Based on the legal position of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 11074/05 of February 28, 2006, an overpaid amount of tax can be recognized as the crediting of funds to the accounts of the corresponding budget in an amount exceeding the amounts payable for certain tax periods.

The presence of an overpayment is identified by comparing the tax amounts payable for a certain period with payment documents relating to the same period, taking into account information about settlements with budgets.

Both the company itself and the tax authority can establish the fact of overpayment. If the latter reveals the fact of an overpayment, then he is obliged to inform the company about this within 10 working days from the date of establishing this fact (clause 3 of article 78, clause 6 of article 6.1 of the Tax Code of the Russian Federation).

The most common way to detect overpayments is to jointly reconcile settlements with the budget. Both the company and the inspection can initiate this procedure. The procedure for conducting reconciliation is established in Section 3 of the Regulations, approved by Order of the Federal Tax Service of Russia dated September 9, 2005 No. SAE-3-01/ [email protected]

In the case when the reconciliation is carried out at the initiative of the organization, the inspection is obliged to carry it out. To do this, you must submit an application in any form. But if the initiative comes from the tax authority, then participating in the reconciliation is the taxpayer’s right, not an obligation.

If there are no discrepancies between the data of the company and the inspection, then a report is signed; it must be completed within 10 working days. If discrepancies are identified, the period for resolving the issue should not exceed 15 working days.

What to do with overpayment?

According to subparagraph 5 of paragraph 1 of Article 21 of the Tax Code of the Russian Federation, a company has the right to a timely offset or refund of overpaid taxes, penalties and fines. The offset or return of the overpayment is regulated by Article 78 of the Tax Code of the Russian Federation.

To offset tax overpayments against upcoming payments for this or other taxes, you must submit an application to the tax authority. Please note: the offset of the amount of overpaid tax to pay off arrears on other taxes, arrears on penalties and (or) fines is carried out by the tax authorities independently.

The amount of overpaid tax is also subject to refund upon application by the company. In this case, the refund of the amount of overpayment if the company has arrears on other taxes of the corresponding type, as well as penalties, fines, is made only after the amount of overpaid tax is offset against the arrears.

Overpayment refund procedure

As in any other case of interaction between the taxpayer and the Federal Tax Service (FTS), the rules for the return of overpayments are strictly regulated:

- Confirmation of the fact of overpayment. Before starting the process of refunding overpaid tax, you should first think about how to document it. It all depends on what actions resulted in the overpayment.

- If this happened due to a banal accounting error, which was subsequently discovered, then you need to submit an updated tax return;

- You can draw up a reconciliation report with the tax service. It can be initiated by both representatives of the tax service and the accounting department of the second interested party. If the reconciliation report was drawn up in the manner prescribed by law and signed by a tax specialist, then the clarification may no longer be submitted;

- Another way to establish excessively overpaid taxes is to go through litigation. This is a long, troublesome and difficult matter, but if the amount of tax overpayment is significant, and the tax authorities refuse to recognize it, then the game is worth the candle. If the fact of overpayment is established by the court, then the tax authorities will not be able to avoid returning the overpaid amount.

- Overpayment of taxes may also be discovered as a result of an on-site desk audit. This is not the most pleasant procedure for all organizations and individual entrepreneurs, however, the presence of an overpayment is better than the discovery of tax arrears. In this case, tax specialists will be required to send the taxpayer a written notice of the overpayment and its amount.

- Once the overpayment is proven, something must be done about it. According to the law, there are also several directions here:

- The first and most obvious option is to simply return taxes to the taxpayer's bank accounts;

The second thing you can do is to redirect this amount to pay arrears, penalties, fines, etc. fees. Moreover, as for the arrears, it can only cover the type of tax for which it was formed. That is, if the overpayment was to the federal budget, then it can only cover federal taxes. It is impossible to redirect overpayments from the general state treasury to the regional pocket. The situation is exactly the same with local taxes - it is impossible to transfer overpayments on them to the federal budget.

- The third way is to set aside the excess for upcoming tax payments. The scheme here is the same as in the previous version.

