Concept and types of payments

Both employees and employers have a number of questions related to misunderstanding of the law or unwillingness to comply with all its provisions.

The most common violation on the part of management is late payment upon dismissal. The fine for such actions depends on what types of payments were not provided to the employee, as well as the reason for the delay. In rare cases, the prosecutor's office can acquit an unscrupulous owner of an enterprise, but more often the lawsuits of those dismissed are subject to satisfaction. Subordinates can count on several types of payments and compensation, the amounts of which depend on various factors (amount of time actually worked, use of vacations, reasons for dismissal). The main ones are:

- payment for work on a day off (if it is officially recognized as such);

- payment for calendar days that have not been paid since the last accrual;

- compensation for unused days of planned paid leave.

In some cases, the law also provides for additional severance pay. Upon dismissal due to staff reduction, headcount optimization or due to a change of ownership, staff have the right to receive compensation in the amount of several average monthly salaries. But those dismissed under articles for violation of labor discipline, absenteeism or professional inadequacy cannot claim such compensation.

The law provides not only for the financial liability of the employer for non-payment of compensation upon dismissal. In some cases, the court may impose criminal penalties or administrative penalties.

For the employer

The employer is obliged, after issuing an order to terminate the employment relationship, to make a settlement with the employee.

The calculation includes:

- Payment of wages calculated up to the employee’s last work shift.

- Issuance of funds as compensation for unused vacation days.

- Transfer of severance pay. Provided only in case of dismissal due to reduction or in case of collapse of the company.

If the fact of a delay in settlement with the dismissed person is revealed, the former employer will be obliged to index the amount of debt for the recipient at a rate determined by the Central Bank of the Russian Federation.

Also, the culprit may be held accountable and pay compensation for the damage caused to a citizen who was deprived of payments in a timely manner.

Calculation procedure

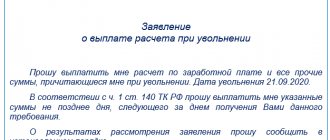

According to Article 140 of the Labor Code in force in the Russian Federation, an employee has the right to receive all amounts due to him on the last day when he is on the staff of the enterprise, that is, immediately upon dismissal. If these dates do not coincide, then the accounting department is obliged to pay the funds the next day.

In practice, employers most often face liability for late payment upon dismissal due to delayed wages.

According to the law, if the debt is not paid within 15 days from the established date of payment of salaries , then the staff has the right to suspend the performance of their production functions.

But when it comes to dismissal, such actions are meaningless, so employees can get their money by going to court or the prosecutor’s office. In this case, you do not have to express any claims or demands to the company; it is enough to attach an extract from the employment record to the statement of claim.

Delay is considered every day of delay after termination of the employment contract with the employee. Financial liability and a fine for non-payment of compensation for unused vacation upon dismissal apply to both the manager and the legal entity.

What should an employee do if there is no payment after dismissal?

An employee must protect his rights independently . If you do not openly report violations to the competent authorities and/or the court, no one will know about them and no one will voluntarily deal with them.

If the dismissal payment has not been paid, the employee may:

- file a complaint with the State Labor Inspectorate (SIT);

- apply for protection of your rights to the prosecutor's office;

- file a claim in court.

How to contact the State Tax Inspectorate and the prosecutor's office

In the first 2 options, the application is submitted in writing or through the website of the relevant department. It must indicate:

- name of the addressee of the complaint;

- contact details of the applicant - full name, address, telephone;

- identification information about the employer who committed the violation;

- a description of the circumstances of the violation and a requirement to compel the former employer to eliminate them;

- date of writing;

- signature of the applicant.

The supervisory authority accepts and considers the application within 30 days . During this time an unscheduled inspection , during which the fact of a violation is established.

If dismissal without payment of wages is confirmed, the employer is ordered to repay the debt with penalties, and is also awarded an administrative fine. If there is a criminal offense, the prosecutor's office may initiate appropriate proceedings by investigative authorities.

At the end of the entire procedure, the applicant is given a written response.

How to go to court

Mandatory pre-trial settlement in cases where the dismissal settlement was not paid is not established . Therefore, the employee can immediately file a claim, without writing preliminary complaints to the supervisory authorities.

