Hello, Vasily Zhdanov is here, in this article we will look at profitable investments in material assets. In addition to fixed assets, the objects of which are intended for long-term use within the enterprise for the purpose of carrying out economic activities and extracting profit from it, organizations also have the right to acquire property that they will not use themselves. Such objects can be transferred to third parties for rent, leasing or rental. And profitable investments in material assets are reflected in the balance sheet on line 1160.

Profitable investments in material assets on the balance sheet: definition, characteristics

As the name implies, profitable investments in material assets involve an enterprise making monetary investments in the acquisition of any property, which will subsequently bring it additional income instead of being exploited directly by the company. This can be the purchase of structures, plots of land, buildings, machines, vehicles, equipment and other valuables that necessarily have a tangible form and are acquired with the purpose of transferring them to third parties on rental, leasing, rental terms .

Take our proprietary course on choosing stocks on the stock market → training course

Everything is clear with the word “income” - the property must bring income to the owner. Let us dwell in more detail on the concept of material assets - these are understood as objects characterized by the presence of a material form (as opposed to, for example, rights to the result of intellectual activity), high cost and the ability to bring economic benefits to the owner over a long period of time. These may include:

- natural resources (land plots, reservoirs, etc.);

- buildings, various structures;

- vehicles, cars and trucks;

- production equipment;

- computer technology, control devices;

- high-value household equipment;

- breeding, draft cattle;

- perennial plants.

Despite the fact that profitable investments in tangible assets are reflected on the balance sheet separately from fixed assets that are acquired for the purpose of exploitation within the company, they are also fixed assets. And before accepting any assets for accounting as fixed assets, the accountant must make sure that all of the following conditions are met in aggregate:

- At the time of purchase of an object, the enterprise does not intend to resell it in the near future for the purpose of obtaining economic gain. They will receive income in another way - by receiving payment from third parties who have accepted this object for use under a leasing, rental or rental agreement.

- For the acquired property, the useful life is 1 year or more (or it is intended for operation for exactly one operating cycle, the duration of which exceeds 1 year).

- The company planned to transfer the asset for temporary use (possession) to other legal entities on a reimbursable basis.

Count 03: concept

The term “income-generating investments” (II) refers to investments aimed at acquiring property, the use of which will bring benefits to the company.

The company receives income from the transfer of this property for temporary possession/use (hire, lease) to third-party organizations for a fee. Such transactions are formalized with appropriate agreements; the transfer is accompanied by the preparation and endorsement of a transfer and acceptance certificate.

Most often, assets acting in this capacity are residential buildings, production facilities and cars.

Capitalization of profitable investments in material assets

Profitable investments in material assets must be capitalized (put into operation) at the original cost, which consists of the direct purchase price of the object, the amount of costs for delivery and preparation for use (installation, assembly, configuration, calibration , etc.) - these amounts collected on account 08 to form the final initial cost before transferring the property for use to third parties.

When the accountant finishes collecting information and the amounts spent by the company on transportation and procurement work, the material value is accounted for at the calculated book price in account 03.

Important! If an object is purchased under leasing terms, the lessee's costs can be included exclusively as part of the costs of purchasing the asset and transferring it to the lessee.

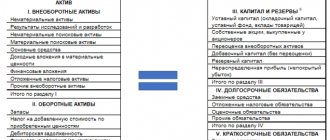

A controversial issue is the reflection in the balance sheet of unfinished capital investments in fixed assets, including property that is planned to be subsequently accepted for accounting on account 03. There are 2 opinions on this issue (when choosing one of the positions of the organization, a unified approach should be used to reflect all types investments in non-current assets):

- The amount of unfinished capital investments in assets that the enterprise intends to reflect in the future on account 03 should be included in the indicator of line 1160 (in this case, the value should be reflected on one of the lines in order to detail the indicator of line 1160).

- Information on incomplete capital investments is best reflected in section I “Non-current assets”. The accountant opens a separate line. If the value of the indicator is insignificant, it should be reflected in line 1190 “Other non-current assets”.

Account 03 in accounting

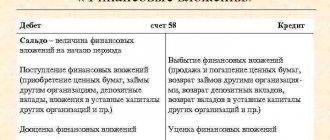

Account 03 is included in accounting. accounting for non-current assets. Therefore, the account is active.

The debit of account 03 reflects the receipt of investments that should generate income for the organization by providing it for temporary use with subsequent redemption or without redemption.

The credit of account 03 reflects disposals: write-off, sale, shortage, damage, gratuitous transfer, liquidation.

It is important to note : for organizations whose main activity is not leasing property on an ongoing basis, records of leased property are kept in account 01 “Fixed Assets”.

The organization of analytical accounting on account 03 is shown in the diagram:

Line 1160: profitable investments in material assets

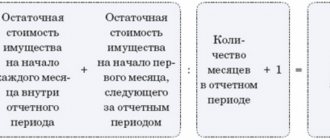

Line 1160 of the Balance Sheet reflects the residual value of profitable investments in tangible assets. Residual value means the initial book value of the object minus accumulated depreciation as of December 31, __ of the reporting year (accordingly, if the property is not subject to depreciation, the line indicator takes the value of its original cost).

The value of the final indicator in accounting for depreciable property can be found using the formula:

When applying this formula, it is important not to forget that if the enterprise also has fixed assets that are accounted for on account 01, the amount of accumulated depreciation related to such property must be subtracted from the balance of account 02.

