Home / Labor Law / Payment and Benefits / Compensation

Back

Published: 05/28/2016

Reading time: 7 min

0

1629

The standard annual paid leave for a citizen of the Russian Federation with official employment is 28 days.

But, in our country there are also special conditions for providing official rest to specialists whose activities are associated with difficult working conditions .

In addition to a month of paid rest, representatives of such professions can count on additional days of rest, or instead of the weekends allotted in addition to the standard vacation, demand monetary compensation.

- Legislation of the Russian Federation on additional leave

- Are all employees entitled to substitute additional leave compensation?

- How is compensation calculated?

- Calculation examples Example 1

- Example 2

- If an employee wants to quit

Experience for granting leave

Based on Article 121 of the Labor Code of the Russian Federation, the right to basic leave is given by length of service, which includes the working time of a particular employee in the following cases:

- when the employee retained his job, but he did not actually work (due to paid leave, non-working days and days off, or due to other days of rest);

- removal from duties of an employee who was unable to undergo a medical examination required by the company or organization through no fault of his own;

- vacation not exceeding 14 days (total for 1 year), which is provided at the request of the employee, during which the salary is not maintained;

- absenteeism, which was committed by an employee during illegal removal from work (or dismissal) with the subsequent reinstatement of the employee in his position.

Payment of compensation for unused vacation and the Labor Code of the Russian Federation

The Labor Code of the Russian Federation considers two situations in which payment of monetary compensation for unused vacation is provided (Article 126 “Replacement of annual paid leave with monetary compensation” and Article 127 “Exercising the right to leave upon dismissal of an employee”). We are talking about such situations:

- At the written request of the employee, part of the annual leave (lasting more than 28 days) may be replaced by monetary compensation.

- In case of dismissal of an employee, compensation is calculated for unused vacation days.

Compensation for unused vacation while working

In accordance with Article 126, compensation is paid to employees who have extended vacations. This category includes:

- minors, teachers and disabled people;

- employees who apply for additional leave;

- employees who have irregular hours or work in dangerous (harmful) conditions;

- medical workers;

- athletes and coaches;

- workers in the regions of the Far North (and other regions equivalent to this).

The above rule gives the employer the right to replace vacation with compensation. Thus, if the employer deems it necessary, he has the right to provide the employee with leave and refuse to pay monetary compensation.

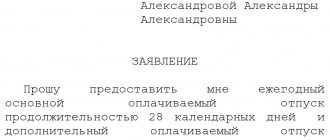

It should be noted that compensation for unused vacation in 2017 is only possible if the employee has submitted a corresponding application. If the employer has not received a statement from the employee, then even by a court decision it will be impossible to force the employer to compensate in cash for part of the unused vacation.

Please note that in accordance with Article 126 of the Labor Code of the Russian Federation, the norm for replacing basic and additional leave with monetary compensation cannot be applied to employees under eighteen years of age, to pregnant employees and employees engaged in heavy work and work with hazardous working conditions .

It is prohibited to replace the entire vacation with monetary compensation, in this case Art. 5.27 of the Code of the Russian Federation on Administrative Offenses provides for the following fines:

- from 1000 to 5000 rubles for officials (manager);

- from 1000 to 5000 rubles for individual entrepreneurs;

- from 30,000 to 50,000 rubles for legal entities.

Leave must be granted annually. It is possible to postpone a vacation to the next year only if there is a justified production need. According to Part 4 of Art. 124 of the Labor Code of the Russian Federation it is prohibited not to provide vacation for two years in a row.

In 2021, Omega LLC accountant Mikhailov has the right to:

- basic leave lasting 28 calendar days;

- additional leave for special working conditions lasting 8 calendar days.

The total duration of Mikhailov’s annual paid leave in 2021 will be 36 calendar days (28 days + 8 days). In 2021, with the consent of the administration, he can replace with compensation part of the vacation lasting only 8 calendar days.