- The next stage of tax refund: writing an application to the tax service. Here you must indicate the exact amount of overpaid funds, provide confirmation, and also state your intentions for their further disposal. The application can be submitted either:

- In person at the tax office at the place of registration of the enterprise or individual entrepreneur;

- By sending a letter with notification of delivery via Russian Post. In this case, it is necessary to make an inventory of the investment;

- Through the taxpayer's representative upon provision of a notarized power of attorney.

Attention! The law in no way obliges the taxpayer to dispose of the entire amount of the overpayment in any one specific way. It is quite possible to distribute it in parts for different purposes.

For your information! The application must be written in two copies, one of which remains in the hands of the taxpayer. When accepting an application for overpayment, the tax specialist must stamp both.

After receiving the application, tax authorities are obliged to consider it no longer than ten days. As a result, a decision must be made either to offset the tax against other payments, or to return it.

Important! The overpayment must be returned to the taxpayer's bank account no later than one month from the date of submission of the relevant application to the tax authority.

Does it make sense to return the overpayment?

Paragraph 7 of Article 78 of the Tax Code establishes that an application for a credit or refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount, unless otherwise provided by law. According to the Federal Tax Service, an application for a refund of the amount of overpaid income tax can be submitted within three years from the date of submission of the declaration.

That is, the company will not be able to return or offset the “old” overpayment, from the moment of which more than three years have passed. Therefore, it is necessary to take care of her “fate” in a timely manner.

According to the letter of the Federal Tax Service dated November 1, 2013 No. ND-4-8 / [email protected] , the Tax Code of the Russian Federation does not determine the grounds and procedure for the inspection to write off overpaid amounts of taxes, fees, penalties and fines, from the date of payment of which more than three years have passed. But on the other hand, the Tax Code of the Russian Federation does not prevent the write-off of overpayments with an expired statute of limitations on the basis of a decision of the head (deputy head) of the tax authority. In addition, auditors have the right to write off the amount of overpaid tax on the basis of a court decision that has entered into force on the company’s refusal to restore the statute of limitations for refunding the tax amount.

As for writing off overpayments, the Tax Code of the Russian Federation does not prevent the tax authority from writing off amounts for which the period specified in paragraph 7 of Article 78 of the Tax Code of the Russian Federation has expired when the company applies to the inspectorate with a request to write off these funds, including amounts of canceled taxes. At the same time, writing off these amounts without the will of businessmen is unlawful (Official website of the Federal Tax Service of Russia, section “Frequently Asked Questions”, 2014). There are court decisions that state that if the court has confirmed the impossibility of returning the overpayment, then the tax authority has the right to write it off (Resolution of the Court of Justice of the West Siberian District of May 20, 2021 in case No. A27-14361/2015).

How long does it take for an overpayment to be counted and returned?

The decision to offset the overpayment against future payments is made by the inspectorate within 10 working days from the date of receipt of the application or from the date of signing the joint reconciliation report (if one was carried out). As stated above, the offset of the amount of overpayment towards repayment of arrears on other taxes, arrears on penalties and (or) fines is carried out by the auditors independently. Such a decision is made within 10 working days from the date the inspectors discover the fact of excessive tax payment, or from the date the joint reconciliation act is signed, or from the date the court decision comes into force.

The norms of the Tax Code of the Russian Federation do not prevent the company from submitting an application to the inspectorate to offset the overpayment against the arrears repayment account. In this case, the decision of the auditors is also made within 10 working days from the date of receipt of the application or from the date of signing the reconciliation report. The decision to return the overpayment is made by the controllers within 10 working days from the date of receipt of an application from the company for the return of the overpayment or from the date of signing the reconciliation report. In this case, the overpayment amount must be refunded within one month from the date of receipt of the application.

According to the clarifications of the Ministry of Finance, given in letter No. 03-04-05/9949 dated February 21, 2021, the amount of overpaid tax is subject to refund upon a written application from the company within one month from the date the inspection received the application, in the case of filing an updated declaration - within four months.

This position is confirmed by paragraph 11 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98, according to which the period for refund (offset) of the amount of overpaid tax begins to be calculated from the date of filing the application, but not earlier than from the completion of the desk audit for the relevant period or from the moment when such verification must be completed according to the rules of Article 88 of the Tax Code of the Russian Federation.

