Photo: pixabay.com Updated: 11/26/2020

Calculation of maternity benefits replacement of the billing period Statement calculation period of maternity leave Calculation of maternity leave for the billing period Calculation period for maternity years Years of the billing period Days in the billing period Calendar days of the billing period Calculation period for vacation Calculation period for calculating benefits Calculation period for sick leave Calculation period for child care Definitions of the billing period periodExcluded days from the billing period

The amount of maternity benefits is calculated from the average salary for the last 2 calendar years, before going on maternity leave. This time period is called the billing period. If during the last 2 years, the woman has been on maternity leave or child care leave. Then she has the right to replace the last 2 years with earlier ones (one or both accounting years can be replaced).

- Estimated period of maternity leave

- Rules and conditions for changing the billing period

- Calculation period if vacation immediately after maternity leave

- Will income increase when the billing period changes?

- Formulas for calculating maternity payments

- Examples of calculating maternity benefits

- Online maternity period calculator

- How to submit an application to change the billing period

- conclusions

Estimated period of maternity leave

The billing period is 2 calendar years preceding the insured event. The billing period is necessary to calculate the average salary. The amount of wages affects the amount of the following payments:

- Temporary disability benefits

- Maternity benefits

- Child care benefits up to one and a half years old

In addition to wages, the billing period takes into account:

- Number of calendar days for both years, for example: 2021 and 2019 = 731, 2021 and 2021 = 730, 2021 and 2021 = 730

- Number of excluded days during the period: temporary disability

- maternity leave

- maternity leave

- releasing an employee from work with full or partial retention of his salary, provided that no insurance premiums were charged on the retained salary

How to request a replacement billing period

If you understand that replacing calendar years when calculating benefits will be beneficial to you, you need to take into account the nuances of this procedure.

What documents are needed

The law states that replacement can only be made after a written application has been made.

If the application is not completed, the employer is not obliged to change anything else. He will calculate benefits from the last two years, as established by law.

If the employer has received a request from an employee in writing, he must carry out two calculations at once and choose the one that is most beneficial for the woman.

If both options are not calculated, benefits will be paid based on the application. But at any time the employee has the right to demand recalculation and payment of lost funds.

- Along with the application, the woman provides her sick leave.

- Certificate of registration up to 12 weeks.

- Passport and its copy.

- Bank card information if salary is paid in cash.

The documents are sent to your immediate supervisor, accountant, or HR employee.

Be sure to warn about the importance, since after receiving your documents, funds must be credited within 10 calendar days. It is very important to keep within these lines.

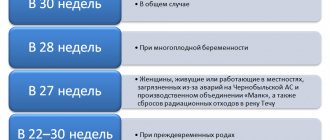

Periods that can be used when replacing years

The number of days in the period under consideration should be 730 days and 731 days if a leap year occurs.

You can only change the year in which maternity leave took place. But the years in which there was no decree cannot be skipped.

The periods must necessarily precede maternity or parental leave.

For example, if replacement is required in 2021, then you can take the previous year as the calculation period, for example, for 2021, 2021 is suitable, for 2017 - 2021, and so on.

The calculation period should be 730 days and 731 in a leap year. 732 days if both years are leap years.

In the event that a period change occurs, the following important information must be taken into account.

- What was the maximum base for contributions to the Social Insurance Fund that occurred in the year that should be used for calculating benefits.

- Time intervals that are excluded from the entire estimated period are taken into account.

Rules and conditions for changing the billing period

You can replace years in the billing period, subject to the following rules and conditions:

- The calendar year contains vacation days: maternity leave

- child care up to 3 years old

Example:

The employee went on maternity leave at the beginning of 2021. She spent 3 years on maternity leave. She went back to work in 2021. After working for a year, at the beginning of 2021 she went on maternity leave again.

In this case, the billing period 2019-2020 can be replaced by 2021 and 2021. Since the employee worked in full for 2021, and the previous period of work was until 2021.