Compensation for unused vacation upon dismissal

An employee has the right to receive compensation for unused vacation before dismissal, if he has not taken advantage of it before that time. It should be noted that the Labor Code of the Russian Federation does not stipulate the calculation of compensation for unused vacation upon dismissal. Employers mainly rely on the Vacation Rules (dated April 30, 1930 No. 169) and clarifications of the Ministry of Labor.

In accordance with these documents, an employee who is dismissed by the employer, having worked for at least eleven months (which are counted towards the period of work), has the right to receive full monetary compensation for unused vacation (maximum 28 days).

If an employee worked for one year and eleven months and did not use vacation, then he is entitled to vacation compensation upon dismissal (in this case - 56 days).

Full compensation for unused vacation (which is 28 days) is due to employees who have worked from 5.5 to 11 months under the following conditions:

- The enterprise (or its individual divisions) was liquidated.

- Work has been temporarily suspended or the company is undergoing reorganization.

- Reducing the volume of work performed or the organization's staff.

- An employee's entry into military service.

Thus, an employee who has worked in an organization for 1.5 years and has not used his vacation, after the liquidation of the company and dismissal, has the right to count on compensation for 56 vacation days (Article 81 of the Labor Code of the Russian Federation).

Answers to common questions about calculating additional leave for hazardous working conditions

Question No. 1: Are medical workers of any specialization entitled to additional leave?

Answer: Additional leave may be provided to health workers for night work, irregular days, and overtime. But additional rest for harmful activities is provided only to those health workers who spend time with patients with HIV infection or tuberculosis, or with materials that contain the human immunodeficiency virus.

Question No. 2: Is additional leave granted to a production employee who is recognized as harmful by the commission, if the work is not carried out under the influence of harmful factors?

Answer: No, work in itself at an enterprise where working conditions are recognized as harmful does not give the right to additional leave.

Only those employees who directly interact with harmful factors (elevated temperatures, polluted air, low ambient temperatures, radiation, gases, etc.) have the right to extra rest. Rate the quality of the article. Your opinion is important to us:

Formula and examples for calculating compensation for unused vacation

Article 139 of the Labor Code of the Russian Federation and Regulation No. 922 describe the norms according to which the average daily wage is calculated from data for the last 12 months.

That is, in order to calculate the amount of compensation to an employee for unused vacation, you must use the following formula:

(S/29.3)/12 XK, where:

S is the employee’s total income that he received in one calendar year; K - duration of leave (28 days - standard leave, 56 days - for teachers); 29.3 – average number of days per month for the year;

There is another calculation option: the number of months worked by the employee is multiplied by the number of vacation days falling in one month. The resulting number of days is multiplied by the average daily earnings.

Full settlement with the employee must be made directly on the day of dismissal (Article 140 of the Labor Code).

The deadline for paying compensation for unused vacation to an employee who continues to work at the enterprise is not established by law.

Taxation when paying compensation for unused vacation

In accordance with Article 223 of the Tax Code of the Russian Federation, the calculation and payment of contributions and personal income tax are made from the full amount of compensation if the employee continues to work at the enterprise, namely:

- personal income tax;

- contributions for compulsory pension and health insurance;

- contributions for temporary disability and maternity benefits;

- contributions for injuries.

When calculating and paying compensation for unused vacation, upon dismissal of an employee, only personal income tax is withheld from the amount of monetary compensation and transferred to the budget. Contributions for pension, health insurance, as well as in case of temporary disability and injury are not charged.

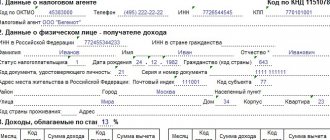

Paper work

When dismissing an employee and compensating his vacation with money, you need to fill out his personnel documents. In the employee’s personal card, these are columns 4 to 7. You also need to make an entry in the vacation column in the notes section, noting the fact of compensation and the details of the corresponding order. Compensation for unused additional leave upon dismissal is classified as labor costs in the income tax and simplified tax system at 15%. But it is fully subject to personal income tax and insurance contributions.

