What is the calculation note used for?

A note-calculation on the provision of leave is created by a specialist in the personnel department in order to generate the necessary data for the accounting department, which is used to determine the amount of vacation pay due.

At the same time, the accountant makes the calculation in the same document, which allows you to check not only the initial information, but also the correctness of the calculation.

It is drawn up together with the order for the provision of rest time, and after drawing up it is transferred to the accounting department for further filling out.

The front side contains information entered by the personnel inspector and repeats the information of the leave order. It must reflect for which periods of work annual paid leave is used, the start and end dates, as well as the duration.

The company can use the form approved by Rosstat - form T-60, or create its own template, which includes the necessary details required for this document.

However, we must remember that if an employee is dismissed and compensation is calculated for the time not taken off, the note-calculation for the provision of leave in the T-60 form should not be used, since there is a form specially designed for this.

Attention! Based on the calculation note, payment documents are generated according to which wages are paid.

After this, the document is filed with the rest of the payroll documents and goes as an attachment to the payroll sheet for the corresponding period of time.

General issues

Each employee is entitled to leave of at least 28 calendar days, which he can receive after working in the organization for 6 months. For each year, the employer must draw up a vacation schedule in the T-7 form, taking into account the wishes of the employee. In accordance with this schedule, employees go on vacation.

Attention! 2 weeks before the due date, the employee writes a corresponding statement, on the basis of which an order is issued in form T-6. Based on these documents, the accounting department must calculate vacation pay and issue the due amount 3 days before departure.

The calculation is calculated and entered into the calculation note in the T-60 form. In addition to calculating vacation pay, the statement is also filled out to justify the provision of vacation days

How long before vacation should you write a note?

The Labor Code of the Russian Federation does not determine the exact timing for issuing a note-calculation for vacation. The law requires company management to warn its employees about the start of vacation at least 14 days before it starts.

The rules also define the obligation for the administration to make payments to an employee going on vacation no less than 3 days before leaving. The new rules stipulate that if a person working at an enterprise applies for leave and immediately leaves for this period, then the money must be paid within three days from the date of receipt of the application.

Attention! Based on this, it is advisable to draw up a settlement note in the period from 2 weeks to 3 days before the start of your vacation. Their final determination is carried out at each enterprise individually, taking into account the peculiarities of its work.

Specific deadlines can be fixed at an enterprise in its local acts, for example, in the Regulations on Vacations.

You might be interested in:

Order on wage indexation: grounds for publication, who issues it in 2021, sample

Documents serving as the basis for drawing up a settlement note

A vacation schedule drawn up in advance in the organization, an order from the company’s management to provide planned vacation to a particular employee, a payroll and cash settlements serve as documentary justification for drawing up a settlement note.

Before sending an employee on a planned vacation, the enterprise's personnel specialist must send him a notice of vacation, but no later than two weeks before it starts.

In turn, the future vacationer must put his signature under it, which will indicate that he agrees with the period and conditions of the annual planned paid leave.

What calculations are included in the calculation note

When an employee goes on vacation, he is entitled to receive the following amounts:

- Amounts of previously unpaid wages.

- Vacation pay amounts calculated in accordance with the methodology for determining average earnings approved by law.

- Amounts of financial assistance, if the employee is entitled to them in accordance with the Regulations of the enterprise.

- Amounts of bonuses, if during the performance of work before the vacation the employee met the conditions for receiving it in accordance with regulations.

- Temporary disability benefits if the employee’s illness or injury preceded the vacation.

- Other payments provided by law.

Normative base

Based on Articles 114-126 of the Labor Code of the Russian Federation, leave with pay stipulated by the employment contract (annual, educational, pregnancy and child care) is granted to every employed citizen. In this regard, the Decree of the Government of the Russian Federation No. 922 dated December 24, 2007 (as amended on February 10, 2016) approved an algorithm for calculating average earnings to determine the amount of payments to a subordinate when he goes on vacation.

Help for drawing up the T-60 form are:

- An order from the head of the company authorizing going on vacation, written in form T-6.

- Pay slips or statements from a personal account for the previous 12 months, which contains information about the amount of accrued earnings.

Advice! It is recommended to draw up a note after submitting the employee’s request for a period of rest, which is submitted no later than 14 days before the planned date, and the corresponding order.

calculation notes in form T-60 for 2021

Calculation note on granting leave to an employee, form T-60 form, download for free in Excel format.

Download a sample of filling out a calculation note for granting leave in Pdf format.

