Clause 1 of Part 1 of Art. 333.36 of the Tax Code of the Russian Federation exempts from paying state duty workers who apply to courts of general jurisdiction with claims for the recovery of employee wages, pay for civil servants and military personnel, and other requirements arising from labor relations, as well as with claims for the recovery of benefits. The same norm is contained in Article 393 of the Labor Code of the Russian Federation.

In addition, Article 393 of the Labor Code of the Russian Federation exempts plaintiffs from paying state duty in claims regarding non-fulfillment or improper fulfillment of the terms of an employment contract that are of a civil nature.

State duty for refusal of a claim regarding labor relations

Exemption from payment of state duty applies regardless of the outcome of the court's consideration of the claim. The costs of paying the state duty are not recovered from the employee even if the claim is refused partially or in full (Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2021 No. 15 “On the application by courts of legislation regulating the labor of employees working for employers - individuals and for employers - small businesses that are classified as micro-enterprises").

As explained by the Supreme Court of the Russian Federation, the rule on exempting an employee from legal costs when considering a labor dispute is aimed at ensuring his right to judicial protection in order to provide him with equal access to justice with the employer. Therefore, it is unlawful to impose on an employee the obligation to pay a state fee if the decision is made in favor of the defendant, both in the first instance and during the review of the case (Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated October 6, 2014 No. 18-KG14-123) .

Payment of state duty by the employer in a labor dispute

Only employees, and not employers, are exempt from paying state fees for claims arising from labor relations (Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 16, 2006 No. 52 “On the application by courts of legislation regulating the financial liability of employees for damage caused to the employer”). Therefore, the employer, in a claim against an employee, is obliged to pay a state duty in the usual amount established by Art.

333.19 of the Tax Code of the Russian Federation:

- if the claim is non-property - in the amount of 6,000 rubles for employers - organizations, and in the amount of 300 rubles for employers - individual entrepreneurs (clause 3, clause 1, article 333.19 of the Tax Code of the Russian Federation);

- if the claim is property (for example, compensation for damage caused to an employee), the state duty on it is paid in the amount established by clause. 1 clause 1 art. 333.19 of the Tax Code of the Russian Federation (Resolution of the Plenum of the Supreme Court of the Russian Federation of November 16, 2006 No. 52):

State duty for appealing GIT orders

The employer pays a state fee when appealing an order of a state labor inspector, as well as when filing complaints against decisions of the labor inspectorate in the amount of:

- 2000 rubles for employers of organizations) or

- 300 rubles for employers - individuals (IP).

This state duty is established by paragraphs. 7 p.

1 tbsp. 333.19 of the Tax Code of the Russian Federation for filing administrative claims to invalidate non-normative legal acts, as well as to invalidate decisions, actions or inactions of government bodies, which include the State Labor Inspectorate and its territorial divisions.

Still have questions? Contact a lawyer. The information above is general in nature and is not a substitute for legal advice regarding your specific dispute.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

Labor relations between employers and employees are formalized by an agreement establishing mutual obligations and rights and are regulated by the Labor Code of the Russian Federation, state laws, agreements, and other regulatory documents.

Between the parties to such an agreement, misunderstandings and contradictions may arise regarding certain aspects of their relationship: the amount of payment, working conditions, compensation and benefits, etc. In legal practice, such disagreements are called individual labor disputes.

If a group of people comes into conflict with the employer, the dispute is called collective. The procedure for eliminating mutual claims is determined by the Labor Code of the Russian Federation.

Worker group lawsuit

In the Code of Civil Procedure of the Russian Federation, in particular in Art. 40, does not contain such a term as “class action”. We are talking only about procedural complicity. At the same time, Part 3 of Art. 40 of the Code of Civil Procedure of the Russian Federation specifically emphasizes that each of the plaintiffs in such a situation acts in relation to the defendant-employer independently.

Accordingly, employees have the right to file a joint claim against the employer. In practice, this means combining several independent claims for payment of wages within the framework of one proceeding. In this case, each of the plaintiffs will need to either represent their interests independently or entrust this to one of the employees (or his representative). This will require a power of attorney. There are no special requirements for filing a joint claim. That is, it will be formalized according to the rules of Art. 131 and 132 of the Code of Civil Procedure of the Russian Federation with the difference that there will be several plaintiffs. Consequently, it will be more convenient to divide the claim into blocks for each employee (to describe the situation, calculate the amount of debt, etc. separately).

