The possibility of obtaining tax benefits is regulated by the provisions of the Tax Code of the Russian Federation. Pensioners could always count on tax breaks due to their low income. However, since the pension reform, the right to exemption from taxation and a reduction in the tax rate began to be associated not with the very fact of receiving a pension benefit, but with reaching the age that, before changes in legislation, was considered the retirement age (55 years for women, 60 years - for men). We suggest you figure out how a pensioner can get a tax break on real estate and land in 2021, as well as apply for other tax preferences.

Federal and regional tax benefits for pensioners: what is the difference

Before moving on to the list of tax benefits available to pensioners, you should understand which preferences are available to all residents of Russia, and which can only be obtained by residents of a separate constituent entity of the Russian Federation. In the first case we are talking about federal (all-Russian) benefits, and in the second – about regional privileges:

| Type of benefits | Federal benefits | Regional benefits |

| Who approves | Government of the Russian Federation | Local authorities |

| Who can apply | All pensioners in the country, regardless of region of residence | Residents of a specific subject of the Russian Federation |

Types of tax benefits.

Preferential taxation of certain categories of citizens is provided for by both federal and regional legislation.

Thus, local government bodies establish the possibility of exempting pensioners from fees to the treasury for owning a car (under certain conditions) and land plots.

An application for tax benefits for pensioners of a property nature can be submitted to the Federal Tax Service in any subject of the Russian Federation.

The provision of relief on taxes to the treasury is regulated by federal law. In this case, the basis for assigning a pension does not matter. According to the Federal Tax Service, up to 20 million Russians use tax discounts annually.

List of tax benefits for pensioners in 2021

In 2021, pensioners are entitled to receive benefits in relation to the payment of the following taxes and fees (some preferences are provided at the federal level, others at the regional or municipal level):

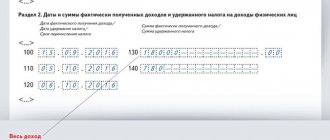

- exemption from taxation of certain types of income;

- the right to refuse to pay certain state duties;

- discounts on payment of transport and land taxes or complete exemption from taxation of vehicles and land;

- exemption from property taxes on a limited number of real estate properties.

Let's consider the conditions for obtaining tax benefits for citizens aged 55-60 years this year:

| No. | Tax benefits | Additional information | Legislative regulation |

| 1 | Benefits for paying personal income tax (personal income tax) | In relation to personal income tax payment, 2 benefits apply at once:

| Art. 208 Tax Code of the Russian Federation Art. 217 Tax Code of the Russian Federation |

| 2 | Exemption from payment of state duties | Pensioners have the right to refuse to pay the state fee if they need to file a claim in court regarding the registration of a pension benefit (but the amount of property claims against the defendant should not exceed 1 million rubles, otherwise the fee will have to be paid). If a pensioner has problems with the Pension Fund due to the accrual of a pension that is 5,000 rubles less than the recipient is entitled to, the fee for consideration of the case by the court is also not charged. If a pensioner needs to go to court not on the issue of pension provision, the state duty is paid on a general basis. | Art. 333.36 Tax Code of the Russian Federation |

| 3 | Transport tax benefits | Each subject of the Russian Federation has its own transport benefits. Local authorities establish their list of beneficiaries, the size of the tax discount, and the conditions for registering the privilege. For example, consider federal cities: ● Moscow pensioners cannot be exempt from paying car tax if they do not belong to the following categories of persons: Chernobyl survivors, disabled people and combat veterans, former prisoners of concentration camps, disabled people and WWII veterans, holders of the Order of Glory of three degrees, Heroes of the Russian Federation or the USSR. ● In St. Petersburg, pensioners are not taxed on transport, but only if we are talking about a domestic car with an engine no more powerful than 150 hp. But Heroes of the Russian Federation, disabled people and veterans may not pay tax even on a foreign-made car. | Art. 4 of the Moscow City Law of July 9, 2008 No. 33 Art. 4.1 of the Law of St. Petersburg of November 4, 2002 No. 487-53 |

| 4 | Property tax benefits | Despite the fact that funds from taxation of property of individuals go to the regional budget, the benefit for its payment is approved at the federal level. Before the pension reform was carried out, women over 55 years old and men over 60 years old could take advantage of a 100% discount. Since the beginning of 2021, changes have been made to the Tax Code of the Russian Federation - today pre-retirees - persons who are 55 and 60 years old, but who have not yet retired due to an increase in the retirement age - can receive an exemption from property tax. The Tax Code of the Russian Federation allows you not to pay tax on one object of each type of property: ● apartment, share, room; ● private house, part of a house; ● garage, parking place; ● outbuilding with an area of up to 50 sq.m.; ● premises for a creative workshop, gallery, museum, etc. | pp. 10 p. 1 art. 407 Tax Code of the Russian Federation |

