report.

Since the ability to make transactions without meeting with the counterparty, to send payments without visiting the bank, forms a significant volume of documents received by mail or courier. When preparing accounting and tax reporting, the document allows the accountant to be sure that all documents are reflected in the accounting. - In order to comply with the accounting rules (PBU), adopted by Order No. 34 of the Ministry of Finance of the Russian Federation on July 29, 1998 (as amended on March 26, 2007 No. 26n), which oblige organizations to clarify the volume of property and liabilities before submitting annual reports.

Calculations are classified as mandatory for inventory. - To confirm the fact of the counterparty's debt.

Every creditor wants to be sure that the debtor remembers the debt and is ready to pay. According to the judges, the reconciliation act is not unambiguous evidence of the existence of a debt, but it can become an additional resource in a dispute with the debtor. In addition, the act extends the limitation period - if it exists, the limitation period begins to be calculated not from the date of the transaction, but from the date of signing the act (Resolution of the Presidium of the Supreme Arbitration Court, No. 13096/12 of 02/12/2013).

A request for the current status of settlements with the Federal Tax Service and extra-budgetary funds is made in order to:

- Return of excess funds transferred and stored in the accounts of the inspection or fund of the organization.

- Identification of arrears in taxes and contributions in order to pay off the debt and eliminate the possibility of accrual of fines and penalties.

- Identifying discrepancies in the accounting data of the organization and the fund or inspection in order to identify and correct errors of one of the parties.

FSS response to the request: contents of the certificate

The certificate in question reflects:

1. General information about the document, the payer of contributions:

- full name of the territorial structure of the Social Insurance Fund that issued the document;

- name of the certificate;

- date of preparation, document number;

- name of the company paying the contributions, its registration number, subordination code, INN, KPP, address.

2. Formulations reflecting the essence of the FSS response: that as of the date requested by the policyholder, there is one or another state of the insurer’s settlements.

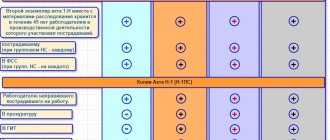

The corresponding indicators are reflected in the table, which indicates:

1. Names of payments. They can be presented:

- contributions to compulsory insurance, which pays sick leave and maternity leave;

- contributions to compulsory insurance, which pays compensation for incidents at work and occupational diseases;

- fines and penalties for violations of the requirements of the legislation of the Russian Federation on insurance.

2. Total amounts of payments listed above.

3. BCC for each of the payments indicated above.

4. Indicators reflecting the state of mutual settlements between the employer and the Social Insurance Fund for each payment. These mutual settlements are considered in the context of:

5. The total amount of debt or, conversely, overpayment of penalties, fines and contributions to the Social Insurance Fund as of the date of sending the request to the Social Insurance Fund.

The certificate is certified by the head of the territorial structure of the Social Insurance Fund or his deputy, as well as its seal. The full name and telephone number of the specialist who compiled the document are indicated.

In accordance with the legislation regulating legal relations with the participation of employers and the Social Insurance Fund, the former have the right to request from the Fund information about the status of settlements for payments, fines and penalties. To do this, an application is sent to the FSS, similar in structure to an application for obtaining a certificate of settlements with the Federal Tax Service. Having received the corresponding application, the Social Insurance Fund must send a certificate to the employer company within 5 days with the necessary information.

You can learn more about the features of interaction between employers and the Social Insurance Fund in the articles:

What is the content of the document?

The required application details are:

- Name and details of the organization sending the request (TIN, address, telephone numbers).

- Purpose of payments and period of their making, which are subject to reconciliation.

- It is a desirable option to receive a prepared report (the applicant can receive a paper version of the report in person or by mail).

- Date of the application.

- Full name and contact details of the official responsible for the request and reconciliation.

The procedure for submitting a request to the FSS is regulated by Federal Law No. 243 of July 3, 2016. The request form can be arbitrary, or it can be focused on the application form to the Federal Tax Service (Appendix No. 8 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n).

How to request information

The tax office for policyholders is the same counterparty as other third-party organizations. Consequently, you will have to reconcile mutual settlements with the Federal Tax Service as often as with business partners. However, sending a reconciliation report to the Federal Tax Service or the Social Insurance Fund (for contributions for injuries) is not enough. To obtain information from state and extra-budgetary bodies, you should act differently:

- Prepare your request in the prescribed form. The current application form for the provision of information about SV is available for download below.

