The Labor Code provides several grounds on which an employing organization can make deductions from the wages of its employees.

One of such grounds is the executive documents received by the company.

In addition to alimony, according to writs of execution, for example, deductions can be made on the following grounds:

- compensation for damage caused to individuals,

- compensation for moral damage,

- the amount of principal and interest on the loan,

- compensation for material damage caused to legal entities.

Deductions from wages according to executive documents are mandatory and do not depend in any way on the will of the employer and employee.

According to Article 98 of the Federal Law of October 2, 2007. No. 229-FZ “On Enforcement Proceedings”, persons paying the debtor:

- wages,

- other periodic payments,

from the date of receipt of the writ of execution, they are obliged to withhold funds from the wages and other income of the debtor in accordance with the requirements contained in the writ of execution.

The company is obliged to pay (transfer) the withheld funds to the claimant within three days from the date of payment of the above-mentioned income to the employee.

In this case, the transfer and transfer of funds are made at the expense of the debtor .

The Labor Code limits the amount of deductions from wages to the provisions of Article 138:

- The total amount of all deductions for each payment of wages cannot exceed 20%, and in cases provided for by federal laws - 50% of wages due to the employee.

In accordance with paragraph 2 of Article 99 of Law No. 229-FZ, when executing an executive document (several executive documents), the following may be withheld from a debtor-citizen:

- No more than 50% of wages and other income.

Withholdings are made until the requirements contained in the executive document are fulfilled in full.

The above restrictions do not apply to salary deductions:

- when collecting alimony for minor children,

- when compensating for damage caused to the health of another person,

- when compensating for damage to persons who suffered damage due to the death of the breadwinner,

- when compensating for damage caused by a crime.

The amount of deductions from wages in these cases cannot exceed 70%.

In the article we will talk about the features of the current legislation regarding deductions from an employee’s salary according to executive documents.

Receipt procedure

A certificate of withholding under a writ of execution is issued by the employer or another institution that makes periodic payments to the debtor. To obtain it, you must contact the accounting department at your place of work with a written application for the issuance of the required certificate. The application must contain:

- a request to issue a certificate;

- the period of time for which deductions must be entered.

The document preparation period does not exceed three working days. There are often situations when data on the amount of deductions from the debtor and the bailiff differ, in which case the bailiff can independently request a certificate from the place of work.

In addition, the right to receive information about the amount of the amount withheld from the debtor is vested in:

- judiciary;

- tax service divisions;

- collector.

The employer has no right to refuse to issue a certificate, and if the official’s request is ignored, administrative liability may be imposed.

Form and content

A certificate to bailiffs about deductions made, a sample of which is presented on specialized portals, is drawn up in any form on the organization’s letterhead or on a simple sheet of paper. The document contains:

- employer's name, registration numbers, location;

- information about the debtor: passport details;

- details of the writ of execution, as well as the deduction order;

- the period for which the certificate was submitted;

- the amount of deductions broken down by month, indicating monthly income and the amount of deductions for the period;

- date of issue.

This is important to know: Initiating enforcement proceedings based on a writ of execution: grounds, terms and procedure

Additionally, the certificate indicates the form of payment of income to the debtor, and the certificate itself is issued both for one enforcement proceeding and for several at once, including in case of separate collection. The document is certified by the signature of the head of the organization, and if there is a chief accountant, then by his signature.

If deductions are made according to a writ of execution sent to the employer by the claimant independently, a special note is made in the certificate. Retention, carried out under a notarial agreement, requires similarly a mark.

When issuing a certificate, the employer should remember the responsibility for providing false information. If inaccuracies are identified, for example, in the amount or period, the erroneous document is recalled and a new one is sent.

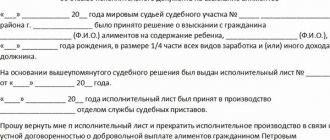

Sample mark on the writ of execution for execution

This magazine does not have a unified form. Approve it with an internal administrative document of the institution, for example an order. Use the sample.

Sample. Journal of writs of execution

Entrust the registration and recording of writs of execution to the legal service. Let her transfer only copies of them to the accounting department, since the writ of execution may get lost in the accounting archive due to the large volume of documents. And for this, the manager or chief accountant faces a fine of up to 20 thousand rubles. (Part 3 of Article 17.14 of the Code of Administrative Offenses of the Russian Federation).

In what cases is a notification letter written?

Chapter 11 of Federal Law-229 provides for the obligation of the employer or persons paying wages to the debtor under a writ of execution to withhold part of the funds to pay off the debt. The basis for this is a writ of execution or a court order, which can be transferred to an organization (IP) either by the collector (recipient of alimony) or by the bailiff.