| 5 | Benefits for paying land tax | The land tax benefit applies at the federal level to pensioners (recipients of any type of pension benefit) and persons of pre-retirement age (women over 55 years old and men over 60 years old). For them, up to 6 acres of land are exempt from taxation. If the plot is larger, you will have to pay tax for the difference. Local authorities may approve additional privileges regarding the payment of land taxes. Pensioners without special status in Moscow are not entitled to land tax benefits. Full holders of the orders “For Service to the Motherland in the USSR Armed Forces”, Glory, Labor Glory, as well as Heroes of the USSR and the Russian Federation, Heroes of Socialist Labor are exempt from taxation. And veterans and disabled people of the Second World War and other military operations, as well as Chernobyl survivors, have the right to refuse to pay taxes on plots worth up to 1 million rubles. In St. Petersburg, recipients of all types of pensions and citizens of pre-retirement age do not have to pay tax on plots of up to 25 acres from January 1, 2021. | Art. 387 Tax Code of the Russian Federation Art. 3.1 Law of Moscow dated November 24, 2004 No. 74 Art. 5 of the Law of St. Petersburg dated November 23, 2012 No. 617-105 |

“The property tax benefit for individuals is provided in the form of exemption of one of the objects of each of the following types of property: apartment (part of an apartment or room), residential building (part of a residential building), garage (car space). For land tax, the benefit is provided in the form of a deduction from the tax base in the amount of the cadastral value of 600 square meters per land plot located on the territory of the Russian Federation.”

Yulia Zhuseyeva, Head of the Property Taxation Department of the Federal Tax Service of Russia for the Trans-Baikal Territory

What taxes do pensioners not pay?

The basic law of the Russian Federation regarding taxation is the Tax Code. According to the provisions introduced into it, in 2021, citizens who retired due to the loss of a breadwinner, ability to work, or due to reaching the appropriate age do not pay taxes on the payments assigned to them. Income tax is not charged even if state compensation is allocated for them.

Some pensioners are granted additional tax benefits. They were allowed not to pay property fees for one type of registered real estate.

The benefit is given:

- citizens who have reached retirement age;

- people who are years away from performing work duties;

- disabled people in respect of whom a decision has been made to assign the first two groups or to assign the status of disabled people since childhood;

- retired military personnel or members of their families who have lost their breadwinner;

- persons included in the category of federal beneficiaries.

These are all tax privileges. Federal laws do not provide anything else for pensioners. They pay the remaining taxes applicable to individuals in full. With one exception - if the decision of local authorities provides for relaxations at the regional level.

How can a retiree get a property tax break?

Important! Despite the fact that specialists of the Federal Tax Service today monitor the age of property owners on their own and stop sending tax receipts when the payer reaches the “old” retirement age, the human factor may come into play and the benefit will not be taken into account.

Thus, women aged 55 years and men aged 60 years and older can do the following:

- submit an application once to the territorial branch of the Federal Tax Service of Russia immediately upon reaching the specified age in order to remind you of your right to benefits;

- check whether the benefit is taken into account, and if not, send a request using your Personal Account on the tax website or a special service.

Important! The law does not establish clear deadlines for filing an application for the desire to apply the benefit. However, it is advisable to do this no later than April 1 of the next year - this way the benefit will be taken into account in current accruals before sending out receipts for payment of property taxes.

If a pensioner has several properties of the same type (2 apartments, for example), he has the opportunity to choose the property that he would like to be exempt from taxation . To declare your choice, you must submit a notice to the tax authorities before December 31 of the year for which the amount of tax payable is calculated (for example, a notice of tax assessments for 2021 must be submitted no later than December 31, 2021).

In the event that the taxpayer has not notified the tax service of his choice of real estate, specialists will independently exempt from property tax the property whose value is greater (this will be more profitable for the pensioner).

An example of a tax benefit for a pensioner's real estate

The man reached the age of 60 and sent an application to the territorial branch of the Federal Tax Service about his desire to exempt real estate from property tax. The pensioner owns the following real estate assets:

- 2-room apartment in Vladivostok worth 3 million rubles;

- share in an apartment in Moscow worth 3.5 million rubles;

- creative studio in Mytishchi worth 1 million rubles;

- garage in Mytishchi cost 500 thousand rubles;

- 2 parking spaces worth 300 thousand rubles each in Moscow.

