Right to compensation in lieu of additional leave

Officially employed people have four weeks a year off from their work duties. But there are professions that allow specialists to spend more time on vacation (up to 45 days):

- workers of the Far North or equivalent areas;

- workers who are in working conditions of hazard class 2, 3 or 4 based on the results of the special labor safety assessment;

- workers on irregular schedules without required days off;

- teachers and university professors;

- scientific researchers;

- medical workers;

- employees with a disability group;

- athletes and coaches;

- donors;

- civil servants.

When a manager has difficulty finding a suitable replacement for such a long period of time, he agrees to provide compensation in lieu of additional time off. If last year an employee did not take all of his vacation, then this year he has the right to receive compensation in cash equivalent. The amount depends on the average earnings for the year.

ATTENTION! Compensation for unused additional leave can be asked from the employer after six months, when, according to the law, the newcomer is entitled to rest for the first time. But if a person does not work until the end of the year, then according to Article 137 of the Labor Code of the Russian Federation, the funds paid are withheld from the salary.

Employees who want to terminate their employment relationship have the right to compensation. The employee may go on vacation with subsequent dismissal or receive money for not taking advantage of this.

IMPORTANT! During vacation, you cannot fire a person; any employee has the right to change his mind and return to work.

If an employee who resigns has the right to an increase in rest days and did not use them in a timely manner, then together with the resignation letter he writes an application for payment.

Categories

Some employees of the organization work irregular working hours. For this, they are granted additional annual leave of three calendar days. Can such additional leave be replaced with monetary compensation?

An employee who has an irregular working day, as a general rule, has the right to annual basic paid leave of 28 calendar days (Article 115 of the Labor Code of the Russian Federation) and annual additional paid leave of at least three calendar days, as determined by a collective agreement or internal labor regulations (Article 119 of the Labor Code of the Russian Federation).

Article 126 of the Labor Code of the Russian Federation provides that part of the annual paid leave exceeding 28 calendar days, upon the written application of the employee, can be replaced by monetary compensation.

When summing up annual paid leave or transferring annual paid leave to the next working year, monetary compensation can be replaced by a part of each annual paid leave exceeding 28 calendar days, or any number of days from this part.

Consequently, an employee who has an irregular working day can, upon his written application, be replaced with monetary compensation for a part of the vacation not exceeding three calendar days (Part 2 of Article 126 of the Labor Code of the Russian Federation).

To receive monetary compensation in exchange for annual additional leave for irregular working hours (as part of annual leave), the employee must write an application addressed to the head of the organization. However, it should be borne in mind that replacing part of the annual leave with monetary compensation is the right and not the obligation of the employer, that is, he can refuse the employee.

Is it possible to replace annual additional paid leave with monetary compensation for employees employed in jobs with harmful and (or) dangerous working conditions?

Based on the results of a special assessment of working conditions carried out in the organization, certain workplaces were classified as hazardous. In this regard, employees are provided with an additional annual paid leave of 12 calendar days. Is it possible to replace annual additional paid leave with monetary compensation for employees who work in jobs with hazardous working conditions?

According to Part 1 of Art. 117 of the Labor Code of the Russian Federation, annual additional paid leave is provided to employees whose working conditions at their workplaces, based on the results of a special assessment of working conditions, are classified as hazardous working conditions of the 2nd, 3rd or 4th degree or hazardous working conditions.

The minimum duration of annual additional paid leave for work with harmful and (or) dangerous working conditions is 7 calendar days (Part 2 of Article 117 of the Labor Code of the Russian Federation).

The duration of the annual additional paid leave of a particular employee is established by an employment contract on the basis of an industry (inter-industry) agreement and a collective agreement, taking into account the results of a special assessment of working conditions (Part 3 of Article 117 of the Labor Code of the Russian Federation). That is, taking into account the working conditions and specifics of the work of a particular employee, he may be assigned a longer duration of annual additional leave (for example, 12 calendar days).