- Submit your request to the Federal Tax Service. It is acceptable to submit the application in person, by mail, or by sending a request through the taxpayer’s personal account.

- Get an answer: a certificate about the status of insurance premium payments (the document form is presented below).

- Conduct an independent data check: compare the indicators of the certificate received and the accounting and reporting data for the reporting period.

- Identified errors in the organization's accounting should be corrected in the prescribed manner. If there are disagreements, you should contact the Federal Tax Service for advice and clarification.

Note that the organization of settlements for the Pension Fund of the Russian Federation is carried out in a similar manner. However, the form of the request to the Pension Fund of the Russian Federation differs from the form sent to the Federal Tax Service.

Writing algorithm

With a counterparty

A written request is drawn up in accordance with the rules of record keeping: in an official style, in a respectful manner, indicating regulations and details of the parties.

- The request letter is drawn up on the organization’s letterhead, containing the name and all details.

- An already prepared reconciliation report may be attached to the letter. In this case, the letter must indicate the attachments.

- The presence of data from the second party in the letter will allow you to uniquely identify the addressee.

- A polite address to the head of the organization (indicating the position) will increase the degree of trust and loyalty of the counterparty.

- The essence of the request should be stated clearly and in detail.

- The applicant’s request will sound more convincing if the letter contains a link to the contract, its specific clause indicating the obligation to sign the reconciliation report.

- Specifying a time frame for responding to a request may be of particular importance. This is important in 3 cases:

- when the presence of a reconciliation report is specified in the accounting policy;

- the contract specifies the periods for reconciliation;

- There are industry regulations for reconciliations.

- The appeal is signed by the manager (or the official replacing him with reference to the relevant order), since only the manager is vested with the right to conduct correspondence on behalf of the legal entity.

Example of a letter text for a business partner:

Due to the need to carry out an inventory of payments (Regulations on accounting and financial reporting in the Russian Federation), we are sending to you a reconciliation report No. 267 dated 04/02/2018. for the period from January 1, 2018 to January 31, 2018.

We kindly ask you:

- until April 10, 2021, confirm the debt of Rassvet JSC under agreement No. 15/18 dated January 12, 2017. in the amount of 15,477.60 rubles by letter addressed to the General Director of Perekrestok OJSC;

- sign the act of reconciliation of mutual settlements;

- before April 10 inclusive, return the document to the address: Kolomna, Pervomaiskaya St., 16, office 402.

In accordance with the Civil Code of the Russian Federation, in the absence of a response and declared disagreements, the settlement balance will be considered confirmed.

Appendix 1. Reconciliation report of mutual settlements No. 267 between Rassvet JSC and Perekrestok JSC for the period from January 1, 2018 to March 31, 2018.

In the FSS about the status of settlements

In accordance with Federal Law dated July 3, 2016 N 250-FZ, the powers to administer insurance contributions to the FFS and the Pension Fund of the Russian Federation have been transferred to the tax inspectorate .

There is no approved form for requesting a reconciliation with the Social Security Fund. When drawing up an application, it is allowed to use any similar document as a sample, including the application form on the status of settlements with the Federal Tax Service of the Russian Federation, which is contained in Appendix No. 8 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n.

The basic requirements for the composition of the application are not unique:

- The name of the organization that receives the request is the territorial representative office of the fund.

- Full details of the applicant: name, form of ownership, TIN, KPP, address, registration number in the Social Insurance Fund.

- The text of the request containing the clear purpose of the request: for what period, for what payments reconciliation is required.

- Request details: date of preparation, executor (full name, telephone, email), full name of the manager, signature, seal.

Example of a statement text for verification:

Statement

on conducting a joint reconciliation of calculations for paid contributions, penalties and fines

In accordance with Federal Law “250 dated July 3, 2016. I ask you to reconcile the insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity, for compulsory social insurance against industrial accidents and occupational diseases for the organization of Kalibr LLC as of April 1, 2018.

Registration number in the FSS 129/16.

Below you can see a sample request for a certificate of absence of debt from the Social Insurance Fund.

Find out about the specifics of drawing up a request to the Federal Tax Service regarding the absence of debt here.

Reasons for drawing up a Reconciliation Report with the Social Insurance Fund

Reconciliation is an important document, because no one is immune from errors. This document will allow you to avoid incorrect information. There are several reasons why fund reconciliation may be necessary. This:

- reorganization or liquidation of the enterprise;

- to identify debt to the fund or overpayment for the return of funds;

- to systematize information;

- Reconciliation is also carried out by organizations that are going to participate in competitions and tenders for licensing.

