What's behind the balance sheets?

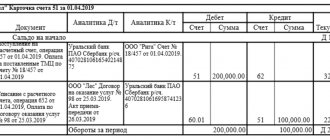

Below is a complete breakdown of the balance sheet lines for 2018/2019. Moreover, each line is specified according to the most characteristic accounts for it, which are reflected in it. Of course, the specifics of economic activity in practice may leave their mark on this correspondence.

Also, the order of formation of accounting reports, as well as the reflection of certain indicators, is influenced by the accounting policy for accounting purposes adopted by the company.

The following is a breakdown of the balance sheet lines for the accounts in two tables - by asset and liability of the balance sheet.

Balance sheet lines approved for 2016-2017 with their decoding codes

Each line is a value that characterizes the operation of the enterprise and its availability:

- Money;

- material reserves;

- current and non-current assets:

For each line of the report, an individual code is provided, which will allow you to further systematize the information contained in the company’s balance sheet and draw up a general forecast. The codes for each line were approved within the framework of Appendix No. 4 of Order No. 66n of the Ministry of Finance of the Russian Federation dated July 2, 2010, which amended the list of codes and now modern codes have four characters, while outdated ones consisted of only three digits.

Let's look at what codes are provided for Assets and Liabilities in financial statements:

| Assets | Passive |

| 1100, 1150, 1160, 1170, 1180, 1190, 1200, 1210, 1220, 1230, 1240, 1250, 1260, 1600 | 1300, 1360, 1370, 1410, 1420, 1500, 1510, 1520, 1530, 1540, 1550, 1700 |

| The basic order of the lines in this section is the principle of increasing liquidity. At the top is the property, which remains in its original form until the very end. | The information in these lines allows you to study the dynamics of changes in the balance sheet structure. Here you can see when the funds were received by the organization and when the company must return them. |

Explanation of lines for balance sheet assets

| Indicator name | Code | Which account data is used? | Algorithm for calculating the indicator |

| Intangible assets | 1110 | 04 “Intangible assets”, 05 “Amortization of intangible assets” | Dt 04 (excluding R&D expenses) – Kt 05 |

| Research and development results | 1120 | 04 | Dt 04 (in terms of R&D expenses) |

| Intangible search assets | 1130 | 08 “Investments in non-current assets”, 05 | Dt 08 – Kt 05 (all regarding intangible exploration assets) |

| Material prospecting assets | 1140 | 08, 02 “Depreciation of fixed assets” | Dt 08 – Kt 02 (all regarding material exploration assets) |

| Fixed assets | 1150 | 01 “Fixed assets”, 02 | Dt 01 – Kt 02 (except for depreciation of fixed assets accounted for in account 03 “Income-generating investments in tangible assets” |

| Profitable investments in material assets | 1160 | 03, 02 | Dt 03 – Kt 02 (except for depreciation of fixed assets accounted for on account 01) |

| Financial investments | 1170 | 58 “Financial investments”, 55-3 “Deposit accounts”, 59 “Provisions for impairment of financial investments”, 73-1 “Settlements on loans provided” | Dt 58 – Kt 59 (regarding long-term financial investments) + Dt 73-1 (regarding long-term interest-bearing loans) |

| Deferred tax assets | 1180 | 09 “Deferred tax assets” | Dt 09 |

| Other noncurrent assets | 1190 | 07 “Equipment for installation”, 08, 97 “Deferred expenses” | Dt 07 + Dt 08 (except for exploration assets) + Dt 97 (in terms of expenses with a write-off period of more than 12 months after the reporting date) |

| Reserves | 1210 | 10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the cost of material assets”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”, 20 “Main production”, 21 “Semi-finished products own production”, 23 “Auxiliary production”, 28 “Defects in production”, 29 “Service production and facilities”, 41 “Goods”, 42 “Trade margin”, 43 “Finished products”, 44 “Sales expenses”, 45 “Goods shipped”, 97 | Dt 10 + Dt 11 – Kt 14 + Dt 15 + Dt 16 + Dt 20 + Dt 21 + Dt 23 + Dt 28 + Dt 29 + Dt 41 – Kt 42 + Dt 43 + Dt 44 + Dt 45 + Dt 97 (in part expenses with a write-off period of no more than 12 months after the reporting date) |

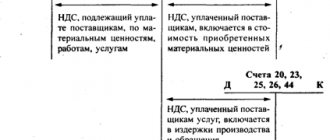

| Value added tax on purchased assets | 1220 | 19 “Value added tax on acquired assets” | Dt 19 |