According to the general rule provided for in Part 3 of Art. 126 of the Labor Code of the Russian Federation, replacing annual additional paid leave with monetary compensation for employees engaged in work with harmful and (or) dangerous working conditions is not allowed. However, there are exceptions to this rule. Such employees cannot be replaced with monetary compensation only for that part of the annual additional paid leave for work with harmful (dangerous) working conditions, which is the minimum amount of the specified leave, that is, 7 calendar days. If an employee engaged in work with harmful and (or) dangerous working conditions is given a duration of additional leave that exceeds the minimum duration of such leave (7 calendar days), then the part of the leave exceeding this minimum, with the written consent of the employee, can be replaced with cash compensation according to established rules.

In accordance with Part 4 of Art. 117 of the Labor Code of the Russian Federation, industry (inter-industry) agreements and collective agreements may provide for a rule according to which part of the annual additional paid leave for work in harmful and (or) dangerous working conditions, exceeding the minimum duration of this leave (7 calendar days), can be replaced separately established monetary compensation. Replacement with monetary compensation of a part of additional leave exceeding 7 calendar days is allowed only with the written consent of the employee, executed by concluding a separate agreement to the employment contract .

Thus, if an employee is entitled to 12 calendar days of additional annual leave for working in hazardous working conditions, then the organization is obliged to provide the employee with 7 calendar days of leave , and for the remaining 5 calendar days, monetary compensation can be paid . Moreover, this can only be done if there is an agreement to the employment contract and a fixed procedure for providing monetary compensation for unused vacation.

An employee engaged in hazardous work must, in any case, use part of the additional leave of 7 calendar days out of the 12 calendar days of additional leave due to him, since the main purpose of this leave is to reduce the negative impact on the employee’s health of harmful factors in the working environment and the labor process. It must be taken into account that it is impossible to pay an employee monetary compensation for the entire annual additional leave , as this would be a violation of the requirements of labor legislation.

By the way,

partial replacement of annual additional paid leave for work in harmful and (or) dangerous working conditions became possible due to the entry into force on January 1, 2014 of the Federal Law of December 28, 2013 No. 421-FZ “On Amendments to Certain Legislative Acts of the Russian Federation in connection with the adoption of the Federal Law “On Special Assessment of Working Conditions.” The previous version of Art. 117 and art. 126 of the Labor Code of the Russian Federation did not provide for such a possibility.

Can an employer compensate a Chernobyl employee for unused annual additional paid leave?

Can an employer pay monetary compensation to a Chernobyl employee for unused annual additional leave provided under the Law of the Russian Federation of May 15, 1991 No. 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”?

Based on clause 5 of Art. 14 of the Law of the Russian Federation of May 15, 1991 No. 1244-1 “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant” (as amended on October 4, 2014; hereinafter referred to as the Law of the Russian Federation No. 1244-1) employee who was exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, has the right to receive annual additional paid leave of 14 calendar days.

Such leave is provided to the employee not in connection with the performance of his job duties or special working conditions, but as a measure of social support provided for by Law of the Russian Federation No. 1244-1.

This annual additional paid leave does not have a labor legal nature, and its provision is due to the need to provide annual rest to persons who find themselves in the zone of influence of radiation factors resulting from the disaster at the Chernobyl nuclear power plant on April 26, 1986, in order to reduce the impact of these factors on human health. The provision of leave does not depend on whether the relevant provisions are contained in the employment contract concluded with the employee or not.

In accordance with Art. 5 of Law of the Russian Federation No. 1244-1, social support measures for this category of citizens are expenditure obligations of the Russian Federation, and not of employers. Financing of expenses associated with the provision of additional leave is carried out not at the expense of the employer, but at the expense of funds provided for by the law on the federal budget for the corresponding year by the Ministry of Finance of the Russian Federation.

Thus, the annual additional leave for a Chernobyl employee is paid not by the employer, but by the social protection authorities at the expense of the federal budget. The rules for payment of additional paid leave and payment of one-time compensation for recovery, provided simultaneously with additional paid leave to citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, were approved by Decree of the Government of the Russian Federation of 03.03.2007 No. 136 (as amended on 03.25.2013).

