Form

The form of the pledge agreement and its terms are regulated by Art.

339 of the Civil Code of the Russian Federation as amended by Law No. 367-FZ of December 21, 2013. According to it, the loan agreement is an agreement between the bank, acting as the mortgagee, and the borrower, who is the mortgagor, as a result of which the mortgagee, having accepted real estate as collateral, if the borrower fails to fulfill its obligations, receives the right to foreclose on the mortgaged property and dispose of it at its own discretion. The following can serve as collateral:

- Any property, including money.

- Land plot.

- Real estate.

- Property rights.

- Company.

The DZ form must be in writing and it requires:

- Display the subject of the pledge, its parameters, conditions and time of fulfillment of the obligation secured by the pledge. The conditions that relate to the main obligation will be considered agreed upon if the contract contains a link to the main agreement for the fulfillment of the obligation. The participants in the transaction can stipulate in the contract a condition on the sale of real estate under encumbrance (by a court decision or by way of a settlement agreement).

- Provide real estate valuation. If the mortgagor is an individual entrepreneur, a future obligation can act as collateral, within the amount of the main agreement. At the same time, the valuation of the mortgaged property and its parameters can be displayed in any way that provides identification and its value at the date of foreclosure.

- Unless otherwise specified by law or the main agreement, the DP must be drawn up and certified by a notary.

Note. Ignoring the listed points entails invalidation of the contract.

The procedure for concluding a real estate pledge agreement in 2021

The loan agreement is drawn up when the bank accepts real estate, which serves as collateral for the loan. Participants in the transaction can be individuals or legal entities. individuals and the state. The mortgagor can be:

- A borrower who receives a loan from a bank and is the owner of the property that serves as collateral.

- A third party (property guarantor), who is the owner of the property, transfers to the borrower the right to transfer the property as collateral.

The DA is required to display the essence of the agreement, assessment, time of fulfillment of the obligation, description of the pledged item, as well as other conditions between the contracting parties.

The display of the pledged item in the document can be stated in a general form (by indicating the name of the pledge). By agreement of the parties, an audit of the reliability of data on the mortgaged real estate and its valuation can be carried out, in accordance with the legislation of the Russian Federation.

The document can be certified by a notary in accordance with the legislation of the Russian Federation or at the request of the parties to the transaction.

When concluding a contract, you must provide the following documents:

- Charter of the institution.

- Memorandum of association.

- Certificate of state registration.

- Certificate of registration of the enterprise in the Unified State Register of Enterprises and Organizations.

- Certificate confirming the authority of the chief.

- Protocol of the highest department on obtaining a loan and registering property as collateral.

- Document confirming the absence of tax arrears.

- Institution's balance sheet.

- Explanation of the balance sheet line, which displays the accounting price of the pledged item.

- Certificates certifying that the pledged property belongs to the pledgor.

- Documents certifying the value of the pledged property upon purchase.

- Customs declaration (if the property was brought into the territory of the Russian Federation).

- Extract from Rosreestr.

- Expert opinion on the value of the pledged item.

Note. Banks have the right to request additional materials, depending on the type of collateral (land plots, cars, unfinished buildings, bills, etc.).

After signing the contract, the document will need to be registered with Rosreestr, providing an agreement with attached documents and a receipt for the transfer of state duty.

Article 339 of the Civil Code of the Russian Federation. Conditions and form of the pledge agreement (current version)

1. Clause 1 of the commented article lists the conditions that are essential for the pledge agreement. Essential conditions include conditions that are recognized as such by law or are necessary for contracts of this type and without reaching agreement, under which the contract is considered not concluded.

The pledge agreement must indicate the subject of the pledge, the essence, size and deadline for fulfilling the obligation secured by the pledge. In this case, the conditions relating to the main obligation are considered agreed upon if the pledge agreement contains a reference to the agreement from which the secured obligation arose or will arise in the future.

If at least one of these conditions is missing, the contract is considered not concluded (see commentary to Article 432 of the Civil Code).

As an optional (optional) condition, the parties may provide a condition on the procedure for the sale of the pledged property, the foreclosure of which is directed by a court decision, or a condition on the possibility of foreclosure on the pledged property out of court.

It seems that it should also contain, as an essential element, an indication of which party has the pledged property (although this is not stated in the commented article), i.e. determine the type of collateral.

Paragraph 43 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 6, the Plenum of the Supreme Arbitration Court of the Russian Federation No. 8 of July 1, 1996 “On some issues related to the application of part one of the Civil Code of the Russian Federation” (as amended on March 24, 2016) explains the following: “Essential conditions Pledge agreements include the subject of the pledge and its valuation, the essence, size and period of fulfillment of the obligation secured by the pledge, as well as the condition regarding which of the parties (the pledgor or the pledgee) has the pledged property (clause 1 of Article 339). If the parties do not reach an agreement on at least one of these conditions or the corresponding condition is absent in the agreement, the pledge agreement cannot be considered concluded.