Attention! The easiest way is to use an online vacation pay calculator, which will make calculations based on your data. After which they will simply need to be included in the calculation note.

How to fill it out correctly?

The calculation note form can be filled out by hand or in a special computer program. In any case, the paper version must be signed by officials in person. As a rule, the head of the company appoints employees of the personnel and accounting departments to be responsible for entering information into such a document.

When filling out the T-60 form, you must adhere to the following rules:

- indicate the amount of vacation pay to be paid not only in numbers, but also in words;

- provide accurate information;

- do not make any mistakes and do not try to correct them if they are made. If necessary, it is better to take a new form and fill it out again;

- the column about the number of hours worked must be filled out only if a summary record of working time was kept;

- When writing a document, use a pen with waterproof and light-resistant ink. The form should be filled out carefully and legibly;

- the working year may exceed 365 days. This is explained by the fact that the length of service of a subordinate, according to Article No. 121 of the Labor Code of Russia, does not include absenteeism and vacations.

Expert opinion

Irina Vasilyeva

Civil law expert

Form T-60 is subject to mandatory accounting.

Form T-60 is a two-sided document. It has its own nuances and filling features. It is important to understand what information and how correctly should be entered into the calculation certificate.

When filling out a calculation note, the employer must take into account that such a document must be drawn up and signed before the actual payment is made to the employee (that is, at least three days before the subordinate goes on vacation). After all, it is on the basis of the T-60 form that according to the rules money is issued.

Front side

The front side of the T-60 form is filled out by a personnel service employee. It contains basic information about the employer and subordinate. It also provides information about the types and dates of release from work.

Before you start filling out the front side of the T-60 form, you need to decide whether the employee is granted basic or additional leave. This determines which columns the information will be entered into.

The front side is filled out in the following order:

- enter the organizational and legal form (LLC, IP, CJSC) and the full name of the company, its OKPO code;

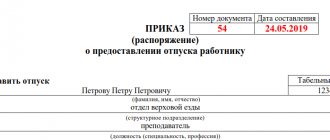

- the number of the settlement note for internal document flow and the date of filling out the form are indicated;

- personal information of the employee is indicated. His last name, first name and patronymic in full, position and personnel number are written down. The latter is assigned upon hiring. It is noted in which structural unit the subordinate works;

- Below is the period for which the employee is granted basic or additional leave (working year);

- the duration of exemption from work is indicated. A note is made indicating whether leave is granted in working days or calendar days;

- the start and end dates of the period of release from work are written;

- The signature of the person responsible for filling out the document is affixed.

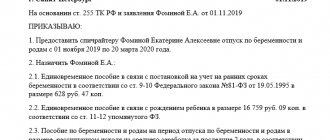

If an employee is granted not the main, but additional leave (study leave, maternity leave, child care leave, etc.), then a special table is filled out, which is located at the bottom of the sheet.

It must indicate the code, the number of calendar or working days, the start and end dates of the period of exemption from work. The basis for granting the employee leave must be noted. As a rule, this is an order from the company's management.

Reverse side

The reverse side of the T-60 form is filled out by an employee of the accounting department. It is considered the main one. It provides information on calculating vacation pay. To do this, information is taken from the last 12 months of the subordinate’s work at the enterprise. There are four tables on the reverse side of the T-60 form.

The first includes monthly payments, which are taken into account when determining the average salary for vacation pay. The second table indicates the duration of the billing period and the average income of the subordinate. An employee’s daily earnings are determined according to the rules given in Russian Government Decree No. 922. The total salary for the reporting period is divided into 12 months and then into 29.3 days.

Next, fill out the “Accrued” table, indicating the following information:

- number of vacation days (main and (or) additional);

- The amount of money payable for each type of work exemption (before taxes). Determined by multiplying the average daily earnings by the duration of the vacation;

- the total amount of cash payment without deduction of personal income tax. Accruals for basic and additional vacations are summed up;

- the amount to be deducted for paying income tax. Determined by multiplying the total amount of vacation pay by 13%;

- total amount to be paid. Personal income tax is deducted from the total amount of vacation pay.

Below the table it is indicated in words how much money the employee will receive in hand. The details of the expense order (payroll) are written. At the end, the person responsible for filling out the T-60 form (accountant) puts his last name with initials and signature. The calculation certificate is filled out annually for each full-time employee.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Sample of filling out a note-calculation on granting leave to an employee in 2021

Front side

This side of the note, form T-60, is drawn up by a human resources specialist. At the top of the form the full name of the company or full name is written down. entrepreneur. In the field on the right is the code according to the OKPO directory (if there is one).

