Signs of business trips

In 2021, business trips are considered:

- Sending employees from the head office to company branches or individual divisions;

- Seconding employees, on the contrary, from branches and divisions to the head office;

- Travel to the head office of those employees who work remotely;

- Travel of persons traveling to another company on a working visit, including abroad.

The first change in the rules that occurred in 2021 can be seen here. Now, to go on a business trip, it is not necessary to physically be at the production site or in the organization’s office; you can work remotely without keeping track of working hours.

If an employee works on a rotational basis or his work involves constant travel, this is another item in the company’s budget, so it cannot be documented as a business trip.

It is important to pay attention to what exactly is considered a business trip and who can be sent on it, because travel expenses may be excluded from the tax base when reporting. Errors and inaccuracies can cause problems with the Federal Tax Service for both the owner of the organization and the accountant.

Sample travel order for director

In large organizations, management often has to travel on official matters. However, for this, a number of formalities must be taken into account, and also performed in accordance with the legislation of the Russian Federation and the Charter of this organization (as well as when registering even such a moment as temporary replacement of an employee, for which an appropriate order is issued). Namely, to draw up and publish a document about sending superiors on a business trip. How to do this? What changes have the required documentation undergone in 2021?

Basic document for a business trip in 2021

The main document that is issued to an employee before a trip is a travel order. Based on his employee:

- Receives the right to go on a business trip.

- Receives an advance amount before departure.

- After returning, he can issue an advance report, according to which travel funds will be taken into account in tax reports and when paying the tax amount itself.

The order in 2021 must contain the following data:

- The name of the company where the traveler works and its OKPO.

- The name of the document, the date of its preparation and the number in the company’s internal records of documents.

- The full name of the employee going on a business trip, his position and personnel number.

- Place of arrival in the form of the name of the locality, country or organization to which the business traveler is going to work.

- Exact or approximate start and end dates of the trip, as well as its duration in days.

- The purpose of the business trip is that if this item is drawn up correctly, then you don’t have to fill out the official assignment and report on it.

- It is indicated who finances the trip - the sending or receiving party.

- Reason for travel - usually noted if the initiator was the employee and not his employer.

- Full name of the head of the organization or person in charge.

- Signatures of the employer and the traveler.

To draw up an order, the T-9 form is sometimes used, an example of how to fill it out correctly can be found in the document at the link, and here you can download a blank form. You can also use an internal document compiled specifically for the organization.

If not one employee, but a group, is going on a business trip, it is allowed to issue one order for them in the T-9a form (sample at the link), the principles for filling out which do not differ from the T-9 form. Here in 2021 you can also use your own form.

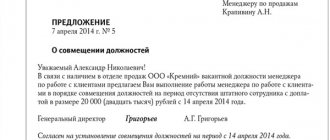

Order on assigning the duties of a director during a business trip

Due to the absence of the head of the enterprise, a deputy is needed who will perform the functions of the head for a certain period of time.

In this case, in addition to the unified T-9 form, an administrative act on the appointment of a director for the duration of the business trip is added. That is, a certain employee is temporarily appointed as a boss, who is assigned the responsibilities of the absent superiors.

A sample order on the temporary assignment of duties must contain:

- The fact of the absence of management and the assignment of his duties to a specific employee;

- List of powers granted (if they are not specified anywhere);

- The period of validity of these powers;

- Item for financing temporary replacement (if this is not part of the assigned employee’s job responsibilities).

Correctly completing all of the above points will provide the manager with a calm work trip, formalized in accordance with the law.

www.samso.ru

The procedure for processing documents for a business trip in 2021

A sample algorithm for how to properly arrange a business trip in 2021 looks like this:

- Make sure that the employee can be sent on a business trip. This is necessary because there are groups of employees who cannot be sent on business trips or can only be sent with their permission. Thus, pregnant workers, minors and those working under an apprenticeship contract cannot be sent on trips. You should ask for written permission from employees with young children or disabled children, especially single parents, as well as those employees who care for relatives.

- Create an order. In 2021, you can use the T-9 or T-9a form, as well as an internal document. There is no need for a service assignment.

- Issue funds. The company must pay the employee for travel tickets, housing, and also issue daily allowances. The total amount of the advance to the employee is established in a local act of the organization or by the employee himself in a memo, which must be approved by the manager. If an employee goes abroad, then the daily allowance must be paid in foreign currency only for going abroad. Within the Russian Federation, all daily allowances are issued in rubles.