In cases where the mortgagor is the debtor in the main obligation, the conditions on the essence, size and timing of the fulfillment of the obligation secured by the pledge should be considered agreed upon if the pledge agreement contains a reference to the agreement governing the main obligation and contains the corresponding conditions.”

2. In paragraph 2 of the commented article we are talking about the so-called global security, when in the pledge agreement, the mortgagor of which is a person carrying out business activities, all the property of the entrepreneur is indicated as an encumbrance.

The subject of the pledge in such an agreement can be described in any way that allows the property to be identified as the subject of the pledge at the time of foreclosure, including by indicating the pledge of all the property of the pledgor or a certain part of his property, or the pledge of property of a certain kind or type.

In this case, we can talk about securing all existing and (or) future obligations of the debtor to the creditor within a certain amount.

Thus, paragraph 2 of the commented article refers to the case when the pledge agreement will also apply to the future property of the pledgor, corresponding to the characteristics contained in the pledge agreement. The condition about the description of the main obligation can be considered essential, taking into account the rules of paragraph 2 of the commented article.

It should be taken into account that Art. 357 of the Civil Code of the Russian Federation (see commentary to it) provides for the possibility of pledging goods in circulation, in which the pledgor has the right to change the composition and physical form of the pledged property, i.e. The pledge of goods in circulation also presupposes the creation of a pledge in relation to property that the pledgor will acquire in the future.

3. In paragraph 3 of the commented article, it is established that regardless of the form in which the main agreement is concluded (oral or written), the form of the pledge agreement, under penalty of invalidity, must be written, unless a notarial form is established by law or agreement of the parties. Thus, an example of a mandatory notarial form established by law is the provisions of Art. 22 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” (as amended on 12/31/2017), according to which the pledge agreement for a share or part of a share in the authorized capital of a company is subject to notarization.

In this case, a pledge agreement to secure obligations under the agreement, which must be notarized, is also subject to notarization. For example, an agreement on the pledge of a gold watch, concluded for the purpose of securing a notarized obligation to buy and sell a car, must be notarized by agreement of the parties.

Failure to comply with the notarial form of the specified transaction entails its invalidity. In this case, the pledge of a share or part of a share in the authorized capital of the company is subject to state registration and arises from the moment of such state registration.

According to paragraph 44 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 6, the Plenum of the Supreme Arbitration Court of the Russian Federation No. 8 dated July 1, 1996 “On some issues related to the application of part one of the Civil Code of the Russian Federation” (as amended on March 24, 2016) “in resolving disputes related with a pledge of movable property or rights to property, it should be taken into account that such a pledge agreement is subject to notarization only in cases where the agreement secured by the pledge in accordance with paragraph 2 of Article 163 must be concluded in notarized form (paragraph 2 of Article 339).”

A special feature of pledging things in a pawnshop is that it is formalized by the pawnshop issuing a pawn ticket (see commentary to paragraph 2 of Article 358 of the Civil Code of the Russian Federation).

Comment source:

“CIVIL CODE OF THE RUSSIAN FEDERATION. PART ONE. ARTICLE-BY-ARTICLE COMMENT"

S.P. Grishaev, T.V. Bogacheva, Yu.P. Sweet, 2019

How to draw up a real estate pledge agreement in 2021

Compilation of remote control is carried out according to a standard algorithm:

- Applying for a loan, after providing documents, and agreeing on the terms of loan servicing, etc.

- Filling out the contract and signing it by the parties.

- Registration of property rights in Rosreestr with the provision of the necessary documents and a receipt for payment of the state duty.

When registering a contract, you need to pay attention to the following:

- The designation must be in writing.

- The pledgor can be the debtor or a third party.

- The parties to the transaction themselves establish a list of requirements for securing the collateral.

- The price of the pledged item is also set by the parties to the agreement.

- The collateral can be any real estate (estate, apartment, plot of land). At the same time, narcotic and psychotropic substances, weapons, chemicals, etc. cannot be used as collateral).

- The mortgaged property usually remains with the mortgagor.

- The pledgor has the right to use the collateral for its intended purpose and is responsible for unexpected liquidation or damage to the collateral.

- Mortgaged real estate can be insured against the risk of damage or destruction.

You can get acquainted with the conditions of remote control more clearly by watching the video.

( Video : “081 Conditions of pledge agreements”)

Contents of the agreement

As noted above, the DZ is drawn up in writing.

At the same time, the document, in accordance with the provisions of Article 339 of the Civil Code of the Russian Federation, must contain the following sections: Preamble , where it is necessary to display the name of the document, details of the parties.