What to do if the inspectors refuse?

According to the Decision of the Constitutional Court of June 21, 2001 No. 173-O, the provisions of Article 78 of the Tax Code do not prevent a company, if the established deadline is missed, from filing a claim in court for the return of the overpaid amount from the budget in civil or arbitration proceedings. And in this case, the general rules for calculating the limitation period apply - from the day when the person learned or should have learned about the violation of his right (Clause 1 of Article 200 of the Civil Code of the Russian Federation).

Therefore, if the deadline established by paragraph 7 of Article 78 of the Tax Code is missed, the company can go to court to protect its rights within the general limitation period established by Article 196 of the Civil Code of the Russian Federation (letter of the Ministry of Finance of Russia dated November 17, 2021 No. 03-02- 08/75912).

The company has the right to file a claim with the court within three years, counting from the day when it discovered a violation of its right to timely offset or return of the overpayment (clause 79 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

note

Clause 10 of Article 78 of the Tax Code of the Russian Federation establishes that if the refund of the amount of overpaid tax is carried out in violation of the legal deadlines, the auditors are charged interest on the amount of the overpayment that has not been returned in favor of the company for each calendar day of violation of the refund deadline.

The lower courts also agree with the above (Resolutions of the Administrative Court of the North Caucasus District dated June 14, 2021 No. F08-3157/2017, Administrative Court of the Central District dated July 5, 2021 No. F10-1951/2016, Administrative Court of the Volga-Vyatka District dated April 5, 2021 No. F01-638/2016, AS of the Moscow District dated January 18, 2021 No. F05-18975/2015).

The issue of determining the time when the company learned or should have learned about the excessive payment of tax should be resolved taking into account an assessment of all circumstances relevant to the case in the aggregate:

- establish the reason why the taxpayer overpaid;

- determine whether the company had the opportunity to correctly calculate the tax according to the original tax return;

- check changes in legislation during the tax period under review;

- identify other circumstances that may be recognized by the court as sufficient to recognize that the deadline for a tax refund has not been missed.

In this case, the burden of proving the circumstances rests with the company (Resolution of the Arbitration Court of the Volga-Vyatka District dated February 8, 2017 No. F01-6252/2021 in case No. A11-13538/2015).

Application for refund of overpaid taxes

Before applying for a refund of overpaid taxes, you need to check your calculations with the Federal Tax Service data. To do this, you need to obtain a certificate about the status of settlements with the budget or sign a reconciliation report. Once you are sure that the amounts match, you can safely notify the inspectorate of your desire to return the money.

An application for a refund of overpaid taxes can be completed both on paper and in electronic format. And send it to the Federal Tax Service - by mail, directly into the hands of the inspector, as well as through a telecom operator or personal account on the Federal Tax Service website.

The “paper” form of the application for a refund was approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-8/ [email protected] dated 02/14/2017, and the electronic form was approved by Order No. ММВ-7-8/ [email protected] dated 03/18/2019.

The application contains the following data:

- full name of the applicant;

- full name and BCC of the payment;

- amount to be refunded.

You need to submit an application for a refund of overpaid taxes to the Federal Tax Service, where the businessman is registered. This right can be exercised within 3 years from the date of overpayment.

If this deadline is missed, the taxpayer does not lose the right to a refund of his funds. He can go to court “on a general basis” within three years from the moment he learned about the overpayment.

But in this case, it will be necessary to justify your position, that is, for example, to prove that the taxpayer was not previously aware of the error made in the calculation. As practice shows, courts, including higher authorities, often side with the businessman in such situations (clause 79 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

To the application for a refund of overpaid taxes, you must attach available documents that confirm the fact of the overpayment.

If the tax office violated the refund deadlines

Clause 10 of Article 78 of the Tax Code of the Russian Federation establishes that if the refund of the amount of overpaid tax is carried out in violation of the legal deadlines, the auditors are charged interest on the amount of the overpayment that has not been returned in favor of the company for each calendar day of violation of the refund deadline.