Resolution of individual disputes in courts of first instance

Art. 391 of the Labor Code of the Russian Federation names a list of employee claims that can be resolved exclusively in court:

- Cancellation of the dismissal order and reinstatement;

- On transfer at the request of the plaintiff to another job due to various circumstances;

- On compensation for the difference in pay for the period of filling a lower-paid position;

- About the amount of compensation for absenteeism due to reasons beyond the employee’s control;

- On changes in the order of data on the reasons for termination of work and the date of dismissal;

- About violation by the employer of the procedure for protecting personal data.

Only a court can consider an employer's claim for damages against an employee in the amount of material damage caused. On other issues, the parties can file a complaint with the labor dispute commission, the formation and procedure of which is established by the Labor Code of the Russian Federation.

The members of the commission, having considered the complaint, may refuse to make a decision or make it in favor of the employer. Then the employee needs to apply to the courts to protect his interests.

An employee can immediately file a claim on any issue. The hearing of the case is scheduled in the district court at the location of the defendant.

Jurisdiction of labor disputes regarding the collection of wages

Jurisdiction of labor disputes means that all rights with which a conflict situation can be considered and resolved belong to the court.

In other words, the concept of Jurisdiction means that an employee of a particular company can go to court in order to protect his own rights or prevent violation of interests.

Each jurisdiction is divided into a generic or territorial component.

How are issues of jurisdiction and jurisdiction of collective labor disputes resolved?

To resolve issues of jurisdiction and jurisdiction, you first need to choose which court to go to - the world court or the district court.

Each judicial institution has a territorial location in which various rights can be exercised. As a rule, labor disputes are often referred to the district court.

At the same time, it is necessary to distinguish them from civil law. Disputes are considered regarding the jurisdiction of such cases.

On compensation for damage by an employee

Article 23 of the Civil Code of the Russian Federation listed the main conflicts that are subject to justices of the peace. After carefully analyzing them, no labor disputes were found.

Therefore, jurisdiction over labor disputes regarding compensation for damages by an employee is exercised by the district court. If the employer did not pay wages on time at the time of dismissal of the employee, the second may recover it in court.

To do this, you need to contact the nearest district court.

The claim should be filed in the district court of the defendant, in particular the employer. If the wages were not paid by the representative office or branch of the organization, then the applicant may send an application to the location of this representative office or branch. You can choose which institution to file your claim with.

You can submit it either at the location of the company’s head office or branch. The procedure for late payment of wages has a certain peculiarity. If an employee intends to demand his own wages from the defendant, then the claim should be filed in the district court of the region in which the company is located. Collection can also be made by order.

In order to issue such an order, it is necessary to contact a magistrate.

Territorial jurisdiction for labor disputes

Residents who do not want to file a claim at their place of registration can use the rules for determining jurisdiction. They are also valid in 2021. First you need to choose the right court. In the application, indicate the method of protection.

Its period ranges from 90 days to 360. If we are talking about a disagreement that affects the topic of dismissal, the maximum period for filing an application is one month from the date of dismissal.

This is stated in Article 392 of the Labor Code of the Russian Federation.

Jurisdiction of labor disputes regarding reinstatement at work

The procedure for reinstatement to a previous position is an integral part of the system with which the rights of an employee can be protected.

Of course, you can be reinstated if mistakes were made when completing documents. However, your relationship with your employer is unlikely to be smooth, because no one likes court cases.

Therefore, first, try to be restored to your previous position peacefully.

State duty for employees

In the Russian Federation, filing an application with the courts is accompanied by the transfer of state fees in a certain amount to the budget. This fee is regulated by the Tax Code. The state duty on labor disputes in accordance with Article 333.36 of the Tax Code of the Russian Federation is not paid for the following claims:

- About non-payment of wages;

- On the collection of social benefits;

- For other issues arising as a result of the labor relationship between employer and employee.

The opportunity for workers filing claims in cases of labor disputes not to pay state duty is provided for in Art. 393 Labor Code of the Russian Federation.

It provides for exemption from all legal costs in any amount. This means that, even after losing the court, the plaintiff does not have to reimburse the funds spent on experts, translators, the amount of postage, transportation and other expenses of the parties and third parties associated with being summoned to a meeting, etc.