- Complete the necessary documents. At this stage, a travel certificate and other documents described in the first section of this article are usually issued.

After this, the employee can safely go on a work trip, after which he will need to:

- Prepare an advance report. This document is completed within three days after the employee returns to the workplace. The advance report is filled out by him using Form AO-1 and submitted to the accountant. If it is customary for the company to fill out reports, then they must be completed and submitted along with the expense report. You also need to attach documents confirming expenses - hotel bills or rental agreements, tickets and boarding passes, checks, forms, waybills, etc. The accountant must give the tear-off counterfoil to the employee so that he can confirm the execution of travel documents in 2021 and their transfer for accounting.

- Give away the excess amount issued. It is transferred to the cash desk within three days after submitting the advance report. Before this, you will need to fill out a cash receipt order. If the employee does not give these funds, then the employer can withhold them from the salary after a month, but no more than 20% of the salary at a time. Expenses in foreign currency are converted into rubles at the rate current at the time of filing the expense report. If an employee received funds in rubles and then transferred them into foreign currency, they will be transferred back to rubles at the exchange rate at that time.

- Compensate for overspending. The employee can spend either less or more than what was issued. So, if all excess expenses are considered justified according to the advance report, then the employee can be paid for the overexpenditure in full using an expense cash order. In 2021, expenses for obtaining a foreign passport and visas will also be reimbursed.

After this, the procedure for sending an employee on a work trip can be considered officially closed, and information about it is entered into the business trip log, provided that there is one. If you act according to the template indicated above and follow all the rules for registering a business trip in 2021, then the company, and especially its accounting department, will easily avoid problems with reporting in the field of business trips. And since accounting was significantly simplified in 2021, it is almost impossible to make mistakes when arranging and paying for business trips in 2021.

How to arrange a business trip for the director and founder?

The general director of the company can also go on a business trip, since there are issues in which his personal presence may be necessary. HR officers sometimes have questions about how to properly arrange a business trip for a director, what documents are needed and who should sign them. We will answer them, and also consider the features of arranging a business trip for the founder.

The procedure for sending employees on business trips is regulated by regulations. The first of them is the Labor Code of the Russian Federation, in particular, Art. 166. It defines a business trip. The second document, which is also the main one, is the Regulation on the specifics of sending employees on business trips. It was approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

Normative base

The procedure for sending employees on business trips is regulated by regulations. The first of them is the Labor Code of the Russian Federation, in particular, Art. 166. It defines a business trip. The second document, which is also the main one, is the Regulation on the specifics of sending employees on business trips. It was approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

Business travel is possible only for persons who are in an employment relationship with the employer.

Employees of third-party organizations or performers under a civil contract cannot be sent on a business trip, since the expenses will not be recognized as tax expenses.

The main regulations governing the process of sending personnel on business trips, their terms, the procedure for registration are the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation of October 13, 2008 No. 749 “On the peculiarities of sending employees on business trips” together with the Regulations of the same name, which applies to business travelers employees both in the Russian Federation and foreign countries.

note

Decree of the Government of the Russian Federation of October 13, 2008 N 749

The rules and requirements of the current legislation also apply when a manager is on a business trip, since he is an employee of the organization.

Travel purposes

Official purposes are reflected in the current Decree of the Government of the Russian Federation No. 749.

The purpose of a business trip for the general director is to perform official duties in accordance with his position to improve the work of the organization.

The documentary basis for the trip is the manager’s order in the form of a formal memo.

Examples of the purposes of a director’s business trip abroad and within the country may include:

- starting a new project, conducting negotiations with contractors and other counterparties, concluding long-term cooperation agreements with them;

- carrying out an audit of a branch when serious violations are identified during inspections of regulatory government bodies at enterprise divisions located in another city or region. This requires the presence of a manager to resolve all controversial issues;

- searching for new opportunities for business development, holding meetings with potential partners of the enterprise, creating and implementing new business projects;

- opening new structural units, branches or branches in other cities and countries.

The purposes of business trips are not recorded in regulatory or personnel documents. They must always be indicated either in a memo from the manager or in a business trip order.

Reasons for a director's business trip

The purposes of a business trip of the head of an organization may be the following:

- meetings with future contractors, implementation of new business ideas;

- opening new company representative offices in other cities or even countries;

- work related to the opening of a new project, participation in negotiations with contractors, conclusion of contracts with them;

- settlement of controversial issues that arose as a result of inspections of branches or separate divisions by state control authorities.