This is important to know: Compensation for unused vacation upon dismissal: personal income tax code 2020

Before calculating compensation, first figure out whether the employee is entitled to it at all. But the most important part of compensation is calculating its amount. If you can handle this, no problems will arise.

Calculation examples

Example 1. Employee of a commercial company

An employee of the company earns 25,000 rubles per month. For 6 months of work, he will receive an income equal to 150,000 rubles. Average daily earnings 25,000 / 29.3 = 853.24 rubles. For a company employee, there are 2.33 days of vacation per month. 6x2.33 = 13.8.

13.98 × 853.24 = 11928.29 rubles (the amount of compensation to the employee for unused leave upon dismissal for 6 months).

Example 2. Teacher

A teacher earns 22,000 rubles a month. In 6 months he will receive an income equal to 132,000 rubles.

For a teacher, there are 5 days of vacation per month. 6x5 = 30.

The average daily salary of a teacher will be:

22,000. 29.3 = 750.85 rubles.

30 × 750.85 = 22,525.50 rubles (amount of compensation to the teacher for unused vacation for 6 months).

Example 3. Employee of a company that has closed

The employee was hired on March 2, 2007. Every year he took a vacation (28 days). On September 2, 2015, he resigns due to the cessation of the enterprise. His estimated length of service is 6 months (from March 2 to September 2, 2015). This employee has the right to receive compensation for 28 days of vacation (his length of service is more than 5.5 months).

When compensation cannot be obtained

Additional vacations that employees receive, according to Law of the Russian Federation No. 1244–1, are not compensated.

Additional leave for workers employed in hazardous and hazardous industries is not subject to compensation. Moreover, according to Article 117 of the Labor Code of the Russian Federation, the minimum duration of such leave is 7 calendar days.

If the employee is entitled to a longer vacation, then the part of the vacation exceeding 7 days can be replaced by compensation based on:

- collective agreement;

- industry (inter-industry) agreement;

- written consent of the employee (in the form of a special agreement to the employment contract).

Thus, to summarize, we can conclude that the amount of compensation for unused vacation depends on the number of vacation days (that were not used by the employee or not provided by the employer).

Compensation is paid only if the employee submits a corresponding application to the employer.

In order to pay compensation, you need to take into account the employee’s length of service since the last vacation and the average daily income.

Funds are not paid for child care and for periods when a person did not work (weekends and holidays, absences for unexcused reasons).

Helpful information? Share it with your friends!

Upon dismissal, should an employee be paid compensation for unused days of additional leave for length of service?

At the time of dismissal, the employee had unused days of additional leave for length of service. Additional leave for length of service is provided for by local regulations of the organization. Upon dismissal, should an employee be paid compensation for unused days of additional leave for length of service? If so, what is the procedure for calculating this compensation?

Having considered the issue, we came to the following conclusion:

Upon dismissal, the employee must be paid compensation, including for unused days of additional leave for length of service. The procedure for calculating this compensation in most cases will coincide with the procedure for calculating compensation for unused days of the main vacation.

According to Art. 127 of the Labor Code of the Russian Federation, upon dismissal, an employee is paid compensation for all unused vacations, and therefore, unused additional vacation for length of service is also subject to compensation.

The procedure for calculating compensation for unused vacation is regulated by the Rules on regular and additional vacations, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 N 169 (hereinafter referred to as the Rules). In accordance with Art. 423 of the Labor Code of the Russian Federation, this document continues to be applied at the present time, since there are no other regulatory legal acts establishing the procedure for calculating compensation for unused vacation.

According to clause 28 of the Rules, employees dismissed for any reason who have worked for a given employer for at least 11 months, included in the length of service giving the right to leave, receive full compensation. In all other cases, employees receive proportional compensation.