In the event that an individual dispute is lost, the court will not make a decision on the recovery of costs. This is explained in the documents of the plenary session of the Supreme Court No. 2 dated March 17, 2004.

State duty on labor disputes

Individual labor disputes that arose between an employee and an employer and, in general, were not resolved with the help of a labor dispute commission, are resolved in court. And in some cases, disputes between the parties to labor relations are considered exclusively by the court without the involvement of the labor commission (Articles 382, 391 of the Labor Code of the Russian Federation). We will tell you about the state fee paid when going to court in connection with a labor dispute in our consultation.

This is important to know: Application to the bailiff service for debt collection under a writ of execution: sample

State duty for the employer

The employer has the right to file a claim in the only case - if as a result of actions on the part of the employee, he suffered material damage. This can be done no later than a year from the moment the fact was discovered.

It turns out that the employer files a property claim in court. That is, this is no longer a labor dispute; the state duty in accordance with Article 333.19 of the Tax Code of the Russian Federation must be paid.

Its size will depend on the cost of the claim, but if it was not possible to estimate the amount of material damage, the employer will pay 6,000 rubles. If he wins the trial, he will be exempt from state fees and has the right to a refund of the funds spent.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

Art. 393 of the Labor Code of the Russian Federation has nothing to do with the employer. If he is the losing party, he will have to pay the costs of the defendant and the third party in the amount determined by the court.

How to file a claim, what documents to attach, state fees

A statement of claim for non-payment of wages is drawn up according to the rules of Art. 131 and 132 of the Code of Civil Procedure of the Russian Federation. A current sample statement of claim for recovery of wages, drawn up based on the listed requirements, is presented below.

The header of the application for the recovery of wages shall indicate:

- the name of the court where the plaintiff is applying;

- information about the applicant (initials and address);

- information about the defendant (if it is a company, then name and address, as well as identifiers - TIN and OGRN).

The main part of the statement of claim for recovery of wages must include:

- the essence of the violation of the employee’s rights;

- circumstances confirming the employee’s correctness;

- calculation of claims and, accordingly, the cost of the claim.

For the convenience of readers, the above points in relation to the indicated situation are described in detail in the sample claim for payment of wages presented above.

The document must be dated and signed by the employee.

For reference: in addition to the salary amount, an employee can also collect interest for the use of his funds according to the rules of Art. 236 of the Labor Code of the Russian Federation in the amount of 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay, starting from the moment when a specific part of the salary should have been paid until the moment of actual payment.

The amount of state duty when applying to higher judicial authorities

If the district court leaves the claim for violation of rights unsatisfied, the employee can successively file an appeal, cassation and supervisory complaint. How and in what amount is the state duty paid on labor disputes in this case? The Court of Appeal is reviewing the case anew.

This is the first instance, but in a different composition; accordingly, there are benefits for exemption from payment of state duty for plaintiffs provided for by the Tax Code.

The Court of Cassation is the next step, which does not consider the labor dispute itself, but evaluates the correct application of legislative acts in previous decisions. On the basis that the Labor Code of the Russian Federation does not specify in which courts employees do not have to pay the state duty, when filing a cassation appeal the state duty is not paid.

In this regard, there is a ruling of the Constitutional Court of the Russian Federation dated December 21, 2011, which fully confirms this conclusion.

The supervisory complaint is submitted to the presidium of the court of the republic, territory, region in which previous claims were considered. What is the amount of the state duty if a labor dispute is resolved in a supervisory authority, is explained in a letter from the Ministry of Finance dated 05/05/2011.

The ministry’s conclusion is clear - the state duty must be paid in accordance with Art. 333.19 Tax Code of the Russian Federation.

For claims related to non-property interests of individuals, its amount is 200 rubles. For legal entities, the state duty will be 400 rubles.

You can see how to make a payment through Sberbank

How to recover wages through court: step-by-step instructions

If the problem cannot be resolved peacefully, you need to go to court.

What does the legal recovery procedure look like step by step:

- Preparation of evidence.

- Drawing up a statement of claim.

- Sending a copy of the application to the defendant. From 2021, this responsibility falls on plaintiffs.

- Submission of statements and evidence to the court.

- Receive notice of the date of the court hearing.

- Participation in meetings. First, the preliminary is carried out, then the main. There may be several hearings. The parties will have to defend their positions and present evidence.

- Receiving a certified copy of the decision within five days after its issuance (Article 214 of the Code of Civil Procedure of the Russian Federation).