The pensioner did not indicate which properties of the same type he would prefer not to pay property tax on, and therefore specialists of the Federal Tax Service of the Russian Federation exempted the following property of the taxpayer from tax:

- a share in an apartment in Moscow (since a 2-room apartment and a share in an apartment are the same type of objects, and a share in a Moscow apartment turned out to be more expensive than an apartment in Vladivostok);

- creative studio;

- garage (since garages and parking spaces are the same type of objects, and the cost of a garage is higher than the cost of each parking space separately).

Property tax: exemption.

A pensioner has the right to a property deduction when owning real estate such as:

- apartment;

- House;

- garage;

- outbuildings (up to 50 sq. m.), etc.

The main condition is that the property should not be used for commercial purposes. The benefit is provided only for one piece of real estate registered in the name of a pensioner. The basis for granting benefits can be any, including disability.

If a pensioner works, then the property benefit still remains.

In the case when several real estate properties are registered in the name of a citizen, he must choose for which of them he will not pay the fee and write an application to the Federal Tax Service.

If he has not completed this, officials will independently select property for which the tax will not be charged. By default, this is the property for which the amount would be the maximum.

An example of applying for land tax benefits for pensioners

A woman aged 55 years living in the Samara region applies for a tax exemption on a land plot. The area of the plot is 16 acres . The cadastral value of the plot is 680 thousand rubles . In the Samara region there is a tax rate for land tax equal to 0.3% of the cadastral value .

Persons of pre-retirement age, with whom the woman belongs, have the right to tax exemption in respect of 6 acres of land. This means that the following are subject to taxation:

16 acres - 6 acres = 10 acres of land

The cadastral value of one hundred square meters of land owned by a woman is:

680,000 rub. : 16 acres = 42,500 rubles.

The land tax will be calculated annually and after applying the benefits will be:

RUB 42,500 x 10 acres x 0.3% = 1,275 rubles.

Exemption of a pensioner from land tax

Land tax (hereinafter ZN) is assigned by local authorities.

In certain regions of the country, such categories of elderly people as:

- Disabled people of all categories

- Military veteran

- Heroes of the USSR and the Russian Federation

- Citizens affected by radiation.

It is important to know! What is the pension in England?

In accordance with Article 391 of the Tax Code, the reduction in tax payments can be 10,000 rubles.

Recommended reading: compensation for military pensioners for land tax.

In addition, some plots are not subject to tax legislation, namely:

- cultural heritage area;

- objects withdrawn from circulation;

- a site located on the territory of a forest fund;

- land occupied by water bodies.

To pay for ZN, the object must have a cadastral number. Unregistered plots are not subject to tax legislation.

To assign a regional benefit, the pensioner must contact the local tax authority with the following documents:

- Statement.

- Passport.

- Pensioner's ID.

- Documents for land.

- TIN.

Tax payments are recalculated from the date this right arises. But if the documents were submitted at a later period, recalculation is carried out only for the last 3 years.

How can a pensioner apply for a tax benefit in 2021?

Important! The use of tax benefits is a right, not a duty, of a citizen. If you submit an application later than when the right to a benefit arises, you will not have to bear responsibility, this will not be considered a violation.

The algorithm of actions for pensioners and citizens of pre-retirement age who want to apply for tax benefits is established by Article 56 of the Tax Code of the Russian Federation:

- Write an application (application form) for a tax benefit:

- in person at the regional office of the tax service (only a passport is needed, specialists must request other documents through interdepartmental interaction channels);

- through your personal account on the tax website (the application will be completed automatically);

- By Russian Post (by registered mail with acknowledgment of delivery and a list of the contents).

- Wait for the application to be reviewed by Federal Tax Service specialists (takes up to 30 days).

- Make a request for a refund of overpaid taxes or to offset them against future accruals for other taxes, but not more than for 3 years preceding the application.

Important! If you do not decide in time on the property that the pensioner would like to exempt from taxation, it will not be possible to make a choice “retroactively”.

List of documents for receiving benefits

Let's consider what documents are needed in order to receive tax benefits for pensioners.

To receive property tax benefits for pensioners, you must prepare and submit the following list of documentation:

- an application for benefits in the established form; the Federal Tax Service can provide you with the necessary form and sample application, and you can fill it out using an example;

- notice of the object in respect of which a property privilege will be granted;

- it is also necessary to provide papers certifying that the individual is the owner of the property;

- presence of a certificate.

Documentation is provided in the form of originals and copies, copies of which are certified by the official bodies of the Federal Tax Service. The most important of the entire list of documents is the application of an individual, as an expression of will to receive a privilege.