In this case, the obligation to send a letter to the bailiffs about the dismissal of an employee or a change of place of work or residence, Part 5 of Art. 95 FZ-229 is assigned to the debtor. It is he who must notify the collector or bailiff of new circumstances.

In practice this does not always happen. Moreover, a significant portion of debtors avoid payments in every possible way and do not comply with notification requirements. Because of this, the legislator duplicated the requirement to dismiss the debtor, imposing this obligation not only on the citizen-debtor, but also on the employer. A similar obligation is provided for in Part 3 of Art. 98 FZ-229.

Failure by the employer to comply with the requirement to return the writ of execution and notify the bailiff and the claimant about the dismissal of his alimony employee entails administrative liability under Part 1 of Art. 17.14 Code of Administrative Offenses of the Russian Federation.

Sample note on the writ of execution for the execution of the contract

I didn’t see the norm, unless in the Civil Procedure Code, and even then there are contradictions in the Federal Law “OIP”, as I understand it:

Article 439. Termination of enforcement proceedings……….. 3. If there are grounds for termination of enforcement proceedings, the enforcement document with the appropriate mark is returned by the bailiff to the court or the state or other body that issued this document. All enforcement measures appointed by the bailiff are cancelled. Terminated enforcement proceedings cannot be initiated again.

In the current edition of the Civil Procedure Code, clause 3 of Article 439 has been changed: https://www.consultan...gpkrf/8_58.html

Article 439. Termination of enforcement proceedings

3. In the event of termination of enforcement proceedings, all assigned enforcement measures are canceled by the bailiff.

Sample note on the writ of execution regarding the performance of duties

At the same time, in the notification:

- make a note about receipt of the writ of execution;

- indicate your office phone number;

- sign (this is done by the chief accountant);

- affix the seal of the institution.

The deadline within which the notice must be returned is not established by law. However, the memo says that this must be done on the day of delivery.

This is important to know: Deadline for checking a writ of execution by the bank

If the debtor resigns, notify the bailiff or the collector no later than the next day after the relevant grounds occur (see table). Before the changes were made, upon dismissal of the debtor, it was necessary to “immediately notify the bailiff and (or) the collector about this.” At the same time, the concept of immediacy was not deciphered. And three days were allotted to return the writ of execution for the collection of alimony (subparagraphs 1, 2 of Article 111 of the Family Code of the Russian Federation).

Table.

What should be written in the writ of execution, the entire decision or only part of it?

- A claim was filed, it was partially satisfied, I am appealing the decision in the unsatisfied part. Can I get a writ of execution for that part of the decision that was satisfied? (2 answers)

- We received a writ of execution based on a court decision to collect the debt. What to do with this sheet to get money from the debtor (organization)? (1 answer)

- Please name the powers of the arbitration court. Does the district court have the right to issue a writ of execution based on the decision of the arbitration court? (1 answer)

- Please explain the process of issuing a writ of execution against a decision of the Arbitration Court in connection with the entry into force of the Federal Law “On Arbitration Courts” and the new Arbitration Procedure Code of the Russian Federation, (1 answer)

- Is it possible to submit to an arbitration court a court decision that has entered into legal force instead of a writ of execution? (1 answer)

- Decision on writ of execution

- Executive decision of the court

- Enforcement proceedings by court decision

- Writ of execution by court decision

- Enforcement proceedings are a court decision

Sample mark on the writ of execution for execution

So, the priority deductions are:

- alimony;

- compensation for damage caused to health and in connection with the death of the breadwinner;

- damage caused by the crime;

- compensation for moral damage.

Secondly come the payment requirements:

- severance pay;

- remuneration of persons working under an employment contract;

- remuneration to the authors of the results of intellectual activity;

Thirdly, fulfill the requirements for mandatory payments to the budget and extra-budgetary funds. Satisfy all other requirements last, fourth. Let's look at examples.

Example 1.

A writ of execution with notes received from the claimant: – on the basis for the completion of execution; – about the period during which the executive document was with the institution for execution; – about the amount collected (in case of partial execution)

No later than the day following the day of the occurrence of the event that entailed the termination of execution of the writ of execution

A copy of the writ of execution, which was received from the bailiff, with the following notes: – on the basis for the completion of the execution; – about the amount collected (in case of partial execution)

How to fill out a writ of execution when dismissing a debtor employee

When dismissing a debtor employee, you must make a special mark on the writ of execution (a copy of it received from the bailiff). To do this, on the reverse side of the writ of execution, in a special line, indicate the following (clause 2, part 4, part 4.1, article 98 of the Law on Enforcement Proceedings):

- execution was completed due to the debtor changing his place of work;

- the amount collected.