The decision comes into force one month from the date of adoption in its final form (Article 321 of the Code of Civil Procedure of the Russian Federation). If the plaintiff or defendant does not agree with the results of the proceedings, they have the right to appeal everything through the appellate authority.

Where to contact

As a general rule, the application is submitted to the court at the place of residence of the defendant or location of the organization (Article 28 of the Code of Civil Procedure of the Russian Federation).

Documentation

When going to court you will need (Article 132 of the Code of Civil Procedure of the Russian Federation):

- Passport.

- Statement of claim.

- Proof.

- Power of attorney for a representative.

- Employment contract (if any).

- A claimant's or lawyer's estimate of the amount of money to be recovered. Copies are also needed in quantities equal to the number of participants in the process.

- Documents confirming the sending of a copy of the application to the defendant (for example, a notification of delivery).

Note! Copies are made of the originals of some documents, then everything is returned to the owner.

State duty

According to Art. 333.36 of the Tax Code of the Russian Federation, citizens in claims for recovery of wages and other labor disputes are exempt from paying state duty.

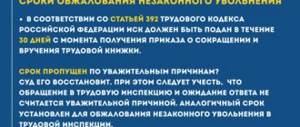

Statute of limitations

According to Art. 392 of the Labor Code of the Russian Federation, the statute of limitations is one year from the day the defendant was supposed to pay wages. If the employee missed it for valid reasons, an application for reinstatement of the deadline must first be submitted.

Good reasons include illness, stay in another city, long-term treatment, etc.

Who pays the state fee for filing a class action and how much?

Collective disputes are a very serious matter, because the interests of a large number of people are affected. Such conflicts between workers and employers can lead to a strike. Therefore, the Labor Code of the Russian Federation provides for a multi-stage system for pre-trial resolution of collective disputes.

Government bodies can be involved to resolve conflicts. Collective labor disputes rarely go to court. In cases where a claim is nevertheless filed, the state duty is not paid, because the plaintiffs are employees, and the subject of the claim is disagreements arising from labor relations.

Exemption of workers from reimbursement of expenses in the judicial settlement of labor disputes expands their ability to protect their interests and provides equal access to justice with the employer.

It is common for a dispute to arise between an employer and an employee. If the resolution of the conflict reaches a dead end, and even the labor dispute commission is unable to resolve it, then you have to go to court.

One of the mandatory conditions that must be met when filing an application with the court is the payment of the state fee. As a rule, the consideration of the case starts only after the amount specified by law is transferred to the state account. Typically, the payment of the state fee is made by the person filing the claim.

Labor dispute concept

The employer is often to blame for conflicts because he ignores the law. Here are a few examples: the boss does not pay wages or gives them in an envelope, refuses to transfer benefits during maternity leave, dismisses employees, forgetting about the algorithm for imposing penalties prescribed in the Labor Code of the Russian Federation (LC RF).

Such actions by the employer serve as grounds for going to court. However, a contract does not have to be signed between the parties. Even before joining the company, an unpleasant situation may occur. This is due to the fact that now many job advertisements are compiled incorrectly.

It is important to know! Often, recruiters do not hide the fact that they need young workers under 25 with a good appearance. Thus, the rights of other applicants are violated, since the refusal of employment must be related to professional qualities. Candidates for a vacant position can accept failure or appeal the demands of managers in court.

You can transfer the conflict into a peaceful direction by organizing negotiations or creating a commission at the enterprise. Next, you should get together and discuss the situation that has arisen, and come to a solution that will suit both parties. If the first participant needs to resolve the issue, but the opponent refuses to dialogue, then all that remains is to contact the competent structures or the court.

Two signs of a labor dispute:

- Disagreements arose between a boss and a subordinate regarding payment of wages, compliance with discipline, and other issues.

- The conflict has been referred to a court or other authorized body.

An individual conflict is a disagreement that arises between two participants. When the interests of several employees in an enterprise are violated, this is a collective dispute.

Nowadays, instead of an employment contract, a contract for the provision of services is often signed. Misunderstandings may also arise between the parties to civil law relations. But this is a different nature of the dispute, and it is resolved in the manner prescribed by the Civil Code of the Russian Federation.

State duty and determination of its size

State duty means a mandatory fee, the payment of which is provided for by law in case of contacting a government agency when there is a need for it to implement a certain function.