The documented basis is always a properly executed memo.

The purposes of the business trip are also indicated in the business trip order.

Do I need a business trip order for the director?

An order to send a director on a business trip is used to confirm in writing the fact of the business trip, which is required by law . And breaking the law entails liability, so it is important to comply with this requirement. Moreover, the order is mandatory even in case of departure lasting less than one day. The presence of an order also establishes the terms of payment for the sending person’s trip and all calculations of tax costs en route.

It is possible to avoid its registration only when the work activity of the person sent on a work trip is not related to staying at a permanent place of work. In this case, neither the order nor the official trip itself have any right to exist. Otherwise, this document is necessary.

Registration of the director's business trip and necessary documents

The general director, who is not at the same time the founder of the company, is exactly the same employee as the rest. The only difference is that he is the legal representative of the employer in relations with other employees. Therefore, the procedure for processing his business trip will have only slight differences from the registration of a business trip for an ordinary employee.

So, the order of registration is as follows:

- A memo is written by the manager about being sent on a business trip. This paper is considered the basis for issuing a travel certificate and order.

- An order is drawn up to send the employee on a business trip in the T-9 form. It states the purpose of the trip, duration, place and other important information.

- The order is registered in the order register, the employee gets acquainted with the document and puts his signature in the register as a sign of consent.

- A travel certificate is issued in form T-10. Organizations do it on their own initiative, since it is not required by law. It is prescribed only for internal control.

- The general director, like any other employee, is given an advance to pay for travel-related expenses.

- Not necessarily, but you can record the fact that an employee goes on a trip in the logbook for employees going on business trips. The company has the right to provide for the presence and maintenance of such a journal at its own discretion.

- After an employee, and in this case the general director, has gone on a business trip, the days spent on the trip are noted in the time sheet.

- Upon return, the employee provides a report on the funds spent in connection with the business trip. Checks and receipts confirming expenses are attached to the expense report.

Documents must be drawn up correctly; the fate of the company’s taxable base will depend on this (subclause 12, clause 1 of Article 264 of the Tax Code of the Russian Federation). For example, if the order is issued later, it turns out that the number of days on a business trip will be taken into account by accountants in a smaller amount, and then the amount of expenses in the tax base will also be less than the actual amount (which the general director received in his hands when he had already gone on the trip). Therefore, it is so important to comply with the deadlines for drawing up primary documentation. All nuances are indicated in Resolution of the State Statistics Committee of the Russian Federation No. 1 of January 5, 2004.

Order on assigning the duties of a director during a business trip

The main aspect that needs to be paid attention to when sending a boss is the transfer of leadership responsibilities for the duration of the trip. This issue must be taken seriously, especially if the absence involves a long period.

If the CEO is away on a one-day business trip, then delegation of authority may not be necessary. However, a situation often arises when even on the specified day the presence of the manager at work will be necessary.

To transfer authority, two documents must be drawn up:

- order to replace the manager for the duration of the business trip;

- power of attorney for the specified person to perform the relevant duties.

They are drawn up according to the same principles as the transfer of authority when a manager goes on vacation.

Sample order for replacing a director during a business trip

Typically, an order to replace a director is drawn up in the name of his deputy or assistant. However, this point is not mandatory and the corresponding powers can be delegated to any person.

When drawing up a sample, the following points must be taken into account:

- additional duties assigned to the employee must be paid in full;

- if all duties are transferred, then the commissioner will be required to perform all the work of the superior in accordance with the prescribed position;

- partial assignment of responsibilities must be indicated in the appropriate manner.

When drawing up the document, the documentary reason for the transfer of responsibilities must be indicated. The time period during which the person is vested with powers is also specified.

russiansu.ru

Assignment of responsibilities

In cases where the manager is absent from the workplace, and in this case, went on a business trip, his powers are transferred to another employee in order to fulfill the duties of the director: signing contracts, orders, etc. The choice of such an employee may depend on the decision of the manager. But in most cases, such an employee becomes the one who is registered in the organization’s statutory documentation (Article 53 of the Civil Code of the Russian Federation).

As a rule, these are the following employees:

- Deputy Director;

- head of HR department;

- head of any division or department;

- co-founder, if any;

- accountant.