In the case of objects whose cost is not repaid by depreciation (land plots, reservoirs, etc.), the formula takes on a simplified form:

The financial statements will need to reflect information as of the moment in time:

- current reporting period (for example, 2021);

- December 31 of the year preceding the reporting year (2017);

- December 31 of the year preceding the preceding year (2016).

Example of filling out line 1160 “Profitable investments in material assets”

The company reflects incomplete capital investments separately according to a independently entered line in section I “Non-current assets”. If the value of the indicator is insignificant, it is reflected in line 1190 “Other non-current assets”.

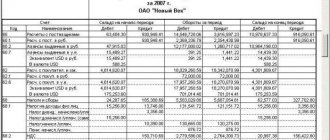

Let's pay attention to the company's accounting - the following indicators are shown for accounts 02 and 03:

Let's look at a fragment of the company's balance sheet for 2013:

Let's find out what the residual value of fixed assets that were taken into account by the company as part of profitable investments in tangible assets is:

We get the following reflection of the values in the balance sheet of the enterprise (the fragment of interest):

Free book

Go on vacation soon!

To receive a free book, enter your information in the form below and click the “Get Book” button.

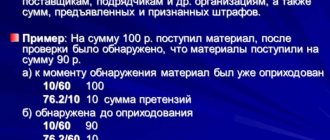

On the bottom line of the balance sheet indicate the property that is intended for rent, leasing or rental. The cost of such property is taken into account on account 03 “Income-producing investments in material assets”.

In accounting, such material assets are reflected at their original cost. The balance sheet indicates their residual value (original cost minus accrued depreciation).

Frequently used accounting entries for cash investments in material assets

Important! To account 03, accountants have the right to open an additional sub-account in order to transfer the value of disposed objects to it - this will allow for more detailed monitoring of monetary investments in material assets.

The table below shows the most common accounting entries regarding investments in tangible assets:

| Operations | DEBIT | CREDIT |

| The initial cost of the property has been formed, taking into account the costs of delivery, installation, preparation for operation | 03 | 08 |

| Income assets transferred to fixed assets | 01 | 03 |

| The objects are transferred to the balance of the lessee under the terms of the agreement | 76 | 03 |

| Depreciation accruals are written off on the disposal of property | 02 | 03 |

| The residual value of retired income-generating assets is written off | 91 | 03 |

An example of accounting for a retiring profitable asset

The company “Vygoda DV” LLC, in addition to other fixed assets, owned several real estate properties that were acquired with the purpose of renting them out under a lease agreement to other legal entities. It was decided to sell one of the apartment buildings, which was listed on the balance sheet as a profitable investment in material assets. The sale price of the house was 8 million 550 thousand rubles (incl. VAT 970 thousand rubles) . As of the date of sale, the balance sheet contained information about accumulated depreciation charges in the amount of 1 million 300 thousand rubles . The company at one time bought this property at a price of 7 million 125 thousand rubles . When disposing of an asset, the company's accountant will make the following accounting entries:

| Operation | Amount (rubles) | DEBIT | CREDIT |

| Accounts receivable reflected | 8 550 000 | 76 | 91.1 |

| VAT accrued for payment | 970 000 | 91.2 | 68 |

| The original (accounting) cost of the object has been written off | 7 125 000 | 03 (disposal) | 03 |

| Accumulated depreciation written off | 1 300 000 | 02 | 03 (disposal) |

| The residual value of the object has been written off | 5 825 000 | 91.2 | 03 (disposal) |

Repayment of accounts receivable by the acquirer in the amount of 8,550,000 rubles under Dt 51 Kt 76

Profitable investments in material assets (an example of accounting for leasing property)

The company Leasing Future LLC purchases equipment at a price of 350,000 rubles (including VAT at a rate of 20%) with the aim of transferring it to another company under a leasing agreement. The organization needed to pay for the services of a transport company to deliver equipment from St. Petersburg to Volgograd, which cost it 17,000 rubles. The accountant of Leasing Future LLC generates the following accounting entries:

| Operation | Amount (rubles) | DEBIT | CREDIT |

| Equipment purchase costs taken into account | 180 000 | 08 | 60 |

| Input VAT reflected | 70 000 | 19 | 60 |

| Funds were transferred to the equipment seller | 350 000 | 60 | 51 |

| Additional costs are included in the accounting cost of equipment | 17 000 | 08 | 60 |

| The initial cost of the equipment has been formed | 197 000 | 03 | 08 |

| Submitted for deduction of input VAT | 17 000 | 68 | 19 |

Answers to frequently asked questions about profitable investments in material assets on the balance sheet

Question: The company leases equipment that is listed on its balance sheet as a profitable investment in tangible assets. Further transfer of the object under a lease agreement will not be subject to value added tax. How to determine the initial cost of this equipment?

Answer: The accounting value of equipment in your case should be formed including the amount of tax that was paid at the time of its acquisition by the organization for the purpose of renting it out.

Question: How to determine the initial cost of income-generating investments in material assets accepted for accounting?

Answer: The procedure for determining the accounting value is given in the text of paragraphs 8-13 of PBU 6/01.

Features of profitable investments

The essence of profitable investments is obvious from their name. These are company contributions that are made specifically for profit. The funds will be received not indirectly, as from fixed assets, but directly. For example, a company purchased retail space specifically to rent it out in the future. The company receives a monthly profit.

It is assumed that the income from such investments will be guaranteed. For example, when purchasing real estate, managers can be sure that it will bring profit.