Below, next to the name of the document, its serial number and the date on which it was issued are indicated. Next, personal information about the employee for whom the calculation is being performed is recorded in the document - his full name, number according to the report card, name of position and department.

Further on the form there are three sections. They look similar to the T-6 leave order. In section A you need to enter information when an employee goes on annual leave. Among the information that must be indicated is the period for which the vacation is provided, how long it will last in days and the start and end dates.

In section B you need to write down information if the calculation is made for additional leave or other paid rest period. The right to this kind of leave is provided by federal laws or internal regulations of the company. In this section you need to write down the full name of the period, the basis for its provision, the start and end dates

Section B is a summary of all types of recreation. It is necessary to add up all the periods from sections A and B, and indicate the total duration, start and end dates of the rest. If an employee wants to take only annual leave, then the information in this section should simply be transferred from section A.

After this, the specialist checks the specified data and puts down information about himself at the end of the sheet.

Reverse side

The calculation note regarding the provision of leave on the second side is filled out by a payroll accountant. This is done after the personnel officer, having processed his side of the form, transfers it to the accounting department.

First, you need to select all the information about payroll for the past 12 months. For this purpose, payroll statements for these periods or a personal account are used. After sampling, the information must be recorded in the calculation table.

You might be interested in:

Application for transfer of salary to a bank card: why it is written, how to write it correctly

It is filled out as follows. In the table you need to write down, line by line, the month and year for which the salary data is entered (in columns 1 and 2), and then the amount itself for the specified period (in column 3). At the bottom of the table, you need to sum up all salaries for each month and enter the overall total.

Next you need to go to the right table. It records the total number of days that are used by the accountant to calculate the average salary (in column 4), or the total number of hours (in column 5).

Based on these data and the total salary for the entire period, the average earnings are determined (in column 6). The calculation is made as follows: the total amount of earnings for the period (column 3) is divided by the number of days or hours (columns 4 or 5).

The following tabular part includes two sections. It can be used when vacation needs to be divided into two parts between adjacent months. Both parts of the table are identical in structure.

In columns 7 and 11 you need to write down the duration of each period in days. In columns 8 and 9, as well as 12 and 13, you need to write down the amount of vacation pay for each period, depending on the source from which payment will be made.

All additional payments that need to be given to the employee during these periods are entered in columns 10 and 14. In column 15 you need to write down the total amount of recorded vacation pay.

In the following table you need to record all deductions that are made from vacation pay. This includes, for example, the amount of personal income tax (column 16), the amount of alimony, deduction of material damage, etc.

The accountant himself must indicate the necessary information in columns 17-21. Column 22 includes the total amount of all deductions. Then in column 23 you need to enter the total amount for issue: from the result of column 15 you need to subtract the result in column 22.

The same amount is then written down in words, and next to it you will need to put down information about the document on which it was paid. After completely filling out the document, the payer checks it and indicates information about himself.

Filling the front side of T-60

- This part of the document includes data on the full name of the organization in which the employee works with a mandatory indication of its organizational and legal status (CJSC, LLC, individual entrepreneur).

- Then, just below, enter the serial number of the document to be filled out for internal document flow and information relating to the employee personally: his full name, position, structural unit to which he belongs, as well as the personnel number assigned to him when hired.

- In the next line, it is necessary to indicate the period for which leave is granted (the employee’s length of service at the place of work) and the exact number of days of leave (according to the calendar) with a clear indication of the start and end dates of the leave.

- If an employee does not go on a planned paid vacation, but takes additional or educational leave, then this must be entered in the appropriate column with a mandatory indication of the number of calendar vacation days, as well as a link to the document that served as the basis for its provision (management order, etc. )

- At the end of the sheet there must be a signature of the official who filled out the document - in this case, a HR specialist.

What it is?

This document is drawn up at the time an employee of the organization goes on vacation. It is necessary in order to correctly calculate and accrue vacation pay. Therefore, the role of paper is quite significant. After all, if you do not fill out the T-60 form, you may make a mistake in the calculations. Accordingly, the employee will receive less or more money than he is owed. One of the parties to the labor relationship will lose.

Reference! The form approved by the State Statistics Committee is a sheet of A4 paper, on which there are special fields and tables where the company’s accountant enters the necessary information.

The contents of the document will be discussed later in this article. For now, let’s touch on cases when a settlement note is drawn up. What is the procedure for granting leave to an employee?