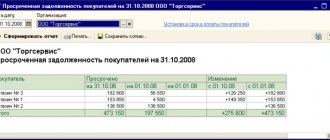

| Accounts receivable | 1230 | 46 “Completed stages of work in progress”, 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 63 “Provisions for doubtful debts”, 68 “Settlements for taxes and duties”, 69 “Settlements for social insurance and security", 70 "Settlements with personnel for wages", 71 "Settlements with accountable persons", 73 "Settlements with personnel for other operations", 75 "Settlements with founders", 76 "Settlements with various debtors and creditors" | Dt 46 + Dt 60 + Dt 62 – Kt 63 + Dt 68 + Dt 69 + Dt 70 + Dt 71 + Dt 73 (except for interest-bearing loans accounted for in subaccount 73-1) + Dt 75 + Dt 76 (less reflected in accounts for VAT calculations on advances issued and received) |

| Financial investments (excluding cash equivalents) | 1240 | 58, 55-3, 59, 73-1 | Dt 58 – Kt 59 (in terms of short-term financial investments) + Dt 55-3 + Dt 73-1 (in terms of short-term interest-bearing loans) |

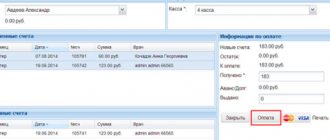

| Cash and cash equivalents | 1250 | 50 “Cash”, 51 “Current accounts”, 52 “Currency accounts”, 55 “Special bank accounts”, 57 “Transfers in transit”, | Dt 50 (except for subaccount 50-3) + Dt 51 + Dt 52 + Dt 55 (except for the balance of subaccount 55-3) + Dt 57 |

| Other current assets | 1260 | 50-3 “Money documents”, 94 “Shortages and losses from damage to valuables” | Dt 50-3 + Dt 94 |

Balance sheet asset: current assets

| Name of the accounting object | Code in new balance | Formula for calculating the value of an accounting object | Notes |

| Reserves | 1210 | Amount Dt 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 amount Kt 14, 42 | When calculating the indicator corresponding to the interpretation of line 1210 of the balance sheet, account 97 considers expenses that are written off no later than 12 months of the next year |

| VAT | 1220 | Dt 19 | The indicator corresponding to the decoding of line 1220 of the balance sheet is VAT not accepted for deduction |

| Accounts receivable | 1230 | Amount Dt 46, 60, 62, 68, 69, 70, 71, 73, 75, 76 amount Kt 63 subaccount “Provisions for doubtful debts” | When calculating the indicator corresponding to the interpretation of line 1230 of the balance sheet, loans at interest on account 73 and VAT on advances on account 76 are not considered |

| Financial investments | 1240 | Amount Dt 58, Kt 59, | According to Dt 58 Kt 59, only short-term investments and provisions for their depreciation are considered |

| Cash and equivalents | 1250 | Amount Dt 50, 51, 52, 55, 57 | When calculating the indicator corresponding to the interpretation of line 1250 of the balance sheet, financial investments in the account are not considered. 55.3 and monetary documents according to the account. 50.3 |

| Other assets | 1260 | Amount Dt 50.3, 94 |

The indicators on lines 1210–1260 are summed up, and the result is reflected in line 1200 of the balance sheet.

The next part of the report is the one that reflects the capital and reserves of the organization, which are already classified as liabilities. Let's look at the corresponding transcripts of the balance sheet lines.

Decoding lines for balance sheet liabilities

| Index | Code | Which account data does it use? | Algorithm for calculating the indicator |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 80 “Authorized capital” | Kt 80 |

| Own shares purchased from shareholders | 1320 | 81 “Own shares (shares)” | Dt 81 (in parentheses) |

| Revaluation of non-current assets | 1340 | 83 “Additional capital” | Kt 83 (regarding the amounts of additional valuation of non-current assets) |

| Additional capital (without revaluation) | 1350 | 83 | Kt 83 (except for amounts of additional valuation of non-current assets) |

| Reserve capital | 1360 | 82 “Reserve capital” | Kt 82 |

| Retained earnings (uncovered loss) | 1370 | 99 “Profits and losses”, 84 “Retained earnings (uncovered loss)” | Or Kt 99 + Kt 84 Or Dt 99 + Dt 84 (the result is reflected in parentheses) Or Kt 84 - Dt 99 (if the value is negative, it is reflected in parentheses) Or Kt 99 - Dt 84 (same) |

| Borrowed funds | 1410 | 67 “Calculations for long-term loans and borrowings” | Kt 67 (regarding debts with a maturity date of more than 12 months at the reporting date) |

| Deferred tax liabilities | 1420 | 77 “Deferred tax liabilities” | Kt 77 |

| Estimated liabilities | 1430 | 96 “Reserves for future expenses” | Kt 96 (regarding estimated liabilities with a maturity period of more than 12 months after the reporting date) |

| Other obligations | 1450 | 60, 62, 68, 69, 76, 86 “Targeted financing” | Kt 60 + Kt 62 + Kt 68 + Kt 69 + Kt 76 + K86 (all in terms of long-term debt) |