When there is a property dispute (providing for the recovery of material resources from the guilty party), the amount of state duty is calculated based on the monetary compensation provided for in the claim.

If we are talking about non-property claims, then the amount of the state duty on labor disputes is determined by the current regulatory documents and is fixed. The amount is different for individuals and legal entities: the former must pay 300 rubles, while the latter – 6,000 rubles.

Payment options

The state duty on labor disputes can be repaid in one of the following ways:

- by depositing cash at Sberbank branches through cash desks or special terminals;

- by cash payment at one of the post offices;

- non-cash method by transferring from the company's current account.

In order to confirm in court that the state duty has been paid, it is necessary to request a receipt for this transaction from the department where the money was deposited.

Payment of state duty by employees

Article 393 of the Labor Code sets out a rule according to which the state duty on labor disputes is not paid by employees if the claim is filed in a court of general jurisdiction.

In addition, there is a ruling of the Constitutional Court, from which it follows that workers are also exempt from paying state duty if they file claims regarding labor disputes in the appellate courts.

At the same time, payment of the required amount to employees cannot be avoided when the case is scheduled to be considered in the supervisory and cassation courts. Moreover, the transfer of the proper amount must be made regardless of whether the case is a losing or winning one for the employee himself.

The amount of state duty on labor disputes in this case is determined by paragraph 1 of Article 333.19 of the Tax Code.

What documents are attached to the application?

Copies of documents on claims for reinstatement at work are attached according to the number of persons participating in the case. A sample list of them looks like this:

- Work record book or extract from it.

- Employment contract.

- The order in accordance with which the employee was dismissed.

- Certificate of salary (tariff rate) and average earnings of the plaintiff.

- Documentation from the labor inspectorate (if available).

Documents confirming the illegality of dismissal may include written explanations from colleagues and other witnesses, certificates confirming a valid reason for absence from work (certificate of incapacity for work, certificate of illness of a close relative), as well as other documents related to the case.

Nuances of payment of state duty by legal entities-employers

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

The norms of labor and tax legislation when resolving labor disputes in court do not provide for any benefits regarding the transfer of state duties from employers who are legal entities.

Article 392 of the Labor Code of the Russian Federation dictates the possibility of an employer filing a lawsuit against its employee only in order to recover from the latter the amount of material damage caused to him. The amount of the state duty for labor disputes in this case will be floating and dependent directly on the cost of the claim, determined by the amount of property damage caused.

If a property claim is filed, the price of which cannot be properly determined, then the employer-legal entity must pay a fixed amount of 6,000 rubles. Complete exemption of the employer from transferring state duty is possible provided that the court makes a decision in his favor.

Specifics of the claim after dismissal

Wage arrears can be owed either to a working employee or to one who has already been fired. If you file a claim for recovery of wages after dismissal, you should remember one important feature - the statute of limitations.

The specifics of this point are specially emphasized in paragraph 56 of the resolution of the Plenum of the Armed Forces of the Russian Federation “On the application ...” of March 17, 2004 No. 2. Thus, if the employee continues his employment relationship with the company, then the statute of limitations is not applicable at all to disputes regarding the collection of wages, since the employer’s violation is considered lasting until the debt is repaid. This conclusion of the Plenum of the RF Armed Forces, although not entirely compatible with the rules of Part 2 of Art. 392 of the Labor Code of the Russian Federation, but it is quite logical due to the need to ensure the protection of employee rights.

But if an employee is fired, then the statute of limitations, based on established judicial practice, will begin to be calculated from the moment of his dismissal.

For reference: in contrast to the general three-year limitation period for the collection of wages, a shortened period is provided, which is 1 year in accordance with Part 2 of Art. 392 Labor Code of the Russian Federation.

Persons exempt from paying state duty

Article 333.35 clearly defines the list of persons who do not need to pay state fees when applying to the court:

- WWII veterans and those who became disabled during hostilities, as well as persons who were captured;

- citizens who were forcibly held by the Nazis in concentration camps and similar places of confinement;

- received the title of Hero of the USSR or Hero of the Russian Federation;

- full holders of the Order of Glory.

The employer is given the opportunity, when filing a claim for compensation for material damage incurred as a result of the employee’s actions, to include the amount of the state duty in the claims presented to the guilty employee.