Payment of compensation for unused annual additional paid leave is not provided for , which is confirmed by the explanations contained in the letter of the Ministry of Labor of Russia dated March 26, 2014 No. 13-7 / B-234.

How to apply for compensation

To apply for reimbursement of unused rest days, the employee writes a corresponding application addressed to the director. The manager decides to provide compensation instead of additional leave within three days. If the director agrees, then an order is issued to accrue monetary compensation for additional leave. The order form is free, but the period for which payment is due and the date of transfer are indicated. The employee reads the order and signs. The data is entered into the employee’s personal card and general vacation schedule.

What taxes are levied on compensation?

Compensation for unused additional leave is represented by the citizen’s income. It is missing from Art. 217 of the Tax Code, containing all types of income from which personal income tax is not required. Therefore, the employer, represented by the tax agent, must correctly calculate and remit the tax on these cash receipts of its employees.

Personal income tax is paid on the day when compensation is transferred to the citizen’s bank account. Additionally, the entire amount is subject to various contributions to state funds represented by the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund.

Example of compensation calculation

The amount depends on the average salary for one or two years. All money earned is divided by 12 months, then by the average number of working days in a month. This is how you get your salary per day. The number of unused days is multiplied by this number to obtain the amount payable.

For example, teacher A. N. Sokolov has 12 extra days, his annual salary is 390 thousand rubles, and he works 20 days a month. We calculate:

390000 / 12 / 20 = 1625 rub. – this is the average salary per day. 1625 * 12 = 19500 rub. – amount of compensation.

IMPORTANT! Since the compensation is considered income, income taxes are deducted from it. But there are enterprises that classify this payment as monetary compensation, in which case it is not subject to taxation.

Who should not replace vacation with monetary compensation?

The employee asks you to replace the vacation with monetary compensation. And before you grant his request, you should make sure whether the employee is one of the people for whom you cannot replace vacation with money. The list of such persons is provided for in Part 3 of Article 126 of the Tax Code of the Russian Federation. These include:

- pregnant women;

— workers under the age of 18;

— workers exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant (see also letter of the Ministry of Labor of Russia dated March 26, 2014 N 13-7/B-234);

— workers engaged in work with harmful and (or) dangerous working conditions. There is, however, an exception here.

Thus, you can replace with monetary compensation a part of the annual additional paid leave for Chernobyl victims that exceeds its minimum duration - 7 calendar days (Parts 2 and 4 of Article 117 of the Labor Code of the Russian Federation).

Accordingly, if your employee does not fall into any of the specified categories of persons, then you can replace his vacation with monetary compensation.

How the amount of compensation is calculated: formulas and examples

The amount of cash grants is determined based on the average profit received during the year.

A citizen receives compensation if he has worked for the company for more than 15 days. The length of service is rounded up to the nearest month and the employee is given the amount for 2.33 days.

If an employee’s length of service in an organization is 11 months, then payments are accrued for a full year. Compensation is provided for 12 months if the employee’s length of service is from 5 months 15 days to 11 months, subject to dismissal for the following reasons:

Calculation examples

Example 1

Irina Nikolaevna is a specialist in the human resources department at the St. Petersburg State Budgetary Healthcare Institution “City Clinic No. 5”. Irina’s salary is 30 thousand rubles. According to the collective agreement, an employee of the public sector, to which this specialty belongs, has an irregular working day. Therefore, Irina Nikolaevna can take an additional 14 days to her vacation. From May 1, 2021, Irina Nikolaevna rested for 28 days. After returning from vacation, the employee decided to receive compensation for additional vacation and wrote a statement addressed to management with a request to provide her with such a monetary payment. On the next payday, Irina will receive a payment in the amount of 14,286 rubles.

Example 2

A pregnant employee working in an enterprise with hazardous working conditions has the right to an addition to the standard leave - 14 days. The employee's salary is 25 thousand rubles. From June 1, 2021, a woman goes on vacation and wants to add up her standard and additional vacations. She wrote about this in a statement to her employer. Thus, the employee’s return date to work is July 13, 2021. The vacation payment she will receive will be equal to 35,714 rubles.