Subject of collateral. The amount and time of fulfillment of the obligation to secure the collateral are noted here.

Rights and obligations of the parties to the agreement

Responsibility of the parties

Procedure for handling conflicts

Procedure for terminating the agreement

Duration of the agreement

Legal addresses and signatures of the parties to the transaction

Situation in which the Collateral Loan Agreement is applicable:

One Party intends to lend money in return (i.e. for a fee), and the second Party intends to borrow money and pay a reward for this to the first Party, i.e.:

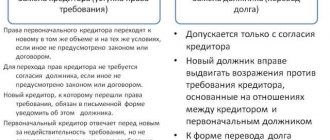

- the subject of legal relations is the transfer of money into ownership, where one party transfers money into the ownership of the other, and the second party undertakes to promptly return the same amount of money and pay remuneration for the use of money;

- loan repayment is ensured by a penalty, i.e. the amount of money that the Debtor is obliged to pay to the Creditor in the event of non-fulfillment or improper fulfillment of the obligation, in particular, in case of delay in performance;

- Ensuring the fulfillment of obligations is determined by additional obligations: a pledge, a guarantee or a surety, however, the conditions for such obligations must be defined in certain types of contracts, which must be concluded in writing.

In the totality of these features, the legal relationship is regulated by the Money Loan Agreement with collateral. Ensuring the fulfillment of obligations to repay the loan is formalized by a pledge, guarantee or surety.

A pledge is recognized as such a method of securing the fulfillment of an obligation, by virtue of which the Creditor (pledgee) has the right, in the event of failure by the Debtor to fulfill the obligation secured by the pledge, to receive satisfaction from the value of the pledged property preferentially before other Creditors of the person who owns this property (the pledgor).

It should be borne in mind that legal entities and citizens are prohibited from raising money in the form of a loan from citizens as a business activity.

Subject and parties of the agreement

The most essential condition of the loan agreement is the subject of the loan agreement, which is real estate transferred by the mortgagor as security for the obligation assumed.

At the same time, according to paragraph 1 of Art. 336 of the Civil Code of the Russian Federation, certain types of property cannot act as collateral. The parties to the loan agreement are the pledgee and the pledgor. At the same time, not only the borrower, but also a third party can act as a mortgagor (Clause 1, Article 335 of the Civil Code of the Russian Federation).

In addition, the mortgagor is obliged to confirm that the property being transferred belongs to him.

The mortgagee is the party who accepts the property to secure the loan.

The parties to the contract can be both individuals and legal entities. faces.

Note. Parties to the DZ cannot be incapacitated persons or citizens with limited abilities.

Main elements of a pledge agreement

The form of the work permit is always written.

At the same time, certification of the document by a notary is not necessary. The Civil Code of the Russian Federation does not define a single template for the RD, however, it provides for a number of essential requirements for the form and content of the document. The main elements of remote sensing include:

Subject of the agreement.

This element presupposes the name of the real estate being pledged, its parameters and other features that ensure its identification. The property rights of the mortgagor are also noted here, with the display of title materials for the immovable mortgaged property.

Contract time.

This item reflects the period for fulfilling the accepted obligation secured by the mortgaged real estate. Here it is required to display the specific moment of the beginning of the validity of the contract and the moment of the end of full fulfillment of the accepted obligations.

The procedure for transferring the collateral.

This shows how the mortgaged property is transferred to the mortgagee. When transferring mortgaged real estate to the mortgagee, a bilateral acceptance deed is required.

Basic conditions

This agreement does not have a clearly established form, and can be drawn up in any order with the addition of individual sections. However, there are a number of recommendations for drawing up this type of document.

We recommend reading

Contract for chartering a bus and other vehicle for transporting children

The pledge agreement must contain such a section as “Introductory Part” - it contains the necessary information about the persons representing the parties to the agreement. This section should contain details of participants in legal relations, namely:

- Full names (full name).

- Place of actual residence.

- Accurate passport details of the parties.

In addition, it is recommended to identify the following sections:

- the rights and obligations of each participant in legal relations;

- full details of the parties;

- guarantees for each representative of the contract;

- subject of the agreement;

- force majeure;

- insurance;

- final provisions.

The subject of the agreement is the amount of money that is issued as a loan to the borrower. The size of the loan is indicated, as well as the timing of its provision.

The borrower undertakes to repay the required amount of money on time; this obligation is secured by collateral in the form of real estate - a house, apartment, land, garage. It is necessary to indicate which real estate object acts as collateral - indicate its name, address, area, main characteristics, details of documents confirming ownership. After all, you can only pledge your property, that is, non-privatized housing cannot act as collateral under a contract. Here you need to pay attention to the condition of the real estate; not every person will agree if the collateral is an unsafe and dilapidated building.