| Borrowed funds | 1510 | 66 “Calculations for short-term loans and borrowings”, 67 | Kt 66 + Kt 67 (in terms of debt with a repayment period of no more than 12 months as of the reporting date) |

| Accounts payable | 1520 | 60, 62, 68, 69, 70, 71, 73, 75, 76 | Kt 60 + Kt 62 + Kt 68 + Kt 69 + Kt 70 + Kt 71 + Kt 73 + Kt 75 + Kt 76 (in terms of short-term debt, minus VAT calculations reflected in the accounts on advances issued and received) |

| revenue of the future periods | 1530 | 98 “Deferred income” | Kt 98 |

| Estimated liabilities | 1540 | 96 | Kt 96 (regarding estimated liabilities with a maturity period of no more than 12 months after the reporting date) |

| Other obligations | 1550 | 86 | Kt 86 (regarding short-term liabilities) |

Read also

31.07.2018

Changes in the balance sheet

Since 06/01/2019, an updated version of accounting reporting has been in effect, approved by order of the Ministry of Finance dated 04/19/2019 No. 61n.

The following adjustments have been made to the balance sheet:

- “Header” of the document - a line has been added in which it is necessary to indicate information about whether the company is subject to mandatory audit, and information about the audit company (IP) that conducted the audit.

- The unit of measurement million rubles has been excluded. — all indicators in the updated form are entered in thousands of rubles.

- OKVED has been replaced by OKVED 2.

- OKEI code 385 has been abolished.

Read about how other forms of accounting reporting have changed here.

You can download the updated balance sheet at the beginning of our article.

ATTENTION! Accounting statements no longer need to be submitted to statistics. For details, see the material “Changes in reporting”.

Let's take a closer look at what the new balance sheet looks like with line codes for all its sections.

The first is about non-current assets.

Balance sheet liability: capital and reserves

| Name of the accounting object | Code in new balance | Formula for calculating the value of an accounting object | Notes |

| Authorized capital | 1310 | Kt 80 | When calculating the indicator corresponding to the interpretation of line 1310 of the balance sheet, the debt of the founders for contributions to the authorized capital is not considered |

| Share price | 1320 | Kt 81 | |

| Revaluation of fixed assets and intangible assets | 1340 | Kt 83 | Only indicators reflecting the increase in the value of non-current assets are considered |

| Revaluation and capital injections | 1350 | Indicators reflecting the increase in the value of non-current assets are not considered | |

| Reserve capital | 1360 | Kt 82 | |

| Profit Loss | 1370 | Kt or Dt 84 | What matters is what the profits and losses are on the balance sheet. The profit in the balance sheet corresponds to the balance on the credit of account 84. The loss in the balance sheet is shown in parentheses based on the data on the debit of account 84. |

The indicators on lines 1310–1370 are summed up and form an indicator corresponding to the decoding of line 1300 of the balance sheet (that is, the total amount for the capital and reserves of the company).

Next, the balance sheet reflects data on the organization’s long-term and short-term liabilities.

Let's get acquainted with the balance sheet items for 2021: their codes and explanations

Everyone who has ever held a balance sheet in their hands, much less drawn it up, paid attention to the “Code” column.

Thanks to this column, statistical authorities are able to systematize the information contained in the balance sheets of all companies. Therefore, it is necessary to indicate codes in the balance sheet only when this report is submitted to state statistics bodies and other executive authorities (Article 18 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, clause 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). Let us remind you that only organizations whose reports contain information classified as state secrets, as well as in cases established by the Government of the Russian Federation, need to submit their balance sheet for 2021 to the statistics. Other companies do not need to submit a balance sheet.

If the balance is not annual and is needed only by owners or other users, it is not necessary to indicate the codes.

ATTENTION! From 2021, financial statements will be submitted exclusively in electronic form. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here.

From 06/01/2019, the balance sheet form is valid as amended by Order of the Ministry of Finance dated 04/19/2019 No. 61n.

The key changes in it (as well as in other financial statements) are as follows:

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art. 93 Tax Code of the Russian Federation.

What negative consequences are possible if the auditor’s report is not yet ready at the time of reporting, find out from a typical situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

In the balance sheet, line codes from 2014 must correspond to the codes specified in Appendix 4 to Order No. 66n. At the same time, outdated codes from the expired order No. 67n with the same name, dated July 22, 2003, are no longer applied.

It is not difficult to distinguish previously used codes from modern ones - by the number of digits: modern codes are 4-digit (for example, lines 1230, 1170 of the balance sheet), while outdated ones contained only 3 digits (for example, 700, 140).

For information on what the form of the current balance sheet with line codes looks like, read the article “Filling out Form 1 of the balance sheet (sample)” .