If you have the original writ of execution received from the claimant, additionally indicate the period during which the writ of execution was in your possession (clause 1, part 4.1, article 98 of the Law on Enforcement Proceedings).

This mark must be certified by the seal of your organization (if any) and the signature of an accountant, which follows, in particular, from the Letter of the FSSP of Russia dated June 25, 2012 N 12/01-15257.

On execution from 01/09/2019 to 04/05/2019. Executed in the amount of 90,000 (ninety thousand rubles) 35 kopecks. The execution was completed due to the debtor changing his place of work.

Is it necessary to keep a copy of the writ of execution closed upon dismissal of an employee?

No, such a requirement is not established by law, but we recommend doing so.

This way, in particular, you can confirm the legality of deductions from the wages of a dismissed employee in the event of claims on his part. If the dispute goes to court, you will have proof of the legality of your actions and will not have to ask the court for confirmation that the deductions were made according to a writ of execution.

We recommend keeping a copy of this document for at least two years. We believe that this period is optimal, since the employee has a year to go to court to collect wages (Part 2 of Article 392 of the Labor Code of the Russian Federation). In this case, the court may extend this period in accordance with Part 4 of Art. 392 Labor Code of the Russian Federation.

Where should the execution paper be returned?

When an employee quits, the employer is obliged to:

- notify the bailiffs that collection of amounts under the writ of execution is impossible;

- return the sheet to the bailiff department.

The writ of execution must be returned along with the application and a copy of the dismissal order. The application shall indicate:

- the amount of penalties made;

- the reason why further penalties are impossible (in this case, it is the dismissal of the employee);

- information about the debtor’s new place of work, if such information is available.

How much can you keep from someone?

The maximum threshold is 50 percent of the employee’s wages and other income, if you are deducting it under writs of execution. This limit is valid until the collected amounts are fully repaid (Art.

But in some cases, the maximum amount of deduction may be 70 percent (Article 138 of the Labor Code of the Russian Federation, Part 3 of Article 99 of Law No. 229-FZ). This is how much you can deduct from your salary when collecting:

- child support for minor children;

- compensation for damage caused to health, as well as in connection with the death of the breadwinner;

- compensation for damage caused by the crime.

The amount of withholding is affected by the amount of personal income tax, since it is calculated from net income, that is, after withholding personal income tax (Clause 1, Article 210 of the Tax Code of the Russian Federation).

If there are additional costs when transferring money under writs of execution, for example, bank commission or postal transfer, compensate them from the employee’s earnings.

But not just like that, but with a mark of execution. We present a sample of entries that must be made on this document in cases of dismissal of the “alimony provider” and the child turning 18 years old.

An employer who withholds alimony for minor children on the basis of a writ of execution, upon the occurrence of certain circumstances, is obliged to return this document in a timely manner. In particular, in cases where the child for whom alimony is paid has reached the age of majority, as well as when such an employee is dismissed. Let's consider these situations and the employer's actions corresponding to them.

The child of the “alimony payer” turned 18 years old

Situation. An employee of the private unitary enterprise “Artist” Seleznev Alexey Viktorovich pays alimony for a child under the age of 18 to Selezneva’s ex-wife Margarita Petrovna (claimant).

There is no alimony debt. The total amount of alimony withheld under this writ of execution amounted to 405 rubles. 40 kopecks

The employer's actions are as follows

1. Makes a note on the determination about the deductions made, indicating the amount withheld and the balance of the debt. The mark is sealed with the signature and seal of the employer (part 2, clause 91 of Instruction No. 67).

This is important to know: Help in obtaining a loan with a writ of execution

Note

We believe that you can make a mark in the free lines of this document (if any) or on its reverse side. If there is no free space, it is permissible to indicate the required information on a separate sheet or letterhead of the organization.

Returns the definition of Martynova V.S. (to the claimant) within three days from the date of dismissal of Martynov A.V.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

(Moscow) (St. Petersburg) (Federal number)

What to send to bailiffs when terminating an employment contract with an alimony provider

The procedure for collecting alimony payments is regulated not only by Art. 98 of the law on enforcement proceedings, but also Ch. 17 of the Family Code of the Russian Federation (hereinafter referred to as the Code). By virtue of Art. 109 of the Code, the employer must withhold funds on the basis of:

- alimony payment agreement certified by a notary;

- IL.

Read about the rules for calculating alimony in our article “Calculation of alimony from wages.”

More complete information on the topic can be found in ConsultantPlus. Full and free access to the system for 2 days.