Only the court (!) can finally resolve a labor dispute. Therefore, after filing a claim, it makes no sense to write complaints to the State Tax Inspectorate and the prosecutor’s office.

An application to the court must be filed within 1 year from the date when the deadline for payment has expired (Part 2 of Article 392 of the Labor Code of the Russian Federation). In this case, debt collection is possible in 2 ways:

- if the amount of debt does not exceed 500,000 rubles. and is not disputed by any of the parties, and the claim does not contain additional requirements - in the manner of simplified (mandatory) proceedings through a magistrate judge;

- when the amount of debt is over 500,000 rubles. or there is a dispute about its amount or other requirements - in the manner of claim proceedings in the district court.

In the first case, the application is submitted to the magistrate’s court at the place of residence of the employee or the territory where the defendant is located (at the choice of the plaintiff).

If the document is drawn up correctly, the judge accepts it, personally reviews it and issues a court order within 5 days .

One copy of the document is sent to the employer. After receiving it, he has 10 days to object to it. If he files an objection, the order is canceled. If not, the document is handed over to the plaintiff or, at his request, to the bailiffs to begin collection. If the order is cancelled, the applicant retains the right to initiate a full-fledged trial.

If the limit on simplified (mandatory) proceedings is not observed or the order has been cancelled, the dismissed person has the right to file a claim in the district court. The application is submitted to the judicial authority of the employee’s choosing :

- at his place of residence;

- on the territory where the employer is located;

- at the place of work.

After filing a written claim with the district court, a hearing is scheduled. At the end of the consideration of the case, a decision is made, which can be appealed by the defendant within 1 month from the date of its adoption. After this period, the decision comes into force. The employee can present it to the defendant for execution or forward it to the bailiffs.

Decisions to collect wages for up to 3 months are subject to immediate execution (Article 211 of the Code of Civil Procedure).

Read also

18.09.2020

Financial liability and penalties

The amount of fines and sanctions for violation of labor laws in the field of settlements with resigning workers depends on the length of the delay period.

When the period exceeds 90 days from the date of termination of the employment contract, the employer will be fined 120 thousand rubles. If late payments become systematic and regular at the enterprise, the owner may be charged and then criminally liable in the form of imprisonment for at least 1 year. For employees who do not receive timely payment, mandatory compensation is provided. Its amount consists of:

- total debt on the part of the enterprise;

- overdue period multiplied by 1/150 of the Central Bank rate.

This scheme is considered standard. But when an enterprise or private company enters into an agreement with a subordinate or a collective agreement with special instructions, the accrual formula may be different.

The violator faces not only a fine for failure to accrue compensation for unused vacation or long delay, but also administrative liability. These types of sanctions are regulated by the Code of Administrative Offenses and help combat negligence, irresponsibility and fraud on the part of employers. The severity of the sanctions and the type of penalties depend on the total number of violations detected at the enterprise, as well as on the amount of damage that was caused to the dismissed persons.

An individual entrepreneur may be fined 1,000 rubles if he delays payments for the first time.

Particularly severe punishment is provided for LLCs that are required to pay a fine of 100 thousand rubles for regular late payments upon dismissal. The Code of Administrative Offenses provides for the following types of penalties for guilty employers:

- warning;

- fine (paid to the state treasury or municipal fund);

- removal from office (temporary or permanent);

- suspension of work of a legal entity for 90 days.

After termination of the employment contract, no more than 3 months must pass, during which you can file a lawsuit. In addition to fines and sanctions, the owner may be required to pay moral compensation. In order to obtain unpaid amounts through the court, when leaving a position, you must ask the manager for a copy of the signed order and other documents related to work at the enterprise.

Fines

In the event of a violation by the administration or the employer of the regulated deadlines for the payment of wages and other payments due to the employee, vacation accruals, dismissal benefits, and everything that is due to him by law, the amount of material resources increases by the amount of penalties.

In relation to this violation, this is a penalty. Its value is set at least one three hundredth of the refinancing rate according to the lost funds for each day of delay, including the date of dismissal.

The situation discussed above concerns penalties to the employee. The nominal amount of administrative punishment in relation to an employer who has violated the law is 120,000 rubles.

Criminal penalty

Failure to pay a settlement to a dismissed person is punishable by Article 145 of the Criminal Code of the Russian Federation. This crime has the following elements:

- the official is at fault for causing a delay;

- personal interest or self-interest (the intention to gain benefit or help in a certain matter, the desire to hide professional incompetence).