State duty when applying to the courts of second instance

To the Court of Appeal

The Tax Code contains a rule that exempts a person filing a claim in connection with a labor dispute in a court of general jurisdiction from paying state fees. However, if a person remains dissatisfied with the decision, he can appeal to the judicial organization of the second instance, and the Tax Code does not say anything regarding exemption from paying state duty in this case.

The employer will not be able to avoid paying the fee if he decides to file a complaint with the appellate authority, since neither tax nor labor legislation provides for any benefits for him. An appeal is allowed within 10 days from the moment the court of first instance made its decision.

To the Court of Cassation

If an employee wants to challenge a decision of the court of first instance that has already been made and has already entered into force, he will have to appeal to the court of cassation, which also belongs to the second instance. The employer has the right to file the same complaint.

Based on the above-mentioned Determination made by the Constitutional Court, the employee does not need to pay the fee, while the employer is responsible for paying the full amount of this payment.

However, on May 5, 2011, the Ministry of Finance published a letter according to which the employee is not exempt from paying state duty if he decides to file a cassation and supervisory appeal. In this case, the amount of payment is determined based on the norms prescribed in paragraph 1 of Article 333.19 of the Tax Code.

Example of a statement of claim

To the Tyndinsky District Court of the Amur Region

Plaintiff: Viktor Vyacheslavovich Afanasyev, address: 676282, Tynda, st. Zhemchuzhnaya, 70

Defendant: Limited Liability Company "ProfiYur", address: 676282, Tynda, st. Vasnetsova, 156,

TIN 8594359566326, OGRN 154896552482

Claim for reinstatement at work

On March 17, 2021, the plaintiff was hired as an economist in the planning and economic department at ProfiYur LLC. I worked in this position until July 1, 2022. The employment relationship was terminated due to the reduction of the position. On April 30, 2022, the head of the personnel department of ProfiYur LLC personally handed me a notice of job reduction effective July 1, 2022. I became familiar with the notice and order on April 30, 2022.

The employer did not offer me any vacant positions at the time the notice was given. On June 29, 2022, the employer offered 2 vacant positions: assistant economist and assistant payroll accountant. At the same time, according to the staffing schedule of ProfiYur LLC, at the time of the procedure for reducing my position in the organization, there was a vacant position of the head of the economic department, as well as a procurement economist.

In accordance with Art. 180 of the Labor Code, when reducing staff, the employer is obliged to provide the employee with another job available to him. In accordance with Art. 179 of the Labor Code, family citizens (if there are two or more dependents) have a priority right to remain at work.

I am married to Afanasyeva Elena Viktorovna, she is currently not working. We have 2 minor children. In accordance with Art. 81 of the Labor Code, the employer is obliged to offer the employee all vacancies available to him in the given area. The employer did not offer me positions that match my qualifications.

Furthermore, in accordance with Art. 82 of the Labor Code, the employer was obliged to notify the primary trade union organization no later than 2 months before dismissal

Dismissal of employees who are members of a trade union is carried out taking into account the opinion of the trade union organization. When I was dismissed on July 1, 2022, under Part 2 of Art. 81 of the Code, the opinion of the trade union was not taken into account; all vacant positions were not offered to me. The order of organizational and staffing activities has been significantly disrupted. In addition, on July 14, 2022, the position of specialist in the planning and economic department was reintroduced into the staffing table, and on July 15, 2022, a new employee was hired for this position. Thus, there was no need to carry out organizational and staffing measures. This means that the reduction was illegal.

Based on the above, guided by Art. 81, 82, 179 Labor Code,

Ask:

- Reinstate Viktor Vyacheslavovich Afanasyev to his job as an economist in the planning and economic department of ProfiYur LLC, oblige him to pay wages for the period of forced absence and compensate for moral damages in the amount of 25,000 rubles.

Application:

- Employment history;

- Employment contract;

- A copy of the notice of layoff;

- A copy of the list of positions proposed for replacement in connection with staff reduction;

- Extract from the dismissal order;

- Notification of sending documents and claims to the defendant.

Afanasyev V.V. July 20, 2022

Summing up

Thus, payment of the state fee is one of the mandatory conditions for the court to consider the claim. The employee does not need to make this payment if he goes to the district court or files an appeal to the second level court to appeal the previous decision.

An appeal through a cassation or supervisory procedure does not relieve you of payment. When filing a claim of a non-material nature, the employer must in any case pay a state fee in the amount established by the regulations.