Before an individual wishes to contact the Federal Tax Service, it is better for him to familiarize himself with the list of documents and the work schedule of government bodies. Constant changes are coming, and in order not to waste time and then stand in a long line, it is better to prepare in advance.

You can submit your application in various forms:

- hand over in person to the tax office;

- send by post office;

- There are a number of advantages in order to receive the benefit without standing in a long line. It is possible to send documentation via email. You will need to go to the website, register, fill out a standard form, and if necessary, upload photos or scans of documents.

Please note that documents must be submitted before November 1 of the current year. If you miss the deadline for submitting documents, you will no longer be able to make changes. This will only be possible next year.

How to apply for property tax relief for pensioners? In order to receive a privilege, you must take an active action, make a statement. If an individual has never submitted an application or contacted government agencies, then the privilege will not be accrued to him. And he will be required to pay for all his property. If a pensioner previously submitted an application, but did not select an object that is subject to benefits, the state will perform this action for him, so to speak, by default, and will select the most expensive object.

Those receiving benefits are required to write a statement. The document is written in any form with all the necessary data about the individual entered.

Common mistakes on the topic “How can a pensioner apply for a tax benefit in 2021”

Error: The pensioner believes that he has the right to be exempt from paying personal income tax on his salary and on income from renting out an apartment.

In fact, pensioners are only exempt from paying personal income tax in relation to pension payments, additional payments and pension supplements. But if an elderly person continues to work under an employment contract, he is obliged to pay personal income tax on his salary. The same applies to income received as a result of concluding a rental agreement with a tenant.

Error: A pensioner submits an application about the desire to exempt his apartment, a share in another apartment and a garage from property taxation.

According to the instructions of the Tax Code, citizens of pre-retirement age (55 years old - women, 60 years old - men) have the right not to pay property tax on one object of each type of real estate. In this case, an apartment and a share in another apartment are objects of the same type, and therefore only one object can be exempt from taxation. It will be more profitable to apply the exemption to an apartment, since its cost is higher, and, accordingly, the amount of tax payable is also higher. The pensioner will no longer pay tax on the garage.

Payment of transport tax

The conditions for assigning transport tax (hereinafter referred to as TN) are enshrined in the Tax Code of Russia (hereinafter referred to as TC).

However, the Tax Code does not have standards for TN for older citizens. In most cases, these benefits are established by municipal authorities.

The Tax Code allocates a portion of vehicles that are not subject to taxes . These types of transport include:

- rowing (or motor) boats with power up to 5 hp. (horsepower);

- wheelchair;

- transport up to 100 hp, which is provided to social protection authorities.

As for benefits for older people, most regions distinguish the following categories of citizens who have the right to receive a discount when paying for TN:

- Heroes of the USSR and the Russian Federation with medals and awards (for example, the Order of Glory of any degree).

- Citizens affected by radiation.

- Disabled people of all types (except group 3).

- Parents of disabled children.

- Residents of the Far North.

- Veterans and participants of the Second World War (Great Patriotic War);

- Citizens with more than one vehicle.

To find out about possible benefits, a pensioner must contact the tax department. Let us give examples of benefits in St. Petersburg and Moscow.

Find out how transport tax is calculated for pensioners here.

In St. Petersburg, older people do not pay tax contributions for one vehicle if the following conditions are met:

- year of manufacture of the car - before 1991, power no more than 150 hp;

- motor boat, cutter or other watercraft up to 30 hp.

It is important to know! How is the northern pension formed?

As for Moscow bonuses, pensioners are not provided with transport benefits in accordance with Law No. 33 of 07/09/2008.

TN benefits are of a declarative nature , therefore, an elderly person is required to submit an application to the tax authority. The form should include the following information:

- name of the tax department;

- Full name of the official and the applicant;

- TIN;

- passport information;

- address of registration and actual residence;

- category of pension payments;

- contact information (phone, email);

- the essence of the request;

- reference to the regional law on the provision of transport benefits;

- complete information on transport;

- a list of documents that are attached to the application;

- date and signature.

In addition to the application, the elderly person must prepare the necessary list of documentation, namely:

- Passport details.

- Pensioner ID or certificate.

- Documents for the vehicle.

- Certificates confirming the pensioner’s right to appropriate benefits.

The Government is currently discussing the issue of abolishing the labor tax for pensioners, but this bill has not yet entered into force.

When calculating TN, the following indicators are taken into account:

- Vehicle ownership period.

- Engine power.

- Gross tonnage.

- Transport category.

- Lifetime.