“Rights and Responsibilities” also has many of its own features; this part of the agreement provides for the legal equality of participants in legal relations. It should be noted that if you do not understand any points of the document, you must enlist the support of a knowledgeable specialist. An agreement can be concluded between any individuals, including stateless persons and foreign citizens.

What is the difference between a real estate loan agreement between an individual and a legal entity?

These loan agreements have practically the same form and content.

Remote control of real estate between individuals

- The document is completed in any written form. Under its terms, it is possible to provide an interest-free loan, in contrast to the loan agreement between legal entities. persons where interest should be provided for the use of the loan.

- After registration of the contract, the document must be sent to Rosreestr for registration and imposition of an encumbrance.

- At the request of the parties to the transaction, the executed document can be notarized.

DZ of real estate between legal entities. persons

- The subject of the pledge in such an agreement between legal entities. persons cannot be living space.

- Interest-free loans are also not allowed if one of the parties to the transaction is a legal entity. face.

- The RD and attached documents for the mortgaged property are sent to Rosreestr.

Real estate pledge agreement between individuals

This document refers to the most common and popular type, as well as a more effective way to protect yourself from various risks.

A loan agreement between individuals involves taking any amount on credit, with the guarantee that if the amount received is not repaid, settlement is carried out with the pledged property.

According to the legislative norms of the Russian Federation, the DZ is drawn up only in writing. At the same time, when registering a contract between individuals, the following points must be displayed:

1. Preamble, indicating:

- FULL NAME. sides

- Addresses of actual location.

- Passport data.

2. Subject of mortgaged real estate.

3. Valuation of the mortgaged property in rubles (in numbers and in words).

4. The essence of the accepted obligation.

5. Contents and amount of the loan.

6. Date and time of fulfillment of the undertaken obligation.

7. A link to the document on which the borrower receives a loan.

Note. If you ignore any of the points listed above, the agreement will not have legal status.

After signing the contract between individuals, it is necessary to send documents to Rosreestr for registration of the pledged property.

Sample

and sample

- Form, doc

- Sample, doc

Real estate pledge agreement between legal entities

DZ between legal entities

persons, as well as between individuals, is formalized only in writing. To fill out such a document, you will need to present materials certifying your legal status. persons (institution registration certificate, etc.), as well as title documents for real estate pledged. Note: In order for DZ between legal entities. persons has received the status of a valid one, it is certainly required to be registered in the relevant state. structure.

To assign a document legal force and obtain approval from Rosreestr, you must strictly follow all the filling rules:

- In the preamble of the DS it is required to display:

- FULL NAME.

- Details of the institution.

- Powers of legal representatives persons and grounds.

- In addition, the document displays the subject of the pledge and the time during which it is necessary to fulfill the assumed obligations under the main contract.

- You will also need to write:

- Rights and obligations of the parties to the transaction.

- Procedure for resolving conflicts.

- Period of validity of the DZ.

- Legal addresses of the parties, bank details and signatures of the parties to the agreement.

A registered real estate record between legal entities. persons requires notarization and registration in Rosreestr.

Sample

and sample

- Form, doc

- Sample, doc

Registration of the agreement

After filling out the property data sheet, the parties need to go through the procedure of registering the transaction.

To do this, it is recommended to perform the following steps: Stage 1: Preparation of remote sensing

The DZ is filled out, as a rule, in 3 copies - one for each participant in the transaction and one copy for Rosreestr.

Stage 2: Preparation of documents for registration of property rights

At this stage, documentation is collected for sending to Rosreestr. This includes:

- A photocopy of the applicant's passport with presentation of the original.

- DZ issued.

- Title documents for real estate pledged.

- Receipt for transfer of state duty.

- Permission of the applicant's spouse (if necessary).

- Consent of the trustee department (if necessary).

Stage 3: Contacting Rosreestr

To register a property plot, you will need to submit a request along with the prepared documents to Rosreestr at the location of the real estate.

Note. State Registration must be completed within 7 working days.

State duty

From January 1, 2018, the amount of state duty for registering a real estate pledge is set in the following amounts:

- If a mortgage agreement was concluded by legal entities after July 1, 2014, and the collateral is one piece of real estate, then the state duty is 15,000 rubles (7,500 for each legal entity).

- If the mortgage agreement is concluded between an individual and a legal entity. person after July 1, 2014, and the collateral is one piece of real estate, then the state duty is 8,000 rubles (500 for an individual, 7,500 for a legal entity).

Contracts to change the terms of a registered mortgage agreement, presented to the state. registration after July 1, 2014, subject to state registration. registration. The state duty is calculated according to clause. 28 clause 1 art. 333.33 Tax Code of the Russian Federation:

- For individuals - 200 rubles.

- For legal entities persons - 600 rubles.

0 0 vote

Article rating