- Before the start of the calendar year, the employer draws up a schedule indicating which employee will rest when.

- Two weeks before the start of the vacation, the specific employee is notified of this (read about the specifics of drawing up and delivering a vacation notice here).

- Next, an order is issued for the employee to take annual paid leave.

Thus, it turns out that the calculation note is drawn up on the basis of the vacation schedule and the order for a specific employee .

We described in more detail the procedure and rules for registering annual leave for an employee in a separate article.

Is it necessary to fill out the document?

The unified form T-60 was approved by a resolution of the State Statistics Committee in 2004. The act states that this form must be filled out by all organizations, regardless of their legal form. Meanwhile, the Government of the Russian Federation has allowed organizations that are budgetary not to fill out the T-60 form.

However, there is an opinion that there is no requirement for non-budgetary organizations to use this form without fail. But it is provided in all modern accounting programs. And it is filled. Another case when you do not need to fill out the T-60 form :

The conditions are:

- the employee quits;

- he does not want to go on vacation, but wants to receive compensation for the days he did not take off.

For this case, there is another unified form - T-61 .

Design rules

As noted, the document has a front and back side. Let's talk about each of them, paying attention to individual fields and columns.

Front side

At the very top the following information is indicated:

- full name of the organization (left);

- code according to the OKPO classifier (right);

- document number and date of completion.

The next block is information about the employee. Namely:

- Full Name.

- Personnel number assigned by the organization.

- The name of the structural unit in which the person works.

- Job title.

Reference! We can say that the calculation note on the front side duplicates the information from the order for granting leave.

Next, there are several sections under the letters:

- Section A. It indicates the period for which leave is granted. And just in case, the number of days that the employee has to rest is entered.

- Section B. It is filled in only when an employee of the organization is granted some additional leave provided for by law, labor or collective agreement.

- Section B. It sums up how long the employee will rest in total and during what period. If section B is empty, then in block B you need to duplicate the information from section A.

Rules for forming the form and sample document

The calculation note is filled out on both sides - the face is filled out by the personnel officer, the back side is filled out by the accountant, where the calculation is entered.

Front side

At the top of the form, a header is formed from data about the enterprise:

- Serial number of the form;

- Personnel number of the worker;

- FULL NAME;

- Information about the structural unit where the employee is assigned;

- His position is indicated;

- Field “A” contains information about the employee’s length of service, using which the number of vacation days is calculated. The first and last dates of rest are also indicated here;

- Field “B” – information about additional leaves;

- Column “B” contains the number of days provided for rest and its total duration;

- As a result, the employee filling out the document signs.

Paying for purchases in online stores using electronic wallets is very convenient. What advantages does this provide and how to connect electronic payment systems for online stores, read the link.

Back page

Calculations are recorded on the back using information from the personnel officer:

- The column “Calculation of vacation pay” contains data on accruals for each month of the year used in deducting vacation pay. In addition, the total number of days of service per year according to the calendar is indicated and the equivalent of average earnings is calculated;

- The “Accrued” column contains estimated accruals;

- At the same time, in gr. 8 indicates the accrued funds for vacation, which is equal to the calculation of average earnings based on the number of vacation days;

- Gr. 7 – the sum of days for rest;

- Gr 6 contains the number of average earnings;

- If there are other charges, fill in the following columns;

- The result is recorded in column 15;

- The “Held” field contains information about withholdings:

- In gr. 16 withholding personal income tax from accruals in group 15;

- In gr. 22 all amounts withheld are being counted;

- Column 23 contains data on the amount paid;

- This amount is indicated in numbers and deciphered in words;

- As a result, the accountant signs it.

A sample calculation note can be downloaded from this link.

Purchasing a car is a very important and responsible step. But what if you don’t have enough money for the model you like? A sample car leasing agreement and all the advantages of such a purchase are in this publication.

Sample note-calculation on granting leave.

Subtleties when filling out a vacation calculation note

When filling out a vacation calculation note, you need to pay attention to the following points:

- This document is of great importance in the enterprise. This document confirms the expenses of the enterprise, and is of great importance in case of controversial issues with tax inspectors. If the enterprise does not have a vacation calculation note, but there is a vacation order, then these expenses will not be taken into account.

- When filling out, you do not need to take into account holidays when calculating vacation days;

- Note calculation in form T-60 is used in enterprises with a general taxation system and a simplified one;

- This document can be filled out either on paper or electronically.