During a working interaction, the parties may be dissatisfied with each other or question the legality of a particular action. The dispute can be resolved independently, and if a positive result is not achieved, then either party to the employment agreement can file a claim in court.

Courts charge a fee for the consideration of cases, the amount of which depends on the subject of the dispute and on who the applicant is - an individual or a legal entity. The state duty on labor disputes is regulated by the legislative norms of the Russian Federation, and its collection is carried out in accordance with the established procedure.

Payment order

The state fee is always paid in advance before the claim is accepted for consideration. Since taxes are not charged to the employee, he can simply submit an application supported by a package of supporting documentary facts. But the employer must independently or with judicial consultation calculate the amount of preliminary payments and make the payment to the bank account of the court. To make a payment, it is best to contact the court directly, where you can get specific details, or go to the department’s website and download the receipt form there.

After consideration of the case, the employer may be returned the amounts spent by collecting them from the employee found guilty of causing material damage.

Also, the amount of payments may be increased if, during the consideration of the case, circumstances are identified that could increase financial requirements. The established additional payment is made based on the outcome of the decision on the case and is assigned either to the applicant or to the defendant.

Cases of going to court

To resolve any disagreements that arise during the interaction between the parties to an employment contract, there are several recommended ways:

- Internal settlement, when an agreement is reached within the organization itself without the involvement of outside specialists.

- Contacting the Labor Inspectorate. This service was created precisely to maintain a balance of interests of the employer and employees.

- A petition to the prosecutor's office, which must not only be considered, but also based on it, the circumstances must be checked and violations identified.

The injured party can choose any of the proposed ways to solve the problem, you can not adhere to hierarchy and apply those measures that seem most necessary and effective.

If none of the chosen methods of resolving the dispute brings results, then the injured party can go to court.

Labor disputes initiated by employees may arise due to:

- Illegal dismissal from work, with a demand for reinstatement at work.

- Incorrectly specified reason for termination of the contract or its date.

- Transfer to another position without the employee’s consent.

- Wages not paid on time or not paid in full.

Employers may file claims based on the need to recover property damages.

Courts accept only individual claims for consideration, while collective claims are considered in a different manner with the creation of a special labor commission.

Where to file a claim for reinstatement?

Cases regarding the reinstatement of citizens at work fall under the jurisdiction of district (city) courts (clause 1, part 1, article 22 of the Code of Civil Procedure of the Russian Federation). As a general rule, the claim must be filed in court at the location of the employer. But in cases where the employment contract specifies a specific place for performing work duties or the employer has branches, the plaintiff has the right to choose.

The injured worker may contact the Labor Inspectorate before filing a complaint or skip this step. Complaints to this authority are accepted within three months from the date of dismissal. After the inspection, TI employees can issue an order to the employer to eliminate violations, issue him a large administrative fine, and also help the applicant prepare documents for court proceedings.

The need to pay state duty

When submitting a statement of claim to the court, the applicant is charged a state fee.

A state fee is a payment that is made to the account of a specific organization for the fact that they will consider and register some fact. In the case of judicial proceedings, we are talking not only about registering a legal fact, but also about considering the case as a whole, as well as making a balanced and legally verified decision.

The state fee is paid before the claim is accepted for consideration, and a receipt for payment is attached to the general package of documents. However, this does not mean that you should not file complaints without a receipt.

The Tax Code of the Russian Federation provides many reasons for providing benefits, namely reducing the size of payments or their complete abolition. Before filing a claim, it is better to first clarify whether there is a benefit in this particular case.

For employee

The Labor Code of the Russian Federation and the Tax Code regulate that employees, when resolving individual labor disputes through courts of general jurisdiction, are exempt from paying duties.

Article 333.36 of the Tax Code of the Russian Federation states that a hired person cannot be subject to state duty if he files a claim for:

- payment of previously unpaid part of wages or other payments;

- accrual of penalties, fines, compensation for moral or physical damage caused;

- other issues that arise in the process of labor interaction.

When the case is reviewed by higher authorities, the employee also has no reason to pay for the appeal filed. Although the Tax Code does not clearly indicate this fact, the Constitutional Court made just such a decision when considering a dispute about the need to collect duties from individuals on labor claims.

For the employer

There is not a single article in the legislative norms of the Russian Federation that talks about the possibility of reducing the state duty or its complete abolition when resolving labor disputes for employers. Moreover, the employer must pay the amount that is calculated for legal entities.