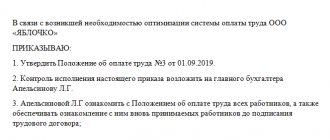

What to consider when assigning the duties of the General Director to another employee:

- The employee begins to perform new duties that are additional to the main ones, so this fact must be agreed upon with the employee. New responsibilities and payment features must be specified in an additional agreement to the employment contract.

- To transfer the right to sign, it is necessary to issue a power of attorney (Article 185 of the Labor Code of the Russian Federation). Its duration can be any, but, as a rule, it corresponds to the period of the business trip.

- The employee's written consent must be obtained.

- An order is issued to transfer the powers of the manager for a certain period.

Attention! If the employee was vested with the authority of a manager before the latter’s business trip was arranged, then he has the right to sign all documents related to the trip.

Registration procedure

In order for the director of an organization to go on a business trip, in 2021 it is necessary to draw up a number of documents, as well as appoint a deputy for the period of absence. This appointment will help the organization operate as normal without downtime.

At the same time, the transfer of the rights of the director of the organization is secured not only by an order on the appointment of an acting director, but also by a power of attorney, in accordance with Art. 185 of the Civil Code of the Russian Federation.

Documentation

To go on a business trip, management must complete the following documents:

- order on the appointment of a deputy acting as director during the absence of the director;

- written consent of the person to be appointed as acting official;

- an order for sending on a business trip, which the director can draw up independently;

- official assignment that requires execution during a business trip;

- Director's advance report;

- memo if necessary, etc. the list may vary depending on the organization.

Sample order

An order for assignment to a business trip is drawn up in the T-9 form, enshrined in the legislative acts of the Russian Federation.

In this way, the organization’s management can not only control the expenses incurred by the employee during the business trip, but also make sure that the official assignment is completed in full. The management itself is controlled in the same way.

A sample order for sending on a business trip is here.

Founder's business trip

There are situations when it is necessary to send the founder on a business trip. More precisely, the trip must be registered as a business trip, because the founder is traveling on company business, and the expenses must be taken into account as travel expenses. But he is not an employee of the company, so he cannot be sent on a business trip (Article 166 of the Labor Code of the Russian Federation) and money cannot be given on account. If this rule is neglected, the tax office may have questions.

To arrange a business trip for the founder (and at the same time write off expenses in tax accounting, not withhold personal income tax and receive a VAT deduction), you can use three methods.

Employment contract

The first way is to conclude a fixed-term employment contract with the founder and hire him for a position (for example, assistant director) with a minimum salary. Then you can arrange a business trip according to all the rules: with payment for accommodation and daily allowance.

Important! The employment contract must specify the responsibilities related to the business trip: participation in negotiations, preparation for concluding transactions, etc. The salary in this case should not be lower than the minimum wage.

Civil contract

The second way is to conclude a civil law agreement for each “business trip”. Such an agreement must specify specific tasks: what it must do, what result it must obtain.

The contract can be of two types: provision of services and assignments (it is concluded if it is necessary to sign any documents during the trip; a power of attorney is also drawn up for the right to sign documents on behalf of the company).

If a GPA is concluded, the company must reimburse the founder for the costs of this trip or buy tickets, pay for accommodation, etc. In the first case, personal income tax and insurance premiums are not charged for compensation of costs; this amount is included in the tax expenses of the organization. All expenses must be confirmed by the primary source; VAT cannot be deducted, because Only the founder will appear in the documents.

If the company itself pays for travel and accommodation, then VAT deduction will be possible, because documents will be issued in the name of the company.

Cash for the trip is not issued on account, but simply from the cash register as funds necessary for the implementation of the GAP. The cash receipt order must indicate the date and number of this agreement.

Without an agreement

There is no need to conclude any agreements if the trip is related to a transaction, the conclusion of which requires the presence and approval of the founder. There are types of transactions that a director cannot enter into independently:

- large (these are transactions with property worth more than 25% of the value of the enterprise’s property);

- with interest;

- which are stated in the LLC charter as requiring approval.

If the reason for the trip is one of these transactions, then the Federal Tax Service will not doubt the justification of the costs of the trip (Article 252 of the Tax Code of the Russian Federation). Typically, such expenses are considered as other or non-operating expenses.

Since the funds were not used to pay the founder’s personal expenses, but to pay the company’s expenses, payment of personal income tax and insurance premiums is not required. VAT can be deducted.