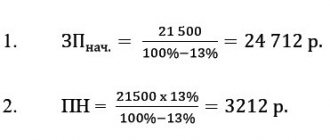

The amount of interest for late returns is determined based on the actual number of calendar days of delay, taking into account the day of the actual tax refund and the interest rate, which is defined as the refinancing rate of the Central Bank in effect on the days of violation of the refund period, divided by the number of days in a year (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 21, 2014 No. 11372/13, Methodological recommendations for maintaining an information resource of results on offsets and returns, approved by order of the Federal Tax Service of Russia dated December 25, 2008 No. MM-3-1/ [email protected] , letter of the Ministry of Finance of Russia dated 18 July 2021 No. 03-05-04-03/45570).

Which taxes can be offset and which cannot?

In Russia, the following types of taxes and fees are established: federal, regional and local (Clause 1, Article 12 of the Tax Code of the Russian Federation). In accordance with paragraphs 1 and 2 of Article 78 of the Tax Code, the offset of amounts of overpaid federal taxes and fees, regional and local taxes is carried out according to the corresponding types of taxes and fees, as well as penalties.

In other words, it is possible to offset the overpayment of corporate property tax against the payment of transport tax, but not against the payment of income tax, since the first two taxes are regional, and the last one is federal, although it is paid to the federal and regional budgets. But you can offset the overpayment of VAT against income tax.

According to the explanations of the tax service, given in letter No. GD-4-8/ [email protected] , the rules established by Article 78 of the Tax Code apply to tax agents, payers of fees and participants in a consolidated group of taxpayers (clause 14 of Art. 78 Tax Code of the Russian Federation). Therefore, the overpayment of the corresponding type of tax can be offset against the tax agent’s personal income tax debt.

note

Confirmation of the fact of erroneous transfer of amounts according to personal income tax payment details, as well as confirmation of the fact of excessive withholding and transfer of personal income tax, is made on the basis of an extract from the tax accounting register for the corresponding period and reconciliation of payment documents.

But on the issue of offsetting the overpaid amount of personal income tax against future payments for the same tax, the Federal Tax Service said the following: paragraph 9 of Article 226 of the Tax Code establishes that payment of personal income tax at the expense of tax agents is not allowed, therefore, transferring to the budget an amount exceeding the amount of tax actually withheld from employee income does not constitute payment of personal income tax.

In this case, the tax agent has the right to contact the inspectorate with an application for the return to the current account of an amount that is not personal income tax and was mistakenly transferred to the budget.

The auditors, if the specified agent does not have debts for other federal taxes that are not personal income tax, make a refund in the manner established by Article 78 of the Tax Code.

Confirmation of the fact of erroneous transfer of amounts according to personal income tax payment details, as well as confirmation of the fact of excessive withholding and transfer of personal income tax, is made on the basis of an extract from the tax accounting register for the corresponding period and reconciliation of payment documents.

In addition, it is possible to offset such erroneously transferred amounts using the personal income tax payment details against the repayment of debts on taxes of the corresponding type, as well as against future payments on other taxes of the corresponding type.

Return via credit.

Article 79 of the Tax Code of the Russian Federation establishes the right of a taxpayer to return the collected amount of tax, except for cases when he has a tax debt.

Note:

The refund to the taxpayer of the amount of overcharged tax if he has arrears on other taxes of the corresponding type is made only after offsetting the indicated amount to pay off the specified arrears in accordance with Art. 78 Tax Code of the Russian Federation.

In this case, the tax authority independently sends the amount of excessively collected tax to pay off this debt (paragraph 2, paragraph 1, article 79 of the Tax Code of the Russian Federation). As the Federal Tax Service indicates in Letter No. SA-4-7/23263 dated December 24, 2013 with reference to the Decree of the Constitutional Court of the Russian Federation dated September 24, 2013 No. 1277-O, such legal regulation makes it possible to quickly and effectively satisfy the property claim of the state and contributes to the fulfillment of the taxpayer’s constitutional obligation to payment of legally established, but not paid tax on time

A similar position is followed by the judicial authorities (see, for example, Resolution of the Arbitration Court of the Moscow Region dated October 26, 2016 No. F05-2889/2016 in case No. A40-57347/2015).