In accordance with part four of Art. 139 of the Labor Code of the Russian Federation, the average daily earnings for paying for vacations and paying compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (the average monthly number of calendar days). This procedure is general and is used when determining compensation for unused days of both main and additional vacation. The length of service giving the right to leave is calculated in accordance with Art. 121 Labor Code of the Russian Federation. For all additional leave, except for leave for work with harmful and (or) dangerous working conditions, in our opinion, the rules for calculating length of service contained in parts one and two of Art. 121 Labor Code of the Russian Federation. Thus, the amount of compensation for unused additional leave provided to an employee in accordance with the organization’s local regulations for length of service is calculated in the same way as the amount of compensation for unused main leave.

Moreover, in most cases, the length of service that gives the right to basic leave coincides with the length of service that gives the right to additional leaves (except for leave for work in harmful or dangerous working conditions); the number of days subject to compensation can be calculated immediately for the entire annual vacation, without dividing it into main and additional.

Counting rules for certain categories of citizens

Calculation of compensation for certain categories of citizens

When calculating compensation, many managers have questions and difficulties. This applies not only to part-time workers, but also to minors, pensioners, disabled people, and women on maternity leave. They also retain the right to compensation for unused vacation, in accordance with current legislation. The differences lie only in the counting procedure itself.

In the case of part-time workers, calculations are carried out for both the main and additional places of work. Official registration of part-time activities becomes the main condition for these categories of citizens. Civil contracts cannot serve as evidence.

When it comes to maternity leave, only maternity, maternity and maternity leave should be deducted from the length of service. Income is taken per year of work actually performed.

Women are entitled to at least 2.5 days of vacation on average per month. The rest of the calculations involve the use of a special formula.

For disabled people, the standard duration of leave is 30 days. This must also be taken into account when making calculations.

Minors have the right to rest for at least 31 days every year.

Calculation of compensation for unused vacation upon dismissal of an employee

Compensation for unused vacation is paid in two cases: in return for vacation exceeding 28 calendar days (Article 126 of the Labor Code of the Russian Federation), and upon dismissal of an employee (Article 127 of the Labor Code of the Russian Federation).

Cash compensation for unused vacation is paid in two cases: compensation in lieu of vacation exceeding 28 calendar days (Article 126 of the Labor Code of the Russian Federation), and compensation upon dismissal of an employee (Article 127 of the Labor Code of the Russian Federation).

The procedure for paying compensation is established by clause 28 of the Rules on regular and additional leaves, approved by the USSR People's Commissariat of Labor dated 04/30/30 No. 169 (hereinafter referred to as the Rules on Leaves).

Length of work with this employer and the right to compensation . An employee receives the right to take annual paid leave after six months of work with a given employer.

It is reasonable to assume that if an employee quits without working for six months, then he has no right to vacation, and therefore no compensation. However, we will not find confirmation of this assumption either in the Labor Code or in the Vacation Rules.

Paragraph 35 of the Leave Rules states that the number of days of work amounting to less than half a month is excluded from the calculation of length of service giving the right to compensation. It follows from this that an employee who has worked for more than half a month has the right to compensation for unused vacation upon dismissal. This position is confirmed by the letter of Rostrud dated 06/08/2007 No. 1920-6.

If by the day of dismissal the employee has worked for this employer for more than half a month, he has the right to compensation for unused vacation.

Who is not entitled to compensation for unused vacation?

Upon dismissal, compensation for unused vacations is not paid:

- employees who have worked for the organization for less than half a month. For example, a specialist was hired on March 25, 2015, and already on April 2 he resigned by agreement of the parties to the employment contract (Article 78 of the Labor Code of the Russian Federation). In October - November, the employee worked seven working days. Therefore, he does not need to accrue compensation for unused vacation;

- performers under civil contracts (Article 11 of the Labor Code of the Russian Federation).

Leaves subject to compensation upon dismissal

When calculating compensation, it is necessary to take into account not only unused basic leave (Part 1 of Article 115 of the Labor Code of the Russian Federation), but also additional leave.

