Early registration of a pension in the event of a layoff is possible only in cases where a person has 2 years left before a well-deserved rest. This condition is regulated by Art. 32 of the Federal Law “On Employment”.

Early pension is calculated using an identical formula with payments made on a general basis. In addition, the citizen will have to officially confirm his unemployed status. Let's consider the main provisions that provide the basis for calculating pension payments.

Download for viewing and printing:

Law of the Russian Federation of April 19, 1991 N 1032-1 “On Employment”

Upon reaching age

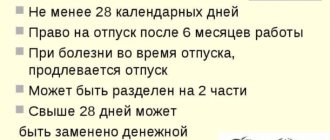

The calculation of old-age pensions is regulated by Article 8 of the Federal Law “On Insurance Payments”. The law states that such accruals are due to every citizen of Russia, subject to the following requirements:

- reaching retirement age;

- length of service required for minimum payments;

- the minimum permissible number of accumulated pension points.

Now we will give detailed explanations for each point. According to current legislation, the retirement age of Russian citizens is 60 and 55 years old, for males and females, respectively. Please note that there is a possibility that the retirement age will increase in the future.

To count on an old-age pension, the insurance period must be at least 6 years. By 2024, the numbers will increase to 15 years.

Here you need to clarify what is taken into account:

- actual transfers to the pension fund made by the employer;

- periods when a citizen did not work:

- service in the armed forces;

- maternity leave to care for a child;

- receiving unemployment benefits;

- after registration at the city employment center.

Important!

Pension points or personal coefficient are set at 6.6. In the future, it is planned to increase the coefficient annually to 30 points. Download for viewing and printing: Federal Law of December 28, 2013 N 400-FZ, as amended.

dated 12/19/2016 “On insurance pensions”

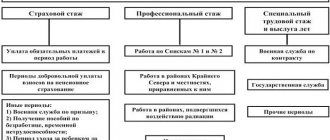

Insurance experience

This concept means the total period of work or other activity during which contributions were made to the Pension Fund of the Russian Federation.

Other activities - time:

- completing military service;

- full-time studies in secondary and higher educational institutions;

- being on sick leave for health reasons, caring for a child or a disabled family member, etc. (Article 11 Law of the Russian Federation No. 173-FZ of December 17, 2001).

If this length of service is greater than the level established for registration of early state support, for each year of excess it is allowed to receive 2 weeks of benefits.

Its total payment period is limited to two years.

Early retirement in case of layoff

Considering the current economic situation in the country, a reduction in staff or a complete cessation of the company’s activities is far from uncommon.

Such manipulations primarily affect people of pre-retirement age. For obvious reasons, such a citizen is unlikely to be able to get another job with a commensurate salary and working conditions. Those who find themselves in this situation have two options:

- Registration at the labor exchange.

- Registration of early pension.

The second option looks more attractive, but early processing of the required transfers is possible if certain requirements are met.

In particular:

- The applicant officially receives unemployed status;

- The insurance period is 25 and 20 years for men and women, respectively;

- There are no more than 24 months left until the retirement age established by law;

- The labor exchange cannot offer suitable vacancies.

Important!

The last item on the list often becomes impossible to achieve. Employment centers constantly offer job seekers vacancies. If a person himself refuses the proposed options, early retirement becomes impossible. It should be noted that a citizen’s actual work experience may be below the legally established threshold.

This condition is relevant for professions associated with special working conditions.

How to properly fire someone from a position?

Step-by-step instructions for the procedure for dismissing a pensioner from his place of permanent work are as follows::

- First, a commission is created to review employees who are being laid off. To do this, an order is issued specifying the members of the commission and their role. This stage is not mandatory, but desirable. In court, a reduction with the participation of a commission will be more credible.

- Based on the commission's choice, an order to reduce staff is issued. It states which departments, positions and employees will be cut and who should be retained. The date by which all this should be completed is also confirmed.

- Two months before the redundancy date, each person being laid off is given a notice. Pensioners receive it in the same manner as other employees.

- Also, two months before the date of reduction, it is necessary to report it to the Trade Union and the Employment Center.

- Each employee is given an order against signature to familiarize himself with the plans of the enterprise. If he refuses to sign it, an act of refusal is drawn up.

- The notification offers a position corresponding to the education and qualification level.

- If the proposed position does not suit the employee, on the last day the pensioner writes a letter of resignation indicating the reason for staff reduction.

- The employee is given a personnel order for review against signature.

- Next, a work book is issued and a full settlement is made with the employee with the issuance of benefits.

You will find more information about the procedure for dismissal from work due to staff reduction in a separate article, and here we have presented a list of documents required to be completed.

Early pension for the unemployed

First of all, a citizen must register with the municipal employment center.