Clause 1 Art. 111 of the Code establishes the employer’s obligation to inform the bailiff and the person receiving alimony payments about the termination of the employment contract with the alimony-paying employee. The question often arises about what else to send to the bailiffs when dismissing the alimony worker?

The answer to this question is contained in clause 4.1 of Art. 98 of the law on enforcement proceedings. No later than the next day after the dismissal of the alimony employee, the IL must be returned to the bailiff indicating the amount collected.

The notarial agreement submitted by the recipient of the alimony must be returned to this person with a note about the period the agreement was in this organization and the amount of money paid.

How to inform the recipient of alimony and the bailiff about the dismissal of the alimony worker

Compose a notice of dismissal of an employee who is obligated to pay alimony in any form, since there is no normatively established one. Please include your full name. the employee, information that he has been fired and, if you know, his new place of work and place of residence (Clause 1 of Article 111 of the RF IC). We also recommend that you indicate the details of the writ of execution on the basis of which alimony was collected from the employee, and if you do not know the new place of work (residence) of the dismissed employee, make a reservation about this.

Attention: there is an opinion that in such a message it is necessary to indicate the basis for dismissal (article). We recommend not to do this, since this goes beyond the scope of paragraph 1 of Art. 111 IC RF. This means that it can be regarded as a violation of the procedure for processing personal data and entail, for example, administrative liability under Part 2 of Art. 13.11 Code of Administrative Offenses of the Russian Federation.

In accordance with paragraph 1 of Art. 111 of the Family Code of the Russian Federation, we inform about the dismissal of Yuri Pavlovich Krikunov (dismissal order dated 04/05/2019 N 131-k), from whose wages alimony for minor children was collected on the basis of the Supreme Court writ of execution N 111367485, issued by the magistrate of court district N 156 r- on Khoroshevo-Mnevniki in Moscow.

New place of work and place of residence of Krikunov Yu.P. unknown.

Such a message must be sent directly to the recipient of the alimony within three days after the day the alimony provider is dismissed. And if the bailiff sent you a copy of the writ of execution, then also to him - that is, there may be two addressees. Such conclusions follow from paragraph 1 of Art. 111 RF IC, part 4.1 art. 98 of the Law on Enforcement Proceedings.

The recommendations for sending this message are the same as for returning the writ of execution - it doesn’t matter in what way, it is important to record the date and fact of sending.

Risks associated with the dismissal of a debtor employee

In this case, in particular, the following risks are possible:

- administrative liability under Part 3 of Art. 17.14 of the Code of Administrative Offenses of the Russian Federation for the loss or untimely sending of a writ of execution - for an organization this is a fine of 50,000 to 100,000 rubles;

- administrative liability under Art. 19.7 of the Code of Administrative Offenses of the Russian Federation for failure to inform (untimely communication) upon dismissal of an employee who pays alimony to the bailiff about his new place of work (residence) (if they are known to you), taking into account clause 1 of Art. 111 of the RF IC - for an organization this is a fine of 3,000 to 5,000 rubles.

Attention: there is an opinion that for failure to send the specified message, the bailiff faces liability under Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation, and not under Art. 19.7 Code of Administrative Offenses of the Russian Federation. However, Part 3 of Art. 17.14 of the Code of Administrative Offenses of the Russian Federation does not provide for liability for this. This means, in our opinion, you can challenge the prosecution if you are held accountable under this rule.

Contradictions in the timing of notification of the dismissal of an employee and the return of the writ of execution for alimony

Notification of the dismissal of an employee to the bailiffs by virtue of clause 1 of Art. 111 of the Code must be sent within 3 days from the date of termination of the employment contract with the alimony provider, while the IL must be returned to the bailiff no later than the next day after termination of the contract. At first glance, it seems that there are no contradictions, since we are talking about 2 different actions.

However, on the other hand, by virtue of sub. 2 clause 4 art. 98 of the Law on Enforcement Proceedings, a change of place of work is grounds for termination of the execution of the executive document; therefore, when returning the IL, it is necessary to indicate the reason for this action. Therefore, in order to avoid claims from the bailiff, it is recommended to send the notice of termination of the employment contract and the writ of execution for alimony upon dismissal of the employee to the bailiff at the same time. This must be done the next day after the termination of the employment contract with the employee.

Failure to fulfill the obligation to notify the bailiff of the debtor's dismissal entails administrative liability under Art. 19.7 of the Code of the Russian Federation on Administrative Offenses (CAO). Those found guilty face a warning or a fine of up to RUB 5,000.

Untimely return of IL is punishable by a fine (clause 3 of Article 17.14 of the Administrative Code):

- 15,000–20,000 rub. for entrepreneurs and directors of organizations;

- 50,000–100,000 rub. for organizations.