Maternity payments in 2021 - find out full information. You can find out how to correctly calculate the average daily earnings taking into account sick leave here. Read about the child tax deduction in this article.

How to calculate compensation

To determine the amount of monetary compensation to be paid to the employee, you need to multiply the average daily earnings by the number of days replaced by compensation.

Note. The amount of monetary compensation paid in lieu of vacation is calculated based on the employee’s average daily earnings.

The average daily earnings in this case are calculated according to the rules for calculating vacation pay. They are established by Article 139 of the Labor Code of the Russian Federation and clause 10 of the Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922).

So, if the employee worked the entire billing period, you should divide the actual amount of the employee’s salary for this billing period by 12 and by 29.3 (the average monthly number of calendar days).

If one or more months of the billing period are not fully worked out or there were excluded periods, then the average daily earnings are calculated as follows. First, determine the number of calendar days in fully worked calendar months:

KDMP = KMP x 29.3,

where KDMP is the number of calendar days in fully worked months of the billing period;

KMP - number of fully worked months;

29.3 is the average monthly number of calendar days.

Next, calculate the number of calendar days in months not fully worked by the employee. To do this, use the following formula:

KDMN = 29.3: KKDMN x CODE,

where KDMN is the number of calendar days in a month that is not fully worked;

KKDMN - the number of calendar days of the month that is not fully worked;

CODE - the number of calendar days worked in a given month.

If there are several months that are not fully worked, then the number of calendar days must be determined for each of them. And then add up the results.

Then calculate the total number of calendar days taken into account when determining average earnings:

KKD = KDMP + KDMN,

where KKD is the number of calendar days taken into account when calculating average earnings.

Finally, determine your average daily earnings:

NW = NE: KKD,

where SZ is the average daily earnings;

SV - the amount of payments accrued to the employee in the billing period.

Example 2. An employee of AvtoLombard LLC, O.V. According to the employment contract, Simonova is entitled to additional leave of 4 calendar days. She appealed to the employer with a request to replace this part of the vacation with monetary compensation. The billing period is from August 1, 2013 to July 31, 2014. From April 1 to April 28, 2014 O.V. Simonova was on regular vacation for 28 calendar days. And in January 2014, the employee was sick for 10 days. The remaining months of the billing period have been fully worked out.

Over the last 12 calendar months, payments in favor of the employee amounted to 420,500 rubles, of which vacation pay was 29,800 rubles. and payments for a certificate of incapacity for work - 9200 rubles. We will calculate the amount of compensation that the employee is entitled to.

First, we determine the number of calendar days in fully worked months. It is 234 days. (8 months x 29.3 days). Now let's calculate the number of days in months not fully worked. For January 2014 it is equal to 19.85 days. (29.3 days: 31 days x 21 days), for April 2014 - 1.95 days. (29.3 days: 30 days x 2 days). The total number of days in months not fully worked was 21.8 days. (19.85 days + 1.95 days).

The number of calendar days taken into account when calculating average earnings is 255.8 days. (234 days + 21.8 days). The payments taken into account do not include average earnings maintained during vacation and temporary disability benefits. Therefore, vacation pay must be calculated based on RUB 381,500. (RUB 420,500 - RUB 29,800 - RUB 9,200). The average daily earnings for calculating compensation will be 1,491.4 rubles. (RUB 381,500: 255.8 days). The amount of compensation to be paid to O.V. Simonova, will be 5965.6 rubles. (RUB 1,264.04 x 4 days).

Please note that labor legislation does not define the period within which you must pay compensation to the employee in lieu of vacation. But we recommend doing this on the next day established for payment of wages.

Note. FAQ

Is it possible to replace study leave with monetary compensation?

No. Labor legislation allows only part of the annual paid leave to be replaced with monetary compensation (Articles 126 and 127 of the Labor Code of the Russian Federation). And your employee’s study leave is not related to annual paid leave. It is considered additional targeted leave related to training (Articles 173-176 of the Labor Code of the Russian Federation).

What will happen to us if we replace an employee’s vacation not exceeding 28 calendar days with money?

