The following two tabs change content below.

- Author

- Author's articles

Mikhail Demidov (Lawyer)

Work experience 8 years.

Author: Mikhail Demidov (Lawyer) (All articles by the author)

- What to do if someone else's car is blocking the exit? — 06/30/2020

- How to fire employees during bankruptcy of an enterprise - 06/19/2020

- Is it possible to legally reduce an employee's salary? — 05/05/2020

Gifts, in the form of small surprises or large material assets, are pleasant for everyone to receive - and it seems that nothing will overshadow the joy experienced at the moment of delivery. This is where the recipient usually remembers domestic legislation, and more specifically, the requirement of the Tax Code to share part of his income with the state. When the gift tax is paid and in what cases it can be avoided - in the next article.

Who pays

Based on the spirit of tax legislation, deductions from income received in favor of the state are made exclusively by the recipient - and only if he falls under one of the criteria below.

Tax cannot be collected from the donor: he does not receive a profit from his act; rather, on the contrary, he voluntarily loses part of his disposable assets.

It should be borne in mind that the donor can act as a tax agent, independently deducting the amount of tax from the amount of the gift or other deductions in favor of the recipient - for the most part this concerns the relationship between the employer and the employee.

In addition, a tax agent must stand between the tax office and the recipient of the gift if the recipient is a child under fourteen years of age.

In this case, the parents, adoptive parents or other legal representatives of the minor undertake the settlements with the state - and it is they who bear the responsibility for non-payment or untimely deduction of funds.

Good to know:

- Real estate tax for individuals: procedure and features of payment, amount and tax rate, example of calculation

- How can a pensioner avoid paying property taxes?

- Who is exempt from paying property tax?

- Property tax benefits for individuals

List of things for which donation duties do not need to be paid

The following gifts are exempt from having to pay tax for them:

- Necessary for education (finances that are needed to pay the cost of education at colleges and universities, provided that these funds are transferred directly to the account of the educational institution). Those. the parent has the right to personally, without transferring money to the child, pay for his education, and in this case the tax office will not have any questions;

- Amounts that will be spent on payment for treatment and medical services, provided that the transfer goes directly to the medical institution where the course of recovery or treatment will take place;

- Funds that are transferred to the account of various types of charitable foundations.

In any case, it would be a good idea to consult with a lawyer. There is an opinion among people that there is no need to pay tax in Russia in 2021, if only because tax officials simply will not find out about a valuable gift.

In reality, the recipient of the gift has to go and register his ownership of a brand new car or apartment. In addition to registering the agreement, you will then need to go to the Unified State Register, which directly transmits the information to the tax office. Therefore, in order to avoid problems, it is better to familiarize yourself with the current legislation in advance.

Tax rate

As follows from the explanations on the official website of the Federal Tax Service, the gift received, if it is taxed, is part of the citizen’s income for the reporting period. Accordingly, it is subject to the standard rate established by the legislator:

- 13% of the total value of the assets transferred to the disposal, if the recipient is a tax resident of Russia, that is, lives in the country for at least 183 days a year;

- 30% of the declared value - in all other cases.

It should be borne in mind that when assessing the recipient’s status (resident/non-resident), not only personal statements of the taxpayer and the witnesses presented by him may be taken into account, but also objective data - primarily entry and exit stamps in the foreign passport.

When not to give money

- It is believed that on gender holidays (March 8, February 23, February 14, Mother's Day, Father's Day) giving a gift in money means showing that you are not particularly fond of this person. Because these are the most convenient occasions when you can especially clearly show your love and care.

- Men don't like accepting money from women because it shows that he earns less than she does. This does not apply to relatives.

- For the same reason, younger people should not give money to elders.

- Based on subordination, you should not give a monetary gift to your superiors. It looks stupid: most likely, the boss earns more than you.

When you don't have to pay

Tax on a given gift, regardless of its specific execution, occasion and other incidental circumstances, is not required to be paid in the following cases (Article 217):

- The gift is made in money or in the form of property (in kind), unless the latter falls into one of the following categories:

- vehicles;

- real estate;

- shares and other securities;

- shares, interests and other ways of participating in common assets.

In particular, tax will not have to be paid when delivering a sum of money in an envelope, expensive alcohol, flowers, jewelry, etc. (clause 18.1, first paragraph).