If a debt is identified, the payer is given the opportunity and a certain period to make payment.

If there is an overpayment, the payer is given a choice. He can apply for payment of this amount. Or you can simply leave the money in the account for further payments of contributions to the fund. It is also possible to request a certain part of the amount of money, then the exact amount must be indicated in the refund application.

If the company’s management does not want to have any problems and troubles with FSS employees, it is best to conduct a reconciliation every quarter. But at the request of the payer, this can be done more often or less often. In any case, the reconciliation must be successful, otherwise you can earn penalties, and considerable ones.

Shipping methods

In case of a personal visit to the office of the Federal Tax Service, the application is transferred to the tax office. On the second copy of the application, the secretary will put a mark indicating acceptance of the application (clause 3.4.1 of the Regulations).

Sending an application by mail is standard: a registered letter with an inventory and return receipt will allow the applicant to be confident that the request has been received; the date of delivery will help calculate the date of expected receipt of the response.

Healthy. The Federal Tax Service must respond to a taxpayer’s request for a reconciliation report within 10 days (clause 3 of Article 78 of the Tax Code of the Russian Federation).

A modern and reliable way to submit an application to the Federal Tax Service is electronic document management . The resources on the official website allow you to send a request electronically and receive the same (electronic) response.

In accordance with Order No. ММВ-7-8/781, the exchange of documents can be carried out using special software “Taxpayer Legal Entities”. The program can be downloaded from the Federal Tax Service website www.nalog.ru. The software's capabilities are broader than just exchanging letters.

In what form is the application submitted?

An application for offset of insurance premiums can be submitted in writing or in the form of an electronic document (Clause 6, Article 26.12 of the Federal Law of July 24, 1998 No. 125-FZ). In written form on paper, the application can be submitted to the territorial body of the Social Insurance Fund where the policyholder is registered, in person or sent by registered mail with a list of the attachments.

The application is drawn up in accordance with Form 22-FSS of the Russian Federation. This form was approved by the FSS Order No. 457 dated November 17, 2016 and is given in Appendix No. 2 to the Order.

The application shall indicate, in particular, information about the insured (name of the organization, registration number in the Social Insurance Fund, INN/KPP, address of location), the amounts that need to be offset (broken down into the actual contributions, penalties and fines), as well as what the insured is paying for asks to offset the overpayment (against the payment of fees, penalties or fines). The application is signed by the head of the organization and its chief accountant. If the organization has a seal, it must be placed on the application.

Expected response

In response to a written request, the organization can count on receiving a written response in the form of a reconciliation report, which can be received within 5 working days in person or by mail (clause 3.4 of Order No. SAE-3-01 / [email protected] dated 09.09.2005. ) Options for receiving the act are indicated in the text of the application when preparing it for transfer.

In response to an electronic request, the Federal Tax Service Inspectorate will respond with an electronic version of the reconciliation report , which is intended only to inform the taxpayer about the status of settlements (clause 2.22 of the Recommendations for organizing electronic document management, approved by Federal Tax Service Order No. ММВ-7-6 of June 13, 2013 / [email protected] , edition 4.04.2017).

Obviously, the electronic version does not involve comments about disagreement, and in the paper version the taxpayer has the right to mark the presence of discrepancies or confirm agreement with the specified amounts.

Read more about how to properly respond to a request for information here.

The current financial position of an organization is largely assessed by the state of its property (including accounts receivable) and financial liabilities (including accounts payable). A timely and competently completed reconciliation request will help avoid litigation.

Joint reconciliation of settlements with the Social Insurance Fund

Sometimes it becomes necessary to reconcile the information available to the payer and the fund. For this purpose, a special application is drawn up in any form. The Fund will issue a special act in response. FSS employees have the right to invite the payer to conduct a joint reconciliation of payments to the budget. The payer himself may also request it.

Most often, this is done to avoid any troubles with FSS employees, or to find out about the presence of debts or overpayments by the company.

As a rule, this reconciliation is carried out every quarter, after the reports are submitted. But the law does not provide for a time frame, so it can be arranged at any time.

These calculations help organizations eliminate possible problems with the Social Insurance Fund. And when liquidating a company, you can easily deal with existing debt and incorrect tax collection information. This reconciliation will help you get your funds back and avoid fines.