In this case, you may be held accountable under Article 5.27 of the Code of Administrative Offenses of the Russian Federation for violating labor laws. The head of the company faces a fine of 1,000 to 5,000 rubles. For a repeated violation, he may be disqualified for a period of one to three years. And an organization can be fined in the amount of 30,000 to 50,000 rubles, and an entrepreneur - from 1,000 to 5,000 rubles. Instead of a fine, the organization and businessman may face suspension of activities for up to 90 days. True, this violation can only be detected if the labor inspectorate comes to you with an inspection.

When won't you be able to exchange your vacation for money in 2021?

It is unacceptable to compensate vacation balances in cash for such categories of citizens.

| Category of citizens | Law |

| Pregnant women Minor workers Employees engaged in hazardous work activities or working in hazardous working conditions | Grounds – part three of article 126 of the Labor Code |

It will not yet be possible to exchange vacation for money for citizens whose vacation does not reach the 28 calendar day limit. If this is the case, then money can be paid in the event of dismissal - for any unused vacation days.

Note! When a person does not take advantage of the allotted vacation in a certain year, the vacation remains his and can be used the next year.

Article 126 of the Labor Code of the Russian Federation

How to get a?

The replacement of additional leave with monetary compensation must be formalized legally.

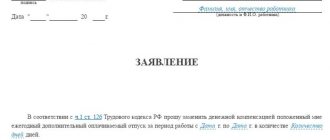

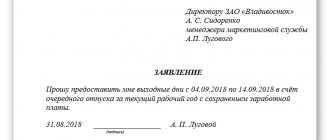

To receive a payment, an employee who has every right to receive it should write an application. In this document, you need to express a request to replace the additional days of rest required by law with financial compensation. It is recommended to refer to the provisions of labor legislation. In particular, we are talking about the first part of Article No. 126 of the Labor Code of the Russian Federation. It is necessary to indicate for what period annual paid leave is provided and for what duration.

The application is written to the director of the company. You can compose it by hand or by typing. It must be indicated to whom and from whom the document is being submitted, the date of preparation and a personal signature.

A sample application is available.

A statement of such content must be handed over to the head of the company personally or through a representative (secretary, HR department employee). The employer will review the submitted document and make a decision. If he agrees, an order will be issued for monetary payment in lieu of leave. The employee must be familiarized with this order against signature. After this, the subordinate will be credited with money.

He will be able to receive them along with the next advance payment or salary. There are no clear deadlines for payment of compensation not related to dismissal in labor legislation. This is because replacing additional leave is not mandatory for the company. Therefore, the timing of payment is determined by agreement between the administration and the employee.

Correct design

If an employee decides that he wants to give up part of his vacation in favor of material remuneration, then to do this he must contact his manager with a corresponding application.

In particular, the document must indicate the following:

- What period of vacation are we talking about now?

- it is necessary to note how many days are planned to be replaced by compensation.

The application can be written by hand or printed on a printer. At the end of the document there must be the signature of the applicant, its transcript and the date of preparation of the document.

The boss will review the application and decide whether he agrees with it or not. If the outcome is positive, an order will be issued for the accounting department to make the calculation.

The order must contain the following information:

- Company details.

- Date and document number.

- Place of order.

- The basis for the document is the employee’s application for monetary compensation, and also a reference is made to Article 126 of the Labor Code.

- An instruction is given to replace a certain part of the vacation with the payment of a sum of money. In this case, the number of vacation days and the period to which they relate is indicated.

The director orders the accounting department to make calculations and make payments.

At the end of the document there is a date, the manager’s signature and its transcript. Below, the chief accountant and the employee who wrote the application must sign that they are familiar with the order.

It is possible that the boss will refuse. In this case, the days in question will be added to subsequent vacations.

If we are talking about the dismissal procedure, then you will not need to write an application to receive money. The corresponding calculation will be carried out in accordance with legal requirements.

The nuances of receiving compensation money

The employer may grant a request for compensation money instead of additional rest or refuse to issue funds. This right is enshrined at the legislative level. Usually, if the budget allows, the applicant’s request is granted. If the applicant is denied funds, then the employee has the right to take time off whenever he wants, and the presence of a Russian on site is not necessary.