If vacation is used in advance

If, shortly before dismissal, an employee used vacation for a working year that was not fully worked, then upon dismissal, overpaid vacation pay must be withheld from his salary. In some cases, such deduction is not made, for example, during the liquidation of an organization, the employee’s refusal to transfer to another job, which is necessary for him in accordance with a medical report, etc. This is provided for in Part 2 of Article 137 of the Labor Code.

Let us remind you that additional holidays are provided:

- for workers engaged in work with harmful and (or) dangerous working conditions (Article 117 of the Labor Code of the Russian Federation);

- persons working in the regions of the Far North, equivalent areas and areas with severe climatic conditions (Article 321, Part 5 of Article 302 of the Labor Code of the Russian Federation and Article 14 of the Law of the Russian Federation of February 19, 1993 No. 4520-1 “On State Guarantees and compensation for persons working and living in the Far North and equivalent areas");

- persons injured as a result of the Chernobyl accident (Articles 14, 18, 19 and 20 of the Law of the Russian Federation of May 15, 1991 No. 1244-1 “On the social protection of citizens exposed to radiation as a result of the Chernobyl NPP disaster”);

- employees with irregular working hours (Article 119 of the Labor Code of the Russian Federation);

- professional athletes and sports coaches (Article 348.10 of the Labor Code of the Russian Federation), etc.

In addition, an organization can provide additional leave (in excess of that established by law) in accordance with an employment or collective agreement (Part 2 of Article 116 of the Labor Code of the Russian Federation). Below we will look at the procedure for calculating the amount of compensation for unused annual paid leave.

Number of vacation days for which compensation is due upon dismissal Calculation of the number of days of unused vacation subject to compensation is made in accordance with the norms of Articles 114, 115 and 121 of the Labor Code and paragraphs 28 and 35 of the Vacation Rules.

To determine the number of days of unused vacation at the time of dismissal of an employee, you should analyze his vacation history with a given employer, that is, compare the number of days of annual paid leave earned by the employee with the number actually used. The difference will be the desired result.

Let's start by determining the standard number of days of paid leave.

Work experience for vacation . The number of calendar days of vacation provided for a year of work with this employer is 28, that is, for each month there are 2.33 days (28 calendar days ÷ 12 months).

When determining the number of vacation days that are subject to compensation, not the calendar year is taken into account - from January 1 to December 31, but the working year. The working year is determined for each employee individually. It is 12 months from the date the employee starts working for this employer. If an employee started work, for example, on March 20, 2015, then the first working year for which leave is granted will be from March 20, 2015 to March 19, 2021.

From the period that the employee worked in the working year, the following must be excluded (Article 121 of the Labor Code of the Russian Federation):

- the time of his absence from work without good reason, for example in the cases provided for in Article 76 of the Labor Code (appearing at work while intoxicated or if the employee has not passed a mandatory medical examination, etc.);

- time of parental leave until the child reaches the age of three.

At the same time, the employee’s vacation period includes the following time (Article 121 of the Labor Code of the Russian Federation):

- actual work;

- when the employee did not actually work, but he retained his place of work (position);

- forced absenteeism due to illegal dismissal or suspension from work and subsequent reinstatement to the previous job;

- removal from work of a specialist who has not passed a mandatory medical examination (examination) through no fault of his own;

- unpaid leave provided at the request of the employee, not exceeding 14 calendar days during the working year.

Work experience for compensation for unused vacation . If an employee worked for more than 11 months in a working year, upon dismissal he is entitled to full compensation for 28 calendar days of vacation, but if less than 11 months, then the number of unused vacation days will be calculated in proportion to the time he worked using the formula:

This procedure is provided for in paragraph 28 of the Leave Rules.