Both individual employers and legal entities can be held criminally liable.

The heads of the company or structural divisions, as well as chief accountants, are found guilty.

Based on the circumstances that have arisen, an investigation is conducted and evidence of guilt is identified. Punishment may include measures such as removal from office, forced labor, restriction or imprisonment. Some sanctions may be applied in combination by a court decision, for example, a fine along with forced labor. The court almost always takes the side of dismissed employees who were unable to receive all the payments due to them. In some cases, the delay may be due to circumstances beyond the defendant's control. The debt to the employee will still have to be repaid, but the amount of moral compensation can be reviewed and reduced taking into account the circumstances that have arisen.

Responsibility of the employer for non-payment of payment upon dismissal

The head of the enterprise that delayed payment to the dismissed person, or an individual entrepreneur, is held liable. The employer's fault may fall within the scope of the following types of liability:

- Financial liability, expressed through the calculation of compensation in favor of the dismissed person for each day of delay.

- Administrative fine for late payment of wages upon dismissal.

- Criminal liability that occurs when the employer systematically ignores legal norms.

The Code of Administrative Offenses considers issues of non-payment of wages or untimely settlements with hired personnel in Part 6 of Art. 5.27:

- officials are punished with a fine in the amount of 10-20 thousand rubles; in case of repeated offenses, the amount of the fine increases to the range of 20-30 thousand rubles;

- a fine for late payment of wages issued by an individual entrepreneur can be equal to 1-5 thousand rubles. (10 - 30 thousand rubles, if this is a repeated fact of delay in payments);

- For legal entities, a penalty of 30–50 thousand rubles is provided. (if the violation is repeated - 50 - 100 thousand rubles).

The arsenal of administrative law instruments also includes warnings to employers and disqualification of officials for up to 3 years.

Individual entrepreneurs, business managers and chief accountants may be held criminally liable if their actions are dictated by selfish or personal interests. The penalty for late payment is provided for in Art. 145.1 of the Criminal Code of the Russian Federation. For a delay of 2 months or more, the amount of the penalty will vary in the range of 100 - 500 thousand rubles; in case of partial non-payment, the maximum amount is reduced to 120 thousand rubles. Alternative measures to influence the management of the employing company include:

- ban on filling a certain list of positions;

- involvement in forced labor;

- short term imprisonment.

Minakova Yulia

- The employer, by virtue of Art. 140 of the Labor Code of the Russian Federation pays the employee the unpaid part of the salary, compensation for unused vacation days, etc. To the manager dismissed by decision of the owner of the organization’s property, when the termination of the employment contract is not related to the actions of the head of the organization, under Art. 279 of the Labor Code of the Russian Federation, special compensation is paid.

- The employee compensates for real damage caused to the employer, but the amount of such compensation is limited to the average monthly earnings of the dismissed person (Article 241 of the Labor Code of the Russian Federation). If the employee is a financially responsible person, then for him the limitation on the amount of compensation is removed, and he compensates for all direct actual damage. The list of positions for which it is possible to conclude an agreement on full financial liability was approved by Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85.

accountant

In practice, this looks, for example, like this: in the case when the Central Bank revokes the license of a bank serving an employer under Part 9 of Art. 20 of the Law “On Banks and Banking Activities” dated December 2, 1990 No. 395-1-FZ, the bank no longer has the right to transfer money based on customer payment orders. If the employer did not react on time and did not ensure that employees received their salaries in another way, then a delay will occur. Formally, the employer is not to blame for the delay in payments, but nevertheless he bears financial responsibility to his employees.

Legal consultation. Still have questions after reading? Call number 8 and our lawyers will advise you! The call is free. We recommend you read it. Section news. Receive email notification of response.

Violation of deadlines is an offense against one’s own employees. One of the main obligations of a manager to his employees is to provide not only comfortable working conditions, but also decent wages, which must be paid within the time limits established by law. In addition to financial liability for violating deadlines, employers are subject to administrative and criminal liability. When calculating compensation, all days of non-payment of wages must be taken into account, expressed as a percentage of the amount of debt. An organization may increase the rate of compensation payments, which is prescribed in internal documents: an employment contract with an employee, a collective agreement, regulations on internal labor regulations.