This is a mandatory condition to confirm your unemployed status. If there are less than 2 years left before the statutory retirement age, the labor exchange employees themselves will offer the applicant to arrange early payments. Let us note that the procedure is possible with the consent of the citizen, on the basis of a personally drawn up written application to the Pension Fund.

Having received the application, employment center specialists prepare the following documents:

- proposal to the Pension Fund for early pension payments;

- an extract about the periods of work that are included in the insurance period.

Download for viewing and printing:

Statement of claim for early pension assignment

With these documents, the citizen applies to the Pension Fund, where a decision will be made on granting him an early pension. Note that this is the required minimum. When applying, Pension Fund employees give the applicant their list of necessary documents to be prepared.

What payments are due?

Next, we will consider what payments an employee is entitled to upon dismissal due to reduction.

Severance pay

The amount of severance pay is calculated based on average monthly earnings . If a pensioner registers at the labor exchange in a timely manner, he will be paid benefits for 2 months, but will not be considered unemployed. If he does not register, he will be accrued severance pay once. There are groups of pensioners who can receive payments for more than 2 months:

- Persons with a disability group that allows them to continue working.

- Employees working in the Far North.

- Persons working in certain closed institutions.

Compensation

What compensation payments are due to a pensioner laid off due to redundancy?

The following types of compensation may be available::

- With merit to the enterprise.

- For unused vacation, if any.

- In case of early termination of an employment contract, additional funds are paid in the amount of average earnings, calculated in proportion to the time remaining before the expiration of 2 months.

Individual allowance

The law does not prohibit an employer from paying an employee an individual allowance for staff reduction and staff reduction (what are the differences between staff reduction and staff reduction?).

Amount of early pension for 2021

Such payments are calculated on a general basis, taking into account increasing factors. A little clarification needs to be made here. At the legislative level, payments are regulated by the federal law “On Insurance Pensions” of 2013. In addition, there is a law on payments of the funded part. The key feature is that citizens born in 1967 and older can count on a funded pension. Today's pensioners can only rely on the insurance portion.

You can find out the amount of early pension by applying the formula SP=PC*S*K+FV*K, where:

- SP - insurance pension;

- PC - pension savings;

- C - personal coefficient valid at the time of payment calculation;

- K - indexation of due accruals;

- FV - fixed payments.

Today, the amount of fixed payments established by the state is 4,823 rubles. In addition, to receive an early pension, a citizen must have 11 points. The established size of each is 78 rubles.

Let us clarify that the size of the fixed pension increases for the following categories of citizens:

- disabled people of the 1st health group;

- people involved in providing for dependents;

- persons living or working in northern conditions.

Fixed payments and personal coefficients are re-indexed annually, taking into account inflation.

Important! If the amount received during the calculation does not reach the minimum subsistence level, the size of the pension is artificially increased to the established norm by calculating social benefits. Download for viewing and printing:

Federal Law of December 28, 2013 N 424-FZ, as amended. dated 05/23/2016 “On funded pensions”

Amount of unemployment benefit for pre-retirees and payment period

The period during which unemployment benefits are paid to pre-retirees and the amount of payment are regulated by Article 34.2 of the Law of the Russian Federation No. 1032-1 of April 19, 1991 “On Employment in the Russian Federation”. At the same time, the minimum and maximum amounts of payments are established annually by the Government of the Russian Federation. For example, the standards for 2020 were approved by Resolution No. 346 of March 27, 2020:

- the minimum payment is 1,500 rubles;

- maximum - 12130 rubles.

If a pre-retirement pensioner lives in the Far North region or in an equivalent area, the minimum and maximum amount is established using the regional coefficient in the given area.

Using the table below, you can determine the size and period of payment of unemployment benefits depending on the category to which the pre-retirement person belongs:

| Payment term | Benefit amount |

| Those who applied for assignment of unemployed status within a year after dismissal for any reason, having 26 or more weeks of work experience | |

| no more than 12 months in total within 18 months | as a percentage of average monthly earnings for the last 3 months of work, but not more than the maximum established amount:

|

| Those who applied for assignment of unemployed status within a year after dismissal for any reason, without 26 or more weeks of work experience | |

| no more than 12 months in total within 18 months | minimum benefit amount (1500 rubles in 2021) |

| Dismissed for violation of labor discipline or illegal actions; persons sent by the employment service for training, but expelled for violations; those who applied for unemployed status a year or more after dismissal | |

| no more than 3 months in total within 12 months | minimum benefit amount (1500 rubles in 2021) |

Benefit amount for pre-retirees with extensive experience

For pre-retirees with a long work history, an additional increase in the period of payment of unemployment benefits is provided, in accordance with Part 2 of Art. 34.2 of Law No. 1032-1. However, this right is granted only to pre-retirees who contact the employment service within a year after dismissal.