- The donors are close relatives of the recipient. In accordance with the list given in the Family Code, as well as comments on the Federal Tax Service website, this list includes:

- husband or wife of the recipient - if the marriage, at least formally, continues to be valid;

- native father and mother;

- native children;

- adoptive parent or adoptive mother;

- adapted children;

- brother or sister - both from father and mother, and from one of the parents;

- grandparent;

- grandson or granddaughter.

Thus, a gift from a father to a son, whatever its value, cannot be taxed - neither the donor nor the recipient will have to apply to the Federal Tax Service.

But if the first is an uncle, and the second is a nephew, the material value received free of charge turns into a taxable base, with all the ensuing consequences (clause 18.1, second paragraph).

- The total cost of a gift given by an individual entrepreneur or legal entity is up to 4,000 rubles (clause 28, second paragraph).

Today, this is an exhaustive list of cases in which the recipient may not pay tax on a gift - however, the inspector will not be able to prohibit him from transferring part of his funds to the budget.

When is a gift taxable?

Payment of personal income tax on a gift is the responsibility of the party who is the recipient of the gift.

The citizen who transferred the value for use should not make deductions, since he does not receive any income as a result of his action. According to the law, the donor has the right to withhold the amount of tax deductions from his gift. In this case, personal income tax will be taken from him, not the recipient.

According to paragraph 1 of Article 572 of the Civil Code, a gift is a gratuitous transfer of ownership rights to the donor of the following values:

- things;

- money;

- securities;

- prizes or winnings;

- real estate.

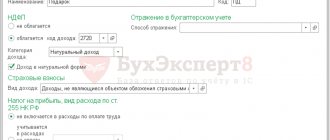

If a legal entity or entrepreneur is a donor, then the gift is not subject to taxation if its value is estimated at an amount equal to less than 4,000 rubles. If a citizen received one or more gifts from an employer during a calendar year, the total amount of which exceeds 4,000 rubles, then the recipient of the gift will have to pay tax.

Important! The gift can be in cash or in kind.

If the donor is a third-party individual who is not considered a close relative, then tax will need to be paid when receiving the following gifts:

- real estate object;

- stock;

- PAI;

- automobile;

- share in limited liability companies.

It is these gifts that are specified in paragraph 18, article 217 of the Tax Code of the Russian Federation, and are subject to income tax of 13%.

Personal income tax is not charged on monetary gifts from strangers. The Federal Tax Service should not be notified of the receipt of monetary reward, regardless of its size. But this restriction does not apply to citizens serving in public service.

A cash gift should not be confused with a prize given by strangers. Money given for a birthday, wedding, or other occasion will not be considered income. Prizes received as a result of competitions or special promotions are subject to tax.

Participants are often given gift certificates or gifts in the form of equipment, instruments, etc. If their value exceeds 4,000 rubles, the recipient will be forced to pay 35% of the amount to the Federal Tax Service.

Important! Prizes won in a lottery or casino are subject to income tax equal to 13% of the amount.

In Russian legislation, the concepts of “gift” and “prize” are different. The latter refers to things that were received by a citizen who took part in shows, promotions or competitions. You should check with the organizers how the gift is registered: the interest rate will depend on this.

Gift tax can be paid by both the recipient and the event organizer. In most cases, if the gift is money, then the donor independently withholds the required amount. If the prize won is an item, then the winner must pay tax on it. The organizer is obliged to inform the Federal Tax Service about the cost of the gift and the recipient’s details.

Read also: How to send an alcoholic for compulsory treatment?

Article 572 of the Civil Code of the Russian Federation “Donation Agreement”

Article 217 of the Tax Code of the Russian Federation “Income not subject to taxation (exempt from taxation)”

When do you have to pay?

Using the exclusion method, you can determine situations in which the recipient is required to pay tax on a gift given to him:

- The cost of a present received from an individual entrepreneur, company or organization, including from an employer, is over 4,000 rubles.

- As a result, the recipient becomes the owner of a private house, apartment, room, and other types of real estate, regardless of its purpose.

- Gift - a car or truck, motorcycle, moped, scooter or other property classified as a vehicle.

- A citizen receives ownership free of charge of securities of any nature (most often these are shares), shares or shares in common property.

- The donor and the recipient are not closely related - a complete list of family relationships that are exempt from paying tax is given in the previous section.

In all these cases, the obligation to share with the state arises for the taxpayer, in accordance with Article 228, paragraph 1, automatically - immediately after accepting the gift.

Similar articles:

- What happens if you don't pay property taxes?

- Responsibility for non-payment of taxes by an individual