Responsibility of the employer for non-payment of payment upon dismissal

Amount of fine in thousand Conditions objective side of the crime Overdue period is more Types of punishments Amount of punishments Partial non-payment, i.e. Income of the convicted person for up to 3 years Imprisonment with deprivation of the right to hold a position, engage in certain activities for up to 5 years or without it for 2-5 years. Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week. I agree with the terms of personal data processing.

The employer's liability for non-payment of compensation upon dismissal may be expressed in the application of material, criminal or administrative sanctions to him. The procedure for bringing an employer to these types of liability, their features and size deserve special attention. Fine, imprisonment and other types of criminal punishment for non-payment of payment upon dismissal. When a worker is dismissed, payments must be made by one or both parties:. According to Art. After a salary delay of 15 days or more, the employee, as specified in Part.

We recommend reading: If the Employee Has Worked Since January 2021 When He is Entitled to Vacation

You were FIRED, but your payment is DELAYED: The employer is at risk

The delay in payment upon dismissal is considered to be every day after the day of dismissal. The employer will have to pay the dismissed employee compensation, which is three hundredth of the “refinancing rate of the Central Bank of the Russian Federation, for each overdue day of payment” (Article 236 of the Labor Code of the Russian Federation).

In all cases, without exception, the employee’s last working day is considered the day of termination of the current employment contract, that is, the day of dismissal. Payment can be made later only if the employee, for certain reasons, was absent on the day of dismissal. Then the calculation is made after the employee submits the request, the next day.

Fine for late payment of wages upon dismissal

At the beginning of October 2021, the State Duma of Russia made amendments to the Labor Code of the Russian Federation. From 10/03/16, liability for incorrect payment of wages was increased. In our article we will tell you what fines are due to those employers who do not fulfill their duties in a timely manner.

Article 142 in its 2nd part of the Labor Code of the Russian Federation states that if a manager, vested with the power to decide when to pay and when to delay payment of wages, does not fulfill his duties on time and the delay is more than 15 days, the employee has every right to refuse to fulfill his labor obligations. duties, even his absence from the workplace is acceptable. Such rules are enshrined in letter of the Ministry of Labor of the Russian Federation 14 2 337 dated December 25. 2013

Can the labor inspectorate oblige you to pay wages?

For non-payment of wages upon dismissal, the employer will be held liable under the criminal and administrative legislation of our country. It is necessary for the employee himself to initiate proceedings and an inspection of the enterprise by filing a complaint against the actions of his management to the relevant departments.

As a rule, an employer who does not pay wages on time is subject to administrative liability, which includes penalties in the form of a monetary penalty. The manager or owner of an enterprise of any type will be fined up to 100 thousand rubles. The final fine depends on the type of violation and its scale.

Administrative liability is provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation for violations in the field of labor activity. A large enterprise or LLC faces a fine of up to 50 thousand rubles for non-payment of wages. If a violation is detected again, the amount of penalties will increase to one hundred thousand rubles. For individual entrepreneurs, the fine is up to 5 thousand rubles (up to 30 thousand rubles if brought to justice again).

The employer, according to Article 3.4 of the Code of Administrative Offenses of the Russian Federation, can get off with a written warning if the delay in wages was not his fault. By the way, the management of the enterprise will receive a fine for its other violations. For example, for non-payment of taxes when refusing official employment to subordinates.

What will happen according to the Criminal Code of the Russian Federation?

More serious measures against an unscrupulous employer are provided for in the Criminal Code of our country. According to Article 145.1 of the Criminal Code of the Russian Federation, non-payment of wages threatens the manager with:

- Deprivation of the right to carry out activities;

- A large fine of up to 500 thousand rubles;

- Arrest for up to 3 years (in some cases the period is five years);

- Correctional work.

The maximum period of arrest (5 years) is used in practice as a punishment for an employer extremely rarely. The basis for such a harsh court decision is the scale of the defendant’s actions, as well as the serious damage suffered by employees due to lack of wages.

Under the above article, a criminal case will be initiated if the delay in salary payment is two months. In case of partial non-payment of earnings, liability begins after three months. To punish the employer, it is necessary to submit an appeal to law enforcement agencies, which will initiate further inspection and proceedings.