Conditions for selecting and replacing a billing period

To replace (select) RP, the following conditions must be met:

- the employee was on leave due to employment and labor regulations;

- written statement from the employee;

- replacing the RP should not worsen the employee’s position, that is, replacing the RP should help increase the amount of benefits.

When replacing, you should follow the established rules.

So, you can replace the CG only entirely. One changes to another. You can’t split it up by selecting several months from each month.

When replacing the billing period, the entire period of time changes and the RP will still have two calendar years, although it is not necessary that it be two consecutive years.

This may be the first one preceding the occurrence of the insured event and the third, or the second and third, third and fourth - if there are grounds for replacing two years.

If the employee was on maternity leave during the two years included in the calculation, one or both years of the RP can be replaced with the previous ones. Provided that this will lead to an increase in the benefit amount. And it doesn’t matter that the billing period accounts for only part of the specified time off.

Calculation period if vacation immediately after maternity leave

An insured event (maternity leave) that occurs immediately after the previous maternity leave gives the woman the right to choose the years preceding the years of the billing period.

Example: If a woman goes on vacation in 2021, then the calculation period includes 2 years - 2021 and 2021. However, if they include maternity days (maternity leave, or parental leave up to 3 years), then these years can be replaced by earlier previous years of the current billing period.

In what cases can you choose

The opportunity to change the periods for calculating bir benefits appears if the woman has grounds, in accordance with paragraph 1 of Article 14 of Federal Law 255.

The first reason sounds like the employee being on maternity leave or maternity leave during the specified period.

Also, an increase in the amount of maternity leave as a result of replacing periods with an earlier period of time.

It is important to note that the offset can be made no more than one or two calendar years that precede the ones in question.

Will income increase when the billing period changes?

Before changing the billing period, you need to assess whether income will increase and whether it is advisable to change it. Not only the income received should be taken into account, but also the number of days excluded.

Example: Income for the year was 517,500 rubles, there are 365 days in the year, and 20 excluded days, then the average income will be: 517,500 / (365 - 20) = 1,450 rubles per day

Example: Income for the year was 457,600 rubles, there are 366 days in the year, and 80 excluded days, then the average income will be: 457,600 / (366 - 80) = 1,600 rubles per day

The examples show that even if the income for the accounting year is higher, the average income per day may be lower. This is due to the fact that the average income per day depends not only on the income for the year, but also on the actual time worked. And it is possible that the option with a low income for the year will be more profitable than the year in which the income is higher.

Formulas for calculating maternity payments

The size of the maternity benefit is 100% of average earnings, and for child care up to 1.5 years old - 40%.

Formula for calculating maternity benefits:

(Income for both billing years) / (Number of days in the billing period - Excluded days) x Maternity days

- The number of days in the billing period can be 730 or 731 if there was a leap year

- Excluded days include days: vacation, sick leave, time off or unpaid

- The duration of sick leave for pregnancy and childbirth can be: 140, 156 or 194 days

Formula for calculating child care benefits:

(Income for both billing years) / (Number of days in the billing period - Excluded days) x Maternity days x 40%

What are the benefits (730, 731 or 732 days)?

- For pregnancy and childbirth (maternity leave).

- For temporary disability (sick leave).

- Monthly benefits for child care up to 1.5 years (children).

According to Article 14 of Law 255-FZ, the calculation period (RP) for any benefits is two CG according to the income certificate. That is, in 2021, when calculating (maternity leave, sick leave and childcare benefits for children under 1.5 years old), it is necessary to take the employee’s income for 2021 and 2021 and divide the resulting value by the number of days. This is how the average daily earnings are calculated, which is used in the formulas when calculating the amount of benefits.

How many days are included in the RP - 365+365=730 or 365+366=731 days (if the recalculation falls on a leap year).

But in life everything is more complicated. Because the calculation of average daily earnings for benefits (maternity leave, sick leave, care for up to 1.5 years) is different. And there in some situations the number of days is strictly 730 days

.

Examples of calculating maternity benefits

When calculating maternity benefits, you need to carry out calculations with and without replacement of years in the billing period. Below are examples of situations on how to choose the most profitable option.