The main leave does not have to be replaced by payments upon dismissal from position. An employee has the right to request days off in the period before dismissal.

Replacing vacation with compensation is an opportunity to receive money instead of additional days off. The payment is also provided upon dismissal of an employee as compensation for unspent time off. In the first case, money is issued at the discretion of the employer, in the second - without fail, regardless of the wishes of the enterprise administration.

Financial compensation for vacation balances upon dismissal

Let's say you want to leave your current job. At the time of writing your resignation letter, you had not taken a vacation for several years. In addition, you are not going to rest for the next long months, since you have already found a new position. You don’t want to waste time, so you directly inform your boss about your desire to receive financial compensation.

Important! Providing money for unused vacation days is a mandatory measure that the employer undertakes to comply with, as it is prescribed in the Labor Code.

The employer is obliged to pay compensation for unused vacation days

It doesn’t matter what kind of contract you entered into with your superiors - fixed-term or open-ended - the amount is calculated based on all remaining vacation days. When you decide to leave a position mid-year, the total applies to all time carried forward from previous years and 14 days from the current year. The calculation of deadlines and corresponding monetary compensation in such a situation is carried out by an employee of the personnel department and the company’s accountants.

There are cases in which a person had to engage in work activities during vacation (while working part-time). Thus, by the day of dismissal, the person had accumulated approximately 30.2 days of unused vacation. When management does not accept the use of fractional numbers, it is allowed to increase the period to a full day in favor of the employee, that is, 31 days. All this is stated in the recommendations of the Ministry of Health of our country.

Important! Compensation will be provided to you only if you write a statement. In other words, when writing a letter of resignation, you must indicate whether you intend to use the rest of your vacation time or not. There is absolutely no need to specifically write about compensation in the application, since management will do all the calculations on their own based on the Labor Code.

To receive compensation you need to write an application

Is it possible to compensate for unused extras? vacation with money?

In accordance with Article No. 126 of the Labor Code (LC) of the Russian Federation, part of the annual paid leave that exceeds 28 calendar days can be compensated in money.

In addition to the main rest, some employees are also entitled to additional rest by law. This type of leave can be provided either with financial compensation or without pay. Paid additional rest is provided for: employees with irregular work schedules, athletes working in special conditions, liquidators of the Chernobyl disaster, coaches, etc.

The employer has the right to expand the list of employees who will be granted such leave in the local regulatory acts of the organization. It should be noted that if unused days of the main vacation accumulate, then with additional leave everything is different. If a person does not take advantage of the right to take preferential leave during the year, then it will not be transferred to the next period.

Due to their poor financial situation, many employees do not want to take such days off. The relevant question is whether additional leave can be replaced with monetary compensation. In this case, the employee continues to work and receives wages. With material compensation for unused vacation, his income increases. There are no direct prohibitions in the law that additional leave cannot be compensated with money.

The only thing is that four conditions must be met:

- the vacation is paid;

- the employee is not included in the category of persons who should be granted leave in full;

- the subordinate expressed a desire to replace rest with money;

- the employer has agreed to compensate the vacation.

If the additional vacation does not provide for continued pay, then no monetary compensation will be paid for it. Therefore, if desired, an employee can demand financial resources from the employer only for unused days of preferential leave with pay.

Article No. 126 of the Labor Code states that it is unacceptable to replace an additional type of rest with monetary compensation for the following categories of workers:

- those employed in special, dangerous and harmful working conditions;

- minors;

- pregnant women.

Such employees should take advantage of the opportunity to take additional paid days off. Other categories of workers are not prohibited from replacing preferential rest with a cash payment. But this is done at the request of the employee.

An employer does not have the right to arbitrarily deprive a subordinate of the opportunity to rest as provided by law.

Expert opinion

Irina Vasilyeva

Civil law expert

It is mandatory to provide monetary compensation for unused days of additional leave in the event of an employee being laid off, dismissed at his own request or by agreement of the parties. This point is reflected in Article No. 127 of the Labor Code of the Russian Federation.