Law

In Russia, there are several regulations that regulate this issue to the greatest extent and indicate many specific features of business trips:

- The Labor Code of the Russian Federation, which establishes the most general provisions concerning labor relations between employees and employers and, in particular, issues of business travel.

- Government Resolution No. 749, which refers to the Regulation “On the specifics of sending employees on business trips”, this legislative act prescribes more detailed explanations, comments and ways to regulate issues related to business trips.

All provisions also apply to the head of the organization who needs to be sent on a business trip.

Budget organization

In the case of arranging a business trip for the director of a budget organization, a number of difficulties may arise, since for such a boss it is necessary to prepare not only a standard package of documents, but also to reflect the funds through which the business trip is carried out and travel allowances are paid.

At the same time, before a manager goes on a business trip, it is very important to register the person acting in the duties of the management.

In this case, it is necessary to transfer the director’s powers, as well as to grant the person performing his duties partial rights in relation to other employees during the director’s business trip.

In particular, such persons must, for example, accept explanatory notes from employees, memos, respond to them and perform other actions that are necessary for the normal operation of the organization despite the absence of management.

Requirements

According to Russian law, any business trip must be:

- appropriately designed and aimed at fulfilling the necessary instructions for the development of the organization;

- not related to the implementation of business trips at a permanent workplace;

- limited by a fixed period for the execution of the order or purpose of the trip.

Requirements for activities on business trips can be supplemented by the organization’s management, however, these rules and requirements are the most general and must be followed regardless of the hierarchy of the organization’s employee.

The duration of a business trip for a company director is not limited by law and is set by management independently, while the legislator notes that the duration of a business trip must be “reasonable”, but does not provide any specific figures.

It is noted that the period is set to the extent necessary to fulfill the purpose of the trip or official assignment.

Manager's business trip

As noted above, a business trip for the director of an enterprise must not only meet all the standards for business trips for an ordinary employee, but also:

- have a goal according to which the business trip is justified and meets the needs for the development or activities of the company;

- be properly formalized in accordance with the requirements of the law and the rules of the organization;

- meet the goal.

Directors

In order for the director of an organization to go on a business trip, it is necessary to develop a clearly defined goal for such a labor action. Moreover, according to the Regulations, the purpose of the manager’s business trip is to perform actions related to the performance of official duties, which are aimed at improving and developing the organization.

Purposes that a director’s business trip may pursue:

- development or opening of a new project that is closely related to the current activity of the organization or is partially related, but is a subsidiary organization;

- conducting an inspection at an existing branch of the company to eliminate suspicions or violations discovered there;

- holding business meetings with potential partners or investors for the development of the organization, preparing presentations and presenting them to such persons;

- opening new branches of the company in other cities both in Russia and abroad, etc.

Often, goals are not reflected in the organization's charters, as they are constantly changing.

The purposes of business trips must be reflected in the order for sending on a business trip, or in a memo, which must be drawn up in order to record the work activities of the manager.

Budget organization

In the case of arranging a business trip for the director of a budget organization, a number of difficulties may arise, since for such a boss it is necessary to prepare not only a standard package of documents, but also to reflect the funds through which the business trip is carried out and travel allowances are paid.

At the same time, before a manager goes on a business trip, it is very important to register the person acting in the duties of the management.

In this case, it is necessary to transfer the director’s powers, as well as to grant the person performing his duties partial rights in relation to other employees during the director’s business trip.

In particular, such persons must, for example, accept explanatory notes from employees, memos, respond to them and perform other actions that are necessary for the normal operation of the organization despite the absence of management.

Requirements

According to Russian law, any business trip must be:

- appropriately designed and aimed at fulfilling the necessary instructions for the development of the organization;

- not related to the implementation of business trips at a permanent workplace;

- limited by a fixed period for the execution of the order or purpose of the trip.

Requirements for activities on business trips can be supplemented by the organization’s management, however, these rules and requirements are the most general and must be followed regardless of the hierarchy of the organization’s employee.

Read more: Law on Non-Disclosure of Confidential Information

The duration of a business trip for a company director is not limited by law and is set by management independently, while the legislator notes that the duration of a business trip must be “reasonable”, but does not provide any specific figures.

It is noted that the period is set to the extent necessary to fulfill the purpose of the trip or official assignment.

Are you interested in tracking working hours while on a business trip? See here.