Example 1:

Maternity leave begins in 2021, and the sick leave list indicates 140 days.

The woman is already expecting her second child, and her first maternity leave ended in 2021.

Income by year: 2021 - 405,000, 2021 - 606,000, 2021 - 690,000 rubles.

There were 2021 and 2021 excluded days, and in 2021 there were 10.

Let's check whether a woman can change her years, and whether it is beneficial.

Calculation period: 2021 and 2021. In 2021, there are days of maternity leave with the first child, but in 2021 there are no such days. Accordingly, a woman has the right to change only 2021. There were no maternity days in 2020, so it cannot be changed.

Amount of maternity leave for 2021 and 2021: (606,000 + 690,000) / (365 + 366 - 10) x 140 = 251,650.49 rubles Amount of maternity leave for 2021 and 2020: (405,000 + 690,000) / (365 + 366) x 140 = 209,712.72 rubles

From the calculation it is clear that changing the years is not profitable, and there is no need to write an application to change the years.

Example 2:

Maternity leave begins in 2021, and the sick leave list indicates 140 days.

The woman is expecting her second child; maternity leave with the first began in 2019 and ended in 2021.

Income by year: 2021 - 350,000, 2021 - 490,000, 2021 - 0, 2021 - 200,000 rubles

Excluded days: 2021 - 0, 2021 - 0, 2021 - 365, 2021 - 200 days

The billing period is 2021 and 2021, but both years contain maternity days, which means they can be replaced by law.

Let's calculate maternity benefits for different years in the billing period:

2019 and 2021: (0 + 200,000) / (365 + 366 - 200) x 140 = 52,730.70 rubles 2021 and 2021: (490,000 + 200,000) / (365 + 366 - 200) x 140 = 181,920 .90 rubles 2021 and 2021: (490,000 + 0) / (365 + 365 - 365) x 140 = 187,945.21 rubles 2021 and 2021: (350,000 + 490,000) / (365 + 365) x 140 = 161 095.89 rubles

From the calculation it is clear that the option of greatest interest is when the calculation period is taken for the years 2021 and 2021.

Example 3:

In the period from January 2021 to June 2021, the woman was unemployed and received child care benefits from the OSZN. In December 2021, she got a job.

Income by year: 2021 - 70,000, 2021 - 400,000

Calculation period: 2021 and 2021. During this period, until June 2021, the woman received child benefits from the OSZN. Being unemployed and receiving benefits does not give a woman the right to change the pay period, since she is not on maternity leave. Therefore, in this example, the calculation period does not change, and income is calculated based on the child benefits received.

The benefit amount will be: (70,000 + 400,000) / (365 + 366) x 140 = 90,013.68 rubles

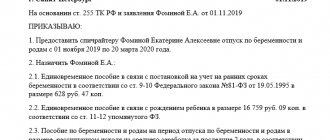

How to submit an application to change the billing period

Replacement of years in the billing period is carried out only upon written request. Therefore, if the application was not submitted, the employer will calculate the benefit based on the last 2 calendar years preceding the decree.

An application for changing years is drawn up in any form. The application indicates which years you wanted to replace in the billing period, as well as the reason for the replacement. The application is submitted in 2 copies, along with other documents for registration of leave; one application is marked as received by the enterprise and remains with the employee.

The application can be submitted later, when maternity leave has already been calculated. In this case, the employer is obliged to recalculate the amount of maternity leave.

The application is submitted:

- at the place of work - working

- by service - employees

- for studies - students

Sample application for changing the billing period

Application for changing the billing period

conclusions

An employer who has received an application from an employee to change the pay period is obliged to make calculations for both pay periods and choose the most profitable option. However, it must be borne in mind that the amount of wages only increases every year, and often changing the pay period is less profitable.

If, based on the application, the employer changes years, but does not check whether the amount of the benefit will increase, then later the employee has the right to demand a recalculation of maternity leave, if this is not the case.