The procedure for calculating compensation for unused vacation upon dismissal

Compensation for unused vacation upon dismissal is calculated based on the employee’s average earnings (Article 114 and Part 4 of Article 139 of the Labor Code of the Russian Federation). The procedure for its calculation is established in the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 (hereinafter referred to as the Regulations on Average Earnings). The algorithm for calculating compensation upon dismissal is given below.

Algorithm for calculating compensation upon dismissal

Let's consider the calculation algorithm in more detail.

System 1C ZUP

Today there are several modernizations of the 1C ZUP system. The most advanced version of all available is considered to be the version of this program, which is designated as 8.3.

Calculation and reflection of compensation upon dismissal

The dismissal process can be quite complicated for those who have just started working with 1C ZUP, but its experienced users suggest the following algorithm of actions:

- The first manipulation is carried out using a document of the same name. Using it, you can record the fact that an employee left work and calculate all the required accruals, including compensation for unused additional leave. So, first you must open the “Dismissal” document. Next, click “Create” – “Human Resources” – “Dismissal”.

- Next, you need to fill out lines such as “Organization”, “Employee” and “Month”.

- Sometimes you need to change settings that require automatic recalculation. To do this, you need to go to the appropriate settings (in “Payroll”) and uncheck the unnecessary box.

- Now, after filling out the column, you should click “Payroll Calculation”. If the settings are correct, this tab will be marked in yellow.

- Next, the date indicated in the dismissal order is indicated.

- If there is not enough information, the corresponding phrase will be displayed on the screen. To solve this situation, you need to go to the tab called “Data Change”.

- After entering information into the empty columns, you need to click on recalculation again.

- Carrying out the document becomes the finishing touch.

When making such a calculation, special attention should be paid to such an item as work experience. The sequence of its determination is described in detail in the Labor Code of the Russian Federation. This point is very important, since only through accurate length of service can you identify all unused main and additional vacations.

We must not forget that full compensation for additional leave upon dismissal is due to those employees who have worked at the enterprise for at least 11 months.

If this condition is not met, then the quitter may be paid compensation of a proportional nature. It is calculated as follows:

- The number of days in the main regular vacation must be divided by the number of months in the year.

- Afterwards, the result must be multiplied by the number of months in vacation work experience. If there is an incomplete month, rounding will be required.

In the 1C ZUP system, all controversial issues are resolved in favor of the employee. This manifests itself in:

- compensation for additional leave upon dismissal is rounded up, regardless of how many days there were in an incomplete month;

- full compensation can be paid even if there is a missing amount of experience;

- the prorated amount is only rounded at the end of the calculation.

Calculation and reflection of unused additional days

There are several ways to calculate such an important payment as compensation for additional vacation days. An important condition is that only two types of additional leave can be compensated: those provided to employees of the Far North and adjacent territories, and those offered to employees working on irregular work schedules.

- Compensation for additional leave through ZUP: simplified method. To complete it, you must: select the calculation of compensation in accordance with the number of calendar days; change “Compensated leave” to “RKS”; create and post a “vacation” document for the company’s employees. Before starting the calculation, you need to check all the data again. An error in this case may occur due to the accountant’s forgetfulness, in particular, the lack of actions specified in the first two paragraphs.

- Compensation for additional vacation using the 1C system: a complicated method. It involves the need to change the supplier's configuration. If this is not possible, then only the method described above remains.

In general, using the 1C ZUP system in your work will significantly facilitate the task of a personnel officer or accountant. With its help, calculate such a payment as monetary compensation for additional leave. Compensation for unused additional leave upon dismissal is also determined without any particular difficulties.

Common mistakes

Error: The employee demands compensation for additional leave, regulated by local regulations, but not established by law as mandatory.

Comment: If the employer assigns additional vacations on his own initiative, but the law does not require this, such days of rest are not subject to compensation.

Error: The employer promised to pay compensation for unused additional vacation when the company received funding in a future pay period.

Comment: Compensation for unused additional leave is paid simultaneously with other payments on the day of final payment.