An employer can file a claim only in one case, if it claims the need for financial penalties from the employee. In this case, the fee directly depends on the amount of the claim. It is noteworthy that the collection of legal costs from the employing organization is carried out not only when it is the applicant, but also if it acts as a defendant.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

The employer pays the full amount of state duty when applying to courts of general jurisdiction, appellate and cassation instances, and supervisory judicial organizations.

The state duty will not be charged to the employer if the guilt of the employee is established, and all penalties will be made from him.

Important aspects

Disputes between various entities are considered through judicial proceedings. If the parties to the conflict are individuals, then the case is conducted by courts of general jurisdiction; if the dispute concerns business activities, then the conflict is resolved by arbitration.

In any case, as a general rule, the plaintiff or applicant is obliged to pay the state fee in the prescribed amount.

The amount of the fee depends on the category of the case, as well as on the amount of claims. The procedure for its calculation is determined by the Tax Code of the Russian Federation.

If the state fee has not been paid, the claim will be returned to the applicant and the case cannot be considered.

However, some categories of cases are considered without paying a fee. More precisely, the amount is not paid by the plaintiff himself when filing a claim; it is subsequently assigned to the losing party.

A dispute is considered a labor dispute if an employment contract or a contract for the provision of services was previously concluded between the parties.

Changing the text of such an agreement unilaterally is not allowed, even if the original version indicates such a possibility.

As a general rule, no state fee is charged for the consideration of such disputes. However, the situation must be considered on an individual basis.

Initial Concepts

| Labor dispute | Dispute between an employee and an employer regarding their labor relations or relations arising on the basis of a concluded agreement for the provision of services and performance of work |

| Essential terms of the agreement | Such conditions that must be present in the text of the transaction without fail. Otherwise, the contract will be considered invalid |

| Court | Government body that considers and resolves disputes between various entities |

| Court of General Jurisdiction | A court that hears disputes not related to business activities. The structure of courts of general jurisdiction includes city, district courts, as well as magistrates |

| Government duty | A fee charged to a person who applies for an action that may result in certain legal consequences. |

| Cassation | This is the next instance that considers complaints against decisions that have already entered into force, after refusal to appeal through the appeal procedure |

What issues do people go to court for?

Labor conflicts can be resolved in various ways. We are talking about holding negotiations, contacting a labor commission or labor inspectorate.

If it is not possible to resolve the dispute pre-trial, the parties have to file a claim in court.

Individual disputes between an employee and an employer are considered by magistrates, with the exception of disputes regarding the collection of wages (and other payments), which are considered by district and city courts.

An employee has the right to go to court in the following situations:

- He was illegally fired and wants his job restored.

- The employee was dismissed for another reason and wants to change the wording in the work book. For example, he resigned of his own free will, but the employer ignored his statement and fired him due to inadequacy for his position. Such an entry in the work book will have serious consequences for future employment.

- He was transferred to another position or territory illegally. Any transfer must be carried out in compliance with legal procedures.

- He was not paid wages or other legal benefits, such as a bonus.

- In accordance with other grounds expressly provided for by current legislation.

The employer, in turn, has the right to file a claim for compensation for damage caused by the employee as a result of his unlawful actions.

The courts also consider the following disputes:

| If the employee was refused employment without explanation or the reason was unlawful | For example, denied due to age, gender, etc. |

| Dispute between individuals, where one of them acts as an employer | The legislator allows the conclusion of such labor disputes. In this case, an employment contract must be concluded between the parties to perform any work |

| Employees of religious organizations also have the right to file a claim in court | Since such organizations do not have labor commissions |

In fact, any conflicts between an employee and an employer can be resolved in court.

And if the dispute is directly related to labor activity, it will be considered taking into account the norms of the Labor Code of the Russian Federation.

Current standards

Legal regulation is carried out on the basis of the following legal acts:

| Labor Code of the Russian Federation | This legal act defines the features of the legal relationship between an employee and an employer, establishes mutual rights and obligations, and so on. |

| Civil Procedure Code | Defines the features of the judicial process and requirements for statements of claim |

| Tax Code of the Russian Federation | Establishes the amount of the state duty, and also determines when this duty may not be paid |

It is also worth paying attention to judicial practice, which in some cases allows you to more deeply understand the situation and consider its perspective.