The right to extend the period is granted to women with at least 20 years of experience and men with at least 25 years of experience. Citizens applying for an early pension (for example, due to disability) have the same right.

- For each year of work beyond the 20/25 years, the payment period increases by two weeks. For example, for a woman with 25 years of experience, another 10 weeks are added to the standard benefit period of 12 months.

- The total period of payment to a pre-retirement pensioner cannot be more than 24 months within 36 months.

Benefit calculation example

Irina Mikhailovna, born in 1965. I was laid off in 2020 and immediately after my dismissal I applied to the employment service to receive unemployment benefits. In 2021, she is considered a pre-retirement person, therefore payments in connection with her unemployed status will be paid according to the scheme provided for citizens of pre-retirement age.

Irina Mikhailovna’s average monthly earnings over the last 3 months of work amounted to 25,000 rubles. Accordingly, benefits will be paid according to the following scheme:

- The first three months - 12,130 rubles (75% of earnings exceeds the maximum benefit amount in 2021).

- The next four months are also 12,130 rubles (60% of her average earnings exceed the maximum).

- The remaining 5 months are 11,250 rubles each (this is 45% of the average monthly earnings).

Photo pixabay.com

Documentation

As mentioned above, the territorial branch of the Russian Pension Fund invites citizens to collect an additional package of documentation to apply for early retirement. This includes:

- a written statement drawn up in the form prescribed by law (a sample can be taken on site);

- passport, or any identification document that includes registration information;

- SNILS - insurance number of a personal personal account;

- work book (original), as well as any extracts and documents that can confirm insurance and work experience;

- statement of salary for any 5 years of work up to 2002 inclusive.

In addition, the following information may be required:

- about supported dependents;

- information about registration and actual place of residence;

- information about changes in personal data: first name, last name.

Attention!

Payments provided for by law are made to a bank card, received in person, and brought to your home. A citizen has the right to choose any of the listed methods, indicating a comfortable option in the application. In addition, the recipient has the right to change the method of receiving payments at any time by notifying the Pension Fund in advance in writing.

Reasons for refusal

Early retirement during layoffs is a rather complex and legally sensitive procedure, where any nuances must be taken into account.

The fundamental factors that give a citizen the right to make early payments were listed above. Failure to comply with any clause may be grounds for refusal. If the decision on the appeal is negative, the applicant receives a written notification from the territorial office of the Pension Fund. In this case, the employment center must continue to select vacancies for the citizen’s employment.

In addition, the following factors may serve as reasons for refusal:

- reduction in the size or complete termination of benefits payments to the unemployed;

- after dismissal, the citizen’s income is equal to or exceeds the average salary at the last place of work (the calculation takes into account the amount of dismissal benefits);

- The citizen ignored job offers from the labor exchange three times (information is taken for 12 months).

In addition, the applicant may be refused if he has not notified the Pension Fund of the following changes in his position:

- Official employment or equivalent activity that is included in the insurance period.

- Change in the number of dependent persons.

- Change of actual address of residence within the country.

- Traveling abroad.

Important!

When a citizen receiving early payments approaches retirement age, he needs to contact the municipal unit of the Pension Fund of the Russian Federation and draw up an application for an old-age pension. Alternatively, you can indicate in your appeal a request for a transfer to a new type of payment.

Employer obligations to pre-retirement workers in 2020

The new pensioner reform has affected almost all areas of life of ordinary citizens, including labor relations with the employer. The innovations affected the relationship between the employer and pre-retirees. The legislation is aimed at ensuring the most favorable working conditions for persons whose age is close to retirement. This is justified by the fact that citizens of this category are less competitive in the labor market, and also, due to their age, require certain social support from the state. Therefore, the amendments to the labor code affected the following aspects:

- Preservation of a job for a citizen of pre-retirement age. An employer does not have the right to dismiss an employee based on age. An exception are professions where there are age criteria for performing job duties, determined by the legal regulations existing in this area of legislation. The same applies to hiring a citizen of pre-retirement age.

- The employer is obliged to provide, by mutual agreement, two additional paid days for undergoing a planned medical examination. A pre-retirement employee can exercise this right by agreeing in advance with his manager on the days for undergoing a medical examination. The employer, in turn, does not have the right to refuse, but may request a transfer to other dates due to production needs. These days off are paid like regular working days, and the employer has the right to receive compensation from the social insurance fund.

- The employer is obliged to provide an alternative vacant place at the enterprise for a pre-retirement person who, due to his age, can no longer perform his job duties. When reducing staff or positions, the organization does not have the right to consider a candidate for dismissal of a citizen of pre-retirement age. Otherwise, the employee has the right to appeal to the labor commission to protect his rights and reinstatement at work.

- A pre-retirement pensioner has the right to undergo free retraining at the center for social protection of the population in order to change his occupation or gain additional knowledge that may be useful in the workplace.