Payments and reimbursements

Any employee, including the head of the enterprise, is entitled to the following payments:

- travel allowances – payment of funds for all days spent on a business trip;

- average daily earnings during absence from work due to a business trip;

- daily allowance, which is the amount paid daily for accommodation;

- reimbursement of personal expenses, if any, during the business trip.

Food and accommodation

Food and accommodation on a business trip is one of the most important issues, so it is so important to take care of it in advance.

As a rule, food and accommodation for a business traveler, including management, is provided on a daily basis, which will be discussed below.

It is believed that daily allowances are issued so that a posted worker can afford decent food and accommodation on a business trip, while, as practice shows, the cost of food outside the permanent place of work increases significantly and therefore daily allowances should be at a good level.

Also, to confirm the cost of services provided, in particular hotels and meals there, you must ask for a receipt, and also collect all receipts to attach them to the trip report.

As practice shows, additional costs incurred are paid by the organization quite quickly if there is strong evidence.

Daily allowance

According to the law, daily allowances are payments of funds to a business traveler before going on a trip so that he has the opportunity to fulfill any personal needs of the body.

In this case, daily allowances are paid for all days spent on a business trip, including holidays and weekends.

By personal car

A business trip in a personal car also requires reimbursement of expenses incurred by the employee.

In order for the organization to be able to reimburse the spent funds to the business traveler, he must provide:

- documents indicating a job assignment or purpose;

- receipts from gas stations, hotels and food places;

- other documentary evidence of expenses incurred.

Very often, for the use of a personal car for the purpose of operating an enterprise, an employee is paid a fixed amount of compensation, thanks to which he will be able, if necessary, to repair the vehicle or maintain it in good condition. These actions are fixed in an agreement between the business traveler and the legal entity.

The same actions apply to the head of the enterprise. An agreement is concluded according to which a certain amount of money will be paid to him for the use of a personal car for the development of the enterprise, in particular for business trips.

Features of arranging a business trip for a manager

The procedure for sending the head of an organization on a business trip has a number of features, since this unit of personnel bears full financial responsibility for the activities of the company, as well as for each of the subordinates and for their actions in the process of performing labor functions. If it is necessary to send a chief on business, his place must be taken by a specialist who will be assigned the functions of an interim acting official (IA).

The period of absence of the head of the organization is indicated in the documentation accompanying the event. This period is fixed and can be extended if there are exceptional circumstances that do not allow returning from the trip on the specified date.

According to the provisions of the law, any posted employee, including the director of a company, is covered by the employer for all business expenses, that is, funds are collected from the organization’s budget in the required amount. Thus, the accountant is required to provide the following types of accruals:

- The average daily earnings of a person for the period of travel for an official nature;

- Daily expenses provided to pay for housing/travel/food during a business trip;

- Additional payments provided for the employee’s personal expenses, if provided for by internal documentation (for example, payment for mobile communications);

- In case of going on a business trip by personal transport, travel expenses are reimbursed to the employee upon return and presentation of receipts from the gas station. Some employers pay posted employees a fixed amount of finance for using their car for business purposes. This payment, if necessary, can be used not only to cover the cost of gasoline, but also to repair the car in the event of an accident.

In Russia, the one who knows his rights wins

If you want to know how to solve your specific problem, then ask

our duty

lawyer online

.

It's fast, convenient and free

or by phone:

Moscow and region:+7

St. Petersburg and region:+7

Federal number:+7

Advance report

An advance report is a document of the established form, which is submitted after the arrival of an employee or manager from a business trip.

It states:

- the amount of money received by a posted employee of the enterprise (in particular the director);

- expenses incurred during the business trip, they may be less or more;

- the declared amounts are supported by the necessary documents.

It is worth noting that this document is submitted to the accounting department of the organization with the signature of the person who arrived from the business trip.

A business trip for a manager follows the same scenario as a business trip for any other employee of the company, however, it has a number of important nuances, without which its implementation is simply impossible.

How and by whom is a director’s travel order drawn up?

Secondment of a company's executive is often an integral part of the work process. In this case, the question arises of how and by whom the relevant documentation is drawn up. The legislation provides that the preparation of the necessary acts is carried out according to a standard procedure . That is, there are no fundamental differences in the secondment of an ordinary employee or manager. The main aspects that need to be paid attention to are the transfer of authority for the duration of the trip and the identification of the person who arranges it.